00018198102022FYfalsehttp://fasb.org/us-gaap/2022#PropertyPlantAndEquipmentNet372http://fasb.org/us-gaap/2022#OtherNonoperatingIncomeExpensehttp://fasb.org/us-gaap/2022#OtherNonoperatingIncomeExpensehttp://fasb.org/us-gaap/2022#OtherNonoperatingIncomeExpensehttp://fasb.org/us-gaap/2022#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2022#PropertyPlantAndEquipmentNetP10D00018198102022-01-012022-12-310001819810us-gaap:CommonStockMember2022-01-012022-12-310001819810us-gaap:WarrantMember2022-01-012022-12-3100018198102022-06-30iso4217:USD00018198102023-03-28xbrli:shares00018198102022-12-3100018198102021-12-31iso4217:USDxbrli:shares00018198102021-01-012021-12-310001819810us-gaap:CommonStockMember2020-12-310001819810us-gaap:AdditionalPaidInCapitalMember2020-12-310001819810us-gaap:RetainedEarningsMember2020-12-310001819810us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-3100018198102020-12-310001819810us-gaap:CommonStockMember2021-01-012021-12-310001819810us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001819810us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001819810us-gaap:RetainedEarningsMember2021-01-012021-12-310001819810us-gaap:CommonStockMember2021-12-310001819810us-gaap:AdditionalPaidInCapitalMember2021-12-310001819810us-gaap:RetainedEarningsMember2021-12-310001819810us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001819810rdw:CosmosIntermediateLLCMember2021-09-010001819810rdw:GenesisParkAcquisitionCorpMemberrdw:CosmosIntermediateLLCMember2021-09-010001819810us-gaap:TreasuryStockCommonMember2021-12-310001819810us-gaap:ParentMember2021-12-310001819810us-gaap:NoncontrollingInterestMember2021-12-310001819810us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001819810us-gaap:ParentMember2022-01-012022-12-310001819810us-gaap:CommonStockMember2022-01-012022-12-310001819810us-gaap:TreasuryStockCommonMember2022-01-012022-12-310001819810us-gaap:NoncontrollingInterestMember2022-01-012022-12-310001819810us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001819810us-gaap:RetainedEarningsMember2022-01-012022-12-310001819810us-gaap:CommonStockMember2022-12-310001819810us-gaap:TreasuryStockCommonMember2022-12-310001819810us-gaap:AdditionalPaidInCapitalMember2022-12-310001819810us-gaap:RetainedEarningsMember2022-12-310001819810us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001819810us-gaap:ParentMember2022-12-310001819810us-gaap:NoncontrollingInterestMember2022-12-310001819810rdw:CosmosParentLLCMemberrdw:CosmosIntermediateLLCMember2022-01-012022-12-31xbrli:pure0001819810rdw:CosmosIntermediateLLCMemberrdw:CosmosFinanceLLCMember2022-01-012022-12-310001819810rdw:CosmosAcquisitionLLCMemberrdw:CosmosFinanceLLCMember2022-01-012022-12-3100018198102020-04-012022-12-31rdw:acquisitionrdw:company00018198102021-09-022021-09-020001819810rdw:SiliconValleyBankLoanAgreementMemberus-gaap:NotesPayableToBanksMember2021-09-022021-09-0200018198102021-09-012021-09-0100018198102021-09-010001819810rdw:CosmosIntermediateLLCMember2021-09-022021-09-020001819810rdw:CosmosIntermediateLLCMember2021-09-022021-09-020001819810rdw:CosmosIntermediateLLCMember2021-09-020001819810rdw:GenesisParkAcquisitionCorpMember2021-09-020001819810us-gaap:PrivatePlacementMember2021-09-022021-09-0200018198102021-09-020001819810us-gaap:PrivatePlacementMember2022-04-140001819810us-gaap:ConvertiblePreferredStockMember2022-10-280001819810rdw:AEIAndBainInvestmentAgreementsMemberus-gaap:ConvertiblePreferredStockMember2022-10-282022-10-280001819810us-gaap:ConvertiblePreferredStockMemberrdw:TowerViewLLCMember2022-11-072022-11-080001819810us-gaap:ConvertiblePreferredStockMember2022-11-072022-11-08rdw:segment0001819810us-gaap:ComputerEquipmentMember2022-01-012022-12-310001819810us-gaap:FurnitureAndFixturesMember2022-01-012022-12-310001819810us-gaap:EquipmentMembersrt:MinimumMember2022-01-012022-12-310001819810srt:MaximumMemberus-gaap:EquipmentMember2022-01-012022-12-310001819810us-gaap:LeaseholdImprovementsMember2022-01-012022-12-31rdw:reportingUnit00018198102022-01-010001819810rdw:OakmanAerospaceIncMember2021-01-150001819810rdw:OakmanAerospaceIncMember2021-01-152021-01-150001819810us-gaap:TrademarksMemberrdw:OakmanAerospaceIncMember2021-01-150001819810us-gaap:TrademarksMemberrdw:OakmanAerospaceIncMember2021-01-152021-01-150001819810rdw:OakmanAerospaceIncMemberus-gaap:DevelopedTechnologyRightsMember2021-01-150001819810rdw:OakmanAerospaceIncMemberus-gaap:DevelopedTechnologyRightsMember2021-01-152021-01-150001819810us-gaap:CustomerRelatedIntangibleAssetsMemberrdw:OakmanAerospaceIncMember2021-01-150001819810us-gaap:CustomerRelatedIntangibleAssetsMemberrdw:OakmanAerospaceIncMember2021-01-152021-01-150001819810rdw:OakmanAerospaceIncMember2021-01-012021-12-310001819810rdw:DeployableSpaceSystemsIncMember2021-02-170001819810rdw:DeployableSpaceSystemsIncMember2021-02-172021-02-170001819810us-gaap:TrademarksMemberrdw:DeployableSpaceSystemsIncMember2021-02-170001819810us-gaap:TrademarksMemberrdw:DeployableSpaceSystemsIncMember2021-02-172021-02-170001819810us-gaap:DevelopedTechnologyRightsMemberrdw:DeployableSpaceSystemsIncMember2021-02-170001819810us-gaap:DevelopedTechnologyRightsMemberrdw:DeployableSpaceSystemsIncMember2021-02-172021-02-170001819810us-gaap:CustomerRelatedIntangibleAssetsMemberrdw:DeployableSpaceSystemsIncMember2021-02-170001819810us-gaap:CustomerRelatedIntangibleAssetsMemberrdw:DeployableSpaceSystemsIncMember2021-02-172021-02-170001819810rdw:DeployableSpaceSystemsIncMember2021-01-012021-12-310001819810rdw:DeployableSpaceSystemsIncMember2021-12-310001819810rdw:TechshotIncMember2021-11-010001819810rdw:TechshotIncMember2021-11-012021-11-010001819810rdw:TechshotIncMemberus-gaap:TrademarksMember2021-11-010001819810rdw:TechshotIncMemberus-gaap:TrademarksMember2021-11-012021-11-010001819810rdw:TechshotIncMemberus-gaap:DevelopedTechnologyRightsMember2021-11-010001819810rdw:TechshotIncMemberus-gaap:DevelopedTechnologyRightsMember2021-11-012021-11-010001819810rdw:TechshotIncMemberus-gaap:CustomerRelatedIntangibleAssetsMember2021-11-010001819810rdw:TechshotIncMemberus-gaap:CustomerRelatedIntangibleAssetsMember2021-11-012021-11-010001819810rdw:TechshotIncMemberus-gaap:InProcessResearchAndDevelopmentMember2021-11-010001819810rdw:TechshotIncMember2021-01-012021-12-310001819810rdw:QinetiqSpaceNVMember2022-10-310001819810rdw:QinetiqSpaceNVMember2022-10-312022-10-31iso4217:EUR0001819810us-gaap:DevelopedTechnologyRightsMemberrdw:QinetiqSpaceNVMember2022-10-310001819810us-gaap:DevelopedTechnologyRightsMemberrdw:QinetiqSpaceNVMember2022-10-312022-10-310001819810us-gaap:CustomerRelatedIntangibleAssetsMemberrdw:QinetiqSpaceNVMember2022-10-310001819810us-gaap:CustomerRelatedIntangibleAssetsMemberrdw:QinetiqSpaceNVMember2022-10-312022-10-310001819810us-gaap:SoftwareDevelopmentMember2022-10-310001819810us-gaap:SoftwareDevelopmentMember2022-10-312022-10-310001819810us-gaap:InProcessResearchAndDevelopmentMemberrdw:QinetiqSpaceNVMember2022-10-310001819810rdw:QinetiqSpaceNVMember2022-01-012022-12-310001819810rdw:BusinessCombinations2021Member2022-01-012022-12-310001819810rdw:BusinessCombinations2021Member2021-01-012021-12-310001819810rdw:PurchaseAgreementEarnoutScenarioOneMemberrdw:RoccorLLCMember2021-12-310001819810srt:MaximumMemberrdw:PurchaseAgreementEarnoutScenarioOneMemberrdw:RoccorLLCMember2021-12-310001819810rdw:PurchaseAgreementEarnoutScenarioTwoMemberrdw:RoccorLLCMember2021-12-310001819810srt:MinimumMemberrdw:PurchaseAgreementEarnoutScenarioTwoMemberrdw:RoccorLLCMember2021-12-310001819810srt:MaximumMemberrdw:PurchaseAgreementEarnoutScenarioTwoMemberrdw:RoccorLLCMember2021-12-310001819810rdw:PurchaseAgreementEarnoutScenarioThreeMemberrdw:RoccorLLCMember2021-12-310001819810rdw:PurchaseAgreementEarnoutScenarioThreeMembersrt:MinimumMemberrdw:RoccorLLCMember2021-12-310001819810us-gaap:MeasurementInputRiskFreeInterestRateMemberrdw:RoccorLLCMember2020-10-280001819810rdw:RoccorLLCMemberus-gaap:MeasurementInputDiscountRateMember2020-10-280001819810us-gaap:MeasurementInputPriceVolatilityMemberrdw:RoccorLLCMember2020-10-280001819810rdw:RoccorLLCMemberrdw:MeasurementInputEarnoutPaymentDiscountRateMember2020-10-280001819810us-gaap:PrivatePlacementMember2022-06-300001819810us-gaap:PrivatePlacementMember2020-04-012022-06-300001819810us-gaap:PrivatePlacementMember2022-01-012022-12-310001819810srt:MinimumMemberus-gaap:PrivatePlacementMember2022-12-310001819810srt:MaximumMemberus-gaap:PrivatePlacementMember2022-12-310001819810us-gaap:PrivatePlacementMember2022-12-310001819810rdw:PrivateWarrantsMember2022-12-310001819810rdw:PrivateWarrantsMember2021-12-310001819810rdw:PrivateWarrantsMember2022-01-012022-12-310001819810rdw:PrivateWarrantsMember2021-01-012021-12-310001819810us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PrivatePlacementMember2022-12-310001819810us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PrivatePlacementMemberus-gaap:FairValueInputsLevel2Member2022-12-310001819810us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:PrivatePlacementMember2022-12-310001819810us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PrivatePlacementMember2022-12-310001819810us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-12-310001819810us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310001819810us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2022-12-310001819810us-gaap:FairValueMeasurementsRecurringMember2022-12-310001819810us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2021-12-310001819810us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2021-12-310001819810us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2021-12-310001819810us-gaap:FairValueMeasurementsRecurringMember2021-12-310001819810us-gaap:PrivatePlacementMember2020-12-310001819810us-gaap:PrivatePlacementMember2021-01-012021-12-310001819810us-gaap:PrivatePlacementMember2021-12-310001819810rdw:ContingentConsiderationLiabilitiesMember2020-12-310001819810rdw:PrivateWarrantsMember2020-12-310001819810rdw:ContingentConsiderationLiabilitiesMember2021-01-012021-12-310001819810rdw:ContingentConsiderationLiabilitiesMember2021-12-310001819810rdw:ContingentConsiderationLiabilitiesMember2022-01-012022-12-310001819810rdw:ContingentConsiderationLiabilitiesMember2022-12-310001819810country:USus-gaap:ComputerEquipmentMember2022-12-310001819810srt:EuropeMemberus-gaap:ComputerEquipmentMember2022-12-310001819810us-gaap:ComputerEquipmentMember2022-12-310001819810country:USus-gaap:ComputerEquipmentMember2021-12-310001819810srt:EuropeMemberus-gaap:ComputerEquipmentMember2021-12-310001819810us-gaap:ComputerEquipmentMember2021-12-310001819810us-gaap:FurnitureAndFixturesMembercountry:US2022-12-310001819810us-gaap:FurnitureAndFixturesMembersrt:EuropeMember2022-12-310001819810us-gaap:FurnitureAndFixturesMember2022-12-310001819810us-gaap:FurnitureAndFixturesMembercountry:US2021-12-310001819810us-gaap:FurnitureAndFixturesMembersrt:EuropeMember2021-12-310001819810us-gaap:FurnitureAndFixturesMember2021-12-310001819810us-gaap:EquipmentMembercountry:US2022-12-310001819810us-gaap:EquipmentMembersrt:EuropeMember2022-12-310001819810us-gaap:EquipmentMember2022-12-310001819810us-gaap:EquipmentMembercountry:US2021-12-310001819810us-gaap:EquipmentMembersrt:EuropeMember2021-12-310001819810us-gaap:EquipmentMember2021-12-310001819810country:USus-gaap:LeaseholdImprovementsMember2022-12-310001819810us-gaap:LeaseholdImprovementsMembersrt:EuropeMember2022-12-310001819810us-gaap:LeaseholdImprovementsMember2022-12-310001819810country:USus-gaap:LeaseholdImprovementsMember2021-12-310001819810us-gaap:LeaseholdImprovementsMembersrt:EuropeMember2021-12-310001819810us-gaap:LeaseholdImprovementsMember2021-12-310001819810rdw:FinanceLeaseRightOfUseAssetsMembercountry:US2022-12-310001819810rdw:FinanceLeaseRightOfUseAssetsMembersrt:EuropeMember2022-12-310001819810rdw:FinanceLeaseRightOfUseAssetsMember2022-12-310001819810rdw:FinanceLeaseRightOfUseAssetsMembercountry:US2021-12-310001819810rdw:FinanceLeaseRightOfUseAssetsMembersrt:EuropeMember2021-12-310001819810rdw:FinanceLeaseRightOfUseAssetsMember2021-12-310001819810country:USus-gaap:ConstructionInProgressMember2022-12-310001819810srt:EuropeMemberus-gaap:ConstructionInProgressMember2022-12-310001819810us-gaap:ConstructionInProgressMember2022-12-310001819810country:USus-gaap:ConstructionInProgressMember2021-12-310001819810srt:EuropeMemberus-gaap:ConstructionInProgressMember2021-12-310001819810us-gaap:ConstructionInProgressMember2021-12-310001819810country:US2022-12-310001819810srt:EuropeMember2022-12-310001819810country:US2021-12-310001819810srt:EuropeMember2021-12-310001819810us-gaap:CustomerRelationshipsMember2022-12-310001819810us-gaap:CustomerRelationshipsMember2022-01-012022-12-310001819810us-gaap:TechnologyBasedIntangibleAssetsMember2022-12-310001819810us-gaap:TechnologyBasedIntangibleAssetsMember2022-01-012022-12-310001819810us-gaap:TrademarksMember2022-12-310001819810us-gaap:TrademarksMember2022-01-012022-12-310001819810us-gaap:SoftwareDevelopmentMember2022-12-310001819810us-gaap:SoftwareDevelopmentMember2022-01-012022-12-310001819810us-gaap:TradeNamesMember2022-12-310001819810us-gaap:InProcessResearchAndDevelopmentMember2022-12-310001819810us-gaap:CustomerRelationshipsMember2021-12-310001819810us-gaap:CustomerRelationshipsMember2021-01-012021-12-310001819810us-gaap:TechnologyBasedIntangibleAssetsMember2021-12-310001819810us-gaap:TechnologyBasedIntangibleAssetsMember2021-01-012021-12-310001819810us-gaap:TrademarksMember2021-12-310001819810us-gaap:TrademarksMember2021-01-012021-12-310001819810us-gaap:SoftwareDevelopmentMember2021-12-310001819810us-gaap:SoftwareDevelopmentMember2021-01-012021-12-310001819810us-gaap:TradeNamesMember2021-12-310001819810us-gaap:InProcessResearchAndDevelopmentMember2021-12-310001819810rdw:DeepSpaceSystemsIncMember2021-01-012021-12-310001819810rdw:InSpaceGroupIncAndSubsidiariesMember2021-01-012021-12-310001819810rdw:RoccorLLCMember2021-01-012021-12-310001819810rdw:LoadPathLLCMember2021-01-012021-12-310001819810rdw:AdamsStreetCapitalAgreementMemberus-gaap:MediumTermNotesMember2022-12-310001819810rdw:AdamsStreetCapitalAgreementMemberus-gaap:MediumTermNotesMember2021-12-310001819810us-gaap:RevolvingCreditFacilityMemberrdw:AdamsStreetCapitalAgreementMemberus-gaap:LineOfCreditMember2022-12-310001819810us-gaap:RevolvingCreditFacilityMemberrdw:AdamsStreetCapitalAgreementMemberus-gaap:LineOfCreditMember2021-12-310001819810rdw:AdamsStreetCapitalAgreementDelayedDrawTermLoanMemberus-gaap:MediumTermNotesMember2022-12-310001819810rdw:AdamsStreetCapitalAgreementDelayedDrawTermLoanMemberus-gaap:MediumTermNotesMember2021-12-310001819810rdw:AdamsStreetCapitalAgreementIncrementalTermLoanMemberus-gaap:MediumTermNotesMember2022-12-310001819810rdw:AdamsStreetCapitalAgreementIncrementalTermLoanMemberus-gaap:MediumTermNotesMember2021-12-310001819810rdw:DOFinancingLoanMemberus-gaap:NotesPayableToBanksMember2022-12-310001819810rdw:DOFinancingLoanMemberus-gaap:NotesPayableToBanksMember2021-12-310001819810rdw:AdamsStreetCapitalAgreementMemberus-gaap:MediumTermNotesMember2020-10-280001819810us-gaap:RevolvingCreditFacilityMemberrdw:AdamsStreetCapitalAgreementMemberus-gaap:LineOfCreditMember2020-10-280001819810rdw:AdamsStreetCapitalAgreementDelayedDrawTermLoanMemberus-gaap:MediumTermNotesMember2020-10-280001819810rdw:AdamsStreetCapitalAgreementMemberus-gaap:MediumTermNotesMember2021-01-152021-01-150001819810rdw:AdamsStreetCapitalAgreementMemberus-gaap:MediumTermNotesMember2021-02-170001819810rdw:AdamsStreetCapitalAgreementMemberus-gaap:LineOfCreditMember2021-12-310001819810rdw:AdamsStreetCapitalAgreementMemberus-gaap:LineOfCreditMember2022-12-310001819810rdw:AdamsStreetCapitalAgreementMemberus-gaap:MediumTermNotesMember2021-09-020001819810us-gaap:RevolvingCreditFacilityMemberrdw:AdamsStreetCapitalAgreementMemberus-gaap:LineOfCreditMember2022-03-250001819810us-gaap:RevolvingCreditFacilityMemberrdw:AdamsStreetCapitalAgreementMemberrdw:FirstCovenantMemberus-gaap:LineOfCreditMember2022-03-250001819810rdw:EurocurrencyRateMemberus-gaap:RevolvingCreditFacilityMemberrdw:AdamsStreetCapitalAgreementMemberrdw:FirstCovenantMemberus-gaap:LineOfCreditMember2022-03-252022-03-250001819810us-gaap:RevolvingCreditFacilityMemberrdw:AdamsStreetCapitalAgreementMemberrdw:FirstCovenantMemberus-gaap:BaseRateMemberus-gaap:LineOfCreditMember2022-03-252022-03-250001819810us-gaap:RevolvingCreditFacilityMemberrdw:AdamsStreetCapitalAgreementMemberrdw:SecondCovenantMemberus-gaap:LineOfCreditMember2022-03-250001819810rdw:EurocurrencyRateMemberus-gaap:RevolvingCreditFacilityMemberrdw:AdamsStreetCapitalAgreementMemberrdw:SecondCovenantMemberus-gaap:LineOfCreditMember2022-03-252022-03-250001819810us-gaap:RevolvingCreditFacilityMemberrdw:AdamsStreetCapitalAgreementMemberrdw:SecondCovenantMemberus-gaap:BaseRateMemberus-gaap:LineOfCreditMember2022-03-252022-03-250001819810srt:MaximumMemberus-gaap:RevolvingCreditFacilityMemberrdw:AdamsStreetCapitalAgreementMemberus-gaap:LineOfCreditMember2022-03-250001819810us-gaap:RevolvingCreditFacilityMemberrdw:AdamsStreetCapitalAgreementMemberus-gaap:LineOfCreditMember2022-03-252022-03-250001819810rdw:AdamsStreetCapitalAgreementMemberus-gaap:MediumTermNotesMember2022-08-080001819810rdw:AdamsStreetCapitalAgreementMemberus-gaap:MediumTermNotesMember2022-08-082022-08-080001819810rdw:AdamsStreetCapitalAgreementMemberus-gaap:MediumTermNotesMember2022-01-012022-12-310001819810rdw:Scenario1Memberrdw:AdamsStreetCapitalAgreementMemberus-gaap:MediumTermNotesMember2022-10-280001819810rdw:AdamsStreetCapitalAgreementMemberus-gaap:MediumTermNotesMemberrdw:Scenario2Member2022-10-280001819810rdw:SiliconValleyBankLoanAgreementMemberus-gaap:NotesPayableToBanksMember2020-08-310001819810rdw:SiliconValleyBankLoanAgreementMemberus-gaap:NotesPayableToBanksMember2020-10-280001819810rdw:PaycheckProtectionProgramCARESActMember2020-05-0100018198102021-06-182021-06-180001819810us-gaap:NotesPayableOtherPayablesMember2021-01-012021-12-310001819810rdw:PaycheckProtectionProgramCARESActMember2021-01-012021-12-310001819810rdw:DOFinancingLoanMemberus-gaap:NotesPayableToBanksMember2021-09-030001819810rdw:DOFinancingLoanMemberus-gaap:NotesPayableToBanksMember2022-09-030001819810srt:MinimumMember2022-12-310001819810srt:MaximumMember2022-12-31rdw:lease0001819810rdw:PublicWarrantsMember2022-12-310001819810rdw:PublicWarrantsMember2022-01-012022-12-310001819810rdw:PublicWarrantsMember2021-12-310001819810us-gaap:DomesticCountryMember2022-12-310001819810us-gaap:StateAndLocalJurisdictionMember2022-12-310001819810us-gaap:ForeignCountryMember2022-12-310001819810us-gaap:ConvertiblePreferredStockMemberrdw:AEIInvestmentAgreementMember2022-10-282022-10-280001819810us-gaap:ConvertiblePreferredStockMemberrdw:BainInvestmentAgreementMember2022-10-282022-10-280001819810rdw:BainInvestmentAgreementMember2022-11-032022-11-030001819810us-gaap:ConvertiblePreferredStockMember2022-11-030001819810us-gaap:ConvertiblePreferredStockMemberrdw:BainInvestmentAgreementMember2022-11-030001819810us-gaap:ConvertiblePreferredStockMemberrdw:AEIInvestmentAgreementMember2022-11-030001819810us-gaap:ConvertiblePreferredStockMemberrdw:BainInvestmentAgreementMember2022-10-280001819810rdw:AEIAndBainInvestmentAgreementsMemberus-gaap:ConvertiblePreferredStockMember2022-10-2800018198102022-10-280001819810us-gaap:PrivatePlacementMember2022-04-142022-04-140001819810us-gaap:PrivatePlacementMember2022-04-22rdw:vote0001819810rdw:CivilSpaceMember2022-01-012022-12-310001819810rdw:CivilSpaceMember2021-01-012021-12-310001819810rdw:NationalSecurityMember2022-01-012022-12-310001819810rdw:NationalSecurityMember2021-01-012021-12-310001819810rdw:CommercialAndOtherMember2022-01-012022-12-310001819810rdw:CommercialAndOtherMember2021-01-012021-12-310001819810us-gaap:ContractsAccountedForUnderPercentageOfCompletionMember2022-01-012022-12-310001819810us-gaap:ContractsAccountedForUnderPercentageOfCompletionMember2021-01-012021-12-3100018198102023-01-012022-12-310001819810country:US2022-01-012022-12-310001819810country:US2021-01-012021-12-310001819810country:NL2022-01-012022-12-310001819810country:NL2021-01-012021-12-310001819810country:LU2022-01-012022-12-310001819810country:LU2021-01-012021-12-310001819810country:GB2022-01-012022-12-310001819810country:GB2021-01-012021-12-310001819810country:IT2022-01-012022-12-310001819810country:IT2021-01-012021-12-310001819810country:DE2022-01-012022-12-310001819810country:DE2021-01-012021-12-310001819810country:ES2022-01-012022-12-310001819810country:ES2021-01-012021-12-310001819810country:KR2022-01-012022-12-310001819810country:KR2021-01-012021-12-310001819810country:PL2022-01-012022-12-310001819810country:PL2021-01-012021-12-310001819810rdw:OtherGeographicalAreasMember2022-01-012022-12-310001819810rdw:OtherGeographicalAreasMember2021-01-012021-12-310001819810us-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMemberrdw:CustomerAMember2022-01-012022-12-310001819810us-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMemberrdw:CustomerAMember2021-01-012021-12-310001819810us-gaap:CustomerConcentrationRiskMemberrdw:CustomerBMemberus-gaap:RevenueFromContractWithCustomerMember2022-01-012022-12-310001819810us-gaap:CustomerConcentrationRiskMemberrdw:CustomerBMemberus-gaap:RevenueFromContractWithCustomerMember2021-01-012021-12-310001819810us-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMemberrdw:CustomerCMember2022-01-012022-12-310001819810us-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMemberrdw:CustomerCMember2021-01-012021-12-310001819810us-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2022-01-012022-12-310001819810us-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2021-01-012021-12-31rdw:plan0001819810rdw:Techshot401kMember2021-01-012021-12-310001819810rdw:Roccor401kMember2021-01-012021-12-310001819810rdw:LoadPath401kMember2021-01-012021-12-310001819810rdw:Oakman401kMember2021-01-012021-12-310001819810rdw:DPSS401kMember2021-01-012021-12-3100018198102020-02-102020-12-310001819810us-gaap:PensionPlansDefinedBenefitMember2022-12-310001819810us-gaap:OtherPensionPlansDefinedBenefitMember2022-12-310001819810us-gaap:PensionPlansDefinedBenefitMember2022-10-310001819810us-gaap:OtherPensionPlansDefinedBenefitMember2022-10-310001819810us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001819810us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:OtherPensionPlansDefinedBenefitMember2022-12-310001819810us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:PensionPlansDefinedBenefitMember2022-10-310001819810us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:OtherPensionPlansDefinedBenefitMember2022-10-310001819810us-gaap:PensionPlansDefinedBenefitMember2022-11-012022-12-310001819810us-gaap:OtherPensionPlansDefinedBenefitMember2022-11-012022-12-31rdw:agerdw:tranche0001819810us-gaap:EmployeeStockMember2021-09-020001819810us-gaap:EmployeeStockMember2021-09-022021-09-020001819810us-gaap:EmployeeStockMember2022-12-310001819810us-gaap:EmployeeStockMember2021-12-310001819810rdw:IncentiveUnitsMember2022-01-012022-12-310001819810us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001819810us-gaap:EmployeeStockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2022-01-012022-12-310001819810us-gaap:EmployeeStockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2022-01-012022-12-310001819810us-gaap:EmployeeStockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2022-01-012022-12-310001819810us-gaap:EmployeeStockOptionMember2022-07-010001819810us-gaap:EmployeeStockOptionMember2021-01-012021-12-3100018198102022-01-012022-03-310001819810us-gaap:RestrictedStockUnitsRSUMember2022-05-182022-05-180001819810us-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedPaymentArrangementNonemployeeMember2022-05-262022-05-260001819810us-gaap:RestrictedStockUnitsRSUMember2022-07-010001819810us-gaap:RestrictedStockUnitsRSUMember2022-07-012022-07-010001819810us-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedPaymentArrangementNonemployeeMember2022-07-012022-07-010001819810us-gaap:RestrictedStockUnitsRSUMember2020-12-310001819810us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001819810us-gaap:RestrictedStockUnitsRSUMember2021-12-310001819810us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001819810us-gaap:RestrictedStockUnitsRSUMember2022-12-310001819810rdw:IncentiveUnitsMemberus-gaap:CostOfSalesMember2022-01-012022-12-310001819810rdw:IncentiveUnitsMemberus-gaap:CostOfSalesMember2021-01-012021-12-310001819810us-gaap:EmployeeStockOptionMemberus-gaap:CostOfSalesMember2022-01-012022-12-310001819810us-gaap:EmployeeStockOptionMemberus-gaap:CostOfSalesMember2021-01-012021-12-310001819810us-gaap:RestrictedStockUnitsRSUMemberus-gaap:CostOfSalesMember2022-01-012022-12-310001819810us-gaap:RestrictedStockUnitsRSUMemberus-gaap:CostOfSalesMember2021-01-012021-12-310001819810us-gaap:CostOfSalesMember2022-01-012022-12-310001819810us-gaap:CostOfSalesMember2021-01-012021-12-310001819810rdw:IncentiveUnitsMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2022-01-012022-12-310001819810rdw:IncentiveUnitsMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2021-01-012021-12-310001819810us-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:EmployeeStockOptionMember2022-01-012022-12-310001819810us-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:EmployeeStockOptionMember2021-01-012021-12-310001819810us-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001819810us-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001819810us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-01-012022-12-310001819810us-gaap:SellingGeneralAndAdministrativeExpensesMember2021-01-012021-12-310001819810rdw:MissionSolutionsMember2022-12-310001819810rdw:ReduSpaceServiceSANVMember2022-12-310001819810us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-01-012022-12-310001819810rdw:ReduSpaceServiceSANVMemberrdw:SESTechcomSAMember2022-12-310001819810rdw:SESTechcomSAMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-01-012022-12-310001819810rdw:ReduOperationsServicesSANVMember2022-01-012022-12-310001819810rdw:ReduOperationsServicesSANVMember2022-12-310001819810us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-12-31rdw:director0001819810rdw:ReduSpaceServiceSANVMember2022-01-012022-12-310001819810rdw:ReduSpaceServiceSANVMember2022-12-310001819810rdw:ReduSpaceServiceSANVMember2022-01-012022-12-3100018198102022-10-310001819810srt:AffiliatedEntityMemberrdw:ManagementFeesMember2022-01-012022-12-310001819810srt:AffiliatedEntityMemberrdw:ManagementFeesMember2021-01-012021-12-310001819810srt:AffiliatedEntityMemberrdw:TransactionFeesMember2022-01-012022-12-310001819810srt:AffiliatedEntityMemberrdw:TransactionFeesMember2021-01-012021-12-310001819810srt:AffiliatedEntityMember2022-01-012022-12-310001819810srt:AffiliatedEntityMember2021-01-012021-12-310001819810srt:AffiliatedEntityMember2020-10-012020-10-310001819810srt:AffiliatedEntityMember2021-12-310001819810rdw:ChairmanChiefExecutiveOfficerAndMemberOfBoardOfDirectorsMember2022-01-012022-12-310001819810rdw:ChairmanChiefExecutiveOfficerAndMemberOfBoardOfDirectorsMember2021-01-012021-12-310001819810rdw:ChairmanChiefExecutiveOfficerAndMemberOfBoardOfDirectorsMember2022-12-310001819810rdw:ChairmanChiefExecutiveOfficerAndMemberOfBoardOfDirectorsMember2021-12-310001819810srt:DirectorMember2022-01-012022-12-310001819810srt:DirectorMember2021-01-012021-12-310001819810srt:DirectorMember2022-12-310001819810srt:DirectorMember2021-12-310001819810us-gaap:ConvertiblePreferredStockMemberrdw:AEIInvestmentAgreementMember2022-01-012022-12-310001819810us-gaap:ConvertiblePreferredStockMemberrdw:BainInvestmentAgreementMember2022-01-012022-12-310001819810rdw:BainInvestmentAgreementMember2022-01-012022-12-310001819810us-gaap:ConvertiblePreferredStockMemberrdw:BainInvestmentAgreementMember2022-12-310001819810us-gaap:ConvertiblePreferredStockMemberrdw:AEIInvestmentAgreementMember2022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| | | | | |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2022

OR

| | | | | |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-39733

Redwire Corporation

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware | | 98-1550429 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

8226 Philips Highway, Suite 101 Jacksonville, Florida | | 32256 |

(Address of Principal Executive Offices) | | (Zip Code) |

(650) 701-7722

Registrant's telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share | RDW | New York Stock Exchange |

| Warrants, each to purchase one share of Common Stock | RDW WS | New York Stock Exchange |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.Yes o No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2022 was approximately $62.1 million based on the closing price of $3.04 for the shares of the registrant’s common stock, as reported by the New York Stock Exchange. The determination of affiliate status is not necessarily a conclusive determination for other purposes.

The registrant had outstanding 64,280,631 shares of common stock as of March 28, 2023.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information in the registrant’s definitive proxy statement to be filed with the Securities and Exchange Commission relating to the registrant’s 2023 Annual Meeting of Stockholders is incorporated by reference into Part III of this Annual Report on Form 10-K.

REDWIRE CORPORATION

Annual Report on Form 10-K

December 31, 2022

Table of Contents

PART I

Each of the terms the “Company,” “Redwire,” “we,” “our,” “us” and similar terms used herein refer collectively to Redwire Corporation, a Delaware corporation, and its consolidated subsidiaries, unless otherwise stated.

INFORMATION RELATING TO FORWARD LOOKING-STATEMENTS

This Annual Report on Form 10-K contains statements that constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 concerning us and other matters. Words such as “will,” “expect,” “anticipate,” “intend,” “may,” “could,” “should,” “plan,” “project,” “forecast,” “believe,” “estimate,” “outlook,” “trends,” “goals,” “contemplate,” “continue,” “might,” “possible,” “potential,” “predict,” “would” and similar expressions generally identify these forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements include, among other things, statements relating to our future financial condition, results of operations and/or cash flows, and our projects and related timelines. Forward-looking statements are based upon assumptions, expectations, plans and projections that we believe to be reasonable when made, but which may change over time. These statements are not guarantees of future performance and inherently involve a wide range of risks and uncertainties that are difficult to predict. Specific risks and uncertainties that could cause actual results to differ materially from those expressed or implied in these forward-looking statements include, but are not limited to, those identified in this Annual Report on Form 10-K, particularly in Part I, Item 1A “Risk Factors” and other important factors disclosed from time to time in our other filings with the Securities and Exchange Commission (“SEC”).

Undue reliance should not be placed on these forward-looking statements. The forward-looking statements contained in this Annual Report on Form 10-K are based on current expectations and beliefs concerning future developments and their potential effects on us. There can be no assurance that future developments affecting us will be those that we have anticipated. We do not undertake any obligation to update or revise any forward looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

Item 1. Business

Redwire is a global leader in mission critical space solutions and high reliability components for the next generation space economy, with valuable intellectual property for solar power generation, in-space 3D printing and manufacturing, avionics, critical components, sensors, digital engineering and space-based biotechnology. We combine decades of flight heritage with the agile and innovative culture. Our “Heritage plus Innovation” strategy enables us to combine proven performance with new, innovative capabilities to provide our customers with the building blocks for the present and future of space infrastructure.

Our mission is to accelerate humanity’s expansion into space by delivering reliable, economical and sustainable infrastructure for future generations. With decades of proven flight heritage uniquely combined with innovative products and culture, Redwire is uniquely positioned to assist our customers in solving the complex challenges of future space missions and industries. Redwire has three primary areas of focus that form our business: (1) Enabling space mission providers, such as government agencies and large prime contractors, with a broad portfolio of space infrastructure, systems, subsystems, and components; (2) Providing the infrastructure and technology needed for people to permanently live and work in space; and (3) assisting international spacefaring allies in the development of organic space capabilities.

Redwire is a global leader in space infrastructure enabling space mission providers with the foundational building blocks needed for their complex space missions to succeed. Space infrastructure is critical to our terrestrial economy in areas such as telecommunications, navigation and timing, climate monitoring, weather forecasting, Earth observation, national security, and even planetary defense. Redwire does not offer full mission solutions for all these areas, but our government and marquee customers such as government agencies and large prime contractors do. We offer a broad array of products and services, many of which have been enabling space missions since the 1960s and have been flight-proven on over 200 spaceflight missions, including missions such as the GPS constellation, New Horizons and Perseverance. We are also a provider of innovative technologies with the potential to help transform the economics of space and create new markets for its exploration and commercialization. Examples of our proprietary technologies include deployable structures, roll out solar array (“ROSA”) systems, human-rated camera systems, in-space servicing, assembly and manufacturing (“ISAM”) products, and advanced payload adapters. Of particular note, our ROSA arrays have been installed on the International Space Station (“ISS”) to efficiently augment its power generation capabilities as the ISS enters its next decade of operations. ROSA systems are experiencing significant market adoption, being utilized not only on the ISS but also on National Aeronautics and Space Administration’s (“NASA”) Double Asteroid Redirect Test mission. Other ROSA systems are being developed and delivered for the OVZON-3 telecommunications satellite, the Power and Propulsion Element for the NASA Lunar Gateway, and other programs. Many Redwire products and services are experiencing similar adoption.

Redwire plays a critical role for people to Explore, Live and Work in space.

•Explore: For decades, we have played a critical role in historic space exploration missions, such as NASA’s Mars Perseverance Rover. More recently, we served our partner Lockheed Martin and our customer NASA by providing the “Eyes of Orion” for NASA’s Artemis I mission.

•Live: NASA has laid out a plan to decommission and deorbit the ISS by 2031. As a result, commercial space station development to replace the ISS is anticipated to occur over the next eight years. Redwire ROSA power solutions, berthing and docking mechanisms, robotics and other key technologies are expected to be major subsystems for this opportunity.

•Work: We are a leader in microgravity research and development on the ISS, with over 20 payloads developed and deployed. As commercial space stations and new space industries become a reality, demand is expected to increase for advanced in-space manufacturing and biotech facilities that generate new materials and breakthrough medical treatments manufactured in microgravity.

With the recently renewed global fascination with space, international spacefaring allies demand for the products and services of a provider like Redwire may increase as they seek to develop their organic space capabilities. With the acquisition of Belgium-based Redwire Space NV (“Space NV”), we have a unique portfolio of highly synergistic and complementary core space infrastructure offerings that significantly enhance our access to addressable markets in Europe and the rest of the world. Redwire’s acquisition of Space NV comes as space budgets in Europe increase, with the European Space Agency receiving a 17% increase in budget compared to 2019. Across the globe, we believe many nations see space as a unique opportunity to build national prestige and expand their economies. In addition to the U.S. and Europe, Saudi Arabia, the United Arab Emirates, Hungary, Poland, and India, are making notable investments in space technology, thereby significantly increasing the total addressable market for Redwire.

We believe the space economy is at an inflection point. The reduction of launch costs over the last decade has eliminated the single largest economic barrier to entry for the expanded utilization of space, and the increasing cadence of launches provides more flexible, reliable access. This lower cost access has resulted in both the expansion and modernization of traditional national security and civil uses of space and has enticed new commercial entrants to invest substantial capital to develop new space-based business models. Our goal is to provide a full suite of infrastructure solutions, including mission-critical components, services and systems that will contribute to a dramatic expansion of the space-based economy. We believe that our products and services are the foundational building blocks essential to the growth of the space civil, commercial and national security ecosystem now and into the future.

History

Redwire was formed to fill a void in the middle market for a pure play, public space infrastructure company with scale. We are achieving this goal by combining proven space technology providers with next generation space disruptors into a single, integrated platform. The Company, in its current form, was founded in 2020 by private equity firm AE Industrial Partners Fund II, LP (“AEI”), but the heritage of the various businesses that were brought together to form Redwire stretch back decades.

AEI formed a series of acquisition vehicles on February 10, 2020, which included AE Red Holdings, LLC (formerly known as Redwire, LLC, which was formerly known as Cosmos Parent, LLC) (“Holdings”), Cosmos Intermediate, LLC (“Cosmos” or the “Successor”), Cosmos Finance, LLC and Cosmos Acquisition, LLC, with Cosmos Parent, LLC being the top holding company. Upon the formation of these acquisition vehicles, Cosmos effected a number of acquisitions through its wholly owned subsidiary, Cosmos Acquisition, LLC. Following the acquisitions, the Successor became a wholly owned subsidiary of Holdings.

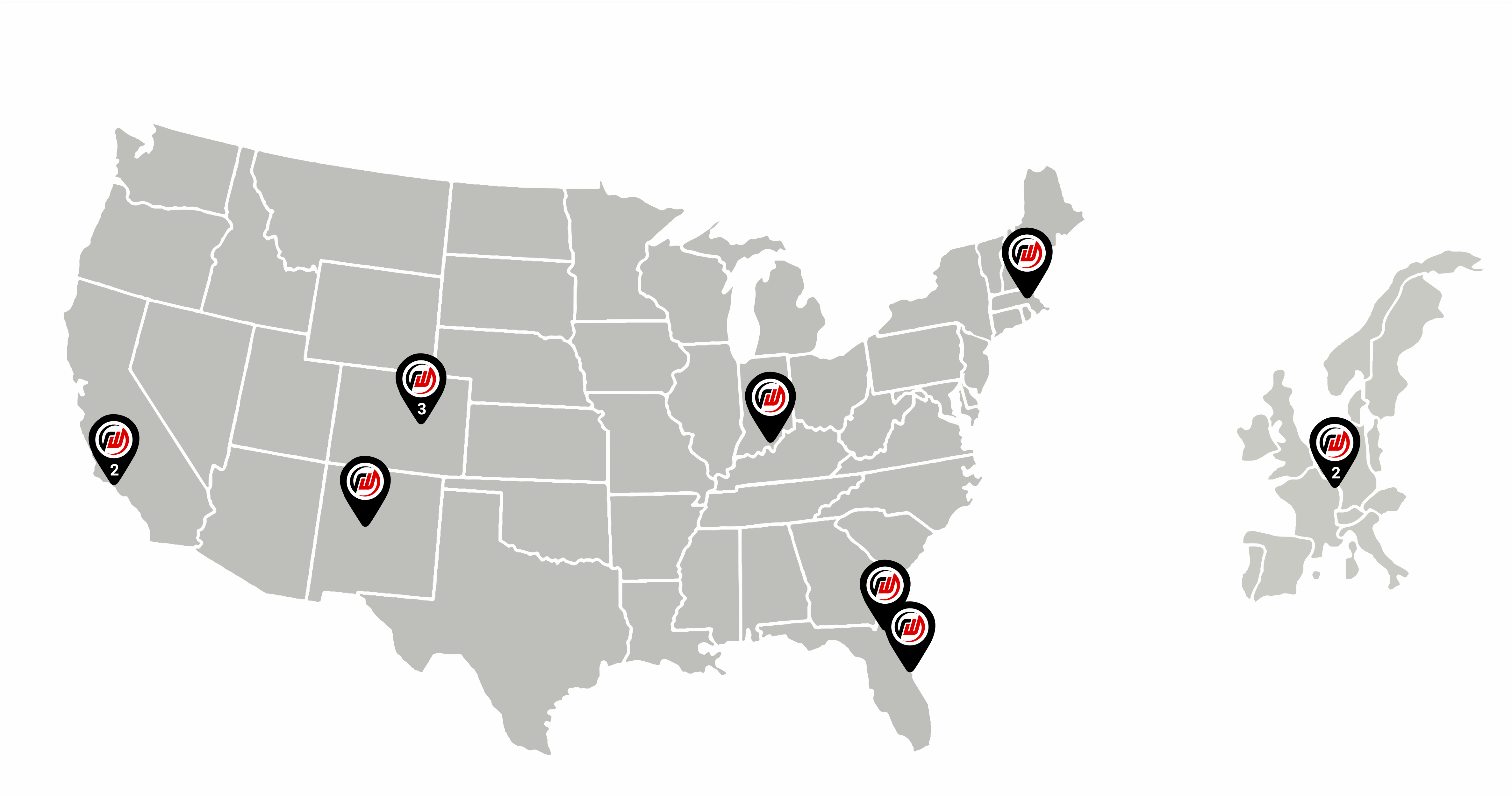

The Company has grown organically while also continuing to integrate several acquisitions from a fragmented landscape of space-focused technology companies with innovative capabilities and deep flight heritage. Strategic acquisitions that augment our technology and product offerings are a key part of our growth strategy. We have completed nine acquisitions since March 2020, which collectively have provided us with a wide variety of complementary technologies and solutions to serve our target markets and customers. These acquisitions include:

•March 2020 – Acquired Adcole Space, LLC (“Adcole”), based in Marlborough, MA was a leading provider of space-capable navigational components. Adcole brought to Redwire 50 years of proven flight heritage providing a foundational set of critical navigation components to some of the most successful missions in the history of space infrastructure development such as the GPS constellation.

•June 2020 – Acquired Deep Space Systems, Inc. (“DSS”), in Littleton, CO, a space-systems engineering company that supports the design, development, integration, testing, and operations of spacecraft and spacecraft systems supporting science, technology, and exploration missions. DSS contributed to Redwire a strong history of spacecraft development and expertise. They are an original prime contractor awardee on NASA’s Commercial Lunar Payload Services (CLPS) contract and continue as part of Redwire to provide mission critical sensors and services to notable spacecrafts such as Orion and Dream Chaser.

•June 2020 – Acquired In Space Group, Inc. and its subsidiaries such as Made In Space (collectively “MIS” or “Predecessor”), was a leader of in-space manufacturing technologies, delivering next-generation capabilities on-orbit to support exploration

objectives and national security priorities. MIS is the first commercial company to additively manufacture in space, and specializes in ISAM technologies, the development of space-enabled materials and exploration manufacturing technologies. They contributed to Redwire the scale necessary to form a platform and a portfolio of disruptive intellectual property with the potential to change the economics of space infrastructure. The MIS facility in Jacksonville, FL became Redwire’s headquarters.

•October 2020 – Acquired Roccor, LLC (“Roccor”), in Littleton, CO, a provider of advanced aerospace structures, including solar arrays, antennas, boom products, deorbit devices and thermal products. Roccor’s novel designs address cost and performance limitations to meet customer mission requirements. Roccor contributed to Redwire a solid foundation in the National Security space markets and one-of-a-kind deployable programs such as providing the solar sail for NASA’s upcoming Solar Cruiser mission.

•December 2020 – Acquired LoadPath, LLC (“LoadPath”), which specializes in the development and delivery of aerospace structures, mechanisms, and thermal control solutions. LoadPath brought to Redwire a long history of strong relationships and contracts with the Air Force Research Lab at Kirkland Air Force base in Albuquerque, New Mexico. They were a key entry point to this critical location and customer.

•January 2021 – Acquired Oakman Aerospace, Inc. (“Oakman”), in Littleton, CO, which specializes in the development of modular open system architecture, rapid spacecraft design and development, and custom missions, payloads, and data distribution services. Oakman added to Redwire a critical software development and digital engineering capability to include an enterprise level digital engineering software system called ACORN which is capable of digitally modeling space capabilities from single components to satellites to full constellations.

•February 2021 – Acquired Deployable Space Systems, Inc. (“DPSS”), in Goleta, CA, whose mission is to develop new and enabling deployable technologies for space applications, transition emerging technologies to industry for infusion into future Department of Defense (“DoD”), NASA, and/or commercial programs and design, analyze, build, test and deliver on-time the deployable solar arrays, deployable structures and space system products. DPSS’s product portfolio includes the award-winning and patented ROSA (Roll-Out Solar Array), Integrated Modular Blanket Assembly; Rigid-Panel and Functional Advanced Concentrator Technology solar array technologies; a multitude of elastically and articulated deployable structures and booms, open-lattice booms, telescopic booms; and a variety of mission-enabling mechanisms for space applications. DPSS brought to Redwire the iROSA program to upgrade the International Space Station with a next generation power solution and a unique facility for the manufacture and test of large solar array capabilities.

•November 2021 – Acquired Techshot, Inc. (“Techshot”), in Greenville, IN, a leader in on-orbit manufacturing, biotechnology in microgravity, and bioprinting needed for commercial space-based biotechnology and pharmaceutical research and development. Techshot enhances the Redwire civil and commercial space capabilities by adding additional in-space manufacturing and biotechnology capabilities to an already premier portfolio of space research, development and commercialization payloads.

•October 2022 – Acquired Redwire Space NV (f/k/a Qinetiq Space NV), (“Space NV”), in Kruibeke, Belgium, a commercial space business providing design and integration of critical space infrastructure and other instruments for end-to-end space missions. Space NV has over 35 years of mission heritage in orbit, delivering observation, platforms, science, navigation and secure communications critical infrastructure to civil and commercial space customers, including the European Space Agency (“ESA”) and the Belgian Science Policy Officer (“BELSPO”).

On September 2, 2021, the Merger (the “Merger”) with Genesis Park Acquisition Corp. (“GPAC”) was consummated pursuant to the Agreement and Plan of Merger (the “Merger Agreement”) dated March 25, 2021 by and among GPAC, Shepard Merger Sub Corporation (“Merger Sub”), a Delaware corporation and direct, wholly owned subsidiary of GPAC, Cosmos Intermediate, LLC and Holdings.

Pursuant to the Merger Agreement, the parties completed a business combination transaction by which, (i) GPAC domesticated as a Delaware corporation in accordance with Section 388 of the Delaware General Corporation Law and the Companies Act of the Cayman Islands (the “Domestication”), (ii) Merger Sub merged with and into Cosmos, with Cosmos being the surviving entity in the merger (the “First Merger”), and (iii) immediately following the First Merger, Cosmos merged with and into GPAC, with GPAC being the surviving entity in the merger (the “Second Merger” and, together with the First Merger, the “Mergers” or the “Merger” and, together with the other transactions contemplated by the Merger Agreement, the “Transactions”). In this Annual Report on Form 10-K, we refer to the Domestication and the Transactions, collectively, as the “Merger”.

Upon the closing of the Merger, GPAC was renamed Redwire Corporation. The Merger was accounted for as a reverse recapitalization in which GPAC is treated as the acquired company. A reverse recapitalization does not result in a new basis of accounting, and the consolidated financial statements of the combined entity represent the continuation of the consolidated financial statements of the Company in many respects. MIS was deemed the accounting predecessor and the combined entity is the successor SEC registrant, Redwire Corporation.

From time to time, the Company will acquire or dispose of businesses and realign contracts, programs or businesses among and within our organization. These realignments are typically designed to leverage existing capabilities more fully and to enhance efficient development and delivery of products and services. As of December 31, 2022, the Company operated in one operating segment and one reportable segment: space infrastructure. Refer to Note B of the accompanying notes to the consolidated financial statements for additional information regarding this conclusion.

Business Strategy

With decades of flight heritage combined with the agile and innovative culture of a commercial space platform, we are uniquely positioned to assist our customers in solving the complex challenges of future space missions. Redwire is providing core technologies that form the foundational building blocks for the future of space infrastructure. Our technology innovation is centered on the following key strategic focus areas:

In-Space Servicing, Assembly & Manufacturing

We anticipate that one of the most dramatic disruptions in the space industry will come from in-space servicing, assembly and manufacturing (“ISAM”) of satellites and other spacecraft. The ability to manufacture in space significantly expands a satellite’s capabilities and reduces costs relative to the conventional method of manufacturing and assembling prior to launch. Space infrastructure such as satellite assets manufactured on Earth are designed to survive the acoustic vibrations and acceleration forces that accompany launch and are inherently limited by these design requirements. Space infrastructure manufactured in space may be optimized for the operational environment in orbit and are never exposed to launch conditions. Design optimization for in-space operation allows for improved performance, such as increased power generation via larger solar arrays or higher gain via large-scale antennas than those that can be economically deployed using conventional manufacturing methods.

By mitigating spacecraft volume limitations imposed by launch vehicles, manufacturing in space can also help to significantly reduce the costs of launch. Launch costs depend in part on the mass and volume of the spacecraft. The manufacturing and assembly of large spacecraft structures in orbit reduces spacecraft volume at launch, resulting in decreased launch costs and increased flexibility in launch provider selection, including utilization of smaller launch providers and rideshare programs.

Current ISAM applications include government-funded programs to enable increased small satellite power generation via large deployable solar arrays attached to booms that are 3D printed on-orbit. Commercial adoption of this technology could be a significant catalyst for growth in the overall space economy, enabling users to put more capability on orbit than state of the art approaches. We believe that ISAM represents a technological sea change that has the potential to upend traditional space operations. With sustainable in-space solutions, we believe ISAM will enable the next generation of growth in the space industry. Redwire’s additive manufacturing intellectual property that is critical to our ISAM solution has been proven in operation on the ISS since 2014 and is protected by our numerous patents.

Additionally, Redwire is developing a robotic arm for space applications. This scalable robotic arm system is expected to meet growing demand for space-capable robotic solutions in mission profiles ranging from lunar surface activities to on-orbit satellite servicing and beyond.

Advanced Sensors & Components

Our technology has been at the forefront of space exploration for decades, providing satellite components that are integral to the mission success of hundreds of low Earth orbit (“LEO”), geosynchronous (“GEO”) and interplanetary spacecraft. These are foundational components that are critical to almost every spacecraft deployment. We are combining our new and innovative space technologies with our proven spaceflight heritage to meet the complexity and demands of today’s growing and evolving space industry. Our sensor and component capabilities include the design and manufacture of mission-critical, high reliability technologies serving a wide variety of functions on the spacecraft. Our offerings include:

Power Solutions: We offer a variety of solar array solutions for spacecraft spanning the entire spectrum of satellite size, power needs, and orbital location. We possess proprietary technologies, technical knowhow, and the facilities to design, build, and deliver competitive power generation solutions tailored to customer need. Of particular note, our patented and award-winning ROSA (Roll-Out Solar Array) technology features an innovative “roll-out” design which uses composite booms to serve as both the primary structural elements and the deployment actuator, and a modular photovoltaic blanket assembly that can be configured into a variety of solar array architectures. When configured for launch, ROSA stows into a compact cylindrical volume yielding efficient space utilization. The unique ROSA stowed configuration allows extremely large solar arrays to be stowed compactly within launch vehicles.

Composite Booms: We develop cost-effective, furlable composite boom products that deploy antennas and instruments from small satellites. We develop very long lightweight composite booms for applications including solar sails, dipole antennas and deployable tethers. The efficient packaging scheme of our Triangular Rollable and Collapsible (“TRAC”) Boom enables our customers to deploy extremely large systems from very small volumes.

RF Systems: We are a supplier of high strain composite (“HSC”) antennas that have much simpler mechanical designs than larger, conventional satellite antennas. HSC structural elements can provide deployment actuation, damping, deployed stiffness and integrated electrical / RF functionality in one multifunctional part, enabling a variety of antenna architectures and structural designs.

Payload Adapters: We are a supplier of integrated structural systems that support multiple satellites of different sizes across multiple launch vehicle platforms. Our payload interface solutions are tailored to launch vehicle/payload requirements to achieve optimal performance, and efficient allocation of mass to support on-orbit function rather than launch vehicle interfaces.

Space-Qualified Camera Systems: We supply customers with low size, weight and power, flight-proven cameras for a variety of use cases. Our camera solutions are used for vehicle docking and near- and far-field cameras are used for space situational awareness and satellite navigation.

Star Trackers and Sun Sensors: Our star tracker solution provides superior guidance, navigation and control as it takes an image of the stars, measures its apparent position in the reference frame of the spacecraft and identifies the stars so its position can be compared with its known absolute position from a star catalog.

Over 1,000 of our sun sensors have been deployed on hundreds of spacecraft since the 1960s and we remain a leader in attitude control, solar array pointing, gyro updating and fail-safe recovery solutions.

Space Domain Awareness & Resiliency

The U.S. national security community is increasingly viewing space as a warfighting domain, as evidenced by significant space-based military infrastructure investment such as the National Defense Space Architecture (“NDSA”) and the creation of the U.S. Space Force. Advances in potentially adversarial capabilities in space have highlighted the need to improve both the physical and cyber resiliency of U.S. and allied space assets, as well as monitoring of all assets, friendly and potentially hostile, on orbit. In our Space Domain Awareness and Resiliency (“SDA&R”) strategic focus area, our core competencies and products support the national security community’s space resiliency and situational awareness missions.

Our key offerings in this area include sensor systems for on-orbit monitoring, advanced modeling & simulation, cyber resiliency, asset hardening, robotics, and full satellite solutions leveraging our ISAM capabilities. Our SDA&R portfolio contains a variety of optical instruments that perform situational awareness functions and can be adapted to act as space situational awareness cameras as a primary or secondary payload.

Digitally-Engineered Spacecraft

Digitally-engineered spacecraft are systems that are designed, developed and manufactured on a digital foundation. Model-based engineering and high fidelity digital engineering tools reduce assembly hours by utilizing an end-to-end virtual environment that is capable of producing a near perfect virtual replica of a physical space system, before a physical instance is created. This capability significantly reduces the cost and schedule required to design, develop and deploy spacecraft while also reducing the risk of deployment and the cost of operations and maintenance. Additionally, “digital twins” of individual components, spacecraft and constellations are used to improve cyber resiliency, health and monitoring, operations and maintenance of deployed space assets.

We believe that the DoD and U.S. Space Force have embraced digital engineering as a foundational technology for the rapid, cost-effective development of their future space architectures. Digital engineering enables the modeling and simulation of future space architectures to provide high fidelity trade analysis, operational concepts and testing. Cyber resiliency is an increasing challenge for deployed space assets. This capability is critical to ensuring future civil, commercial and national security space assets are protected from cyber-based attacks.

Redwire has a proprietary enterprise software suite that enables advanced digital engineering and generation of high fidelity, interactive modeling and simulations of individual components, entire spacecraft and full constellations in a cloud-based Software as a Service (SaaS) business model.

Low-Earth Orbit Commercialization

Our LEO commercialization strategic focus area is developing next-generation capabilities with a goal of developing efficient, commercial services for the ISS and other current and future human spaceflight programs. This focus area includes in-space additive manufacturing, space-based biotechnology applications, space plant and animal science, in-space advanced material manufacturing and support of human exploration, habitation and commercial activities in space.

We created the first permanent commercial manufacturing platform to operate in LEO, the Additive Manufacturing Facility (“AMF”). AMF was developed based on a desire for on-demand local manufacturing that is expected to become a mainstay for mission planning to address critical needs in space. This technology increases the reliability of long-duration missions and makes human spaceflight missions safer by providing crews with additional flexibility in responding to situations that may threaten a mission. The ability for

tools to be manufactured on-site, on-demand, allows mission planners to reduce the amount of specialized equipment that must be included during launch, providing maximum flexibility and contingency while reducing costs. Beginning with a small ratchet created on the International Space Station, we have now manufactured 200+ parts in-space over the past six years and are the only company currently providing commercial 3D printing on the ISS.

Additionally, our in-space manufacturing capabilities and space biotechnology solutions provide the building blocks for a robust commercial space economy building products and solutions for use on Earth. Production of advanced industrial materials and biological materials in microgravity offer performance advantages over comparable products manufactured on Earth. The microgravity environment enables certain space-based products to be created with properties superior to their terrestrial analogue. By identifying advanced manufacturing processes, product development and biotechnology research and development which can leverage the microgravity environment to manufacture high performance materials and groundbreaking biomedical solutions that meet specific industrial and commercial use cases, we believe our approach to space commercialization advances the creation of a space-Earth value chain to spur economic development. We have demonstrated the ability to 3D print biological materials, to manufacture advanced ceramics, fiber optics, crystals and other industrial materials in microgravity.

Products and Solutions

Antennas

Our antenna systems enable space-to-space and space-to-Earth communications. Some form of communications antenna is required for nearly all satellites that are put into orbit. We offer a wide variety of antennas to meet a range of satellite mission requirements. Our Link-16 antenna can be used to facilitate the exchange of tactical imagery from space in near-real time between military aircraft, ships and ground forces. Our antennas also enable the exchange of encrypted messages, imagery data and multiple channels of digital voice communication. We believe this will enable reliable and efficient space-based tactical communications in environments in which it has historically been difficult to conduct communications-intensive operations.

Satellite Technology

We provide the P200 small satellite platform which is capable of supporting payloads up to 70 kg and targets spacecraft mass less than 200 kg, making it compatible with typical shared launch opportunities and small satellites launchers. The P200 platform is an evolution of the PROBA platform which has acquired extensive flight heritage, accumulating more than 25 years in orbit without failure on any of the launched satellites.

Space-Qualified Sensors

We have a deep heritage in manufacturing space-qualified sensors. Every satellite that goes into orbit requires at least one star tracker, sun sensor and avionics package and we have developed advanced capabilities in these critical subsectors of the space supply chain. We also provide narrow and wide-field-of-view camera systems, in addition to camera systems that are rated for human space flight, to our customers across civil, national security and commercial space.

Structures & Deployables

We provide a variety of deployable space structure offerings to help meet our customers’ mission requirements. We believe that our instrument booms are instrumental to the DoD’s goal of achieving space domain awareness. Our composite instrument booms can allow small satellites (“Smallsats”) to deploy high-power solar arrays, large antennas for high data rate communications and large drag augmentation devices for rapid end-of-life deorbiting. We have provided our ROSA technology to NASA to upgrade the International Space Station’s solar arrays since 2021. We have also developed rigid panel solar array systems that are scalable in size and can be configured for a variety of applications. We also develop cost- effective composite booms that deploy antennas and instruments from small satellites, enabling a new generation of satellite constellations to provide science measurements and communications from space.

Berthing and Docking Equipment and Space Instruments

We provide a fully compatible berthing and docking mechanism that performs low impact docking for large and small spacecraft and is aligned with the International Docking System Standard.

Space-enabled Manufacturing Payloads

Space-enabled manufacturing is a form of in-space manufacturing that leverages microgravity to produce materials with superior performance and broader applications when compared to comparable terrestrial materials. We have a suite of space-enabled manufacturing payloads configured for installation and operation aboard the ISS for demonstrating a variety of advanced manufacturing techniques and facilities with broad applications. We offer payloads capable of additive manufacturing, optical fiber manufacturing, ceramic turbine blisk manufacturing, industrial crystal manufacturing, hybrid metal / polymer manufacturing and more. These techniques may one day have the potential to transform the LEO commercial environment by providing solutions in space for space and in space for Earth.

Space-enabled Biotechnology Payloads

Redwire develops advanced space biotechnology payloads for the purpose of pharmaceutical and medical research and development and human space flight operations and sustainment. For example, the 3D BioFabrication Facility (“BFF”) and the ADvanced Space Experiment Processor (“ADSEP”), together comprise the first-ever system capable of manufacturing human tissue in the microgravity condition of space. Utilizing adult human cells (such as pluripotent or stem cells), the system can create viable tissue in space through technology that enables it to precisely place and build ultra-fine layers of bioink – layers that may be several times smaller than the width of a human hair – involving the smallest print tips in existence. Additionally, we have developed critical biotechnology payloads for the research of musculoskeletal disease, osteoarthritis, regenerative medicine, and space plant/food production.

Cloud-enabled Digital Engineering Enterprise Software Platform

Redwire sells a proprietary enterprise software suite that enables advanced digital engineering and generation of high fidelity, interactive modeling and simulations of individual components, entire spacecraft and full constellations in a cloud-based Software as a Service (“SaaS”) business model. This software suite supports spacecraft and constellation developers in the design, development, deployment, management, maintenance and cyber protection of their space assets.

Advanced Payloads

We design and manufacture a range of scientific experiments. The experiments conduct early stage research on emerging capabilities to inform future space missions, predominantly around the fields of microgravity, life support systems and other instruments. Types of instruments include microgravity experiments to improve understanding of how materials behave in the absence of gravity, life support systems to improve the safety and comfort of astronauts, and other scientific instruments and payloads used for space research.

Engineering, Support Services, Testing and Operation Solutions

We are a one-stop-shop for mechanism design and manufacturing, power supply design and analysis, project planning and management, control processes, structural and thermal analysis, and system engineering solutions for space-based products and applications. We provide our engineering services at any stage of the design process for our customers, whether it be final testing or initial project schematics. This service offering allows us to introduce customers to our capabilities and demonstrate our ability to help optimize and enable the success of their missions.

Backlog

We view growth in backlog as a key measure of our business growth. As of December 31, 2022, our total backlog was $465.1 million, which includes contracted and uncontracted backlog of $313.1 million and $152.1 million, respectively. Contracted backlog represents the estimated dollar value of firm funded executed contracts for which work has not been performed (also known as the remaining performance obligations on a contract). Uncontracted backlog represents the anticipated contract value, or portion thereof, of goods and services to be delivered under existing contracts which have not been appropriated or otherwise authorized. For further information, refer to “Backlog” in Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” (“MD&A”).

Seasonality

No material portion of our business is considered to be seasonal. Various factors can affect the distribution of our revenue between accounting periods, including the timing of contract awards and the timing and availability of U.S. Government funding, as well as the timing of product deliveries and customer acceptance.

Customers and Strategic Partnerships / Relationships

Our product and solution offerings are designed to meet the needs of a wide variety of public and private entities operating in space. We have formalized contracts and strategic partnerships with numerous customers, and we plan to continue pursuing additional agreements and partnerships.

Civil Space Community Relationships

Civilian space agencies currently make up the largest portion of our current revenue base. Projects for these customers are typically meant to gather data for the public’s use, advance research objectives, further the exploration and utilization of space, and/or develop new scientific and commercial applications and uses of the space domain. Contracts are primarily fielded by governmental entities that are not funded by defense budgets. Many of these contracts will have a research and demonstration phase which may later convert to full-scale production contracts or commercial opportunities.

NASA

NASA is one of our largest and most long-standing customers. We participate in numerous large, high-profile contracts, such as the Artemis program. In partnership with Lockheed Martin, Redwire is providing the Orion Camera System for the Artemis program. The camera system is an array of 11 internal and external inspection and navigation cameras developed specifically for

the Orion spacecraft. As the “eyes” of Orion, the Orion Camera System enables advanced vehicle imaging capability for Orion and the Artemis program. We have provided services and products supporting a number of other NASA missions, including sun sensors and star trackers for exploration missions like Perseverance, thermal control solutions for technology demonstrators, camera systems for upcoming human spaceflight missions, and development of various additive manufacturing methods on the ISS. We currently have nine active payload facilities on the ISS as of the date of this report.

European Space Agency and Luxembourg Space Agency

Through the acquisition of Space NV, the Company became an established prime contractor in European markets and actively participates in numerous contracts of varying sizes with the European Space Agency, such as PROBA. The PROBA program is focused on the demonstration of technologies and techniques for highly-precise satellite formation flying. In partnership with Sener, we are developing the avionics system, integrating all the electronic units within the platform, performing overall system verification and preparing the operations for PROBA.

We are working with the Luxembourg Space Agency and the European Space Agency to develop a robotic arm for space applications. This scalable robotic arm system is expected to meet growing demand for space-capable robotic solutions in mission profiles ranging from lunar surface activities to on-orbit satellite servicing and beyond.

National Security Community Relationships

We supply a wide variety of technologies and solutions supporting the U.S. and allied countries’ national security objectives in space. As space becomes an increasingly contested domain and near peer threats continue to emerge, the DoD has articulated a need for significant investment in both improving the resiliency of existing space assets and the deployment of new, next-generation capabilities.

Commercial Community Relationships

Through our numerous strategic partnerships with large and high-profile commercial customers, we believe that our technologies are enabling the commercialization of LEO and potentially beyond. We view the commercial market opportunity as one with significant growth possibilities as launch costs continue to decrease, making industrial and other commercial pursuits increasingly viable and prolific.

Customer Concentration

The majority of the Company’s revenues are derived from government contracts. Refer to Note S of the accompanying notes to the consolidated financial statements for further information on sales by major customers and location.

Space Economy Overview

Prior to the 1990’s, access to the global space industry was largely limited to federal governments and a few select telecommunications providers, providing little incentive to lower launch costs or innovate. Over the past three decades, the advent of lower-cost launch technology has driven a paradigm shift and democratized access to space. This has created a vibrant commercial landscape that is driving innovation across major terrestrial industries on Earth. The entrepreneurial energy dedicated to space is disrupting industries including telecommunications, internet infrastructure, weather, aviation, agriculture, advanced materials science, insurance and Earth observation. The military and scientific communities have continued to pursue and fund technological advancement, bolstering a myriad of technologies that have both national security and commercial applications.

We believe that the space industry is at the dawn of a new economic era driven by significant investment. In addition to government contracting, private capital entering the space market has accelerated its growth. Over the last 10 years, there has been approximately $253 billion of equity investment across 1,694 space companies per Space Capital (2021 Q4 Analysis). This has led to a wave of new companies reimagining parts of the traditional space industry.

Today’s space market is primarily driven by satellite technologies and applications but is quickly expanding to include tangential capabilities such as space tourism, in-space manufacturing, LEO commercialization, deep space exploration, space-based resource extraction, and geopolitical space-domain awareness. In 2022, the number of satellites and spacecraft deployed increased 36% to 2,354 deployments, per the Space Report (2022 Q4 Analysis). The rapid deployment of satellite constellations coincides with an increasingly competitive landscape in the launch industry, which is creating unprecedented access to space.

Government agencies have realized the value of the private commercial space industry and have become increasingly supportive and reliant on private companies to catalyze innovation and advance national space objectives. In the U.S., this has been evidenced by notable policy initiatives and commercial contractors’ growing share of federally funded space activity.

Launch Costs and Small Satellite Proliferation

The emergence of large reusable rockets, such as SpaceX’s Falcon 9 and Blue Origin’s upcoming New Glenn rocket, have significantly reduced launch costs over the past decade according to NASA. Additionally, small launch providers have been actively pursuing the market for delivering smaller satellites into LEO. The competition among launch providers is creating a unique opportunity for new space entrants to grow quickly and take advantage of the fact that the per-kilogram cost of launching satellites to LEO is as low as approximately $2,700/kg. Improving launch economics have driven an increase in assets sent to orbit, with both commercial providers and governments participating.

The satellite market has gone through a paradigm shift over the past 10 years, with larger numbers of Smallsats, defined as any satellite under 600 kg, replacing large, exquisite satellites that have traditionally been placed into geosynchronous Earth orbit, or GEO. Smallsat adoption has increased as satellite technology has miniaturized. In LEO, more capability can be offered without the need for redundancy and radiation tolerance that is expected for the harsher GEO environment. The annual number of Smallsats launched has increased almost eightfold since 2012. In 2021, 94% of all launches included a Smallsat, up from 24% in 2012, per Bryce Space and Technology. We anticipate continued growth in the satellite constellation market given the relatively short lifespan, need for larger constellations to provide global coverage and continued technological advancements.