Exhibit 99.1 REDWIRE SPACE NV (Formerly known as QinetiQ Space NV) CONDENSED FINANCIAL STATEMENTS FOR THE SIX MONTHS ENDED SEPTEMBER 30, 2022 Prepared in accordance with accounting principles generally accepted in Belgium

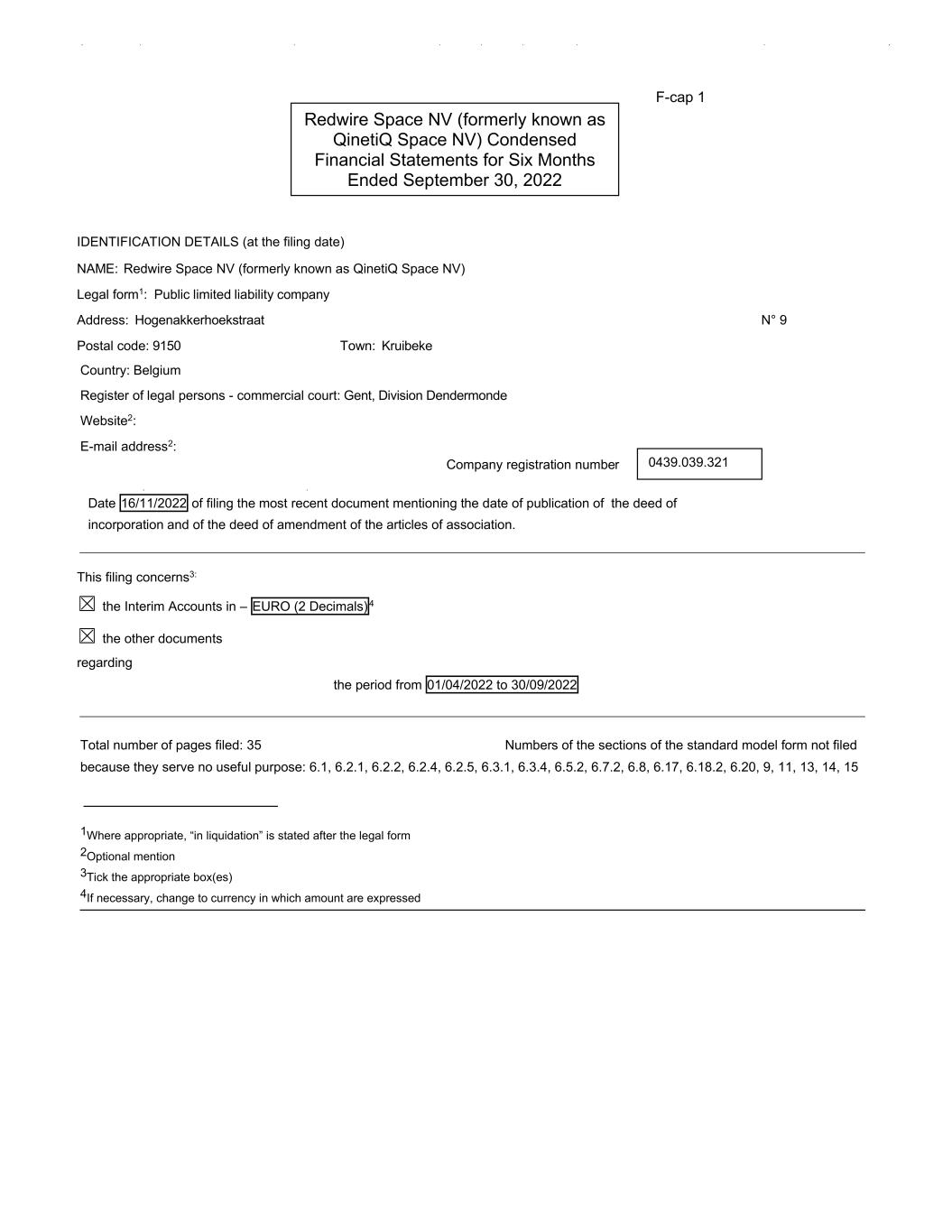

F-cap 1 IDENTIFICATION DETAILS (at the filing date) NAME: Redwire Space NV (formerly known as QinetiQ Space NV) Legal form1: Public limited liability company Address: Hogenakkerhoekstraat N° 9 Postal code: 9150 Town: Kruibeke Country: Belgium Register of legal persons - commercial court: Gent, Division Dendermonde Website2: E-mail address2: Company registration number Date 16/11/2022 of filing the most recent document mentioning the date of publication of the deed of incorporation and of the deed of amendment of the articles of association. This filing concerns3: ☒ the Interim Accounts in – EURO (2 Decimals)4 ☒ the other documents regarding the period from 01/04/2022 to 30/09/2022 Total number of pages filed: 35 Numbers of the sections of the standard model form not filed because they serve no useful purpose: 6.1, 6.2.1, 6.2.2, 6.2.4, 6.2.5, 6.3.1, 6.3.4, 6.5.2, 6.7.2, 6.8, 6.17, 6.18.2, 6.20, 9, 11, 13, 14, 15 1Where appropriate, “in liquidation” is stated after the legal form 2Optional mention 3Tick the appropriate box(es) 4If necessary, change to currency in which amount are expressed 0439.039.321 Redwire Space NV (formerly known as QinetiQ Space NV) Condensed Financial Statements for Six Months Ended September 30, 2022

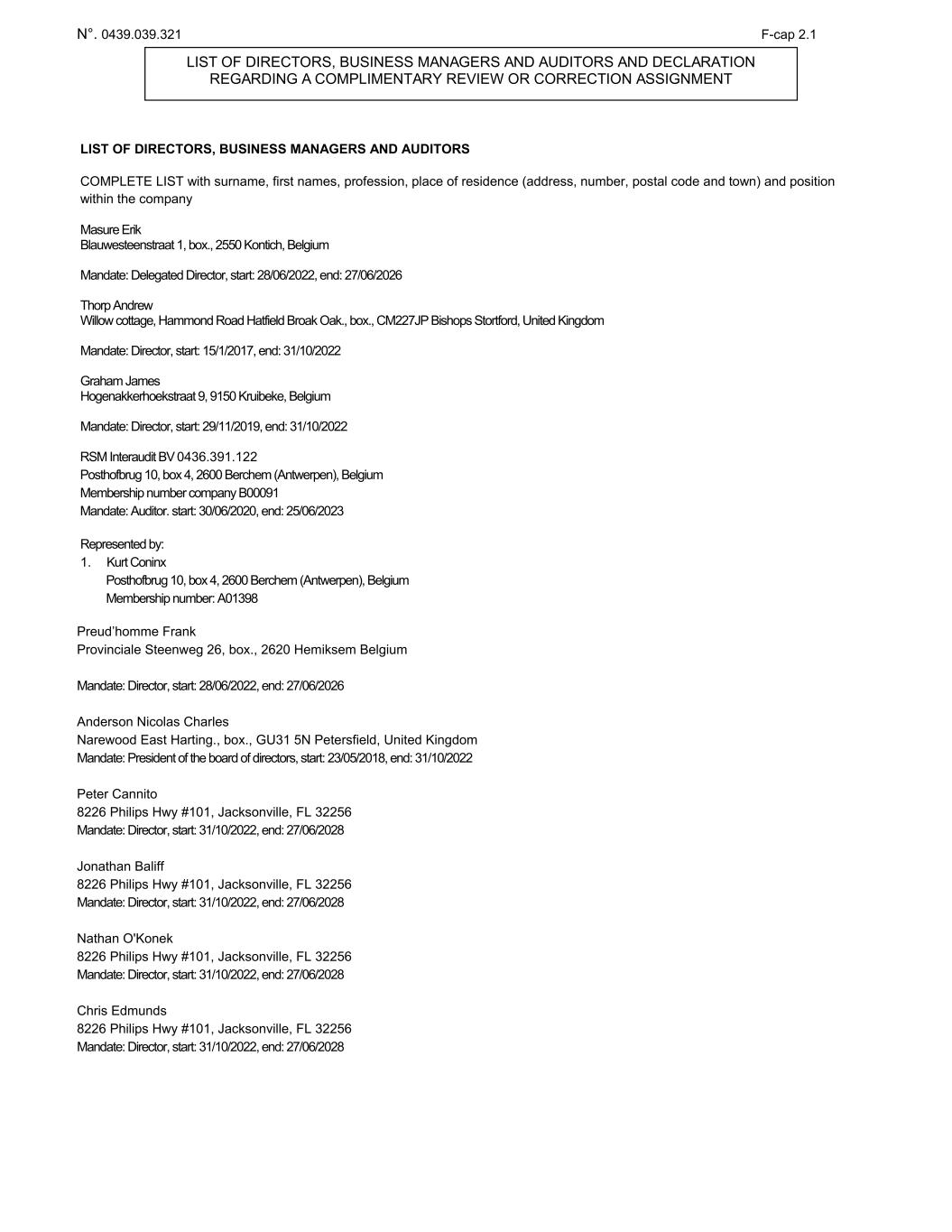

N°. 0439.039.321 F-cap 2.1 LIST OF DIRECTORS, BUSINESS MANAGERS AND AUDITORS COMPLETE LIST with surname, first names, profession, place of residence (address, number, postal code and town) and position within the company Masure Erik Blauwesteenstraat 1, box., 2550 Kontich, Belgium Mandate: Delegated Director, start: 28/06/2022, end: 27/06/2026 Thorp Andrew Willow cottage, Hammond Road Hatfield Broak Oak., box., CM227JP Bishops Stortford, United Kingdom Mandate: Director, start: 15/1/2017, end: 31/10/2022 Graham James Hogenakkerhoekstraat 9, 9150 Kruibeke, Belgium Mandate: Director, start: 29/11/2019, end: 31/10/2022 RSM Interaudit BV 0436.391.122 Posthofbrug 10, box 4, 2600 Berchem (Antwerpen), Belgium Membership number company B00091 Mandate: Auditor. start: 30/06/2020, end: 25/06/2023 Represented by: 1. Kurt Coninx Posthofbrug 10, box 4, 2600 Berchem (Antwerpen), Belgium Membership number: A01398 Preud’homme Frank Provinciale Steenweg 26, box., 2620 Hemiksem Belgium Mandate: Director, start: 28/06/2022, end: 27/06/2026 Anderson Nicolas Charles Narewood East Harting., box., GU31 5N Petersfield, United Kingdom Mandate: President of the board of directors, start: 23/05/2018, end: 31/10/2022 Peter Cannito 8226 Philips Hwy #101, Jacksonville, FL 32256 Mandate: Director, start: 31/10/2022, end: 27/06/2028 Jonathan Baliff 8226 Philips Hwy #101, Jacksonville, FL 32256 Mandate: Director, start: 31/10/2022, end: 27/06/2028 Nathan O'Konek 8226 Philips Hwy #101, Jacksonville, FL 32256 Mandate: Director, start: 31/10/2022, end: 27/06/2028 Chris Edmunds 8226 Philips Hwy #101, Jacksonville, FL 32256 Mandate: Director, start: 31/10/2022, end: 27/06/2028 LIST OF DIRECTORS, BUSINESS MANAGERS AND AUDITORS AND DECLARATION REGARDING A COMPLIMENTARY REVIEW OR CORRECTION ASSIGNMENT

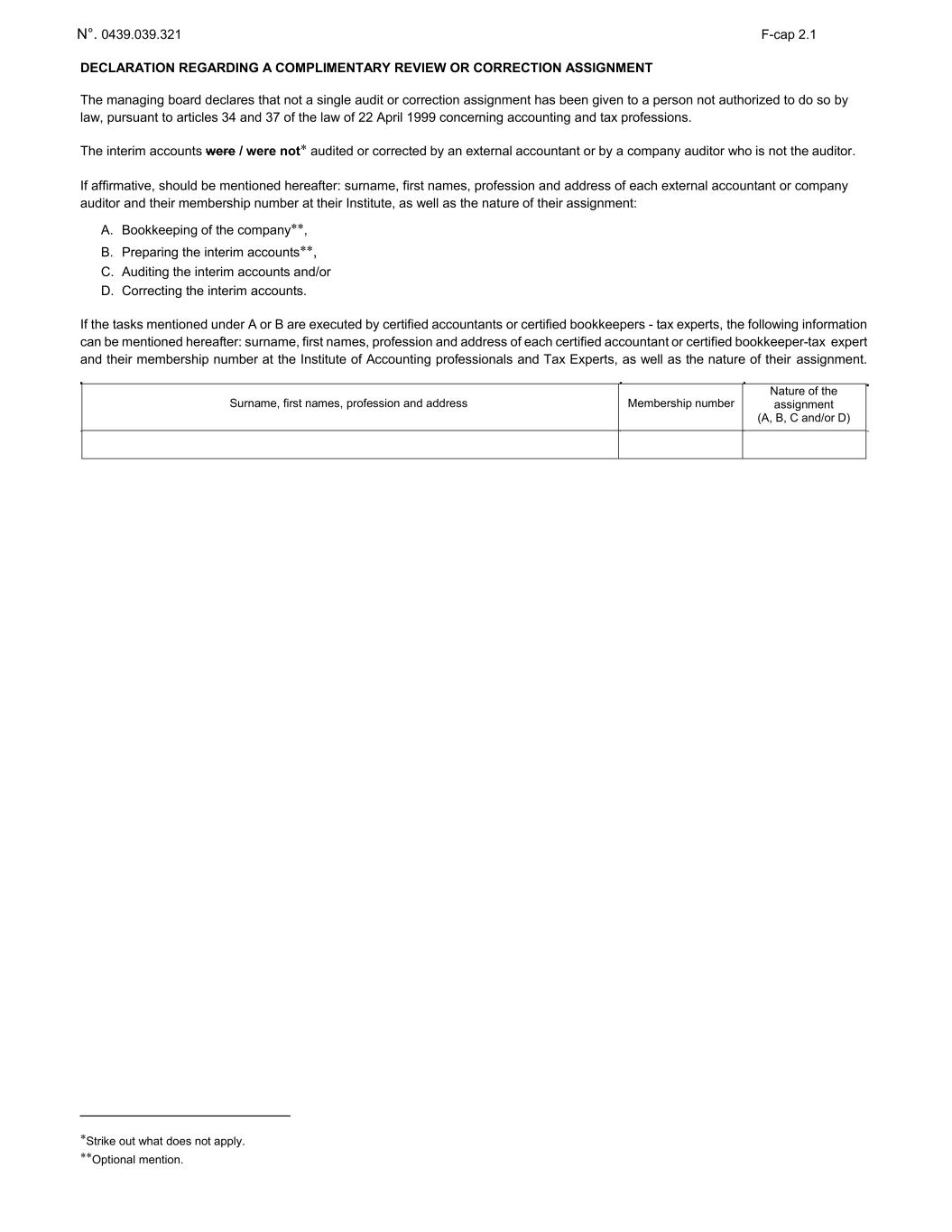

N°. 0439.039.321 F-cap 2.1 DECLARATION REGARDING A COMPLIMENTARY REVIEW OR CORRECTION ASSIGNMENT The managing board declares that not a single audit or correction assignment has been given to a person not authorized to do so by law, pursuant to articles 34 and 37 of the law of 22 April 1999 concerning accounting and tax professions. The interim accounts were / were not audited or corrected by an external accountant or by a company auditor who is not the auditor. If affirmative, should be mentioned hereafter: surname, first names, profession and address of each external accountant or company auditor and their membership number at their Institute, as well as the nature of their assignment: A. Bookkeeping of the company, B. Preparing the interim accounts, C. Auditing the interim accounts and/or D. Correcting the interim accounts. If the tasks mentioned under A or B are executed by certified accountants or certified bookkeepers - tax experts, the following information can be mentioned hereafter: surname, first names, profession and address of each certified accountant or certified bookkeeper-tax expert and their membership number at the Institute of Accounting professionals and Tax Experts, as well as the nature of their assignment. Strike out what does not apply. Optional mention. Surname, first names, profession and address Membership number Nature of the assignment (A, B, C and/or D)

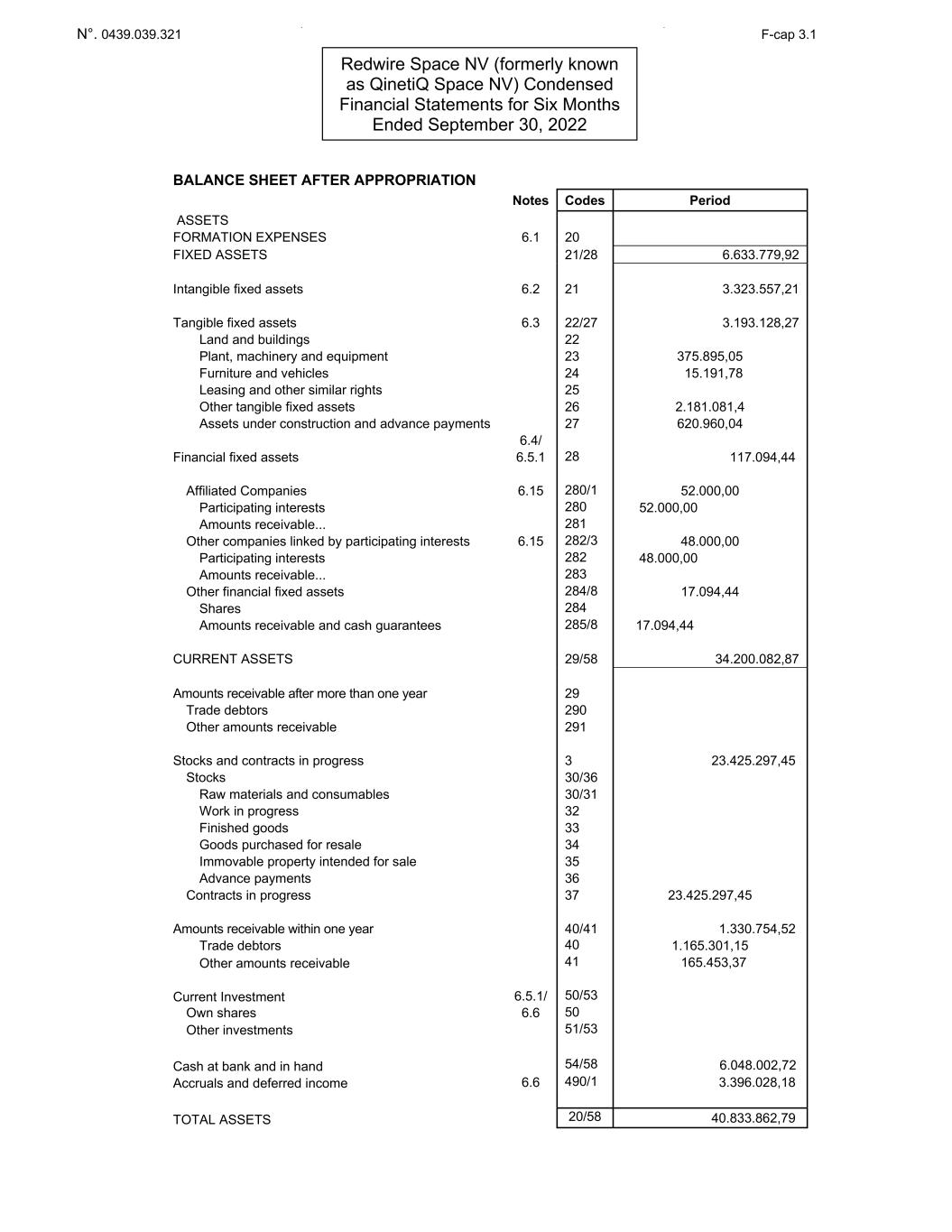

N°. 0439.039.321 F-cap 3.1 BALANCE SHEET AFTER APPROPRIATION Notes Codes Period ASSETS FORMATION EXPENSES 6.1 20 FIXED ASSETS 21/28 6.633.779,92 Intangible fixed assets 6.2 21 3.323.557,21 Tangible fixed assets 6.3 22/27 3.193.128,27 Land and buildings 22 Plant, machinery and equipment 23 375.895,05 Furniture and vehicles 24 15.191,78 Leasing and other similar rights 25 Other tangible fixed assets 26 2.181.081,4 Assets under construction and advance payments 27 620.960,04 6.4/ Financial fixed assets 6.5.1 28 117.094,44 Affiliated Companies 6.15 280/1 52.000,00 Participating interests 280 52.000,00 Amounts receivable... 281 Other companies linked by participating interests 6.15 282/3 48.000,00 Participating interests 282 48.000,00 Amounts receivable... 283 Other financial fixed assets 284/8 17.094,44 Shares 284 Amounts receivable and cash guarantees 285/8 17.094,44 CURRENT ASSETS 29/58 34.200.082,87 Amounts receivable after more than one year 29 Trade debtors 290 Other amounts receivable 291 Stocks and contracts in progress 3 23.425.297,45 Stocks 30/36 Raw materials and consumables 30/31 Work in progress 32 Finished goods 33 Goods purchased for resale 34 Immovable property intended for sale 35 Advance payments 36 Contracts in progress 37 23.425.297,45 Amounts receivable within one year 40/41 1.330.754,52 Trade debtors 40 1.165.301,15 Other amounts receivable 41 165.453,37 Current Investment 6.5.1/ 50/53 Own shares 6.6 50 Other investments 51/53 Cash at bank and in hand 54/58 6.048.002,72 Accruals and deferred income 6.6 490/1 3.396.028,18 TOTAL ASSETS 20/58 40.833.862,79 Redwire Space NV (formerly known as QinetiQ Space NV) Condensed Financial Statements for Six Months Ended September 30, 2022

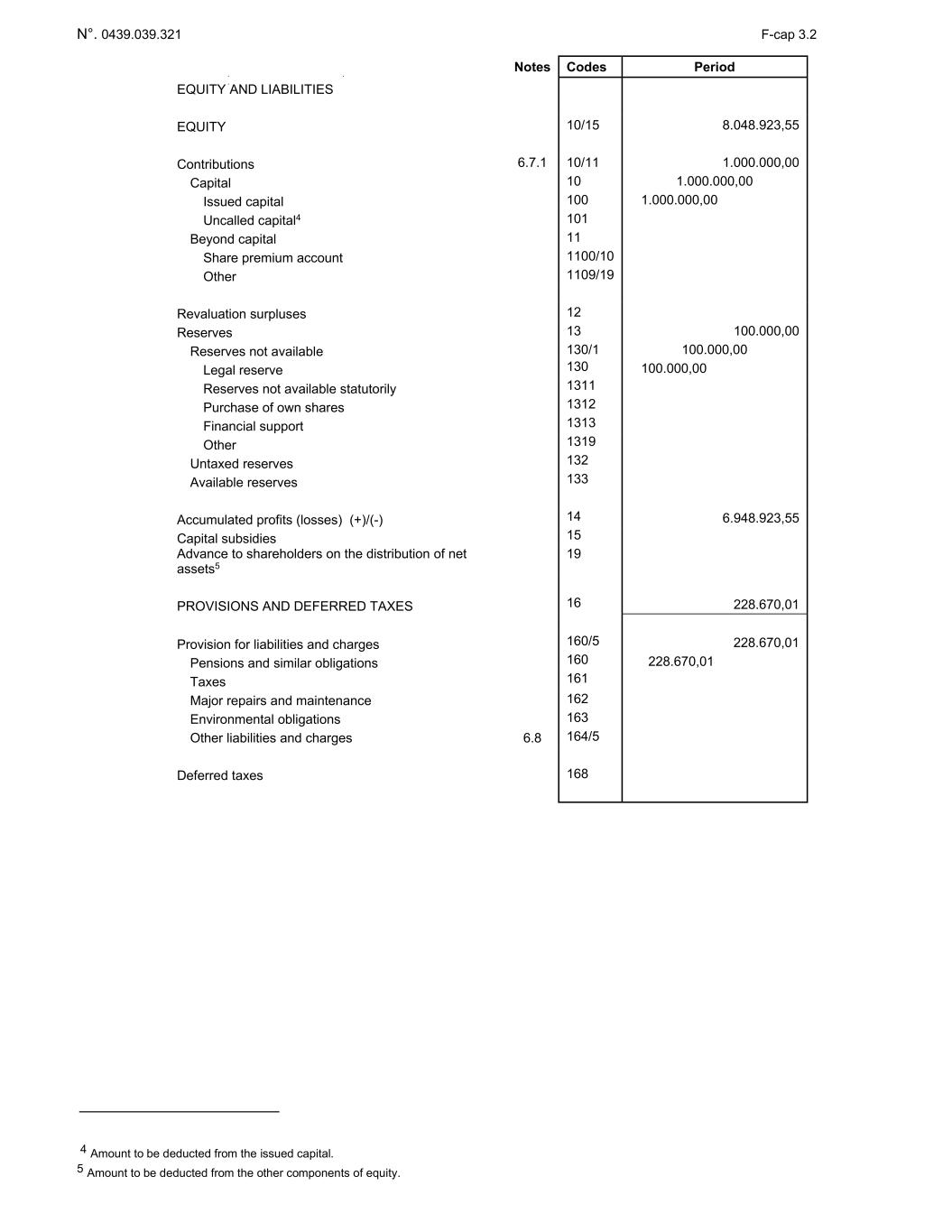

N°. 0439.039.321 F-cap 3.2 Notes Codes Period EQUITY AND LIABILITIES EQUITY 10/15 8.048.923,55 Contributions 6.7.1 10/11 1.000.000,00 Capital 10 1.000.000,00 Issued capital 100 1.000.000,00 Uncalled capital4 101 Beyond capital 11 Share premium account 1100/10 Other 1109/19 Revaluation surpluses 12 Reserves 13 100.000,00 Reserves not available 130/1 100.000,00 Legal reserve 130 100.000,00 Reserves not available statutorily 1311 Purchase of own shares 1312 Financial support 1313 Other 1319 Untaxed reserves 132 Available reserves 133 Accumulated profits (losses) (+)/(-) 14 6.948.923,55 Capital subsidies 15 Advance to shareholders on the distribution of net assets5 19 PROVISIONS AND DEFERRED TAXES 16 228.670,01 Provision for liabilities and charges 160/5 228.670,01 Pensions and similar obligations 160 228.670,01 Taxes 161 Major repairs and maintenance 162 Environmental obligations 163 Other liabilities and charges 6.8 164/5 Deferred taxes 168 4 Amount to be deducted from the issued capital. 5 Amount to be deducted from the other components of equity.

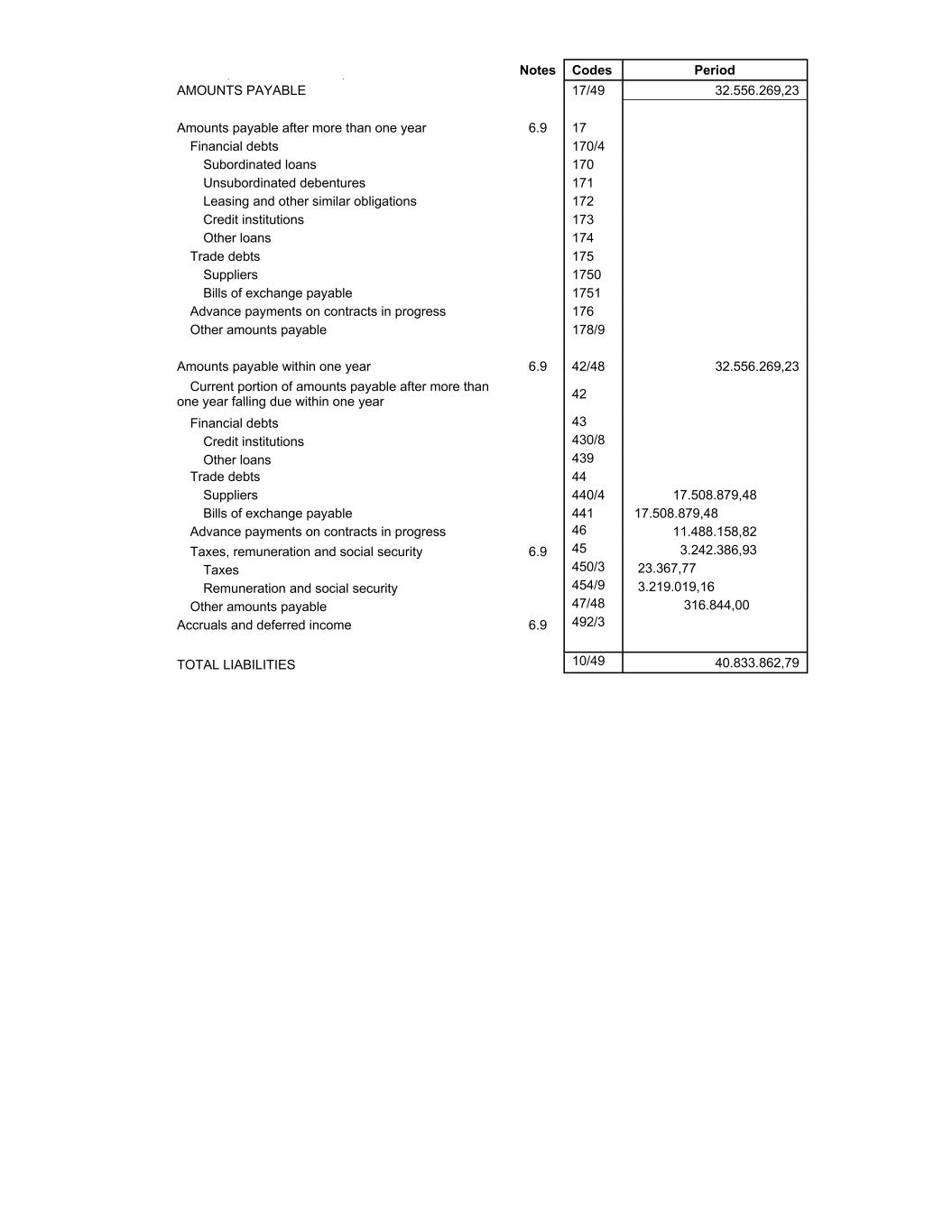

Notes Codes Period AMOUNTS PAYABLE 17/49 32.556.269,23 Amounts payable after more than one year 6.9 17 Financial debts 170/4 Subordinated loans 170 Unsubordinated debentures 171 Leasing and other similar obligations 172 Credit institutions 173 Other loans 174 Trade debts 175 Suppliers 1750 Bills of exchange payable 1751 Advance payments on contracts in progress 176 Other amounts payable 178/9 Amounts payable within one year 6.9 42/48 32.556.269,23 Current portion of amounts payable after more than one year falling due within one year 42 Financial debts 43 Credit institutions 430/8 Other loans 439 Trade debts 44 Suppliers 440/4 17.508.879,48 Bills of exchange payable 441 17.508.879,48 Advance payments on contracts in progress 46 11.488.158,82 Taxes, remuneration and social security 6.9 45 3.242.386,93 Taxes 450/3 23.367,77 Remuneration and social security 454/9 3.219.019,16 Other amounts payable 47/48 316.844,00 Accruals and deferred income 6.9 492/3 TOTAL LIABILITIES 10/49 40.833.862,79

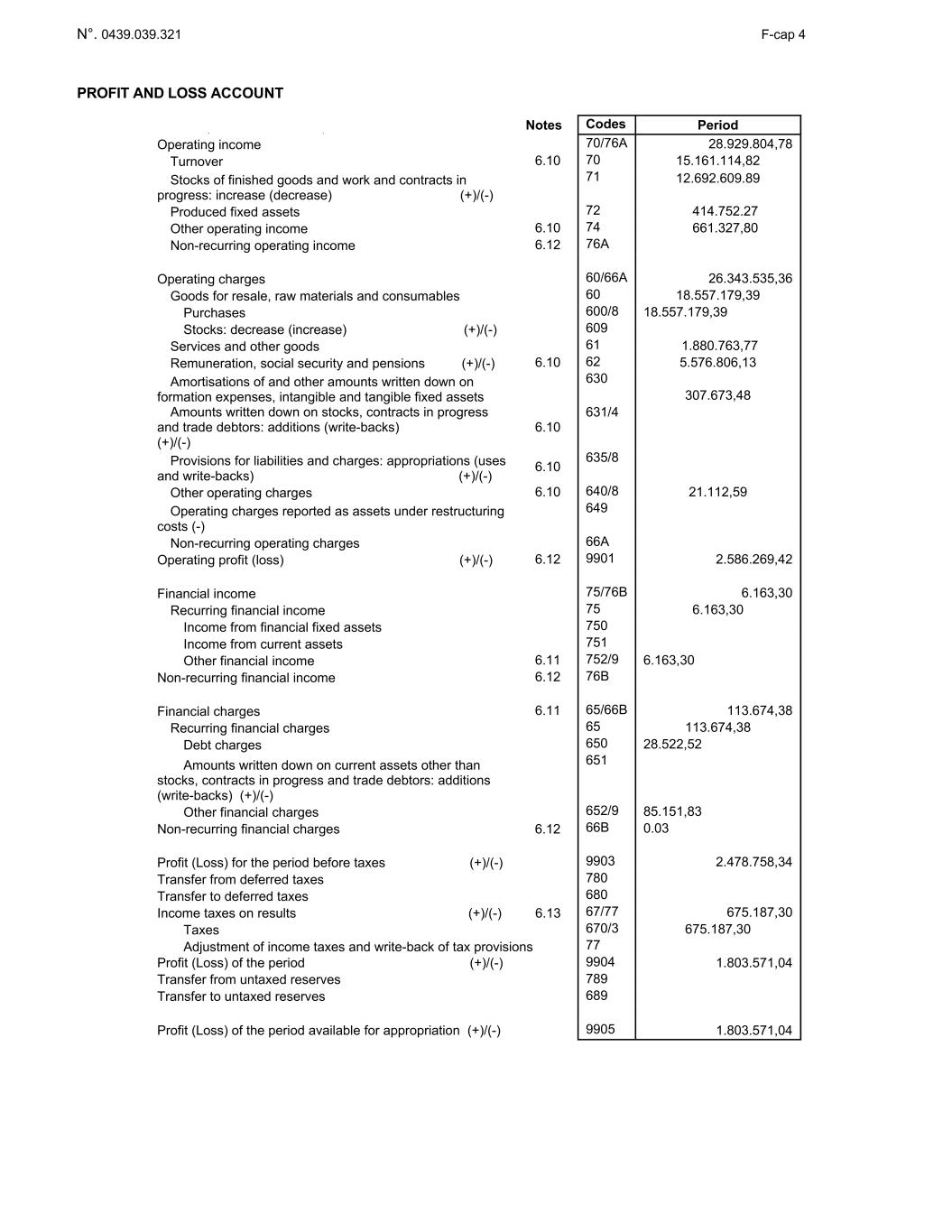

N°. 0439.039.321 F-cap 4 PROFIT AND LOSS ACCOUNT Notes Codes Period Operating income 70/76A 28.929.804,78 Turnover 6.10 70 15.161.114,82 Stocks of finished goods and work and contracts in progress: increase (decrease) (+)/(-) 71 12.692.609.89 Produced fixed assets 72 414.752.27 Other operating income 6.10 74 661.327,80 Non-recurring operating income 6.12 76A Operating charges 60/66A 26.343.535,36 Goods for resale, raw materials and consumables 60 18.557.179,39 Purchases 600/8 18.557.179,39 Stocks: decrease (increase) (+)/(-) 609 Services and other goods 61 1.880.763,77 Remuneration, social security and pensions (+)/(-) 6.10 62 5.576.806,13 Amortisations of and other amounts written down on formation expenses, intangible and tangible fixed assets 630 307.673,48 Amounts written down on stocks, contracts in progress and trade debtors: additions (write-backs) (+)/(-) 6.10 631/4 Provisions for liabilities and charges: appropriations (uses and write-backs) (+)/(-) 6.10 635/8 Other operating charges 6.10 640/8 21.112,59 Operating charges reported as assets under restructuring costs (-) 649 Non-recurring operating charges 66A Operating profit (loss) (+)/(-) 6.12 9901 2.586.269,42 Financial income 75/76B 6.163,30 Recurring financial income 75 6.163,30 Income from financial fixed assets 750 Income from current assets 751 Other financial income 6.11 752/9 6.163,30 Non-recurring financial income 6.12 76B Financial charges 6.11 65/66B 113.674,38 Recurring financial charges 65 113.674,38 Debt charges 650 28.522,52 Amounts written down on current assets other than stocks, contracts in progress and trade debtors: additions (write-backs) (+)/(-) 651 Other financial charges 652/9 85.151,83 Non-recurring financial charges 6.12 66B 0.03 Profit (Loss) for the period before taxes (+)/(-) 9903 2.478.758,34 Transfer from deferred taxes 780 Transfer to deferred taxes 680 Income taxes on results (+)/(-) 6.13 67/77 675.187,30 Taxes 670/3 675.187,30 Adjustment of income taxes and write-back of tax provisions 77 Profit (Loss) of the period (+)/(-) 9904 1.803.571,04 Transfer from untaxed reserves 789 Transfer to untaxed reserves 689 Profit (Loss) of the period available for appropriation (+)/(-) 9905 1.803.571,04

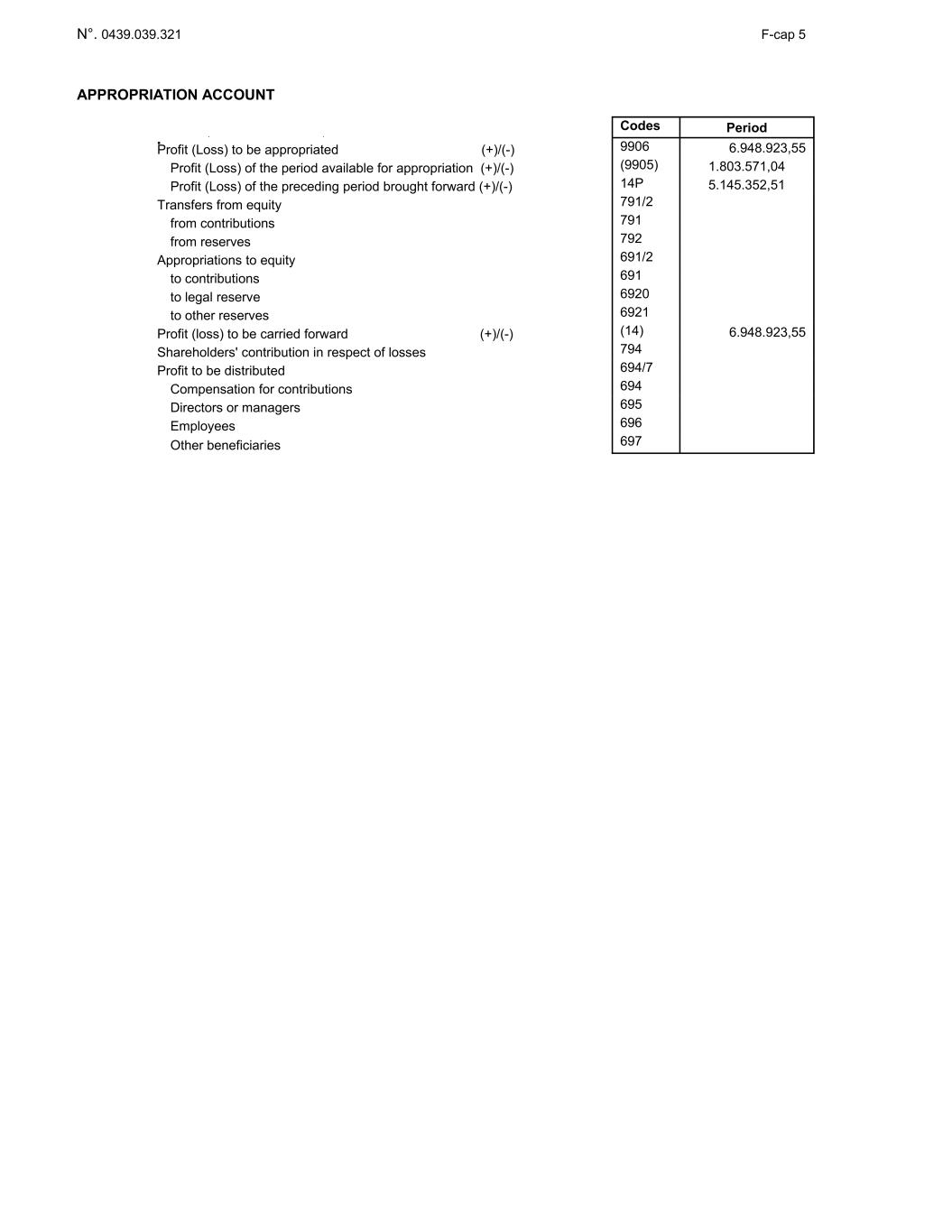

N°. 0439.039.321 F-cap 5 APPROPRIATION ACCOUNT Codes Period Profit (Loss) to be appropriated (+)/(-) 9906 6.948.923,55 Profit (Loss) of the period available for appropriation (+)/(-) (9905) 1.803.571,04 Profit (Loss) of the preceding period brought forward (+)/(-) 14P 5.145.352,51 Transfers from equity 791/2 from contributions 791 from reserves 792 Appropriations to equity 691/2 to contributions 691 to legal reserve 6920 to other reserves 6921 Profit (loss) to be carried forward (+)/(-) (14) 6.948.923,55 Shareholders' contribution in respect of losses 794 Profit to be distributed 694/7 Compensation for contributions 694 Directors or managers 695 Employees 696 Other beneficiaries 697

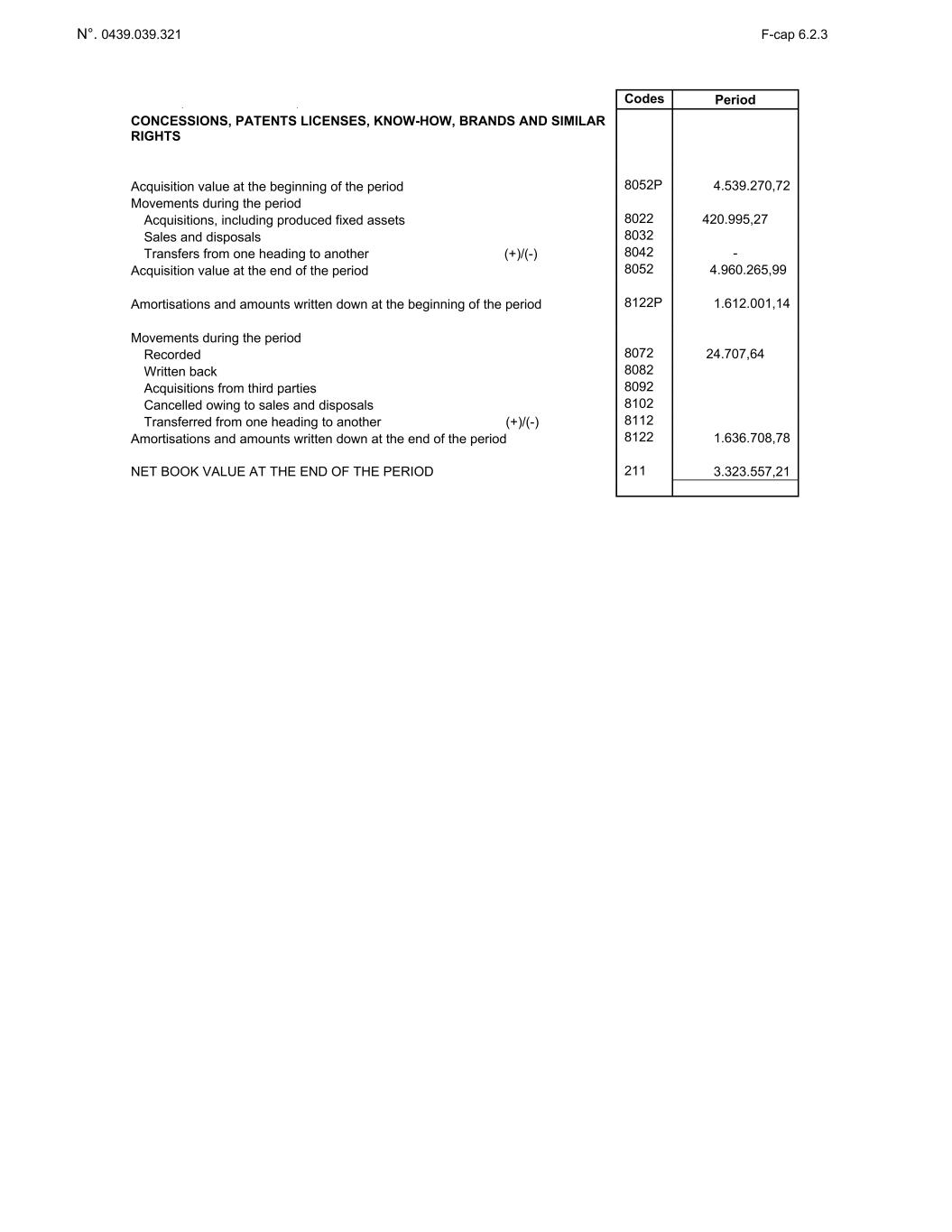

N°. 0439.039.321 F-cap 6.2.3 Codes Period CONCESSIONS, PATENTS LICENSES, KNOW-HOW, BRANDS AND SIMILAR RIGHTS Acquisition value at the beginning of the period 8052P 4.539.270,72 Movements during the period Acquisitions, including produced fixed assets 8022 420.995,27 Sales and disposals 8032 Transfers from one heading to another (+)/(-) 8042 - Acquisition value at the end of the period 8052 4.960.265,99 Amortisations and amounts written down at the beginning of the period 8122P 1.612.001,14 Movements during the period Recorded 8072 24.707,64 Written back 8082 Acquisitions from third parties 8092 Cancelled owing to sales and disposals 8102 Transferred from one heading to another (+)/(-) 8112 Amortisations and amounts written down at the end of the period 8122 1.636.708,78 NET BOOK VALUE AT THE END OF THE PERIOD 211 3.323.557,21

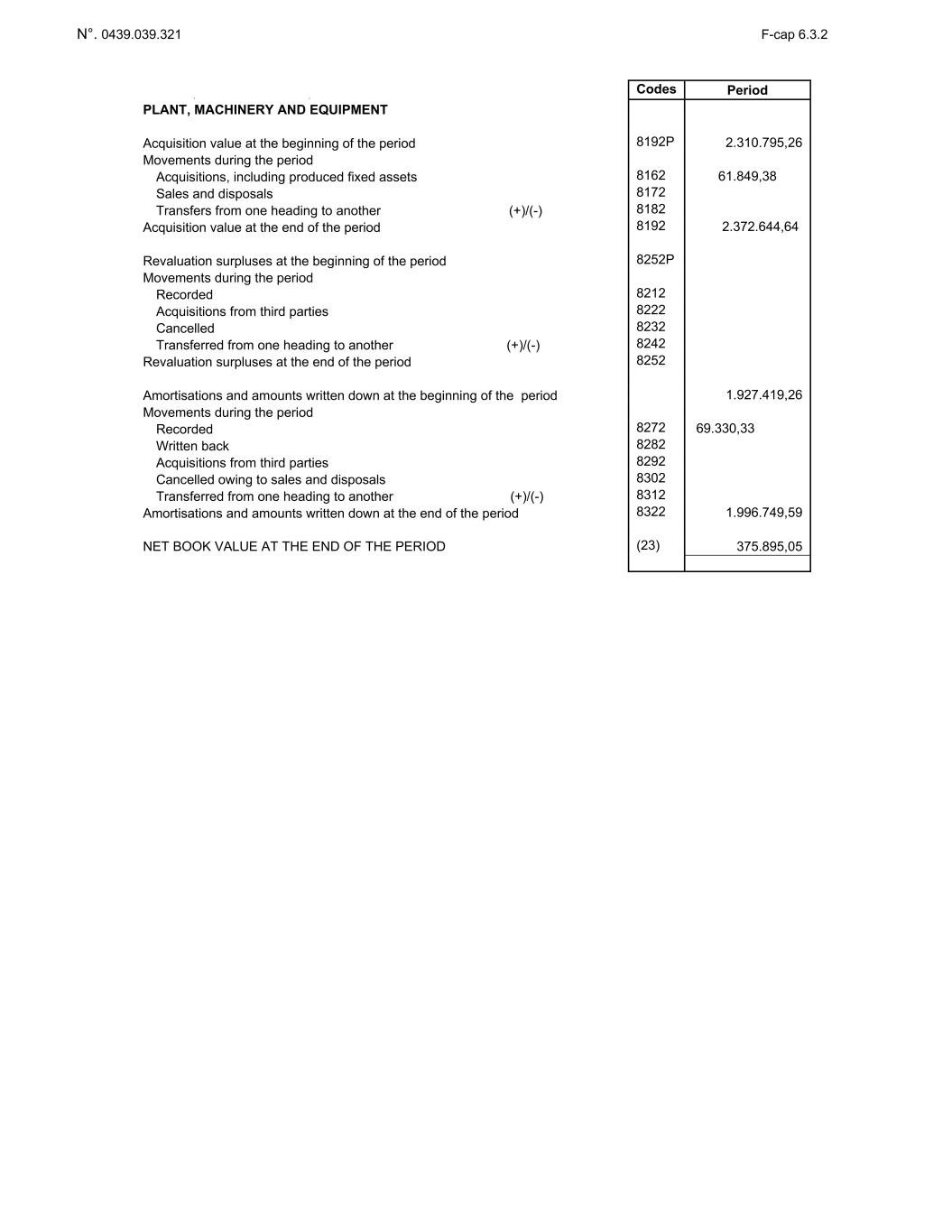

N°. 0439.039.321 F-cap 6.3.2 Codes Period PLANT, MACHINERY AND EQUIPMENT Acquisition value at the beginning of the period 8192P 2.310.795,26 Movements during the period Acquisitions, including produced fixed assets 8162 61.849,38 Sales and disposals 8172 Transfers from one heading to another (+)/(-) 8182 Acquisition value at the end of the period 8192 2.372.644,64 Revaluation surpluses at the beginning of the period 8252P Movements during the period Recorded 8212 Acquisitions from third parties 8222 Cancelled 8232 Transferred from one heading to another (+)/(-) 8242 Revaluation surpluses at the end of the period 8252 Amortisations and amounts written down at the beginning of the period 1.927.419,26 Movements during the period Recorded 8272 69.330,33 Written back 8282 Acquisitions from third parties 8292 Cancelled owing to sales and disposals 8302 Transferred from one heading to another (+)/(-) 8312 Amortisations and amounts written down at the end of the period 8322 1.996.749,59 NET BOOK VALUE AT THE END OF THE PERIOD (23) 375.895,05

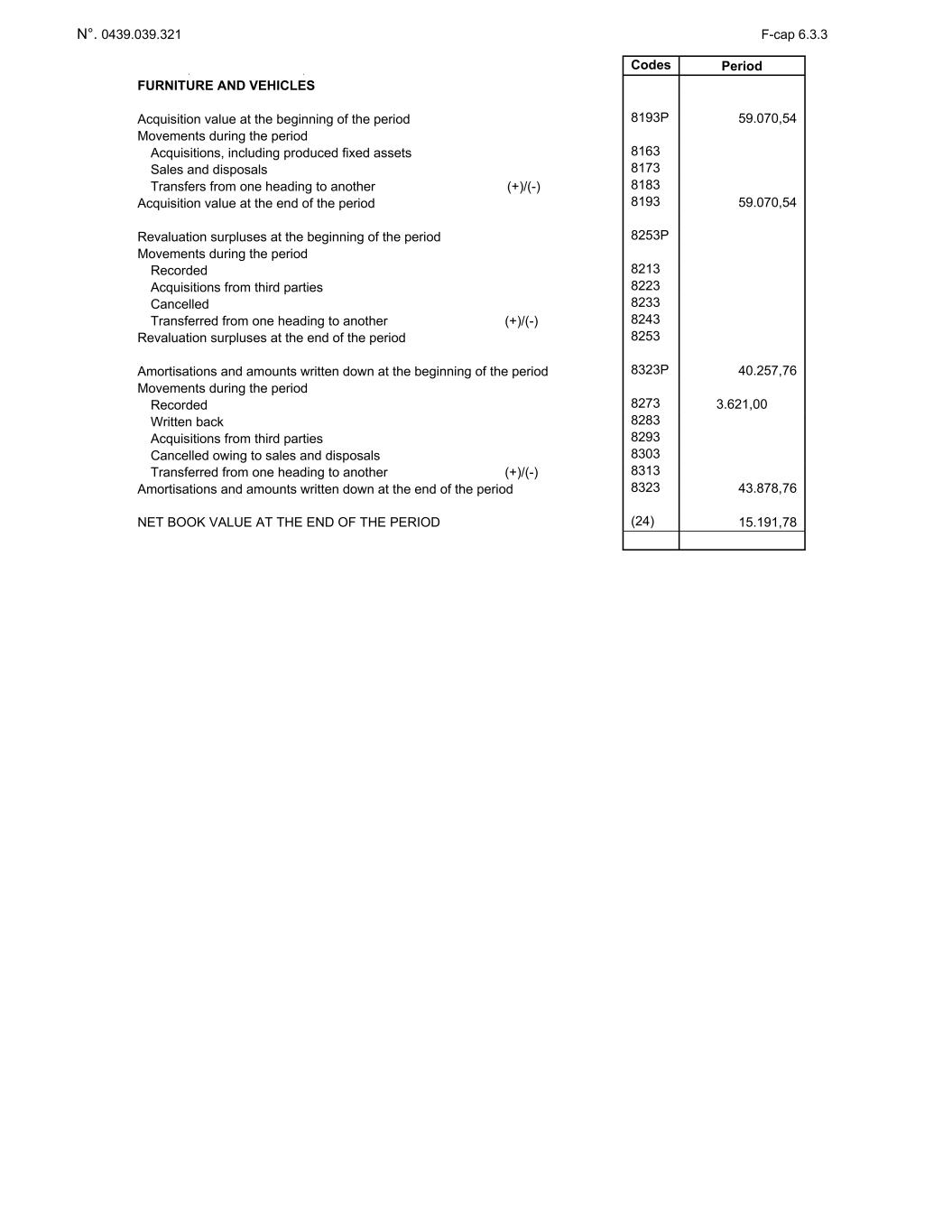

N°. 0439.039.321 F-cap 6.3.3 Codes Period FURNITURE AND VEHICLES Acquisition value at the beginning of the period 8193P 59.070,54 Movements during the period Acquisitions, including produced fixed assets 8163 Sales and disposals 8173 Transfers from one heading to another (+)/(-) 8183 Acquisition value at the end of the period 8193 59.070,54 Revaluation surpluses at the beginning of the period 8253P Movements during the period Recorded 8213 Acquisitions from third parties 8223 Cancelled 8233 Transferred from one heading to another (+)/(-) 8243 Revaluation surpluses at the end of the period 8253 Amortisations and amounts written down at the beginning of the period 8323P 40.257,76 Movements during the period Recorded 8273 3.621,00 Written back 8283 Acquisitions from third parties 8293 Cancelled owing to sales and disposals 8303 Transferred from one heading to another (+)/(-) 8313 Amortisations and amounts written down at the end of the period 8323 43.878,76 NET BOOK VALUE AT THE END OF THE PERIOD (24) 15.191,78

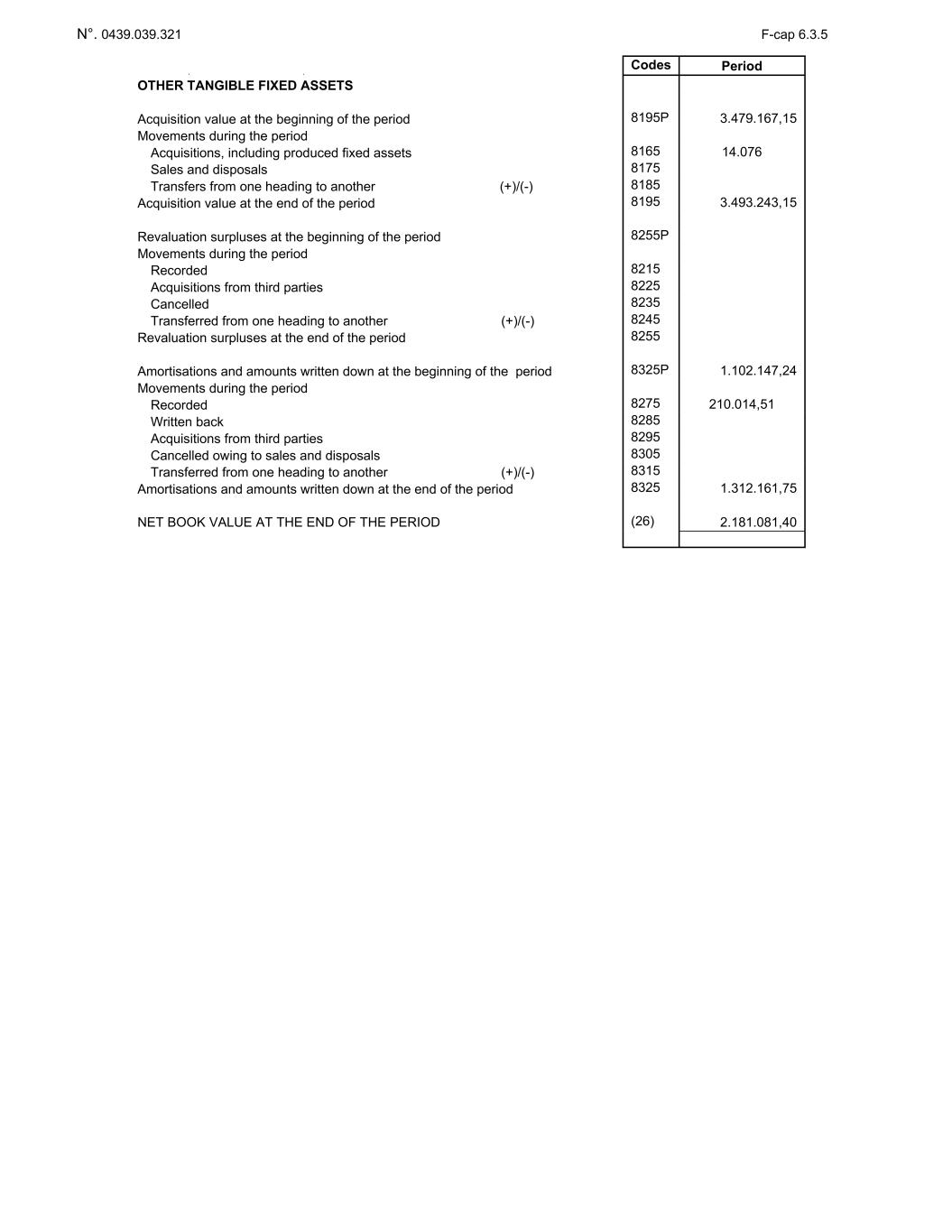

N°. 0439.039.321 F-cap 6.3.5 Codes Period OTHER TANGIBLE FIXED ASSETS Acquisition value at the beginning of the period 8195P 3.479.167,15 Movements during the period Acquisitions, including produced fixed assets 8165 14.076 Sales and disposals 8175 Transfers from one heading to another (+)/(-) 8185 Acquisition value at the end of the period 8195 3.493.243,15 Revaluation surpluses at the beginning of the period 8255P Movements during the period Recorded 8215 Acquisitions from third parties 8225 Cancelled 8235 Transferred from one heading to another (+)/(-) 8245 Revaluation surpluses at the end of the period 8255 Amortisations and amounts written down at the beginning of the period 8325P 1.102.147,24 Movements during the period Recorded 8275 210.014,51 Written back 8285 Acquisitions from third parties 8295 Cancelled owing to sales and disposals 8305 Transferred from one heading to another (+)/(-) 8315 Amortisations and amounts written down at the end of the period 8325 1.312.161,75 NET BOOK VALUE AT THE END OF THE PERIOD (26) 2.181.081,40

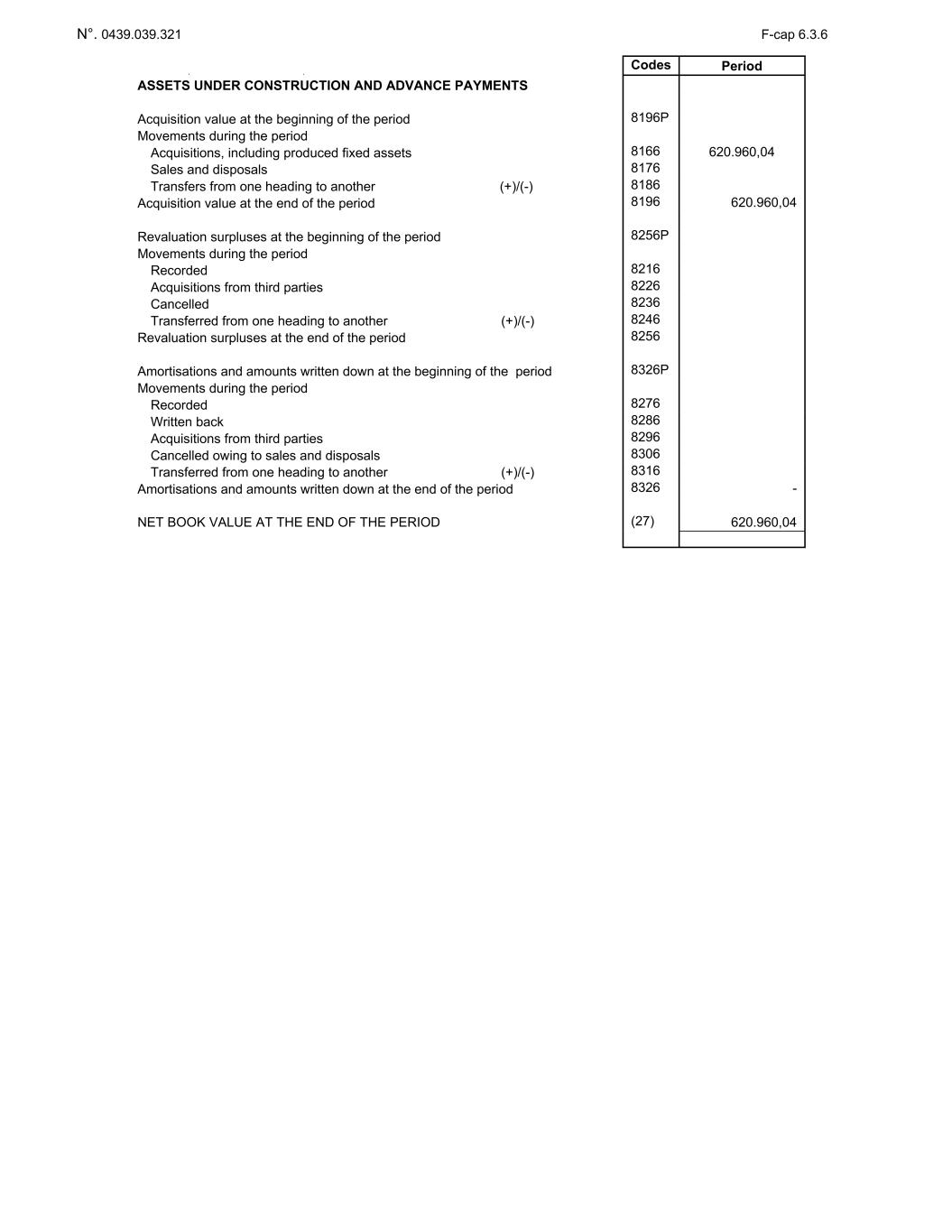

N°. 0439.039.321 F-cap 6.3.6 Codes Period ASSETS UNDER CONSTRUCTION AND ADVANCE PAYMENTS Acquisition value at the beginning of the period 8196P Movements during the period Acquisitions, including produced fixed assets 8166 620.960,04 Sales and disposals 8176 Transfers from one heading to another (+)/(-) 8186 Acquisition value at the end of the period 8196 620.960,04 Revaluation surpluses at the beginning of the period 8256P Movements during the period Recorded 8216 Acquisitions from third parties 8226 Cancelled 8236 Transferred from one heading to another (+)/(-) 8246 Revaluation surpluses at the end of the period 8256 Amortisations and amounts written down at the beginning of the period 8326P Movements during the period Recorded 8276 Written back 8286 Acquisitions from third parties 8296 Cancelled owing to sales and disposals 8306 Transferred from one heading to another (+)/(-) 8316 Amortisations and amounts written down at the end of the period 8326 - NET BOOK VALUE AT THE END OF THE PERIOD (27) 620.960,04

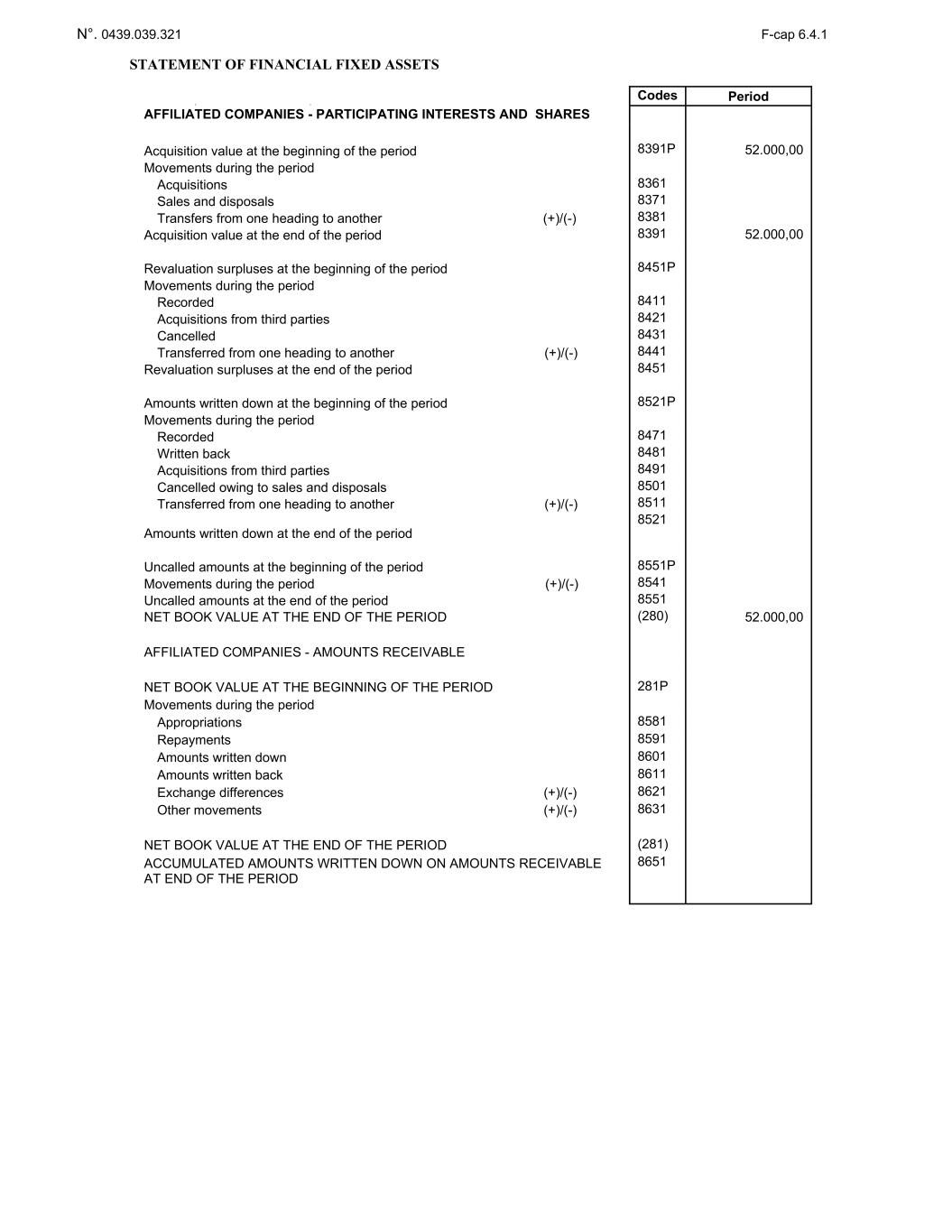

N°. 0439.039.321 F-cap 6.4.1 STATEMENT OF FINANCIAL FIXED ASSETS Codes Period AFFILIATED COMPANIES - PARTICIPATING INTERESTS AND SHARES Acquisition value at the beginning of the period 8391P 52.000,00 Movements during the period Acquisitions 8361 Sales and disposals 8371 Transfers from one heading to another (+)/(-) 8381 Acquisition value at the end of the period 8391 52.000,00 Revaluation surpluses at the beginning of the period 8451P Movements during the period Recorded 8411 Acquisitions from third parties 8421 Cancelled 8431 Transferred from one heading to another (+)/(-) 8441 Revaluation surpluses at the end of the period 8451 Amounts written down at the beginning of the period 8521P Movements during the period Recorded 8471 Written back 8481 Acquisitions from third parties 8491 Cancelled owing to sales and disposals 8501 Transferred from one heading to another (+)/(-) 8511 Amounts written down at the end of the period 8521 Uncalled amounts at the beginning of the period 8551P Movements during the period (+)/(-) 8541 Uncalled amounts at the end of the period 8551 NET BOOK VALUE AT THE END OF THE PERIOD (280) 52.000,00 AFFILIATED COMPANIES - AMOUNTS RECEIVABLE NET BOOK VALUE AT THE BEGINNING OF THE PERIOD 281P Movements during the period Appropriations 8581 Repayments 8591 Amounts written down 8601 Amounts written back 8611 Exchange differences (+)/(-) 8621 Other movements (+)/(-) 8631 NET BOOK VALUE AT THE END OF THE PERIOD (281) ACCUMULATED AMOUNTS WRITTEN DOWN ON AMOUNTS RECEIVABLE AT END OF THE PERIOD 8651

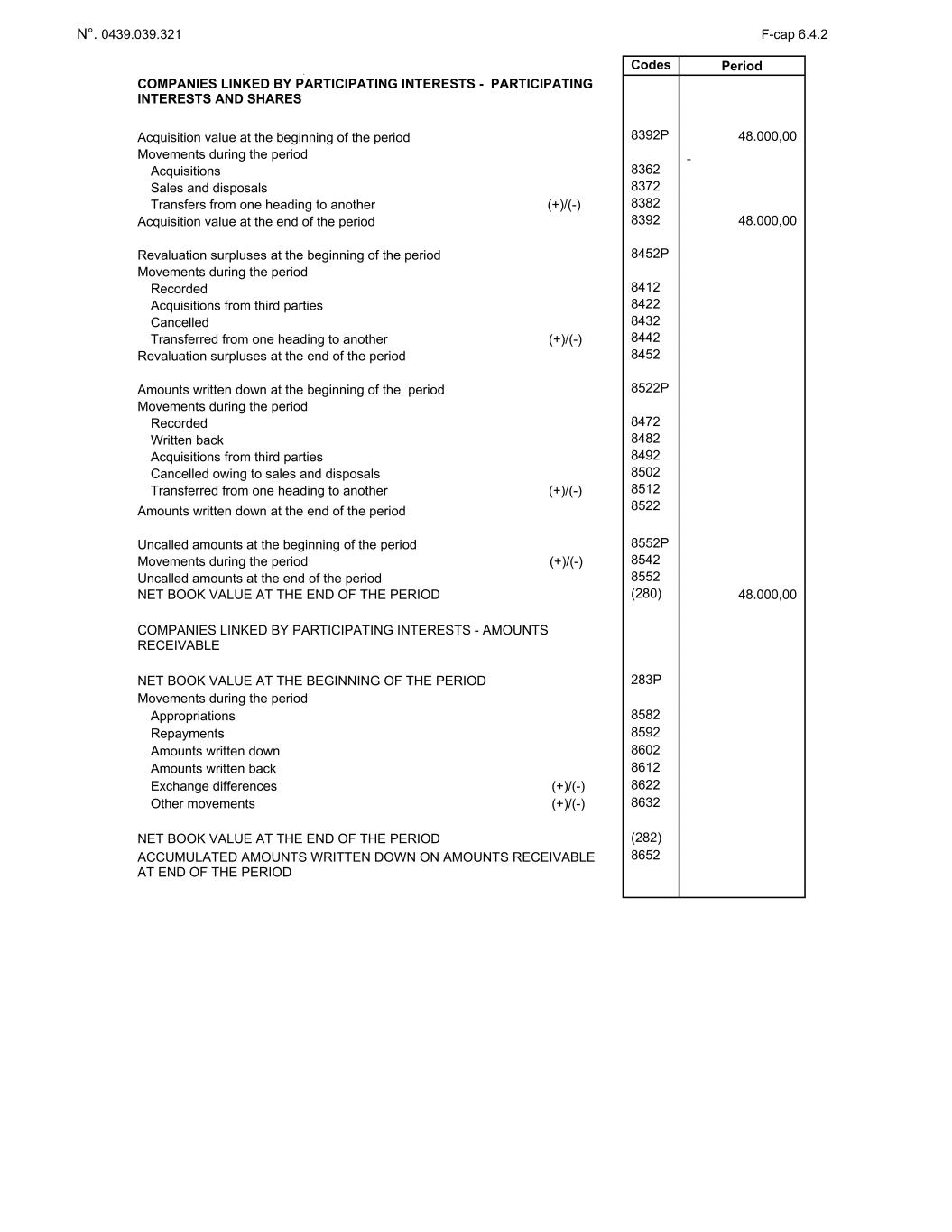

N°. 0439.039.321 F-cap 6.4.2 Codes Period COMPANIES LINKED BY PARTICIPATING INTERESTS - PARTICIPATING INTERESTS AND SHARES Acquisition value at the beginning of the period 8392P 48.000,00 Movements during the period Acquisitions 8362 Sales and disposals 8372 Transfers from one heading to another (+)/(-) 8382 Acquisition value at the end of the period 8392 48.000,00 Revaluation surpluses at the beginning of the period 8452P Movements during the period Recorded 8412 Acquisitions from third parties 8422 Cancelled 8432 Transferred from one heading to another (+)/(-) 8442 Revaluation surpluses at the end of the period 8452 Amounts written down at the beginning of the period 8522P Movements during the period Recorded 8472 Written back 8482 Acquisitions from third parties 8492 Cancelled owing to sales and disposals 8502 Transferred from one heading to another (+)/(-) 8512 Amounts written down at the end of the period 8522 Uncalled amounts at the beginning of the period 8552P Movements during the period (+)/(-) 8542 Uncalled amounts at the end of the period 8552 NET BOOK VALUE AT THE END OF THE PERIOD (280) 48.000,00 COMPANIES LINKED BY PARTICIPATING INTERESTS - AMOUNTS RECEIVABLE NET BOOK VALUE AT THE BEGINNING OF THE PERIOD 283P Movements during the period Appropriations 8582 Repayments 8592 Amounts written down 8602 Amounts written back 8612 Exchange differences (+)/(-) 8622 Other movements (+)/(-) 8632 NET BOOK VALUE AT THE END OF THE PERIOD (282) ACCUMULATED AMOUNTS WRITTEN DOWN ON AMOUNTS RECEIVABLE AT END OF THE PERIOD 8652

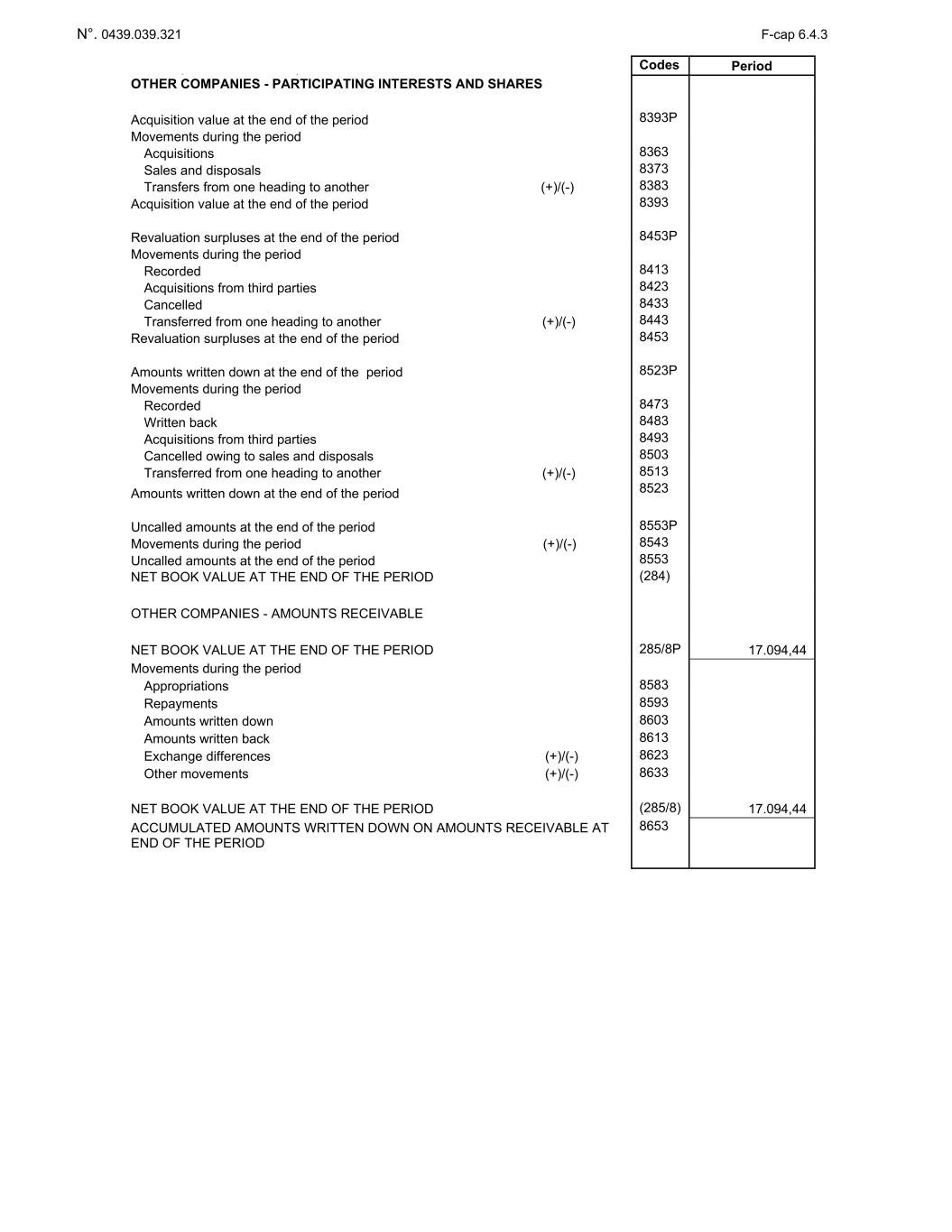

N°. 0439.039.321 F-cap 6.4.3 Codes Period OTHER COMPANIES - PARTICIPATING INTERESTS AND SHARES Acquisition value at the end of the period 8393P Movements during the period Acquisitions 8363 Sales and disposals 8373 Transfers from one heading to another (+)/(-) 8383 Acquisition value at the end of the period 8393 Revaluation surpluses at the end of the period 8453P Movements during the period Recorded 8413 Acquisitions from third parties 8423 Cancelled 8433 Transferred from one heading to another (+)/(-) 8443 Revaluation surpluses at the end of the period 8453 Amounts written down at the end of the period 8523P Movements during the period Recorded 8473 Written back 8483 Acquisitions from third parties 8493 Cancelled owing to sales and disposals 8503 Transferred from one heading to another (+)/(-) 8513 Amounts written down at the end of the period 8523 Uncalled amounts at the end of the period 8553P Movements during the period (+)/(-) 8543 Uncalled amounts at the end of the period 8553 NET BOOK VALUE AT THE END OF THE PERIOD (284) OTHER COMPANIES - AMOUNTS RECEIVABLE NET BOOK VALUE AT THE END OF THE PERIOD 285/8P 17.094,44 Movements during the period Appropriations 8583 Repayments 8593 Amounts written down 8603 Amounts written back 8613 Exchange differences (+)/(-) 8623 Other movements (+)/(-) 8633 NET BOOK VALUE AT THE END OF THE PERIOD (285/8) 17.094,44 ACCUMULATED AMOUNTS WRITTEN DOWN ON AMOUNTS RECEIVABLE AT END OF THE PERIOD 8653

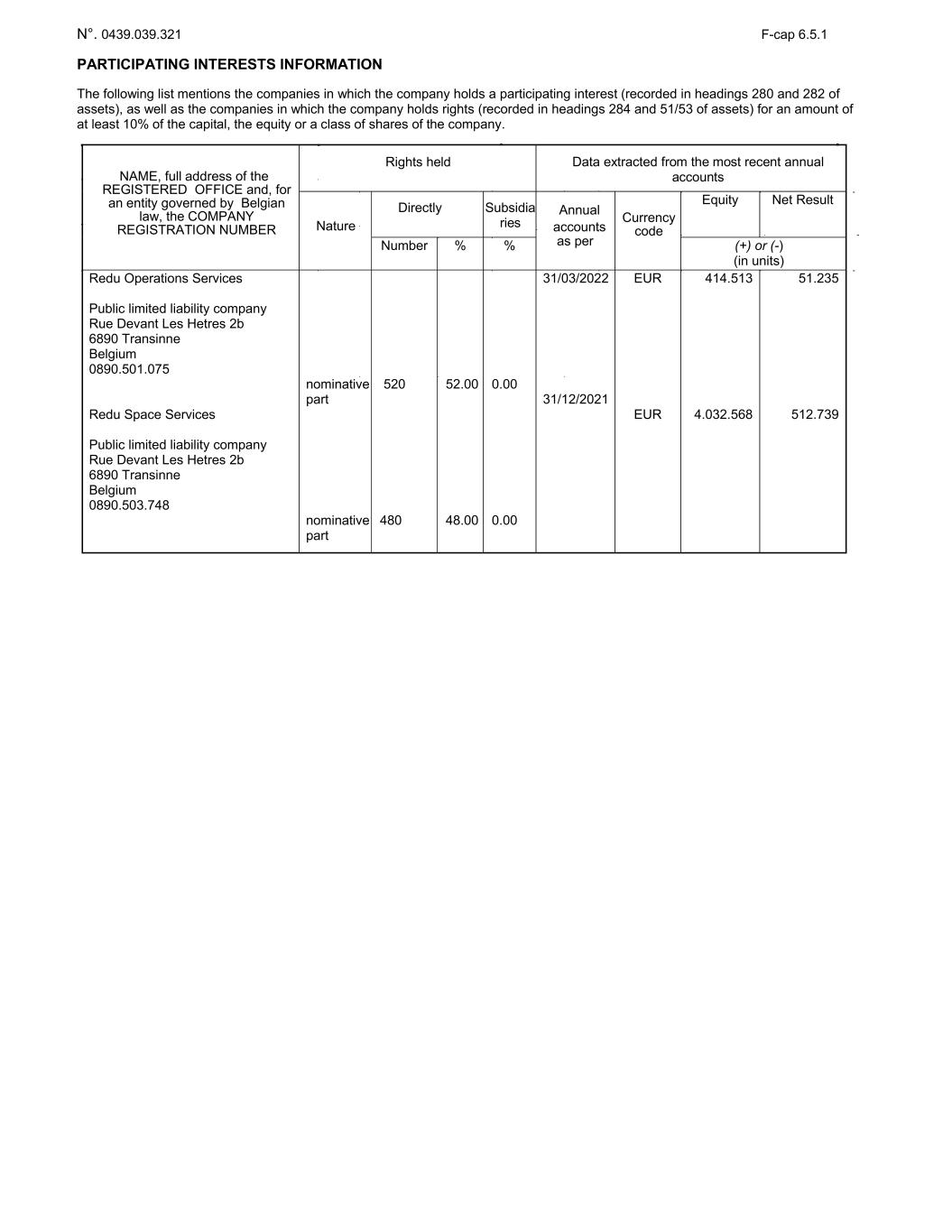

N°. 0439.039.321 F-cap 6.5.1 PARTICIPATING INTERESTS INFORMATION The following list mentions the companies in which the company holds a participating interest (recorded in headings 280 and 282 of assets), as well as the companies in which the company holds rights (recorded in headings 284 and 51/53 of assets) for an amount of at least 10% of the capital, the equity or a class of shares of the company. NAME, full address of the REGISTERED OFFICE and, for an entity governed by Belgian law, the COMPANY REGISTRATION NUMBER Rights held Data extracted from the most recent annual accounts Nature Directly Subsidia ries Annual accounts as per Currency code Equity Net Result Number % % (+) or (-) (in units) Redu Operations Services Public limited liability company Rue Devant Les Hetres 2b 6890 Transinne Belgium 0890.501.075 Redu Space Services Public limited liability company Rue Devant Les Hetres 2b 6890 Transinne Belgium 0890.503.748 nominative part nominative part 520 480 52.00 48.00 0.00 0.00 31/03/2022 31/12/2021 EUR EUR 414.513 4.032.568 51.235 512.739

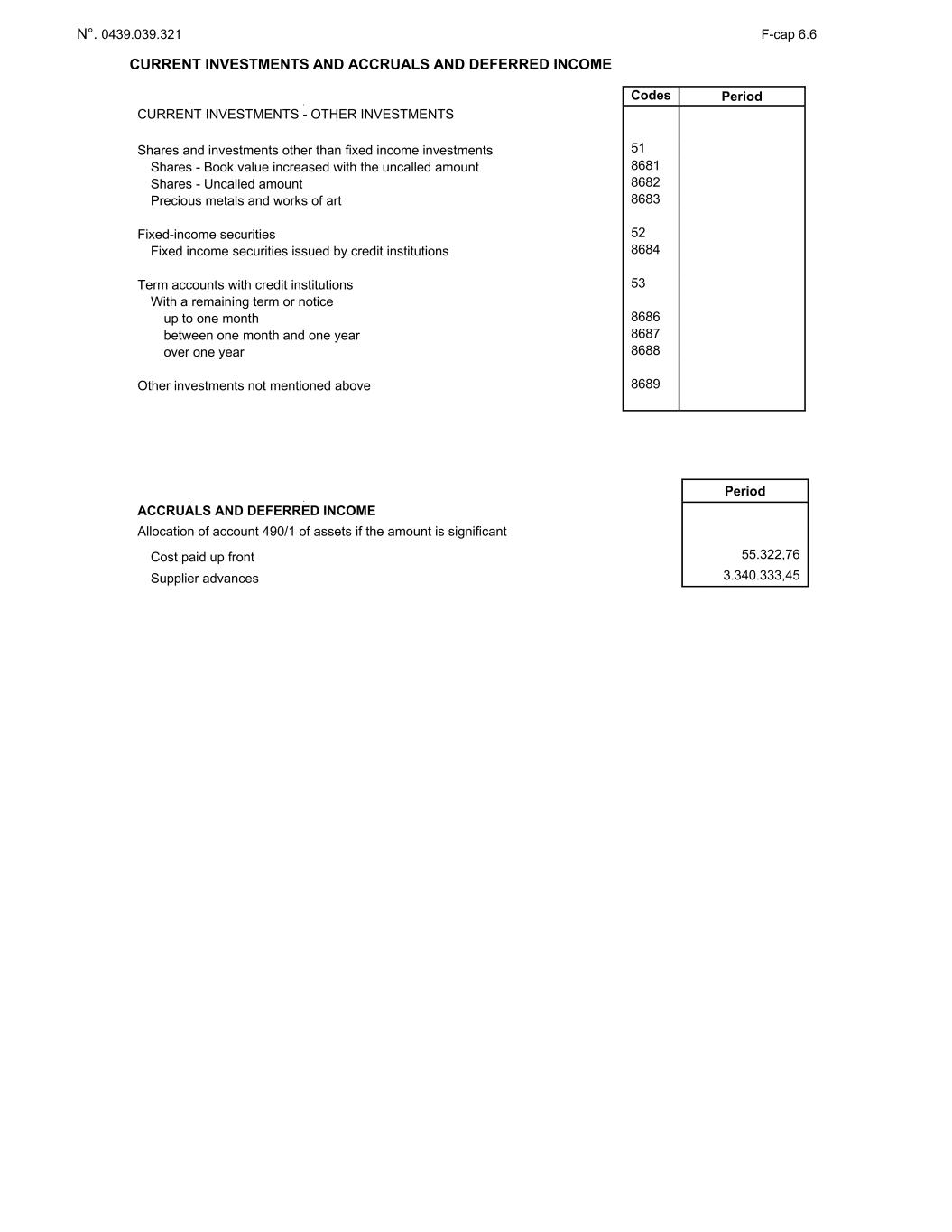

N°. 0439.039.321 F-cap 6.6 CURRENT INVESTMENTS AND ACCRUALS AND DEFERRED INCOME Codes Period CURRENT INVESTMENTS - OTHER INVESTMENTS Shares and investments other than fixed income investments 51 Shares - Book value increased with the uncalled amount 8681 Shares - Uncalled amount 8682 Precious metals and works of art 8683 Fixed-income securities 52 Fixed income securities issued by credit institutions 8684 Term accounts with credit institutions 53 With a remaining term or notice up to one month 8686 between one month and one year 8687 over one year 8688 Other investments not mentioned above 8689 Period ACCRUALS AND DEFERRED INCOME Allocation of account 490/1 of assets if the amount is significant Cost paid up front 55.322,76 Supplier advances 3.340.333,45

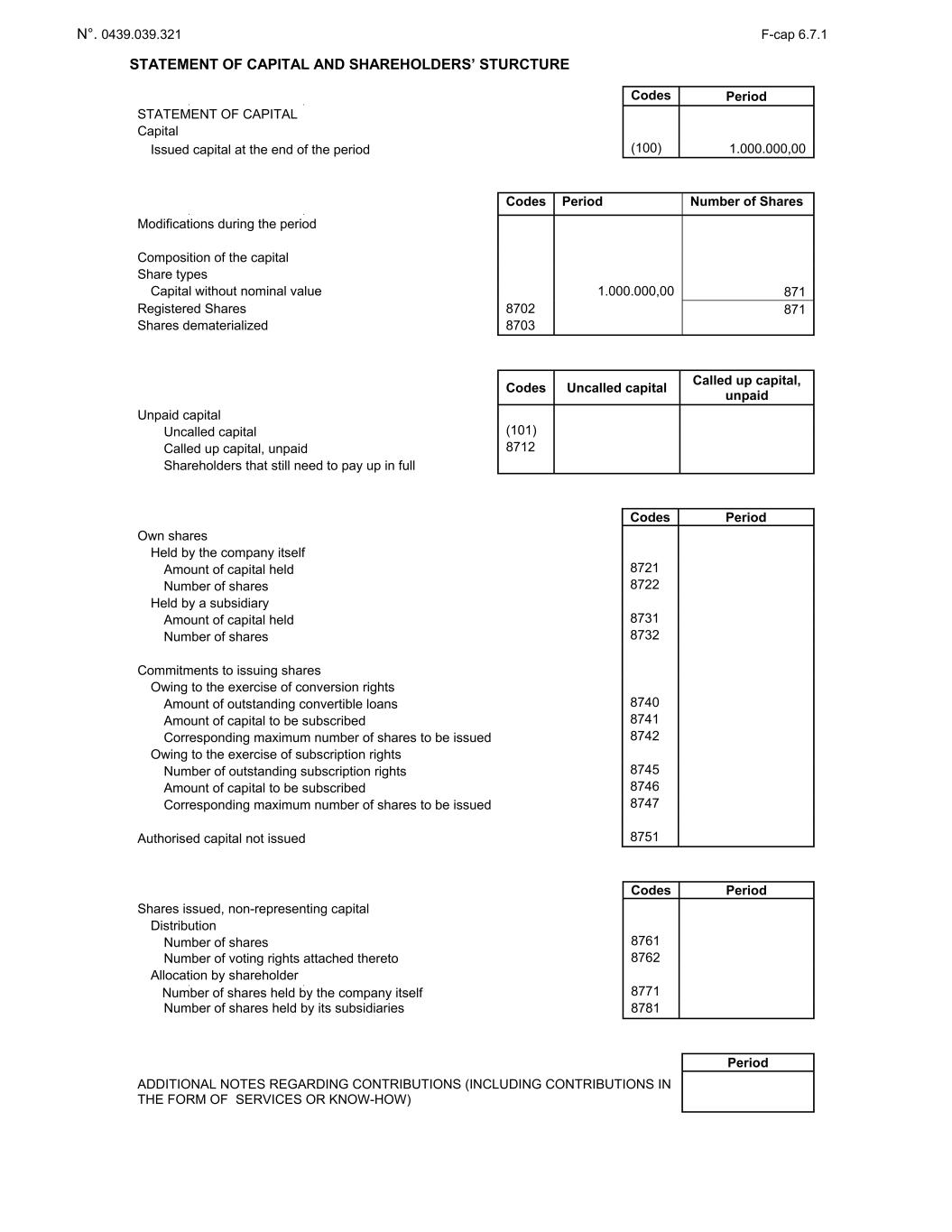

N°. 0439.039.321 F-cap 6.7.1 STATEMENT OF CAPITAL AND SHAREHOLDERS’ STURCTURE Codes Period STATEMENT OF CAPITAL Capital Issued capital at the end of the period (100) 1.000.000,00 Codes Period Number of Shares Modifications during the period Composition of the capital Share types Capital without nominal value 1.000.000,00 871 Registered Shares 8702 871 Shares dematerialized 8703 Codes Uncalled capital Called up capital, unpaid Unpaid capital Uncalled capital (101) Called up capital, unpaid 8712 Shareholders that still need to pay up in full Codes Period Own shares Held by the company itself Amount of capital held 8721 Number of shares 8722 Held by a subsidiary Amount of capital held 8731 Number of shares 8732 Commitments to issuing shares Owing to the exercise of conversion rights Amount of outstanding convertible loans 8740 Amount of capital to be subscribed 8741 Corresponding maximum number of shares to be issued 8742 Owing to the exercise of subscription rights Number of outstanding subscription rights 8745 Amount of capital to be subscribed 8746 Corresponding maximum number of shares to be issued 8747 Authorised capital not issued 8751 Codes Period Shares issued, non-representing capital Distribution Number of shares 8761 Number of voting rights attached thereto 8762 Allocation by shareholder Number of shares held by the company itself 8771 Number of shares held by its subsidiaries 8781 Period ADDITIONAL NOTES REGARDING CONTRIBUTIONS (INCLUDING CONTRIBUTIONS IN THE FORM OF SERVICES OR KNOW-HOW)

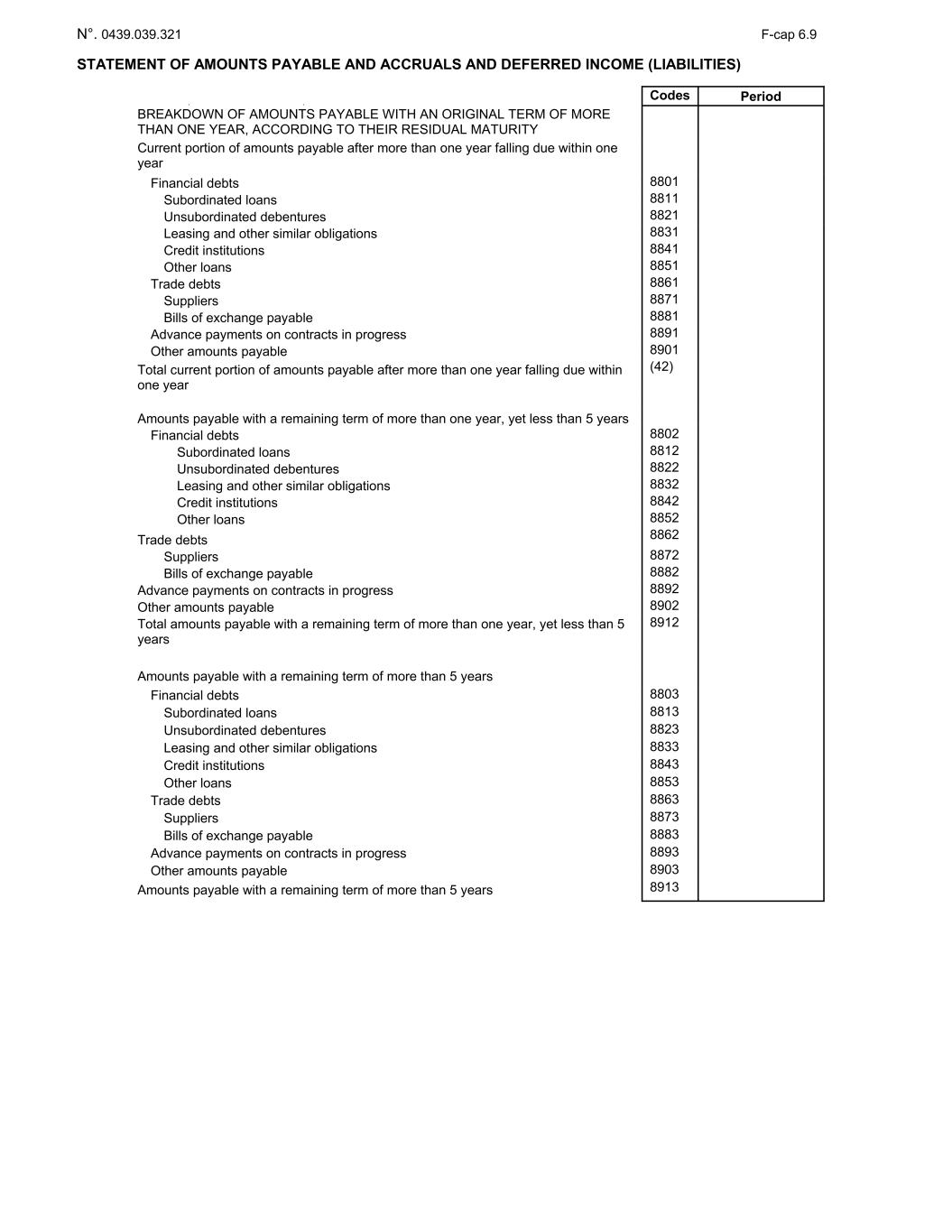

N°. 0439.039.321 F-cap 6.9 STATEMENT OF AMOUNTS PAYABLE AND ACCRUALS AND DEFERRED INCOME (LIABILITIES) Codes Period BREAKDOWN OF AMOUNTS PAYABLE WITH AN ORIGINAL TERM OF MORE THAN ONE YEAR, ACCORDING TO THEIR RESIDUAL MATURITY Current portion of amounts payable after more than one year falling due within one year Financial debts 8801 Subordinated loans 8811 Unsubordinated debentures 8821 Leasing and other similar obligations 8831 Credit institutions 8841 Other loans 8851 Trade debts 8861 Suppliers 8871 Bills of exchange payable 8881 Advance payments on contracts in progress 8891 Other amounts payable 8901 Total current portion of amounts payable after more than one year falling due within one year (42) Amounts payable with a remaining term of more than one year, yet less than 5 years Financial debts 8802 Subordinated loans 8812 Unsubordinated debentures 8822 Leasing and other similar obligations 8832 Credit institutions 8842 Other loans 8852 Trade debts 8862 Suppliers 8872 Bills of exchange payable 8882 Advance payments on contracts in progress 8892 Other amounts payable 8902 Total amounts payable with a remaining term of more than one year, yet less than 5 years 8912 Amounts payable with a remaining term of more than 5 years Financial debts 8803 Subordinated loans 8813 Unsubordinated debentures 8823 Leasing and other similar obligations 8833 Credit institutions 8843 Other loans 8853 Trade debts 8863 Suppliers 8873 Bills of exchange payable 8883 Advance payments on contracts in progress 8893 Other amounts payable 8903 Amounts payable with a remaining term of more than 5 years 8913

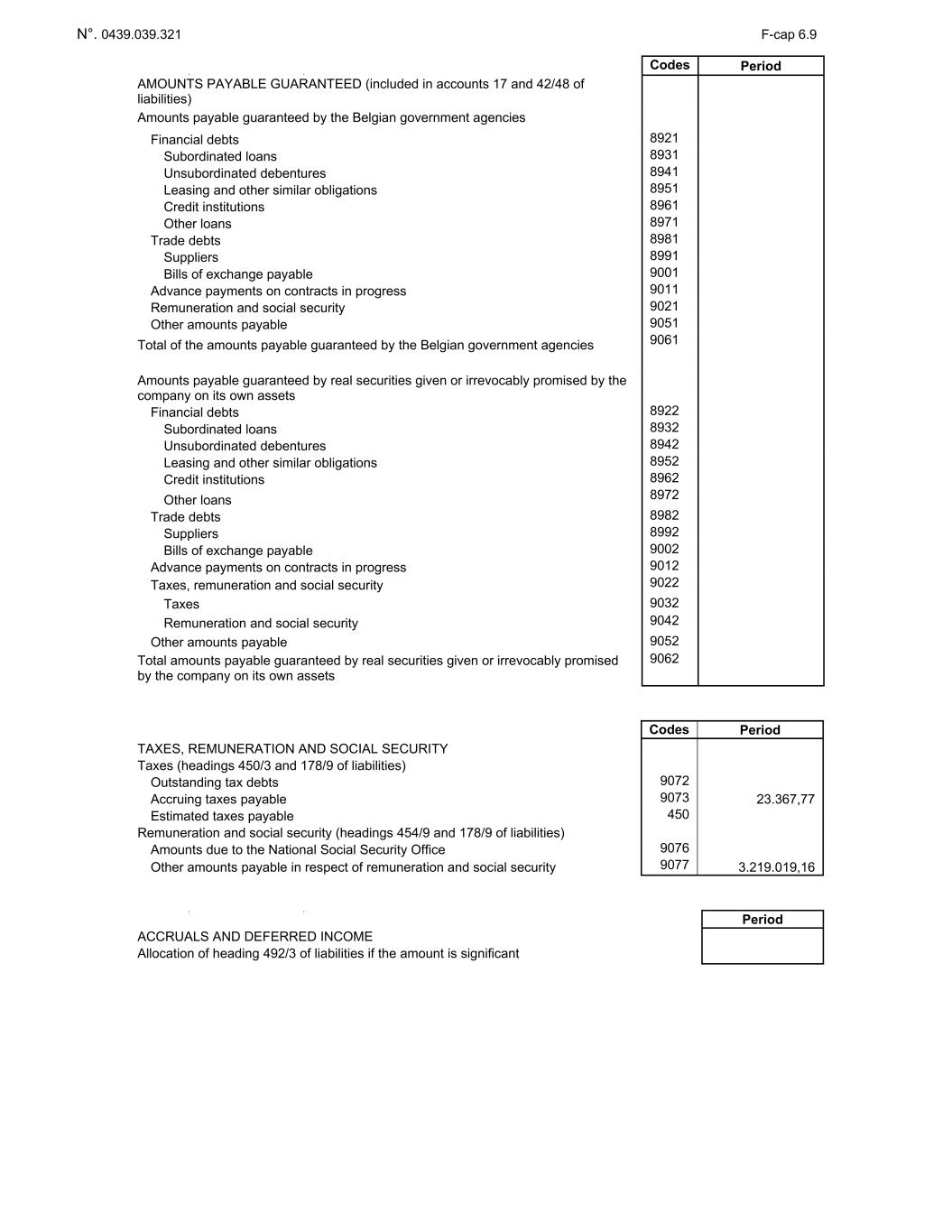

N°. 0439.039.321 F-cap 6.9 Codes Period AMOUNTS PAYABLE GUARANTEED (included in accounts 17 and 42/48 of liabilities) Amounts payable guaranteed by the Belgian government agencies Financial debts 8921 Subordinated loans 8931 Unsubordinated debentures 8941 Leasing and other similar obligations 8951 Credit institutions 8961 Other loans 8971 Trade debts 8981 Suppliers 8991 Bills of exchange payable 9001 Advance payments on contracts in progress 9011 Remuneration and social security 9021 Other amounts payable 9051 Total of the amounts payable guaranteed by the Belgian government agencies 9061 Amounts payable guaranteed by real securities given or irrevocably promised by the company on its own assets Financial debts 8922 Subordinated loans 8932 Unsubordinated debentures 8942 Leasing and other similar obligations 8952 Credit institutions 8962 Other loans 8972 Trade debts 8982 Suppliers 8992 Bills of exchange payable 9002 Advance payments on contracts in progress 9012 Taxes, remuneration and social security 9022 Taxes 9032 Remuneration and social security 9042 Other amounts payable 9052 Total amounts payable guaranteed by real securities given or irrevocably promised by the company on its own assets 9062 Codes Period TAXES, REMUNERATION AND SOCIAL SECURITY Taxes (headings 450/3 and 178/9 of liabilities) Outstanding tax debts 9072 Accruing taxes payable 9073 23.367,77 Estimated taxes payable 450 Remuneration and social security (headings 454/9 and 178/9 of liabilities) Amounts due to the National Social Security Office 9076 Other amounts payable in respect of remuneration and social security 9077 3.219.019,16 Period ACCRUALS AND DEFERRED INCOME Allocation of heading 492/3 of liabilities if the amount is significant

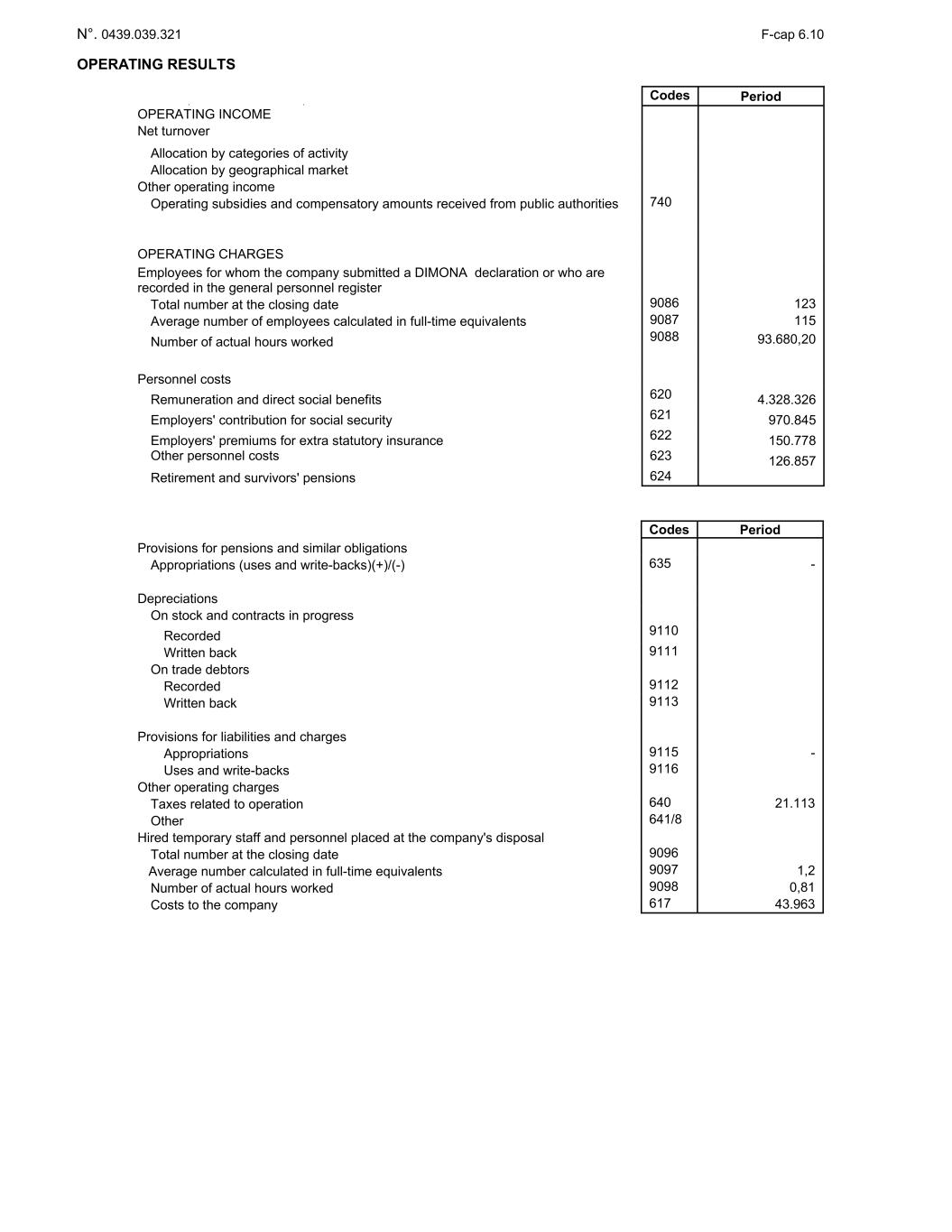

N°. 0439.039.321 F-cap 6.10 OPERATING RESULTS Codes Period OPERATING INCOME Net turnover Allocation by categories of activity Allocation by geographical market Other operating income Operating subsidies and compensatory amounts received from public authorities 740 OPERATING CHARGES Employees for whom the company submitted a DIMONA declaration or who are recorded in the general personnel register Total number at the closing date 9086 123 Average number of employees calculated in full-time equivalents 9087 115 Number of actual hours worked 9088 93.680,20 Personnel costs Remuneration and direct social benefits 620 4.328.326 Employers' contribution for social security 621 970.845 Employers' premiums for extra statutory insurance 622 150.778 Other personnel costs 623 126.857 Retirement and survivors' pensions 624 Codes Period Provisions for pensions and similar obligations Appropriations (uses and write-backs)(+)/(-) 635 - Depreciations On stock and contracts in progress Recorded 9110 Written back 9111 On trade debtors Recorded 9112 Written back 9113 Provisions for liabilities and charges Appropriations 9115 - Uses and write-backs 9116 Other operating charges Taxes related to operation 640 21.113 Other 641/8 Hired temporary staff and personnel placed at the company's disposal Total number at the closing date 9096 Average number calculated in full-time equivalents 9097 1,2 Number of actual hours worked 9098 0,81 Costs to the company 617 43.963

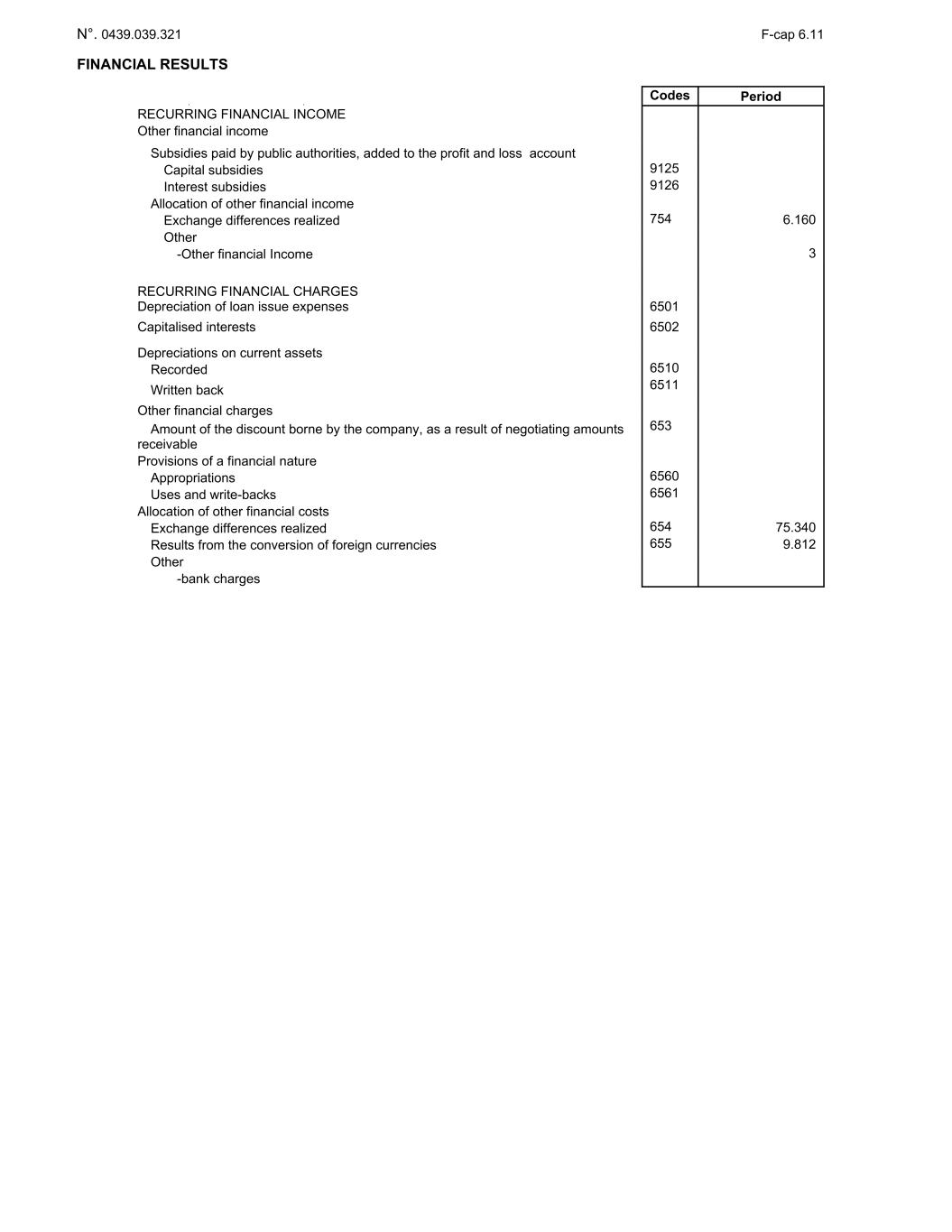

N°. 0439.039.321 F-cap 6.11 FINANCIAL RESULTS Codes Period RECURRING FINANCIAL INCOME Other financial income Subsidies paid by public authorities, added to the profit and loss account Capital subsidies 9125 Interest subsidies 9126 Allocation of other financial income Exchange differences realized 754 6.160 Other -Other financial Income 3 RECURRING FINANCIAL CHARGES Depreciation of loan issue expenses 6501 Capitalised interests 6502 Depreciations on current assets Recorded 6510 Written back 6511 Other financial charges Amount of the discount borne by the company, as a result of negotiating amounts receivable 653 Provisions of a financial nature Appropriations 6560 Uses and write-backs 6561 Allocation of other financial costs Exchange differences realized 654 75.340 Results from the conversion of foreign currencies 655 9.812 Other -bank charges

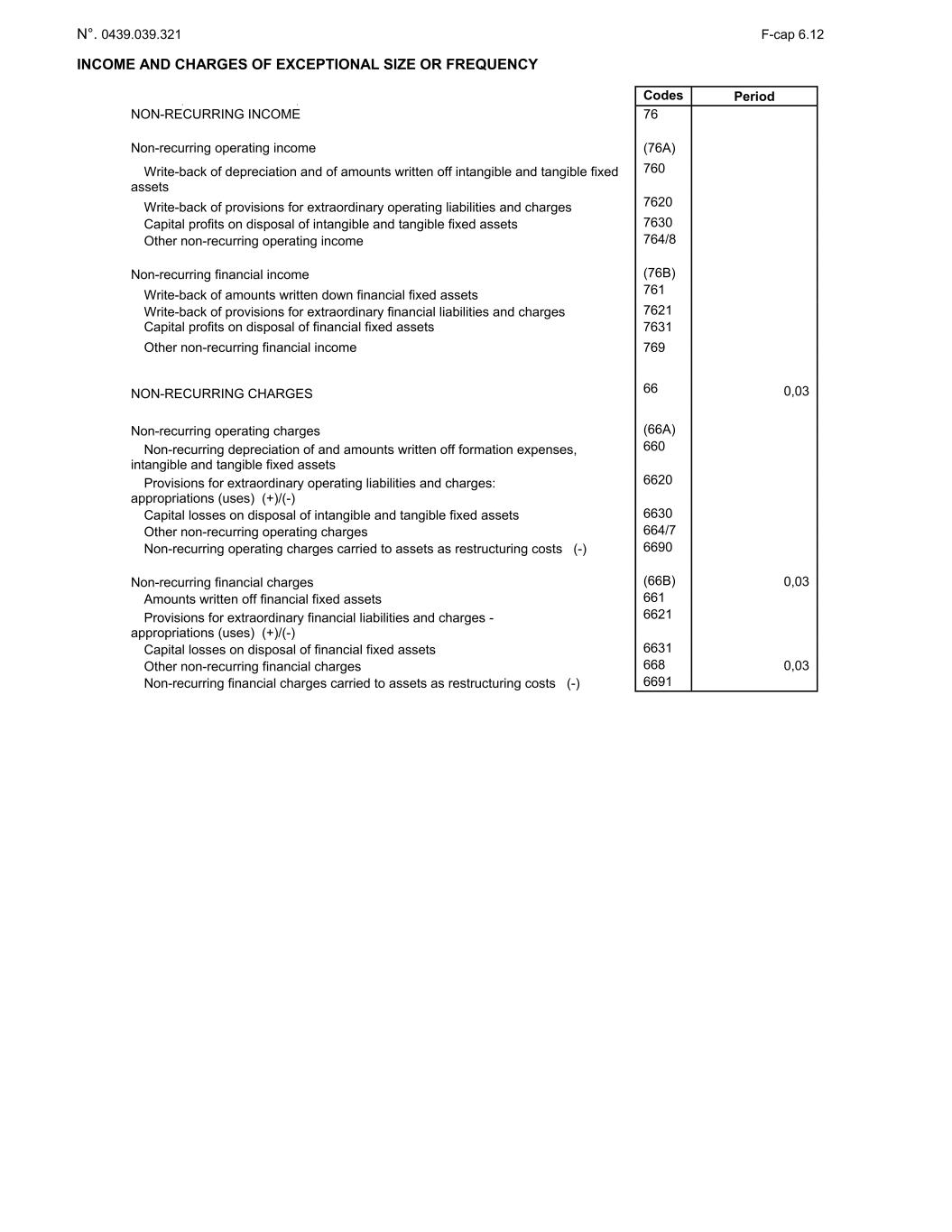

N°. 0439.039.321 F-cap 6.12 INCOME AND CHARGES OF EXCEPTIONAL SIZE OR FREQUENCY Codes Period NON-RECURRING INCOME 76 Non-recurring operating income (76A) Write-back of depreciation and of amounts written off intangible and tangible fixed assets 760 Write-back of provisions for extraordinary operating liabilities and charges 7620 Capital profits on disposal of intangible and tangible fixed assets 7630 Other non-recurring operating income 764/8 Non-recurring financial income (76B) Write-back of amounts written down financial fixed assets 761 Write-back of provisions for extraordinary financial liabilities and charges 7621 Capital profits on disposal of financial fixed assets 7631 Other non-recurring financial income 769 NON-RECURRING CHARGES 66 0,03 Non-recurring operating charges (66A) Non-recurring depreciation of and amounts written off formation expenses, intangible and tangible fixed assets 660 Provisions for extraordinary operating liabilities and charges: appropriations (uses) (+)/(-) 6620 Capital losses on disposal of intangible and tangible fixed assets 6630 Other non-recurring operating charges 664/7 Non-recurring operating charges carried to assets as restructuring costs (-) 6690 Non-recurring financial charges (66B) 0,03 Amounts written off financial fixed assets 661 Provisions for extraordinary financial liabilities and charges - appropriations (uses) (+)/(-) 6621 Capital losses on disposal of financial fixed assets 6631 Other non-recurring financial charges 668 0,03 Non-recurring financial charges carried to assets as restructuring costs (-) 6691

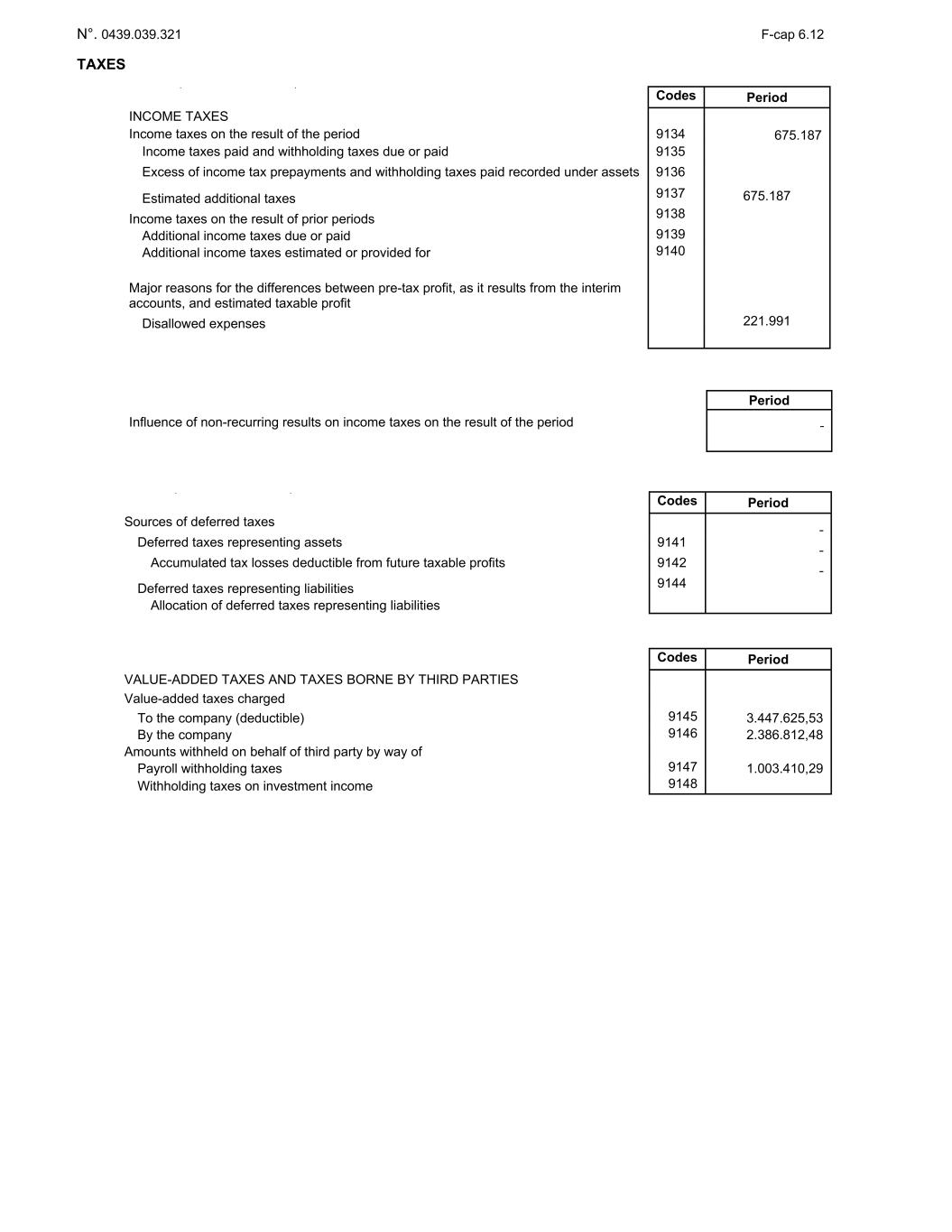

N°. 0439.039.321 F-cap 6.12 TAXES Codes Period Sources of deferred taxes Deferred taxes representing assets 9141 Accumulated tax losses deductible from future taxable profits 9142 Deferred taxes representing liabilities 9144 Allocation of deferred taxes representing liabilities Codes Period VALUE-ADDED TAXES AND TAXES BORNE BY THIRD PARTIES Value-added taxes charged To the company (deductible) 9145 3.447.625,53 By the company 9146 2.386.812,48 Amounts withheld on behalf of third party by way of Payroll withholding taxes 9147 1.003.410,29 Withholding taxes on investment income 9148 Codes Period INCOME TAXES Income taxes on the result of the period 9134 675.187 Income taxes paid and withholding taxes due or paid 9135 Excess of income tax prepayments and withholding taxes paid recorded under assets 9136 Estimated additional taxes 9137 675.187 Income taxes on the result of prior periods 9138 Additional income taxes due or paid 9139 Additional income taxes estimated or provided for 9140 Major reasons for the differences between pre-tax profit, as it results from the interim accounts, and estimated taxable profit Disallowed expenses 221.991 Period Influence of non-recurring results on income taxes on the result of the period

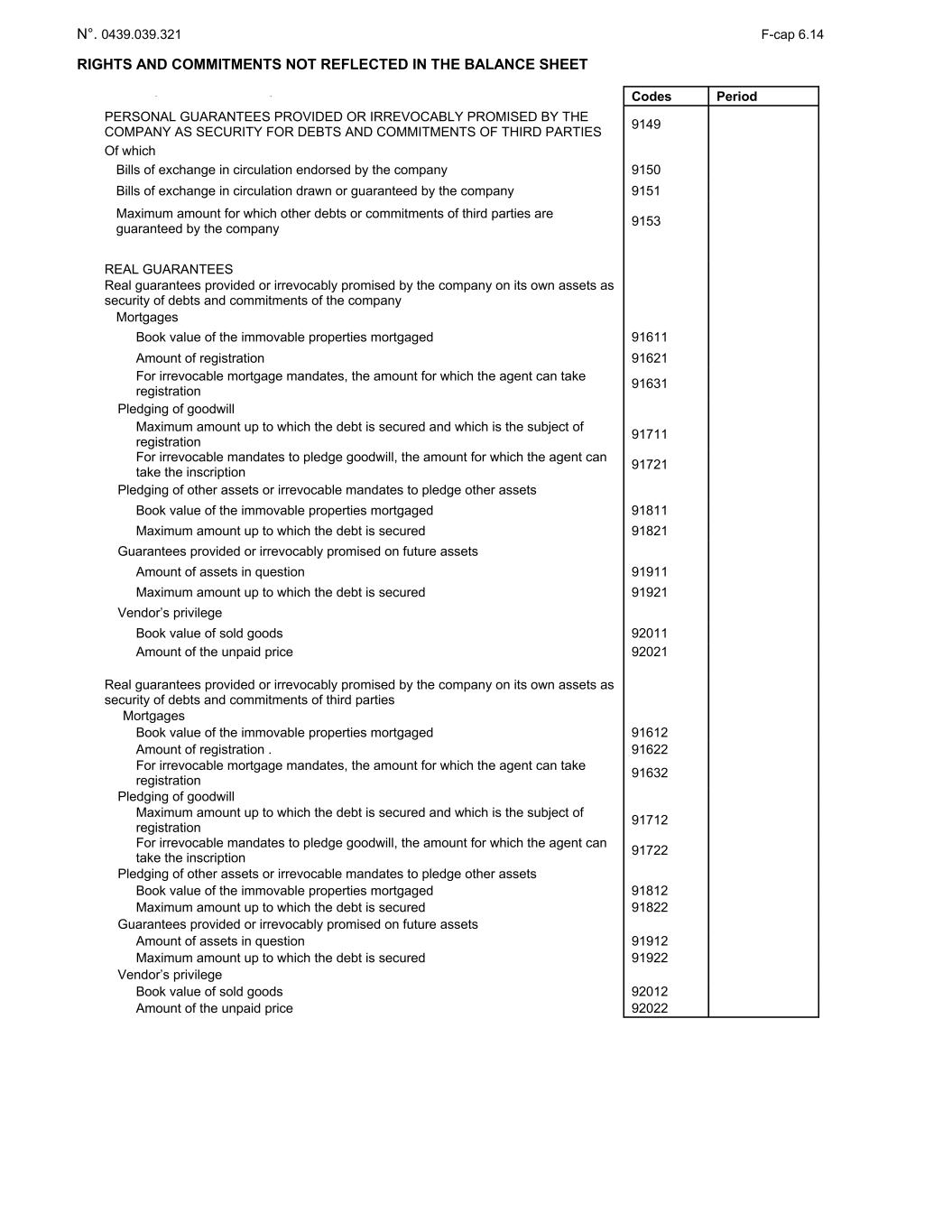

N°. 0439.039.321 F-cap 6.14 RIGHTS AND COMMITMENTS NOT REFLECTED IN THE BALANCE SHEET Codes Period PERSONAL GUARANTEES PROVIDED OR IRREVOCABLY PROMISED BY THE COMPANY AS SECURITY FOR DEBTS AND COMMITMENTS OF THIRD PARTIES 9149 Of which Bills of exchange in circulation endorsed by the company 9150 Bills of exchange in circulation drawn or guaranteed by the company 9151 Maximum amount for which other debts or commitments of third parties are guaranteed by the company 9153 REAL GUARANTEES Real guarantees provided or irrevocably promised by the company on its own assets as security of debts and commitments of the company Mortgages Book value of the immovable properties mortgaged 91611 Amount of registration 91621 For irrevocable mortgage mandates, the amount for which the agent can take registration 91631 Pledging of goodwill Maximum amount up to which the debt is secured and which is the subject of registration 91711 For irrevocable mandates to pledge goodwill, the amount for which the agent can take the inscription 91721 Pledging of other assets or irrevocable mandates to pledge other assets Book value of the immovable properties mortgaged 91811 Maximum amount up to which the debt is secured 91821 Guarantees provided or irrevocably promised on future assets Amount of assets in question 91911 Maximum amount up to which the debt is secured 91921 Vendor’s privilege Book value of sold goods 92011 Amount of the unpaid price 92021 Real guarantees provided or irrevocably promised by the company on its own assets as security of debts and commitments of third parties Mortgages Book value of the immovable properties mortgaged 91612 Amount of registration . 91622 For irrevocable mortgage mandates, the amount for which the agent can take registration 91632 Pledging of goodwill Maximum amount up to which the debt is secured and which is the subject of registration 91712 For irrevocable mandates to pledge goodwill, the amount for which the agent can take the inscription 91722 Pledging of other assets or irrevocable mandates to pledge other assets Book value of the immovable properties mortgaged 91812 Maximum amount up to which the debt is secured 91822 Guarantees provided or irrevocably promised on future assets Amount of assets in question 91912 Maximum amount up to which the debt is secured 91922 Vendor’s privilege Book value of sold goods 92012 Amount of the unpaid price 92022

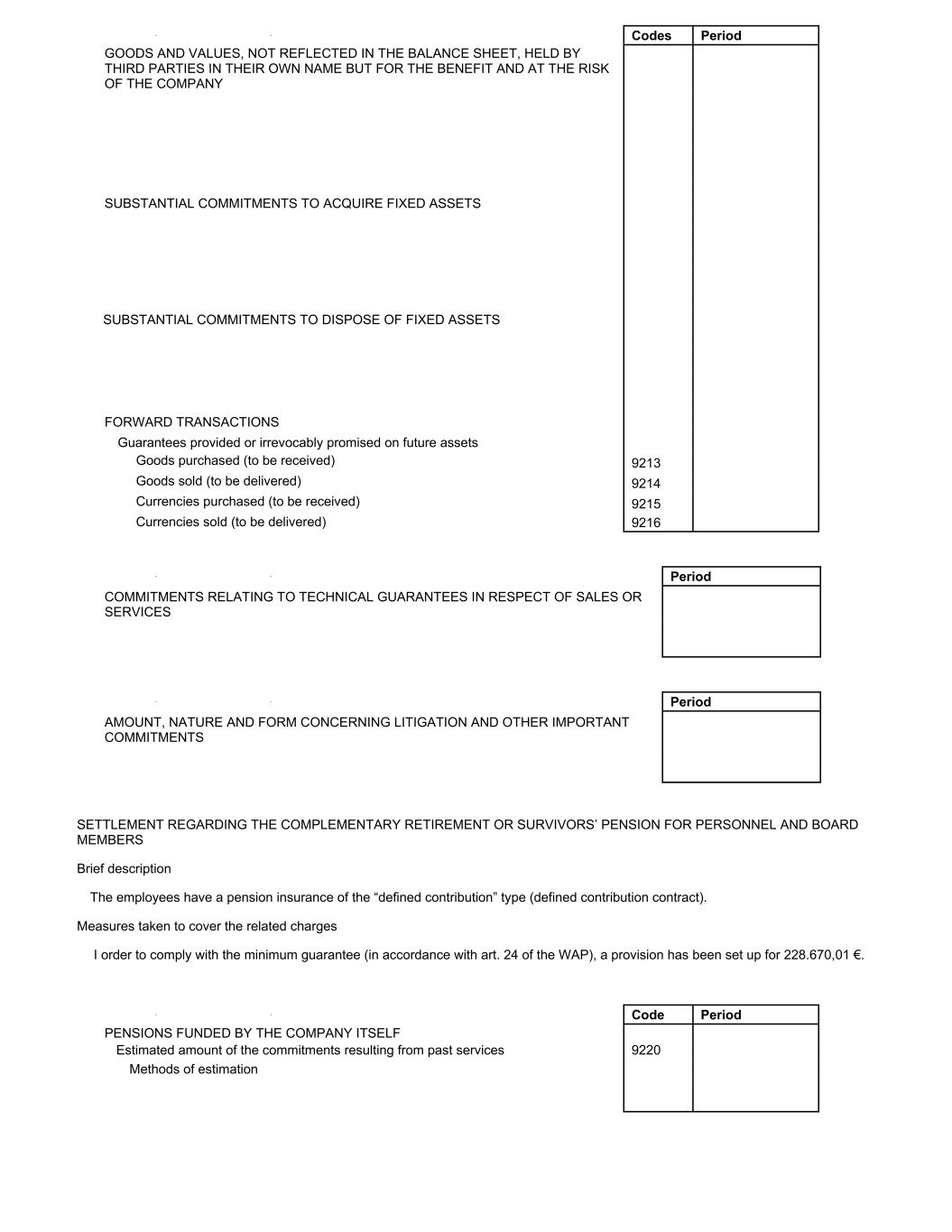

Codes Period GOODS AND VALUES, NOT REFLECTED IN THE BALANCE SHEET, HELD BY THIRD PARTIES IN THEIR OWN NAME BUT FOR THE BENEFIT AND AT THE RISK OF THE COMPANY SUBSTANTIAL COMMITMENTS TO ACQUIRE FIXED ASSETS SUBSTANTIAL COMMITMENTS TO DISPOSE OF FIXED ASSETS FORWARD TRANSACTIONS Guarantees provided or irrevocably promised on future assets Goods purchased (to be received) 9213 Goods sold (to be delivered) 9214 Currencies purchased (to be received) 9215 Currencies sold (to be delivered) 9216 Period COMMITMENTS RELATING TO TECHNICAL GUARANTEES IN RESPECT OF SALES OR SERVICES Period AMOUNT, NATURE AND FORM CONCERNING LITIGATION AND OTHER IMPORTANT COMMITMENTS SETTLEMENT REGARDING THE COMPLEMENTARY RETIREMENT OR SURVIVORS’ PENSION FOR PERSONNEL AND BOARD MEMBERS Brief description The employees have a pension insurance of the “defined contribution” type (defined contribution contract). Measures taken to cover the related charges I order to comply with the minimum guarantee (in accordance with art. 24 of the WAP), a provision has been set up for 228.670,01 €. Code Period PENSIONS FUNDED BY THE COMPANY ITSELF Estimated amount of the commitments resulting from past services 9220 Methods of estimation

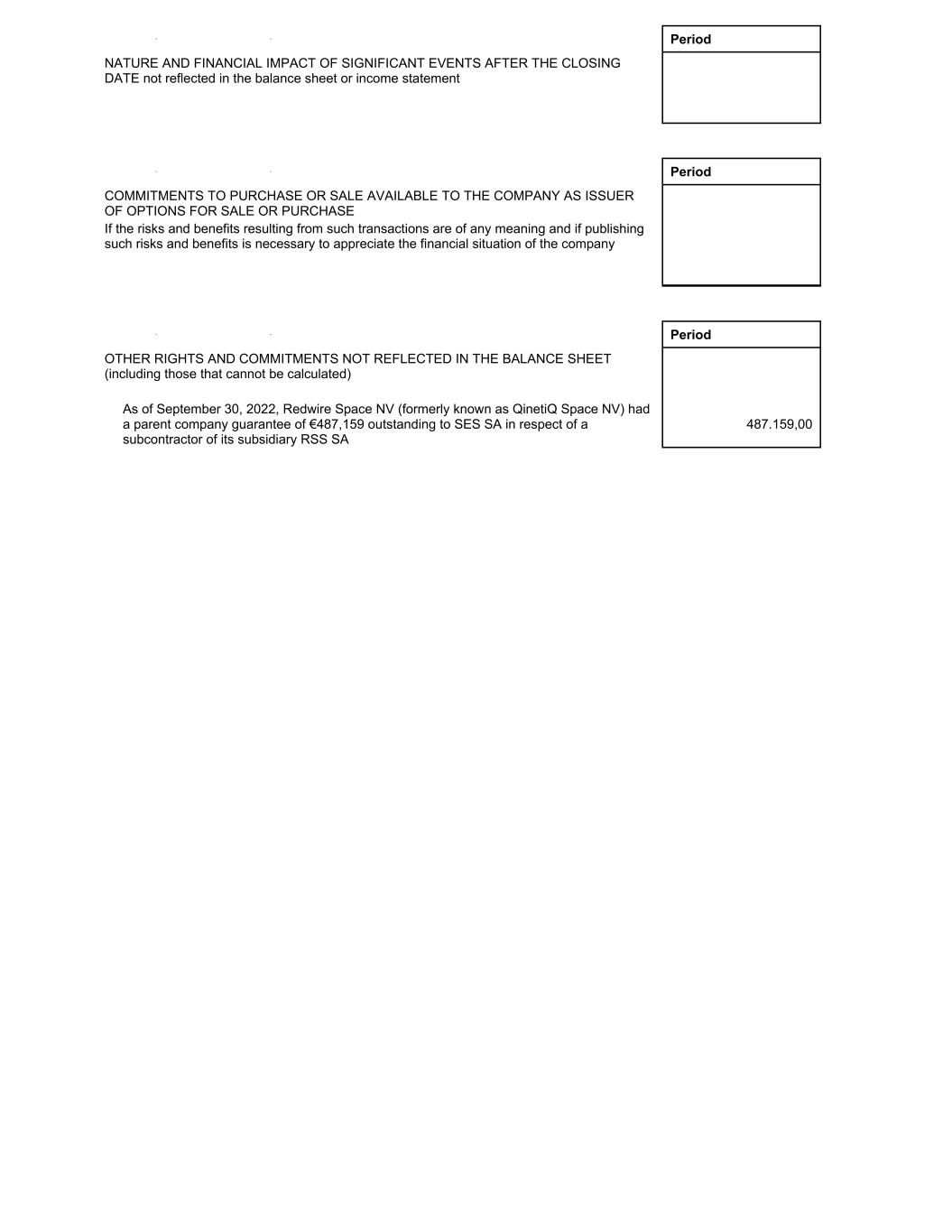

Period NATURE AND FINANCIAL IMPACT OF SIGNIFICANT EVENTS AFTER THE CLOSING DATE not reflected in the balance sheet or income statement Period COMMITMENTS TO PURCHASE OR SALE AVAILABLE TO THE COMPANY AS ISSUER OF OPTIONS FOR SALE OR PURCHASE If the risks and benefits resulting from such transactions are of any meaning and if publishing such risks and benefits is necessary to appreciate the financial situation of the company Period OTHER RIGHTS AND COMMITMENTS NOT REFLECTED IN THE BALANCE SHEET (including those that cannot be calculated) As of September 30, 2022, Redwire Space NV (formerly known as QinetiQ Space NV) had a parent company guarantee of €487,159 outstanding to SES SA in respect of a subcontractor of its subsidiary RSS SA 487.159,00

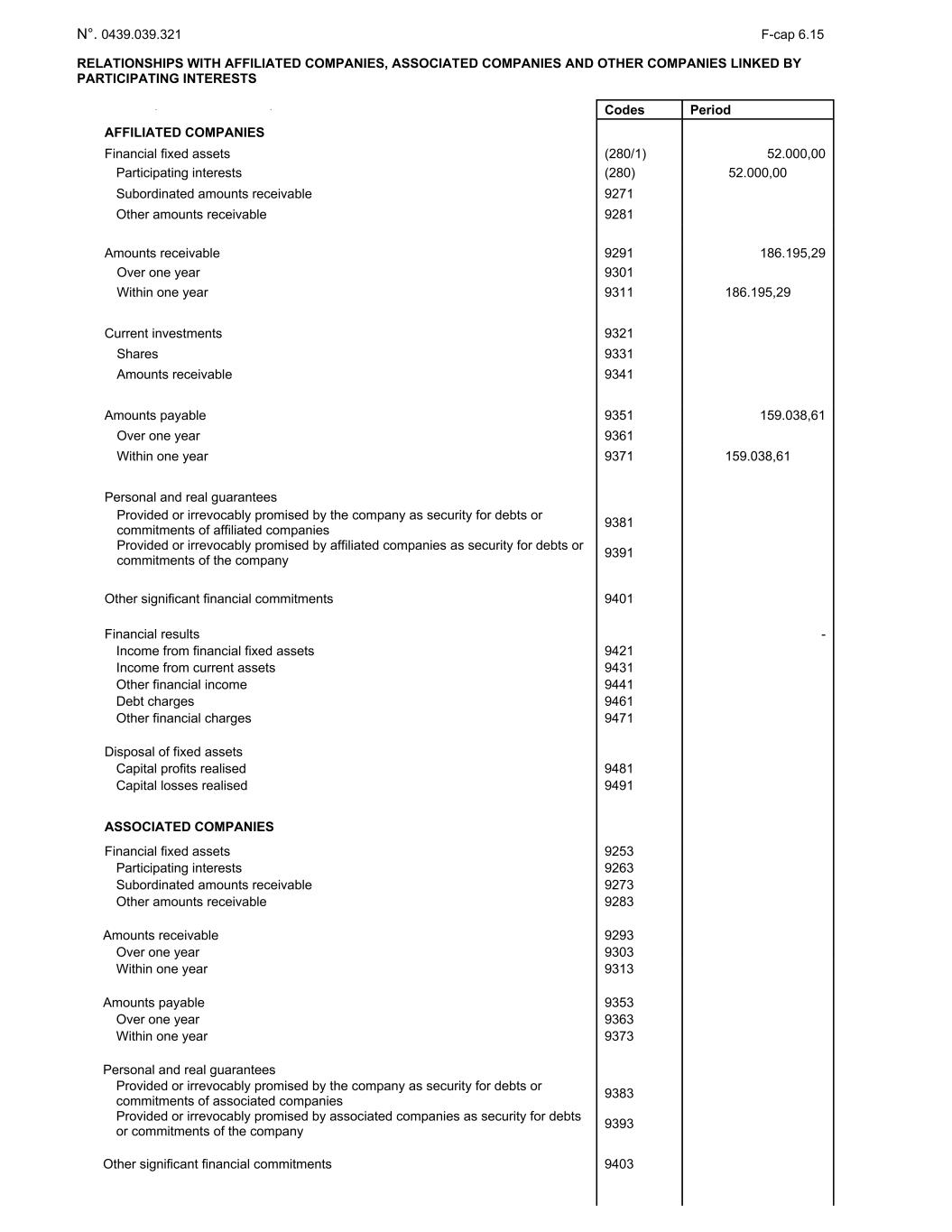

N°. 0439.039.321 F-cap 6.15 RELATIONSHIPS WITH AFFILIATED COMPANIES, ASSOCIATED COMPANIES AND OTHER COMPANIES LINKED BY PARTICIPATING INTERESTS Codes Period AFFILIATED COMPANIES Financial fixed assets (280/1) 52.000,00 Participating interests (280) 52.000,00 Subordinated amounts receivable 9271 Other amounts receivable 9281 Amounts receivable 9291 186.195,29 Over one year 9301 Within one year 9311 186.195,29 Current investments 9321 Shares 9331 Amounts receivable 9341 Amounts payable 9351 159.038,61 Over one year 9361 Within one year 9371 159.038,61 Personal and real guarantees Provided or irrevocably promised by the company as security for debts or commitments of affiliated companies 9381 Provided or irrevocably promised by affiliated companies as security for debts or commitments of the company 9391 Other significant financial commitments 9401 Financial results - Income from financial fixed assets 9421 Income from current assets 9431 Other financial income 9441 Debt charges 9461 Other financial charges 9471 Disposal of fixed assets Capital profits realised 9481 Capital losses realised 9491 ASSOCIATED COMPANIES Financial fixed assets 9253 Participating interests 9263 Subordinated amounts receivable 9273 Other amounts receivable 9283 Amounts receivable 9293 Over one year 9303 Within one year 9313 Amounts payable 9353 Over one year 9363 Within one year 9373 Personal and real guarantees Provided or irrevocably promised by the company as security for debts or commitments of associated companies 9383 Provided or irrevocably promised by associated companies as security for debts or commitments of the company 9393 Other significant financial commitments 9403

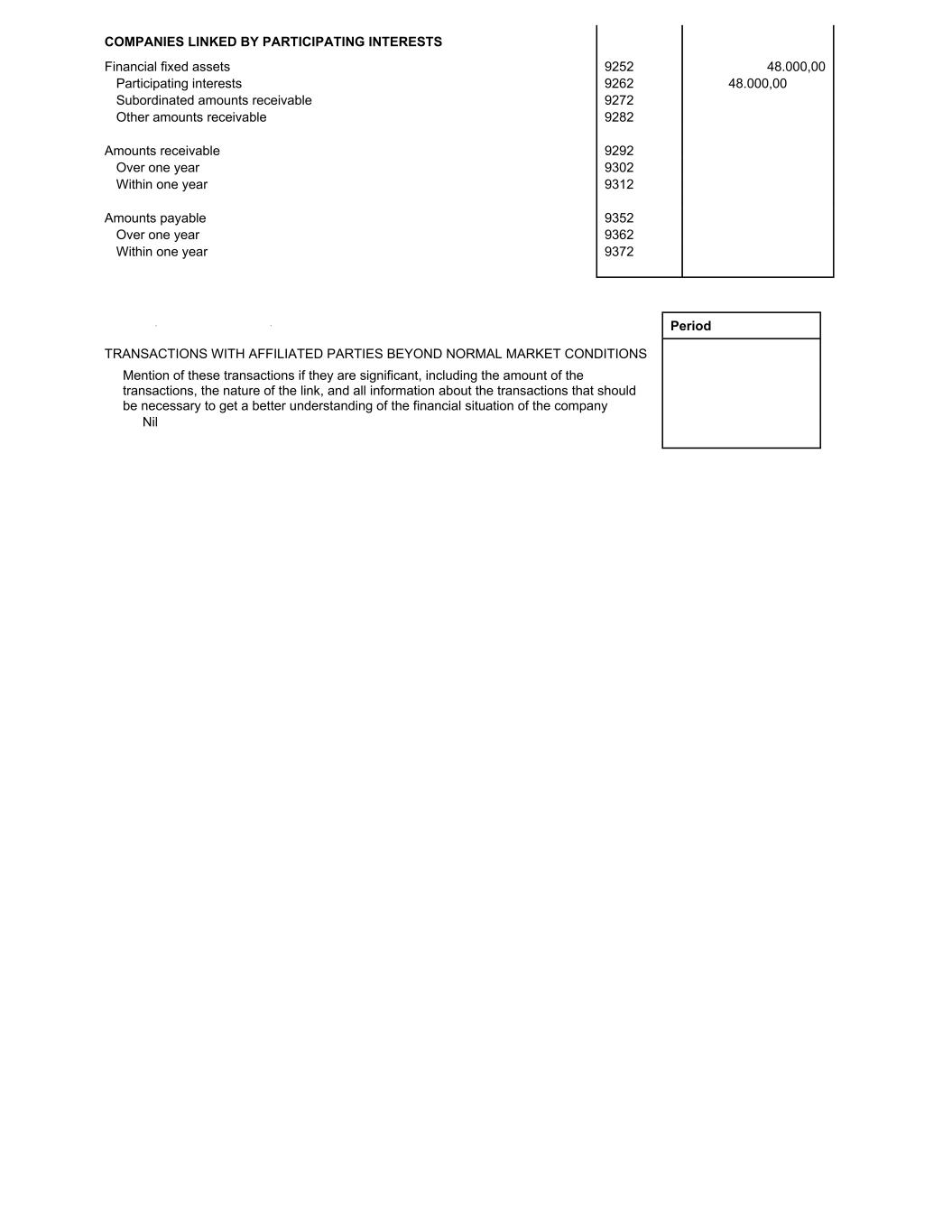

COMPANIES LINKED BY PARTICIPATING INTERESTS Financial fixed assets 9252 48.000,00 Participating interests 9262 48.000,00 Subordinated amounts receivable 9272 Other amounts receivable 9282 Amounts receivable 9292 Over one year 9302 Within one year 9312 Amounts payable 9352 Over one year 9362 Within one year 9372 Period TRANSACTIONS WITH AFFILIATED PARTIES BEYOND NORMAL MARKET CONDITIONS Mention of these transactions if they are significant, including the amount of the transactions, the nature of the link, and all information about the transactions that should be necessary to get a better understanding of the financial situation of the company Nil

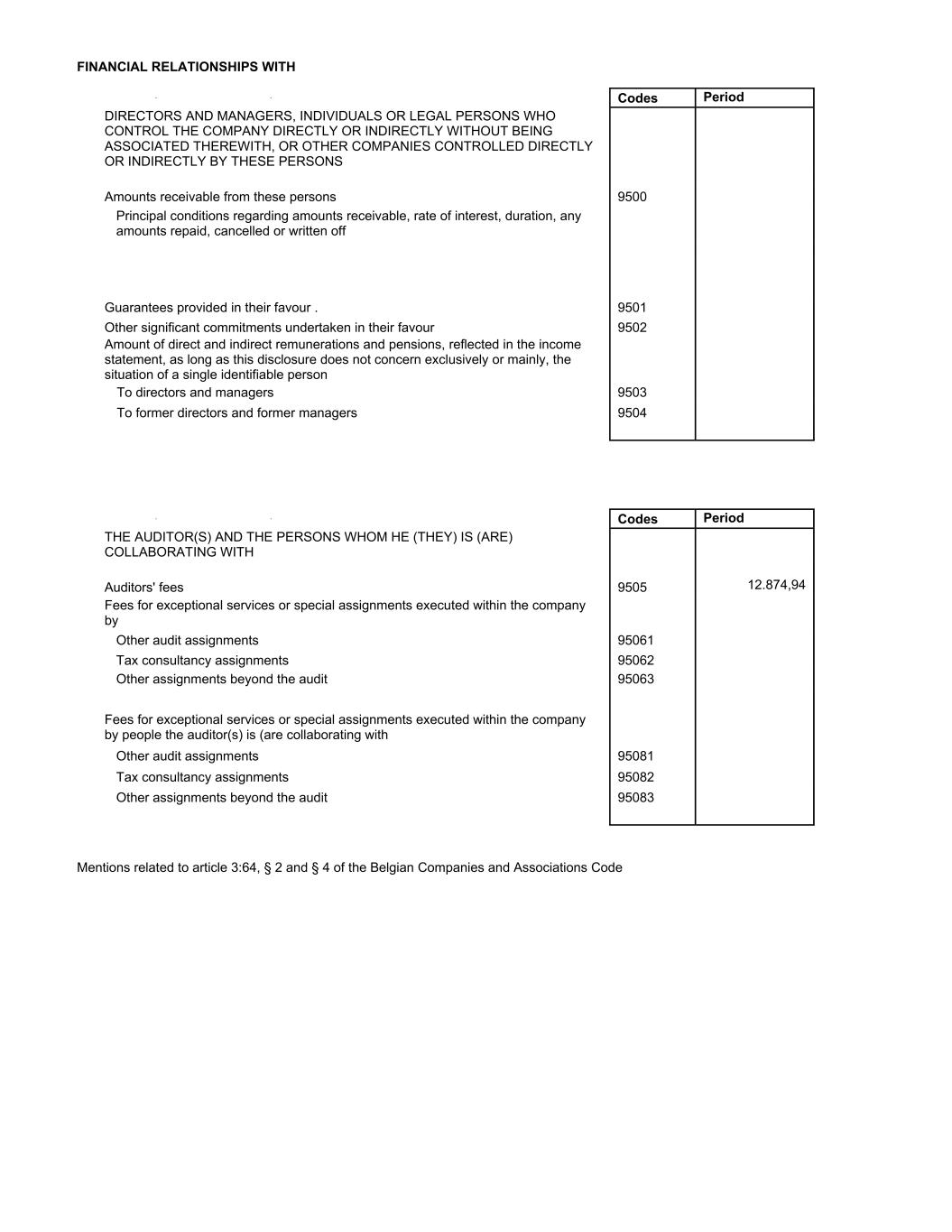

FINANCIAL RELATIONSHIPS WITH Codes Period DIRECTORS AND MANAGERS, INDIVIDUALS OR LEGAL PERSONS WHO CONTROL THE COMPANY DIRECTLY OR INDIRECTLY WITHOUT BEING ASSOCIATED THEREWITH, OR OTHER COMPANIES CONTROLLED DIRECTLY OR INDIRECTLY BY THESE PERSONS Amounts receivable from these persons 9500 Principal conditions regarding amounts receivable, rate of interest, duration, any amounts repaid, cancelled or written off Guarantees provided in their favour . 9501 Other significant commitments undertaken in their favour 9502 Amount of direct and indirect remunerations and pensions, reflected in the income statement, as long as this disclosure does not concern exclusively or mainly, the situation of a single identifiable person To directors and managers 9503 To former directors and former managers 9504 Codes Period THE AUDITOR(S) AND THE PERSONS WHOM HE (THEY) IS (ARE) COLLABORATING WITH Auditors' fees 9505 12.874,94 Fees for exceptional services or special assignments executed within the company by Other audit assignments 95061 Tax consultancy assignments 95062 Other assignments beyond the audit 95063 Fees for exceptional services or special assignments executed within the company by people the auditor(s) is (are collaborating with Other audit assignments 95081 Tax consultancy assignments 95082 Other assignments beyond the audit 95083 Mentions related to article 3:64, § 2 and § 4 of the Belgian Companies and Associations Code

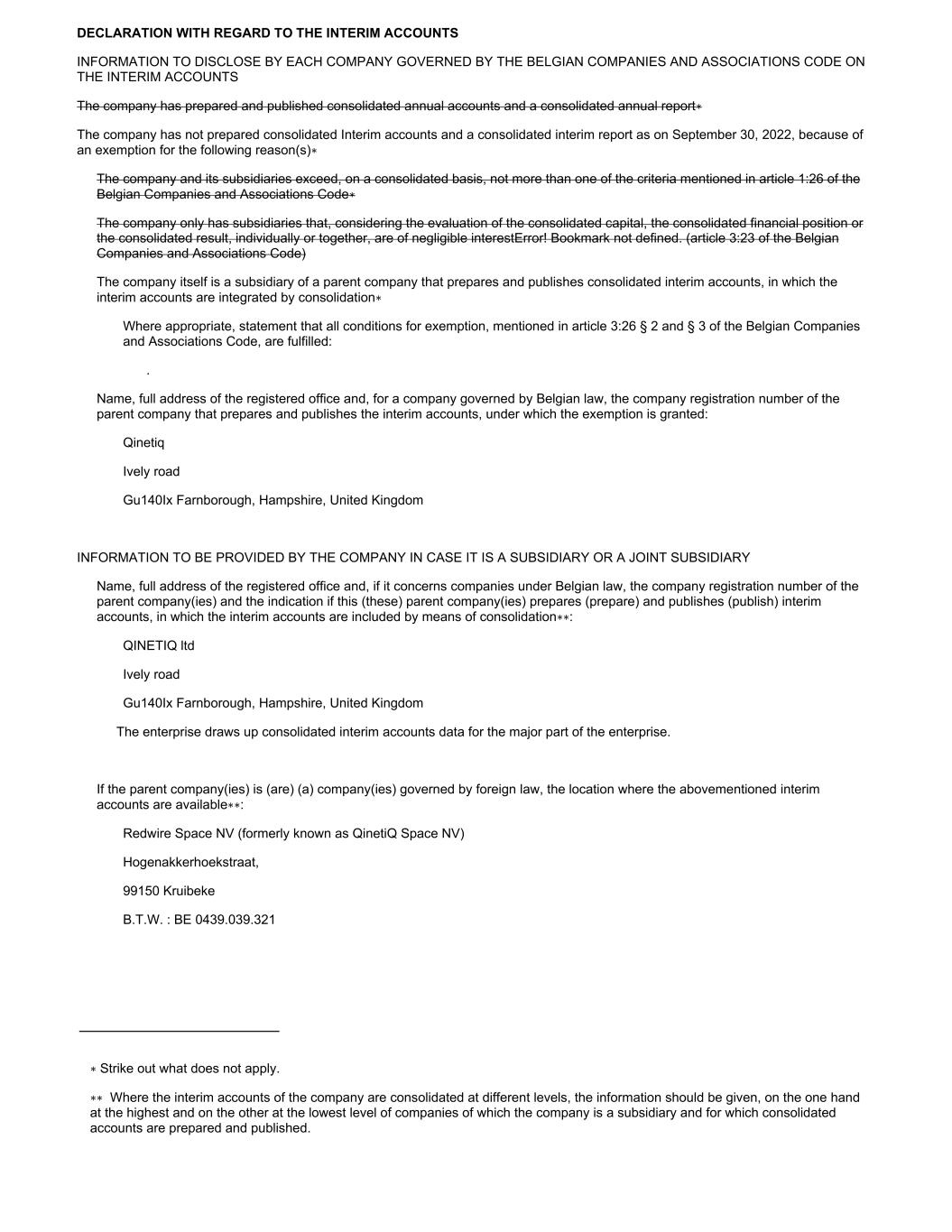

DECLARATION WITH REGARD TO THE INTERIM ACCOUNTS INFORMATION TO DISCLOSE BY EACH COMPANY GOVERNED BY THE BELGIAN COMPANIES AND ASSOCIATIONS CODE ON THE INTERIM ACCOUNTS The company has prepared and published consolidated annual accounts and a consolidated annual report∗ The company has not prepared consolidated Interim accounts and a consolidated interim report as on September 30, 2022, because of an exemption for the following reason(s)∗ The company and its subsidiaries exceed, on a consolidated basis, not more than one of the criteria mentioned in article 1:26 of the Belgian Companies and Associations Code∗ The company only has subsidiaries that, considering the evaluation of the consolidated capital, the consolidated financial position or the consolidated result, individually or together, are of negligible interestError! Bookmark not defined. (article 3:23 of the Belgian Companies and Associations Code) The company itself is a subsidiary of a parent company that prepares and publishes consolidated interim accounts, in which the interim accounts are integrated by consolidation∗ Where appropriate, statement that all conditions for exemption, mentioned in article 3:26 § 2 and § 3 of the Belgian Companies and Associations Code, are fulfilled: . Name, full address of the registered office and, for a company governed by Belgian law, the company registration number of the parent company that prepares and publishes the interim accounts, under which the exemption is granted: Qinetiq Ively road Gu140Ix Farnborough, Hampshire, United Kingdom INFORMATION TO BE PROVIDED BY THE COMPANY IN CASE IT IS A SUBSIDIARY OR A JOINT SUBSIDIARY Name, full address of the registered office and, if it concerns companies under Belgian law, the company registration number of the parent company(ies) and the indication if this (these) parent company(ies) prepares (prepare) and publishes (publish) interim accounts, in which the interim accounts are included by means of consolidation∗∗: QINETIQ ltd Ively road Gu140Ix Farnborough, Hampshire, United Kingdom The enterprise draws up consolidated interim accounts data for the major part of the enterprise. If the parent company(ies) is (are) (a) company(ies) governed by foreign law, the location where the abovementioned interim accounts are available∗∗: Redwire Space NV (formerly known as QinetiQ Space NV) Hogenakkerhoekstraat, 99150 Kruibeke B.T.W. : BE 0439.039.321 ∗ Strike out what does not apply. ∗∗ Where the interim accounts of the company are consolidated at different levels, the information should be given, on the one hand at the highest and on the other at the lowest level of companies of which the company is a subsidiary and for which consolidated accounts are prepared and published.

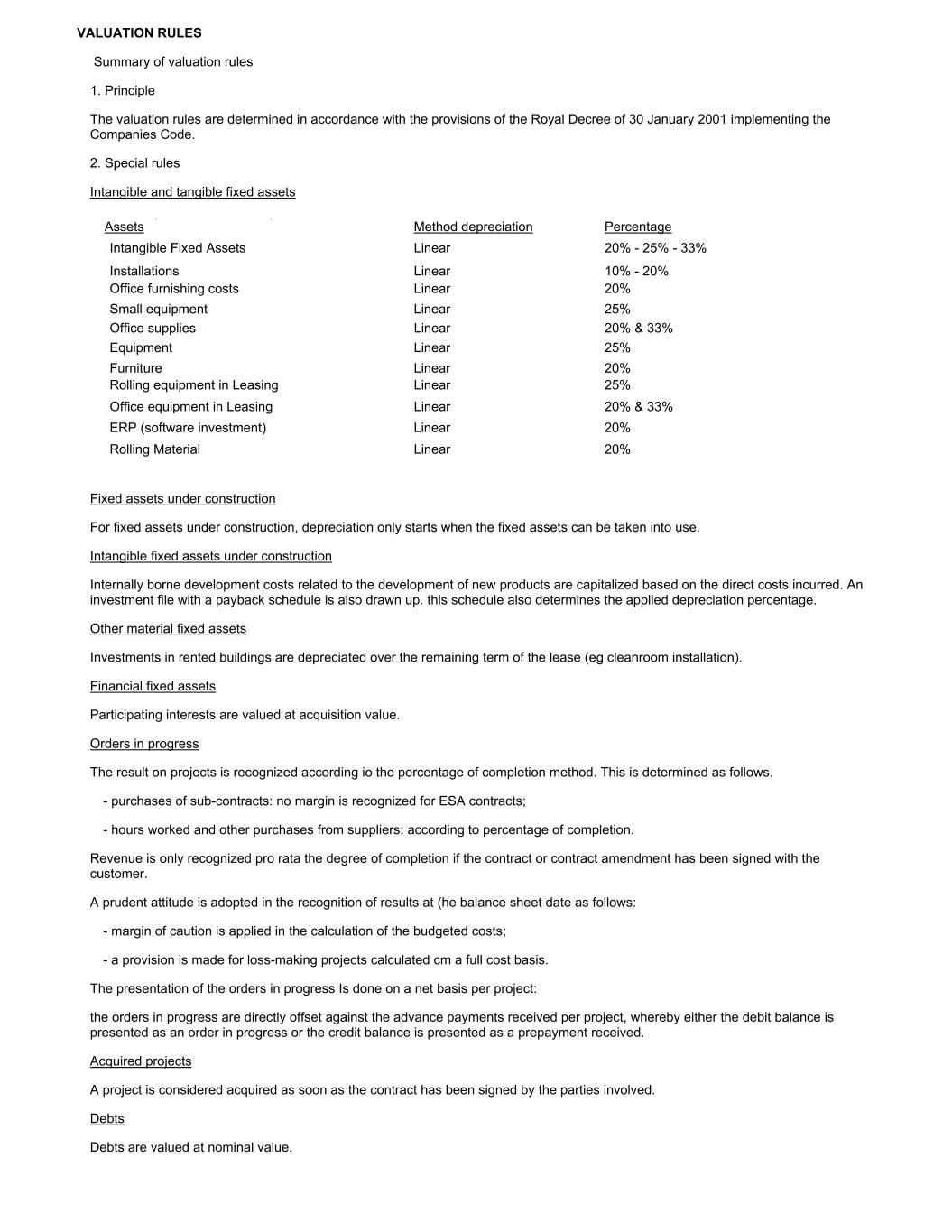

VALUATION RULES Summary of valuation rules 1. Principle The valuation rules are determined in accordance with the provisions of the Royal Decree of 30 January 2001 implementing the Companies Code. 2. Special rules Intangible and tangible fixed assets Assets Method depreciation Percentage Intangible Fixed Assets Linear 20% - 25% - 33% Installations Linear 10% - 20% Office furnishing costs Linear 20% Small equipment Linear 25% Office supplies Linear 20% & 33% Equipment Linear 25% Furniture Linear 20% Rolling equipment in Leasing Linear 25% Office equipment in Leasing Linear 20% & 33% ERP (software investment) Linear 20% Rolling Material Linear 20% Fixed assets under construction For fixed assets under construction, depreciation only starts when the fixed assets can be taken into use. Intangible fixed assets under construction Internally borne development costs related to the development of new products are capitalized based on the direct costs incurred. An investment file with a payback schedule is also drawn up. this schedule also determines the applied depreciation percentage. Other material fixed assets Investments in rented buildings are depreciated over the remaining term of the lease (eg cleanroom installation). Financial fixed assets Participating interests are valued at acquisition value. Orders in progress The result on projects is recognized according io the percentage of completion method. This is determined as follows. - purchases of sub-contracts: no margin is recognized for ESA contracts; - hours worked and other purchases from suppliers: according to percentage of completion. Revenue is only recognized pro rata the degree of completion if the contract or contract amendment has been signed with the customer. A prudent attitude is adopted in the recognition of results at (he balance sheet date as follows: - margin of caution is applied in the calculation of the budgeted costs; - a provision is made for loss-making projects calculated cm a full cost basis. The presentation of the orders in progress Is done on a net basis per project: the orders in progress are directly offset against the advance payments received per project, whereby either the debit balance is presented as an order in progress or the credit balance is presented as a prepayment received. Acquired projects A project is considered acquired as soon as the contract has been signed by the parties involved. Debts Debts are valued at nominal value.

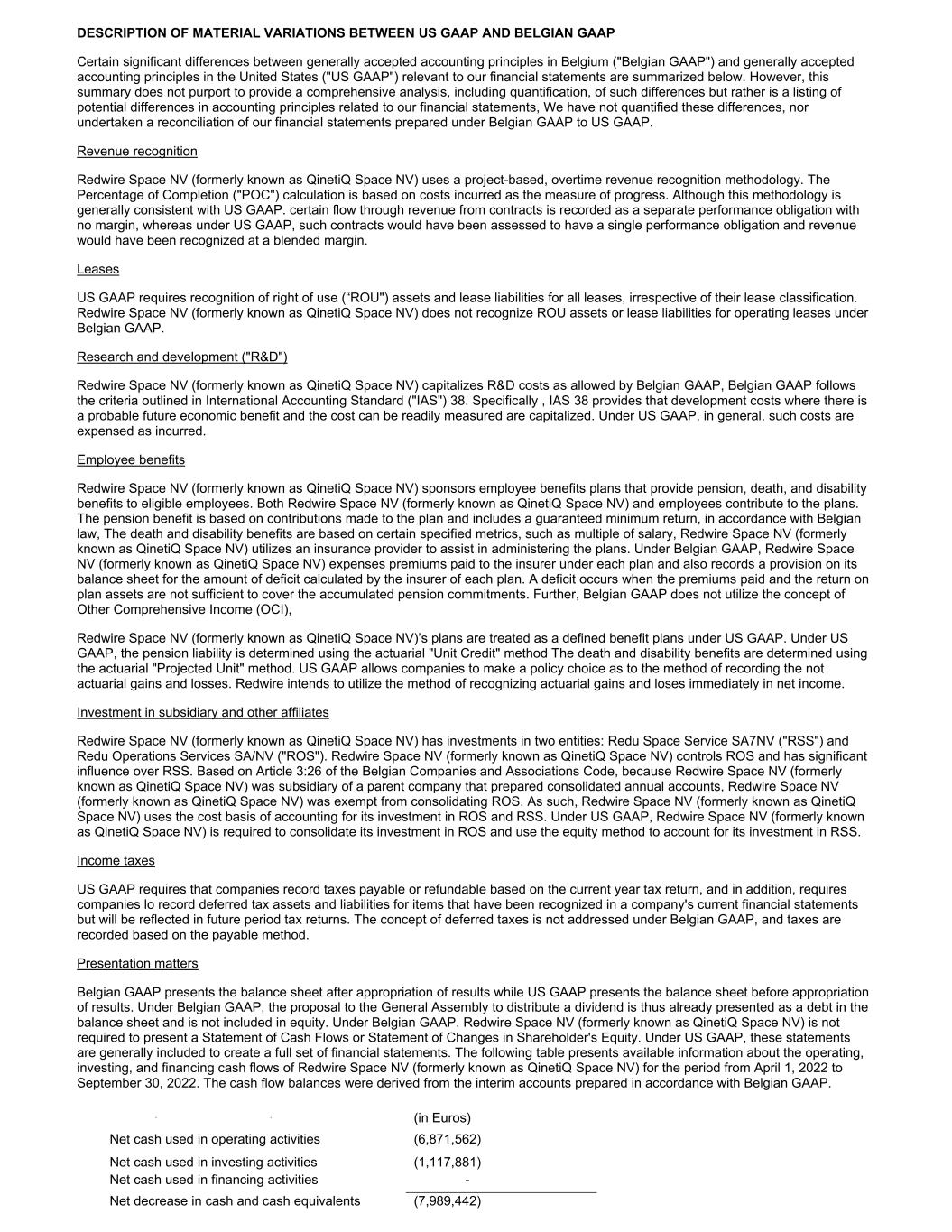

DESCRIPTION OF MATERIAL VARIATIONS BETWEEN US GAAP AND BELGIAN GAAP Certain significant differences between generally accepted accounting principles in Belgium ("Belgian GAAP") and generally accepted accounting principles in the United States ("US GAAP") relevant to our financial statements are summarized below. However, this summary does not purport to provide a comprehensive analysis, including quantification, of such differences but rather is a listing of potential differences in accounting principles related to our financial statements, We have not quantified these differences, nor undertaken a reconciliation of our financial statements prepared under Belgian GAAP to US GAAP. Revenue recognition Redwire Space NV (formerly known as QinetiQ Space NV) uses a project-based, overtime revenue recognition methodology. The Percentage of Completion ("POC") calculation is based on costs incurred as the measure of progress. Although this methodology is generally consistent with US GAAP. certain flow through revenue from contracts is recorded as a separate performance obligation with no margin, whereas under US GAAP, such contracts would have been assessed to have a single performance obligation and revenue would have been recognized at a blended margin. Leases US GAAP requires recognition of right of use (“ROU") assets and lease liabilities for all leases, irrespective of their lease classification. Redwire Space NV (formerly known as QinetiQ Space NV) does not recognize ROU assets or lease liabilities for operating leases under Belgian GAAP. Research and development ("R&D") Redwire Space NV (formerly known as QinetiQ Space NV) capitalizes R&D costs as allowed by Belgian GAAP, Belgian GAAP follows the criteria outlined in International Accounting Standard ("IAS") 38. Specifically , IAS 38 provides that development costs where there is a probable future economic benefit and the cost can be readily measured are capitalized. Under US GAAP, in general, such costs are expensed as incurred. Employee benefits Redwire Space NV (formerly known as QinetiQ Space NV) sponsors employee benefits plans that provide pension, death, and disability benefits to eligible employees. Both Redwire Space NV (formerly known as QinetiQ Space NV) and employees contribute to the plans. The pension benefit is based on contributions made to the plan and includes a guaranteed minimum return, in accordance with Belgian law, The death and disability benefits are based on certain specified metrics, such as multiple of salary, Redwire Space NV (formerly known as QinetiQ Space NV) utilizes an insurance provider to assist in administering the plans. Under Belgian GAAP, Redwire Space NV (formerly known as QinetiQ Space NV) expenses premiums paid to the insurer under each plan and also records a provision on its balance sheet for the amount of deficit calculated by the insurer of each plan. A deficit occurs when the premiums paid and the return on plan assets are not sufficient to cover the accumulated pension commitments. Further, Belgian GAAP does not utilize the concept of Other Comprehensive Income (OCI), Redwire Space NV (formerly known as QinetiQ Space NV)’s plans are treated as a defined benefit plans under US GAAP. Under US GAAP, the pension liability is determined using the actuarial "Unit Credit" method The death and disability benefits are determined using the actuarial "Projected Unit" method. US GAAP allows companies to make a policy choice as to the method of recording the not actuarial gains and losses. Redwire intends to utilize the method of recognizing actuarial gains and loses immediately in net income. Investment in subsidiary and other affiliates Redwire Space NV (formerly known as QinetiQ Space NV) has investments in two entities: Redu Space Service SA7NV ("RSS") and Redu Operations Services SA/NV ("ROS"). Redwire Space NV (formerly known as QinetiQ Space NV) controls ROS and has significant influence over RSS. Based on Article 3:26 of the Belgian Companies and Associations Code, because Redwire Space NV (formerly known as QinetiQ Space NV) was subsidiary of a parent company that prepared consolidated annual accounts, Redwire Space NV (formerly known as QinetiQ Space NV) was exempt from consolidating ROS. As such, Redwire Space NV (formerly known as QinetiQ Space NV) uses the cost basis of accounting for its investment in ROS and RSS. Under US GAAP, Redwire Space NV (formerly known as QinetiQ Space NV) is required to consolidate its investment in ROS and use the equity method to account for its investment in RSS. Income taxes US GAAP requires that companies record taxes payable or refundable based on the current year tax return, and in addition, requires companies lo record deferred tax assets and liabilities for items that have been recognized in a company's current financial statements but will be reflected in future period tax returns. The concept of deferred taxes is not addressed under Belgian GAAP, and taxes are recorded based on the payable method. Presentation matters Belgian GAAP presents the balance sheet after appropriation of results while US GAAP presents the balance sheet before appropriation of results. Under Belgian GAAP, the proposal to the General Assembly to distribute a dividend is thus already presented as a debt in the balance sheet and is not included in equity. Under Belgian GAAP. Redwire Space NV (formerly known as QinetiQ Space NV) is not required to present a Statement of Cash Flows or Statement of Changes in Shareholder's Equity. Under US GAAP, these statements are generally included to create a full set of financial statements. The following table presents available information about the operating, investing, and financing cash flows of Redwire Space NV (formerly known as QinetiQ Space NV) for the period from April 1, 2022 to September 30, 2022. The cash flow balances were derived from the interim accounts prepared in accordance with Belgian GAAP. (in Euros) Net cash used in operating activities (6,871,562) Net cash used in investing activities (1,117,881) Net cash used in financing activities - Net decrease in cash and cash equivalents (7,989,442)