Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Consolidated Financial Statements December 31, 2024 and 2023 and for the Years Ended December 31, 2024, 2023 and 2022 Exhibit 99.1 Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Index Page(s) Report of Independent Auditors ...................................................................................................... 1–2 Consolidated Financial Statements Consolidated Balance Sheets December 31, 2024 and 2023……………………………………………………………………………….…….3 Consolidated Statements of Comprehensive Income (Loss) Years Ended December 31, 2024, 2023 and 2022………………………………………………………………4 Consolidated Statements of Members’ Equity Years Ended December 31, 2024, 2023 and 2022………………………………………………………………5 Consolidated Statements of Cash Flows Years Ended December 31, 2024, 2023 and 2022………………………………………………………………6 Notes to Consolidated Financial Statements December 31, 2024 and 2023 and for the Years Ended December 31, 2024, 2023 and 2022 ............................................................................. 7–28

PricewaterhouseCoopers LLP, 601 South Figueroa, Los Angeles, CA 90017 T: (213) 356 6000, www.pwc.com/us Report of Independent Auditors To the Management and Board of Directors of Edge Autonomy Intermediate Holdings, LLC Opinion We have audited the accompanying consolidated financial statements of Edge Autonomy Intermediate Holdings, LLC and its subsidiaries (the “Company”), which comprise the consolidated balance sheets as of December 31, 2024 and 2023, and the related consolidated statements of comprehensive income (loss), of members’ equity and of cash flows for the years ended December 31, 2024, 2023 and 2022, including the related notes (collectively referred to as the “consolidated financial statements”). In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2024 and 2023, and the results of its operations and its cash flows for the years ended December 31, 2024, 2023 and 2022 in accordance with accounting principles generally accepted in the United States of America. Basis for Opinion We conducted our audit in accordance with auditing standards generally accepted in the United States of America (US GAAS). Our responsibilities under those standards are further described in the Auditors’ Responsibilities for the Audit of the Consolidated Financial Statements section of our report. We are required to be independent of the Company and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audit. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Responsibilities of Management for the Consolidated Financial Statements Management is responsible for the preparation and fair presentation of the consolidated financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. In preparing the consolidated financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for one year after the date the consolidated financial statements are available to be issued. 2 Auditors’ Responsibilities for the Audit of the Consolidated Financial Statements Our objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditors’ report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with US GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the consolidated financial statements. In performing an audit in accordance with US GAAS, we: Exercise professional judgment and maintain professional skepticism throughout the audit. Identify and assess the risks of material misstatement of the consolidated financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. Accordingly, no such opinion is expressed. Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the consolidated financial statements. Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for a reasonable period of time. We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control-related matters that we identified during the audit. Los Angeles, California April 2, 2025

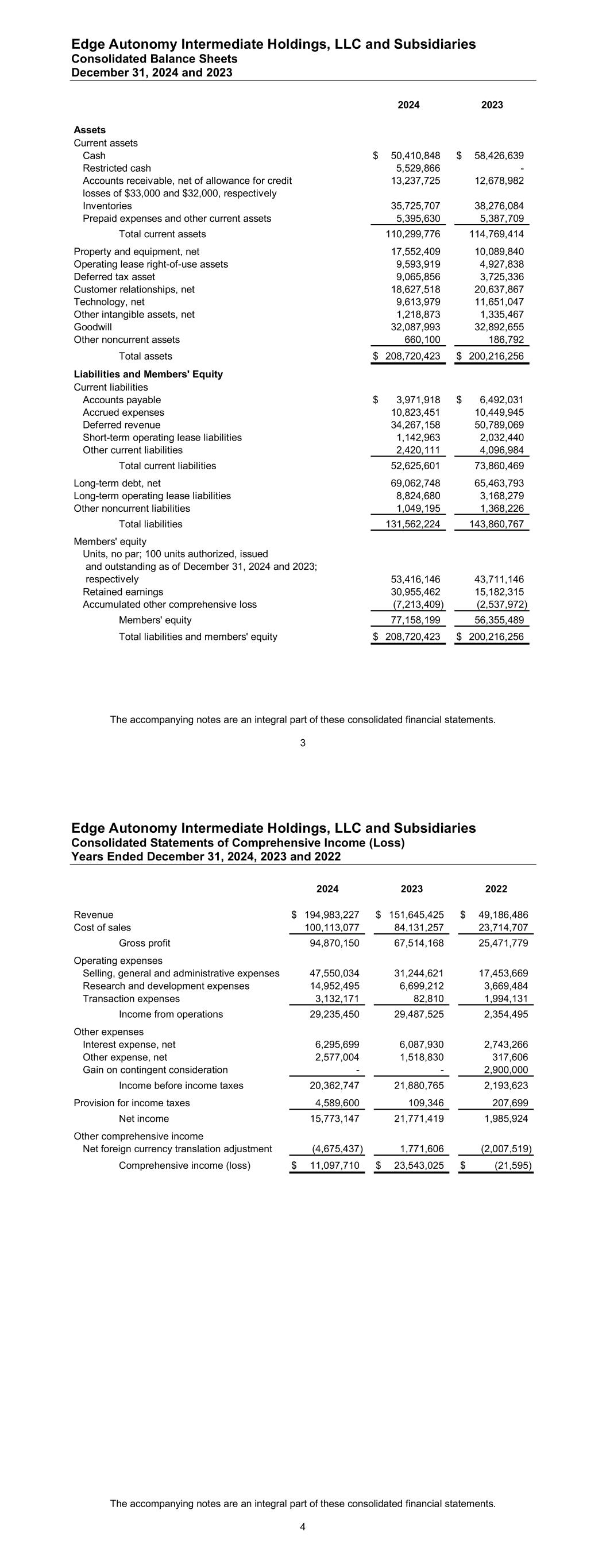

Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Consolidated Balance Sheets December 31, 2024 and 2023 The accompanying notes are an integral part of these consolidated financial statements. 3 2024 2023 Assets Current assets Cash 50,410,848$ 58,426,639$ Restricted cash 5,529,866 - 13,237,725 12,678,982 losses of $33,000 and $32,000, respectively Inventories 35,725,707 38,276,084 Prepaid expenses and other current assets 5,395,630 5,387,709 Total current assets 110,299,776 114,769,414 Property and equipment, net 17,552,409 10,089,840 Operating lease right-of-use assets 9,593,919 4,927,838 Deferred tax asset 9,065,856 3,725,336 Customer relationships, net 18,627,518 20,637,867 Technology, net 9,613,979 11,651,047 Other intangible assets, net 1,218,873 1,335,467 Goodwill 32,087,993 32,892,655 Other noncurrent assets 660,100 186,792 Total assets 208,720,423$ 200,216,256$ Liabilities and Members' Equity Current liabilities Accounts payable 3,971,918$ 6,492,031$ Accrued expenses 10,823,451 10,449,945 Deferred revenue 34,267,158 50,789,069 Short-term operating lease liabilities 1,142,963 2,032,440 Other current liabilities 2,420,111 4,096,984 Total current liabilities 52,625,601 73,860,469 Long-term debt, net 69,062,748 65,463,793 Long-term operating lease liabilities 8,824,680 3,168,279 Other noncurrent liabilities 1,049,195 1,368,226 Total liabilities 131,562,224 143,860,767 Members' equity Units, no par; 100 units authorized, issued and outstanding as of December 31, 2024 and 2023; respectively 53,416,146 43,711,146 Retained earnings 30,955,462 15,182,315 Accumulated other comprehensive loss (7,213,409) (2,537,972) Members' equity 77,158,199 56,355,489 Total liabilities and members' equity 208,720,423$ 200,216,256$ Accounts receivable, net of allowance for credit Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Consolidated Statements of Comprehensive Income (Loss) Years Ended December 31, 2024, 2023 and 2022 The accompanying notes are an integral part of these consolidated financial statements. 4 2024 2023 2022 Revenue 194,983,227$ 151,645,425$ 49,186,486$ Cost of sales 100,113,077 84,131,257 23,714,707 Gross profit 94,870,150 67,514,168 25,471,779 Operating expenses Selling, general and administrative expenses 47,550,034 31,244,621 17,453,669 Research and development expenses 14,952,495 6,699,212 3,669,484 Transaction expenses 3,132,171 82,810 1,994,131 Income from operations 29,235,450 29,487,525 2,354,495 Other expenses Interest expense, net 6,295,699 6,087,930 2,743,266 Other expense, net 2,577,004 1,518,830 317,606 Gain on contingent consideration - - 2,900,000 Income before income taxes 20,362,747 21,880,765 2,193,623 Provision for income taxes 4,589,600 109,346 207,699 Net income 15,773,147 21,771,419 1,985,924 Other comprehensive income Net foreign currency translation adjustment (4,675,437) 1,771,606 (2,007,519) Comprehensive income (loss) 11,097,710$ 23,543,025$ (21,595)$

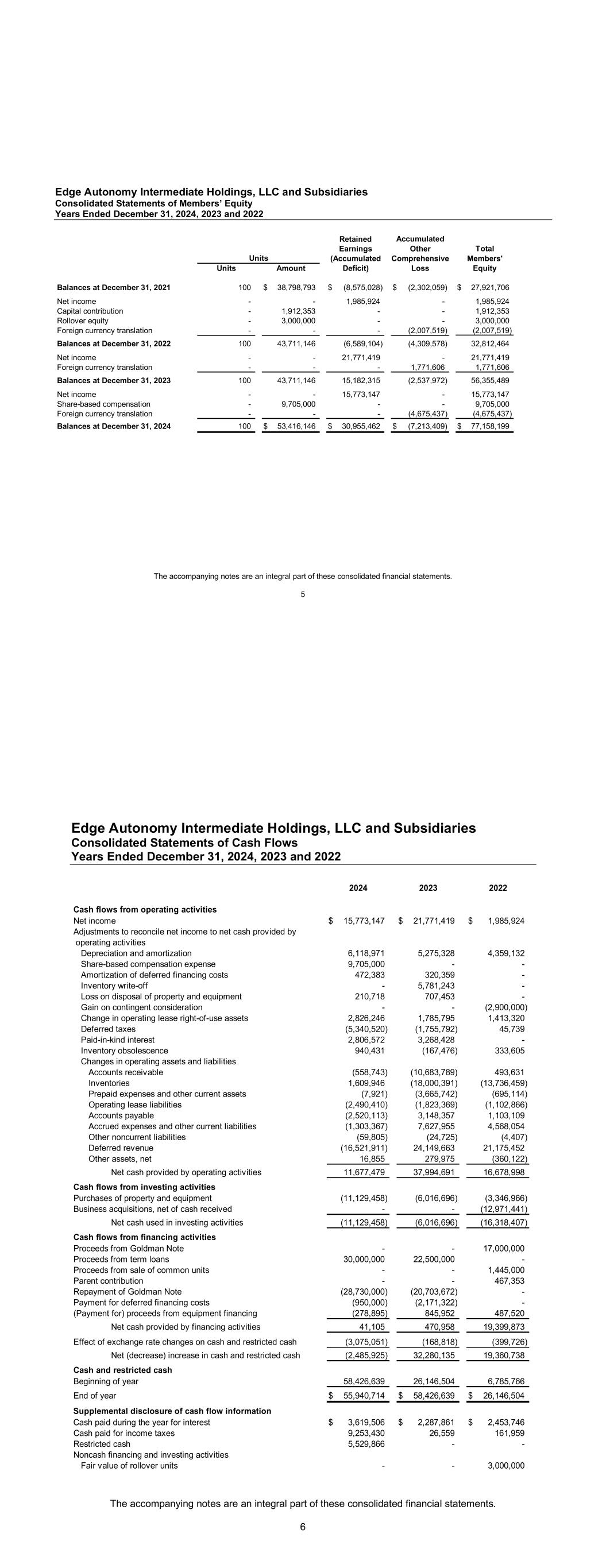

Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Consolidated Statements of Members’ Equity Years Ended December 31, 2024, 2023 and 2022 The accompanying notes are an integral part of these consolidated financial statements. 5 Retained Accumulated Earnings Other Total (Accumulated Comprehensive Members' Units Amount Deficit) Loss Equity Balances at December 31, 2021 100 38,798,793$ (8,575,028)$ (2,302,059)$ 27,921,706$ Net income - - 1,985,924 - 1,985,924 Capital contribution - 1,912,353 - - 1,912,353 Rollover equity - 3,000,000 - - 3,000,000 Foreign currency translation - - - (2,007,519) (2,007,519) Balances at December 31, 2022 100 43,711,146 (6,589,104) (4,309,578) 32,812,464 Net income - - 21,771,419 - 21,771,419 Foreign currency translation - - - 1,771,606 1,771,606 Balances at December 31, 2023 100 43,711,146 15,182,315 (2,537,972) 56,355,489 Net income - - 15,773,147 - 15,773,147 Share-based compensation - 9,705,000 - - 9,705,000 Foreign currency translation - - - (4,675,437) (4,675,437) Balances at December 31, 2024 100 53,416,146$ 30,955,462$ (7,213,409)$ 77,158,199$ Units Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Consolidated Statements of Cash Flows Years Ended December 31, 2024, 2023 and 2022 The accompanying notes are an integral part of these consolidated financial statements. 6 2024 2023 2022 Cash flows from operating activities Net income 15,773,147$ 21,771,419$ 1,985,924$ Adjustments to reconcile net income to net cash provided by operating activities Depreciation and amortization 6,118,971 5,275,328 4,359,132 Share-based compensation expense 9,705,000 - - Amortization of deferred financing costs 472,383 320,359 - Inventory write-off - 5,781,243 - Loss on disposal of property and equipment 210,718 707,453 - Gain on contingent consideration - - (2,900,000) Change in operating lease right-of-use assets 2,826,246 1,785,795 1,413,320 Deferred taxes (5,340,520) (1,755,792) 45,739 Paid-in-kind interest 2,806,572 3,268,428 - Inventory obsolescence 940,431 (167,476) 333,605 Changes in operating assets and liabilities Accounts receivable (558,743) (10,683,789) 493,631 Inventories 1,609,946 (18,000,391) (13,736,459) Prepaid expenses and other current assets (7,921) (3,665,742) (695,114) Operating lease liabilities (2,490,410) (1,823,369) (1,102,866) Accounts payable (2,520,113) 3,148,357 1,103,109 Accrued expenses and other current liabilities (1,303,367) 7,627,955 4,568,054 Other noncurrent liabilities (59,805) (24,725) (4,407) Deferred revenue (16,521,911) 24,149,663 21,175,452 Other assets, net 16,855 279,975 (360,122) Net cash provided by operating activities 11,677,479 37,994,691 16,678,998 Cash flows from investing activities Purchases of property and equipment (11,129,458) (6,016,696) (3,346,966) Business acquisitions, net of cash received - - (12,971,441) Net cash used in investing activities (11,129,458) (6,016,696) (16,318,407) Cash flows from financing activities Proceeds from Goldman Note - - 17,000,000 Proceeds from term loans 30,000,000 22,500,000 - Proceeds from sale of common units - - 1,445,000 Parent contribution - - 467,353 Repayment of Goldman Note (28,730,000) (20,703,672) - Payment for deferred financing costs (950,000) (2,171,322) - (Payment for) proceeds from equipment financing (278,895) 845,952 487,520 Net cash provided by financing activities 41,105 470,958 19,399,873 Effect of exchange rate changes on cash and restricted cash (3,075,051) (168,818) (399,726) Net (decrease) increase in cash and restricted cash (2,485,925) 32,280,135 19,360,738 Cash and restricted cash Beginning of year 58,426,639 26,146,504 6,785,766 End of year 55,940,714$ 58,426,639$ 26,146,504$ Supplemental disclosure of cash flow information Cash paid during the year for interest 3,619,506$ 2,287,861$ 2,453,746$ Cash paid for income taxes 9,253,430 26,559 161,959 Restricted cash 5,529,866 - - Noncash financing and investing activities Fair value of rollover units - - 3,000,000

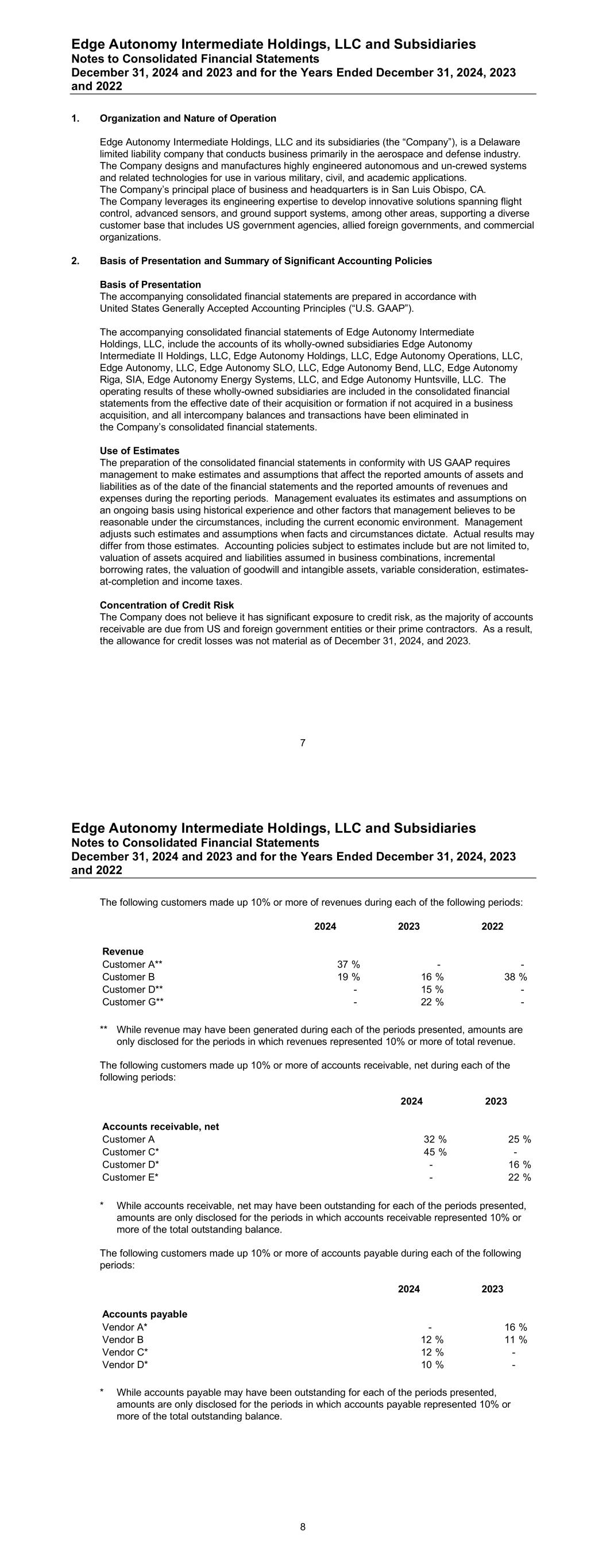

Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Notes to Consolidated Financial Statements December 31, 2024 and 2023 and for the Years Ended December 31, 2024, 2023 and 2022 7 1. Organization and Nature of Operation Edge Autonomy Intermediate Holdings, LLC and its subsidiaries (the “Company”), is a Delaware limited liability company that conducts business primarily in the aerospace and defense industry. The Company designs and manufactures highly engineered autonomous and un-crewed systems and related technologies for use in various military, civil, and academic applications. The Company’s principal place of business and headquarters is in San Luis Obispo, CA. The Company leverages its engineering expertise to develop innovative solutions spanning flight control, advanced sensors, and ground support systems, among other areas, supporting a diverse customer base that includes US government agencies, allied foreign governments, and commercial organizations. 2. Basis of Presentation and Summary of Significant Accounting Policies Basis of Presentation The accompanying consolidated financial statements are prepared in accordance with United States Generally Accepted Accounting Principles (“U.S. GAAP”). The accompanying consolidated financial statements of Edge Autonomy Intermediate Holdings, LLC, include the accounts of its wholly-owned subsidiaries Edge Autonomy Intermediate II Holdings, LLC, Edge Autonomy Holdings, LLC, Edge Autonomy Operations, LLC, Edge Autonomy, LLC, Edge Autonomy SLO, LLC, Edge Autonomy Bend, LLC, Edge Autonomy Riga, SIA, Edge Autonomy Energy Systems, LLC, and Edge Autonomy Huntsville, LLC. The operating results of these wholly-owned subsidiaries are included in the consolidated financial statements from the effective date of their acquisition or formation if not acquired in a business acquisition, and all intercompany balances and transactions have been eliminated in the Company’s consolidated financial statements. Use of Estimates The preparation of the consolidated financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities as of the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Management evaluates its estimates and assumptions on an ongoing basis using historical experience and other factors that management believes to be reasonable under the circumstances, including the current economic environment. Management adjusts such estimates and assumptions when facts and circumstances dictate. Actual results may differ from those estimates. Accounting policies subject to estimates include but are not limited to, valuation of assets acquired and liabilities assumed in business combinations, incremental borrowing rates, the valuation of goodwill and intangible assets, variable consideration, estimates- at-completion and income taxes. Concentration of Credit Risk The Company does not believe it has significant exposure to credit risk, as the majority of accounts receivable are due from US and foreign government entities or their prime contractors. As a result, the allowance for credit losses was not material as of December 31, 2024, and 2023. Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Notes to Consolidated Financial Statements December 31, 2024 and 2023 and for the Years Ended December 31, 2024, 2023 and 2022 8 The following customers made up 10% or more of revenues during each of the following periods: 2024 2023 2022 Revenue Customer A** 37 % - - Customer B 19 % 16 % 38 % Customer D** - 15 % - Customer G** - 22 % - ** While revenue may have been generated during each of the periods presented, amounts are only disclosed for the periods in which revenues represented 10% or more of total revenue. The following customers made up 10% or more of accounts receivable, net during each of the following periods: 2024 2023 Accounts receivable, net Customer A 32 % 25 % Customer C* 45 % - Customer D* - 16 % Customer E* - 22 % * While accounts receivable, net may have been outstanding for each of the periods presented, amounts are only disclosed for the periods in which accounts receivable represented 10% or more of the total outstanding balance. The following customers made up 10% or more of accounts payable during each of the following periods: 2024 2023 Accounts payable Vendor A* - 16 % Vendor B 12 % 11 % Vendor C* 12 % - Vendor D* 10 % - * While accounts payable may have been outstanding for each of the periods presented, amounts are only disclosed for the periods in which accounts payable represented 10% or more of the total outstanding balance.

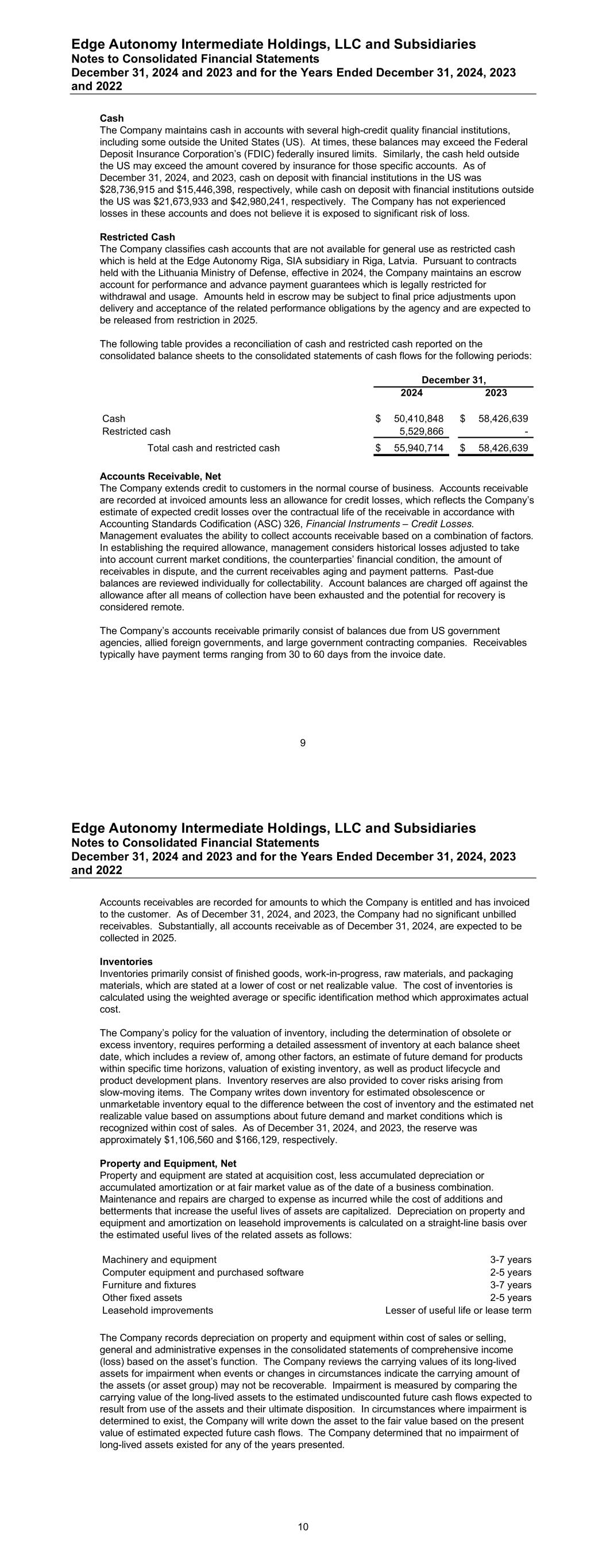

Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Notes to Consolidated Financial Statements December 31, 2024 and 2023 and for the Years Ended December 31, 2024, 2023 and 2022 9 Cash The Company maintains cash in accounts with several high-credit quality financial institutions, including some outside the United States (US). At times, these balances may exceed the Federal Deposit Insurance Corporation’s (FDIC) federally insured limits. Similarly, the cash held outside the US may exceed the amount covered by insurance for those specific accounts. As of December 31, 2024, and 2023, cash on deposit with financial institutions in the US was $28,736,915 and $15,446,398, respectively, while cash on deposit with financial institutions outside the US was $21,673,933 and $42,980,241, respectively. The Company has not experienced losses in these accounts and does not believe it is exposed to significant risk of loss. Restricted Cash The Company classifies cash accounts that are not available for general use as restricted cash which is held at the Edge Autonomy Riga, SIA subsidiary in Riga, Latvia. Pursuant to contracts held with the Lithuania Ministry of Defense, effective in 2024, the Company maintains an escrow account for performance and advance payment guarantees which is legally restricted for withdrawal and usage. Amounts held in escrow may be subject to final price adjustments upon delivery and acceptance of the related performance obligations by the agency and are expected to be released from restriction in 2025. The following table provides a reconciliation of cash and restricted cash reported on the consolidated balance sheets to the consolidated statements of cash flows for the following periods: 2024 2023 Cash 50,410,848$ 58,426,639$ Restricted cash 5,529,866 - Total cash and restricted cash 55,940,714$ 58,426,639$ December 31, Accounts Receivable, Net The Company extends credit to customers in the normal course of business. Accounts receivable are recorded at invoiced amounts less an allowance for credit losses, which reflects the Company’s estimate of expected credit losses over the contractual life of the receivable in accordance with Accounting Standards Codification (ASC) 326, Financial Instruments – Credit Losses. Management evaluates the ability to collect accounts receivable based on a combination of factors. In establishing the required allowance, management considers historical losses adjusted to take into account current market conditions, the counterparties’ financial condition, the amount of receivables in dispute, and the current receivables aging and payment patterns. Past-due balances are reviewed individually for collectability. Account balances are charged off against the allowance after all means of collection have been exhausted and the potential for recovery is considered remote. The Company’s accounts receivable primarily consist of balances due from US government agencies, allied foreign governments, and large government contracting companies. Receivables typically have payment terms ranging from 30 to 60 days from the invoice date. Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Notes to Consolidated Financial Statements December 31, 2024 and 2023 and for the Years Ended December 31, 2024, 2023 and 2022 10 Accounts receivables are recorded for amounts to which the Company is entitled and has invoiced to the customer. As of December 31, 2024, and 2023, the Company had no significant unbilled receivables. Substantially, all accounts receivable as of December 31, 2024, are expected to be collected in 2025. Inventories Inventories primarily consist of finished goods, work-in-progress, raw materials, and packaging materials, which are stated at a lower of cost or net realizable value. The cost of inventories is calculated using the weighted average or specific identification method which approximates actual cost. The Company’s policy for the valuation of inventory, including the determination of obsolete or excess inventory, requires performing a detailed assessment of inventory at each balance sheet date, which includes a review of, among other factors, an estimate of future demand for products within specific time horizons, valuation of existing inventory, as well as product lifecycle and product development plans. Inventory reserves are also provided to cover risks arising from slow-moving items. The Company writes down inventory for estimated obsolescence or unmarketable inventory equal to the difference between the cost of inventory and the estimated net realizable value based on assumptions about future demand and market conditions which is recognized within cost of sales. As of December 31, 2024, and 2023, the reserve was approximately $1,106,560 and $166,129, respectively. Property and Equipment, Net Property and equipment are stated at acquisition cost, less accumulated depreciation or accumulated amortization or at fair market value as of the date of a business combination. Maintenance and repairs are charged to expense as incurred while the cost of additions and betterments that increase the useful lives of assets are capitalized. Depreciation on property and equipment and amortization on leasehold improvements is calculated on a straight-line basis over the estimated useful lives of the related assets as follows: Machinery and equipment 3-7 years Computer equipment and purchased software 2-5 years Furniture and fixtures 3-7 years Other fixed assets 2-5 years Leasehold improvements Lesser of useful life or lease term The Company records depreciation on property and equipment within cost of sales or selling, general and administrative expenses in the consolidated statements of comprehensive income (loss) based on the asset’s function. The Company reviews the carrying values of its long-lived assets for impairment when events or changes in circumstances indicate the carrying amount of the assets (or asset group) may not be recoverable. Impairment is measured by comparing the carrying value of the long-lived assets to the estimated undiscounted future cash flows expected to result from use of the assets and their ultimate disposition. In circumstances where impairment is determined to exist, the Company will write down the asset to the fair value based on the present value of estimated expected future cash flows. The Company determined that no impairment of long-lived assets existed for any of the years presented.

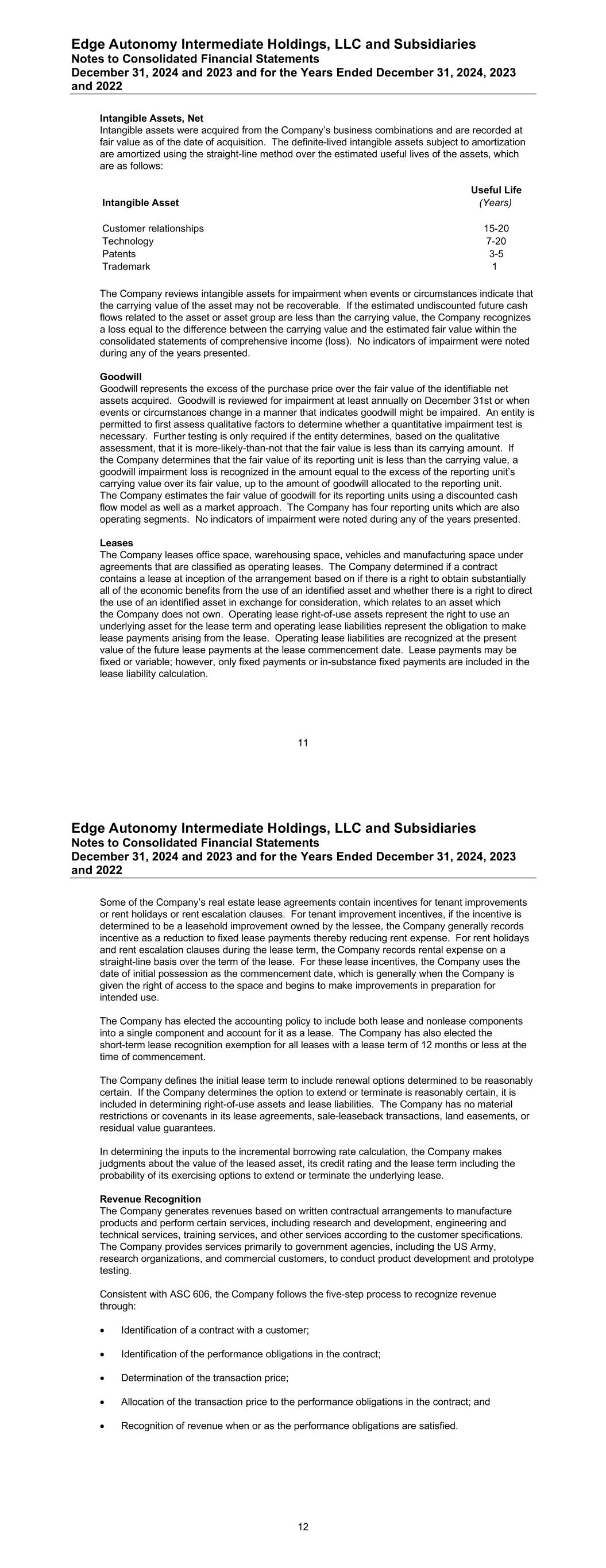

Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Notes to Consolidated Financial Statements December 31, 2024 and 2023 and for the Years Ended December 31, 2024, 2023 and 2022 11 Intangible Assets, Net Intangible assets were acquired from the Company’s business combinations and are recorded at fair value as of the date of acquisition. The definite-lived intangible assets subject to amortization are amortized using the straight-line method over the estimated useful lives of the assets, which are as follows: Useful Life Intangible Asset (Years) Customer relationships 15-20 Technology 7-20 Patents 3-5 Trademark 1 The Company reviews intangible assets for impairment when events or circumstances indicate that the carrying value of the asset may not be recoverable. If the estimated undiscounted future cash flows related to the asset or asset group are less than the carrying value, the Company recognizes a loss equal to the difference between the carrying value and the estimated fair value within the consolidated statements of comprehensive income (loss). No indicators of impairment were noted during any of the years presented. Goodwill Goodwill represents the excess of the purchase price over the fair value of the identifiable net assets acquired. Goodwill is reviewed for impairment at least annually on December 31st or when events or circumstances change in a manner that indicates goodwill might be impaired. An entity is permitted to first assess qualitative factors to determine whether a quantitative impairment test is necessary. Further testing is only required if the entity determines, based on the qualitative assessment, that it is more-likely-than-not that the fair value is less than its carrying amount. If the Company determines that the fair value of its reporting unit is less than the carrying value, a goodwill impairment loss is recognized in the amount equal to the excess of the reporting unit’s carrying value over its fair value, up to the amount of goodwill allocated to the reporting unit. The Company estimates the fair value of goodwill for its reporting units using a discounted cash flow model as well as a market approach. The Company has four reporting units which are also operating segments. No indicators of impairment were noted during any of the years presented. Leases The Company leases office space, warehousing space, vehicles and manufacturing space under agreements that are classified as operating leases. The Company determined if a contract contains a lease at inception of the arrangement based on if there is a right to obtain substantially all of the economic benefits from the use of an identified asset and whether there is a right to direct the use of an identified asset in exchange for consideration, which relates to an asset which the Company does not own. Operating lease right-of-use assets represent the right to use an underlying asset for the lease term and operating lease liabilities represent the obligation to make lease payments arising from the lease. Operating lease liabilities are recognized at the present value of the future lease payments at the lease commencement date. Lease payments may be fixed or variable; however, only fixed payments or in-substance fixed payments are included in the lease liability calculation. Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Notes to Consolidated Financial Statements December 31, 2024 and 2023 and for the Years Ended December 31, 2024, 2023 and 2022 12 Some of the Company’s real estate lease agreements contain incentives for tenant improvements or rent holidays or rent escalation clauses. For tenant improvement incentives, if the incentive is determined to be a leasehold improvement owned by the lessee, the Company generally records incentive as a reduction to fixed lease payments thereby reducing rent expense. For rent holidays and rent escalation clauses during the lease term, the Company records rental expense on a straight-line basis over the term of the lease. For these lease incentives, the Company uses the date of initial possession as the commencement date, which is generally when the Company is given the right of access to the space and begins to make improvements in preparation for intended use. The Company has elected the accounting policy to include both lease and nonlease components into a single component and account for it as a lease. The Company has also elected the short-term lease recognition exemption for all leases with a lease term of 12 months or less at the time of commencement. The Company defines the initial lease term to include renewal options determined to be reasonably certain. If the Company determines the option to extend or terminate is reasonably certain, it is included in determining right-of-use assets and lease liabilities. The Company has no material restrictions or covenants in its lease agreements, sale-leaseback transactions, land easements, or residual value guarantees. In determining the inputs to the incremental borrowing rate calculation, the Company makes judgments about the value of the leased asset, its credit rating and the lease term including the probability of its exercising options to extend or terminate the underlying lease. Revenue Recognition The Company generates revenues based on written contractual arrangements to manufacture products and perform certain services, including research and development, engineering and technical services, training services, and other services according to the customer specifications. The Company provides services primarily to government agencies, including the US Army, research organizations, and commercial customers, to conduct product development and prototype testing. Consistent with ASC 606, the Company follows the five-step process to recognize revenue through: Identification of a contract with a customer; Identification of the performance obligations in the contract; Determination of the transaction price; Allocation of the transaction price to the performance obligations in the contract; and Recognition of revenue when or as the performance obligations are satisfied.

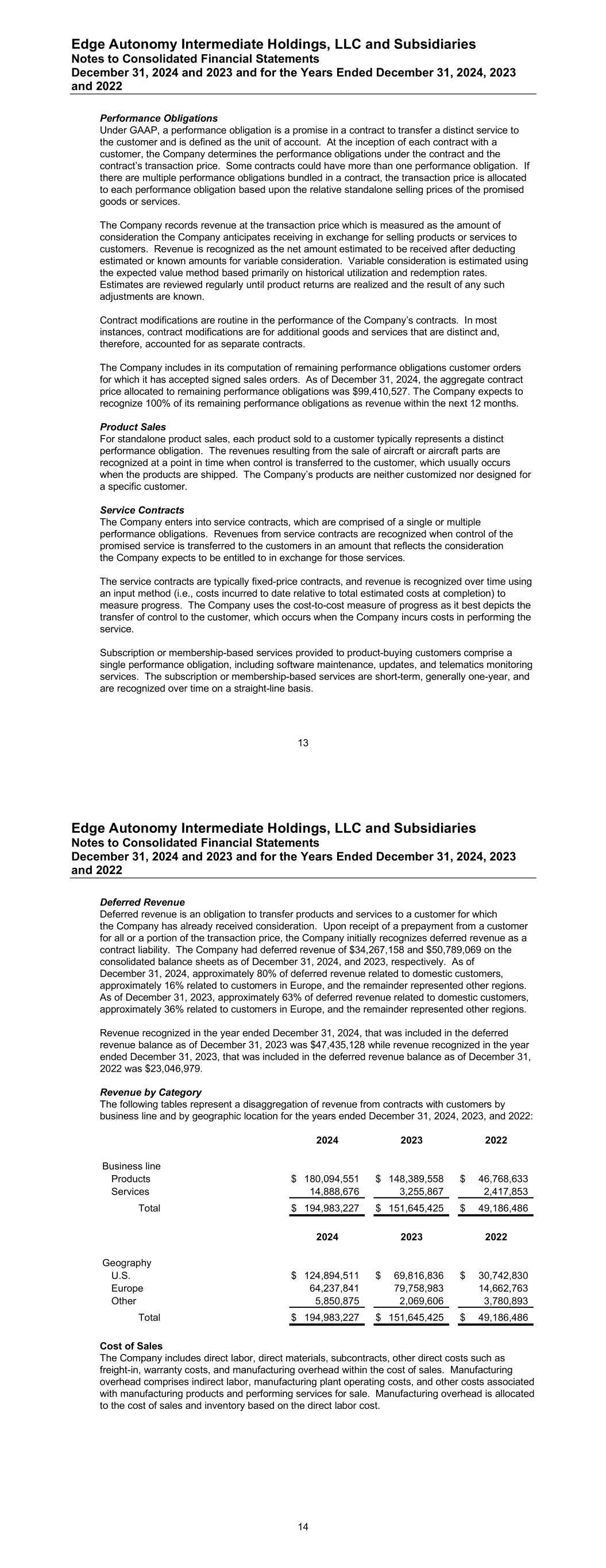

Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Notes to Consolidated Financial Statements December 31, 2024 and 2023 and for the Years Ended December 31, 2024, 2023 and 2022 13 Performance Obligations Under GAAP, a performance obligation is a promise in a contract to transfer a distinct service to the customer and is defined as the unit of account. At the inception of each contract with a customer, the Company determines the performance obligations under the contract and the contract’s transaction price. Some contracts could have more than one performance obligation. If there are multiple performance obligations bundled in a contract, the transaction price is allocated to each performance obligation based upon the relative standalone selling prices of the promised goods or services. The Company records revenue at the transaction price which is measured as the amount of consideration the Company anticipates receiving in exchange for selling products or services to customers. Revenue is recognized as the net amount estimated to be received after deducting estimated or known amounts for variable consideration. Variable consideration is estimated using the expected value method based primarily on historical utilization and redemption rates. Estimates are reviewed regularly until product returns are realized and the result of any such adjustments are known. Contract modifications are routine in the performance of the Company’s contracts. In most instances, contract modifications are for additional goods and services that are distinct and, therefore, accounted for as separate contracts. The Company includes in its computation of remaining performance obligations customer orders for which it has accepted signed sales orders. As of December 31, 2024, the aggregate contract price allocated to remaining performance obligations was $99,410,527. The Company expects to recognize 100% of its remaining performance obligations as revenue within the next 12 months. Product Sales For standalone product sales, each product sold to a customer typically represents a distinct performance obligation. The revenues resulting from the sale of aircraft or aircraft parts are recognized at a point in time when control is transferred to the customer, which usually occurs when the products are shipped. The Company’s products are neither customized nor designed for a specific customer. Service Contracts The Company enters into service contracts, which are comprised of a single or multiple performance obligations. Revenues from service contracts are recognized when control of the promised service is transferred to the customers in an amount that reflects the consideration the Company expects to be entitled to in exchange for those services. The service contracts are typically fixed-price contracts, and revenue is recognized over time using an input method (i.e., costs incurred to date relative to total estimated costs at completion) to measure progress. The Company uses the cost-to-cost measure of progress as it best depicts the transfer of control to the customer, which occurs when the Company incurs costs in performing the service. Subscription or membership-based services provided to product-buying customers comprise a single performance obligation, including software maintenance, updates, and telematics monitoring services. The subscription or membership-based services are short-term, generally one-year, and are recognized over time on a straight-line basis. Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Notes to Consolidated Financial Statements December 31, 2024 and 2023 and for the Years Ended December 31, 2024, 2023 and 2022 14 Deferred Revenue Deferred revenue is an obligation to transfer products and services to a customer for which the Company has already received consideration. Upon receipt of a prepayment from a customer for all or a portion of the transaction price, the Company initially recognizes deferred revenue as a contract liability. The Company had deferred revenue of $34,267,158 and $50,789,069 on the consolidated balance sheets as of December 31, 2024, and 2023, respectively. As of December 31, 2024, approximately 80% of deferred revenue related to domestic customers, approximately 16% related to customers in Europe, and the remainder represented other regions. As of December 31, 2023, approximately 63% of deferred revenue related to domestic customers, approximately 36% related to customers in Europe, and the remainder represented other regions. Revenue recognized in the year ended December 31, 2024, that was included in the deferred revenue balance as of December 31, 2023 was $47,435,128 while revenue recognized in the year ended December 31, 2023, that was included in the deferred revenue balance as of December 31, 2022 was $23,046,979. Revenue by Category The following tables represent a disaggregation of revenue from contracts with customers by business line and by geographic location for the years ended December 31, 2024, 2023, and 2022: 2024 2023 2022 Business line Products 180,094,551$ 148,389,558$ 46,768,633$ Services 14,888,676 3,255,867 2,417,853 Total 194,983,227$ 151,645,425$ 49,186,486$ 2024 2023 2022 Geography U.S. 124,894,511$ 69,816,836$ 30,742,830$ Europe 64,237,841 79,758,983 14,662,763 Other 5,850,875 2,069,606 3,780,893 Total 194,983,227$ 151,645,425$ 49,186,486$ Cost of Sales The Company includes direct labor, direct materials, subcontracts, other direct costs such as freight-in, warranty costs, and manufacturing overhead within the cost of sales. Manufacturing overhead comprises indirect labor, manufacturing plant operating costs, and other costs associated with manufacturing products and performing services for sale. Manufacturing overhead is allocated to the cost of sales and inventory based on the direct labor cost.

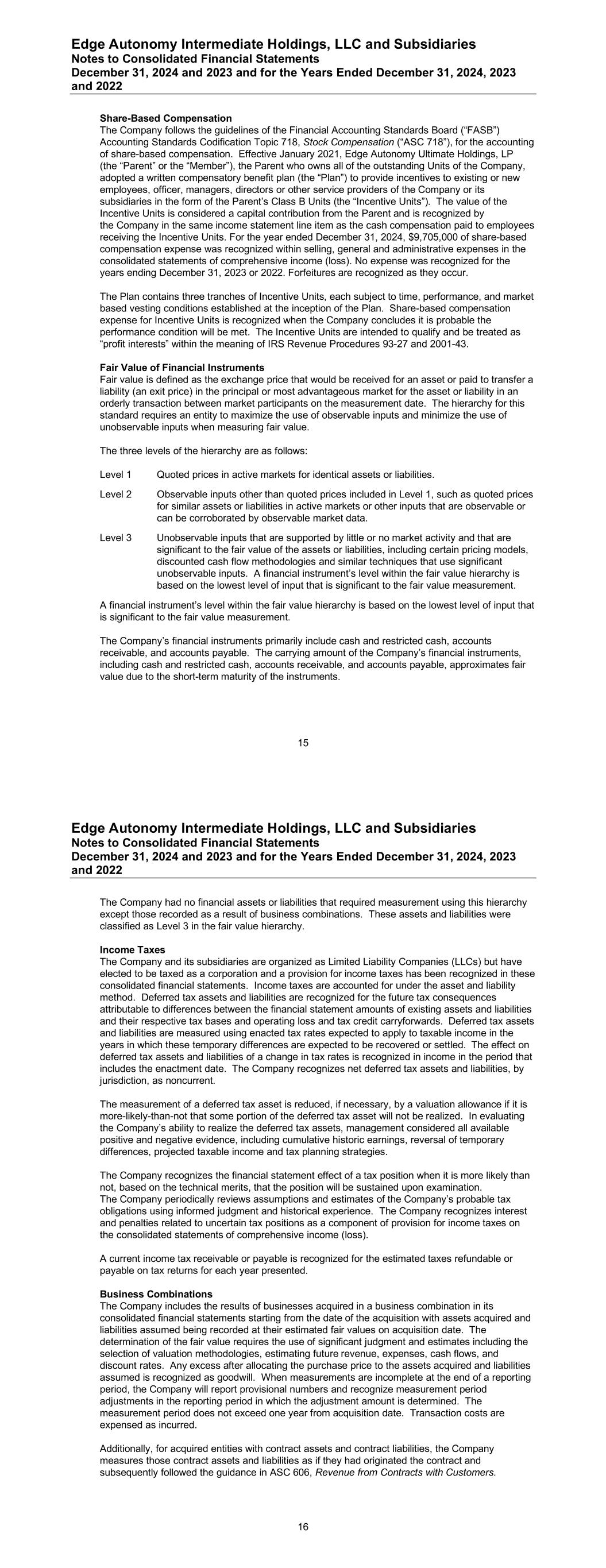

Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Notes to Consolidated Financial Statements December 31, 2024 and 2023 and for the Years Ended December 31, 2024, 2023 and 2022 15 Share-Based Compensation The Company follows the guidelines of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 718, Stock Compensation (“ASC 718”), for the accounting of share-based compensation. Effective January 2021, Edge Autonomy Ultimate Holdings, LP (the “Parent” or the “Member”), the Parent who owns all of the outstanding Units of the Company, adopted a written compensatory benefit plan (the “Plan”) to provide incentives to existing or new employees, officer, managers, directors or other service providers of the Company or its subsidiaries in the form of the Parent’s Class B Units (the “Incentive Units”). The value of the Incentive Units is considered a capital contribution from the Parent and is recognized by the Company in the same income statement line item as the cash compensation paid to employees receiving the Incentive Units. For the year ended December 31, 2024, $9,705,000 of share-based compensation expense was recognized within selling, general and administrative expenses in the consolidated statements of comprehensive income (loss). No expense was recognized for the years ending December 31, 2023 or 2022. Forfeitures are recognized as they occur. The Plan contains three tranches of Incentive Units, each subject to time, performance, and market based vesting conditions established at the inception of the Plan. Share-based compensation expense for Incentive Units is recognized when the Company concludes it is probable the performance condition will be met. The Incentive Units are intended to qualify and be treated as “profit interests” within the meaning of IRS Revenue Procedures 93-27 and 2001-43. Fair Value of Financial Instruments Fair value is defined as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. The hierarchy for this standard requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. The three levels of the hierarchy are as follows: Level 1 Quoted prices in active markets for identical assets or liabilities. Level 2 Observable inputs other than quoted prices included in Level 1, such as quoted prices for similar assets or liabilities in active markets or other inputs that are observable or can be corroborated by observable market data. Level 3 Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities, including certain pricing models, discounted cash flow methodologies and similar techniques that use significant unobservable inputs. A financial instrument’s level within the fair value hierarchy is based on the lowest level of input that is significant to the fair value measurement. A financial instrument’s level within the fair value hierarchy is based on the lowest level of input that is significant to the fair value measurement. The Company’s financial instruments primarily include cash and restricted cash, accounts receivable, and accounts payable. The carrying amount of the Company’s financial instruments, including cash and restricted cash, accounts receivable, and accounts payable, approximates fair value due to the short-term maturity of the instruments. Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Notes to Consolidated Financial Statements December 31, 2024 and 2023 and for the Years Ended December 31, 2024, 2023 and 2022 16 The Company had no financial assets or liabilities that required measurement using this hierarchy except those recorded as a result of business combinations. These assets and liabilities were classified as Level 3 in the fair value hierarchy. Income Taxes The Company and its subsidiaries are organized as Limited Liability Companies (LLCs) but have elected to be taxed as a corporation and a provision for income taxes has been recognized in these consolidated financial statements. Income taxes are accounted for under the asset and liability method. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement amounts of existing assets and liabilities and their respective tax bases and operating loss and tax credit carryforwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which these temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. The Company recognizes net deferred tax assets and liabilities, by jurisdiction, as noncurrent. The measurement of a deferred tax asset is reduced, if necessary, by a valuation allowance if it is more-likely-than-not that some portion of the deferred tax asset will not be realized. In evaluating the Company’s ability to realize the deferred tax assets, management considered all available positive and negative evidence, including cumulative historic earnings, reversal of temporary differences, projected taxable income and tax planning strategies. The Company recognizes the financial statement effect of a tax position when it is more likely than not, based on the technical merits, that the position will be sustained upon examination. The Company periodically reviews assumptions and estimates of the Company’s probable tax obligations using informed judgment and historical experience. The Company recognizes interest and penalties related to uncertain tax positions as a component of provision for income taxes on the consolidated statements of comprehensive income (loss). A current income tax receivable or payable is recognized for the estimated taxes refundable or payable on tax returns for each year presented. Business Combinations The Company includes the results of businesses acquired in a business combination in its consolidated financial statements starting from the date of the acquisition with assets acquired and liabilities assumed being recorded at their estimated fair values on acquisition date. The determination of the fair value requires the use of significant judgment and estimates including the selection of valuation methodologies, estimating future revenue, expenses, cash flows, and discount rates. Any excess after allocating the purchase price to the assets acquired and liabilities assumed is recognized as goodwill. When measurements are incomplete at the end of a reporting period, the Company will report provisional numbers and recognize measurement period adjustments in the reporting period in which the adjustment amount is determined. The measurement period does not exceed one year from acquisition date. Transaction costs are expensed as incurred. Additionally, for acquired entities with contract assets and contract liabilities, the Company measures those contract assets and liabilities as if they had originated the contract and subsequently followed the guidance in ASC 606, Revenue from Contracts with Customers.

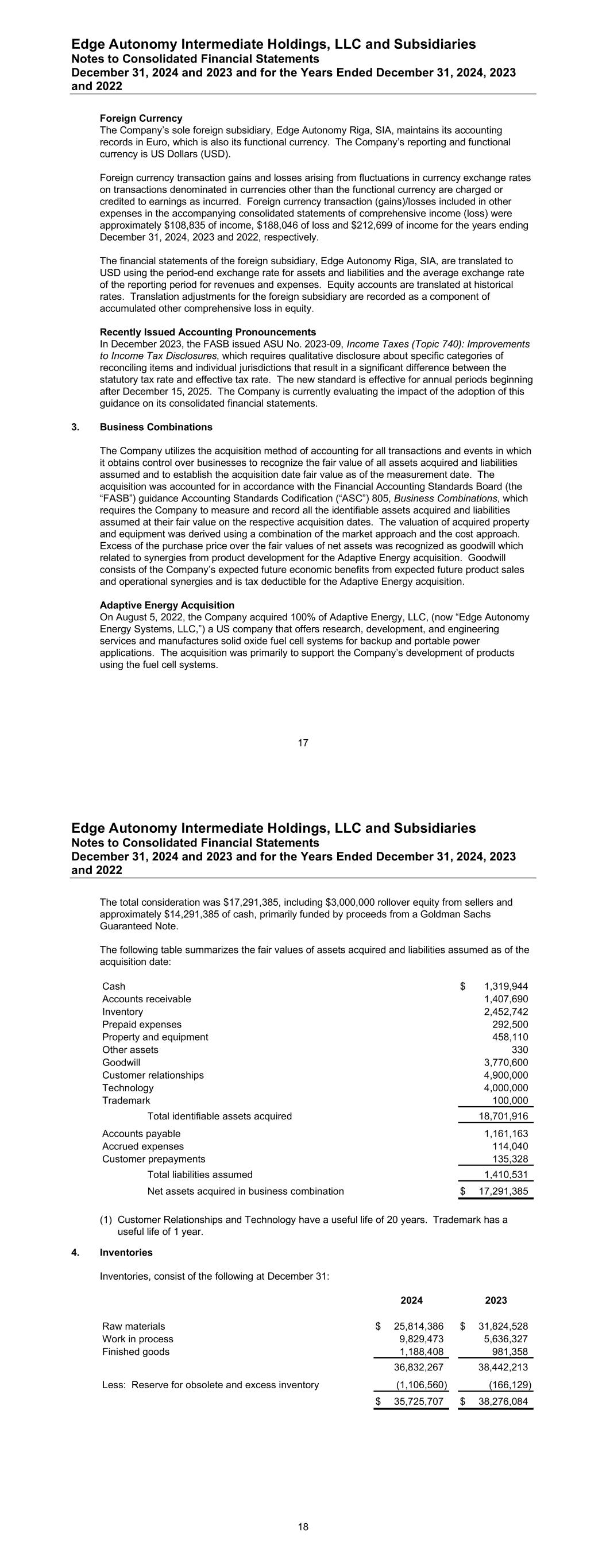

Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Notes to Consolidated Financial Statements December 31, 2024 and 2023 and for the Years Ended December 31, 2024, 2023 and 2022 17 Foreign Currency The Company’s sole foreign subsidiary, Edge Autonomy Riga, SIA, maintains its accounting records in Euro, which is also its functional currency. The Company’s reporting and functional currency is US Dollars (USD). Foreign currency transaction gains and losses arising from fluctuations in currency exchange rates on transactions denominated in currencies other than the functional currency are charged or credited to earnings as incurred. Foreign currency transaction (gains)/losses included in other expenses in the accompanying consolidated statements of comprehensive income (loss) were approximately $108,835 of income, $188,046 of loss and $212,699 of income for the years ending December 31, 2024, 2023 and 2022, respectively. The financial statements of the foreign subsidiary, Edge Autonomy Riga, SIA, are translated to USD using the period-end exchange rate for assets and liabilities and the average exchange rate of the reporting period for revenues and expenses. Equity accounts are translated at historical rates. Translation adjustments for the foreign subsidiary are recorded as a component of accumulated other comprehensive loss in equity. Recently Issued Accounting Pronouncements In December 2023, the FASB issued ASU No. 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures, which requires qualitative disclosure about specific categories of reconciling items and individual jurisdictions that result in a significant difference between the statutory tax rate and effective tax rate. The new standard is effective for annual periods beginning after December 15, 2025. The Company is currently evaluating the impact of the adoption of this guidance on its consolidated financial statements. 3. Business Combinations The Company utilizes the acquisition method of accounting for all transactions and events in which it obtains control over businesses to recognize the fair value of all assets acquired and liabilities assumed and to establish the acquisition date fair value as of the measurement date. The acquisition was accounted for in accordance with the Financial Accounting Standards Board (the “FASB”) guidance Accounting Standards Codification (“ASC”) 805, Business Combinations, which requires the Company to measure and record all the identifiable assets acquired and liabilities assumed at their fair value on the respective acquisition dates. The valuation of acquired property and equipment was derived using a combination of the market approach and the cost approach. Excess of the purchase price over the fair values of net assets was recognized as goodwill which related to synergies from product development for the Adaptive Energy acquisition. Goodwill consists of the Company’s expected future economic benefits from expected future product sales and operational synergies and is tax deductible for the Adaptive Energy acquisition. Adaptive Energy Acquisition On August 5, 2022, the Company acquired 100% of Adaptive Energy, LLC, (now “Edge Autonomy Energy Systems, LLC,”) a US company that offers research, development, and engineering services and manufactures solid oxide fuel cell systems for backup and portable power applications. The acquisition was primarily to support the Company’s development of products using the fuel cell systems. Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Notes to Consolidated Financial Statements December 31, 2024 and 2023 and for the Years Ended December 31, 2024, 2023 and 2022 18 The total consideration was $17,291,385, including $3,000,000 rollover equity from sellers and approximately $14,291,385 of cash, primarily funded by proceeds from a Goldman Sachs Guaranteed Note. The following table summarizes the fair values of assets acquired and liabilities assumed as of the acquisition date: Cash 1,319,944$ Accounts receivable 1,407,690 Inventory 2,452,742 Prepaid expenses 292,500 Property and equipment 458,110 Other assets 330 Goodwill 3,770,600 Customer relationships 4,900,000 Technology 4,000,000 Trademark 100,000 Total identifiable assets acquired 18,701,916 Accounts payable 1,161,163 Accrued expenses 114,040 Customer prepayments 135,328 Total liabilities assumed 1,410,531 Net assets acquired in business combination 17,291,385$ (1) Customer Relationships and Technology have a useful life of 20 years. Trademark has a useful life of 1 year. 4. Inventories Inventories, consist of the following at December 31: 2024 2023 Raw materials 25,814,386$ 31,824,528$ Work in process 9,829,473 5,636,327 Finished goods 1,188,408 981,358 36,832,267 38,442,213 Less: Reserve for obsolete and excess inventory (1,106,560) (166,129) 35,725,707$ 38,276,084$

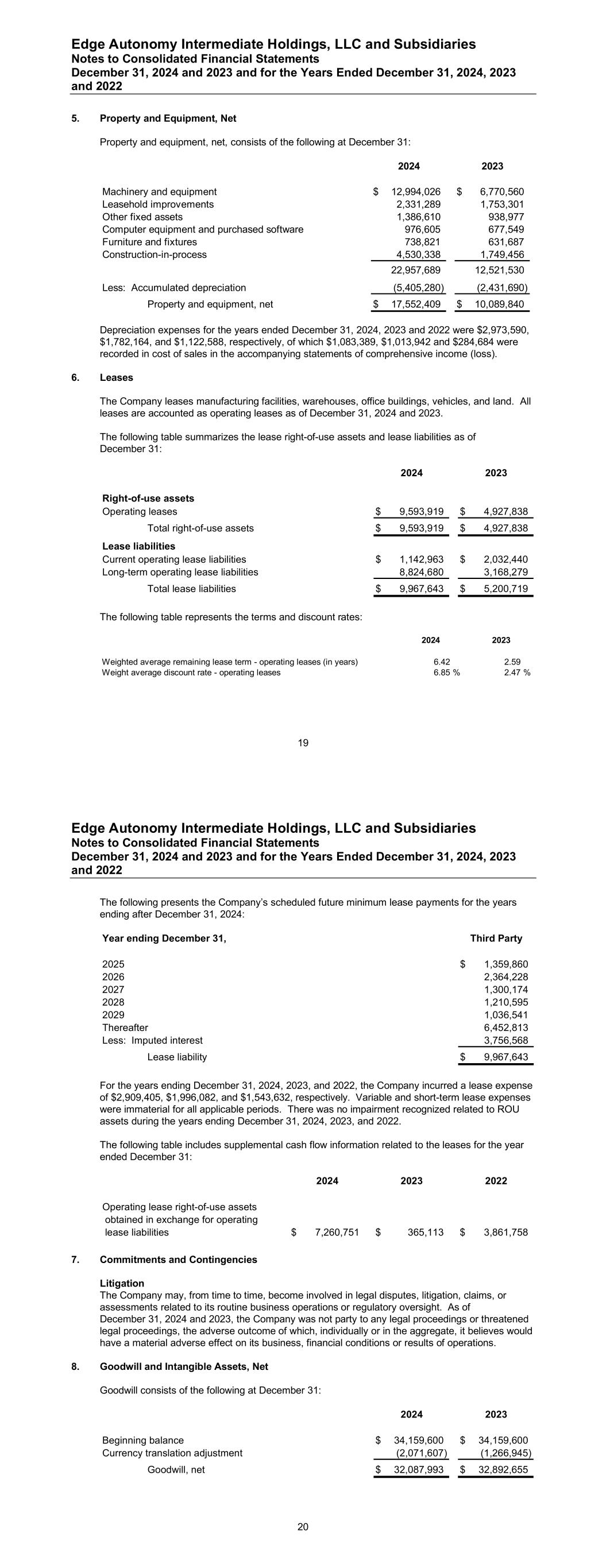

Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Notes to Consolidated Financial Statements December 31, 2024 and 2023 and for the Years Ended December 31, 2024, 2023 and 2022 19 5. Property and Equipment, Net Property and equipment, net, consists of the following at December 31: 2024 2023 Machinery and equipment 12,994,026$ 6,770,560$ Leasehold improvements 2,331,289 1,753,301 Other fixed assets 1,386,610 938,977 Computer equipment and purchased software 976,605 677,549 Furniture and fixtures 738,821 631,687 Construction-in-process 4,530,338 1,749,456 22,957,689 12,521,530 Less: Accumulated depreciation (5,405,280) (2,431,690) Property and equipment, net 17,552,409$ 10,089,840$ Depreciation expenses for the years ended December 31, 2024, 2023 and 2022 were $2,973,590, $1,782,164, and $1,122,588, respectively, of which $1,083,389, $1,013,942 and $284,684 were recorded in cost of sales in the accompanying statements of comprehensive income (loss). 6. Leases The Company leases manufacturing facilities, warehouses, office buildings, vehicles, and land. All leases are accounted as operating leases as of December 31, 2024 and 2023. The following table summarizes the lease right-of-use assets and lease liabilities as of December 31: 2024 2023 Right-of-use assets Operating leases 9,593,919$ 4,927,838$ Total right-of-use assets 9,593,919$ 4,927,838$ Lease liabilities Current operating lease liabilities 1,142,963$ 2,032,440$ Long-term operating lease liabilities 8,824,680 3,168,279 Total lease liabilities 9,967,643$ 5,200,719$ The following table represents the terms and discount rates: 2024 2023 Weighted average remaining lease term - operating leases (in years) 6.42 2.59 Weight average discount rate - operating leases 6.85 % 2.47 % Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Notes to Consolidated Financial Statements December 31, 2024 and 2023 and for the Years Ended December 31, 2024, 2023 and 2022 20 The following presents the Company’s scheduled future minimum lease payments for the years ending after December 31, 2024: Year ending December 31, Third Party 2025 1,359,860$ 2026 2,364,228 2027 1,300,174 2028 1,210,595 2029 1,036,541 Thereafter 6,452,813 Less: Imputed interest 3,756,568 Lease liability 9,967,643$ For the years ending December 31, 2024, 2023, and 2022, the Company incurred a lease expense of $2,909,405, $1,996,082, and $1,543,632, respectively. Variable and short-term lease expenses were immaterial for all applicable periods. There was no impairment recognized related to ROU assets during the years ending December 31, 2024, 2023, and 2022. The following table includes supplemental cash flow information related to the leases for the year ended December 31: 2024 2023 2022 Operating lease right-of-use assets obtained in exchange for operating lease liabilities 7,260,751$ 365,113$ 3,861,758$ 7. Commitments and Contingencies Litigation The Company may, from time to time, become involved in legal disputes, litigation, claims, or assessments related to its routine business operations or regulatory oversight. As of December 31, 2024 and 2023, the Company was not party to any legal proceedings or threatened legal proceedings, the adverse outcome of which, individually or in the aggregate, it believes would have a material adverse effect on its business, financial conditions or results of operations. 8. Goodwill and Intangible Assets, Net Goodwill consists of the following at December 31: 2024 2023 Beginning balance 34,159,600$ 34,159,600$ Currency translation adjustment (2,071,607) (1,266,945) Goodwill, net 32,087,993$ 32,892,655$

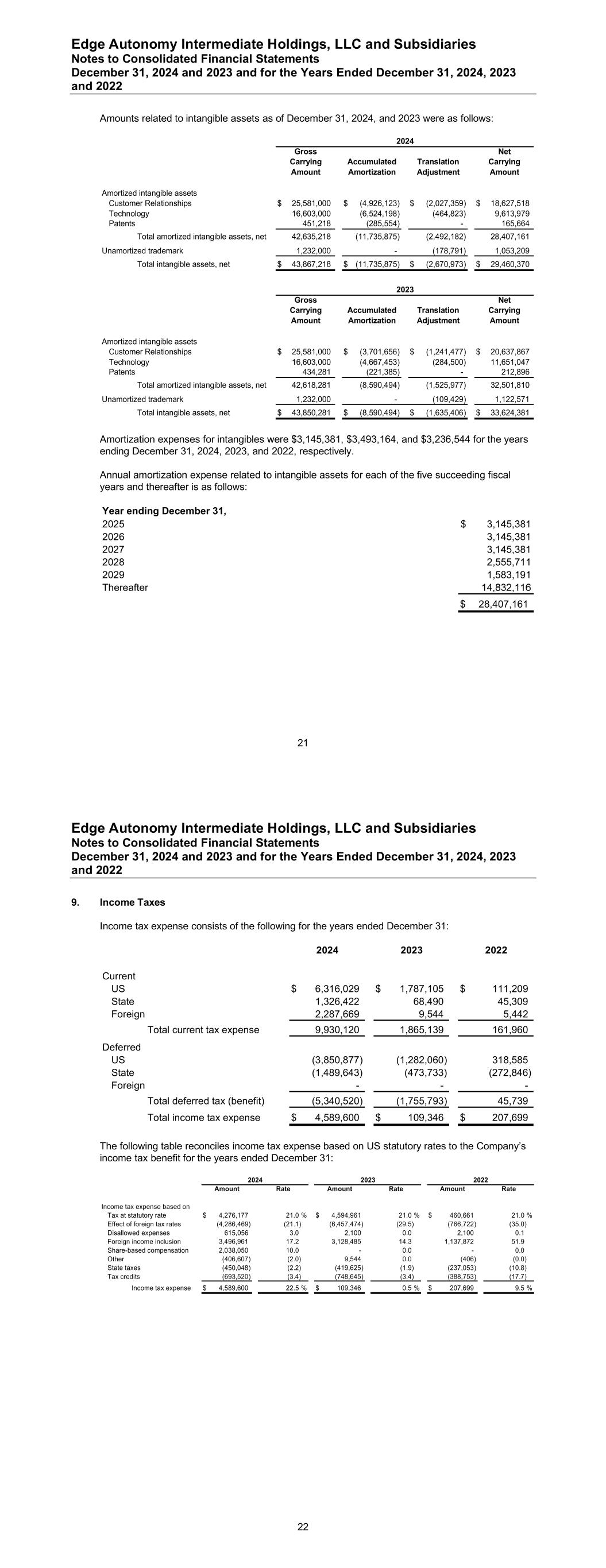

Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Notes to Consolidated Financial Statements December 31, 2024 and 2023 and for the Years Ended December 31, 2024, 2023 and 2022 21 Amounts related to intangible assets as of December 31, 2024, and 2023 were as follows: Gross Net Carrying Accumulated Translation Carrying Amount Amortization Adjustment Amount Amortized intangible assets Customer Relationships 25,581,000$ (4,926,123)$ (2,027,359)$ 18,627,518$ Technology 16,603,000 (6,524,198) (464,823) 9,613,979 Patents 451,218 (285,554) - 165,664 Total amortized intangible assets, net 42,635,218 (11,735,875) (2,492,182) 28,407,161 Unamortized trademark 1,232,000 - (178,791) 1,053,209 Total intangible assets, net 43,867,218$ (11,735,875)$ (2,670,973)$ 29,460,370$ 2024 Gross Net Carrying Accumulated Translation Carrying Amount Amortization Adjustment Amount Amortized intangible assets Customer Relationships 25,581,000$ (3,701,656)$ (1,241,477)$ 20,637,867$ Technology 16,603,000 (4,667,453) (284,500) 11,651,047 Patents 434,281 (221,385) - 212,896 Total amortized intangible assets, net 42,618,281 (8,590,494) (1,525,977) 32,501,810 Unamortized trademark 1,232,000 - (109,429) 1,122,571 Total intangible assets, net 43,850,281$ (8,590,494)$ (1,635,406)$ 33,624,381$ 2023 Amortization expenses for intangibles were $3,145,381, $3,493,164, and $3,236,544 for the years ending December 31, 2024, 2023, and 2022, respectively. Annual amortization expense related to intangible assets for each of the five succeeding fiscal years and thereafter is as follows: Year ending December 31, 2025 2026 2027 2028 2029 Thereafter $ 3, , 3, , 3, , 2,555,711 1,583,191 14, ,11 28,407,161$ Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Notes to Consolidated Financial Statements December 31, 2024 and 2023 and for the Years Ended December 31, 2024, 2023 and 2022 22 9. Income Taxes Income tax expense consists of the following for the years ended December 31: 2024 2023 2022 Current US 6,316,029$ 1,787,105$ 111,209$ State 1,326,422 68,490 45,309 Foreign 2,287,669 9,544 5,442 Total current tax expense 9,930,120 1,865,139 161,960 Deferred US (3,850,877) (1,282,060) 318,585 State (1,489,643) (473,733) (272,846) Foreign - - - Total deferred tax (benefit) (5,340,520) (1,755,793) 45,739 Total income tax expense 4,589,600$ 109,346$ 207,699$ The following table reconciles income tax expense based on US statutory rates to the Company’s income tax benefit for the years ended December 31: Amount Rate Amount Rate Amount Rate Income tax expense based on Tax at statutory rate 4,276,177$ 21.0 % 4,594,961$ 21.0 % 460,661$ 21.0 % Effect of foreign tax rates (4,286,469) (21.1) (6,457,474) (29.5) (766,722) (35.0) Disallowed expenses 615,056 3.0 2,100 0.0 2,100 0.1 Foreign income inclusion 3,496,961 17.2 3,128,485 14.3 1,137,872 51.9 Share-based compensation 2,038,050 10.0 - 0.0 - 0.0 Other (406,607) (2.0) 9,544 0.0 (406) (0.0) State taxes (450,048) (2.2) (419,625) (1.9) (237,053) (10.8) Tax credits (693,520) (3.4) (748,645) (3.4) (388,753) (17.7) Income tax expense 4,589,600$ 22.5 % 109,346$ 0.5 % 207,699$ 9.5 % 2024 2023 2022

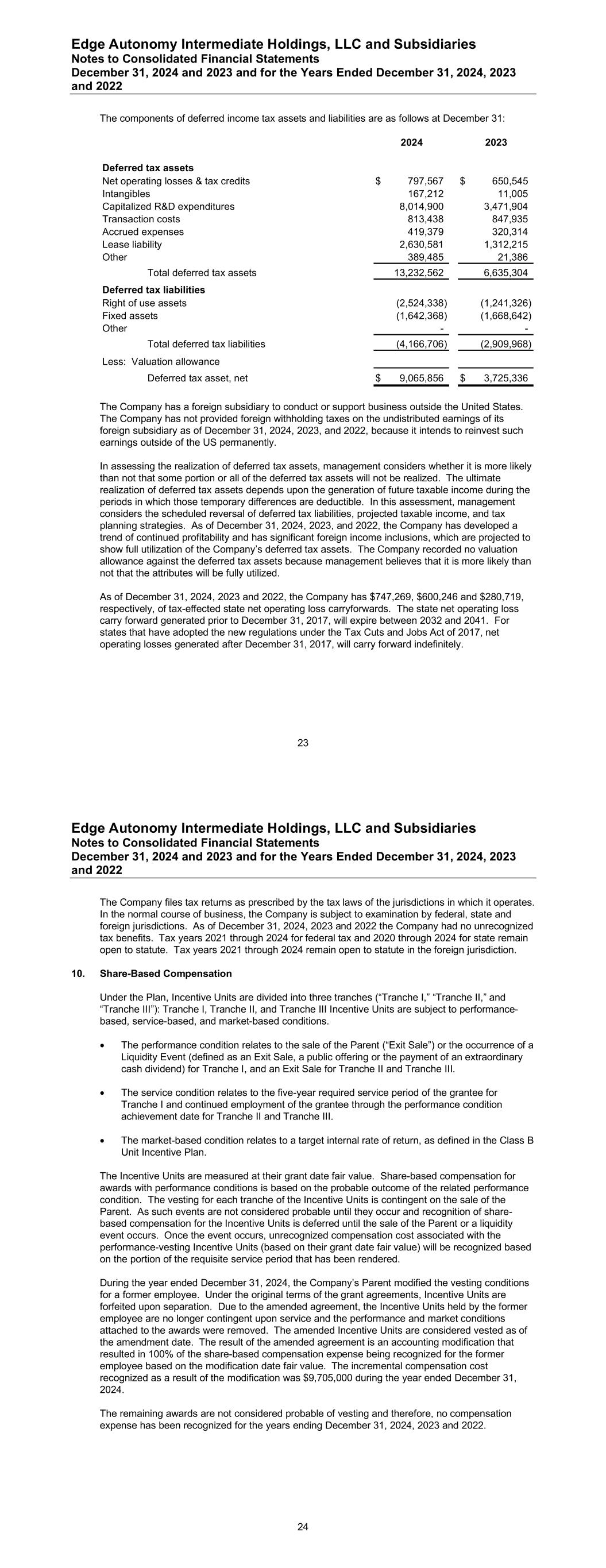

Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Notes to Consolidated Financial Statements December 31, 2024 and 2023 and for the Years Ended December 31, 2024, 2023 and 2022 23 The components of deferred income tax assets and liabilities are as follows at December 31: 2024 2023 Deferred tax assets Net operating losses & tax credits 797,567$ 650,545$ Intangibles 167,212 11,005 Capitalized R&D expenditures 8,014,900 3,471,904 Transaction costs 813,438 847,935 Accrued expenses 419,379 320,314 Lease liability 2,630,581 1,312,215 Other 389,485 21,386 Total deferred tax assets 13,232,562 6,635,304 Deferred tax liabilities Right of use assets (2,524,338) (1,241,326) Fixed assets (1,642,368) (1,668,642) Other - - Total deferred tax liabilities (4,166,706) (2,909,968) Less: Valuation allowance Deferred tax asset, net 9,065,856$ 3,725,336$ The Company has a foreign subsidiary to conduct or support business outside the United States. The Company has not provided foreign withholding taxes on the undistributed earnings of its foreign subsidiary as of December 31, 2024, 2023, and 2022, because it intends to reinvest such earnings outside of the US permanently. In assessing the realization of deferred tax assets, management considers whether it is more likely than not that some portion or all of the deferred tax assets will not be realized. The ultimate realization of deferred tax assets depends upon the generation of future taxable income during the periods in which those temporary differences are deductible. In this assessment, management considers the scheduled reversal of deferred tax liabilities, projected taxable income, and tax planning strategies. As of December 31, 2024, 2023, and 2022, the Company has developed a trend of continued profitability and has significant foreign income inclusions, which are projected to show full utilization of the Company’s deferred tax assets. The Company recorded no valuation allowance against the deferred tax assets because management believes that it is more likely than not that the attributes will be fully utilized. As of December 31, 2024, 2023 and 2022, the Company has $747,269, $600,246 and $280,719, respectively, of tax-effected state net operating loss carryforwards. The state net operating loss carry forward generated prior to December 31, 2017, will expire between 2032 and 2041. For states that have adopted the new regulations under the Tax Cuts and Jobs Act of 2017, net operating losses generated after December 31, 2017, will carry forward indefinitely. Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Notes to Consolidated Financial Statements December 31, 2024 and 2023 and for the Years Ended December 31, 2024, 2023 and 2022 24 The Company files tax returns as prescribed by the tax laws of the jurisdictions in which it operates. In the normal course of business, the Company is subject to examination by federal, state and foreign jurisdictions. As of December 31, 2024, 2023 and 2022 the Company had no unrecognized tax benefits. Tax years 2021 through 2024 for federal tax and 2020 through 2024 for state remain open to statute. Tax years 2021 through 2024 remain open to statute in the foreign jurisdiction. 10. Share-Based Compensation Under the Plan, Incentive Units are divided into three tranches (“Tranche I,” “Tranche II,” and “Tranche III”): Tranche I, Tranche II, and Tranche III Incentive Units are subject to performance- based, service-based, and market-based conditions. The performance condition relates to the sale of the Parent (“Exit Sale”) or the occurrence of a Liquidity Event (defined as an Exit Sale, a public offering or the payment of an extraordinary cash dividend) for Tranche I, and an Exit Sale for Tranche II and Tranche III. The service condition relates to the five-year required service period of the grantee for Tranche I and continued employment of the grantee through the performance condition achievement date for Tranche II and Tranche III. The market-based condition relates to a target internal rate of return, as defined in the Class B Unit Incentive Plan. The Incentive Units are measured at their grant date fair value. Share-based compensation for awards with performance conditions is based on the probable outcome of the related performance condition. The vesting for each tranche of the Incentive Units is contingent on the sale of the Parent. As such events are not considered probable until they occur and recognition of share- based compensation for the Incentive Units is deferred until the sale of the Parent or a liquidity event occurs. Once the event occurs, unrecognized compensation cost associated with the performance-vesting Incentive Units (based on their grant date fair value) will be recognized based on the portion of the requisite service period that has been rendered. During the year ended December 31, 2024, the Company’s Parent modified the vesting conditions for a former employee. Under the original terms of the grant agreements, Incentive Units are forfeited upon separation. Due to the amended agreement, the Incentive Units held by the former employee are no longer contingent upon service and the performance and market conditions attached to the awards were removed. The amended Incentive Units are considered vested as of the amendment date. The result of the amended agreement is an accounting modification that resulted in 100% of the share-based compensation expense being recognized for the former employee based on the modification date fair value. The incremental compensation cost recognized as a result of the modification was $9,705,000 during the year ended December 31, 2024. The remaining awards are not considered probable of vesting and therefore, no compensation expense has been recognized for the years ending December 31, 2024, 2023 and 2022.

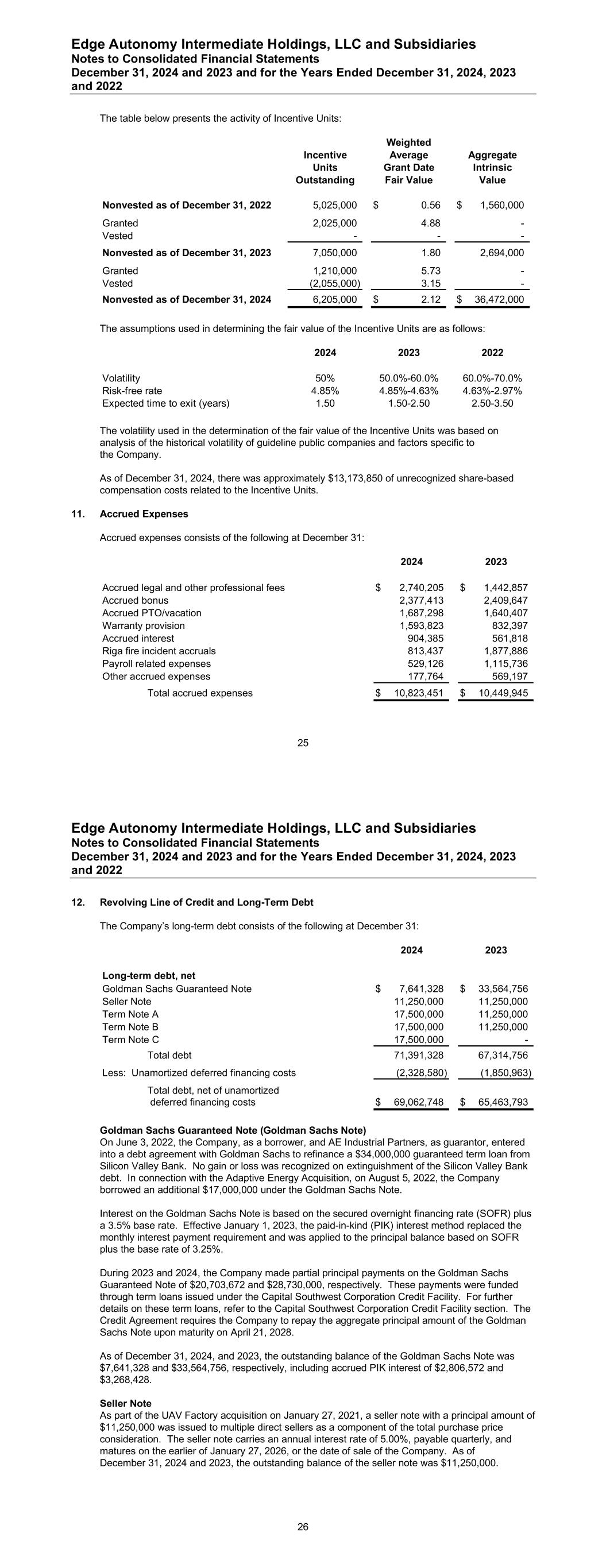

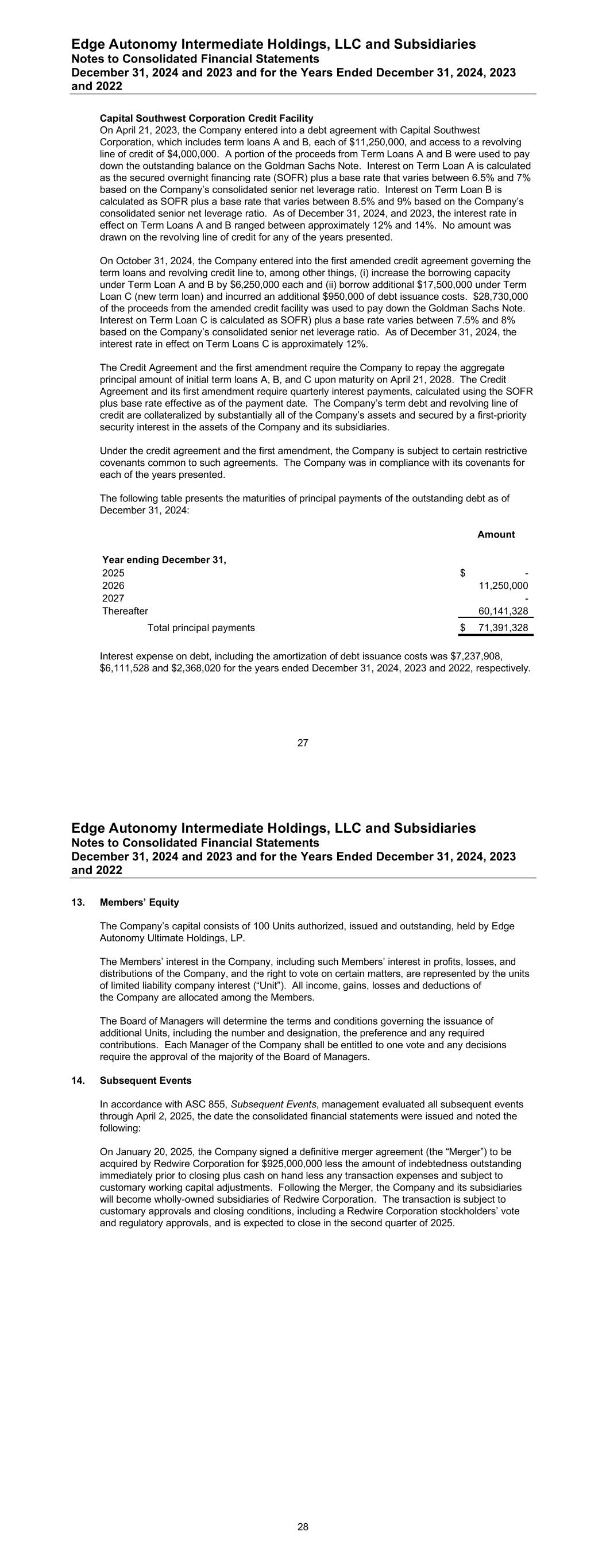

Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Notes to Consolidated Financial Statements December 31, 2024 and 2023 and for the Years Ended December 31, 2024, 2023 and 2022 25 The table below presents the activity of Incentive Units: Weighted Incentive Average Aggregate Units Grant Date Intrinsic Outstanding Fair Value Value Nonvested as of December 31, 2022 5,025,000 0.56$ 1,560,000$ Granted 2,025,000 4.88 - Vested - - - Nonvested as of December 31, 2023 7,050,000 1.80 2,694,000 Granted 1,210,000 5.73 - Vested (2,055,000) 3.15 - Nonvested as of December 31, 2024 6,205,000 2.12$ 36,472,000$ The assumptions used in determining the fair value of the Incentive Units are as follows: 2024 2023 2022 Volatility 50% 50.0%-60.0% 60.0%-70.0% Risk-free rate 4.85% 4.85%-4.63% 4.63%-2.97% Expected time to exit (years) 1.50 1.50-2.50 2.50-3.50 The volatility used in the determination of the fair value of the Incentive Units was based on analysis of the historical volatility of guideline public companies and factors specific to the Company. As of December 31, 2024, there was approximately $13,173,850 of unrecognized share-based compensation costs related to the Incentive Units. 11. Accrued Expenses Accrued expenses consists of the following at December 31: 2024 2023 Accrued legal and other professional fees 2,740,205$ 1,442,857$ Accrued bonus 2,377,413 2,409,647 Accrued PTO/vacation 1,687,298 1,640,407 Warranty provision 1,593,823 832,397 Accrued interest 904,385 561,818 Riga fire incident accruals 813,437 1,877,886 Payroll related expenses 529,126 1,115,736 Other accrued expenses 177,764 569,197 Total accrued expenses 10,823,451$ 10,449,945$ Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Notes to Consolidated Financial Statements December 31, 2024 and 2023 and for the Years Ended December 31, 2024, 2023 and 2022 26 12. Revolving Line of Credit and Long-Term Debt The Company’s long-term debt consists of the following at December 31: 2024 2023 Long-term debt, net Goldman Sachs Guaranteed Note 7,641,328$ 33,564,756$ Seller Note 11,250,000 11,250,000 Term Note A 17,500,000 11,250,000 Term Note B 17,500,000 11,250,000 Term Note C 17,500,000 - Total debt 71,391,328 67,314,756 Less: Unamortized deferred financing costs (2,328,580) (1,850,963) Total debt, net of unamortized deferred financing costs 69,062,748$ 65,463,793$ Goldman Sachs Guaranteed Note (Goldman Sachs Note) On June 3, 2022, the Company, as a borrower, and AE Industrial Partners, as guarantor, entered into a debt agreement with Goldman Sachs to refinance a $34,000,000 guaranteed term loan from Silicon Valley Bank. No gain or loss was recognized on extinguishment of the Silicon Valley Bank debt. In connection with the Adaptive Energy Acquisition, on August 5, 2022, the Company borrowed an additional $17,000,000 under the Goldman Sachs Note. Interest on the Goldman Sachs Note is based on the secured overnight financing rate (SOFR) plus a 3.5% base rate. Effective January 1, 2023, the paid-in-kind (PIK) interest method replaced the monthly interest payment requirement and was applied to the principal balance based on SOFR plus the base rate of 3.25%. During 2023 and 2024, the Company made partial principal payments on the Goldman Sachs Guaranteed Note of $20,703,672 and $28,730,000, respectively. These payments were funded through term loans issued under the Capital Southwest Corporation Credit Facility. For further details on these term loans, refer to the Capital Southwest Corporation Credit Facility section. The Credit Agreement requires the Company to repay the aggregate principal amount of the Goldman Sachs Note upon maturity on April 21, 2028. As of December 31, 2024, and 2023, the outstanding balance of the Goldman Sachs Note was $7,641,328 and $33,564,756, respectively, including accrued PIK interest of $2,806,572 and $3,268,428. Seller Note As part of the UAV Factory acquisition on January 27, 2021, a seller note with a principal amount of $11,250,000 was issued to multiple direct sellers as a component of the total purchase price consideration. The seller note carries an annual interest rate of 5.00%, payable quarterly, and matures on the earlier of January 27, 2026, or the date of sale of the Company. As of December 31, 2024 and 2023, the outstanding balance of the seller note was $11,250,000.

Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Notes to Consolidated Financial Statements December 31, 2024 and 2023 and for the Years Ended December 31, 2024, 2023 and 2022 27 Capital Southwest Corporation Credit Facility On April 21, 2023, the Company entered into a debt agreement with Capital Southwest Corporation, which includes term loans A and B, each of $11,250,000, and access to a revolving line of credit of $4,000,000. A portion of the proceeds from Term Loans A and B were used to pay down the outstanding balance on the Goldman Sachs Note. Interest on Term Loan A is calculated as the secured overnight financing rate (SOFR) plus a base rate that varies between 6.5% and 7% based on the Company’s consolidated senior net leverage ratio. Interest on Term Loan B is calculated as SOFR plus a base rate that varies between 8.5% and 9% based on the Company’s consolidated senior net leverage ratio. As of December 31, 2024, and 2023, the interest rate in effect on Term Loans A and B ranged between approximately 12% and 14%. No amount was drawn on the revolving line of credit for any of the years presented. On October 31, 2024, the Company entered into the first amended credit agreement governing the term loans and revolving credit line to, among other things, (i) increase the borrowing capacity under Term Loan A and B by $6,250,000 each and (ii) borrow additional $17,500,000 under Term Loan C (new term loan) and incurred an additional $950,000 of debt issuance costs. $28,730,000 of the proceeds from the amended credit facility was used to pay down the Goldman Sachs Note. Interest on Term Loan C is calculated as SOFR) plus a base rate varies between 7.5% and 8% based on the Company’s consolidated senior net leverage ratio. As of December 31, 2024, the interest rate in effect on Term Loans C is approximately 12%. The Credit Agreement and the first amendment require the Company to repay the aggregate principal amount of initial term loans A, B, and C upon maturity on April 21, 2028. The Credit Agreement and its first amendment require quarterly interest payments, calculated using the SOFR plus base rate effective as of the payment date. The Company’s term debt and revolving line of credit are collateralized by substantially all of the Company’s assets and secured by a first-priority security interest in the assets of the Company and its subsidiaries. Under the credit agreement and the first amendment, the Company is subject to certain restrictive covenants common to such agreements. The Company was in compliance with its covenants for each of the years presented. The following table presents the maturities of principal payments of the outstanding debt as of December 31, 2024: Amount Year ending December 31, 2025 -$ 2026 11,250,000 2027 - Thereafter 60,141,328 Total principal payments 71,391,328$ Interest expense on debt, including the amortization of debt issuance costs was $7,237,908, $6,111,528 and $2,368,020 for the years ended December 31, 2024, 2023 and 2022, respectively. Edge Autonomy Intermediate Holdings, LLC and Subsidiaries Notes to Consolidated Financial Statements December 31, 2024 and 2023 and for the Years Ended December 31, 2024, 2023 and 2022 28 13. Members’ Equity The Company’s capital consists of 100 Units authorized, issued and outstanding, held by Edge Autonomy Ultimate Holdings, LP. The Members’ interest in the Company, including such Members’ interest in profits, losses, and distributions of the Company, and the right to vote on certain matters, are represented by the units of limited liability company interest (“Unit”). All income, gains, losses and deductions of the Company are allocated among the Members. The Board of Managers will determine the terms and conditions governing the issuance of additional Units, including the number and designation, the preference and any required contributions. Each Manager of the Company shall be entitled to one vote and any decisions require the approval of the majority of the Board of Managers. 14. Subsequent Events In accordance with ASC 855, Subsequent Events, management evaluated all subsequent events through April 2, 2025, the date the consolidated financial statements were issued and noted the following: On January 20, 2025, the Company signed a definitive merger agreement (the “Merger”) to be acquired by Redwire Corporation for $925,000,000 less the amount of indebtedness outstanding immediately prior to closing plus cash on hand less any transaction expenses and subject to customary working capital adjustments. Following the Merger, the Company and its subsidiaries will become wholly-owned subsidiaries of Redwire Corporation. The transaction is subject to customary approvals and closing conditions, including a Redwire Corporation stockholders’ vote and regulatory approvals, and is expected to close in the second quarter of 2025.