Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Unaudited Condensed Consolidated Financial Statements As of March 31, 2025 and December 31, 2024, and For the Three Months Ended March 31, 2025 and 2024 Exhibit 99.1

Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Index Page(s) Condensed Consolidated Financial Statements (Unaudited) Condensed Consolidated Balance Sheets March 31, 2025 and December 31, 2024 ................................................................................................ 3 Condensed Consolidated Statements of Comprehensive Income Three Months Ended March 31, 2025 and 2024 ...................................................................................... 4 Condensed Consolidated Statements of Members’ Equity Three Months Ended March 31, 2025 and 2024 ...................................................................................... 5 Condensed Consolidated Statements of Cash Flows Three Months Ended March 31, 2025 and 2024 ...................................................................................... 6 Notes to Condensed Consolidated Financial Statements .................................................................. 7–16

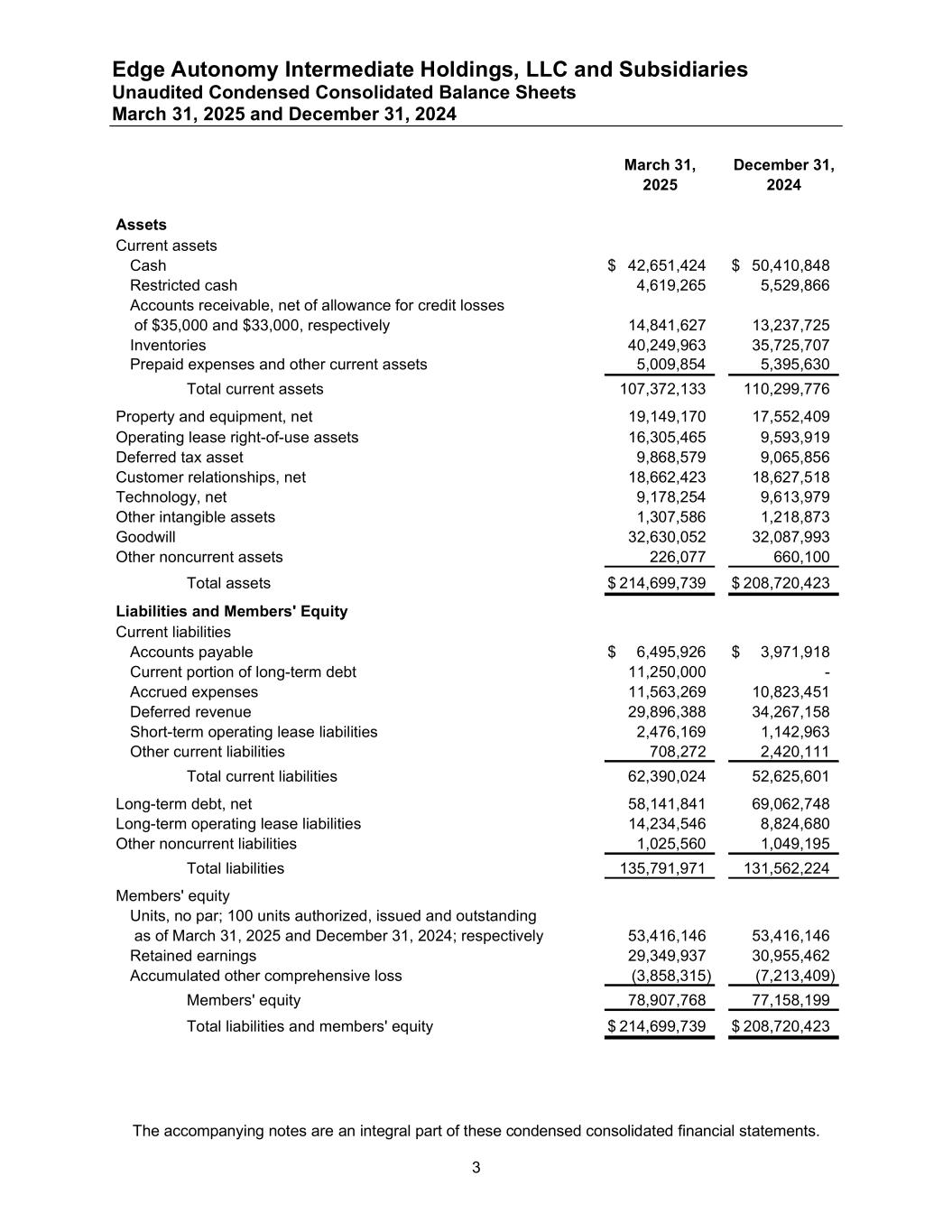

Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Unaudited Condensed Consolidated Balance Sheets March 31, 2025 and December 31, 2024 The accompanying notes are an integral part of these condensed consolidated financial statements. 3 March 31, December 31, 2025 2024 Assets Current assets Cash 42,651,424$ 50,410,848$ Restricted cash 4,619,265 5,529,866 Accounts receivable, net of allowance for credit losses of $35,000 and $33,000, respectively 14,841,627 13,237,725 Inventories 40,249,963 35,725,707 Prepaid expenses and other current assets 5,009,854 5,395,630 Total current assets 107,372,133 110,299,776 Property and equipment, net 19,149,170 17,552,409 Operating lease right-of-use assets 16,305,465 9,593,919 Deferred tax asset 9,868,579 9,065,856 Customer relationships, net 18,662,423 18,627,518 Technology, net 9,178,254 9,613,979 Other intangible assets 1,307,586 1,218,873 Goodwill 32,630,052 32,087,993 Other noncurrent assets 226,077 660,100 Total assets 214,699,739$ 208,720,423$ Liabilities and Members' Equity Current liabilities Accounts payable 6,495,926$ 3,971,918$ Current portion of long-term debt 11,250,000 - Accrued expenses 11,563,269 10,823,451 Deferred revenue 29,896,388 34,267,158 Short-term operating lease liabilities 2,476,169 1,142,963 Other current liabilities 708,272 2,420,111 Total current liabilities 62,390,024 52,625,601 Long-term debt, net 58,141,841 69,062,748 Long-term operating lease liabilities 14,234,546 8,824,680 Other noncurrent liabilities 1,025,560 1,049,195 Total liabilities 135,791,971 131,562,224 Members' equity Units, no par; 100 units authorized, issued and outstanding as of March 31, 2025 and December 31, 2024; respectively 53,416,146 53,416,146 Retained earnings 29,349,937 30,955,462 Accumulated other comprehensive loss (3,858,315) (7,213,409) Members' equity 78,907,768 77,158,199 Total liabilities and members' equity 214,699,739$ 208,720,423$

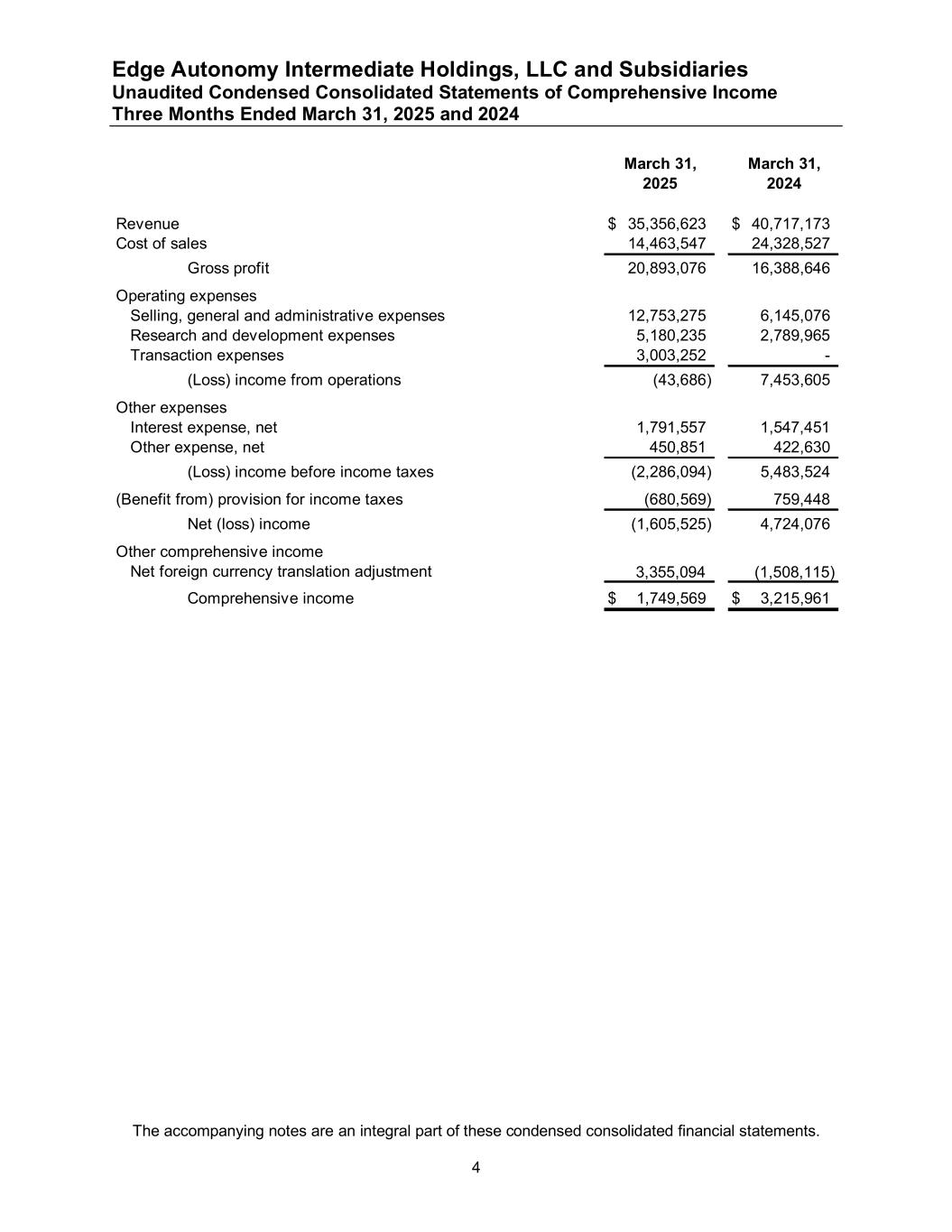

Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Unaudited Condensed Consolidated Statements of Comprehensive Income Three Months Ended March 31, 2025 and 2024 The accompanying notes are an integral part of these condensed consolidated financial statements. 4 March 31, March 31, 2025 2024 Revenue 35,356,623$ 40,717,173$ Cost of sales 14,463,547 24,328,527 Gross profit 20,893,076 16,388,646 Operating expenses Selling, general and administrative expenses 12,753,275 6,145,076 Research and development expenses 5,180,235 2,789,965 Transaction expenses 3,003,252 - (Loss) income from operations (43,686) 7,453,605 Other expenses Interest expense, net 1,791,557 1,547,451 Other expense, net 450,851 422,630 (Loss) income before income taxes (2,286,094) 5,483,524 (Benefit from) provision for income taxes (680,569) 759,448 Net (loss) income (1,605,525) 4,724,076 Other comprehensive income Net foreign currency translation adjustment 3,355,094 (1,508,115) Comprehensive income 1,749,569$ 3,215,961$

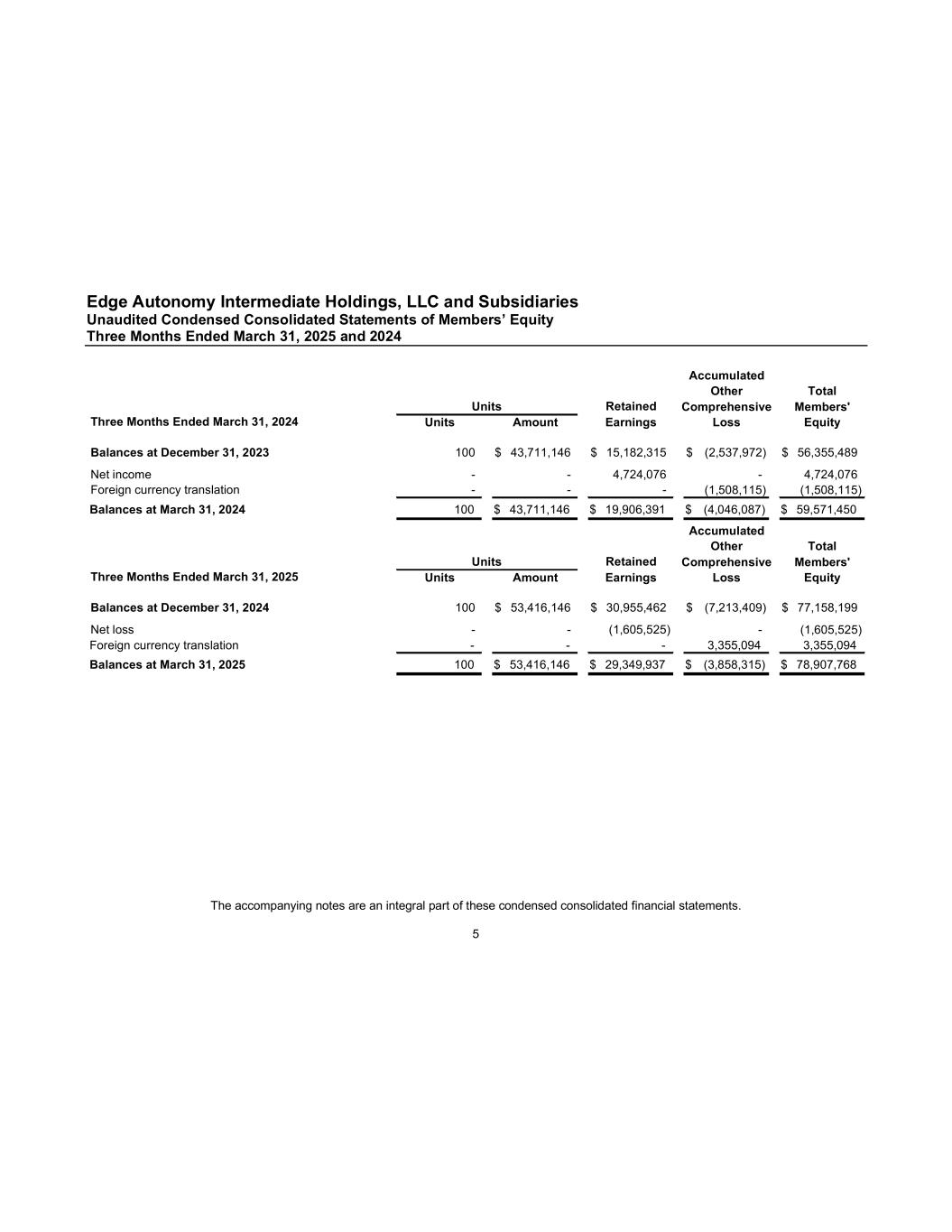

Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Unaudited Condensed Consolidated Statements of Members’ Equity Three Months Ended March 31, 2025 and 2024 The accompanying notes are an integral part of these condensed consolidated financial statements. 5 Accumulated Other Total Retained Comprehensive Members' Three Months Ended March 31, 2024 Units Amount Earnings Loss Equity Balances at December 31, 2023 100 43,711,146$ 15,182,315$ (2,537,972)$ 56,355,489$ Net income - - 4,724,076 - 4,724,076 Foreign currency translation - - - (1,508,115) (1,508,115) Balances at March 31, 2024 100 43,711,146$ 19,906,391$ (4,046,087)$ 59,571,450$ Units Accumulated Other Total Retained Comprehensive Members' Three Months Ended March 31, 2025 Units Amount Earnings Loss Equity Balances at December 31, 2024 100 53,416,146$ 30,955,462$ (7,213,409)$ 77,158,199$ Net loss - - (1,605,525) - (1,605,525) Foreign currency translation - - - 3,355,094 3,355,094 Balances at March 31, 2025 100 53,416,146$ 29,349,937$ (3,858,315)$ 78,907,768$ Units

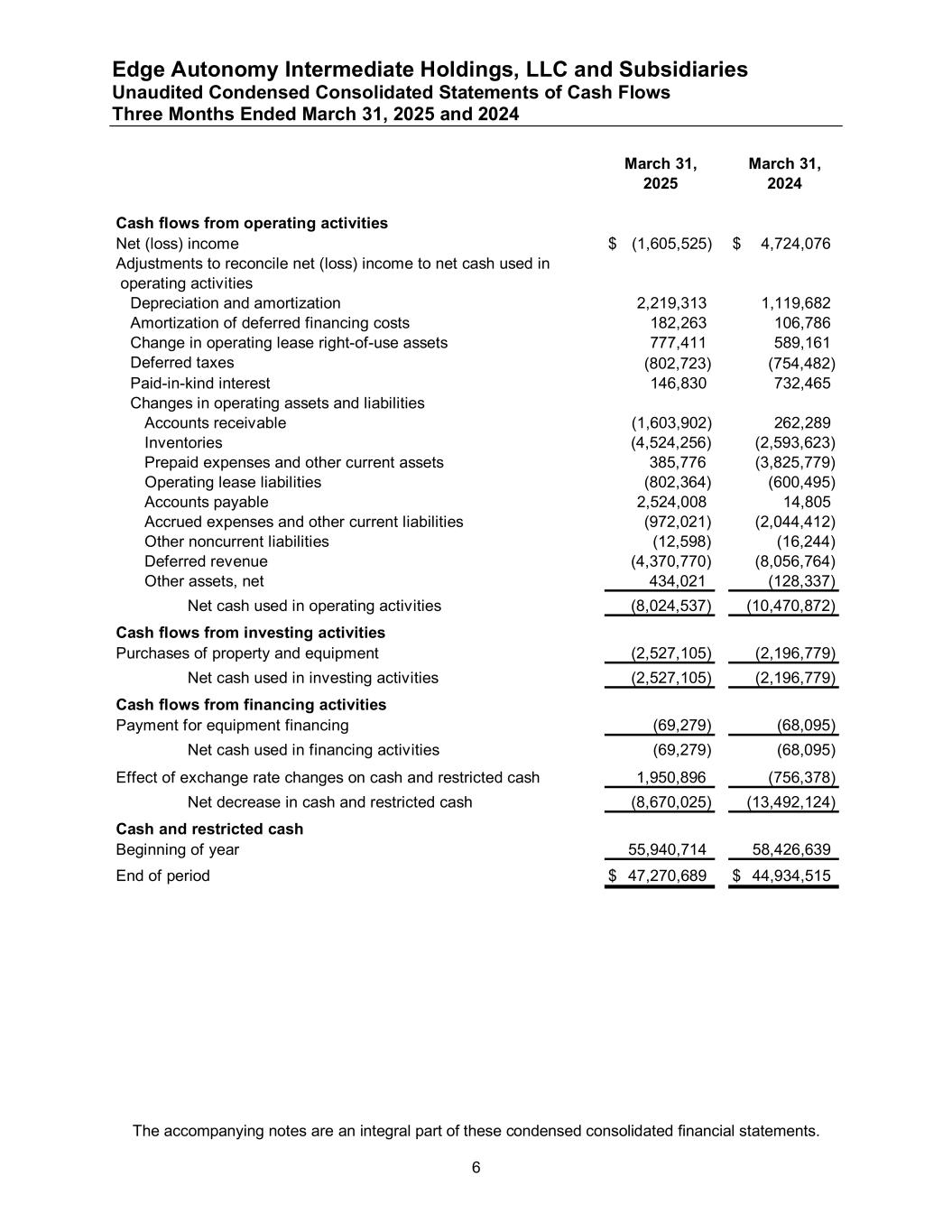

Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Unaudited Condensed Consolidated Statements of Cash Flows Three Months Ended March 31, 2025 and 2024 The accompanying notes are an integral part of these condensed consolidated financial statements. 6 March 31, March 31, 2025 2024 Cash flows from operating activities Net (loss) income (1,605,525)$ 4,724,076$ Adjustments to reconcile net (loss) income to net cash used in operating activities Depreciation and amortization 2,219,313 1,119,682 Amortization of deferred financing costs 182,263 106,786 Change in operating lease right-of-use assets 777,411 589,161 Deferred taxes (802,723) (754,482) Paid-in-kind interest 146,830 732,465 Changes in operating assets and liabilities Accounts receivable (1,603,902) 262,289 Inventories (4,524,256) (2,593,623) Prepaid expenses and other current assets 385,776 (3,825,779) Operating lease liabilities (802,364) (600,495) Accounts payable 2,524,008 14,805 Accrued expenses and other current liabilities (972,021) (2,044,412) Other noncurrent liabilities (12,598) (16,244) Deferred revenue (4,370,770) (8,056,764) Other assets, net 434,021 (128,337) Net cash used in operating activities (8,024,537) (10,470,872) Cash flows from investing activities Purchases of property and equipment (2,527,105) (2,196,779) Net cash used in investing activities (2,527,105) (2,196,779) Cash flows from financing activities Payment for equipment financing (69,279) (68,095) Net cash used in financing activities (69,279) (68,095) Effect of exchange rate changes on cash and restricted cash 1,950,896 (756,378) Net decrease in cash and restricted cash (8,670,025) (13,492,124) Cash and restricted cash Beginning of year 55,940,714 58,426,639 End of period 47,270,689$ 44,934,515$

Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Notes to Unaudited Condensed Consolidated Financial Statements 7 1. Organization and Nature of Operation Edge Autonomy Intermediate Holdings, LLC and its subsidiaries (the “Company”), is a Delaware limited liability company that conducts business primarily in the aerospace and defense industry. The Company designs and manufactures highly engineered autonomous and un-crewed systems and related technologies for use in various military, civil, and academic applications. The Company’s principal place of business and headquarters is in San Luis Obispo, CA. The Company leverages its engineering expertise to develop innovative solutions spanning flight control, advanced sensors, and ground support systems, among other areas, supporting a diverse customer base that includes US government agencies, allied foreign governments, and commercial organizations. On January 20, 2025, as amended on February 3, 2025 and June 8, 2025, the Company signed a definitive merger agreement (the “Merger”) to be acquired by Redwire Corporation for $925,000,000 less the amount of indebtedness outstanding immediately prior to closing plus cash on hand less any transaction expenses and subject to customary working capital adjustments. Following the Merger, the Company and its subsidiaries will become wholly owned subsidiaries of Redwire Corporation. The transaction is subject to customary approvals and closing conditions, including a Redwire Corporation stockholders’ vote and regulatory approvals, and is expected to close in the second quarter of 2025. 2. Basis of Presentation and Summary of Significant Accounting Policies Basis of Presentation The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with United States Generally Accepted Accounting Principles (“U.S. GAAP”) for interim financial statement information and the rules of the SEC. Accordingly, they do not include all of the information and notes required by U.S. GAAP for complete financial statements. The unaudited condensed consolidated balance sheet as of December 31, 2024 was derived from audited financial statements but does not include all disclosures required by U.S. GAAP. In the opinion of management, the condensed consolidated financial statements include all adjustments necessary for the fair presentation of such financial statements. The accompanying condensed consolidated financial statements of Edge Autonomy Intermediate Holdings, LLC, include the accounts of its wholly owned subsidiaries. The operating results of these wholly owned subsidiaries are included in the condensed consolidated financial statements from the effective date of their acquisition or formation if not acquired in a business acquisition, and all intercompany balances and transactions have been eliminated in the Company’s condensed consolidated financial statements. The results of operations for the interim periods presented are not necessarily indicative of results to be expected for the full year or future periods. These condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto for the year ended December 31, 2024 included in Redwire Corporation’s Form 8-K filed on April 3, 2025. Recently Issued Accounting Pronouncements In November 2024, the FASB issued ASU No. 2024-03, Income Statement—Reporting Comprehensive Income—Expense Disaggregation Disclosures (Subtopic 220-40). The ASU requires disclosure, in the notes to financial statements, of specified information about certain costs and expenses, including purchases of inventory, employee compensation, depreciation, and intangible asset amortization included in each relevant expense caption. Additionally, the amendment requires a qualitative description of the amounts remaining in the relevant expense captions that are not separately disaggregated quantitatively, and to disclose the total amount of selling expenses and, in annual reporting periods, an entity’s definition of selling expenses. For

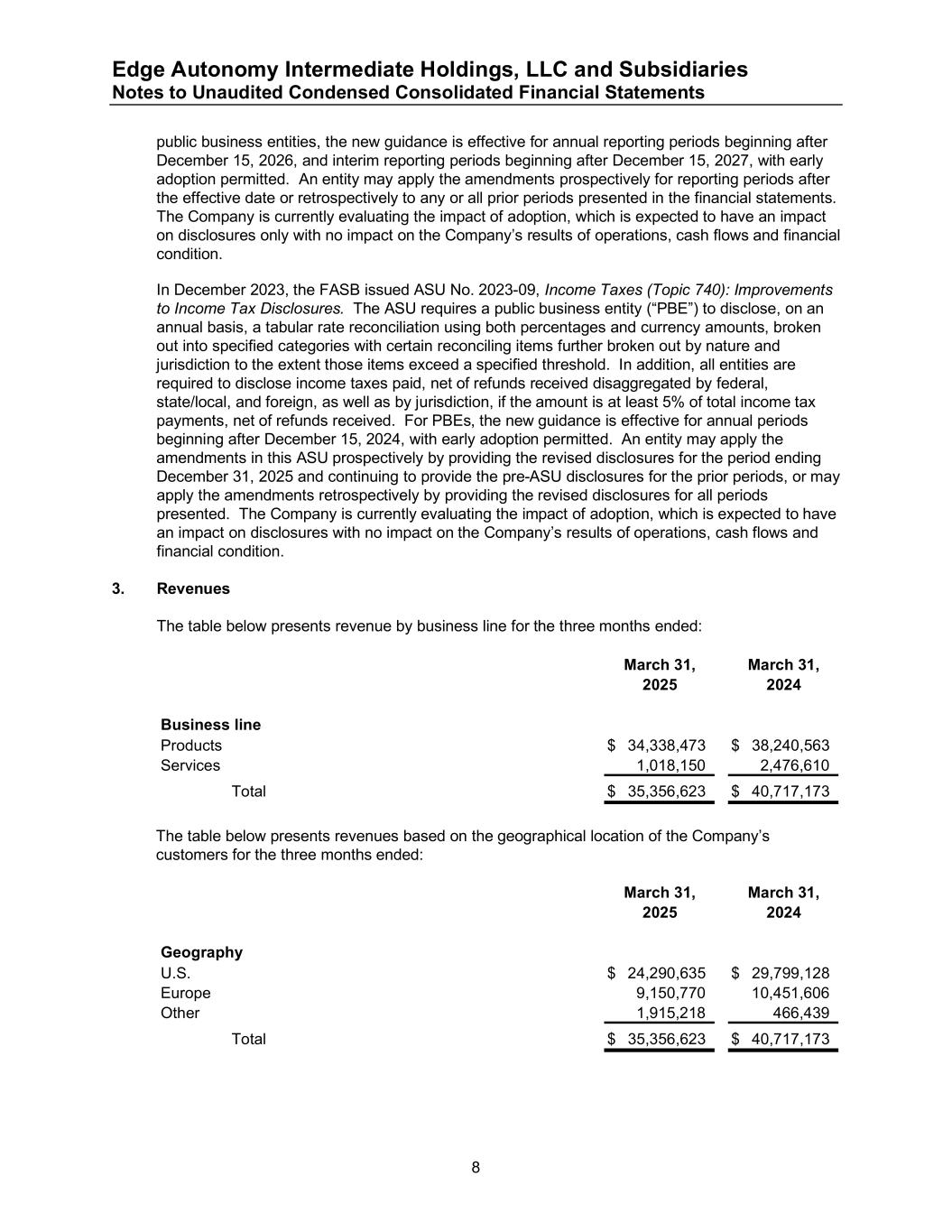

Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Notes to Unaudited Condensed Consolidated Financial Statements 8 public business entities, the new guidance is effective for annual reporting periods beginning after December 15, 2026, and interim reporting periods beginning after December 15, 2027, with early adoption permitted. An entity may apply the amendments prospectively for reporting periods after the effective date or retrospectively to any or all prior periods presented in the financial statements. The Company is currently evaluating the impact of adoption, which is expected to have an impact on disclosures only with no impact on the Company’s results of operations, cash flows and financial condition. In December 2023, the FASB issued ASU No. 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures. The ASU requires a public business entity (“PBE”) to disclose, on an annual basis, a tabular rate reconciliation using both percentages and currency amounts, broken out into specified categories with certain reconciling items further broken out by nature and jurisdiction to the extent those items exceed a specified threshold. In addition, all entities are required to disclose income taxes paid, net of refunds received disaggregated by federal, state/local, and foreign, as well as by jurisdiction, if the amount is at least 5% of total income tax payments, net of refunds received. For PBEs, the new guidance is effective for annual periods beginning after December 15, 2024, with early adoption permitted. An entity may apply the amendments in this ASU prospectively by providing the revised disclosures for the period ending December 31, 2025 and continuing to provide the pre-ASU disclosures for the prior periods, or may apply the amendments retrospectively by providing the revised disclosures for all periods presented. The Company is currently evaluating the impact of adoption, which is expected to have an impact on disclosures with no impact on the Company’s results of operations, cash flows and financial condition. 3. Revenues The table below presents revenue by business line for the three months ended: March 31, March 31, 2025 2024 Business line Products 34,338,473$ 38,240,563$ Services 1,018,150 2,476,610 Total 35,356,623$ 40,717,173$ The table below presents revenues based on the geographical location of the Company’s customers for the three months ended: March 31, March 31, 2025 2024 Geography U.S. 24,290,635$ 29,799,128$ Europe 9,150,770 10,451,606 Other 1,915,218 466,439 Total 35,356,623$ 40,717,173$

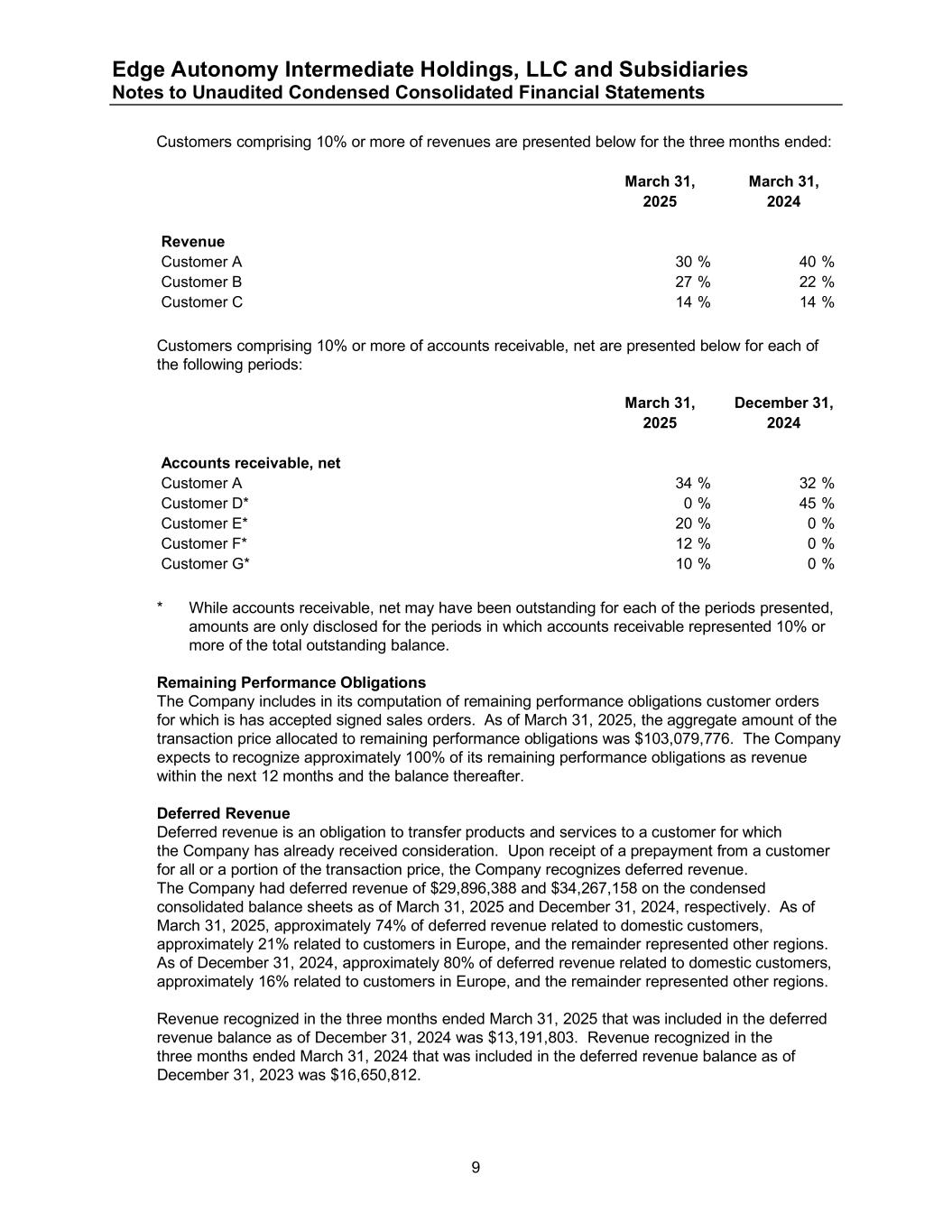

Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Notes to Unaudited Condensed Consolidated Financial Statements 9 Customers comprising 10% or more of revenues are presented below for the three months ended: March 31, March 31, 2025 2024 Revenue Customer A 30 % 40 % Customer B 27 % 22 % Customer C 14 % 14 % Customers comprising 10% or more of accounts receivable, net are presented below for each of the following periods: March 31, December 31, 2025 2024 Accounts receivable, net Customer A 34 % 32 % Customer D* 0 % 45 % Customer E* 20 % 0 % Customer F* 12 % 0 % Customer G* 10 % 0 % * While accounts receivable, net may have been outstanding for each of the periods presented, amounts are only disclosed for the periods in which accounts receivable represented 10% or more of the total outstanding balance. Remaining Performance Obligations The Company includes in its computation of remaining performance obligations customer orders for which is has accepted signed sales orders. As of March 31, 2025, the aggregate amount of the transaction price allocated to remaining performance obligations was $103,079,776. The Company expects to recognize approximately 100% of its remaining performance obligations as revenue within the next 12 months and the balance thereafter. Deferred Revenue Deferred revenue is an obligation to transfer products and services to a customer for which the Company has already received consideration. Upon receipt of a prepayment from a customer for all or a portion of the transaction price, the Company recognizes deferred revenue. The Company had deferred revenue of $29,896,388 and $34,267,158 on the condensed consolidated balance sheets as of March 31, 2025 and December 31, 2024, respectively. As of March 31, 2025, approximately 74% of deferred revenue related to domestic customers, approximately 21% related to customers in Europe, and the remainder represented other regions. As of December 31, 2024, approximately 80% of deferred revenue related to domestic customers, approximately 16% related to customers in Europe, and the remainder represented other regions. Revenue recognized in the three months ended March 31, 2025 that was included in the deferred revenue balance as of December 31, 2024 was $13,191,803. Revenue recognized in the three months ended March 31, 2024 that was included in the deferred revenue balance as of December 31, 2023 was $16,650,812.

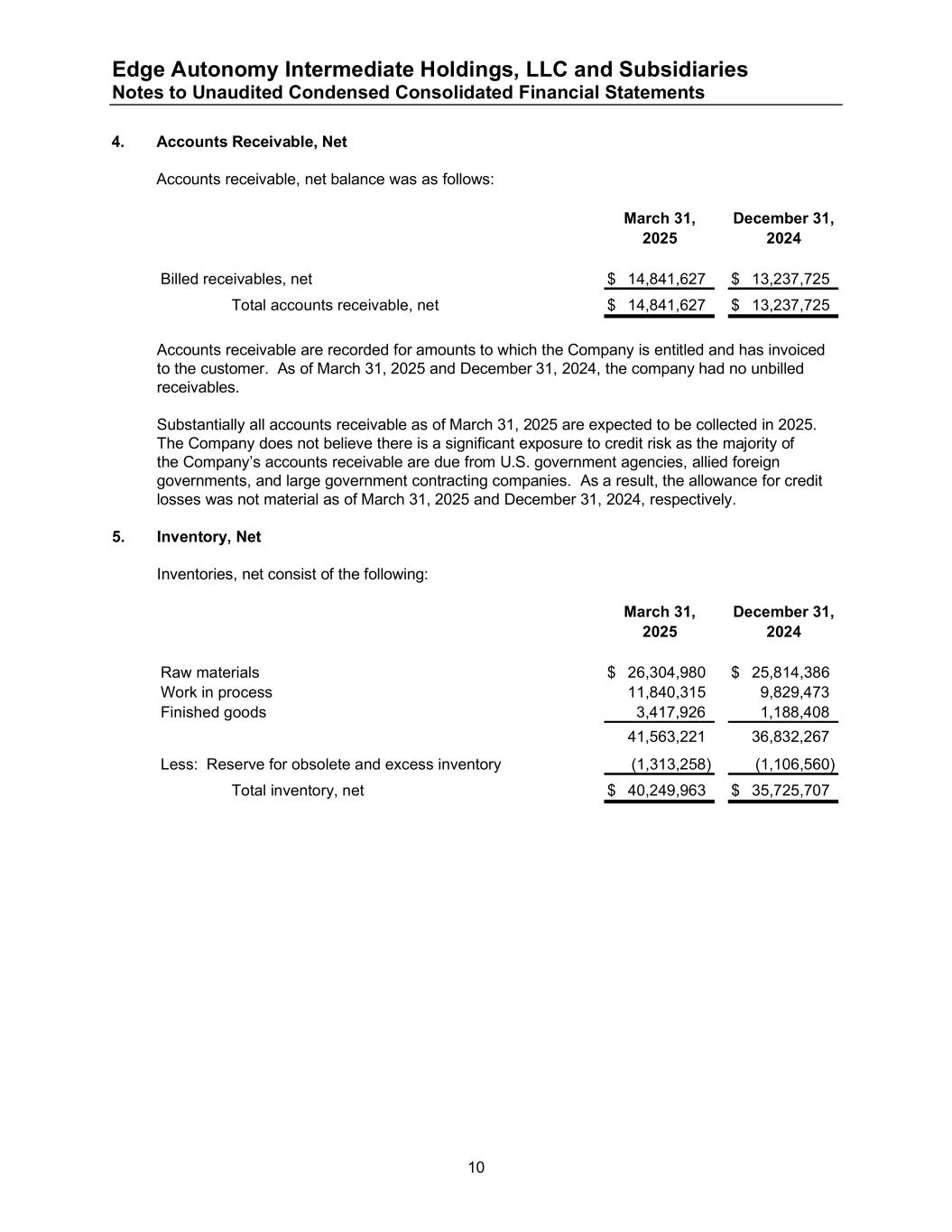

Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Notes to Unaudited Condensed Consolidated Financial Statements 10 4. Accounts Receivable, Net Accounts receivable, net balance was as follows: March 31, December 31, 2025 2024 Billed receivables, net 14,841,627$ 13,237,725$ Total accounts receivable, net 14,841,627$ 13,237,725$ Accounts receivable are recorded for amounts to which the Company is entitled and has invoiced to the customer. As of March 31, 2025 and December 31, 2024, the company had no unbilled receivables. Substantially all accounts receivable as of March 31, 2025 are expected to be collected in 2025. The Company does not believe there is a significant exposure to credit risk as the majority of the Company’s accounts receivable are due from U.S. government agencies, allied foreign governments, and large government contracting companies. As a result, the allowance for credit losses was not material as of March 31, 2025 and December 31, 2024, respectively. 5. Inventory, Net Inventories, net consist of the following: March 31, December 31, 2025 2024 Raw materials 26,304,980$ 25,814,386$ Work in process 11,840,315 9,829,473 Finished goods 3,417,926 1,188,408 41,563,221 36,832,267 Less: Reserve for obsolete and excess inventory (1,313,258) (1,106,560) Total inventory, net 40,249,963$ 35,725,707$

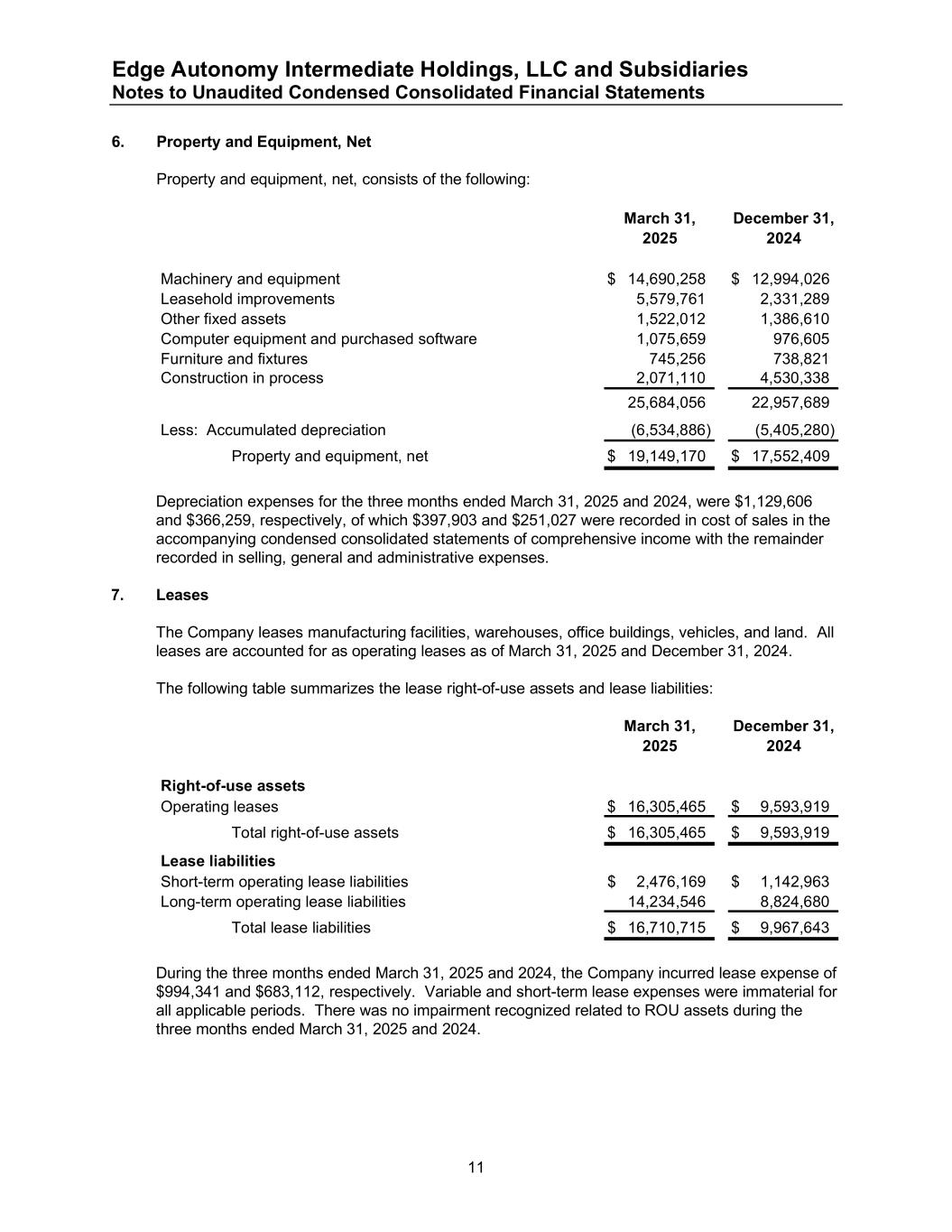

Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Notes to Unaudited Condensed Consolidated Financial Statements 11 6. Property and Equipment, Net Property and equipment, net, consists of the following: March 31, December 31, 2025 2024 Machinery and equipment 14,690,258$ 12,994,026$ Leasehold improvements 5,579,761 2,331,289 Other fixed assets 1,522,012 1,386,610 Computer equipment and purchased software 1,075,659 976,605 Furniture and fixtures 745,256 738,821 Construction in process 2,071,110 4,530,338 25,684,056 22,957,689 Less: Accumulated depreciation (6,534,886) (5,405,280) Property and equipment, net 19,149,170$ 17,552,409$ Depreciation expenses for the three months ended March 31, 2025 and 2024, were $1,129,606 and $366,259, respectively, of which $397,903 and $251,027 were recorded in cost of sales in the accompanying condensed consolidated statements of comprehensive income with the remainder recorded in selling, general and administrative expenses. 7. Leases The Company leases manufacturing facilities, warehouses, office buildings, vehicles, and land. All leases are accounted for as operating leases as of March 31, 2025 and December 31, 2024. The following table summarizes the lease right-of-use assets and lease liabilities: March 31, December 31, 2025 2024 Right-of-use assets Operating leases 16,305,465$ 9,593,919$ Total right-of-use assets 16,305,465$ 9,593,919$ Lease liabilities Short-term operating lease liabilities 2,476,169$ 1,142,963$ Long-term operating lease liabilities 14,234,546 8,824,680 Total lease liabilities 16,710,715$ 9,967,643$ During the three months ended March 31, 2025 and 2024, the Company incurred lease expense of $994,341 and $683,112, respectively. Variable and short-term lease expenses were immaterial for all applicable periods. There was no impairment recognized related to ROU assets during the three months ended March 31, 2025 and 2024.

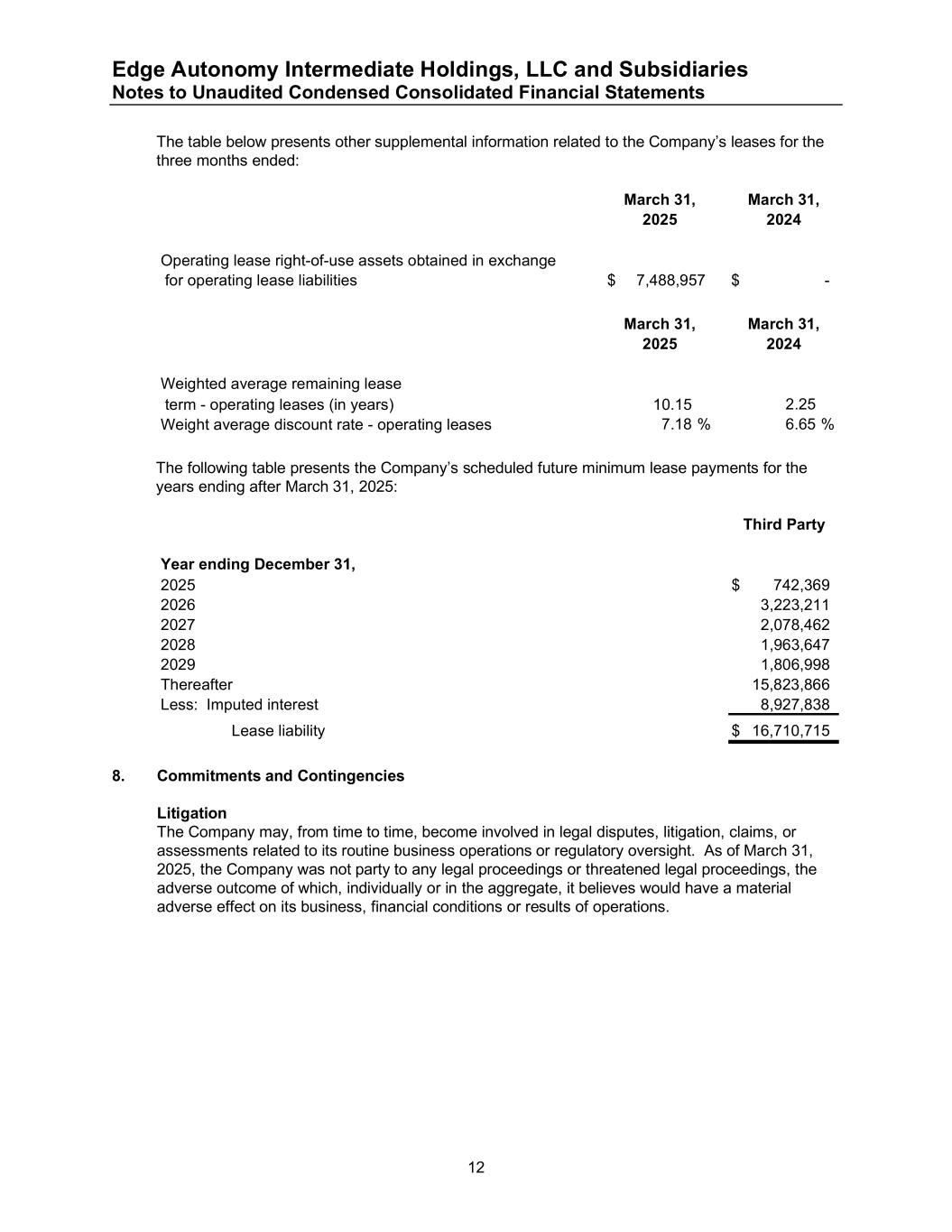

Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Notes to Unaudited Condensed Consolidated Financial Statements 12 The table below presents other supplemental information related to the Company’s leases for the three months ended: March 31, March 31, 2025 2024 Operating lease right-of-use assets obtained in exchange for operating lease liabilities 7,488,957$ -$ March 31, March 31, 2025 2024 Weighted average remaining lease term - operating leases (in years) 10.15 2.25 Weight average discount rate - operating leases 7.18 % 6.65 % The following table presents the Company’s scheduled future minimum lease payments for the years ending after March 31, 2025: Third Party Year ending December 31, 2025 742,369$ 2026 3,223,211 2027 2,078,462 2028 1,963,647 2029 1,806,998 Thereafter 15,823,866 Less: Imputed interest 8,927,838 Lease liability 16,710,715$ 8. Commitments and Contingencies Litigation The Company may, from time to time, become involved in legal disputes, litigation, claims, or assessments related to its routine business operations or regulatory oversight. As of March 31, 2025, the Company was not party to any legal proceedings or threatened legal proceedings, the adverse outcome of which, individually or in the aggregate, it believes would have a material adverse effect on its business, financial conditions or results of operations.

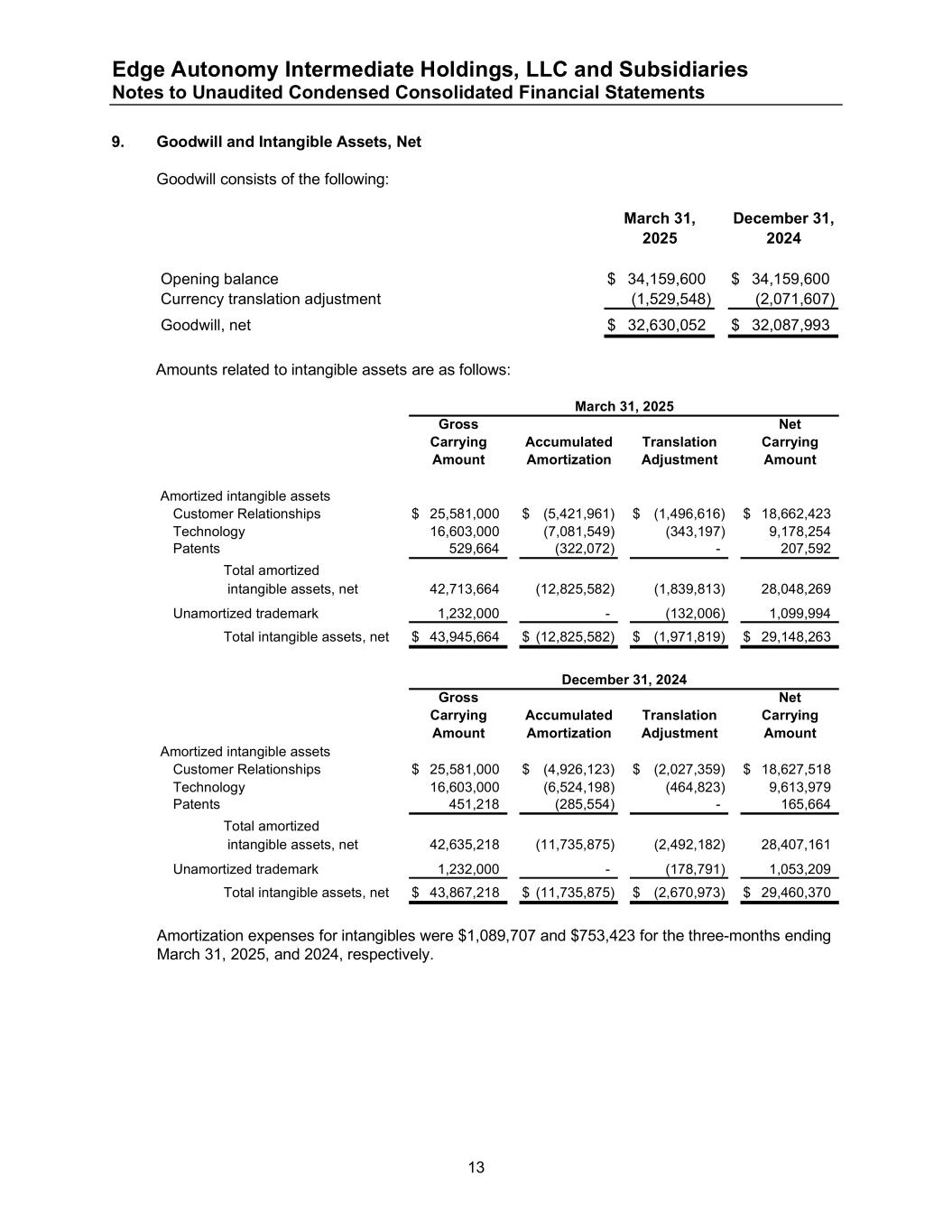

Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Notes to Unaudited Condensed Consolidated Financial Statements 13 9. Goodwill and Intangible Assets, Net Goodwill consists of the following: March 31, December 31, 2025 2024 Opening balance 34,159,600$ 34,159,600$ Currency translation adjustment (1,529,548) (2,071,607) Goodwill, net 32,630,052$ 32,087,993$ Amounts related to intangible assets are as follows: Gross Net Carrying Accumulated Translation Carrying Amount Amortization Adjustment Amount Amortized intangible assets Customer Relationships 25,581,000$ (5,421,961)$ (1,496,616)$ 18,662,423$ Technology 16,603,000 (7,081,549) (343,197) 9,178,254 Patents 529,664 (322,072) - 207,592 Total amortized intangible assets, net 42,713,664 (12,825,582) (1,839,813) 28,048,269 Unamortized trademark 1,232,000 - (132,006) 1,099,994 Total intangible assets, net 43,945,664$ (12,825,582)$ (1,971,819)$ 29,148,263$ March 31, 2025 Gross Net Carrying Accumulated Translation Carrying Amount Amortization Adjustment Amount Amortized intangible assets Customer Relationships 25,581,000$ (4,926,123)$ (2,027,359)$ 18,627,518$ Technology 16,603,000 (6,524,198) (464,823) 9,613,979 Patents 451,218 (285,554) - 165,664 Total amortized intangible assets, net 42,635,218 (11,735,875) (2,492,182) 28,407,161 Unamortized trademark 1,232,000 - (178,791) 1,053,209 Total intangible assets, net 43,867,218$ (11,735,875)$ (2,670,973)$ 29,460,370$ December 31, 2024 Amortization expenses for intangibles were $1,089,707 and $753,423 for the three-months ending March 31, 2025, and 2024, respectively.

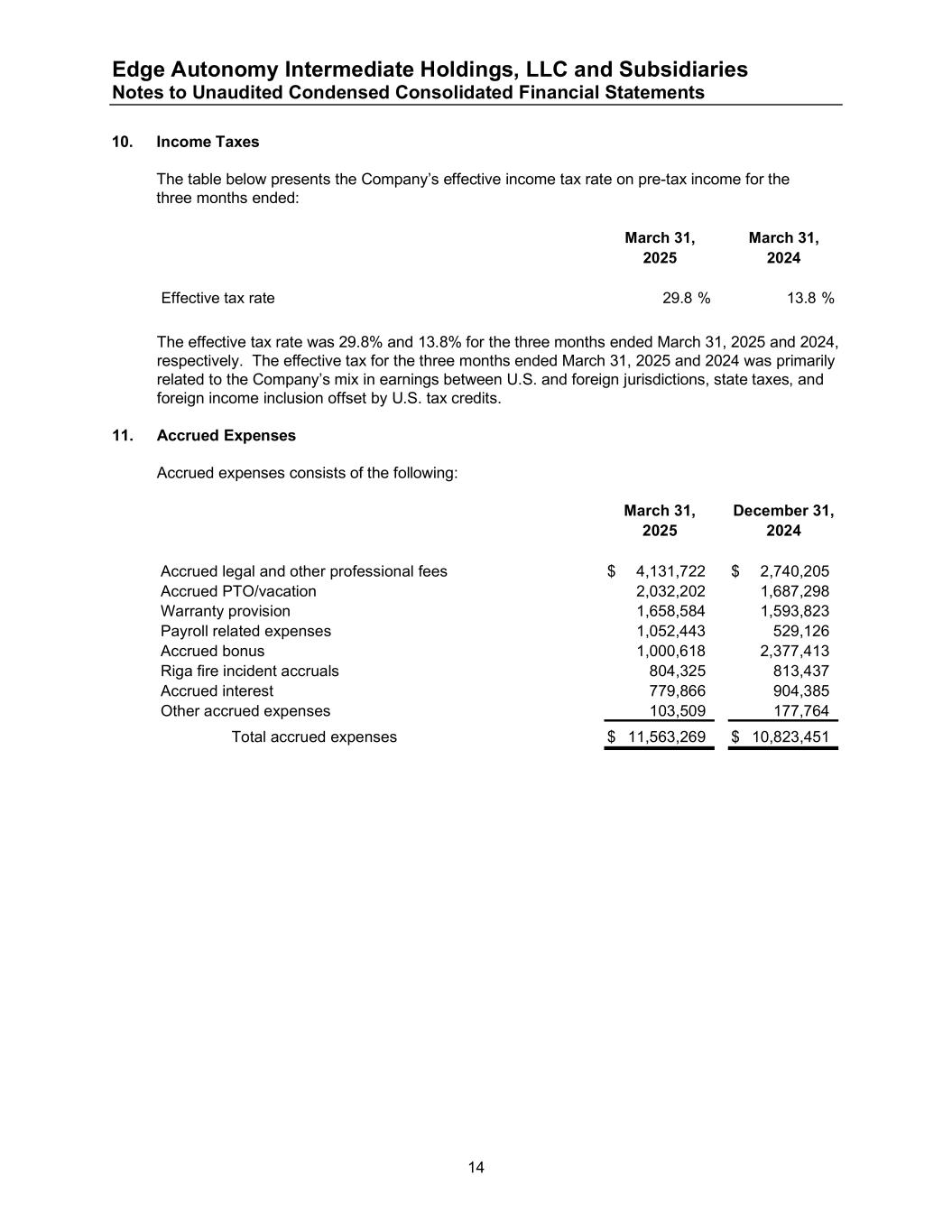

Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Notes to Unaudited Condensed Consolidated Financial Statements 14 10. Income Taxes The table below presents the Company’s effective income tax rate on pre-tax income for the three months ended: March 31, March 31, 2025 2024 Effective tax rate 29.8 % 13.8 % The effective tax rate was 29.8% and 13.8% for the three months ended March 31, 2025 and 2024, respectively. The effective tax for the three months ended March 31, 2025 and 2024 was primarily related to the Company’s mix in earnings between U.S. and foreign jurisdictions, state taxes, and foreign income inclusion offset by U.S. tax credits. 11. Accrued Expenses Accrued expenses consists of the following: March 31, December 31, 2025 2024 Accrued legal and other professional fees 4,131,722$ 2,740,205$ Accrued PTO/vacation 2,032,202 1,687,298 Warranty provision 1,658,584 1,593,823 Payroll related expenses 1,052,443 529,126 Accrued bonus 1,000,618 2,377,413 Riga fire incident accruals 804,325 813,437 Accrued interest 779,866 904,385 Other accrued expenses 103,509 177,764 Total accrued expenses 11,563,269$ 10,823,451$

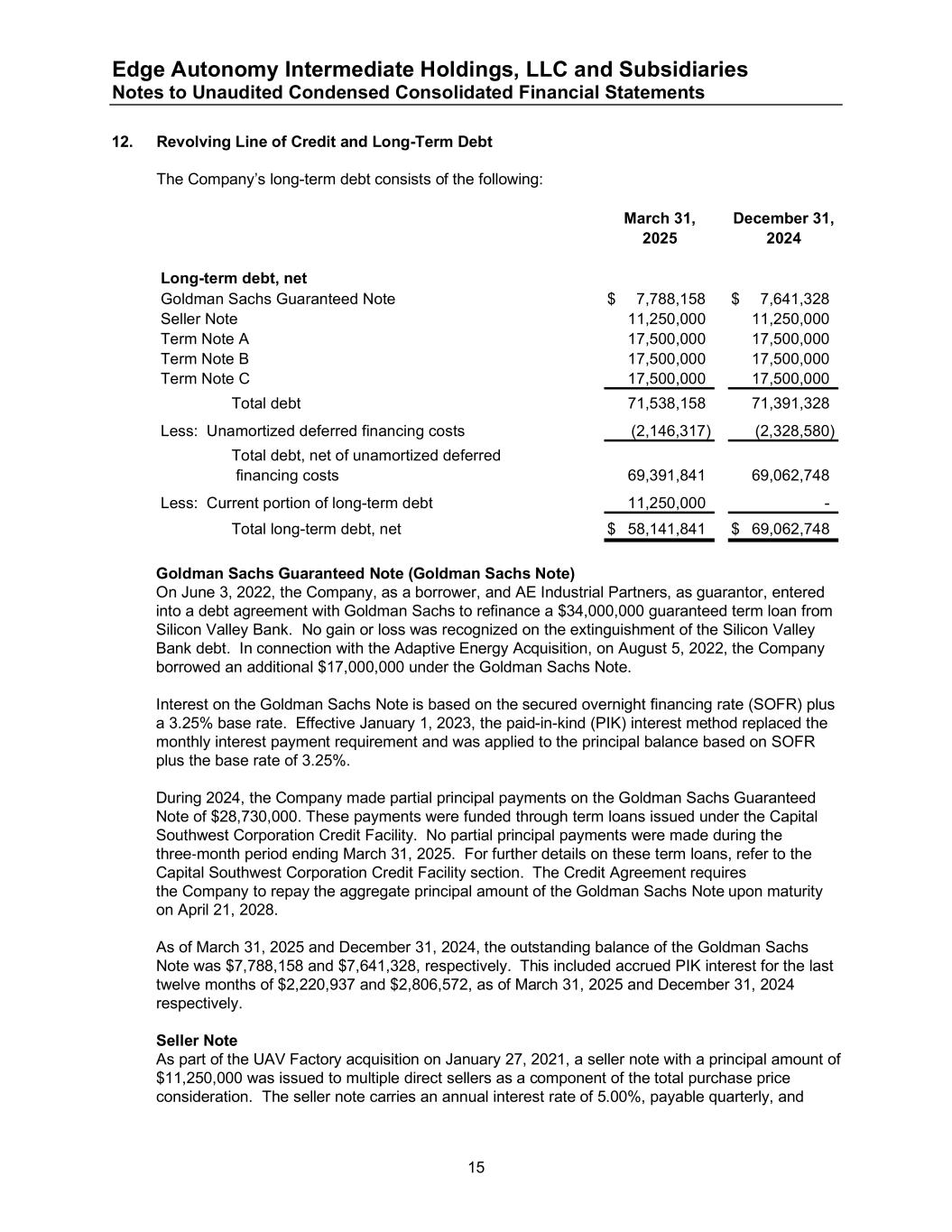

Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Notes to Unaudited Condensed Consolidated Financial Statements 15 12. Revolving Line of Credit and Long-Term Debt The Company’s long-term debt consists of the following: March 31, December 31, 2025 2024 Long-term debt, net Goldman Sachs Guaranteed Note 7,788,158$ 7,641,328$ Seller Note 11,250,000 11,250,000 Term Note A 17,500,000 17,500,000 Term Note B 17,500,000 17,500,000 Term Note C 17,500,000 17,500,000 Total debt 71,538,158 71,391,328 Less: Unamortized deferred financing costs (2,146,317) (2,328,580) Total debt, net of unamortized deferred financing costs 69,391,841 69,062,748 Less: Current portion of long-term debt 11,250,000 - Total long-term debt, net 58,141,841$ 69,062,748$ Goldman Sachs Guaranteed Note (Goldman Sachs Note) On June 3, 2022, the Company, as a borrower, and AE Industrial Partners, as guarantor, entered into a debt agreement with Goldman Sachs to refinance a $34,000,000 guaranteed term loan from Silicon Valley Bank. No gain or loss was recognized on the extinguishment of the Silicon Valley Bank debt. In connection with the Adaptive Energy Acquisition, on August 5, 2022, the Company borrowed an additional $17,000,000 under the Goldman Sachs Note. Interest on the Goldman Sachs Note is based on the secured overnight financing rate (SOFR) plus a 3.25% base rate. Effective January 1, 2023, the paid-in-kind (PIK) interest method replaced the monthly interest payment requirement and was applied to the principal balance based on SOFR plus the base rate of 3.25%. During 2024, the Company made partial principal payments on the Goldman Sachs Guaranteed Note of $28,730,000. These payments were funded through term loans issued under the Capital Southwest Corporation Credit Facility. No partial principal payments were made during the three-month period ending March 31, 2025. For further details on these term loans, refer to the Capital Southwest Corporation Credit Facility section. The Credit Agreement requires the Company to repay the aggregate principal amount of the Goldman Sachs Note upon maturity on April 21, 2028. As of March 31, 2025 and December 31, 2024, the outstanding balance of the Goldman Sachs Note was $7,788,158 and $7,641,328, respectively. This included accrued PIK interest for the last twelve months of $2,220,937 and $2,806,572, as of March 31, 2025 and December 31, 2024 respectively. Seller Note As part of the UAV Factory acquisition on January 27, 2021, a seller note with a principal amount of $11,250,000 was issued to multiple direct sellers as a component of the total purchase price consideration. The seller note carries an annual interest rate of 5.00%, payable quarterly, and

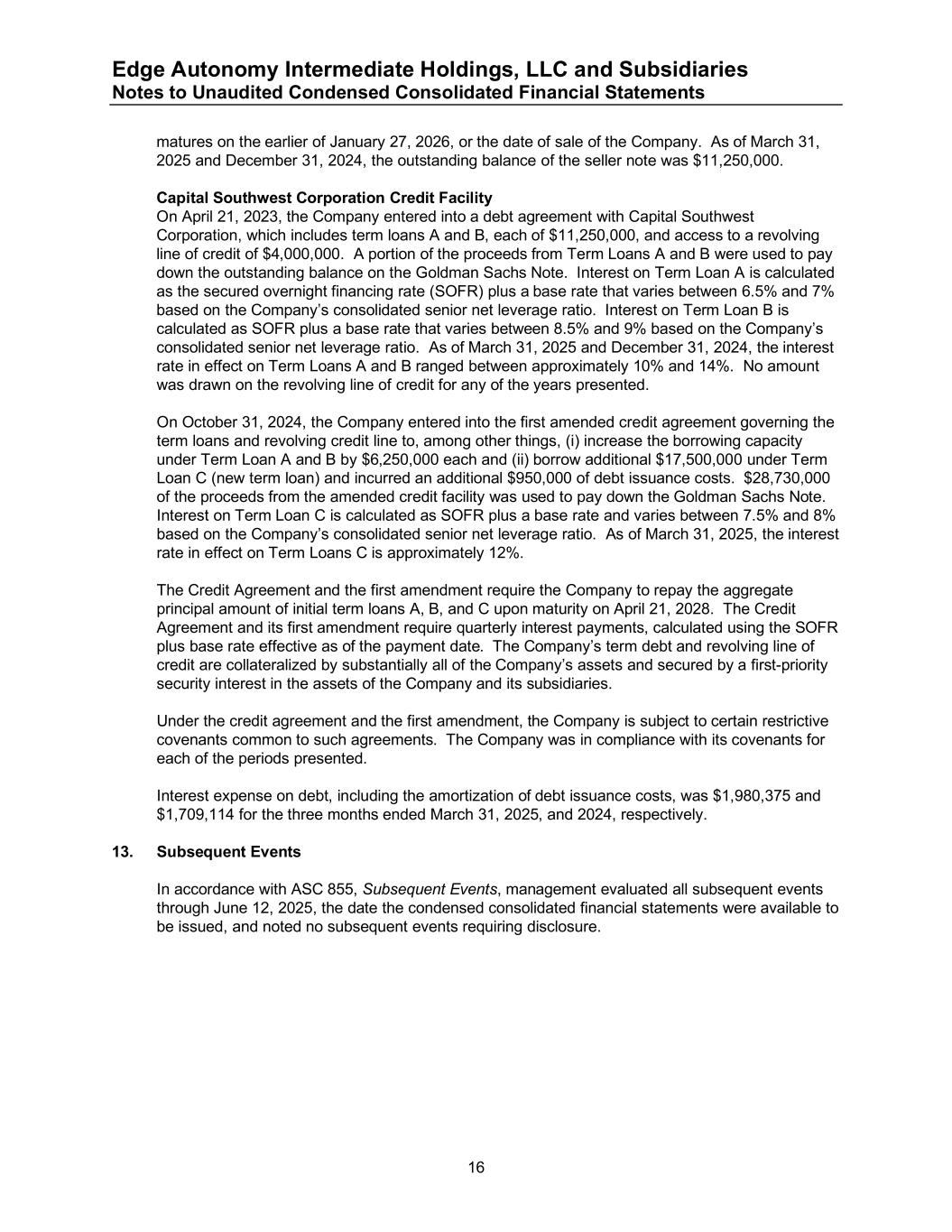

Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Notes to Unaudited Condensed Consolidated Financial Statements 16 matures on the earlier of January 27, 2026, or the date of sale of the Company. As of March 31, 2025 and December 31, 2024, the outstanding balance of the seller note was $11,250,000. Capital Southwest Corporation Credit Facility On April 21, 2023, the Company entered into a debt agreement with Capital Southwest Corporation, which includes term loans A and B, each of $11,250,000, and access to a revolving line of credit of $4,000,000. A portion of the proceeds from Term Loans A and B were used to pay down the outstanding balance on the Goldman Sachs Note. Interest on Term Loan A is calculated as the secured overnight financing rate (SOFR) plus a base rate that varies between 6.5% and 7% based on the Company’s consolidated senior net leverage ratio. Interest on Term Loan B is calculated as SOFR plus a base rate that varies between 8.5% and 9% based on the Company’s consolidated senior net leverage ratio. As of March 31, 2025 and December 31, 2024, the interest rate in effect on Term Loans A and B ranged between approximately 10% and 14%. No amount was drawn on the revolving line of credit for any of the years presented. On October 31, 2024, the Company entered into the first amended credit agreement governing the term loans and revolving credit line to, among other things, (i) increase the borrowing capacity under Term Loan A and B by $6,250,000 each and (ii) borrow additional $17,500,000 under Term Loan C (new term loan) and incurred an additional $950,000 of debt issuance costs. $28,730,000 of the proceeds from the amended credit facility was used to pay down the Goldman Sachs Note. Interest on Term Loan C is calculated as SOFR plus a base rate and varies between 7.5% and 8% based on the Company’s consolidated senior net leverage ratio. As of March 31, 2025, the interest rate in effect on Term Loans C is approximately 12%. The Credit Agreement and the first amendment require the Company to repay the aggregate principal amount of initial term loans A, B, and C upon maturity on April 21, 2028. The Credit Agreement and its first amendment require quarterly interest payments, calculated using the SOFR plus base rate effective as of the payment date. The Company’s term debt and revolving line of credit are collateralized by substantially all of the Company’s assets and secured by a first-priority security interest in the assets of the Company and its subsidiaries. Under the credit agreement and the first amendment, the Company is subject to certain restrictive covenants common to such agreements. The Company was in compliance with its covenants for each of the periods presented. Interest expense on debt, including the amortization of debt issuance costs, was $1,980,375 and $1,709,114 for the three months ended March 31, 2025, and 2024, respectively. 13. Subsequent Events In accordance with ASC 855, Subsequent Events, management evaluated all subsequent events through June 12, 2025, the date the condensed consolidated financial statements were available to be issued, and noted no subsequent events requiring disclosure.