Exhibit 99.3 Additional Information and Where to Find It Redwire will file with the SEC a proxy statement relating to a special meeting of Redwire's stockholders (the "proxy statement"). STOCKHOLDERS ARE URGED TO CAREFULLY READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT REDWIRE, EDGE AUTONOMY, THE TRANSACTION AND RELATED MATTERS. Stockholders will be able to obtain free copies of the proxy statement and other documents filed with the SEC by the parties through the website maintained by the SEC at www.sec.gov. In addition, investors and stockholders will be able to obtain free copies of the proxy statement and other documents filed with the SEC by the parties on investor relations section of Redwire's website at redwirespace.com. Participants in the Solicitation Redwire and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Redwire in respect of the proposed business combination contemplated by the proxy statement. Information regarding the persons who are, under the rules of the SEC, participants in the solicitation of the stockholders of Redwire, respectively, in connection with the proposed business combination, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement when it is filed with the SEC. Information regarding Redwire's directors and executive officers is contained in Redwire's Annual Report on Form 10-K for the year ended December 31, 2023 and its Proxy Statement on Schedule 14A, dated April 22, 2024, which are filed with the SEC. No Offer or Solicitation This Presentation is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote in any jurisdiction pursuant to the proposed business combination or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. Use of Data Industry and market data used in this Presentation have been obtained from third-party industry publications and sources, as well as from research reports prepared for other purposes. Redwire or Edge Autonomy have not independently verified the data obtained from these sources and cannot assure you of the data's accuracy or completeness. This data is subject to change. Statements other than historical facts, including, but not limited to, those concerning market conditions or trends, consumer or customer preferences or other similar concepts with respect to Redwire, Edge Autonomy and the expected combined company, are based on current expectations, estimates, projections, targets, opinions and/or beliefs of Redwire or, when applicable, of one or more third-party sources. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. In addition, no representation or warranty is made with respect to the reasonableness of any estimates, forecasts, illustrations, prospects or returns, which should be regarded as illustrative only, or that any profits will be realized. The metrics regarding select aspects of Redwire's, Edge Autonomy's and the expected combined company's operations were selected by Redwire or its subsidiaries on a subjective basis. Such metrics are provided solely for illustrative purposes to demonstrate elements of Redwire's businesses, are incomplete, and are not necessarily indicative of Redwire's, Edge Autonomy's or their subsidiaries' performance or overall operations. There can be no assurance that historical trends will continue. Use of Projections The financial outlook and projections, estimates and targets in this Presentation are forward-looking statements that are based on assumptions that are inherently subject to significant uncertainty and contingencies, many of which are beyond Redwire's or Edge Autonomy's control. Neither Redwire nor Edge Autonomy's independent auditors have audited, reviewed, compiled or performed any procedures with respect to the financial projections for purposes of inclusion in this Presentation, and, accordingly, they did not express an opinion or provide any other form of assurance with respect thereto for the purposes of this Presentation. While all financial projections, estimates and targets are necessarily speculative, Redwire believes that the preparation of prospective financial information involves increasingly higher levels of uncertainty the further out the projection, estimate or target extends from the date of preparation. The assumptions and estimates underlying the projected, expected or target results for Redwire, Edge Autonomy and the combined company are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the financial projections, estimates and targets. The inclusion of financial projections, estimates and targets in this Presentation should not be regarded as an indication that Redwire, or its representatives, considered or consider the financial projections, estimates or targets to be a reliable prediction of future events. Further, inclusion of the prospective financial information in this Presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved. {jiJbREDWIRE BUILD ABOVE 2

Cautionary Statement Regarding Forward-Looking Statements Readers are cautioned that the statements contained in this Presentation regarding expectations of our performance or other matters that may affect our or the combined company's business, results of operations, or financial condition are "forward-looking statements" as defined by the "safe harbor" provisions in the Private Securities Litigation Reform Act of 1995. Such statements are made in reliance on the safe harbor provisions of Section 27 A of the Securities Act of 1933 and Section 21 E of the Securities Exchange Act of 1934. All statements, other than statements of historical fact, included or incorporated in this Presentation, including statements regarding our or the combined company's strategy, financial position, guidance, including the prospective financial information provided in this Presentation, funding for continued operations, cash reserves, liquidity, projected costs, plans, projects, awards and contracts, and objectives of management, the entry into the potential business combination, the expected benefits from the proposed business combination, the expected performance of the combined company, the expectations regarding financing the proposed business combination, among others, are forward-looking statements. Words such as "expect," "anticipate," "should," "believe," "hope," "target," "continued," "project," "plan," "goals," "opportunity," "appeal," "estimate," "potential," "predict," "demonstrates," "may," "will," "might," "could," "intend," "shall," "possible," "forecast," "trends," "contemplate," "would," "approximately," "likely," "outlook," "schedule," "on track," "poised," "pipeline," and variations of these terms or the negative of these terms and similar expressions are intended to identify these forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements are not guarantees of future performance, conditions or results. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond our control. These factors and circumstances include, but are not limited to: (1) risks associated with the continued economic uncertainty, including high inflation, supply chain challenges, labor shortages, increased labor costs, high interest rates, foreign currency exchange volatility, concerns of economic slowdown or recession and reduced spending or suspension of investment in new or enhanced projects; (2) the failure of financial institutions or transactional counterparties; (3) the Company's limited operating history and history of losses to date; (4) the inability to successfully integrate recently completed and future acquisitions, including the proposed business combination with Edge Autonomy, as well as the failure to realize the anticipated benefits of the transaction or to realize estimated projected combined company results; (5) the development and continued refinement of many of the Company's and the combined company's proprietary technologies, products and service offerings; (6) competition with new or existing companies; (7) the possibility that the Company's forecasts, expectations and assumptions relating to future results and projections with respect to Redwire or Edge Autonomy may prove incorrect; (8) adverse publicity stemming from any incident or perceived risk involving Redwire, Edge Autonomy, the combined company, or their competitors; (9) unsatisfactory performance of our and the combined company's products resulting from challenges in the space environment, extreme space weather events, the environments in which drones operate, including in combat or other areas where hostilities may occur, or otherwise; (10) the emerging nature of the market for in-space infrastructure services and the market for drones and related services; (11) inability to realize benefits from new offerings or the application of our or the combined company's technologies; (12) the inability to convert orders in backlog into revenue; (13) our and the combined company's dependence on U.S. and foreign government contracts, which are only partially funded and subject to immediate termination, which may be affected by changes in government program requirements, spending priorities, or budgetary constraints, including government shutdowns, or which may be influenced by the level of military activities and related spending with respect to ongoing or future conflicts, including the war in Ukraine; (14) the fact that we are and the combined company will be subject to stringent economic sanctions, and trade control laws and regulations; (15) the need for substantial additional funding to finance our and the combined company's operations, which may not be available when needed, on acceptable terms or at all; (16) the dilution of existing holders of our common stock that will result from the issuance of additional shares of common stock as consideration for the acquisition of Edge Autonomy, as well as the issuance of common stock in any offering that may be undertaken in connection with such acquisition; (17) the fact that the issuance and sale of shares of our Series A Convertible Preferred Stock has reduced the relative voting power of holders of our common stock and diluted the ownership of holders of our capital stock; (18) the ability to achieve the conditions to cause, or timing of, any mandatory conversion of the Series A Convertible Preferred stock into common stock; (19) the fact that AE Industrial Partners and Bain Capital have significant influence over us, which could limit your ability to influence the outcome of key transactions; (20) provisions in our Certificate of Designation with respect to our Series A Convertible Preferred Stock may delay or prevent our acquisition by a third party, which could also reduce the market price of our capital stock; (21) the fact that our Series A Convertible Preferred Stock has rights, preferences and privileges that are not held by, and are preferential to, the rights of holders of our other outstanding capital stock; (22) the possibility of sales of a substantial amount of our common stock by our current stockholders, as well as the equity owners of Edge Autonomy following consummation of the acquisition, which sales could cause the price of our common stock and warrants to fall; (23) the impact of the issuance of additional shares of Series A Convertible Preferred Stock as paid-in-kind dividends on the price and market for our common stock; (24) the volatility of the trading price of our common stock and warrants; (25) risks related to short sellers of our common stock; (26) Redwire's or the combined company's inability to report our financial condition or results of operations accurately or timely as a result of identified material weaknesses in internal control over financial reporting, as well as the possible need to expand or improve Edge Autonomy's financial reporting systems and controls; (27) the possibility that the closing conditions under the merger agreement necessary to consummate the merger between Redwire and Edge Autonomy will not be satisfied; (28) the effect of any announcement or pendency of the proposed business combination on Redwire's or Edge Autonomy's business relationships, operating results and business generally; (29) risks that the proposed business combination disrupts current plans and operations of Redwire or Edge Autonomy; (30) the ability of Redwire or the combined company to raise financing in connection with the proposed business combination or to finance its operations in the future; (31) the impact of any increase in the combined company's indebtedness incurred to fund working capital or other corporate needs, including the repayment of Edge Autonomy's outstanding indebtedness and transaction expenses incurred to acquire Edge Autonomy, as well as debt covenants that may limit the combined company's activities, flexibility or ability to take advantage of business opportunities, and the effect of debt service on the availability of cash to fund investment in the business; (32) the ability to implement business plans, forecasts and other expectations after the completion of the proposed transaction, and identify and realize additional opportunities; (33) costs related to the transaction; and (34) other risks and uncertainties described in our most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q and those indicated from time to time in other documents filed or to be filed with the SEC by the Company. The forward-looking statements contained in this Presentation are based on our current expectations and beliefs concerning future developments and their potential effects on us. If underlying assumptions to forward-looking statements prove inaccurate, or if known or unknown risks or uncertainties materialize, actual results could vary materially from those anticipated, estimated, or projected. The forward-looking statements contained in this Presentation are made as of the date of this Presentation, and the Company disclaims any intention or obligation, other than imposed by law, to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. Persons reading this Presentation are cautioned not to place undue reliance on forward-looking statements. REDWIRE ----------------------------------1 BUILD ABOVE 3 Non-GAAP Financial Information This Presentation contains financial measures that have not been prepared in accordance with United States Generally Accepted Accounting Principles ("U.S. GAAP"). These financial measures include Adjusted EBITDA and Free Cash Flow. Non-GAAP financial measures are used to supplement the financial information presented on a U.S. GAAP basis and should not be considered in isolation or as a substitute for the relevant U.S. GAAP measures and should be read in conjunction with information presented on a U.S. GAAP basis. Because not all companies use identical calculations, our presentation of Non-GAAP measures may not be comparable to other similarly titled measures of other companies. Adjusted EBITDA is defined as net income (loss) adjusted for interest expense, net, income tax expense (benefit), depreciation and amortization, impairment expense, transaction expenses, acquisition integration costs, acquisition earnout costs, purchase accounting fair value adjustment related to deferred revenue, severance costs, capital market and advisory fees, litigation-related expenses, write-off of long-lived assets, gains on sale of joint ventures, equity-based compensation, committed equity facility transaction costs, debt financing costs, and warrant liability change in fair value adjustments. Free Cash Flow is computed as net cash provided by (used in) operating activities less capital expenditures. We use Adjusted EBITDA to evaluate our operating performance, generate future operating plans, and make strategic decisions, including those relating to operating expenses and the allocation of internal resources. We use Free Cash Flow as a useful indicator of liquidity to evaluate our period-over-period operating cash generation that will be used to service our debt, and can be used to invest in future growth through new business development activities and/or acquisitions, among other uses. Free Cash Flow does not represent the total increase or decrease in our cash balance, and it should not be inferred that the entire amount of Free Cash Flow is available for discretionary expenditures, since we have mandatory debt service requirements and other non-discretionary expenditures that are not deducted from this measure. Key Performance Indicators Management uses Key Performance Indicators ("KPls") to assess the financial performance of the Company, monitor relevant trends and support financial, operational and strategic decision-making. Management frequently monitors and evaluates KPls against internal targets, core business objectives as well as industry peers and may, on occasion, change the mix or calculation of KPls to better align with the business, its operating environment, standard industry metrics or other considerations. If the Company changes the method by which it calculates or presents a KPI, prior period disclosures are recast to conform to current presentation. {jiJbREDWIRE BUILD ABOVE 4

Red : Investment Highlights: Proven Pure-Play Space Innovator With Growth and Profitability @ Decades-long heritage, reliability, and deep relationships with dependable marquee space customers + + ◊ + Revenue driven by lower launch costs and our critical missions for government and marquee customers + +◊ •*'fl)*• Space is a warfighting domain - we have national security infrastructure and clearances to participate in sensitive defense programs ••• llf Global Footprint expands our TAM as satellite constellations proliferate and lunar exploration accelerates *** .J, Executing on accretive M&A; we are scaling with a Path to Profitability {jiJbREDWIRE BUILD ABOVE I 5

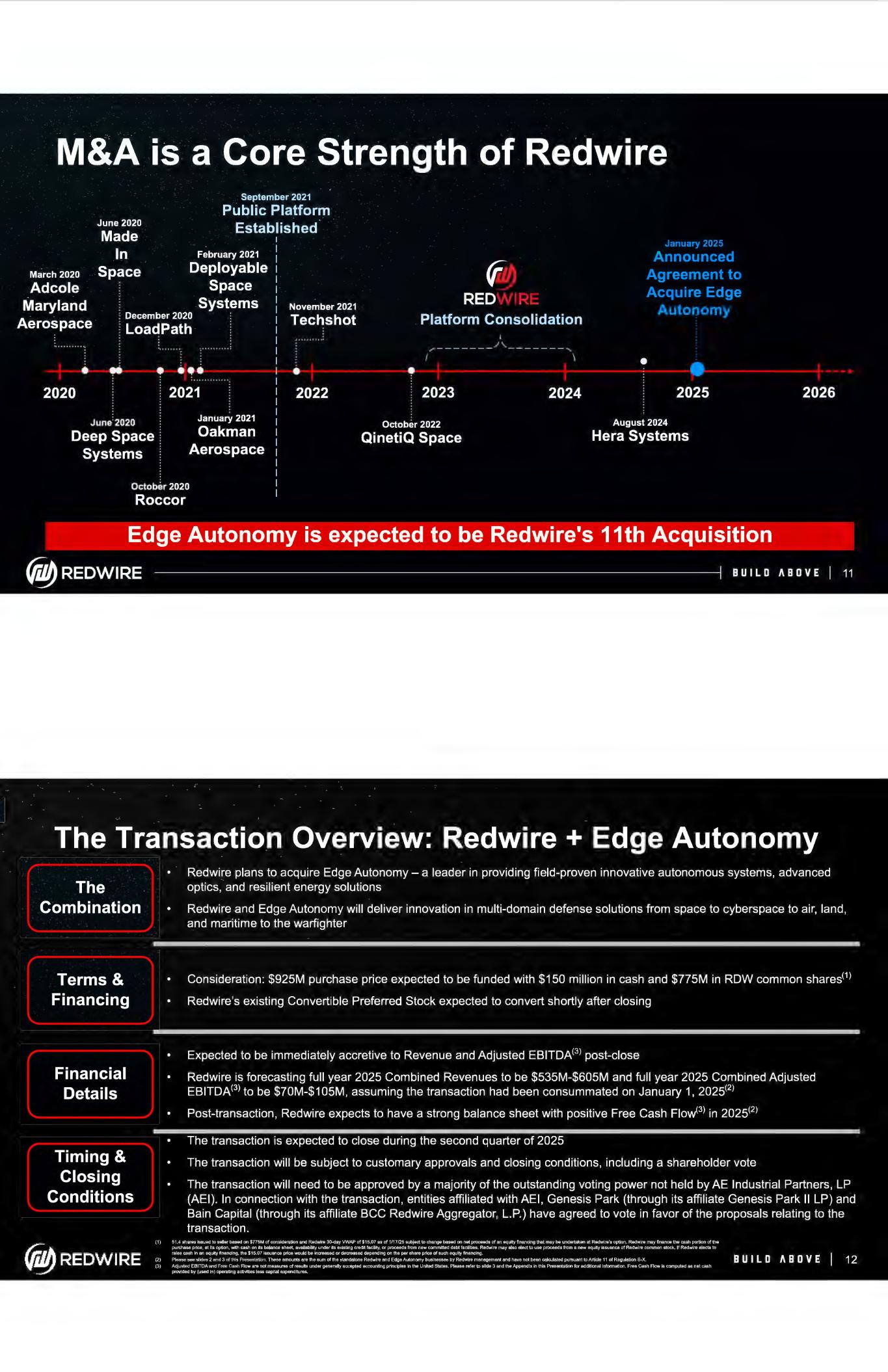

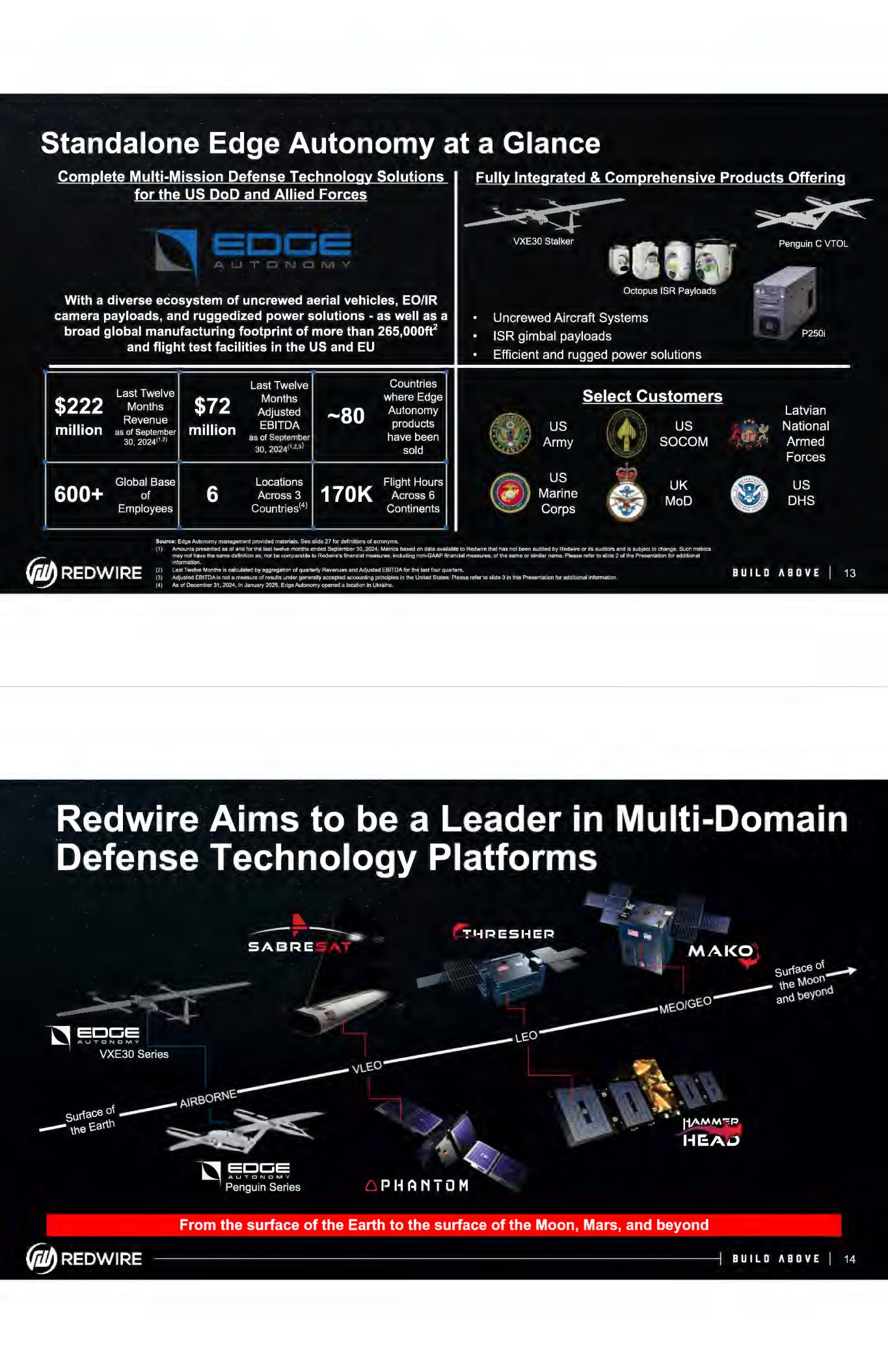

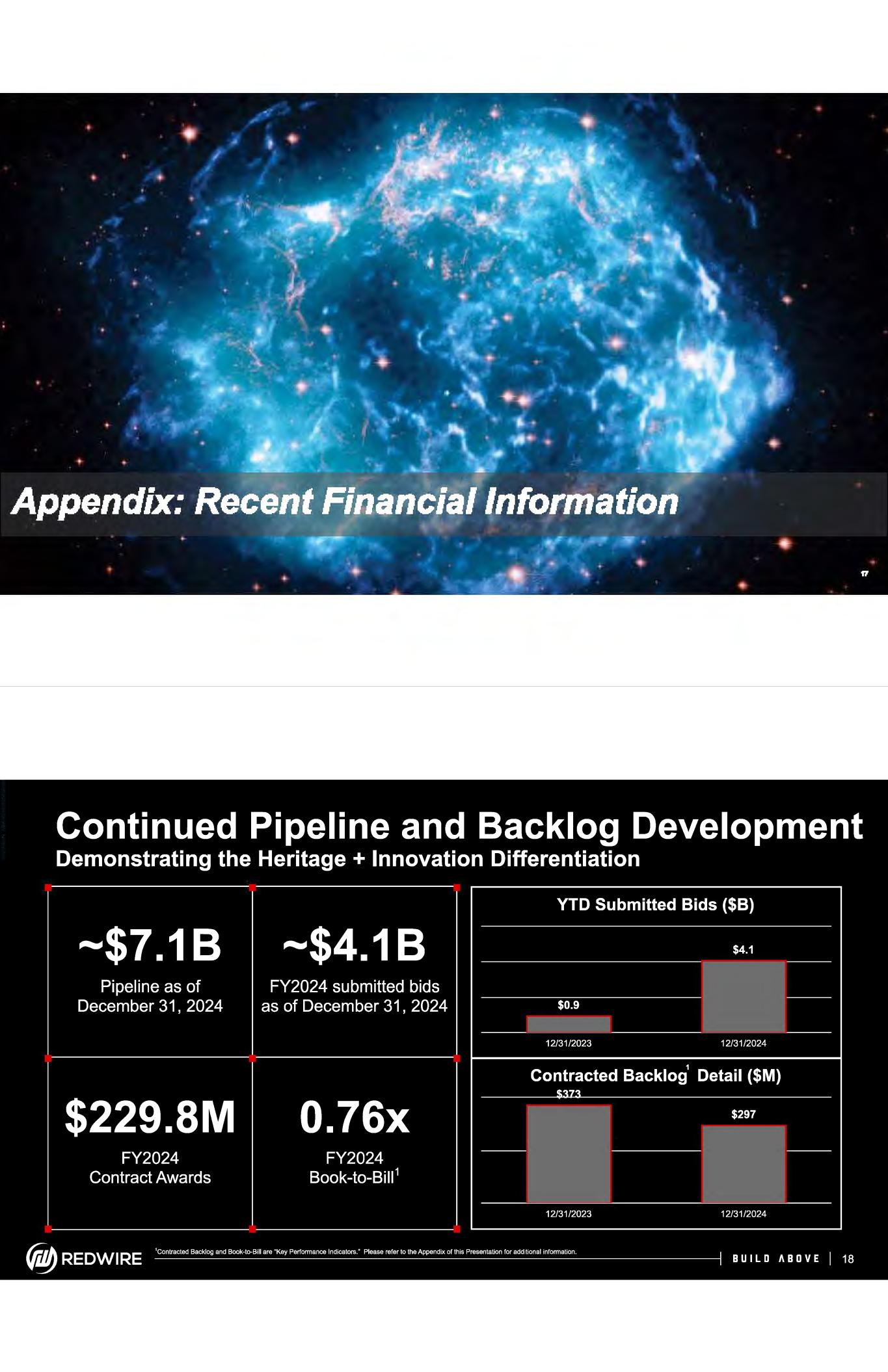

The Transaction Overview: Redwire + Edge Autonomy The Combination Terms & Financing Financial Details Timing & Closing Conditions (jijfJREDWIRE • Redwire plans to acquire Edge Autonomy - a leader in providing field-proven innovative autonomous systems, advanced optics, and resilient energy solutions • Redwire and Edge Autonomy will deliver innovation in multi-domain defense solutions from space to cyberspace to air, land, and maritime to the warfighter • Consideration: $925M purchase price expected to be funded with $150 million in cash and $775M in ROW common shares<1l • Redwire's existing Convertible Preferred Stock expected to convert shortly after closing • Expected to be immediately accretive to Revenue and Adjusted EBITDA<3l post-close • Redwire is forecasting full year 2025 Combined Revenues to be $535M-$605M and full year 2025 Combined Adjusted EBITDA<3l to be $70M-$105M, assuming the transaction had been consummated on January 1, 2025<2) • Post-transaction, Redwire expects to have a strong balance sheet with positive Free Cash Flow3l in 2025<2) • The transaction is expected to close during the second quarter of 2025 • The transaction will be subject to customary approvals and closing conditions, including a shareholder vote • The transaction will need to be approved by a majority of the outstanding voting power not held by AE Industrial Partners, LP (AEI). In connection with the transaction, entities affiliated with AEI, Genesis Park (through its affiliate Genesis Park II LP) and Bain Capital (through its affiliate BCC Redwire Aggregator, L.P.) have agreed to vote in favor of the proposals relating to the transaction. (1) 51.4 shares issued to seller based on $775M of consideration and Redwire 30-day VWAP of$15.07 as of 1/17/25 subject to change based on net proceeds of an equity financing that may be undertaken at Redwire's option. Redwire may finance the cash portion of the purchase price, at its opt,on, with cash on its balance sheet, availability under its existing credit facility, or proceeds from new committed debt facilities. Redwire may also elect to use proceeds from a new equity issuance of Redwire common stock. If Redwire elects to raise cash in an equity financing, the $15.07 issuance price would be increased or decreased depending on the per share price of such equity financing. (2) Please see slides 2 and 3 of this Presentation. These amounts are the sum of the standalone Red wire and Edge Autonomy businesses by Redwire management and have not been calculated pursuant lo Article 11 of Regulation S-X. (3) Adjusted EBITDA and Free Cash Flow are not measures of results under generally accepted accounting principles in the United States. Please refer to slide 3 and the Appendix in this Presentation for additional information. Free Cash Flow is computed as net cash provided by {used in) operating activities less capital expenditures. BUILD ABOVE I 12

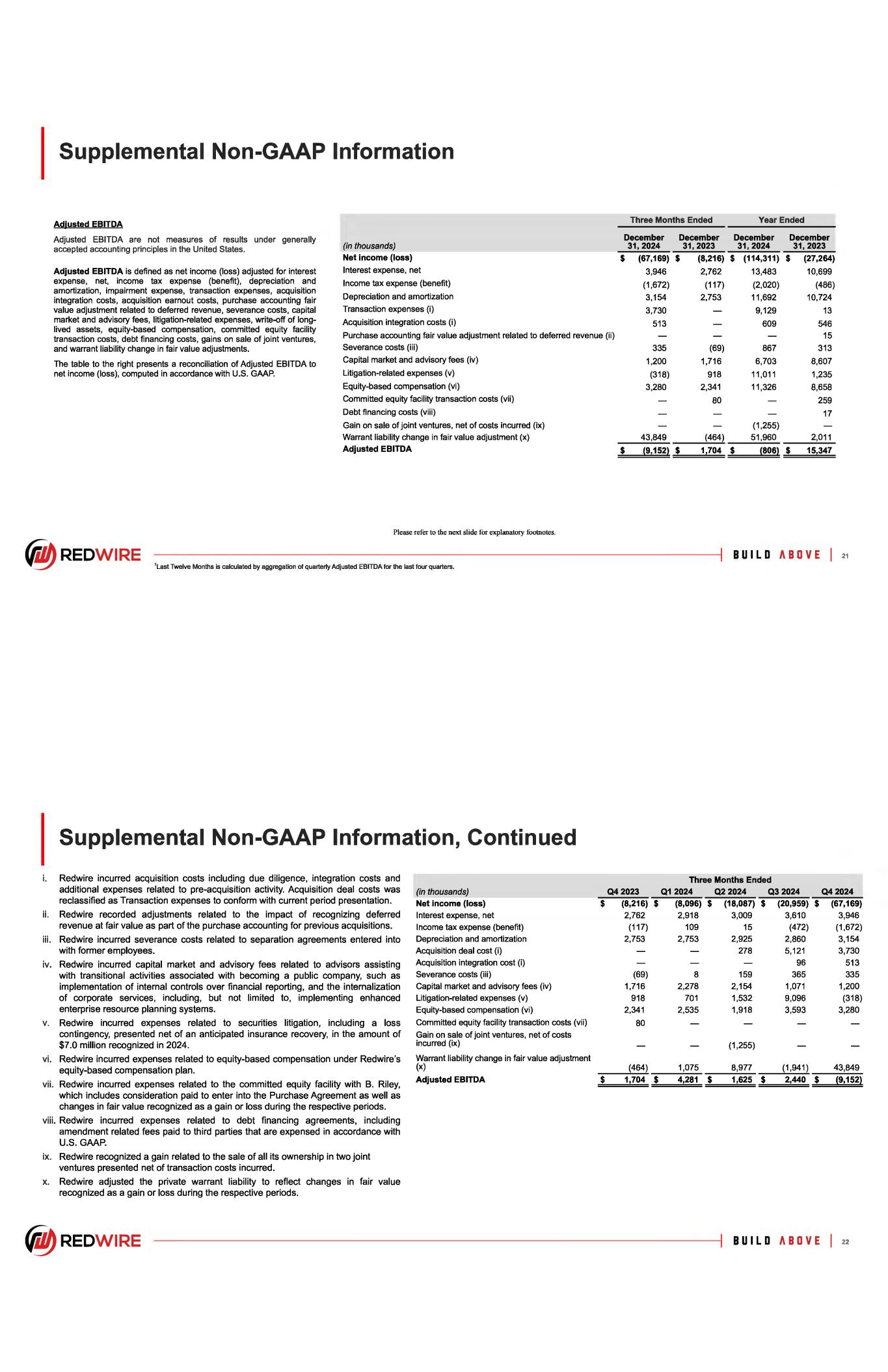

2024 Year-to-Date Performance Year Ended $ Change from prior ($ in thousands, except percentages) Revenues December 31, 2024 December 31, 2023 year period Cost of sales Gross profit Operating expenses: Selling, general and administrative expenses Transaction expenses Research and development Operating income (loss) Interest expense, net Other (income) expense, net Income (loss) before income taxes Income tax expense (benefit) Net income (loss) Net income (loss) attributable to noncontrolling interests Net income (loss) attributable to Redwire Corporation ~ REDWIRE $ $ 304,101 $ 259,646 44,455 71,398 9,129 6,128 (42,200) 13,483 60,648 (116,331) (2,020) (114,311) 4 {114,315} $ 243,800 $ 60,301 185,831 73,815 57,969 (13,514) 68,525 2,873 13 9,116 4,979 1,149 (15,548) (26,652) 10,699 2,784 1,503 59,145 (27,750) (88,581) (486) (1,534) (27,264) (87,047) (1) 5 {27,263} $ {87,052} % Change from prior year period 25 % 40 (23) 4 70,123 23 171 26 3,935 319 316 319 (500) 319 % 8 U I L O A 8 0 V E I 19 Q4 2024 Quarter-to-Date Performance Three Months Ended $ Change from prior ($ in thousands, except percentages) Revenues December 31, 2024 December 31, 2023 year period Cost of sales Gross profit Operating expenses: Selling, general and administrative expenses Transaction expenses Research and development Operating income (loss) Interest expense, net Other (income) expense, net Income (loss) before income taxes Income tax expense (benefit) Net income (loss) Net income (loss) attributable to noncontrolling interests Net income (loss) attributable to Redwire Corporation ~ REDWIRE $ 69,560 $ 64,937 4,623 18,427 3,730 1,447 (18,981) 3,946 45,914 (68,841) (1,672) (67,169) $ (67,169} $ 63,485 $ 6,075 52,754 12,183 10,731 (6,108) 16,499 1,928 3,730 989 458 (6,757) (12,224) 2,762 1,184 (1,186) 47,100 (8,333) (60,508) (117) (1,555) (8,216) (58,953) 72 (72) (8,288} $ (58,881} % Change from prior year period 10 % 23 (57) 12 100 46 181 43 (3,971) 726 1,329 718 (100) 710 % BUILD ABOVE I 20

Supplemental Non-GAAP Information Adjusted EBITDA Adjusted EBITDA are not measures of results under generally accepted accounting principles in the United States. Adjusted EBITDA is defined as net income (loss) adjusted for interest expense, net, income tax expense (benefit), depreciation and amortization, impairment expense, transaction expenses, acquisition integration costs, acquisition earnout costs, purchase accounting fair value adjustment related to deferred revenue, severance costs, capital market and advisory fees, litigation-related expenses, write-off of long lived assets, equity-based compensation, committed equity facility transaction costs, debt financing costs, gains on sale of joint ventures, and warrant liability change in fair value adjustments. The table to the right presents a reconciliation of Adjusted EBITDA to net income (loss), computed in accordance with U.S. GAAP. (in thousands) Net income (loss) Interest expense, net Income tax expense (benefit) Depreciation and amortization Transaction expenses (i) Acquisition integration costs (i) Purchase accounting fair value adjustment related to deferred revenue (ii) Severance costs (iii) Capital market and advisory fees (iv) Litigation-related expenses (v) Equity-based compensation (vi) Committed equity facility transaction costs (vii) Debt financing costs (viii) Gain on sale of joint ventures, net of costs incurred (ix) Warrant liability change in fair value adjustment (x) Adjusted EBITDA Please refer to the next slide for explanatory footnotes. ~ REDWIRE 1Last Twelve Months is calculated by aggregation of quarterly Adjusted EBITDA for the last four quarters. Three Months Ended Year Ended December December December December 31,2024 31,2023 31,2024 31,2023 $ (67,169) $ (8,216) $ (114,311) $ (27,264) 3,946 2,762 13,483 10,699 (1,672) (117) (2,020) (486) 3,154 2,753 11,692 10,724 3,730 9,129 13 513 609 546 15 335 (69) 867 313 1,200 1,716 6,703 8,607 (318) 918 11,011 1,235 3,280 2,341 11,326 8,658 80 259 17 (1,255) 43,849 (464) 51,960 2,011 $ {9,152} $ 1,704 $ {806} $ 15,347 8 U I L O A 8 0 V E I 21 Supplemental Non-GAAP Information, Continued i. Redwire incurred acquisition costs including due diligence, integration costs and additional expenses related to pre-acquisition activity. Acquisition deal costs was reclassified as Transaction expenses to conform with current period presentation. ii. Redwire recorded adjustments related to the impact of recognizing deferred revenue at fair value as part of the purchase accounting for previous acquisitions. iii. Redwire incurred severance costs related to separation agreements entered into with former employees. iv. Redwire incurred capital market and advisory fees related to advisors assisting with transitional activities associated with becoming a public company, such as implementation of internal controls over financial reporting, and the internalization of corporate services, including, but not limited to, implementing enhanced enterprise resource planning systems. v. Redwire incurred expenses related to securities litigation, including a loss contingency, presented net of an anticipated insurance recovery, in the amount of $7 .0 million recognized in 2024. vi. Redwire incurred expenses related to equity-based compensation under Redwire's equity-based compensation plan. vii. Redwire incurred expenses related to the committed equity facility with B. Riley, which includes consideration paid to enter into the Purchase Agreement as well as changes in fair value recognized as a gain or loss during the respective periods. viii. Redwire incurred expenses related to debt financing agreements, including amendment related fees paid to third parties that are expensed in accordance with U.S.GMP. ix. Redwire recognized a gain related to the sale of all its ownership in two joint ventures presented net of transaction costs incurred. x. Redwire adjusted the private warrant liability to reflect changes in fair value recognized as a gain or loss during the respective periods. ~ REDWIRE (in thousands) Net income (loss) Interest expense, net Income tax expense (benefit) Depreciation and amortization Acquisition deal cost (i) Acquisition integration cost (i) Severance costs (iii) Capital market and advisory fees (iv) Litigation-related expenses (v) Equity-based compensation (vi) Committed equity facility transaction costs (vii) Gain on sale of joint ventures, net of costs incurred (ix) Warrant liability change in fair value adjustment (x) Adjusted EBITDA Q4 2023 $ (8,216) $ 2,762 (117) 2,753 (69) 1,716 918 2,341 80 (464) $ 1,704 $ Three Months Ended Q1 2024 Q2 2024 Q3 2024 Q4 2024 (8,096) $ (18,087) $ (20,959) $ (67,169) 2,918 3,009 3,610 3,946 109 15 (472) (1,672) 2,753 2,925 2,860 3,154 278 5,121 3,730 96 513 8 159 365 335 2,278 2,154 1,071 1,200 701 1,532 9,096 (318) 2,535 1,918 3,593 3,280 (1,255) 1,075 8,977 (1,941) 43,849 4,281 $ 1,625 $ 2,440 $ (9,152} BUILD ABOVE I 22

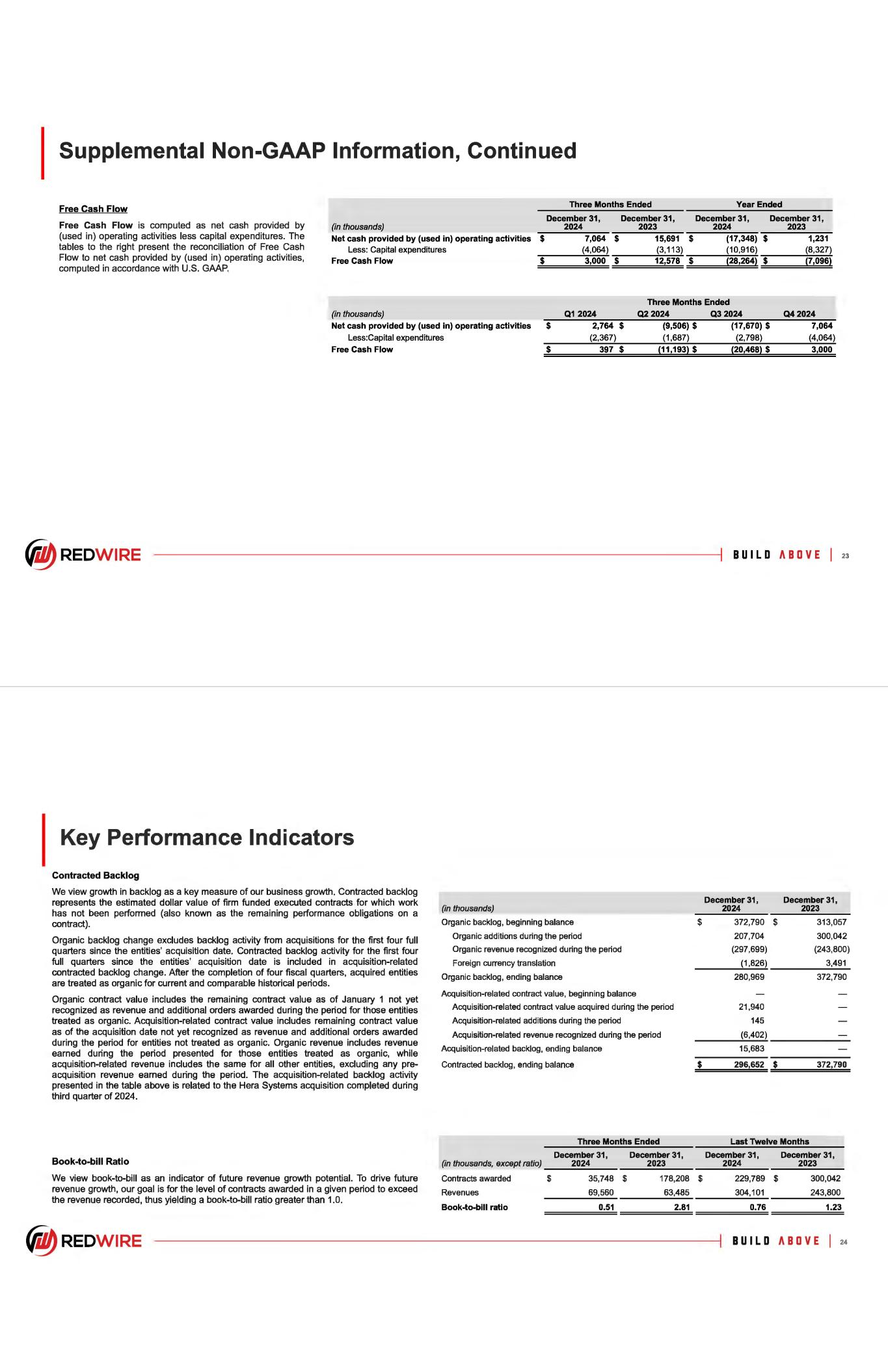

Supplemental Non-GAAP Information, Continued Free Cash Flow Free Cash Flow is computed as net cash provided by (used in) operating activities less capital expenditures. The tables to the right present the reconciliation of Free Cash Flow to net cash provided by (used in) operating activities, computed in accordance with U.S. GAAP. ~ REDWIRE (in thousands) Net cash provided by (used in) operating activities Less: Capital expenditures Free Cash Flow (in thousands) Net cash provided by (used in) operating activities Less:Capital expenditures Free Cash Flow $ $ Three Months Ended Year Ended December 31, December 31, December 31, December 31, 2024 7,064 $ (4,064) 3,000 $ Q1 2024 $ 2,764 $ (2,367) $ 397 $ 2023 2024 15,691 $ (17,348) $ (3,113) (10,916) 12,578 $ (28,264) $ Three Months Ended Q2 2024 Q3 2024 (9,506) $ (17,670) $ (1,687) (2,798) (11,193) $ (20,468) $ 2023 1,231 (8,327) (7,096) Q42024 7,064 (4,064) 3,000 BUILD ABOVE I 23 Key Performance Indicators Contracted Backlog We view growth in backlog as a key measure of our business growth. Contracted backlog represents the estimated dollar value of firm funded executed contracts for which work has not been performed (also known as the remaining performance obligations on a contract). Organic backlog change excludes backlog activity from acquisitions for the first four full quarters since the entities' acquisition date. Contracted backlog activity for the first four full quarters since the entities' acquisition date is included in acquisition-related contracted backlog change. After the completion of four fiscal quarters, acquired entities are treated as organic for current and comparable historical periods. Organic contract value includes the remaining contract value as of January 1 not yet recognized as revenue and additional orders awarded during the period for those entities treated as organic. Acquisition-related contract value includes remaining contract value as of the acquisition date not yet recognized as revenue and additional orders awarded during the period for entities not treated as organic. Organic revenue includes revenue earned during the period presented for those entities treated as organic, while acquisition-related revenue includes the same for all other entities, excluding any pre acquisition revenue earned during the period. The acquisition-related backlog activity presented in the table above is related to the Hera Systems acquisition completed during third quarter of 2024. Book-to-bill Ratio We view book-to-bill as an indicator of future revenue growth potential. To drive future revenue growth, our goal is for the level of contracts awarded in a given period to exceed the revenue recorded, thus yielding a book-to-bill ratio greater than 1.0. vf!!J REDWIRE (in thousands) Organic backlog, beginning balance Organic additions during the period Organic revenue recognized during the period Foreign currency translation Organic backlog, ending balance Acquisition-related contract value, beginning balance Acquisition-related contract value acquired during the period Acquisition-related additions during the period Acquisition-related revenue recognized during the period Acquisition-related backlog, ending balance Contracted backlog, ending balance Three Months Ended December 31, December 31, (in thousands, except ratio) 2024 2023 Contracts awarded $ 35,748 $ 178,208 Revenues 69,560 63,485 Book-to-bill ratio 0.51 2.81 December 31, December 31, 2024 2023 $ 372,790 $ 313,057 207,704 300,042 (297,699) (243,800) (1,826) 3,491 280,969 372,790 21,940 145 (6,402) 15,683 $ 296,652 $ 372,790 Last Twelve Months December 31, December 31, 2024 2023 $ 229,789 $ 300,042 304,101 243,800 0.76 1.23 BUILD ABOVE I 24