1. Insert Footnote Transformational Transaction Creates a Multi-Domain, Scaled and Profitable Space and Defense Tech Company January 20, 2025 1. Insert Footnote This Presentation has been prepared by Redwire Corporation (“Redwire”, “RDW”, the “Company”, “we”, “us” and “our”) in connection with a proposed business combination with Edge Autonomy Intermediate Holdings, LLC (“Edge”) and related transactions thereto (the “proposed business combination”, “Transaction” or “Combination”). Additional Information and Where to Find It The definitive agreement entered into in connection with the proposed business combination described herein and a summary of the material terms of the transaction will be provided in a Current Report on Form 8-K or Schedule 14A to be filed with the Securities and Exchange Commission (the “SEC”). Redwire will file with the SEC a proxy statement relating to a special meeting of Redwire’s stockholders (the “proxy statement”). STOCKHOLDERS ARE URGED TO CAREFULLY READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT REDWIRE, EDGE AUTONOMY, THE TRANSACTION AND RELATED MATTERS. Stockholders will be able to obtain free copies of the proxy statement and other documents filed with the SEC by the parties through the website maintained by the SEC at www.sec.gov. In addition, investors and stockholders will be able to obtain free copies of the proxy statement and other documents filed with the SEC by the parties on investor relations section of Redwire’s website at redwirespace.com. Participants in the Solicitation Redwire and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Redwire in respect of the proposed business combination contemplated by the proxy statement. Information regarding the persons who are, under the rules of the SEC, participants in the solicitation of the stockholders of Redwire, respectively, in connection with the proposed business combination, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement when it is filed with the SEC. Information regarding Redwire’s directors and executive officers is contained in Redwire’s Annual Report on Form 10-K for the year ended December 31, 2023 and its Proxy Statement on Schedule 14A, dated April 22, 2024, which are filed with the SEC. No Offer or Solicitation This Presentation is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote in any jurisdiction pursuant to the proposed business combination or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. Use of Data Industry and market data used in this Presentation have been obtained from third-party industry publications and sources, as well as from research reports prepared for other purposes. Redwire or Edge Autonomy have not independently verified the data obtained from these sources and cannot assure you of the data’s accuracy or completeness. This data is subject to change. Statements other than historical facts, including, but not limited to, those concerning market conditions or trends, consumer or customer preferences or other similar concepts with respect to Redwire, Edge Autonomy and the expected combined company, are based on current expectations, estimates, projections, targets, opinions and/or beliefs of Redwire or, when applicable, of one or more third-party sources. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. In addition, no representation or warranty is made with respect to the reasonableness of any estimates, forecasts, illustrations, prospects or returns, which should be regarded as illustrative only, or that any profits will be realized. The metrics regarding select aspects of Redwire's, Edge Autonomy’s and the expected combined company’s operations were selected by Redwire or its subsidiaries on a subjective basis. Such metrics are provided solely for illustrative purposes to demonstrate elements of Redwire's businesses, are incomplete, and are not necessarily indicative of Redwire’s, Edge Autonomy’s or their subsidiaries’ performance or overall operations. There can be no assurance that historical trends will continue. The Edge Autonomy financial information, including non-GAAP measures, for the last twelve months ended September 30, 2024 and year ended December 31, 2023 included in this Presentation are unaudited and subject to change. The historical financial information, including any related non-GAAP information, for Edge Autonomy is subject to the finalization of year-end financial and accounting procedures (which are in process of being performed) and should not be viewed as a substitute for audited results prepared in accordance with U.S. generally accepted accounting principles. The actual results may be materially different from the unaudited results, and therefore undue reliance should not be placed on the unaudited information. Use of Projections The financial outlook and projections, estimates and targets in this Presentation are forward-looking statements that are based on assumptions that are inherently subject to significant uncertainty and contingencies, many of which are beyond Redwire’s or Edge Autonomy’s control. Neither Redwire nor Edge Autonomy’s independent auditors have audited, reviewed, compiled or performed any procedures with respect to the financial projections for purposes of inclusion in this Presentation, and, accordingly, they did not express an opinion or provide any other form of assurance with respect thereto for the purposes of this Presentation. While all financial projections, estimates and targets are necessarily speculative, Redwire believes that the preparation of prospective financial information involves increasingly higher levels of uncertainty the further out the projection, estimate or target extends from the date of preparation. The assumptions and estimates underlying the projected, expected or target results for Redwire, Edge Autonomy and the combined company are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the financial projections, estimates and targets. The inclusion of financial projections, estimates and targets in this Presentation should not be regarded as an indication that Redwire, or its representatives, considered or consider the financial projections, estimates or targets to be a reliable prediction of future events. Further, inclusion of the prospective financial information in this Presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved. 22

1. Insert Footnote Forward-Looking Statements Readers are cautioned that the statements contained in this Presentation regarding expectations of our performance or other matters that may affect our or the combined company’s business, results of operations, or financial condition are “forward-looking statements” as defined by the “safe harbor” provisions in the Private Securities Litigation Reform Act of 1995. Such statements are made in reliance on the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical fact, included or incorporated in this Presentation, including statements regarding our or the combined company’s strategy, financial projections, including the prospective financial information provided in this Presentation, financial position, funding for continued operations, cash reserves, liquidity, projected costs, plans, projects, awards and contracts, and objectives of management, the entry into the potential business combination, the expected benefits from the proposed business combination, the expected performance of the combined company, the expectations regarding financing the proposed business combination, among others, are forward-looking statements. Words such as “expect,” “anticipate,” “should,” “believe,” “target,” “continued,” “project,” “plan,” “opportunity,” “estimate,” “potential,” “predict,” “demonstrates,” “may,” “will,” “could,” “intend,” “shall,” “possible,” “forecast,” “trends,” “contemplate,” “would,” “approximately,” “likely,” “outlook,” “schedule,” “pipeline,” and variations of these terms or the negative of these terms and similar expressions are intended to identify these forward-looking statements, but the absence of these words does not mean that a statement is not forward looking. These forward-looking statements are not guarantees of future performance, conditions or results. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond our control. These factors and circumstances include, but are not limited to: (1) risks associated with the continued economic uncertainty, including high inflation, supply chain challenges, labor shortages, increased labor costs, high interest rates, foreign currency exchange volatility, concerns of economic slowdown or recession and reduced spending or suspension of investment in new or enhanced projects; (2) the failure of financial institutions or transactional counterparties; (3) Redwire’s limited operating history and history of losses to date as well as the limited operating history of Edge Autonomy and the relatively novel nature of the drone industry; (4) the inability to successfully integrate recently completed and future acquisitions, including the proposed business combination with Edge Autonomy, as well as the failure to realize the anticipated benefits of the transaction or to realize estimated projected combined company results; (5) the development and continued refinement of many of Redwire’s and the combined company’s proprietary technologies, products and service offerings; (6) competition with new or existing companies; (7) the possibility that Redwire’s expectations and assumptions relating to future results and projections with respect to Redwire or Edge Autonomy may prove incorrect; (8) adverse publicity stemming from any incident or perceived risk involving Redwire, Edge Autonomy, the combined company, or their competitors; (9) unsatisfactory performance of our and the combined company’s products resulting from challenges in the space environment, extreme space weather events, the environments in which drones operate, including in combat or other areas where hostilities may occur, or otherwise; (10) the emerging nature of the market for in-space infrastructure services and the market for drones and related services; (11) inability to realize benefits from new offerings or the application of our or the combined company’s technologies; (12) the inability to convert orders in backlog into revenue; (13) our and the combined company’s dependence on U.S. and foreign government contracts, which are only partially funded and subject to immediate termination, or which may be influenced by the level of military activities and related spending such as in or with respect to the war in Ukraine; (14) the fact that we are and the combined company will be subject to stringent economic sanctions, and trade control laws and regulations; (15) the need for substantial additional funding to finance our and the combined company’s operations, which may not be available when needed, on acceptable terms or at all; (16) the dilution of existing holders of our common stock that will result from the issuance of additional shares of common stock as consideration for the acquisition of Edge Autonomy, as well as the issuance of common stock in any offering that may be undertaken in connection with such acquisition; (17) the fact that the issuance and sale of shares of our Series A Convertible Preferred Stock has reduced the relative voting power of holders of our common stock and diluted the ownership of holders of our capital stock; (18) the ability to achieve the conditions to cause, or timing of, any mandatory conversion of the Series A Convertible Preferred stock into common stock; (19) the fact that AE Industrial Partners and Bain Capital have significant influence over us, which could limit your ability to influence the outcome of key transactions; (20) provisions in our Certificate of Designation with respect to our Series A Convertible Preferred Stock may delay or prevent our acquisition by a third party, which could also reduce the market price of our capital stock; (21) the fact that our Series A Convertible Preferred Stock has rights, preferences and privileges that are not held by, and are preferential to, the rights of holders of our other outstanding capital stock; (22) the possibility of sales of a substantial amount of our common stock by our current stockholders, as well as the equity owners of Edge Autonomy following consummation of the transaction, which sales could cause the price of our common stock and warrants to fall; (23) the impact of the issuance of additional shares of Series A Convertible Preferred Stock as pay in kind dividends on the price and market for our common stock; (24) the volatility of the trading price of our common stock and warrants; (25) risks related to short sellers of our common stock; (26) Redwire’s or the combined company’s inability to report our financial condition or results of operations accurately or timely as a result of identified material weaknesses in internal control over financial reporting, as well as the possible need to expand or improve Edge Autonomy’s financial reporting systems and controls; (27) the possibility that the closing conditions under the merger agreement necessary to consummate the merger between Redwire and Edge Autonomy will not be satisfied; (28) the effect of any announcement or pendency of the proposed business combination on Redwire’s or Edge Autonomy’s business relationships, operating results and business generally; (29) risks that the proposed business combination disrupts current plans and operations of Redwire or Edge Autonomy; (30) the ability of Redwire or the combined company to raise financing in connection with the proposed business combination or to finance its operations in the future; (31) the impact of any increase in the combined company’s indebtedness incurred to fund working capital or other corporate needs, including the repayment of Edge Autonomy’s outstanding indebtedness and transaction expenses incurred to acquire Edge Autonomy, as well as debt covenants that may limit the combined company’s activities, flexibility or ability to take advantage of business opportunities, and the effect of debt service on the availability of cash to fund investment in the business; (32) the ability to implement business plans, forecasts and other expectations after the completion of the proposed transaction, and identify and realize additional opportunities; (33) costs related to the transaction; and (34) other risks and uncertainties described in our most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q and those indicated from time to time in other documents filed or to be filed with the SEC by Redwire. The forward-looking statements contained in this Presentation are based on our current expectations and beliefs concerning future developments and their potential effects on us. If underlying assumptions to forward-looking statements prove inaccurate, or if known or unknown risks or uncertainties materialize, actual results could vary materially from those anticipated, estimated, or projected. The forward-looking statements contained in this Presentation are made as of the date of this Presentation, and Redwire disclaims any intention or obligation, other than imposed by law, to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. Persons reading this Presentation are cautioned not to place undue reliance on forward-looking statements. Non-GAAP Financial Information This Presentation contains financial measures that have not been prepared in accordance with United States Generally Accepted Accounting Principles (“U.S. GAAP”). These financial measures include forecasted Adjusted EBITDA and Free Cash Flow for Redwire assuming completion of the acquisition of Edge Autonomy. Non-GAAP financial measures are used to supplement the financial information presented on a U.S. GAAP basis and should not be considered in isolation or as a substitute for the relevant U.S. GAAP measures and should be read in conjunction with information presented on a U.S. GAAP basis. Because not all companies use identical calculations, our presentation of Non-GAAP measures may not be comparable to other similarly titled measures of other companies. We encourage investors and stockholders to review our financial statements and publicly-filed reports in their entirety and not to rely on any single financial measure. As soliciting material that is filed pursuant to Rule 14a-12, this Presentation is exempt from the requirements of Regulation G and Item 10(e) of Reg. S-K with respect to Non-GAAP financial measure disclosure. Trademarks This Presentation contains trademarks, service marks and registered marks of Redwire and its subsidiaries and Edge and its subsidiaries. All other trademarks are the property of their respective owners. 33 1. Insert Footnote Transaction Financial Overview 14 Q&A 17 Transaction Overview & Benefits 5 Agenda & Presenters 2 1 3 Jonathan Baliff Chief Financial Officer & Director Aviation and infrastructure sector leader for 30+ years Former CEO and CFO at Bristow Group ($BRS), the largest global industrial aviation company Operating Partner at Genesis Park; previously at NRG Energy ($NRG), CSFB(1), J.P. Morgan, and an aviator in the U.S. Air Force Peter Cannito Chairman & Chief Executive Officer 25+ years of experience in aerospace and defense Former CEO of Polaris Alpha, a defense technology company acquired by Parsons ($PSN) Operating Partner at AEI Industrial, Chairman BigBear.ai ($BBAI), and previously an officer in the U.S. Marine Corps 4(1) Credit Suisse First Boston

1. Insert Footnote Transaction Overview & Benefits Peter Cannito, Chairman and CEO 5 1. Insert Footnote The Transaction Overview: Redwire + Edge Autonomy 6 (1) 51.4 shares issued to seller based on $775M of consideration and Redwire 30-day VWAP of $15.07 as of 1/17/25 subject to change based on net proceeds of an equity financing that may be undertaken at Redwire’s option. Redwire may finance the cash portion of the purchase price, at its option, with cash on its balance sheet, availability under its existing credit facility, or proceeds from new committed debt facilities. Redwire may also elect to use proceeds from a new equity issuance of Redwire common stock. If Redwire elects to raise cash in an equity financing, the $15.07 issuance price would be increased or decreased depending on the per share price of such equity financing. (2) Please see slides 2 and 3 of this Presentation. These amounts are the sum of the standalone Redwire and Edge Autonomy businesses by Redwire management and have not been calculated pursuant to Article 11 of Regulation S-X. (3) Adjusted EBITDA and Free Cash Flow are not measures of results under generally accepted accounting principles in the United States. Please refer to slide 3 and the Appendix in this Presentation for additional information. Free Cash Flow is computed as net cash provided by (used in) operating activities less capital expenditures. The Combination Terms & Financing Financial Details Timing & Closing Conditions • Redwire plans to acquire Edge Autonomy – a leader in providing field-proven innovative autonomous systems, advanced optics, and resilient energy solutions • Redwire and Edge Autonomy will deliver innovation in multi-domain defense solutions from space to cyberspace to air, land, and maritime to the warfighter • Consideration: $925M purchase price expected to be funded with $150 million in cash and $775M in RDW common shares(1) • Redwire’s existing Convertible Preferred Stock expected to convert shortly after closing • The transaction is expected to close during the second quarter of 2025 • The transaction will be subject to customary approvals and closing conditions, including a shareholder vote • The transaction will need to be approved by a majority of the outstanding voting power not held by AE Industrial Partners, LP (AEI). In connection with the transaction, entities affiliated with AEI, Genesis Park (through its affiliate Genesis Park II LP) and Bain Capital (through its affiliate BCC Redwire Aggregator, L.P.) have agreed to vote in favor of the proposals relating to the transaction. • Expected to be immediately accretive to Revenue and Adjusted EBITDA(3) post-close • Redwire is forecasting full year 2025 Combined Revenues to be $535M-$605M and full year 2025 Combined Adjusted EBITDA(3) to be $70M-$105M, assuming the transaction had been consummated on January 1, 2025(2) • Post-transaction, Redwire expects to have a strong balance sheet with positive Free Cash Flow(3) in 2025(2)

1. Insert Footnote 7 Standalone Edge Autonomy at a Glance Complete Multi-Mission Defense Technology Solutions for the US DoD and Allied Forces With a diverse ecosystem of uncrewed aerial vehicles, EO/IR camera payloads, and ruggedized power solutions - as well as a broad global manufacturing footprint of more than 265,000ft2 and flight test facilities in the US and EU Source: Edge Autonomy management provided materials. See slide 27 for definitions of acronyms. (1) Amounts presented as of and for the last twelve months ended September 30, 2024. Metrics based on data available to Redwire that has not been audited by Redwire or its auditors and is subject to change. Such metrics may not have the same definition as, nor be comparable to Redwire’s financial measures, including non-GAAP financial measures, of the same or similar name. Please refer to slide 2 of the Presentation for additional information. (2) Last Twelve Months is calculated by aggregation of quarterly Revenues and Adjusted EBITDA for the last four quarters. (3) Adjusted EBITDA is not a measure of results under generally accepted accounting principles in the United States. Please refer to slide 3 in this Presentation for additional information. (4) As of December 31, 2024. In January 2025, Edge Autonomy opened a location in Ukraine. $222 million Last Twelve Months Revenue as of September 30, 2024(1,2) $72 million Last Twelve Months Adjusted EBITDA as of September 30, 2024(1,2,3) ~80 Countries where Edge Autonomy products have been sold 600+ Global Base of Employees 6 Locations Across 3 Countries(4) 170K Flight Hours Across 6 Continents Select Customers US Army US Marine Corps US SOCOM Latvian National Armed Forces UK MoD US DHS Fully Integrated & Comprehensive Products Offering • Uncrewed Aircraft Systems • ISR gimbal payloads • Efficient and rugged power solutions VXE30 Stalker Penguin C VTOL Octopus ISR Payloads P250i 1. Insert Footnote Edge Autonomy Provides a Complete Solution to Its Global Customers Mission-ready product suite, including platforms, subsystems, and components, is developed and manufactured in-house, allowing for high-level customer responsiveness Growing and profitable business that achieved 2023 revenue of $152M and Adjusted EBITDA of $52M(1,2) With an experienced management team supported by a highly technical, global workforce, Edge Autonomy offers over three decades of proven, progressive UAS design, development, and production Executing on multiple Programs of Record for U.S. DoD, Five Eyes, and NATO defense partners and delivering robust access to pipeline of opportunity; global footprint positioned for global growth Sustained in-theater activity across 6 continents with direct mission relevance in austere conditions 8 Private and Confidential; Draft Subject to Change Source: Edge Autonomy management provided materials. See slide 27 for definitions of acronyms. (1) Amounts presented as of and for the year ended December 31, 2023, which is the most recently completed fiscal year for Edge Autonomy. Metrics based on data available to Redwire that has not been audited by Redwire or its auditors and is subject to change. Such metrics may not have the same definition as, nor be comparable to Redwire’s financial measures, including non-GAAP financial measures, of the same or similar name. Please refer to slide 2 of the Presentation for additional information. (2) Adjusted EBITDA is not a measure of results under generally accepted accounting principles in the United States. Please refer to slide 3 in this Presentation for additional information.

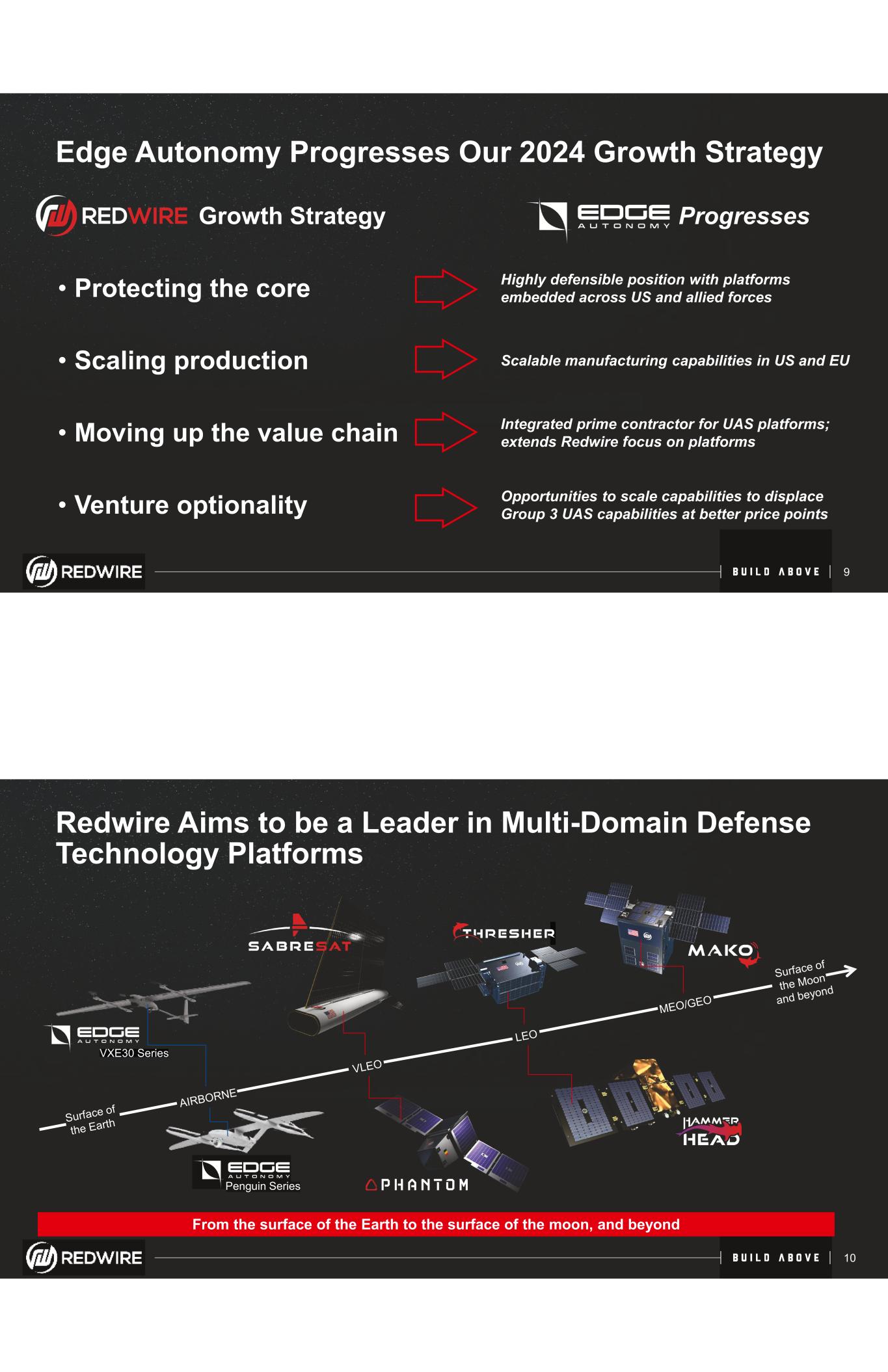

1. Insert Footnote Growth Strategy Progresses • Protecting the core Highly defensible position with platforms embedded across US and allied forces • Scaling production Scalable manufacturing capabilities in US and EU • Moving up the value chain Integrated prime contractor for UAS platforms; extends Redwire focus on platforms • Venture optionality Opportunities to scale capabilities to displace Group 3 UAS capabilities at better price points 9 Edge Autonomy Progresses Our 2024 Growth Strategy 1. Insert Footnote 10 Redwire Aims to be a Leader in Multi-Domain Defense Technology Platforms VXE30 Series Penguin Series From the surface of the Earth to the surface of the moon, and beyond

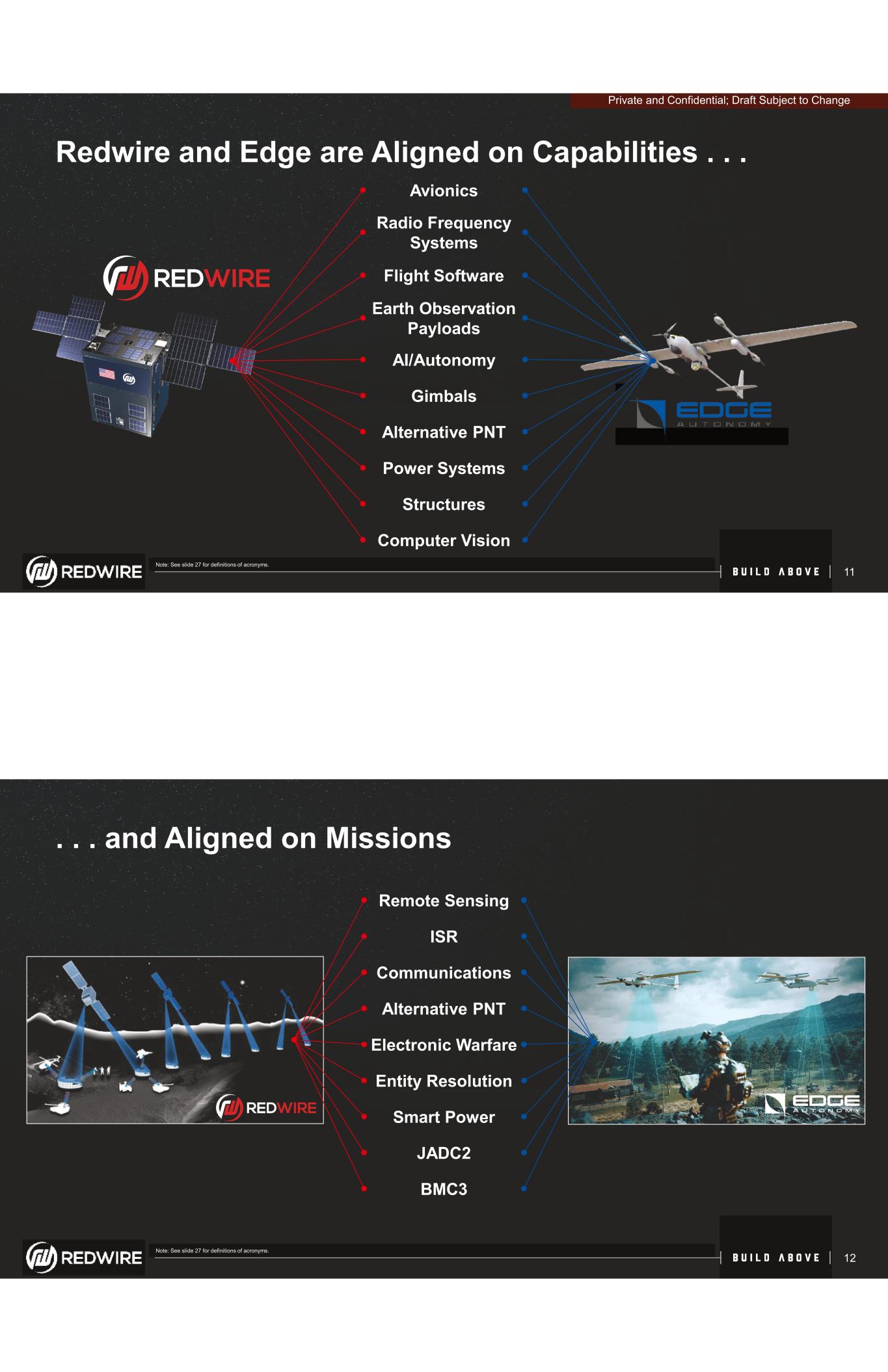

1. Insert Footnote Redwire and Edge are Aligned on Capabilities . . . Avionics Radio Frequency Systems Flight Software Earth Observation Payloads AI/Autonomy Gimbals Alternative PNT Power Systems Structures Computer Vision 11 Note: See slide 27 for definitions of acronyms. Private and Confidential; Draft Subject to Change 1. Insert Footnote . . . and Aligned on Missions 12 Remote Sensing ISR Communications Alternative PNT Electronic Warfare Entity Resolution Smart Power JADC2 BMC3 Note: See slide 27 for definitions of acronyms.

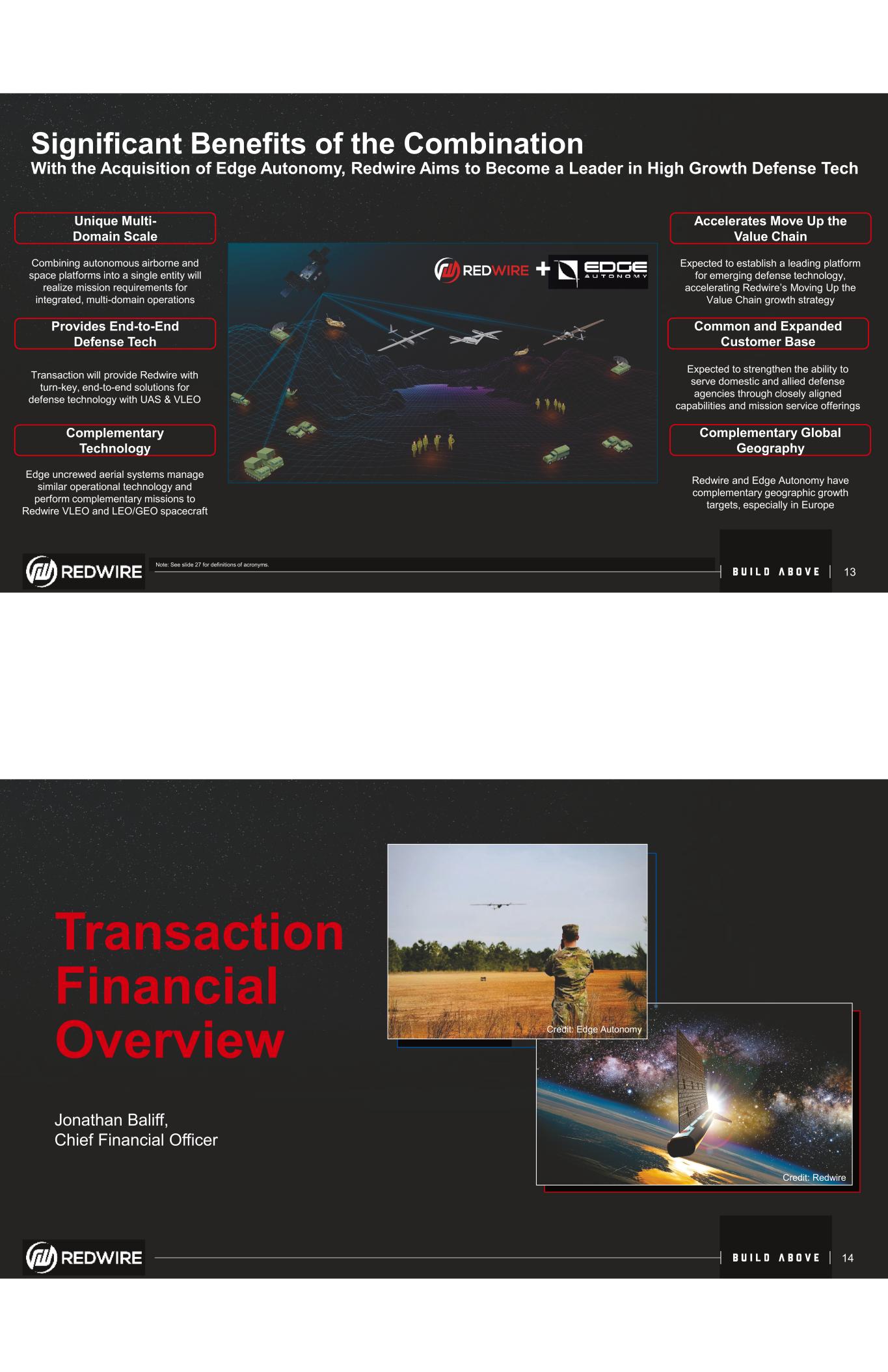

1. Insert Footnote Significant Benefits of the Combination With the Acquisition of Edge Autonomy, Redwire Aims to Become a Leader in High Growth Defense Tech Accelerates Move Up the Value Chain Expected to establish a leading platform for emerging defense technology, accelerating Redwire’s Moving Up the Value Chain growth strategy Common and Expanded Customer Base Expected to strengthen the ability to serve domestic and allied defense agencies through closely aligned capabilities and mission service offerings Complementary Global Geography Redwire and Edge Autonomy have complementary geographic growth targets, especially in Europe Unique Multi- Domain Scale Combining autonomous airborne and space platforms into a single entity will realize mission requirements for integrated, multi-domain operations Provides End-to-End Defense Tech Transaction will provide Redwire with turn-key, end-to-end solutions for defense technology with UAS & VLEO Complementary Technology Edge uncrewed aerial systems manage similar operational technology and perform complementary missions to Redwire VLEO and LEO/GEO spacecraft 13 + Note: See slide 27 for definitions of acronyms. 1. Insert Footnote Transaction Financial Overview Jonathan Baliff, Chief Financial Officer 14 Credit: Edge Autonomy Credit: Redwire

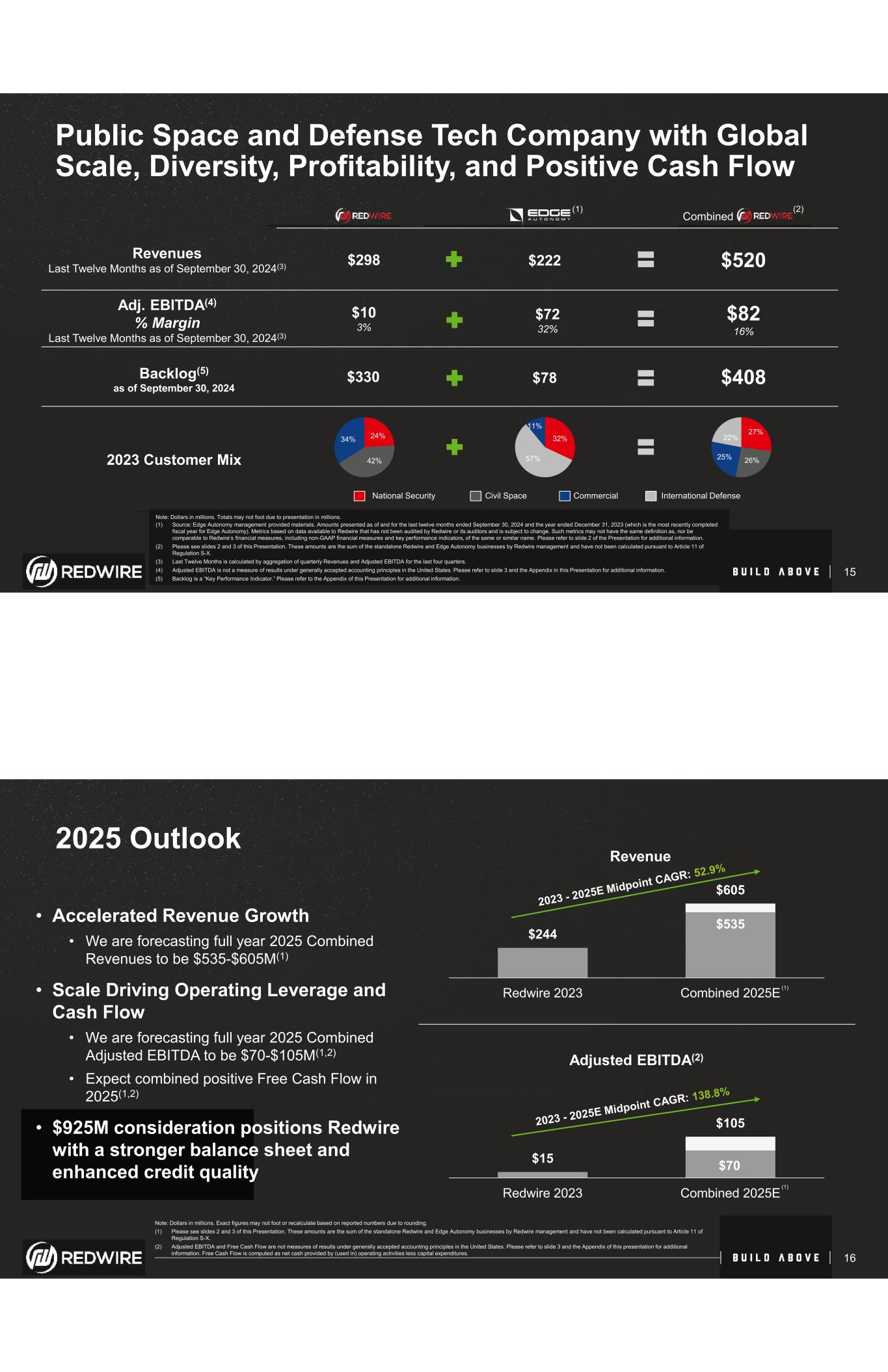

1. Insert Footnote $10 3% Revenues Last Twelve Months as of September 30, 2024(3) $298 $520 Adj. EBITDA(4) % Margin Last Twelve Months as of September 30, 2024(3) $82 16% 2023 Customer Mix 24% 42% 34% 27% 26%25% 22% Backlog(5) as of September 30, 2024 $330 $408 National Security Civil Space Commercial Note: Dollars in millions. Totals may not foot due to presentation in millions. (1) Source: Edge Autonomy management provided materials. Amounts presented as of and for the last twelve months ended September 30, 2024 and the year ended December 31, 2023 (which is the most recently completed fiscal year for Edge Autonomy). Metrics based on data available to Redwire that has not been audited by Redwire or its auditors and is subject to change. Such metrics may not have the same definition as, nor be comparable to Redwire’s financial measures, including non-GAAP financial measures and key performance indicators, of the same or similar name. Please refer to slide 2 of the Presentation for additional information. (2) Please see slides 2 and 3 of this Presentation. These amounts are the sum of the standalone Redwire and Edge Autonomy businesses by Redwire management and have not been calculated pursuant to Article 11 of Regulation S-X. (3) Last Twelve Months is calculated by aggregation of quarterly Revenues and Adjusted EBITDA for the last four quarters. (4) Adjusted EBITDA is not a measure of results under generally accepted accounting principles in the United States. Please refer to slide 3 and the Appendix in this Presentation for additional information. (5) Backlog is a “Key Performance Indicator.” Please refer to the Appendix of this Presentation for additional information. 15 Public Space and Defense Tech Company with Global Scale, Diversity, Profitability, and Positive Cash Flow $222 $72 32% $78 32% 57% 11% (1) (2) Combined International Defense 1. Insert Footnote $535 $244 $605 Redwire 2023 Combined 2025E Revenue 2025 Outlook $70 $15 $105 Redwire 2023 Combined 2025E Adjusted EBITDA(2) Note: Dollars in millions. Exact figures may not foot or recalculate based on reported numbers due to rounding. (1) Please see slides 2 and 3 of this Presentation. These amounts are the sum of the standalone Redwire and Edge Autonomy businesses by Redwire management and have not been calculated pursuant to Article 11 of Regulation S-X. (2) Adjusted EBITDA and Free Cash Flow are not measures of results under generally accepted accounting principles in the United States. Please refer to slide 3 and the Appendix of this presentation for additional information. Free Cash Flow is computed as net cash provided by (used in) operating activities less capital expenditures. 16 • Accelerated Revenue Growth • We are forecasting full year 2025 Combined Revenues to be $535-$605M(1) • Scale Driving Operating Leverage and Cash Flow • We are forecasting full year 2025 Combined Adjusted EBITDA to be $70-$105M(1,2) • Expect combined positive Free Cash Flow in 2025(1,2) • $925M consideration positions Redwire with a stronger balance sheet and enhanced credit quality (1) (1)

1. Insert Footnote Questions & Answers Appendix Private and Confidential; Draft Subject to Change

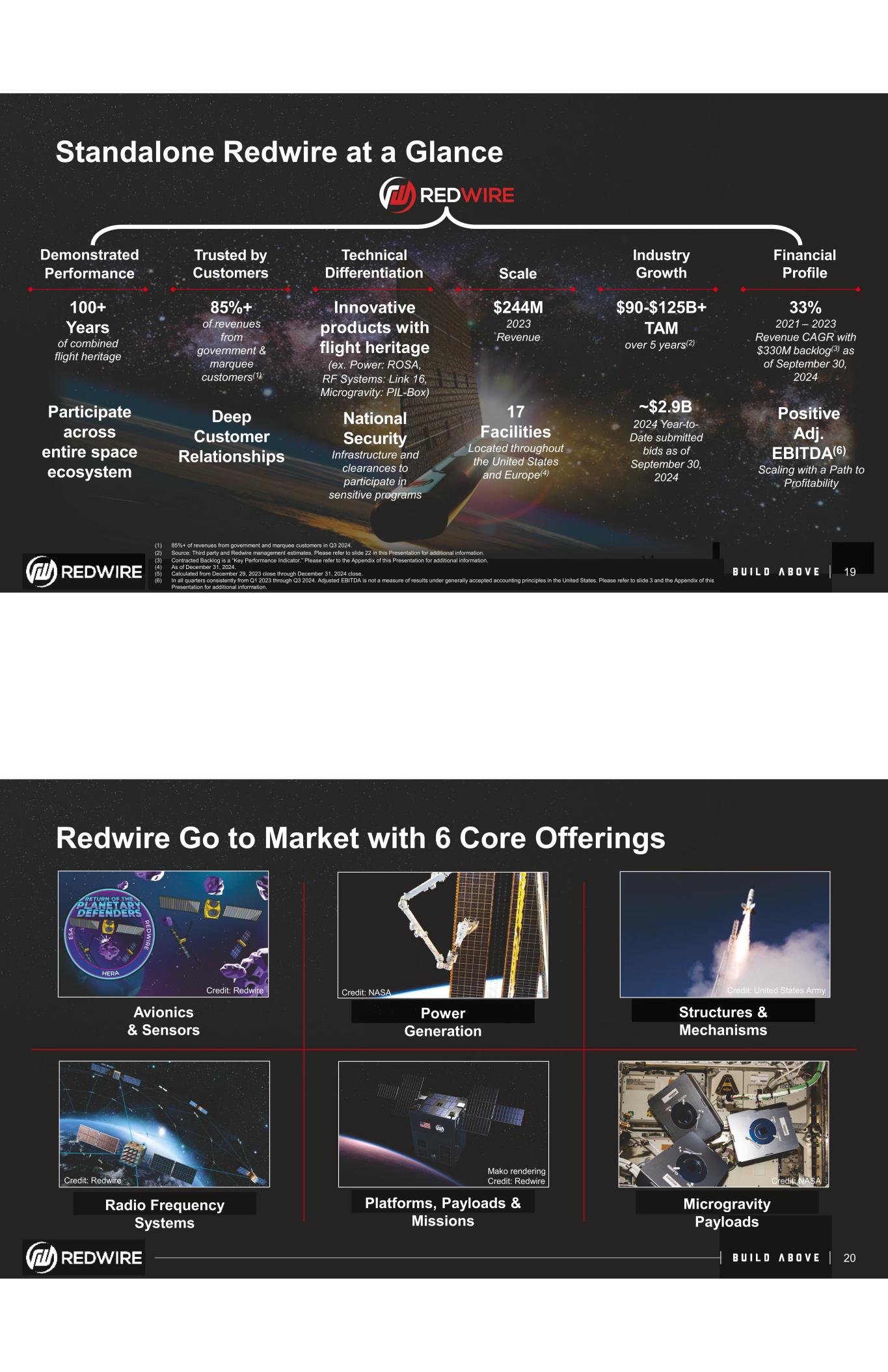

1. Insert Footnote 100+ Years of combined flight heritage Participate across entire space ecosystem 85%+ of revenues from government & marquee customers(1) Deep Customer Relationships Innovative products with flight heritage (ex. Power: ROSA, RF Systems: Link 16, Microgravity: PIL-Box) National Security Infrastructure and clearances to participate in sensitive programs $244M 2023 Revenue 17 Facilities Located throughout the United States and Europe(4) $90-$125B+ TAM over 5 years(2) ~$2.9B 2024 Year-to- Date submitted bids as of September 30, 2024 33% 2021 – 2023 Revenue CAGR with $330M backlog(3) as of September 30, 2024 Positive Adj. EBITDA(6) Scaling with a Path to Profitability Demonstrated Performance Trusted by Customers Technical Differentiation Scale 14 Industry Growth Financial Profile 19 Standalone Redwire at a Glance (1) 85%+ of revenues from government and marquee customers in Q3 2024. (2) Source: Third party and Redwire management estimates. Please refer to slide 22 in this Presentation for additional information. (3) Contracted Backlog is a “Key Performance Indicator.” Please refer to the Appendix of this Presentation for additional information. (4) As of December 31, 2024. (5) Calculated from December 29, 2023 close through December 31, 2024 close. (6) In all quarters consistently from Q1 2023 through Q3 2024. Adjusted EBITDA is not a measure of results under generally accepted accounting principles in the United States. Please refer to slide 3 and the Appendix of this Presentation for additional information. 1. Insert Footnote Mako rendering Credit: Redwire Avionics & Sensors Power Generation Structures & Mechanisms Microgravity Payloads Platforms, Payloads & Missions Radio Frequency Systems Credit: Redwire Credit: NASA Credit: United States Army Credit: Redwire Credit: NASA 20 Redwire Go to Market with 6 Core Offerings

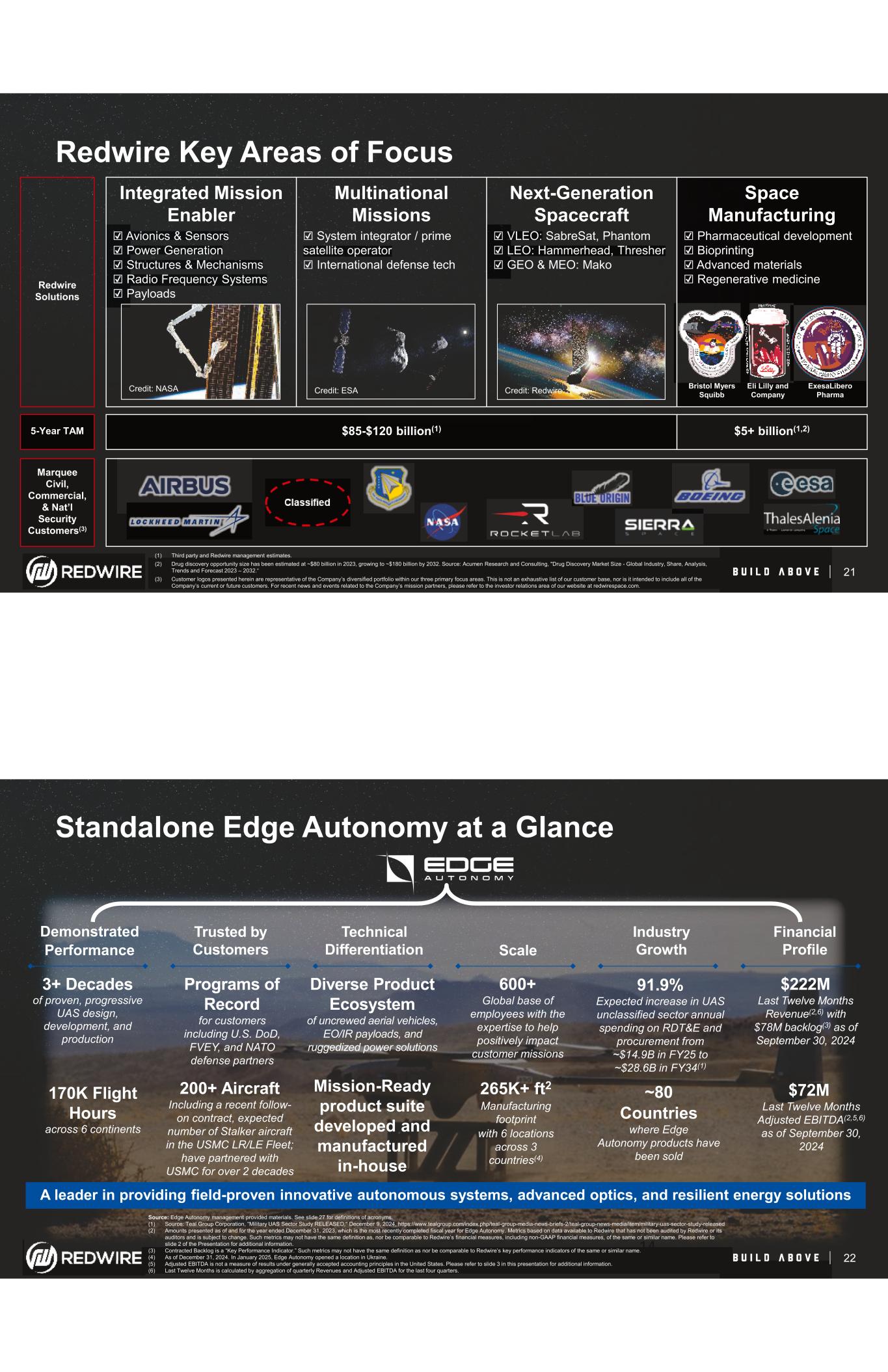

1. Insert Footnote Space Manufacturing Pharmaceutical development Bioprinting Advanced materials Regenerative medicine Integrated Mission Enabler Avionics & Sensors Power Generation Structures & Mechanisms Radio Frequency Systems Payloads Multinational Missions System integrator / prime satellite operator International defense tech Next-Generation Spacecraft VLEO: SabreSat, Phantom LEO: Hammerhead, Thresher GEO & MEO: Mako Redwire Solutions 5-Year TAM Marquee Civil, Commercial, & Nat’l Security Customers(3) $85-$120 billion(1) $5+ billion(1,2) Credit: NASA Credit: ESA Credit: Redwire Bristol Myers Squibb ExesaLibero Pharma Eli Lilly and Company 21 (1) Third party and Redwire management estimates. (2) Drug discovery opportunity size has been estimated at ~$80 billion in 2023, growing to ~$180 billion by 2032. Source: Acumen Research and Consulting, "Drug Discovery Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 – 2032.“ (3) Customer logos presented herein are representative of the Company’s diversified portfolio within our three primary focus areas. This is not an exhaustive list of our customer base, nor is it intended to include all of the Company’s current or future customers. For recent news and events related to the Company’s mission partners, please refer to the investor relations area of our website at redwirespace.com. Redwire Key Areas of Focus 1. Insert Footnote 3+ Decades of proven, progressive UAS design, development, and production 200+ Aircraft Including a recent follow- on contract, expected number of Stalker aircraft in the USMC LR/LE Fleet; have partnered with USMC for over 2 decades Programs of Record for customers including U.S. DoD, FVEY, and NATO defense partners 170K Flight Hours across 6 continents 600+ Global base of employees with the expertise to help positively impact customer missions 265K+ ft2 Manufacturing footprint with 6 locations across 3 countries(4) 91.9% Expected increase in UAS unclassified sector annual spending on RDT&E and procurement from ~$14.9B in FY25 to ~$28.6B in FY34(1) $222M Last Twelve Months Revenue(2,6) with $78M backlog(3) as of September 30, 2024 $72M Last Twelve Months Adjusted EBITDA(2,5,6) as of September 30, 2024 Demonstrated Performance Trusted by Customers Technical Differentiation Scale 14 Industry Growth Financial Profile 22 Standalone Edge Autonomy at a Glance A leader in providing field-proven innovative autonomous systems, advanced optics, and resilient energy solutions Source: Edge Autonomy management provided materials. See slide 27 for definitions of acronyms. (1) Source: Teal Group Corporation, “Military UAS Sector Study RELEASED,“ December 9, 2024, https://www.tealgroup.com/index.php/teal-group-media-news-briefs-2/teal-group-news-media/item/military-uas-sector-study-released (2) Amounts presented as of and for the year ended December 31, 2023, which is the most recently completed fiscal year for Edge Autonomy. Metrics based on data available to Redwire that has not been audited by Redwire or its auditors and is subject to change. Such metrics may not have the same definition as, nor be comparable to Redwire’s financial measures, including non-GAAP financial measures, of the same or similar name. Please refer to slide 2 of the Presentation for additional information. (3) Contracted Backlog is a “Key Performance Indicator.” Such metrics may not have the same definition as nor be comparable to Redwire’s key performance indicators of the same or similar name. (4) As of December 31, 2024. In January 2025, Edge Autonomy opened a location in Ukraine. (5) Adjusted EBITDA is not a measure of results under generally accepted accounting principles in the United States. Please refer to slide 3 in this presentation for additional information. (6) Last Twelve Months is calculated by aggregation of quarterly Revenues and Adjusted EBITDA for the last four quarters. Diverse Product Ecosystem of uncrewed aerial vehicles, EO/IR payloads, and ruggedized power solutions Mission-Ready product suite developed and manufactured in-house ~80 Countries where Edge Autonomy products have been sold

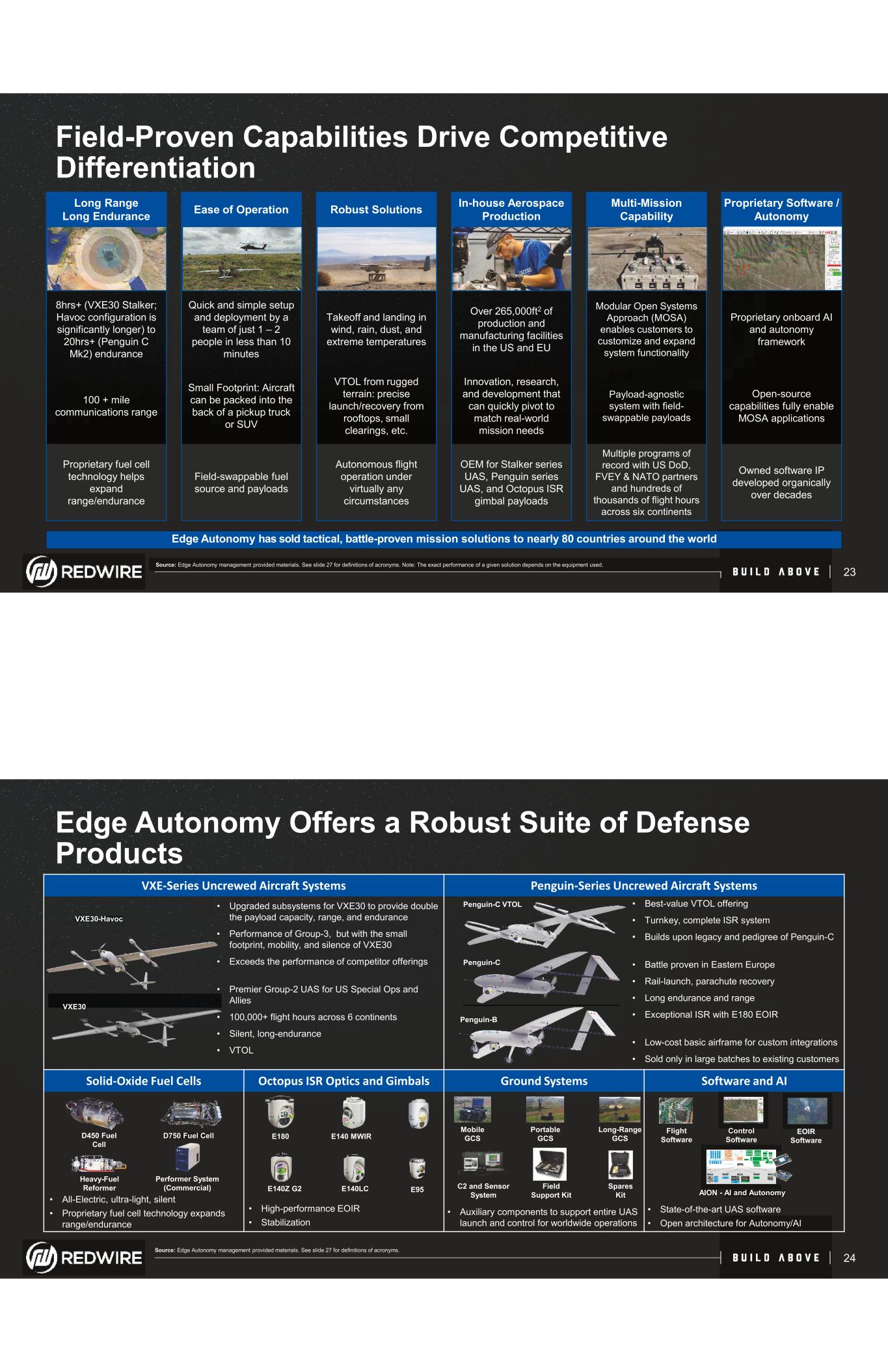

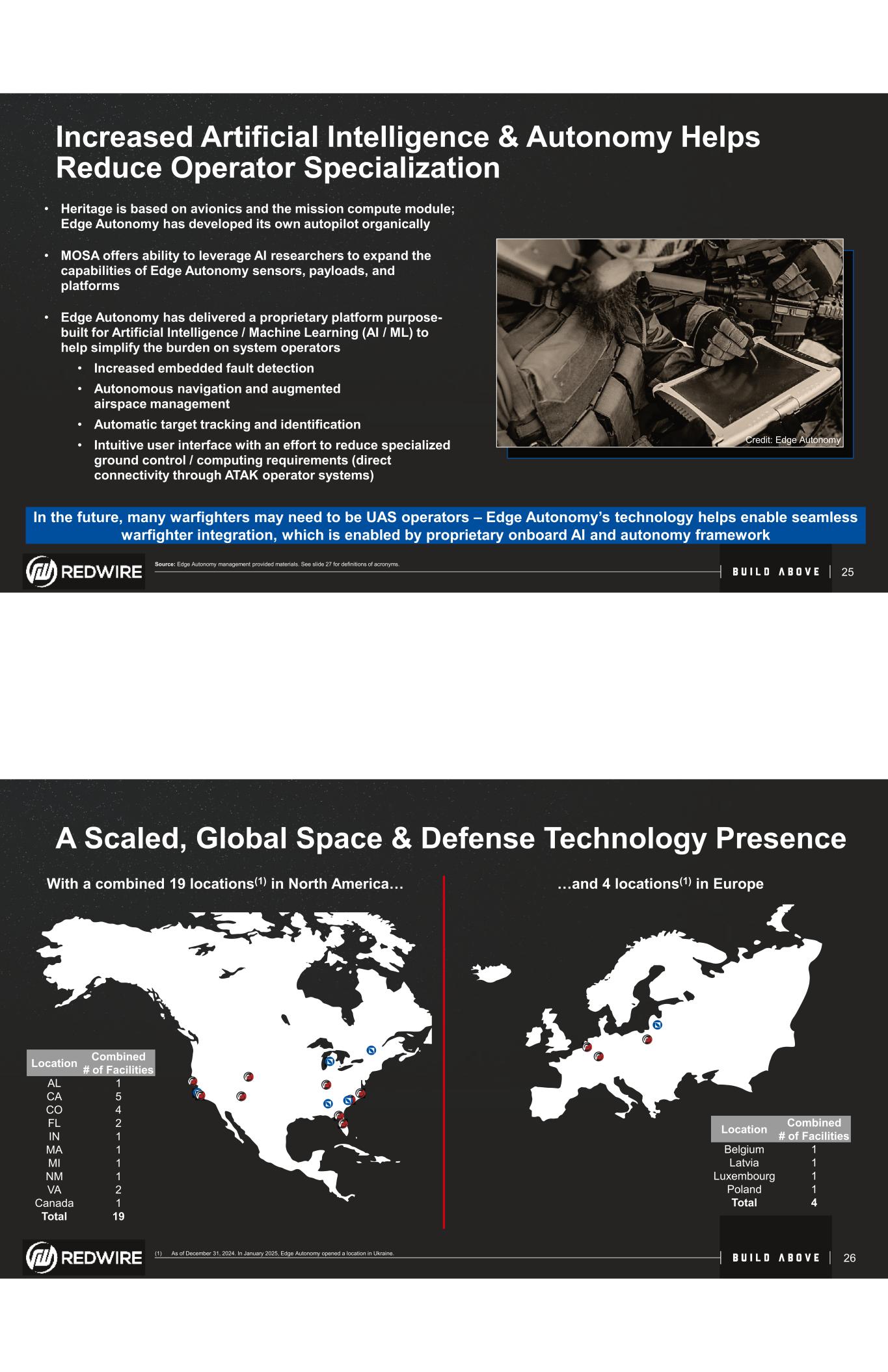

1. Insert Footnote 23 Edge Autonomy has sold tactical, battle-proven mission solutions to nearly 80 countries around the world Source: Edge Autonomy management provided materials. See slide 27 for definitions of acronyms. Note: The exact performance of a given solution depends on the equipment used. Long Range Long Endurance Ease of Operation Robust Solutions In-house Aerospace Production Multi-Mission Capability Proprietary Software / Autonomy 8hrs+ (VXE30 Stalker; Havoc configuration is significantly longer) to 20hrs+ (Penguin C Mk2) endurance Quick and simple setup and deployment by a team of just 1 – 2 people in less than 10 minutes Takeoff and landing in wind, rain, dust, and extreme temperatures Over 265,000ft2 of production and manufacturing facilities in the US and EU Modular Open Systems Approach (MOSA) enables customers to customize and expand system functionality Proprietary onboard AI and autonomy framework 100 + mile communications range Small Footprint: Aircraft can be packed into the back of a pickup truck or SUV VTOL from rugged terrain: precise launch/recovery from rooftops, small clearings, etc. Innovation, research, and development that can quickly pivot to match real-world mission needs Payload-agnostic system with field- swappable payloads Open-source capabilities fully enable MOSA applications Proprietary fuel cell technology helps expand range/endurance Field-swappable fuel source and payloads Autonomous flight operation under virtually any circumstances OEM for Stalker series UAS, Penguin series UAS, and Octopus ISR gimbal payloads Multiple programs of record with US DoD, FVEY & NATO partners and hundreds of thousands of flight hours across six continents Owned software IP developed organically over decades Field-Proven Capabilities Drive Competitive Differentiation 1. Insert Footnote 24 Edge Autonomy Offers a Robust Suite of Defense Products VXE-Series Uncrewed Aircraft Systems Penguin-Series Uncrewed Aircraft Systems Solid-Oxide Fuel Cells Octopus ISR Optics and Gimbals Ground Systems Software and AI VXE30-Havoc VXE30 Penguin-C VTOL Penguin-C Penguin-B • Upgraded subsystems for VXE30 to provide double the payload capacity, range, and endurance • Performance of Group-3, but with the small footprint, mobility, and silence of VXE30 • Exceeds the performance of competitor offerings • Premier Group-2 UAS for US Special Ops and Allies • 100,000+ flight hours across 6 continents • Silent, long-endurance • VTOL • Best-value VTOL offering • Turnkey, complete ISR system • Builds upon legacy and pedigree of Penguin-C • Battle proven in Eastern Europe • Rail-launch, parachute recovery • Long endurance and range • Exceptional ISR with E180 EOIR • Low-cost basic airframe for custom integrations • Sold only in large batches to existing customers D450 Fuel Cell D750 Fuel Cell Heavy-Fuel Reformer Performer System (Commercial) • All-Electric, ultra-light, silent • Proprietary fuel cell technology expands range/endurance E180 E140 MWIR E95E140LCE140Z G2 • High-performance EOIR • Stabilization Field Support Kit Mobile GCS Portable GCS Long-Range GCS C2 and Sensor System Spares Kit • Auxiliary components to support entire UAS launch and control for worldwide operations Flight Software Control Software AION - AI and Autonomy EOIR Software • State-of-the-art UAS software • Open architecture for Autonomy/AI Source: Edge Autonomy management provided materials. See slide 27 for definitions of acronyms.

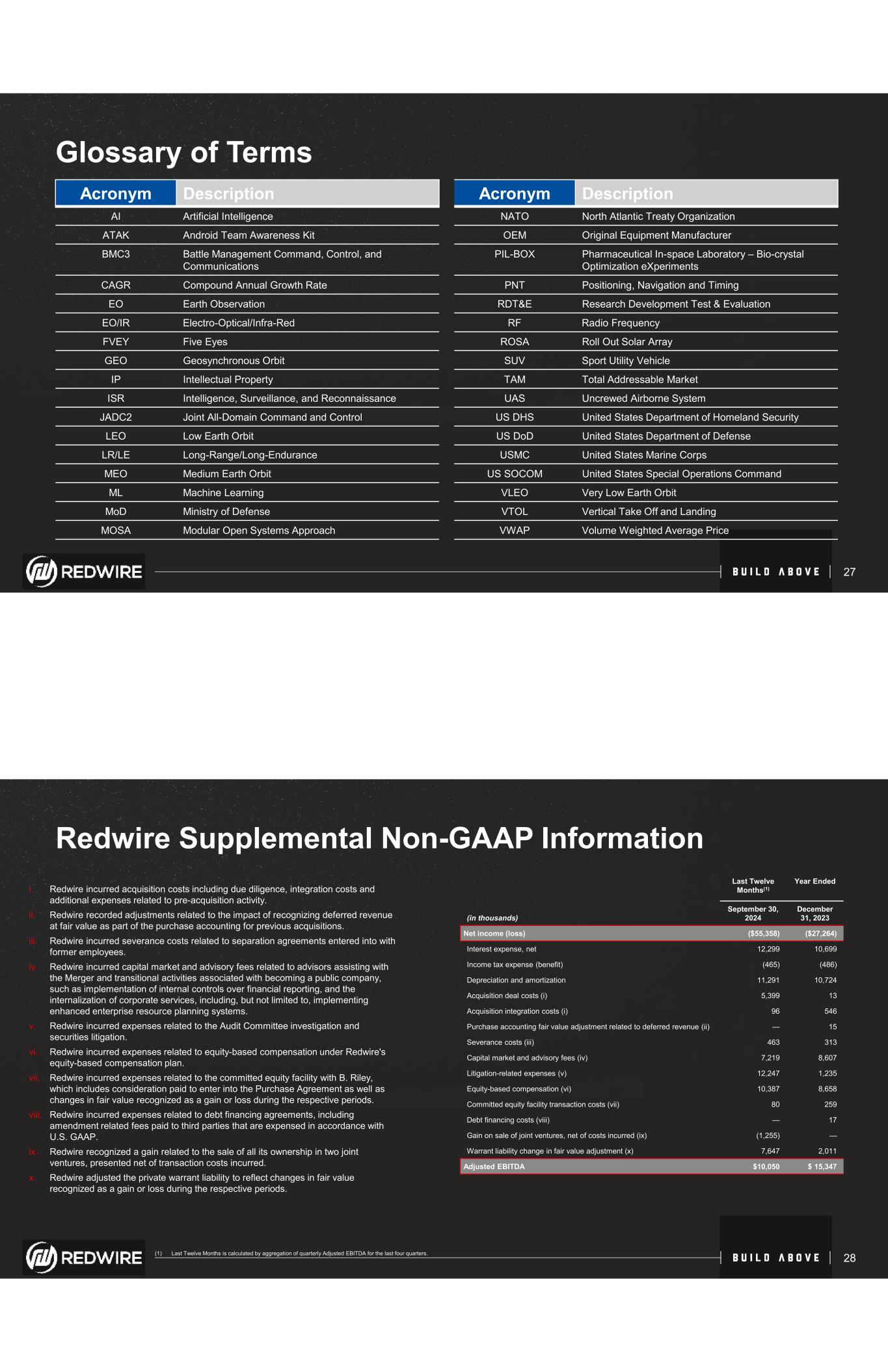

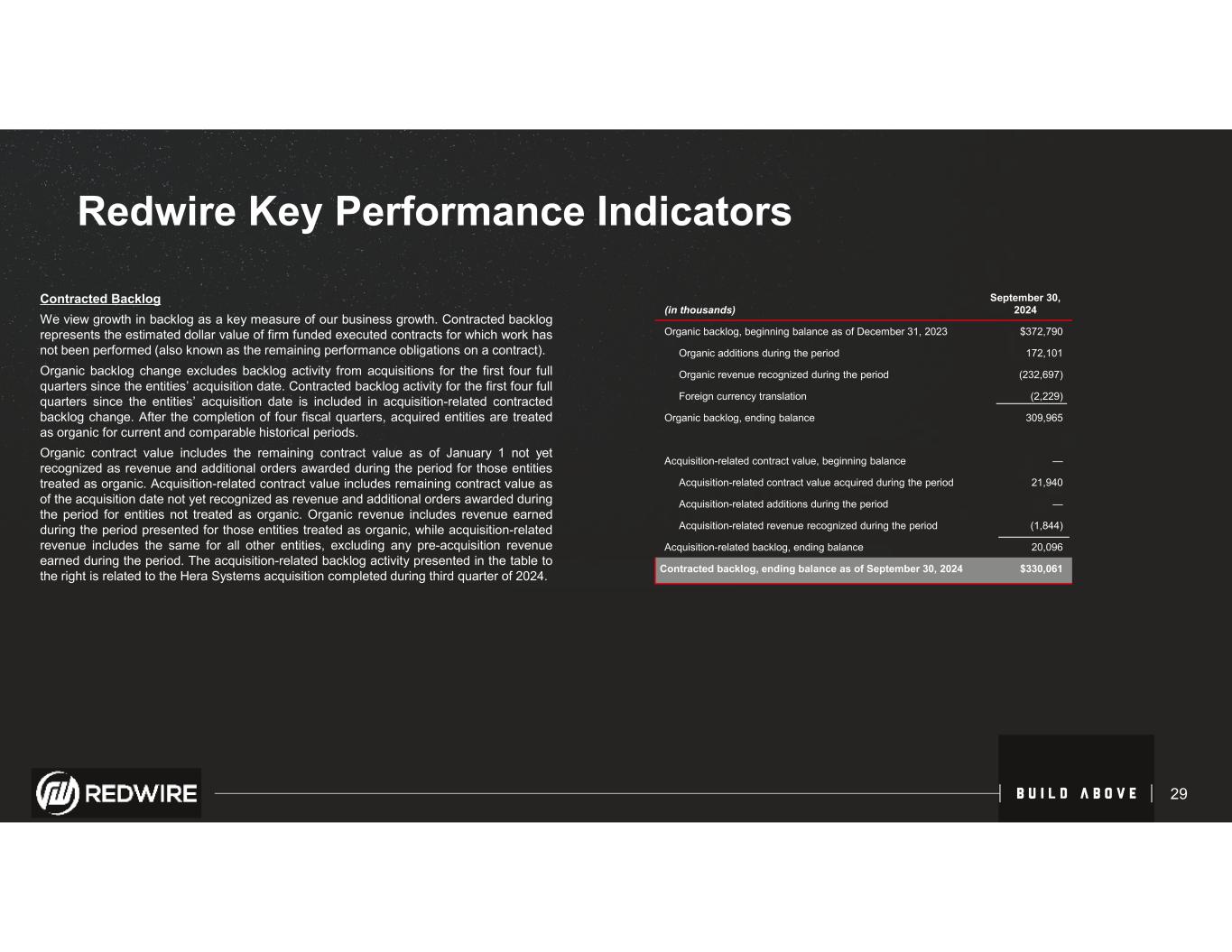

1. Insert Footnote 25 • Heritage is based on avionics and the mission compute module; Edge Autonomy has developed its own autopilot organically • MOSA offers ability to leverage AI researchers to expand the capabilities of Edge Autonomy sensors, payloads, and platforms • Edge Autonomy has delivered a proprietary platform purpose- built for Artificial Intelligence / Machine Learning (AI / ML) to help simplify the burden on system operators • Increased embedded fault detection • Autonomous navigation and augmented airspace management • Automatic target tracking and identification • Intuitive user interface with an effort to reduce specialized ground control / computing requirements (direct connectivity through ATAK operator systems) Increased Artificial Intelligence & Autonomy Helps Reduce Operator Specialization In the future, many warfighters may need to be UAS operators – Edge Autonomy’s technology helps enable seamless warfighter integration, which is enabled by proprietary onboard AI and autonomy framework Credit: Edge Autonomy Source: Edge Autonomy management provided materials. See slide 27 for definitions of acronyms. 1. Insert Footnote 26 A Scaled, Global Space & Defense Technology Presence …and 4 locations(1) in EuropeWith a combined 19 locations(1) in North America… Location Combined # of Facilities AL 1 CA 5 CO 4 FL 2 IN 1 MA 1 MI 1 NM 1 VA 2 Canada 1 Total 19 Location Combined # of Facilities Belgium 1 Latvia 1 Luxembourg 1 Poland 1 Total 4 (1) As of December 31, 2024. In January 2025, Edge Autonomy opened a location in Ukraine.

1. Insert Footnote Glossary of Terms Acronym Description Acronym Description AI Artificial Intelligence NATO North Atlantic Treaty Organization ATAK Android Team Awareness Kit OEM Original Equipment Manufacturer BMC3 Battle Management Command, Control, and Communications PIL-BOX Pharmaceutical In-space Laboratory – Bio-crystal Optimization eXperiments CAGR Compound Annual Growth Rate PNT Positioning, Navigation and Timing EO Earth Observation RDT&E Research Development Test & Evaluation EO/IR Electro-Optical/Infra-Red RF Radio Frequency FVEY Five Eyes ROSA Roll Out Solar Array GEO Geosynchronous Orbit SUV Sport Utility Vehicle IP Intellectual Property TAM Total Addressable Market ISR Intelligence, Surveillance, and Reconnaissance UAS Uncrewed Airborne System JADC2 Joint All-Domain Command and Control US DHS United States Department of Homeland Security LEO Low Earth Orbit US DoD United States Department of Defense LR/LE Long-Range/Long-Endurance USMC United States Marine Corps MEO Medium Earth Orbit US SOCOM United States Special Operations Command ML Machine Learning VLEO Very Low Earth Orbit MoD Ministry of Defense VTOL Vertical Take Off and Landing MOSA Modular Open Systems Approach VWAP Volume Weighted Average Price 27 1. Insert Footnote Redwire Supplemental Non-GAAP Information i. Redwire incurred acquisition costs including due diligence, integration costs and additional expenses related to pre-acquisition activity. ii. Redwire recorded adjustments related to the impact of recognizing deferred revenue at fair value as part of the purchase accounting for previous acquisitions. iii. Redwire incurred severance costs related to separation agreements entered into with former employees. iv. Redwire incurred capital market and advisory fees related to advisors assisting with the Merger and transitional activities associated with becoming a public company, such as implementation of internal controls over financial reporting, and the internalization of corporate services, including, but not limited to, implementing enhanced enterprise resource planning systems. v. Redwire incurred expenses related to the Audit Committee investigation and securities litigation. vi. Redwire incurred expenses related to equity-based compensation under Redwire's equity-based compensation plan. vii. Redwire incurred expenses related to the committed equity facility with B. Riley, which includes consideration paid to enter into the Purchase Agreement as well as changes in fair value recognized as a gain or loss during the respective periods. viii. Redwire incurred expenses related to debt financing agreements, including amendment related fees paid to third parties that are expensed in accordance with U.S. GAAP. ix. Redwire recognized a gain related to the sale of all its ownership in two joint ventures, presented net of transaction costs incurred. x. Redwire adjusted the private warrant liability to reflect changes in fair value recognized as a gain or loss during the respective periods. 28(1) Last Twelve Months is calculated by aggregation of quarterly Adjusted EBITDA for the last four quarters. (in thousands) Last Twelve Months(1) Year Ended September 30, 2024 December 31, 2023 Net income (loss) ($55,358) ($27,264) Interest expense, net 12,299 10,699 Income tax expense (benefit) (465) (486) Depreciation and amortization 11,291 10,724 Acquisition deal costs (i) 5,399 13 Acquisition integration costs (i) 96 546 Purchase accounting fair value adjustment related to deferred revenue (ii) — 15 Severance costs (iii) 463 313 Capital market and advisory fees (iv) 7,219 8,607 Litigation-related expenses (v) 12,247 1,235 Equity-based compensation (vi) 10,387 8,658 Committed equity facility transaction costs (vii) 80 259 Debt financing costs (viii) — 17 Gain on sale of joint ventures, net of costs incurred (ix) (1,255) — Warrant liability change in fair value adjustment (x) 7,647 2,011 Adjusted EBITDA $10,050 $ 15,347

1. Insert Footnote Redwire Key Performance Indicators Contracted Backlog We view growth in backlog as a key measure of our business growth. Contracted backlog represents the estimated dollar value of firm funded executed contracts for which work has not been performed (also known as the remaining performance obligations on a contract). Organic backlog change excludes backlog activity from acquisitions for the first four full quarters since the entities’ acquisition date. Contracted backlog activity for the first four full quarters since the entities’ acquisition date is included in acquisition-related contracted backlog change. After the completion of four fiscal quarters, acquired entities are treated as organic for current and comparable historical periods. Organic contract value includes the remaining contract value as of January 1 not yet recognized as revenue and additional orders awarded during the period for those entities treated as organic. Acquisition-related contract value includes remaining contract value as of the acquisition date not yet recognized as revenue and additional orders awarded during the period for entities not treated as organic. Organic revenue includes revenue earned during the period presented for those entities treated as organic, while acquisition-related revenue includes the same for all other entities, excluding any pre-acquisition revenue earned during the period. The acquisition-related backlog activity presented in the table to the right is related to the Hera Systems acquisition completed during third quarter of 2024. 29 (in thousands) September 30, 2024 Organic backlog, beginning balance as of December 31, 2023 $372,790 Organic additions during the period 172,101 Organic revenue recognized during the period (232,697) Foreign currency translation (2,229) Organic backlog, ending balance 309,965 Acquisition-related contract value, beginning balance — Acquisition-related contract value acquired during the period 21,940 Acquisition-related additions during the period — Acquisition-related revenue recognized during the period (1,844) Acquisition-related backlog, ending balance 20,096 Contracted backlog, ending balance as of September 30, 2024 $330,061