Exhibit 99.1 REDWIRE SPACE NV (Formerly known as QinetiQ Space NV) AUDITED ANNUAL ACCOUNTS as of and for the year ended March 31, 2022 Prepared in accordance with accounting principles generally accepted in Belgium

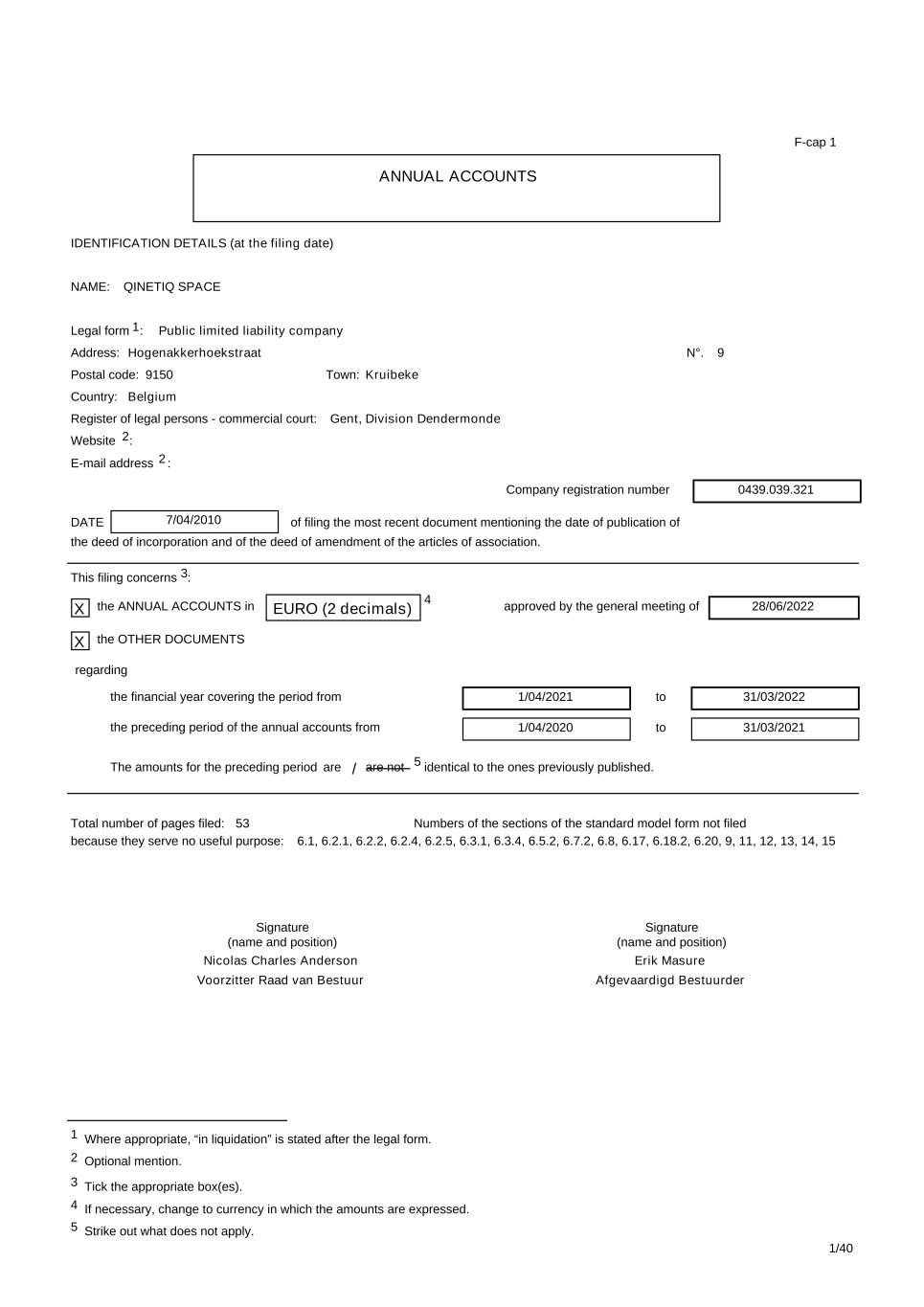

NAME: Legal form : Address: N°. Postal code: Town: Country: Register of legal persons - commercial court: Website : Company registration number 0439.039.321 DATE 7/04/2010 of filing the most recent document mentioning the date of publication of the deed of incorporation and of the deed of amendment of the articles of association. approved by the general meeting of 28/06/2022 the financial year covering the period from 1/04/2021 31/03/2022to 1/04/2020 31/03/2021to The amounts for the preceding period are not ANNUAL ACCOUNTS Public limited liability company Belgium QINETIQ SPACE Hogenakkerhoekstraat 9150 Kruibeke 9 are / Gent, Division Dendermonde identical to the ones previously published. IDENTIFICATION DETAILS (at the filing date) 2 4 5 EURO (2 decimals)the ANNUAL ACCOUNTS in Total number of pages filed: Numbers of the sections of the standard model form not filed because they serve no useful purpose: Signature (name and position) Signature (name and position) 53 6.1, 6.2.1, 6.2.2, 6.2.4, 6.2.5, 6.3.1, 6.3.4, 6.5.2, 6.7.2, 6.8, 6.17, 6.18.2, 6.20, 9, 11, 12, 13, 14, 15 Nicolas Charles Anderson Voorzitter Raad van Bestuur Erik Masure Afgevaardigd Bestuurder F-cap 1 1 E-mail address : 2 This filing concerns : X X 3 the OTHER DOCUMENTS regarding the preceding period of the annual accounts from Where appropriate, “in liquidation” is stated after the legal form. Optional mention. 1/40 1 2 3 Tick the appropriate box(es). If necessary, change to currency in which the amounts are expressed.4 5 Strike out what does not apply.

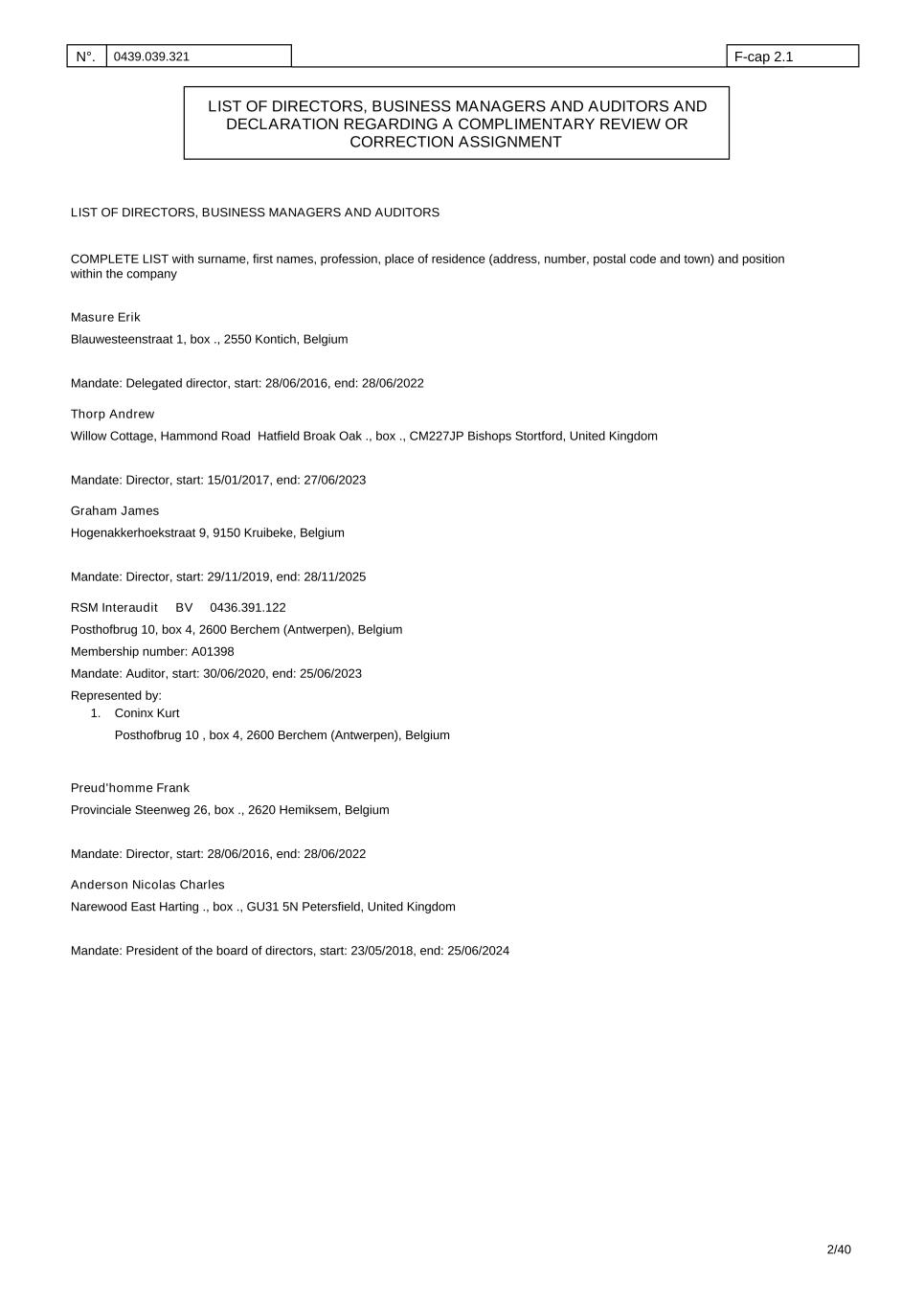

COMPLETE LIST with surname, first names, profession, place of residence (address, number, postal code and town) and position within the company LIST OF DIRECTORS, BUSINESS MANAGERS AND AUDITORS AND DECLARATION REGARDING A COMPLIMENTARY REVIEW OR CORRECTION ASSIGNMENT LIST OF DIRECTORS, BUSINESS MANAGERS AND AUDITORS N°. 0439.039.321 F-cap 2.1 Masure Erik Blauwesteenstraat 1, box ., 2550 Kontich, Belgium Mandate: Delegated director, start: 28/06/2016, end: 28/06/2022 Thorp Andrew Willow Cottage, Hammond Road Hatfield Broak Oak ., box ., CM227JP Bishops Stortford, United Kingdom Mandate: Director, start: 15/01/2017, end: 27/06/2023 Graham James Hogenakkerhoekstraat 9, 9150 Kruibeke, Belgium Mandate: Director, start: 29/11/2019, end: 28/11/2025 RSM Interaudit BV 0436.391.122 Membership number: A01398 Posthofbrug 10, box 4, 2600 Berchem (Antwerpen), Belgium Mandate: Auditor, start: 30/06/2020, end: 25/06/2023 Represented by: Coninx Kurt Posthofbrug 10 , box 4, 2600 Berchem (Antwerpen), Belgium 1. Preud'homme Frank Provinciale Steenweg 26, box ., 2620 Hemiksem, Belgium Mandate: Director, start: 28/06/2016, end: 28/06/2022 Anderson Nicolas Charles Narewood East Harting ., box ., GU31 5N Petersfield, United Kingdom Mandate: President of the board of directors, start: 23/05/2018, end: 25/06/2024 2/40

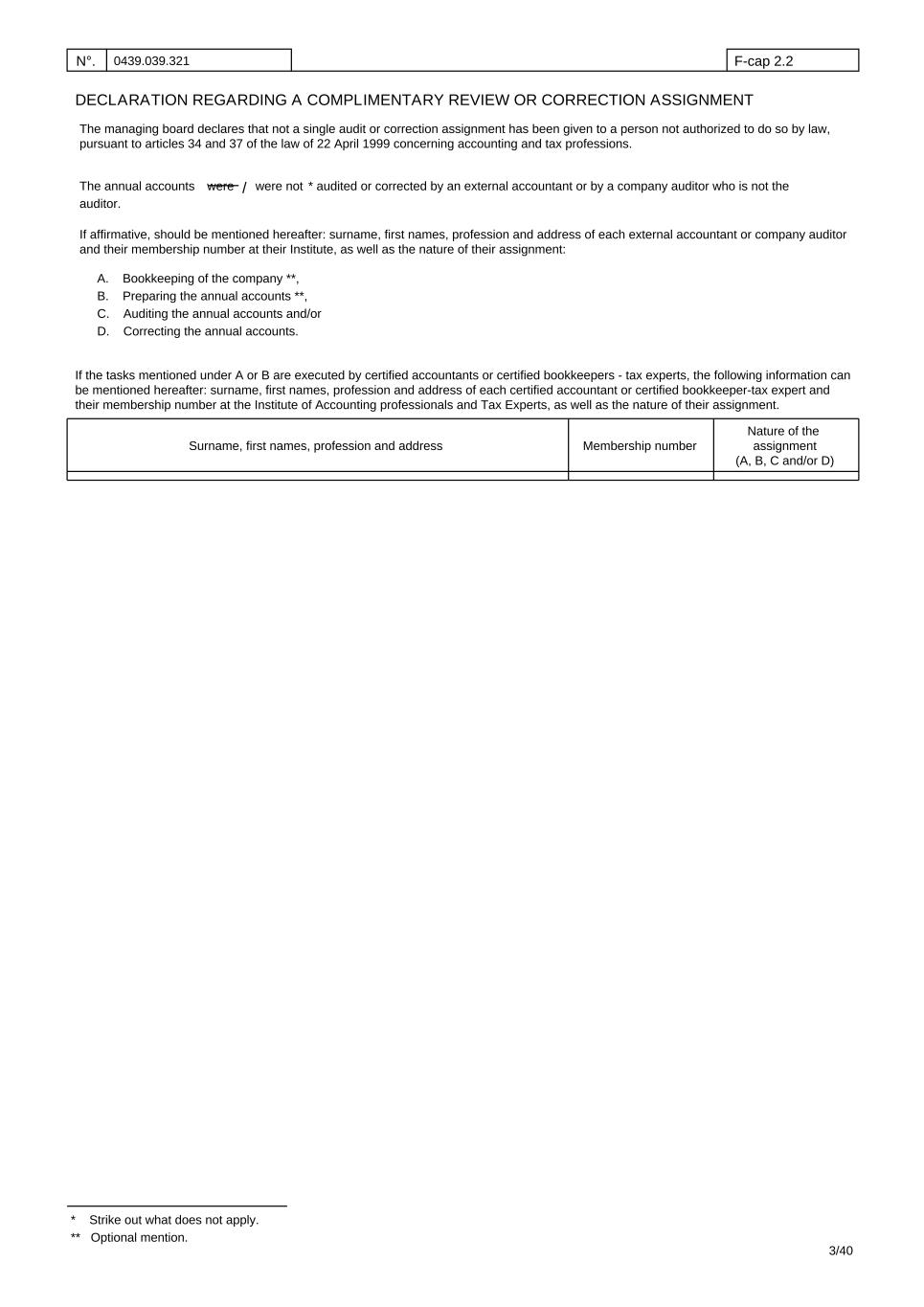

N°. 0439.039.321 F-cap 2.2 DECLARATION REGARDING A COMPLIMENTARY REVIEW OR CORRECTION ASSIGNMENT The managing board declares that not a single audit or correction assignment has been given to a person not authorized to do so by law, pursuant to articles 34 and 37 of the law of 22 April 1999 concerning accounting and tax professions. If affirmative, should be mentioned hereafter: surname, first names, profession and address of each external accountant or company auditor and their membership number at their Institute, as well as the nature of their assignment: A. Bookkeeping of the company **, B. Preparing the annual accounts **, C. Auditing the annual accounts and/or D. Correcting the annual accounts. The annual accounts were were not * audited or corrected by an external accountant or by a company auditor who is not the statutory / If the tasks mentioned under A or B are executed by certified accountants or certified bookkeepers - tax experts, the following information can be mentioned hereafter: surname, first names, profession and address of each certified accountant or certified bookkeeper-tax expert and their membership number at the Institute of Accounting professionals and Tax Experts, as well as the nature of their assignment. auditor. Membership number Nature of the assignment (A, B, C and/or D) Surname, first names, profession and address * Strike out what does not apply. ** Optional mention. 3/40

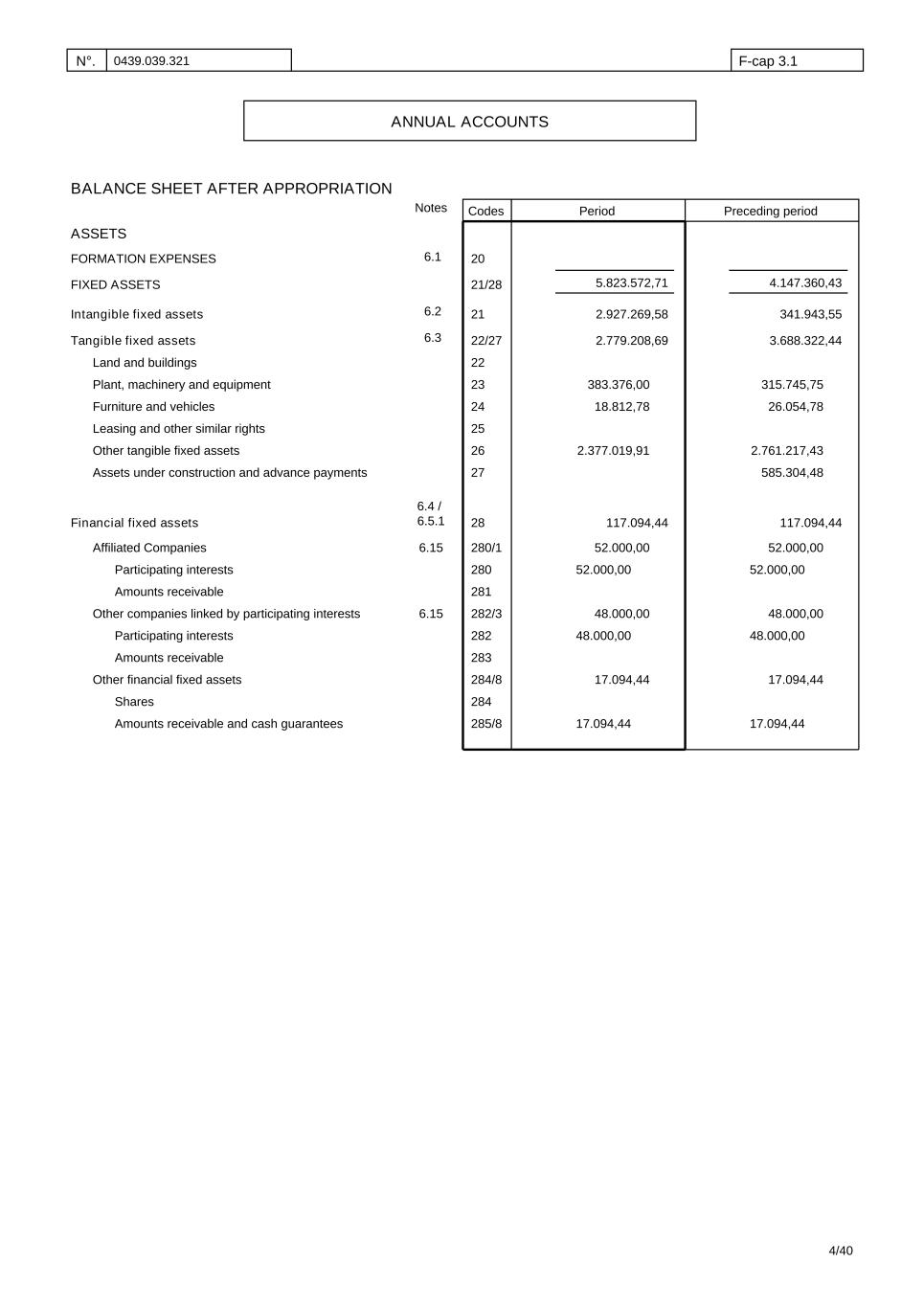

N°. 0439.039.321 F-cap 3.1 BALANCE SHEET AFTER APPROPRIATION Codes Period Preceding period ASSETS Tangible fixed assets FIXED ASSETS Intangible fixed assets FORMATION EXPENSES Land and buildings Plant, machinery and equipment Furniture and vehicles Leasing and other similar rights Other tangible fixed assets Assets under construction and advance payments Financial fixed assets 6.3 6.2 6.4 / 6.5.1 2.927.269,58 2.779.208,69 383.376,00 18.812,78 2.377.019,91 5.823.572,71 117.094,44 4.147.360,43 341.943,55 3.688.322,44 315.745,75 26.054,78 2.761.217,43 585.304,48 117.094,44 21/28 20 21 22/27 22 23 24 25 26 28 27 Notes ANNUAL ACCOUNTS 6.1 Affiliated Companies Participating interests Amounts receivable Other companies linked by participating interests Participating interests Amounts receivable Other financial fixed assets Shares Amounts receivable and cash guarantees 6.15 6.15 52.000,00 52.000,00 48.000,00 48.000,00 17.094,44 17.094,44 52.000,00 52.000,00 48.000,00 48.000,00 17.094,44 17.094,44 280/1 280 281 282/3 282 283 284/8 284 285/8 4/40

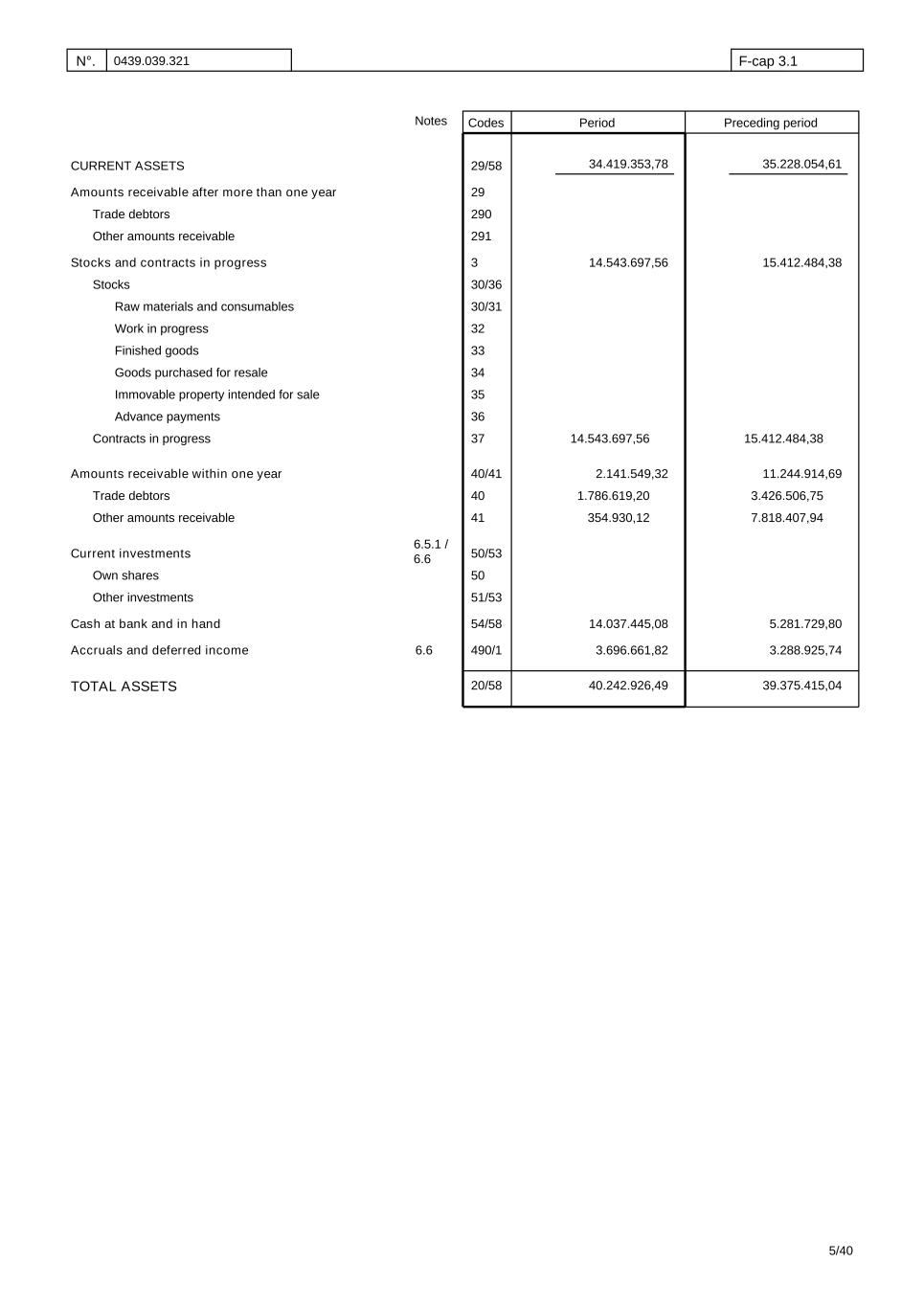

N°. 0439.039.321 F-cap 3.1 Codes Period Preceding period CURRENT ASSETS Amounts receivable after more than one year Trade debtors Other amounts receivable Stocks and contracts in progress Stocks Raw materials and consumables Work in progress Finished goods Goods purchased for resale Immovable property intended for sale Advance payments Contracts in progress Amounts receivable within one year Trade debtors Other amounts receivable Current investments Own shares Other investments Cash at bank and in hand Accruals and deferred income TOTAL ASSETS 6.5.1 / 6.6 6.6 34.419.353,78 14.543.697,56 14.543.697,56 2.141.549,32 1.786.619,20 354.930,12 14.037.445,08 3.696.661,82 40.242.926,49 35.228.054,61 15.412.484,38 15.412.484,38 11.244.914,69 3.426.506,75 7.818.407,94 5.281.729,80 3.288.925,74 39.375.415,04 29/58 29 290 291 3 30/36 30/31 32 33 34 35 36 37 40/41 40 41 50/53 50 51/53 54/58 490/1 20/58 Notes 5/40

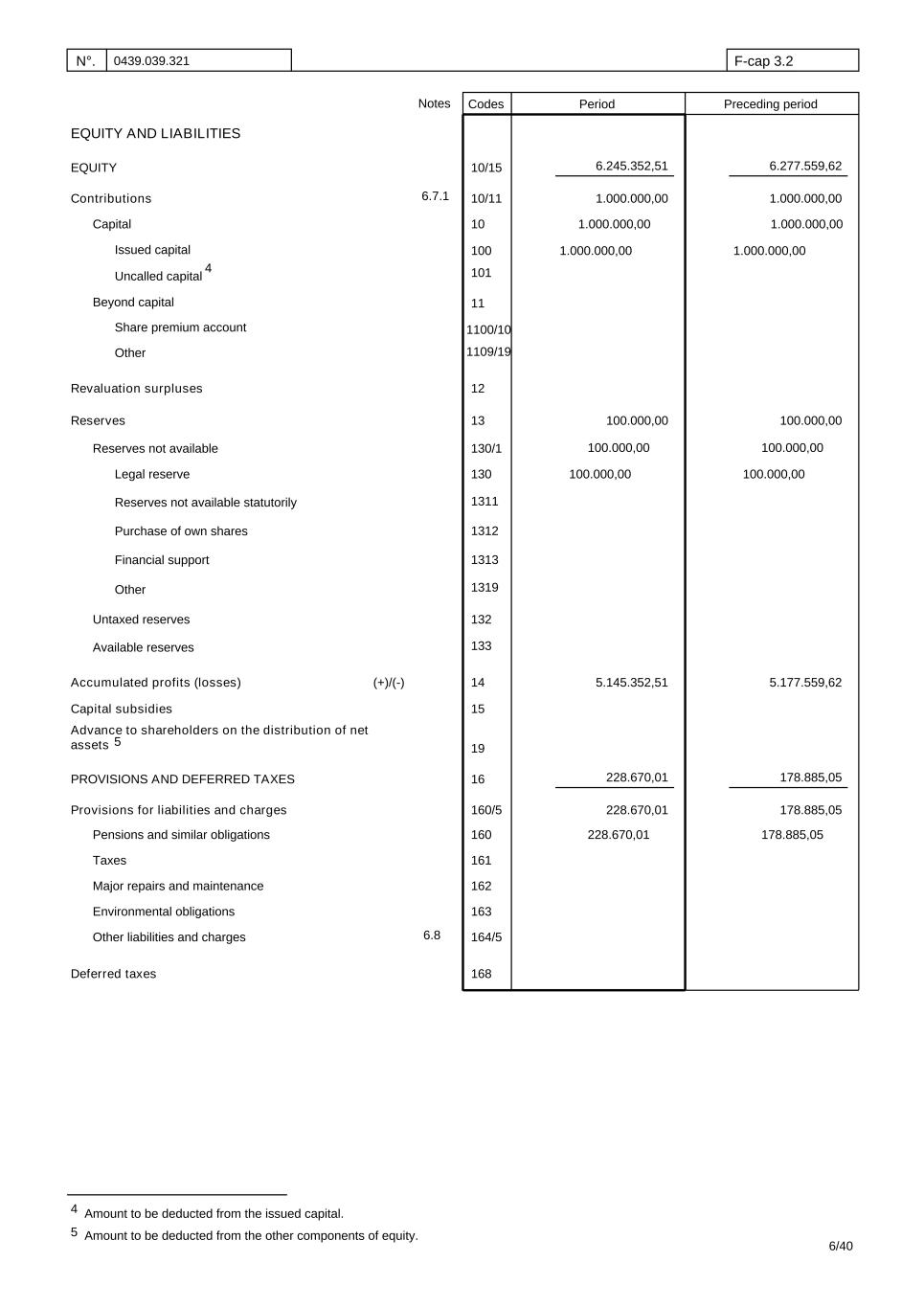

N°. 0439.039.321 F-cap 3.2 Codes Period Preceding period EQUITY AND LIABILITIES Reserves EQUITY Contributions Issued capital Uncalled capital Legal reserve Financial support Other Accumulated profits (losses) Deferred taxes (+)/(-) Untaxed reserves Available reserves Capital subsidies Advance to shareholders on the distribution of net assets PROVISIONS AND DEFERRED TAXES Provisions for liabilities and charges 1.000.000,00 1.000.000,00 5.145.352,51 10/15 10/11 100 101 12 13 130 1319 1313 132 14 15 19 16 160/5 Revaluation surpluses 133 168 228.670,01 228.670,01 6.277.559,62 1.000.000,00 1.000.000,00 100.000,00 100.000,00 100.000,00 5.177.559,62 178.885,05 178.885,05 6.245.352,51 100.000,00 100.000,00 100.000,00 Notes Pensions and similar obligations 228.670,01160 178.885,05 Taxes 161 Major repairs and maintenance 162 Environmental obligations 163 Other liabilities and charges 164/5 4 5 6.7.1 6.8 Capital 10 1.000.000,00 1.000.000,00 Beyond capital Share premium account Other 11 1100/10 1109/19 Reserves not available Reserves not available statutorily Purchase of own shares 130/1 1311 1312 6/40 Amount to be deducted from the issued capital. Amount to be deducted from the other components of equity. 4 5

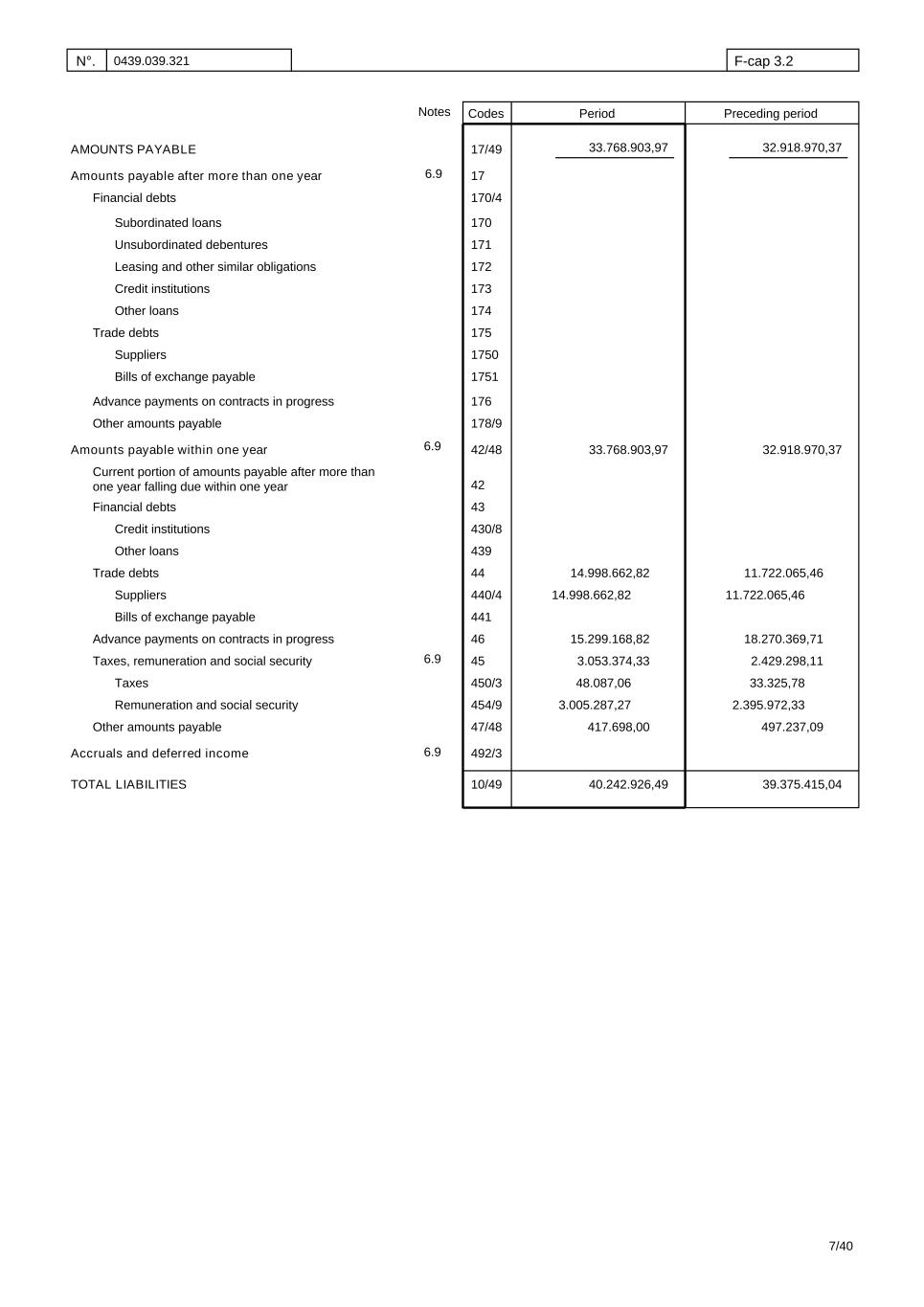

N°. 0439.039.321 F-cap 3.2 Codes Period Preceding period AMOUNTS PAYABLE Amounts payable after more than one year Financial debts Advance payments on contracts in progress Current portion of amounts payable after more than one year falling due within one year Taxes Other amounts payable Accruals and deferred income TOTAL LIABILITIES Remuneration and social security Other amounts payable Amounts payable within one year Financial debts Credit institutions Other loans Trade debts Suppliers Bills of exchange payable Advance payments on contracts in progress Taxes, remuneration and social security 17/49 17 176 178/9 42/48 42 43 430/8 439 44 440/4 441 46 45 450/3 454/9 47/48 492/3 10/49 33.768.903,97 33.768.903,97 14.998.662,82 15.299.168,82 3.053.374,33 48.087,06 3.005.287,27 417.698,00 40.242.926,49 39.375.415,04 32.918.970,37 32.918.970,37 11.722.065,46 11.722.065,46 18.270.369,71 2.429.298,11 33.325,78 2.395.972,33 497.237,09 Notes 170/4 14.998.662,82 6.9 6.9 6.9 6.9 Subordinated loans Unsubordinated debentures Leasing and other similar obligations Credit institutions Other loans Trade debts Suppliers Bills of exchange payable 170 171 172 173 174 175 1750 1751 7/40

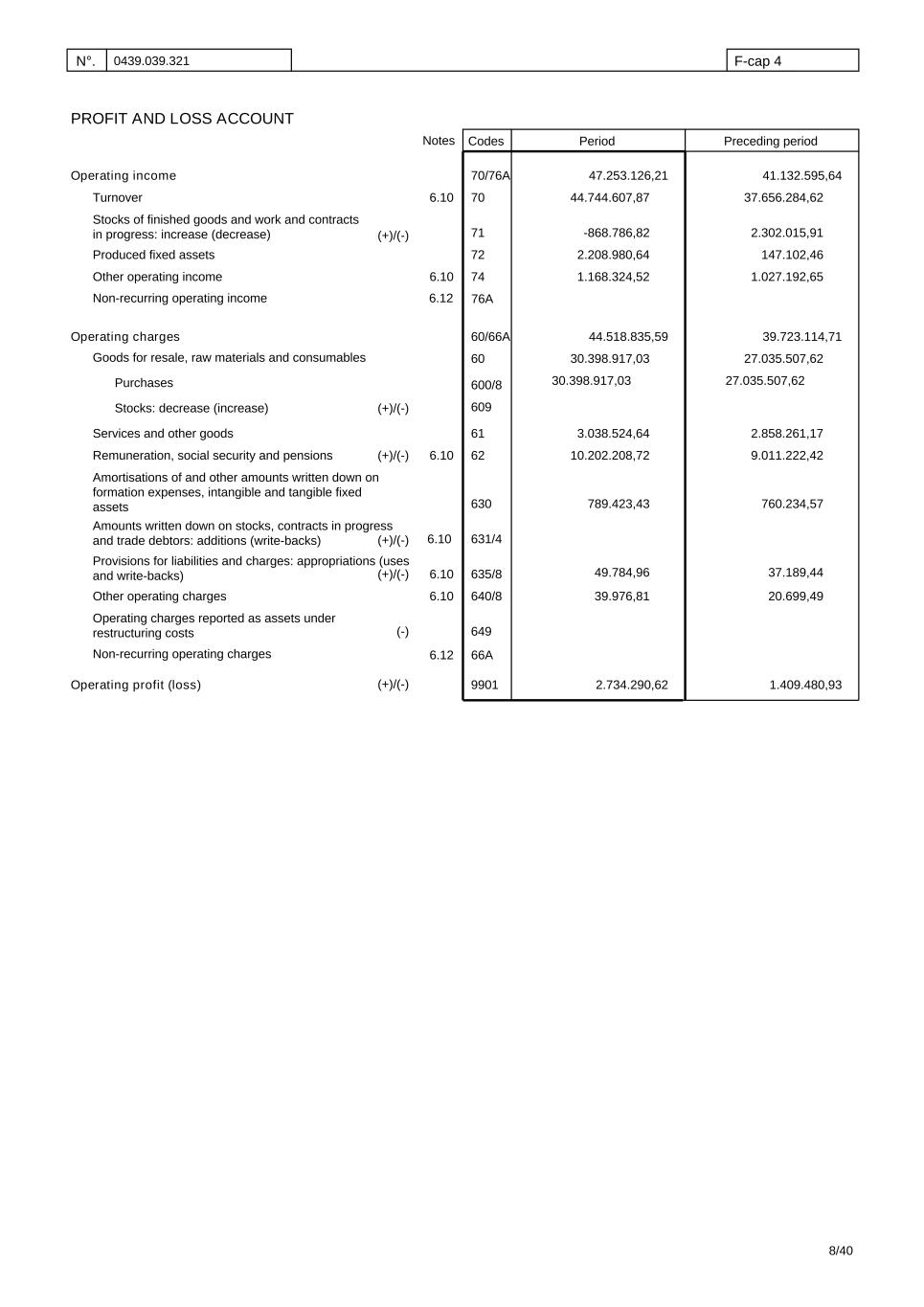

N°. 0439.039.321 F-cap 4 PROFIT AND LOSS ACCOUNT Codes Period Preceding period Operating charges Operating income Turnover Produced fixed assets Other operating income Goods for resale, raw materials and consumables Purchases Stocks: decrease (increase) Services and other goods Remuneration, social security and pensions Amounts written down on stocks, contracts in progress and trade debtors: additions (write-backs) Other operating charges Operating charges reported as assets under restructuring costs Operating profit (loss) 6.10 Stocks of finished goods and work and contracts in progress: increase (decrease) 6.10 Amortisations of and other amounts written down on formation expenses, intangible and tangible fixed assets 6.10 Provisions for liabilities and charges: appropriations (uses and write-backs) 6.10 6.10 47.253.126,21 44.744.607,87 -868.786,82 2.208.980,64 1.168.324,52 44.518.835,59 30.398.917,03 30.398.917,03 3.038.524,64 10.202.208,72 789.423,43 39.976,81 2.734.290,62 41.132.595,64 37.656.284,62 2.302.015,91 147.102,46 1.027.192,65 39.723.114,71 27.035.507,62 27.035.507,62 2.858.261,17 9.011.222,42 760.234,57 20.699,49 1.409.480,93 70/76A 70 630 62 71 72 74 60/66A 60 600/8 609 61 631/4 635/8 640/8 649 9901 Notes Non-recurring operating income 76A 6.12 49.784,96 37.189,44 Non-recurring operating charges 66A 6.12 6.10 (+)/(-) (+)/(-) (+)/(-) (+)/(-) (+)/(-) (+)/(-) (-) 8/40

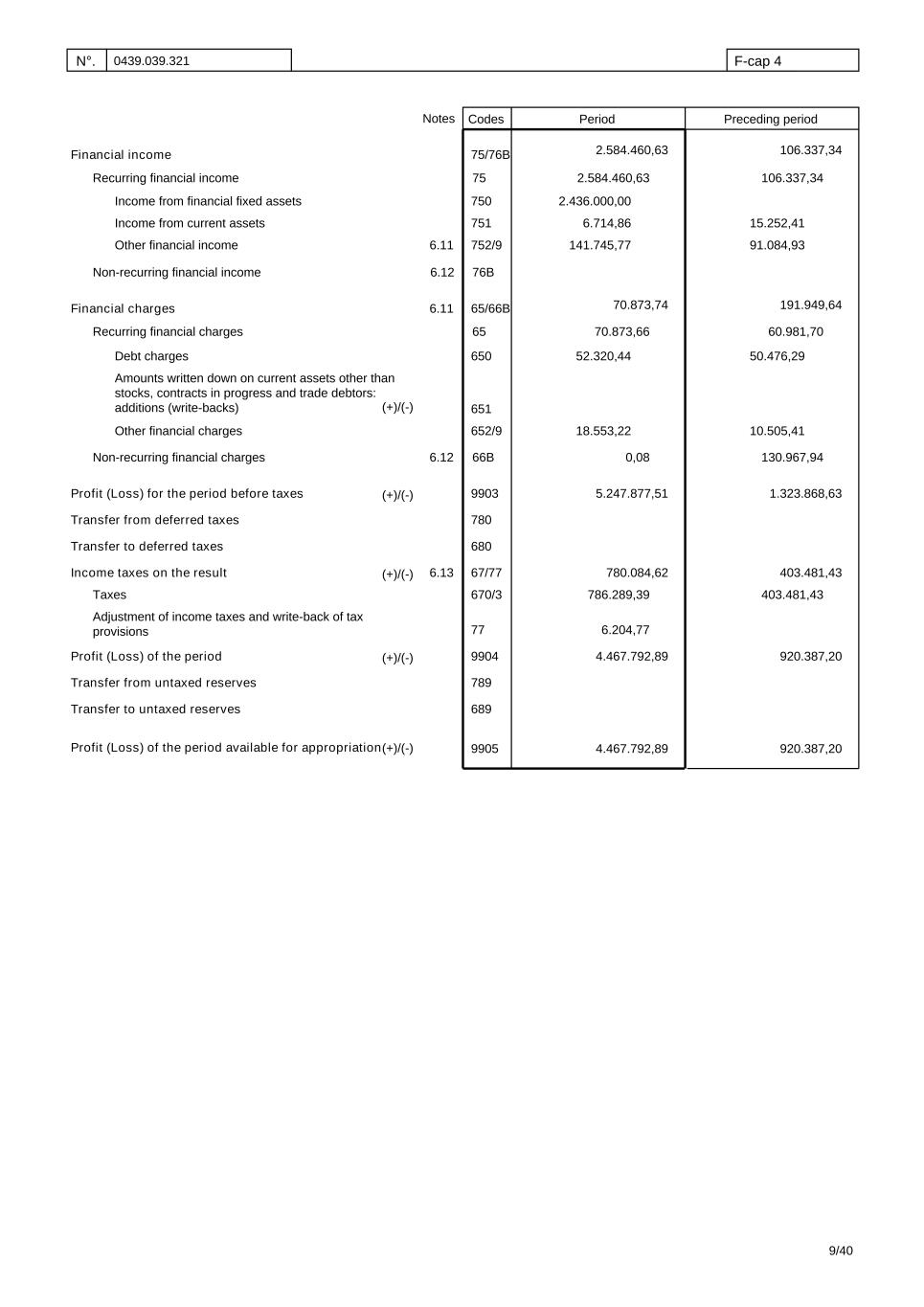

N°. 0439.039.321 F-cap 4 Codes Period Preceding period Taxes Adjustment of income taxes and write-back of tax provisions Profit (Loss) for the period before taxes Profit (Loss) of the period Transfer from deferred taxes Transfer to deferred taxes Income taxes on the result 6.13 Transfer from untaxed reserves Transfer to untaxed reserves Profit (Loss) of the period available for appropriation 5.247.877,51 780.084,62 786.289,39 6.204,77 4.467.792,89 4.467.792,89 1.323.868,63 403.481,43 403.481,43 920.387,20 920.387,209905 689 780 680 67/77 670/3 77 9904 789 9903 Notes Income from financial fixed assets Income from current assets Financial income Debt charges Amounts written down on current assets other than stocks, contracts in progress and trade debtors: additions (write-backs) Other financial charges Other financial income 6.11 Financial charges 6.11 2.436.000,00 6.714,86 141.745,77 18.553,22 52.320,44 15.252,41 91.084,93 50.476,29 10.505,41 75/76B 750 751 752/9 65/66B 650 651 652/9 2.584.460,63 106.337,34 70.873,74 191.949,64 106.337,34Recurring financial income 75 2.584.460,63 Non-recurring financial income 76B 60.981,70Recurring financial charges 65 70.873,66 130.967,94Non-recurring financial charges 66B 0,08 6.12 6.12 (+)/(-) (+)/(-) (+)/(-) (+)/(-) (+)/(-) 9/40

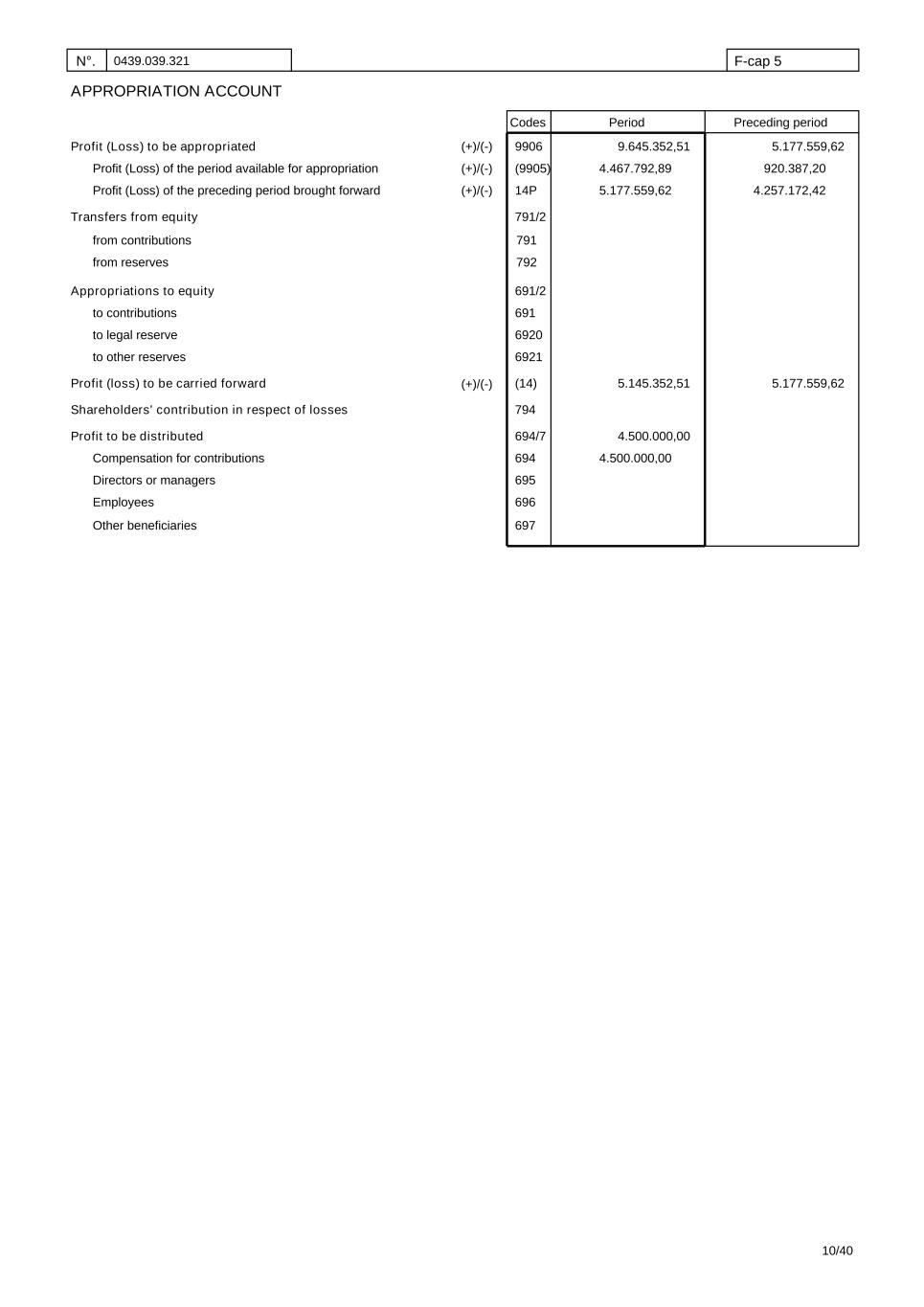

N°. 0439.039.321 F-cap 5 Codes Period Preceding period APPROPRIATION ACCOUNT Profit (Loss) of the period available for appropriation to contributions Employees to legal reserve Compensation for contributions Directors or managers Transfers from equity Appropriations to equity Profit (loss) to be carried forward Shareholders' contribution in respect of losses Profit to be distributed Profit (Loss) to be appropriated Profit (Loss) of the preceding period brought forward to other reserves 9.645.352,51 4.467.792,89 5.177.559,62 5.145.352,51 4.500.000,00 4.500.000,00 5.177.559,62 920.387,20 4.257.172,42 5.177.559,62 9906 (9905) 14P 791/2 691/2 6921 (14) 794 6920 694 696 695 694/7 691 Other beneficiaries 697 from contributions from reserves 791 792 (+)/(-) (+)/(-) (+)/(-) (+)/(-) 10/40

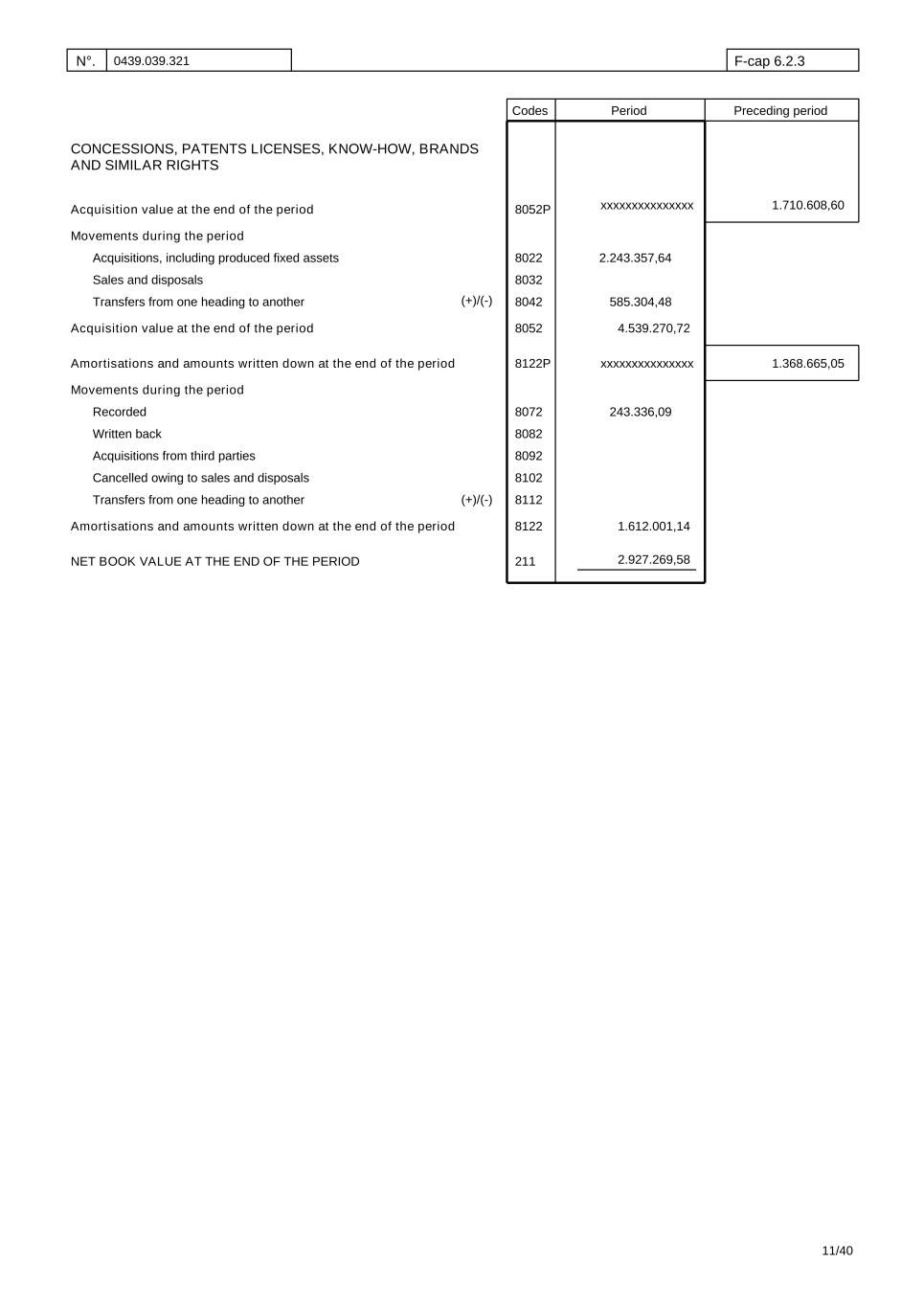

N°. 0439.039.321 F-cap 6.2.3 Codes Period Preceding period Acquisitions, including produced fixed assets Recorded Acquisition value at the end of the period Acquisition value at the end of the period Movements during the period Transfers from one heading to another CONCESSIONS, PATENTS LICENSES, KNOW-HOW, BRANDS AND SIMILAR RIGHTS Sales and disposals xxxxxxxxxxxxxxx Amortisations and amounts written down at the end of the period Written back Acquisitions from third parties Cancelled owing to sales and disposals Amortisations and amounts written down at the end of the period NET BOOK VALUE AT THE END OF THE PERIOD xxxxxxxxxxxxxxx Transfers from one heading to another Movements during the period 1.710.608,60 1.368.665,05 2.243.357,64 585.304,48 4.539.270,72 243.336,09 1.612.001,14 2.927.269,58 8032 8042 8052 8122P 8072 8052P 8022 8092 8102 8082 8122 211 8112 (+)/(-) (+)/(-) 11/40

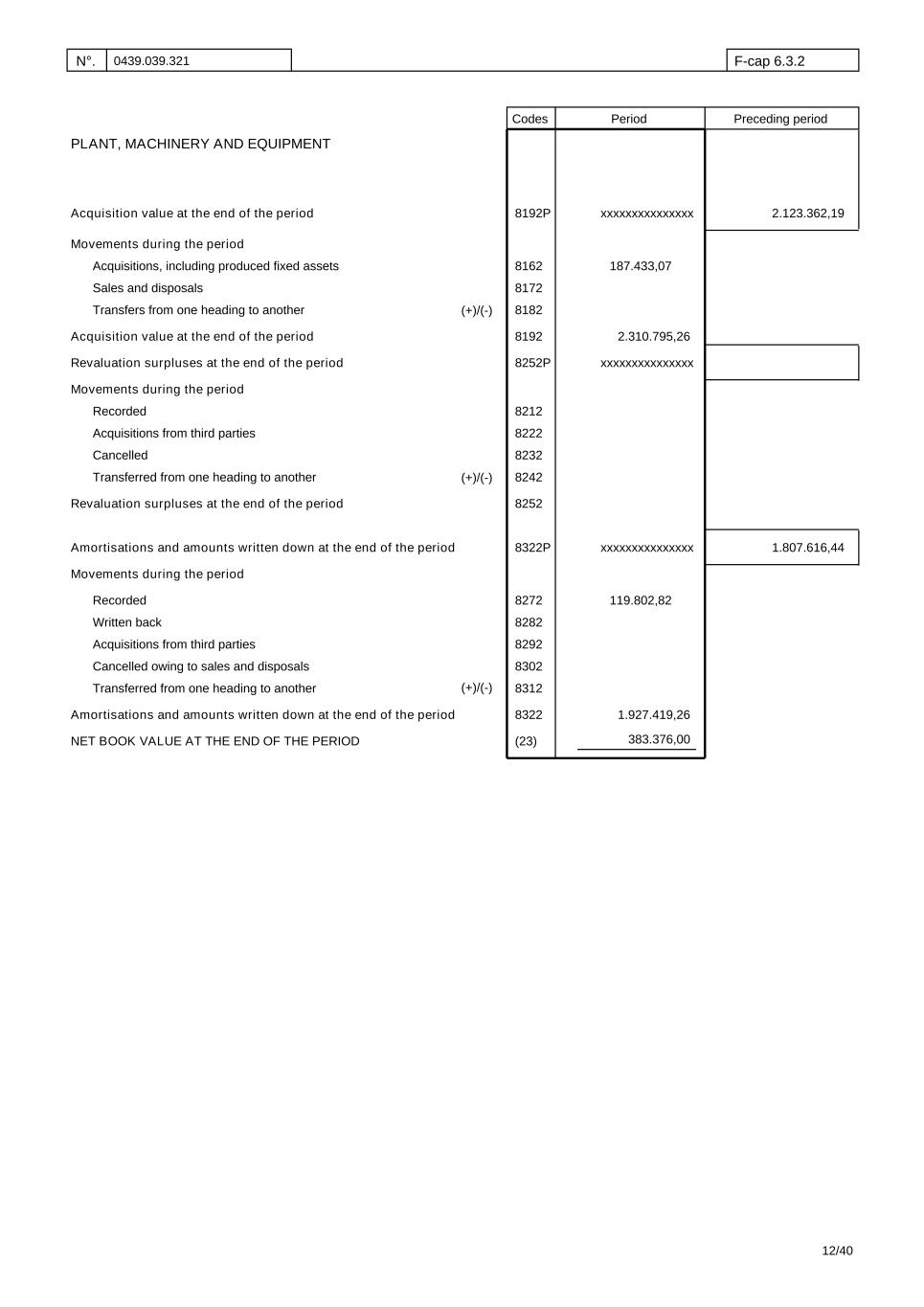

N°. 0439.039.321 F-cap 6.3.2 Codes Period Preceding period Acquisition value at the end of the period Acquisition value at the end of the period Movements during the period xxxxxxxxxxxxxxx Amortisations and amounts written down at the end of the period Amortisations and amounts written down at the end of the period NET BOOK VALUE AT THE END OF THE PERIOD xxxxxxxxxxxxxxx PLANT, MACHINERY AND EQUIPMENT Revaluation surpluses at the end of the period Movements during the period Revaluation surpluses at the end of the period Movements during the period xxxxxxxxxxxxxxx 2.123.362,19 187.433,07 2.310.795,26 119.802,82 1.927.419,26 383.376,00 1.807.616,44 8172 8182 8192 8252P 8212 8192P 8162 8232 8242 8222 8322P 8272 8252 8282 8302 8312 8292 8322 (23) Acquisitions, including produced fixed assets Transfers from one heading to another Sales and disposals Recorded Written back Acquisitions from third parties Cancelled owing to sales and disposals Transferred from one heading to another Cancelled Recorded Acquisitions from third parties Transferred from one heading to another (+)/(-) (+)/(-) (+)/(-) 12/40

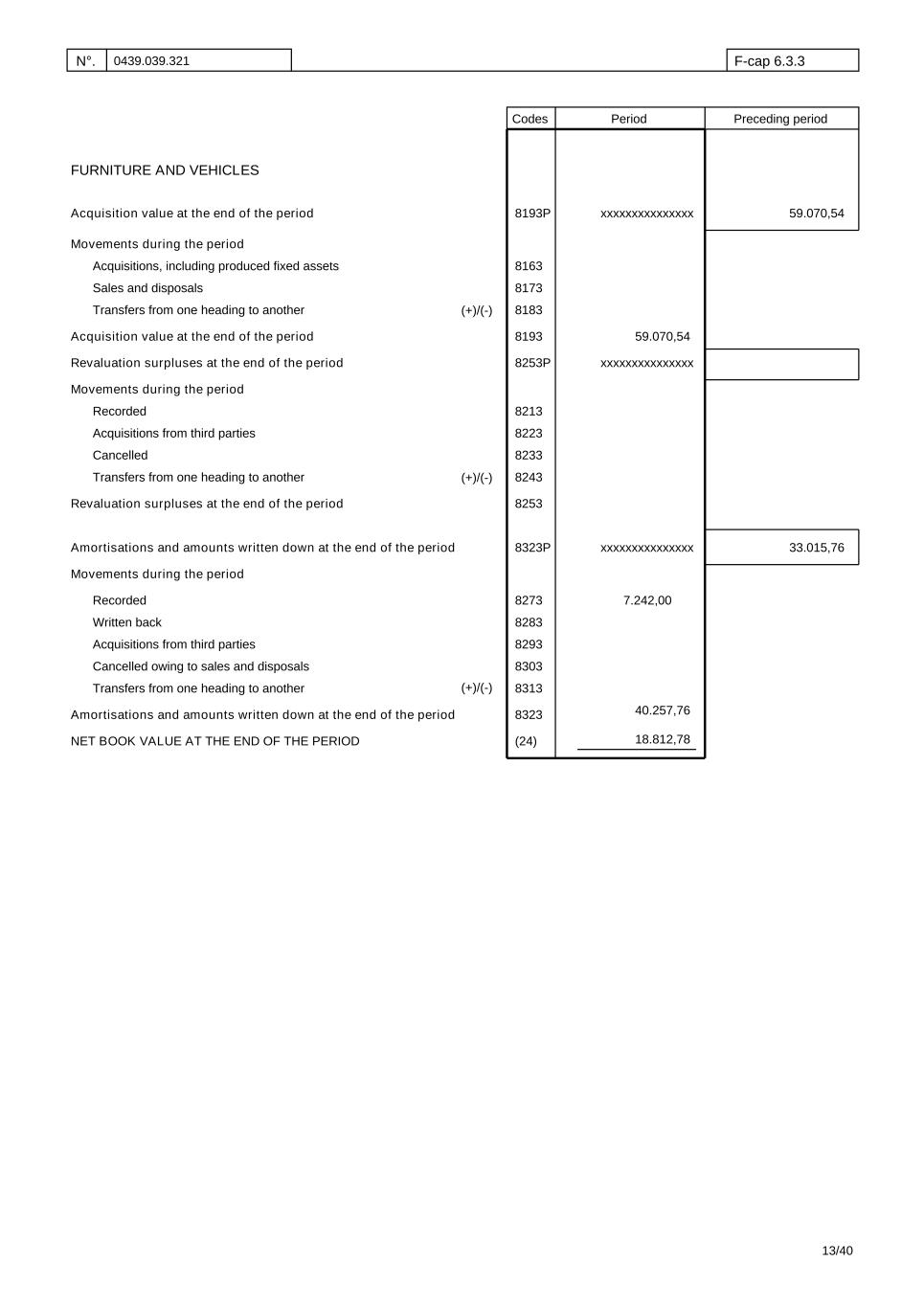

N°. 0439.039.321 F-cap 6.3.3 Codes Period Preceding period Acquisition value at the end of the period Acquisition value at the end of the period Movements during the period xxxxxxxxxxxxxxx Amortisations and amounts written down at the end of the period Amortisations and amounts written down at the end of the period NET BOOK VALUE AT THE END OF THE PERIOD xxxxxxxxxxxxxxx FURNITURE AND VEHICLES Revaluation surpluses at the end of the period Movements during the period Revaluation surpluses at the end of the period Movements during the period xxxxxxxxxxxxxxx 59.070,54 7.242,00 33.015,76 40.257,76 18.812,78 8173 8183 8193 8253P 8213 8193P 8163 8233 8243 8223 8323P 8273 8253 8283 8303 8313 8293 8323 (24) 59.070,54 Acquisitions, including produced fixed assets Transfers from one heading to another Sales and disposals Recorded Written back Acquisitions from third parties Cancelled owing to sales and disposals Transfers from one heading to another Cancelled Recorded Acquisitions from third parties Transfers from one heading to another (+)/(-) (+)/(-) (+)/(-) 13/40

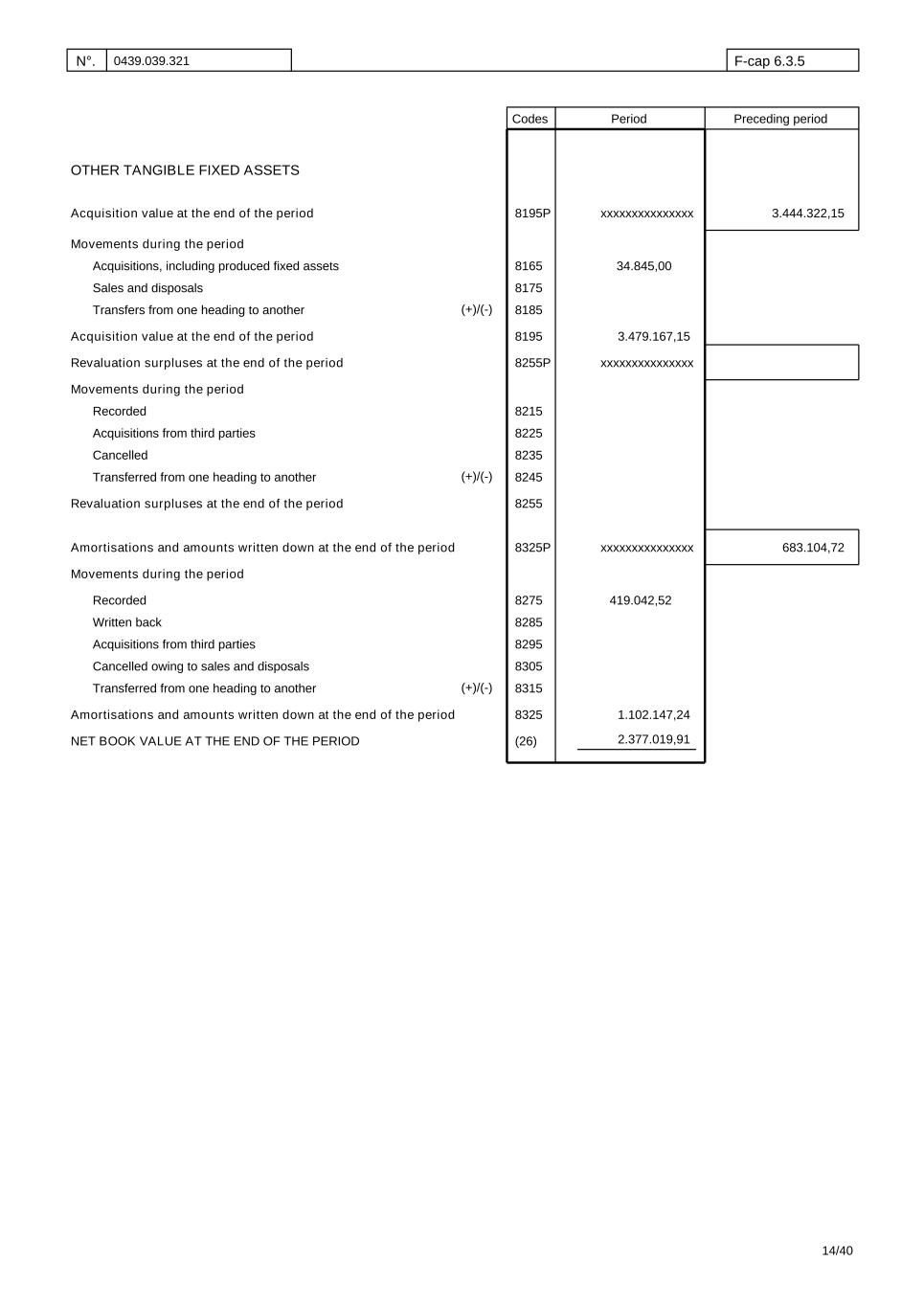

N°. 0439.039.321 F-cap 6.3.5 Codes Period Preceding period Acquisition value at the end of the period Acquisition value at the end of the period Movements during the period xxxxxxxxxxxxxxx Amortisations and amounts written down at the end of the period Amortisations and amounts written down at the end of the period NET BOOK VALUE AT THE END OF THE PERIOD xxxxxxxxxxxxxxx OTHER TANGIBLE FIXED ASSETS Revaluation surpluses at the end of the period Movements during the period Revaluation surpluses at the end of the period Movements during the period xxxxxxxxxxxxxxx 3.444.322,15 34.845,00 3.479.167,15 683.104,72 419.042,52 1.102.147,24 2.377.019,91 8175 8185 8195 8255P 8215 8195P 8165 8235 8245 8225 8325P 8275 8255 8285 8305 8315 8295 8325 (26) Acquisitions, including produced fixed assets Transfers from one heading to another Sales and disposals Recorded Written back Acquisitions from third parties Cancelled owing to sales and disposals Transferred from one heading to another Cancelled Recorded Acquisitions from third parties Transferred from one heading to another (+)/(-) (+)/(-) (+)/(-) 14/40

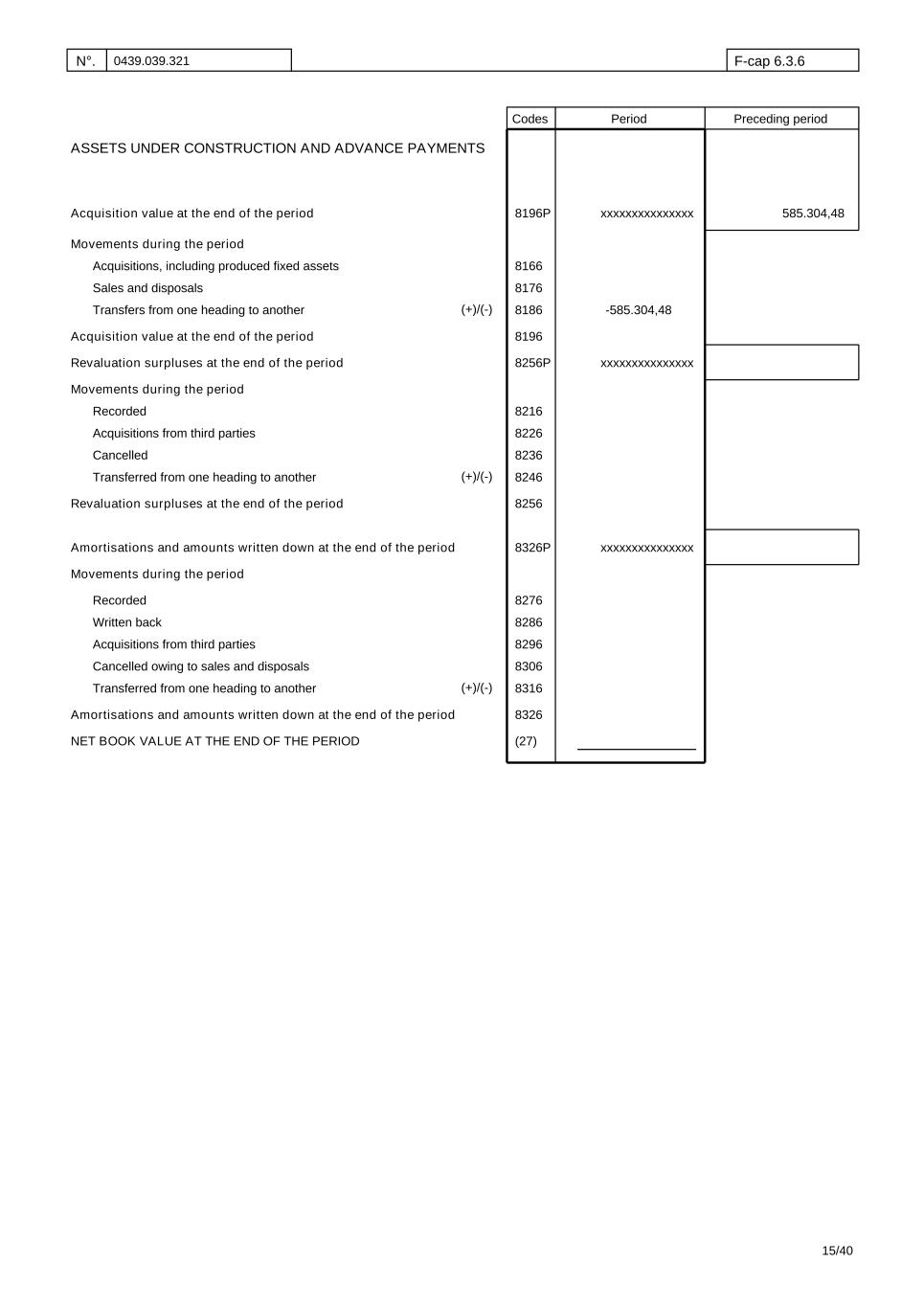

N°. 0439.039.321 F-cap 6.3.6 Codes Period Preceding period Acquisition value at the end of the period Acquisition value at the end of the period Movements during the period xxxxxxxxxxxxxxx Amortisations and amounts written down at the end of the period Amortisations and amounts written down at the end of the period NET BOOK VALUE AT THE END OF THE PERIOD xxxxxxxxxxxxxxx ASSETS UNDER CONSTRUCTION AND ADVANCE PAYMENTS Revaluation surpluses at the end of the period Movements during the period Revaluation surpluses at the end of the period Movements during the period xxxxxxxxxxxxxxx 585.304,48 -585.304,48 8176 8186 8196 8256P 8216 8196P 8166 8236 8246 8226 8326P 8276 8256 8286 8306 8316 8296 8326 (27) Acquisitions, including produced fixed assets Transfers from one heading to another Sales and disposals Recorded Written back Acquisitions from third parties Cancelled owing to sales and disposals Transferred from one heading to another Cancelled Recorded Acquisitions from third parties Transferred from one heading to another (+)/(-) (+)/(-) (+)/(-) 15/40

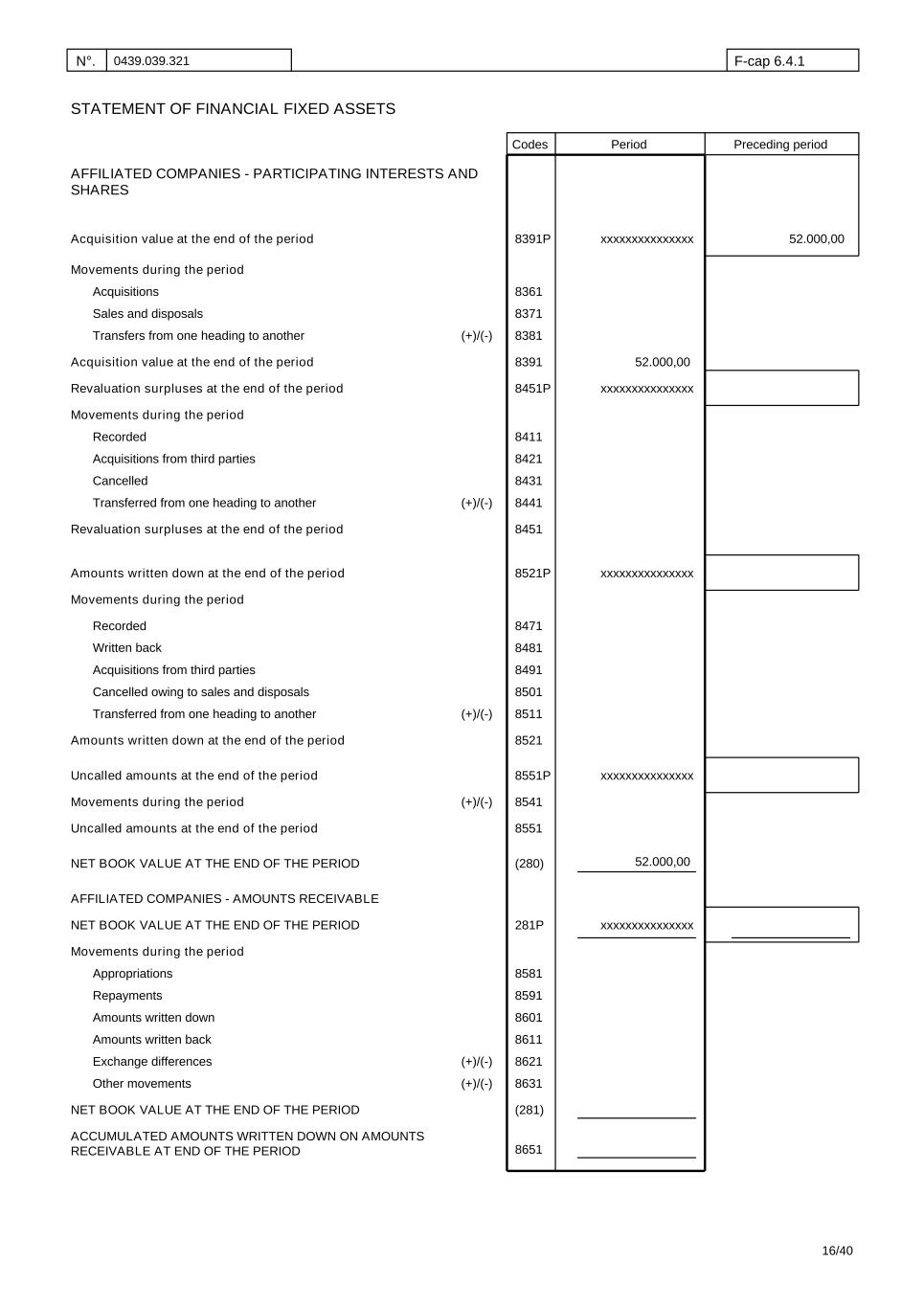

N°. 0439.039.321 F-cap 6.4.1 Codes Period Preceding period Acquisition value at the end of the period Acquisition value at the end of the period Movements during the period xxxxxxxxxxxxxxx Amounts written down at the end of the period Amounts written down at the end of the period xxxxxxxxxxxxxxx AFFILIATED COMPANIES - PARTICIPATING INTERESTS AND SHARES Revaluation surpluses at the end of the period Movements during the period Revaluation surpluses at the end of the period Movements during the period xxxxxxxxxxxxxxx STATEMENT OF FINANCIAL FIXED ASSETS Uncalled amounts at the end of the period Movements during the period Uncalled amounts at the end of the period NET BOOK VALUE AT THE END OF THE PERIOD AFFILIATED COMPANIES - AMOUNTS RECEIVABLE NET BOOK VALUE AT THE END OF THE PERIOD Movements during the period Appropriations Repayments Amounts written down Amounts written back Exchange differences Other movements NET BOOK VALUE AT THE END OF THE PERIOD ACCUMULATED AMOUNTS WRITTEN DOWN ON AMOUNTS RECEIVABLE AT END OF THE PERIOD xxxxxxxxxxxxxxx xxxxxxxxxxxxxxx 52.000,00 52.000,00 52.000,00 8371 8381 8391 8451P 8411 8391P 8361 8431 8441 8421 8521P 8471 8451 8481 8501 8511 8491 8521 8551P 8541 8581 8601 8611 8591 8621 8631 8551 (280) 281P (281) 8651 Acquisitions Transfers from one heading to another Sales and disposals Recorded Written back Acquisitions from third parties Cancelled owing to sales and disposals Transferred from one heading to another Cancelled Recorded Acquisitions from third parties Transferred from one heading to another (+)/(-) (+)/(-) (+)/(-) (+)/(-) (+)/(-) (+)/(-) 16/40

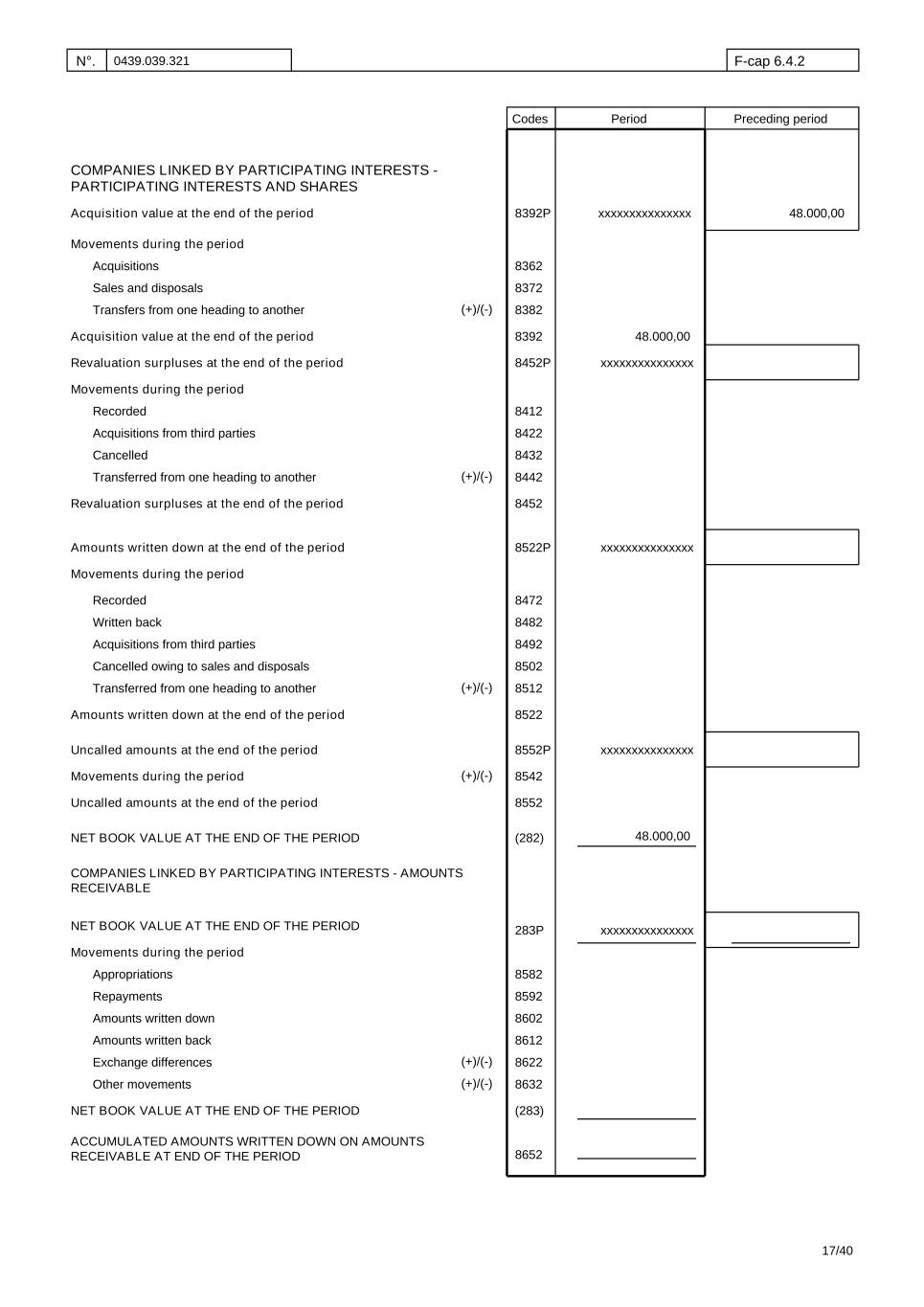

N°. 0439.039.321 F-cap 6.4.2 Codes Period Preceding period Acquisition value at the end of the period Acquisition value at the end of the period Movements during the period xxxxxxxxxxxxxxx Amounts written down at the end of the period Amounts written down at the end of the period xxxxxxxxxxxxxxx COMPANIES LINKED BY PARTICIPATING INTERESTS - PARTICIPATING INTERESTS AND SHARES Revaluation surpluses at the end of the period Movements during the period Revaluation surpluses at the end of the period Movements during the period xxxxxxxxxxxxxxx Uncalled amounts at the end of the period Movements during the period Uncalled amounts at the end of the period NET BOOK VALUE AT THE END OF THE PERIOD COMPANIES LINKED BY PARTICIPATING INTERESTS - AMOUNTS RECEIVABLE NET BOOK VALUE AT THE END OF THE PERIOD Movements during the period NET BOOK VALUE AT THE END OF THE PERIOD ACCUMULATED AMOUNTS WRITTEN DOWN ON AMOUNTS RECEIVABLE AT END OF THE PERIOD xxxxxxxxxxxxxxx xxxxxxxxxxxxxxx 48.000,00 48.000,00 48.000,00 8372 8382 8392 8452P 8412 8392P 8362 8432 8442 8422 8522P 8472 8452 8482 8502 8512 8492 8522 8552P 8542 8582 8602 8612 8592 8622 8632 8552 (282) 283P (283) 8652 Acquisitions Transfers from one heading to another Sales and disposals Recorded Written back Acquisitions from third parties Cancelled owing to sales and disposals Transferred from one heading to another Cancelled Recorded Acquisitions from third parties Transferred from one heading to another Appropriations Repayments Amounts written down Amounts written back Exchange differences Other movements (+)/(-) (+)/(-) (+)/(-) (+)/(-) (+)/(-) (+)/(-) 17/40

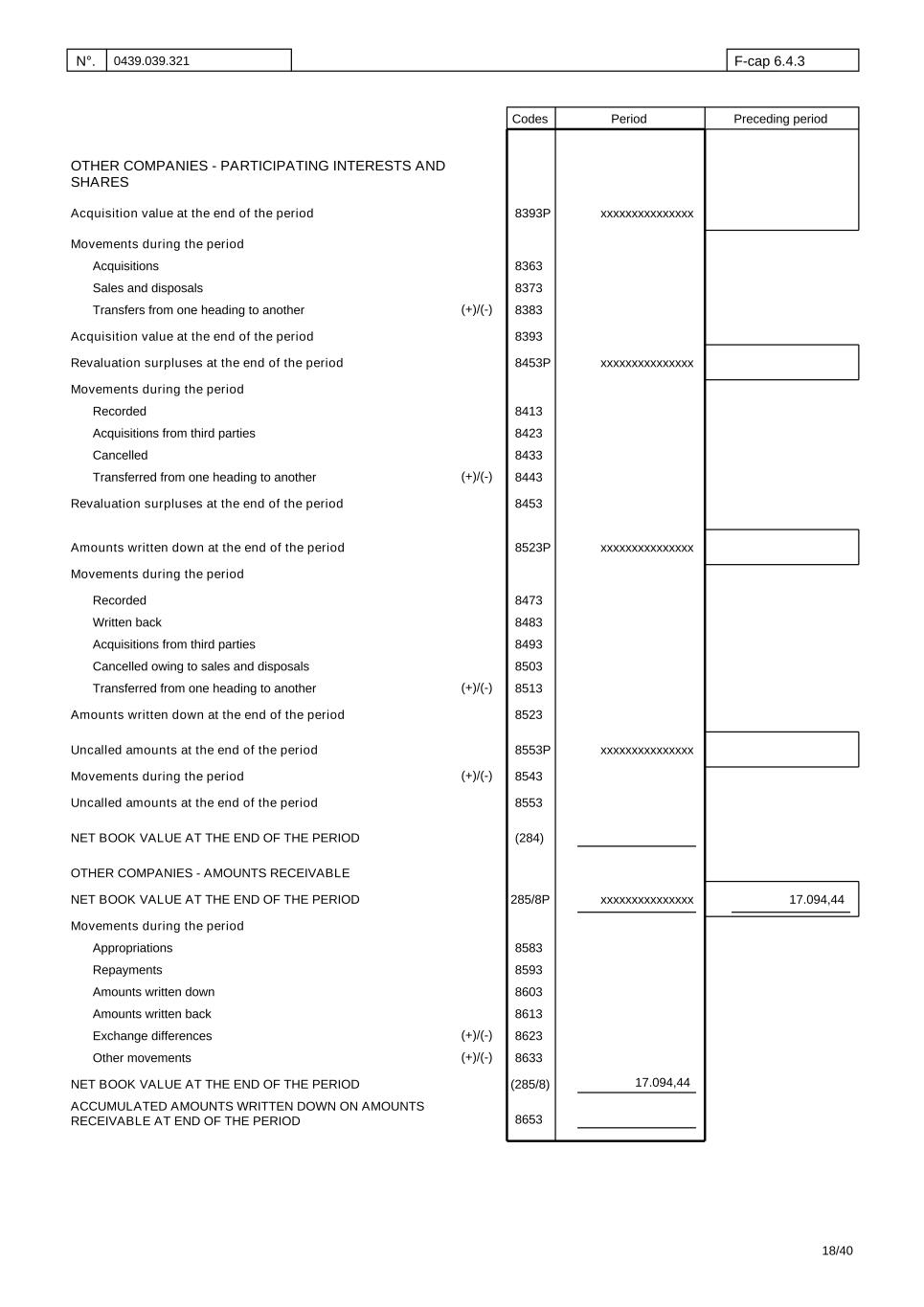

N°. 0439.039.321 F-cap 6.4.3 Codes Period Preceding period Acquisition value at the end of the period Acquisition value at the end of the period Movements during the period xxxxxxxxxxxxxxx Amounts written down at the end of the period Amounts written down at the end of the period xxxxxxxxxxxxxxx OTHER COMPANIES - PARTICIPATING INTERESTS AND SHARES Revaluation surpluses at the end of the period Movements during the period Revaluation surpluses at the end of the period Movements during the period xxxxxxxxxxxxxxx Uncalled amounts at the end of the period Movements during the period Uncalled amounts at the end of the period NET BOOK VALUE AT THE END OF THE PERIOD OTHER COMPANIES - AMOUNTS RECEIVABLE NET BOOK VALUE AT THE END OF THE PERIOD Movements during the period NET BOOK VALUE AT THE END OF THE PERIOD ACCUMULATED AMOUNTS WRITTEN DOWN ON AMOUNTS RECEIVABLE AT END OF THE PERIOD xxxxxxxxxxxxxxx xxxxxxxxxxxxxxx 17.094,44 17.094,44 8373 8383 8393 8453P 8413 8393P 8363 8433 8443 8423 8523P 8473 8453 8483 8503 8513 8493 8523 8553P 8543 8583 8603 8613 8593 8623 8633 8553 (284) 285/8P (285/8) 8653 Acquisitions Transfers from one heading to another Sales and disposals Recorded Written back Acquisitions from third parties Cancelled owing to sales and disposals Transferred from one heading to another Cancelled Recorded Acquisitions from third parties Transferred from one heading to another Appropriations Repayments Amounts written down Amounts written back Exchange differences Other movements (+)/(-) (+)/(-) (+)/(-) (+)/(-) (+)/(-) (+)/(-) 18/40

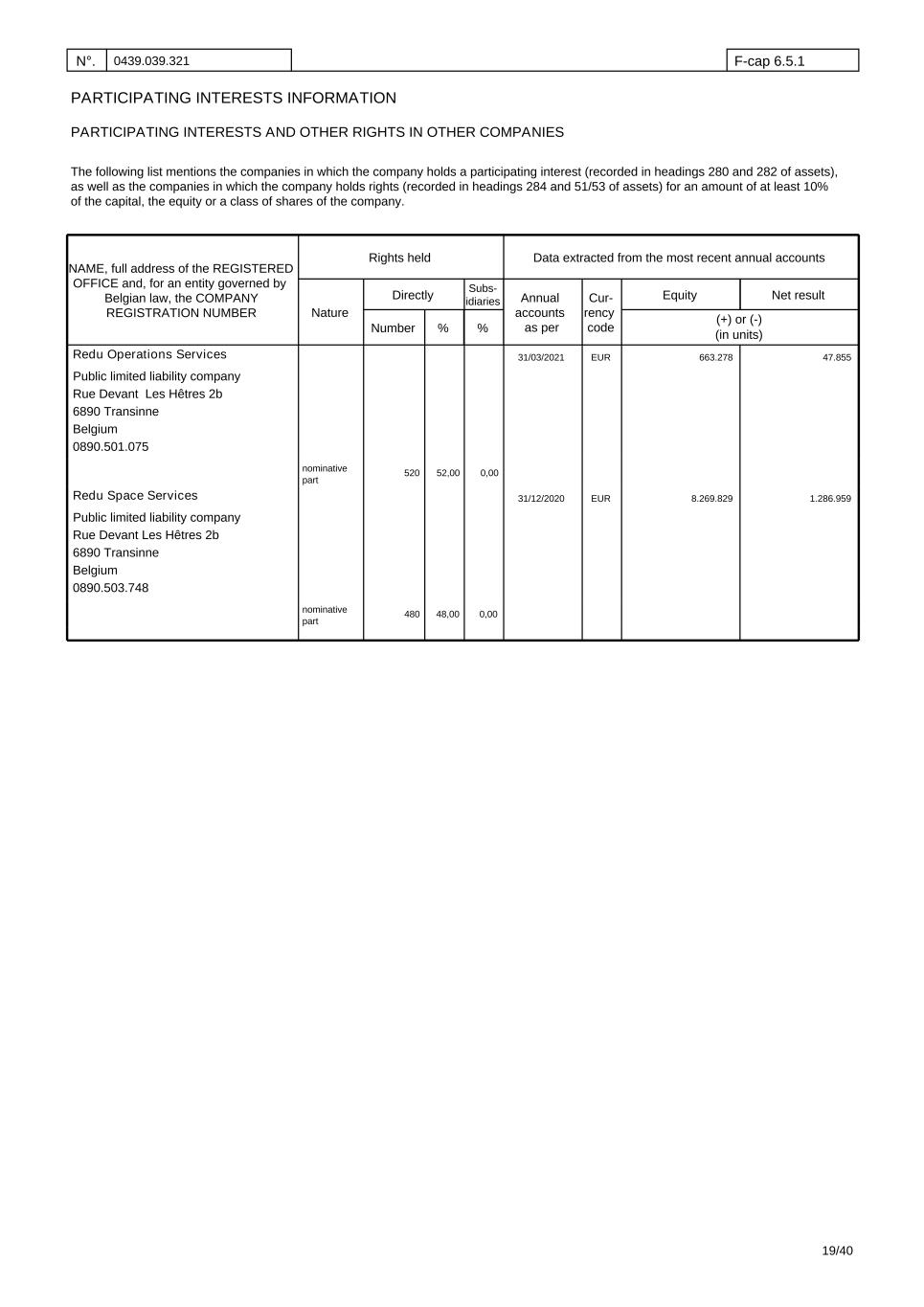

N°. 0439.039.321 F-cap 6.5.1 PARTICIPATING INTERESTS AND OTHER RIGHTS IN OTHER COMPANIES PARTICIPATING INTERESTS INFORMATION The following list mentions the companies in which the company holds a participating interest (recorded in headings 280 and 282 of assets), as well as the companies in which the company holds rights (recorded in headings 284 and 51/53 of assets) for an amount of at least 10% of the capital, the equity or a class of shares of the company. NAME, full address of the REGISTERED OFFICE and, for an entity governed by Belgian law, the COMPANY REGISTRATION NUMBER Rights held Directly Subs- idiaries Number % % Data extracted from the most recent annual accounts Annual accounts as per Cur- rency code Equity Net result (in units) (+) or (-) Nature Redu Operations Services 663.27831/03/2021 EUR 47.855 Rue Devant Les Hêtres 2b 6890 Transinne Belgium 0890.501.075 Public limited liability company nominative part 520 52,00 0,00 Redu Space Services 31/12/2020 EUR 8.269.829 1.286.959 Rue Devant Les Hêtres 2b 6890 Transinne Belgium 0890.503.748 Public limited liability company nominative part 480 48,00 0,00 19/40

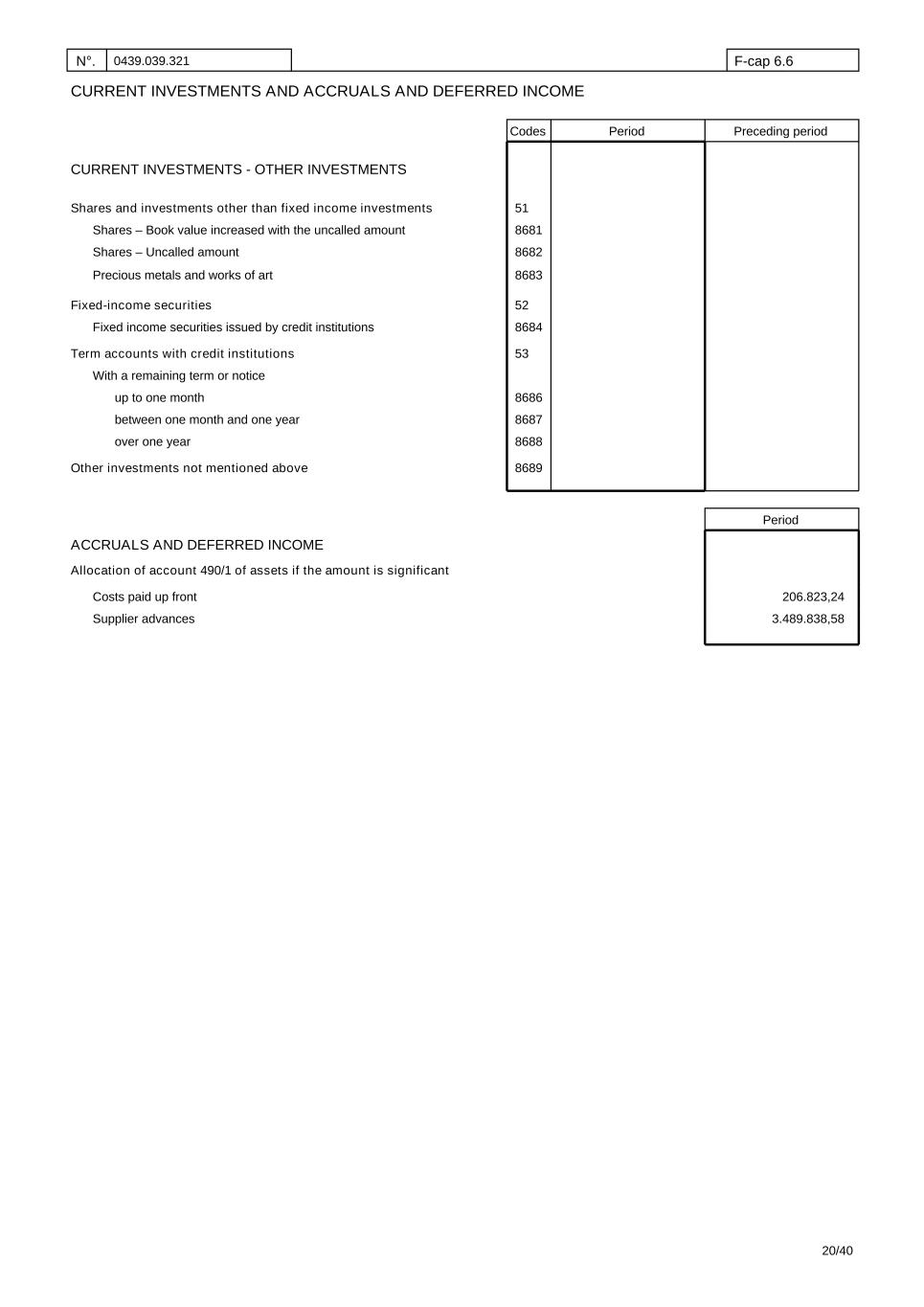

N°. 0439.039.321 F-cap 6.6 CURRENT INVESTMENTS AND ACCRUALS AND DEFERRED INCOME Codes Period Preceding period Shares – Book value increased with the uncalled amount With a remaining term or notice Shares and investments other than fixed income investments Fixed-income securities Fixed income securities issued by credit institutions CURRENT INVESTMENTS - OTHER INVESTMENTS Shares – Uncalled amount Term accounts with credit institutions up to one month over one year between one month and one year Other investments not mentioned above 8681 8682 52 8684 51 53 8686 8687 8688 8689 Precious metals and works of art 8683 Allocation of account 490/1 of assets if the amount is significant ACCRUALS AND DEFERRED INCOME Period Costs paid up front 206.823,24 Supplier advances 3.489.838,58 20/40

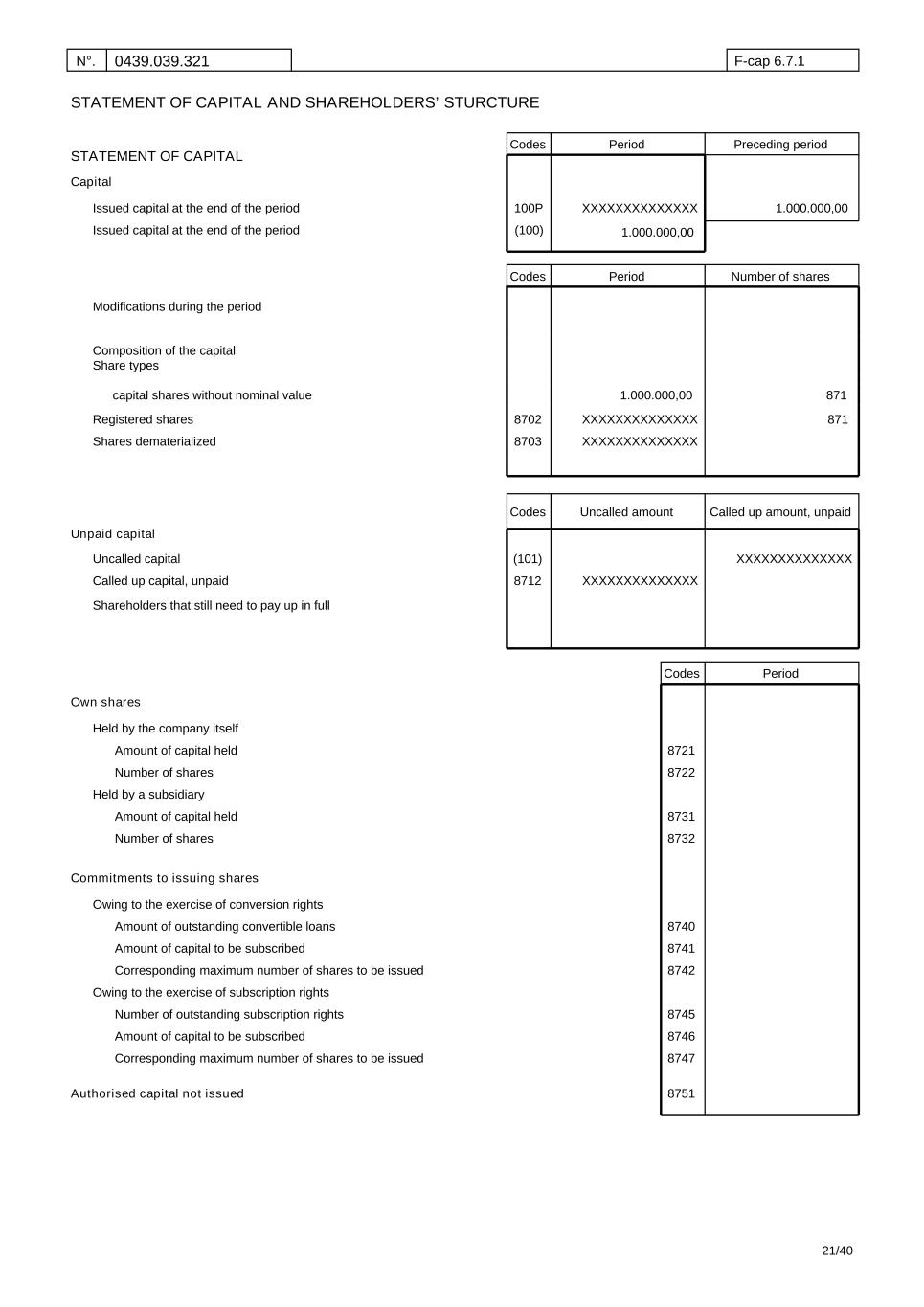

N°. F-cap 6.7.1 0439.039.321 STATEMENT OF CAPITAL Capital Codes Period Preceding period Issued capital at the end of the period Issued capital at the end of the period 100P (100) XXXXXXXXXXXXXX 1.000.000,00 1.000.000,00 STATEMENT OF CAPITAL AND SHAREHOLDERS’ STURCTURE Codes Period Number of shares Modifications during the period Composition of the capital Share types capital shares without nominal value 1.000.000,00 871 8702 8703 XXXXXXXXXXXXXX 871 XXXXXXXXXXXXXX Registered shares Shares dematerialized Uncalled amount Called up amount, unpaid Unpaid capital Codes Uncalled capital Called up capital, unpaid (101) 8712 XXXXXXXXXXXXXX XXXXXXXXXXXXXX Shareholders that still need to pay up in full Own shares Period Held by the company itself Amount of capital held Number of shares Held by a subsidiary Codes 8722 8731 8732 8721 Amount of capital held Number of shares Commitments to issuing shares Owing to the exercise of conversion rights Amount of outstanding convertible loans Amount of capital to be subscribed 8741 8740 Corresponding maximum number of shares to be issued 8742 Owing to the exercise of subscription rights Number of outstanding subscription rights 8746 8745 8747 Authorised capital not issued 8751 Amount of capital to be subscribed Corresponding maximum number of shares to be issued 21/40

N°. F-cap 6.7.1 0439.039.321 Shares issued, non-representing capital Period Distribution Number of shares Number of voting rights attached thereto Allocation by shareholder Number of shares held by the company itself Number of shares held by its subsidiaries Codes 8762 8771 8781 8761 Period ADDITIONAL NOTES REGARDING CONTRIBUTIONS (INCLUDING CONTRIBUTIONS IN THE FORM OF SERVICES OR KNOW-HOW) 22/40

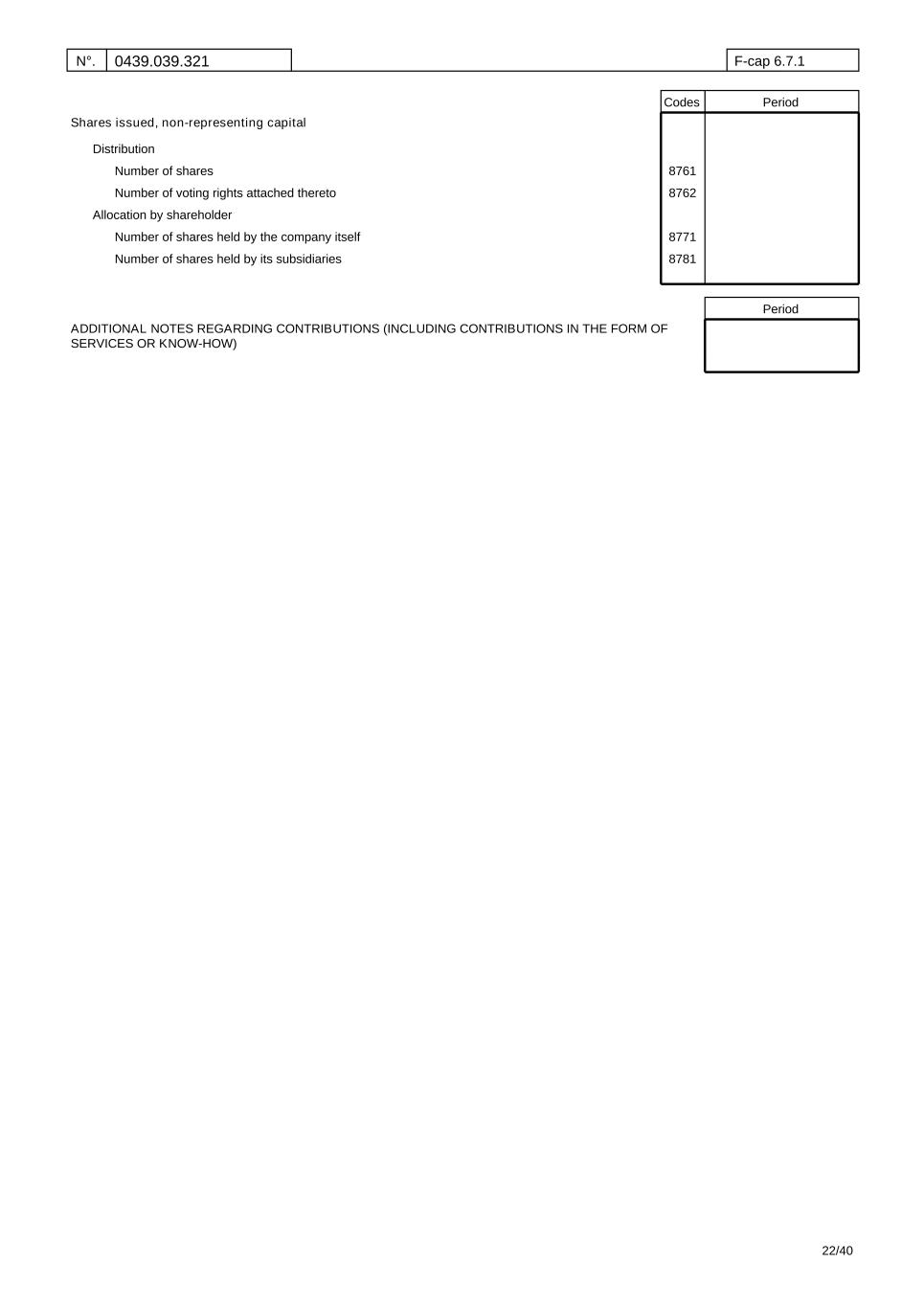

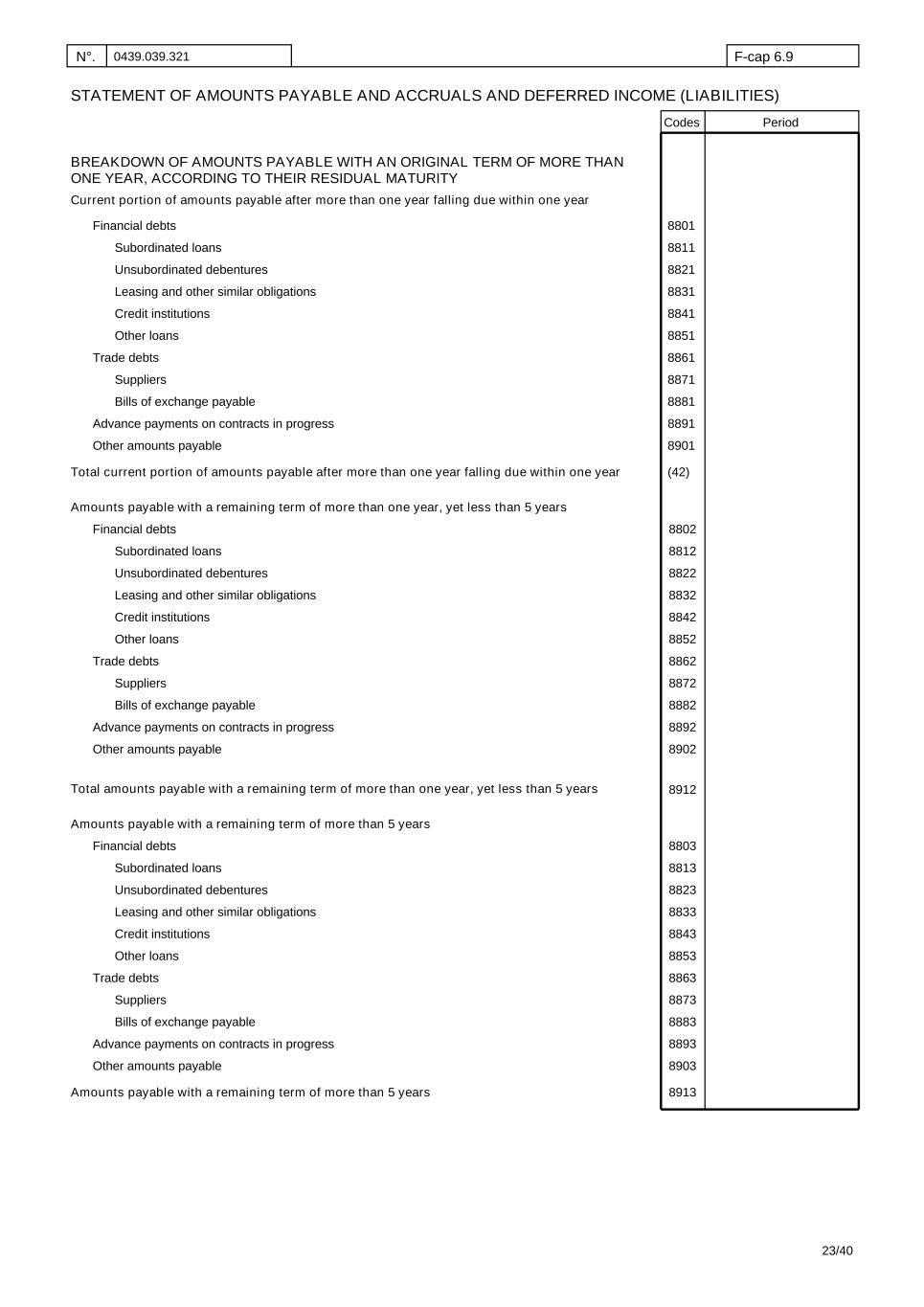

N°. 0439.039.321 F-cap 6.9 Codes Period STATEMENT OF AMOUNTS PAYABLE AND ACCRUALS AND DEFERRED INCOME (LIABILITIES) Leasing and other similar obligations Advance payments on contracts in progress Other loans Suppliers Bills of exchange payable Total current portion of amounts payable after more than one year falling due within one year Trade debts . Amounts payable with a remaining term of more than one year, yet less than 5 years Financial debts Subordinated loans Unsubordinated debentures Total amounts payable with a remaining term of more than one year, yet less than 5 years Amounts payable with a remaining term of more than 5 years BREAKDOWN OF AMOUNTS PAYABLE WITH AN ORIGINAL TERM OF MORE THAN ONE YEAR, ACCORDING TO THEIR RESIDUAL MATURITY Current portion of amounts payable after more than one year falling due within one year Credit institutions Other amounts payable Amounts payable with a remaining term of more than 5 years 8811 8821 8831 8841 8801 8851 8861 8871 8881 8891 (42) 8901 8802 8812 8822 8832 8842 8852 8862 8872 8882 8892 8902 8912 8803 8813 8823 8833 8843 8853 8863 8873 8883 8893 8903 8913 Leasing and other similar obligations Advance payments on contracts in progress Other loans Suppliers Bills of exchange payable Trade debts . Financial debts Subordinated loans Unsubordinated debentures Credit institutions Other amounts payable Leasing and other similar obligations Advance payments on contracts in progress Other loans Suppliers Bills of exchange payable Trade debts . Financial debts Subordinated loans Unsubordinated debentures Credit institutions Other amounts payable 23/40

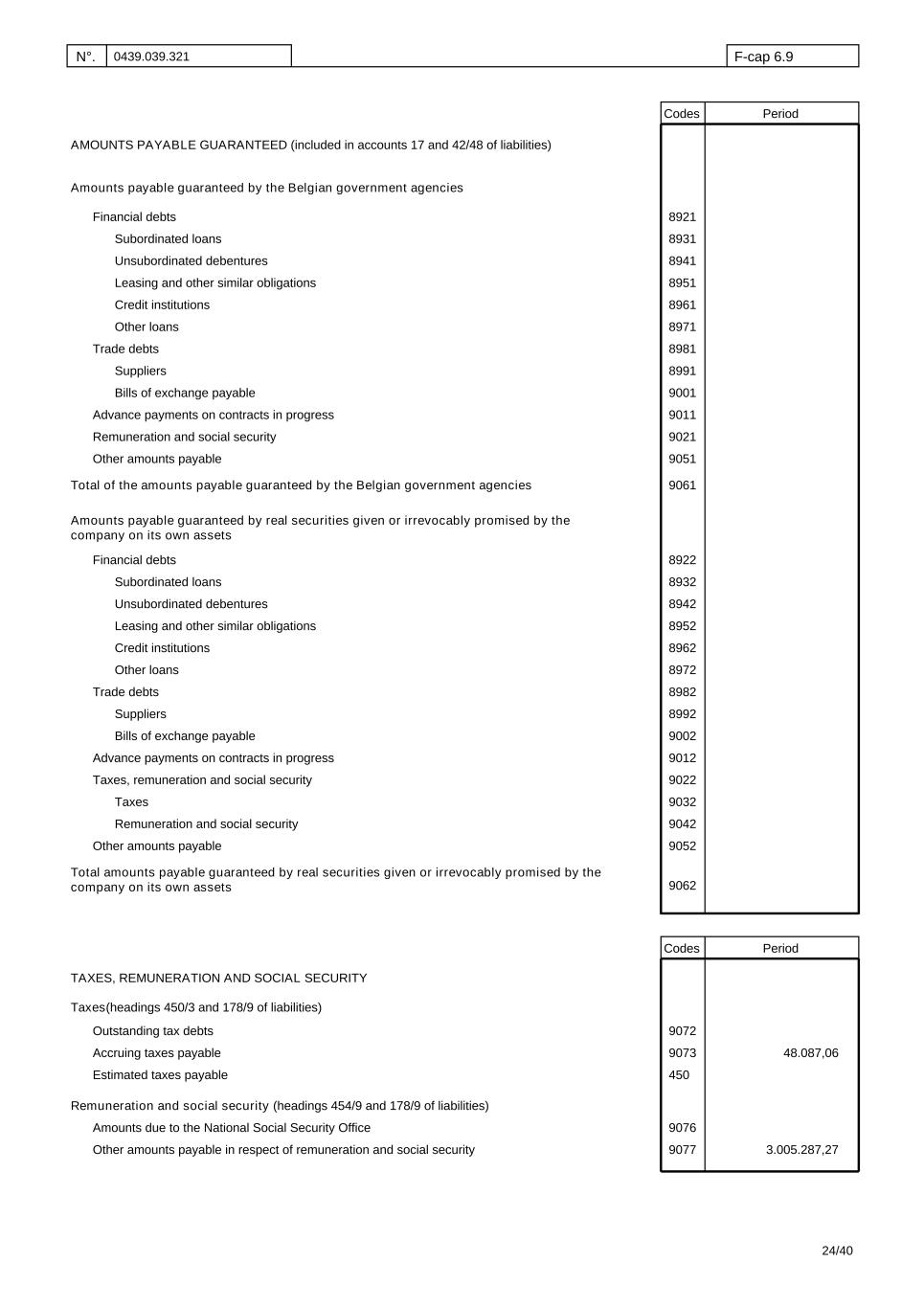

N°. 0439.039.321 F-cap 6.9 Codes Period Total of the amounts payable guaranteed by the Belgian government agencies Amounts payable guaranteed by real securities given or irrevocably promised by the company on its own assets Taxes AMOUNTS PAYABLE GUARANTEED Amounts payable guaranteed by the Belgian government agencies (included in accounts 17 and 42/48 of liabilities) Remuneration and social security Total amounts payable guaranteed by real securities given or irrevocably promised by the company on its own assets TAXES, REMUNERATION AND SOCIAL SECURITY (headings 450/3 and 178/9 of liabilities) Outstanding tax debts Accruing taxes payable Estimated taxes payable Remuneration and social security (headings 454/9 and 178/9 of liabilities) Amounts due to the National Social Security Office Other amounts payable in respect of remuneration and social security 48.087,06 3.005.287,27 8931 8941 8951 8961 8921 8971 8981 8991 9001 9011 9051 9021 9061 8922 8932 8942 8952 8962 8972 8982 8992 9002 9022 9062 9012 9072 9073 450 9076 9077 9052 Taxes Remuneration and social security 9042 9032 Leasing and other similar obligations Advance payments on contracts in progress Other loans Suppliers Bills of exchange payable Trade debts Financial debts Subordinated loans Unsubordinated debentures Credit institutions Other amounts payable Taxes, remuneration and social security Leasing and other similar obligations Advance payments on contracts in progress Other loans Suppliers Bills of exchange payable Trade debts . Financial debts Subordinated loans Unsubordinated debentures Credit institutions Other amounts payable Codes Period 24/40

N°. 0439.039.321 F-cap 6.9 Period Allocation of heading 492/3 of liabilities if the amount is significant ACCRUALS AND DEFERRED INCOME 25/40

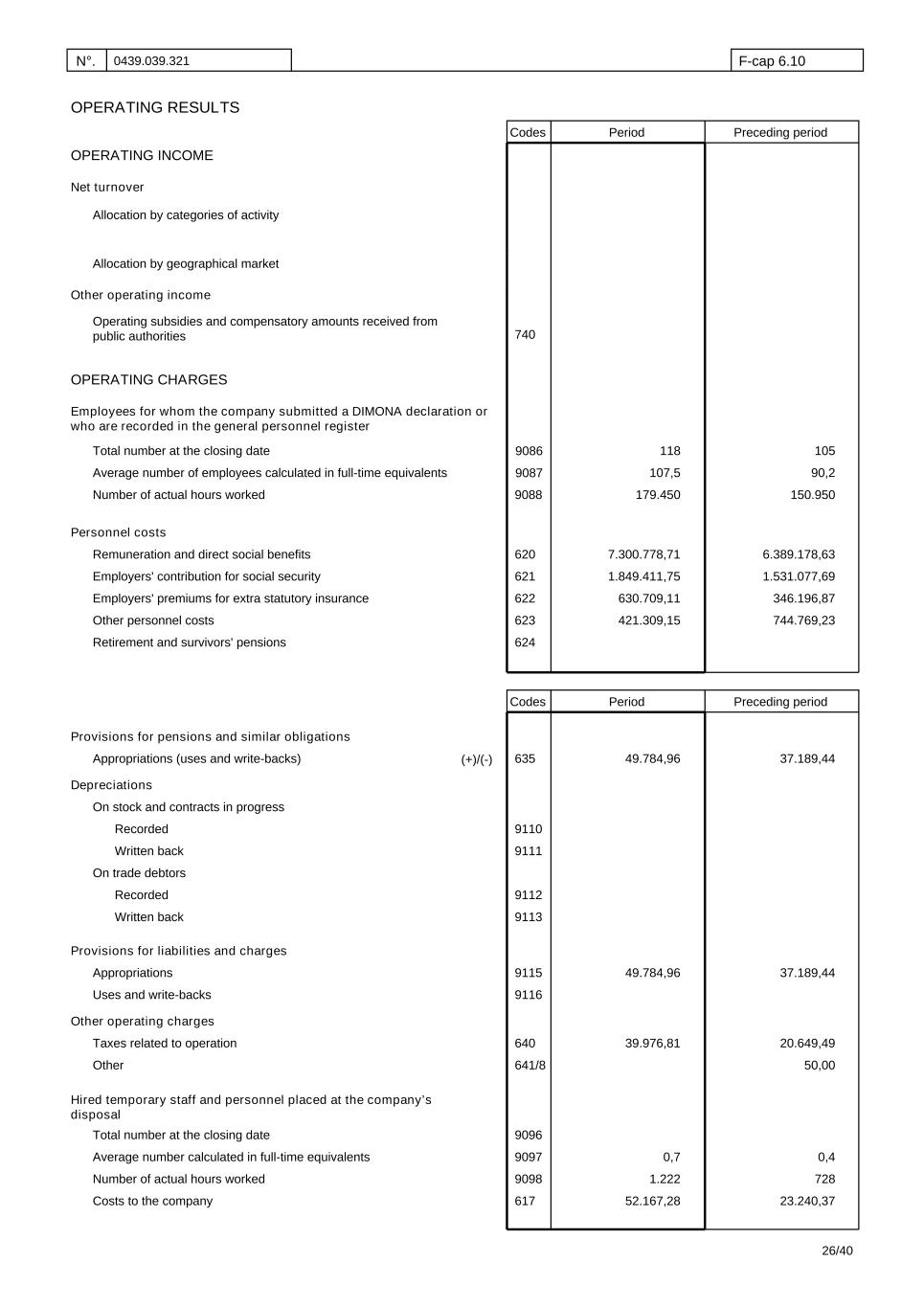

N°. 0439.039.321 F-cap 6.10 Codes Period Preceding period OPERATING RESULTS OPERATING INCOME Net turnover Allocation by categories of activity Allocation by geographical market Operating subsidies and compensatory amounts received from public authorities 740 Other operating income OPERATING CHARGES Employees for whom the company submitted a DIMONA declaration or who are recorded in the general personnel register Total number at the closing date Average number of employees calculated in full-time equivalents Number of actual hours worked 118 107,5 179.450 105 150.950 90,2 9088 9087 9086 Remuneration and direct social benefits Employers' contribution for social security Personnel costs Employers' premiums for extra statutory insurance Other personnel costs Retirement and survivors' pensions 7.300.778,71 1.849.411,75 630.709,11 421.309,15 6.389.178,63 1.531.077,69 346.196,87 744.769,23 620 621 622 623 624 Appropriations (uses and write-backs) On stock and contracts in progress Provisions for pensions and similar obligations Recorded Written back Depreciations On trade debtors 49.784,96 37.189,44635 9110 9111 9112 9113 Recorded Written back Codes Period Preceding period Other Provisions for liabilities and charges Appropriations Uses and write-backs Other operating charges Taxes related to operation 49.784,96 37.189,44 39.976,81 20.649,49 50,00 9115 9116 640 641/8 Hired temporary staff and personnel placed at the company’s disposal Costs to the company 0,7 1.222 52.167,28 0,4 728 23.240,37 9096 9097 9098 617 Total number at the closing date Average number calculated in full-time equivalents Number of actual hours worked (+)/(-) 26/40

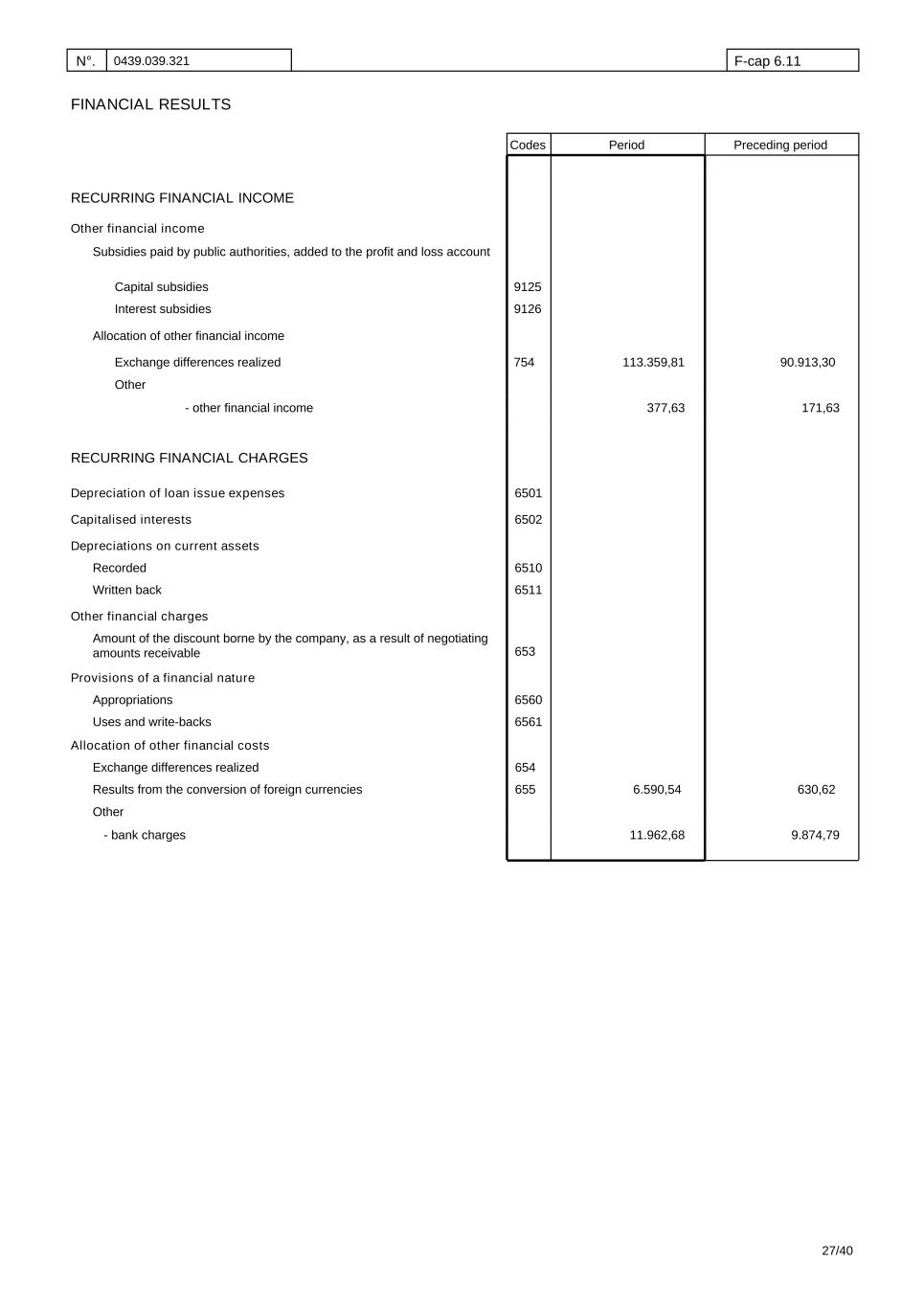

N°. 0439.039.321 F-cap 6.11 FINANCIAL RESULTS Codes Period Preceding period Other financial income RECURRING FINANCIAL INCOME Subsidies paid by public authorities, added to the profit and loss account Capital subsidies Interest subsidies 9126 9125 Allocation of other financial income Exchange differences realized 754 113.359,81 90.913,30 Other - other financial income 377,63 171,63 RECURRING FINANCIAL CHARGES Depreciation of loan issue expenses Depreciations on current assets Amount of the discount borne by the company, as a result of negotiating amounts receivable Appropriations Uses and write-backs Provisions of a financial nature Other financial charges Recorded Written back Capitalised interests 6502 6501 6511 6510 6561 6560 653 Allocation of other financial costs Exchange differences realized Results from the conversion of foreign currencies 654 655 6.590,54 630,62 Other - bank charges 11.962,68 9.874,79 27/40

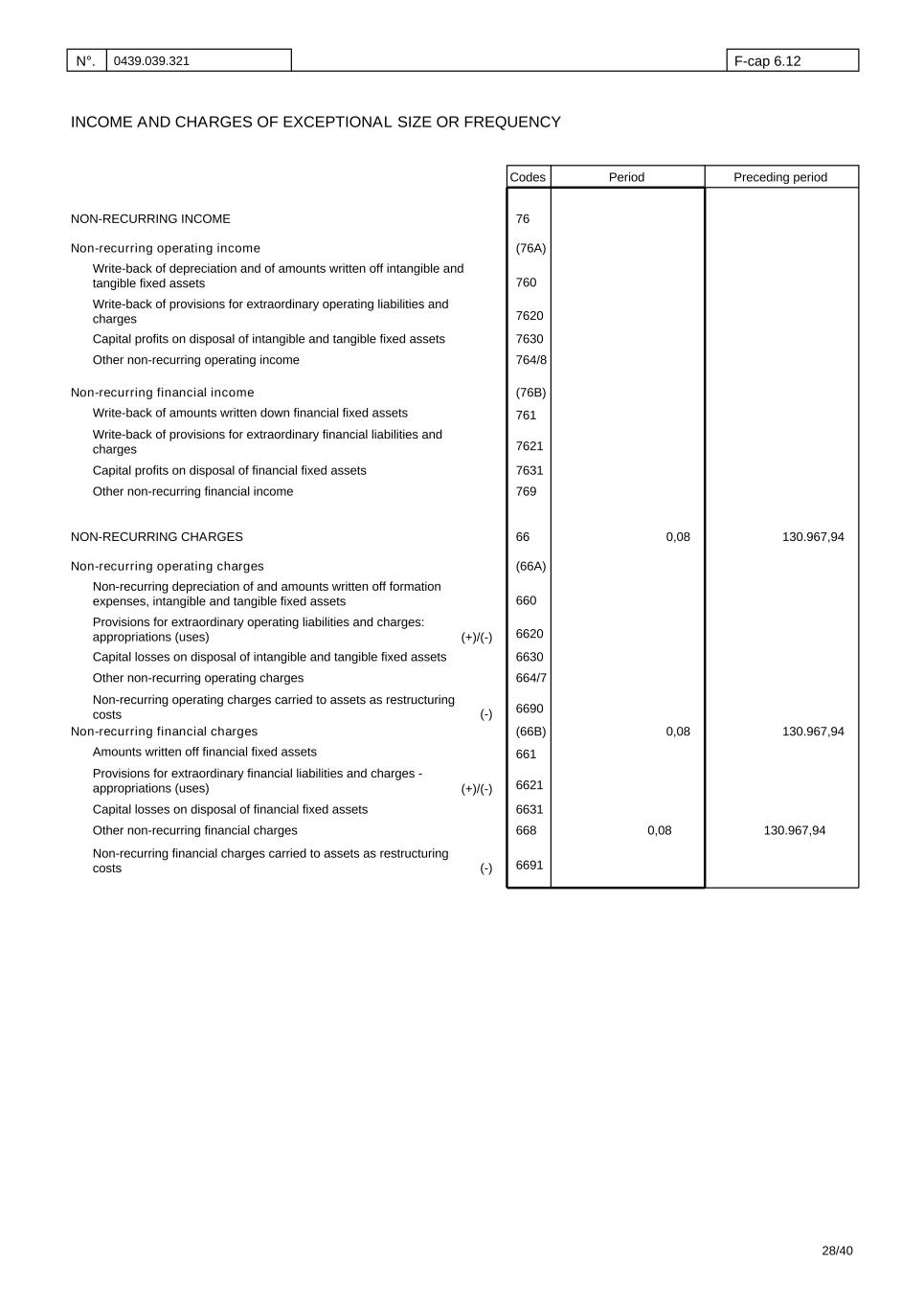

N°. 0439.039.321 F-cap 6.12 INCOME AND CHARGES OF EXCEPTIONAL SIZE OR FREQUENCY Codes Period Preceding period NON-RECURRING INCOME Write-back of depreciation and of amounts written off intangible and tangible fixed assets Write-back of provisions for extraordinary operating liabilities and charges Capital profits on disposal of intangible and tangible fixed assets 76 760 7620 7630 Non-recurring operating income (76A) Other non-recurring operating income 764/8 Write-back of amounts written down financial fixed assets Write-back of provisions for extraordinary financial liabilities and charges Capital profits on disposal of financial fixed assets 761 7621 7631 Non-recurring financial income (76B) Other non-recurring financial income 769 NON-RECURRING CHARGES Non-recurring depreciation of and amounts written off formation expenses, intangible and tangible fixed assets Provisions for extraordinary operating liabilities and charges: appropriations (uses) Capital losses on disposal of intangible and tangible fixed assets 0,08 130.967,9466 660 6620 6630 Non-recurring operating charges (66A) Other non-recurring operating charges 664/7 Amounts written off financial fixed assets Provisions for extraordinary financial liabilities and charges - appropriations (uses) Capital losses on disposal of financial fixed assets 661 6621 6631 Non-recurring financial charges 0,08 130.967,94(66B) Other non-recurring financial charges 0,08 130.967,94668 Non-recurring operating charges carried to assets as restructuring costs 6690 Non-recurring financial charges carried to assets as restructuring costs 6691 (+)/(-) (+)/(-) (-) (-) 28/40

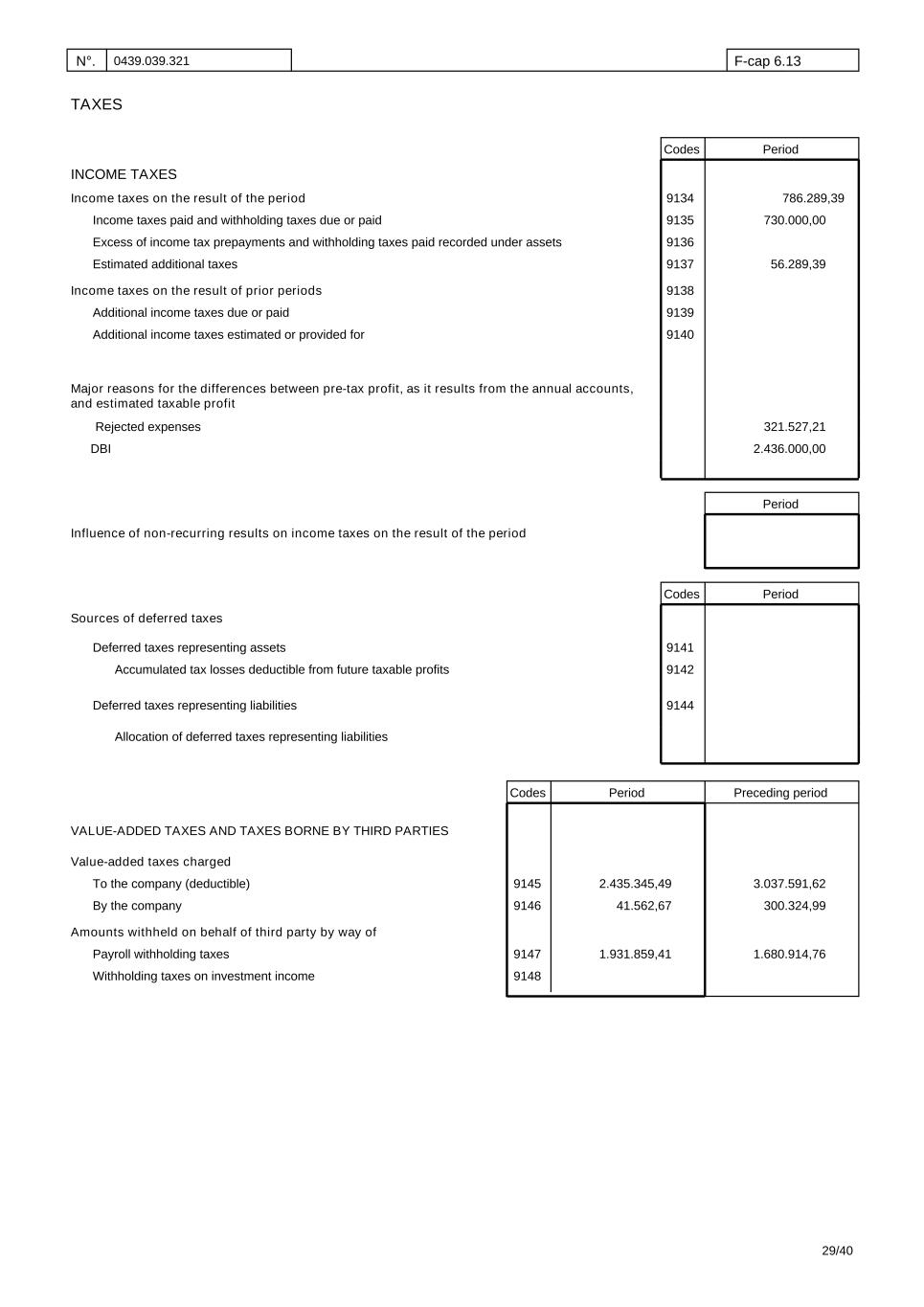

N°. 0439.039.321 F-cap 6.13 TAXES PeriodCodes INCOME TAXES Income taxes on the result of the period Income taxes paid and withholding taxes due or paid Income taxes on the result of prior periods Additional income taxes due or paid Excess of income tax prepayments and withholding taxes paid recorded under assets Estimated additional taxes Additional income taxes estimated or provided for 786.289,39 730.000,00 56.289,39 9135 9134 9137 9136 9139 9138 9140 Major reasons for the differences between pre-tax profit, as it results from the annual accounts, and estimated taxable profit Rejected expenses 321.527,21 DBI 2.436.000,00 Influence of non-recurring results on income taxes on the result of the period Period Sources of deferred taxes PeriodCodes Deferred taxes representing assets Accumulated tax losses deductible from future taxable profits 9142 9141 9144Deferred taxes representing liabilities Allocation of deferred taxes representing liabilities Codes Period Preceding period VALUE-ADDED TAXES AND TAXES BORNE BY THIRD PARTIES Value-added taxes charged To the company (deductible) By the company Amounts withheld on behalf of third party by way of Payroll withholding taxes Withholding taxes on investment income 2.435.345,49 41.562,67 3.037.591,62 300.324,99 1.931.859,41 1.680.914,76 9146 9145 9148 9147 29/40

N°. 0439.039.321 F-cap 6.14 RIGHTS AND COMMITMENTS NOT REFLECTED IN THE BALANCE SHEET Codes Period PERSONAL GUARANTEES PROVIDED OR IRREVOCABLY PROMISED BY THE COMPANY AS SECURITY FOR DEBTS AND COMMITMENTS OF THIRD PARTIES Of which Real guarantees provided or irrevocably promised by the company on its own assets as security of debts and commitments of the company Amount of registration Mortgages Book value of the immovable properties mortgaged Bills of exchange in circulation endorsed by the company REAL GUARANTEES Maximum amount up to which the debt is secured and which is the subject of registration For irrevocable mandates to pledge goodwill, the amount for which the agent can take the inscription 9150 9149 91611 91721 91621 91711 Bills of exchange in circulation drawn or guaranteed by the company 9151 Maximum amount for which other debts or commitments of third parties are guaranteed by the company 9153 For irrevocable mortgage mandates, the amount for which the agent can take registration 91631 Pledging of goodwill Pledging of other assets or irrevocable mandates to pledge other assets Book value of the immovable properties mortgaged Maximum amount up to which the debt is secured 91811 91821 Guarantees provided or irrevocably promised on future assets Amount of assets in question Maximum amount up to which the debt is secured 91911 91921 Vendor’s privilege Book value of sold goods Amount of the unpaid price 92011 92021 30/40

N°. 0439.039.321 F-cap 6.14 Real guarantees provided or irrevocably promised by the company on its own assets as security of debts and commitments of third parties Amount of registration Mortgages Book value of the immovable properties mortgaged Maximum amount up to which the debt is secured and which is the subject of registration For irrevocable mandates to pledge goodwill, the amount for which the agent can take the inscription 91612 91722 91622 91712 For irrevocable mortgage mandates, the amount for which the agent can take registration 91632 Pledging of goodwill Pledging of other assets or irrevocable mandates to pledge other assets Book value of the immovable properties mortgaged Maximum amount up to which the debt is secured 91812 91822 Guarantees provided or irrevocably promised on future assets Amount of assets in question Maximum amount up to which the debt is secured 91912 91922 Vendor’s privilege Book value of sold goods Amount of the unpaid price 92012 92022 Codes Period GOODS AND VALUES, NOT REFLECTED IN THE BALANCE SHEET, HELD BY THIRD PARTIES IN THEIR OWN NAME BUT FOR THE BENEFIT AND AT THE RISK OF THE COMPANY Codes Period SUBSTANTIAL COMMITMENTS TO ACQUIRE FIXED ASSETS SUBSTANTIAL COMMITMENTS TO DISPOSE OF FIXED ASSETS Goods purchased (to be received) FORWARD TRANSACTIONS 9213 Goods sold (to be delivered) 9214 Currencies purchased (to be received) 9215 Currencies sold (to be delivered) 9216 Period COMMITMENTS RELATING TO TECHNICAL GUARANTEES IN RESPECT OF SALES OR SERVICES Period AMOUNT, NATURE AND FORM CONCERNING LITIGATION AND OTHER IMPORTANT COMMITMENTS 31/40

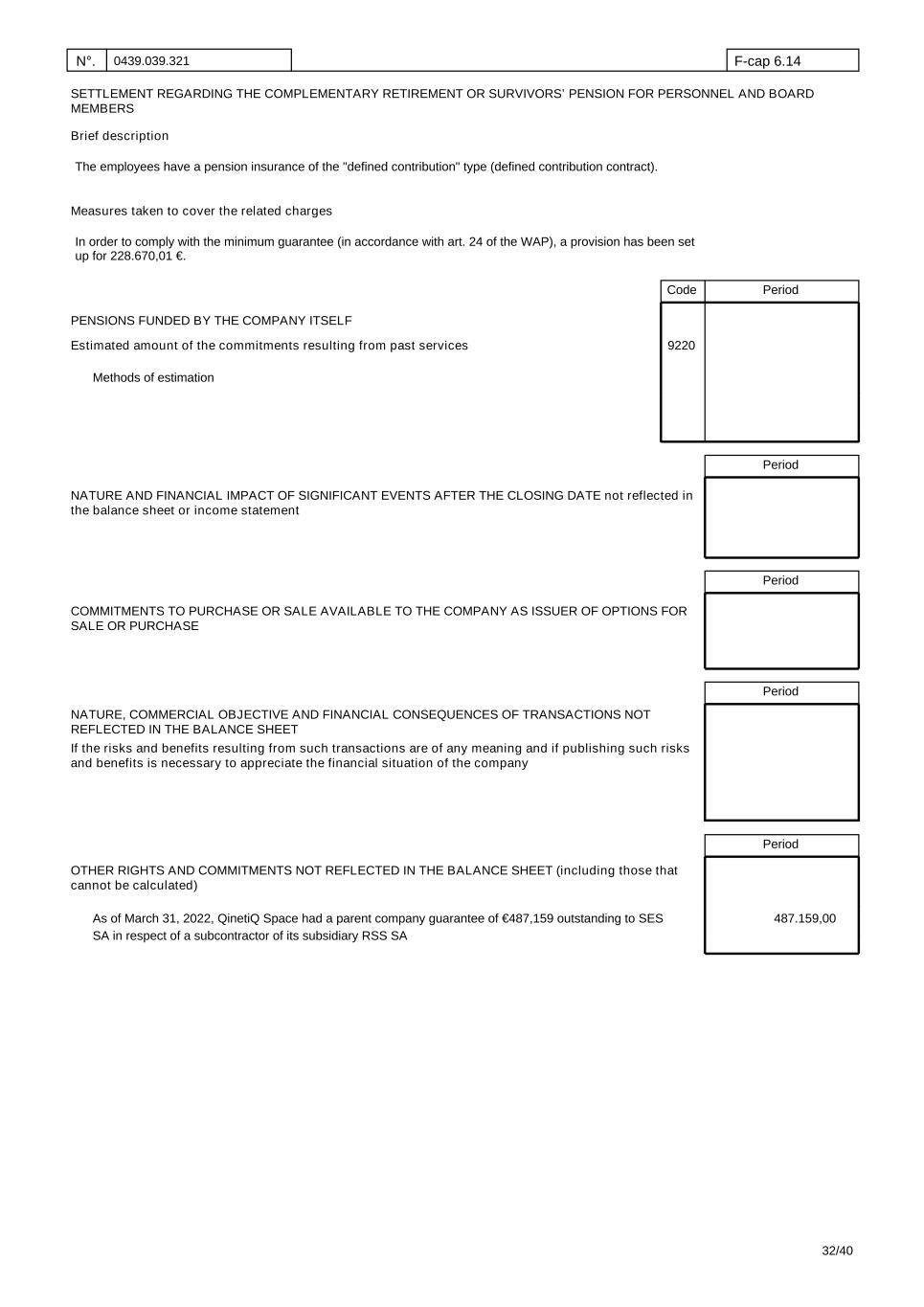

N°. 0439.039.321 F-cap 6.14 SETTLEMENT REGARDING THE COMPLEMENTARY RETIREMENT OR SURVIVORS’ PENSION FOR PERSONNEL AND BOARD MEMBERS Brief description The employees have a pension insurance of the "defined contribution" type (defined contribution contract). Measures taken to cover the related charges In order to comply with the minimum guarantee (in accordance with art. 24 of the WAP), a provision has been set up for 228.670,01 €. Code Period PENSIONS FUNDED BY THE COMPANY ITSELF Methods of estimation 9220Estimated amount of the commitments resulting from past services Period NATURE AND FINANCIAL IMPACT OF SIGNIFICANT EVENTS AFTER THE CLOSING DATE not reflected in the balance sheet or income statement Period COMMITMENTS TO PURCHASE OR SALE AVAILABLE TO THE COMPANY AS ISSUER OF OPTIONS FOR SALE OR PURCHASE Period NATURE, COMMERCIAL OBJECTIVE AND FINANCIAL CONSEQUENCES OF TRANSACTIONS NOT REFLECTED IN THE BALANCE SHEET If the risks and benefits resulting from such transactions are of any meaning and if publishing such risks and benefits is necessary to appreciate the financial situation of the company Period OTHER RIGHTS AND COMMITMENTS NOT REFLECTED IN THE BALANCE SHEET (including those that cannot be calculated) As of March 31, 2022, QinetiQ Space had a parent company guarantee of €487,159 outstanding to SES SA in respect of a subcontractor of its subsidiary RSS SA 487.159,00 32/40

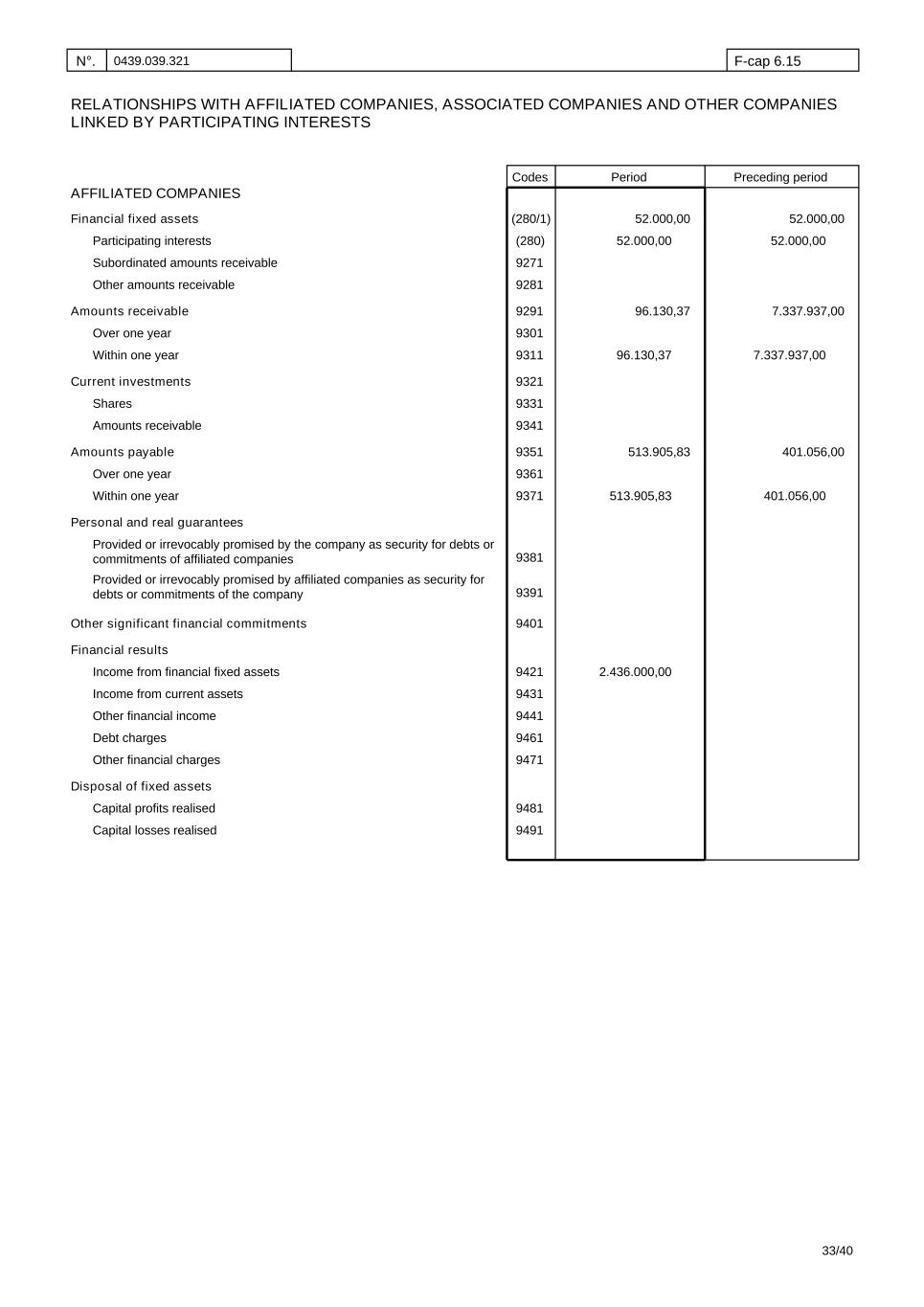

N°. 0439.039.321 F-cap 6.15 RELATIONSHIPS WITH AFFILIATED COMPANIES, ASSOCIATED COMPANIES AND OTHER COMPANIES LINKED BY PARTICIPATING INTERESTS Codes Period Preceding period AFFILIATED COMPANIES Participating interests Provided or irrevocably promised by affiliated companies as security for debts or commitments of the company Subordinated amounts receivable Financial fixed assets Other amounts receivable Amounts receivable Over one year Within one year Current investments Shares Amounts receivable Amounts payable Personal and real guarantees Provided or irrevocably promised by the company as security for debts or commitments of affiliated companies Other significant financial commitments Financial results Income from financial fixed assets Income from current assets Other financial income Debt charges Other financial charges 52.000,00 52.000,00 96.130,37 96.130,37 513.905,83 513.905,83 2.436.000,00 52.000,00 52.000,00 7.337.937,00 7.337.937,00 401.056,00 401.056,00 Disposal of fixed assets Capital profits realised Capital losses realised (280/1) (280) 9271 9281 9291 9301 9311 9321 9331 9351 9341 9361 9371 9381 9391 9401 9421 9431 9441 9461 9471 9481 9491 Over one year Within one year 33/40

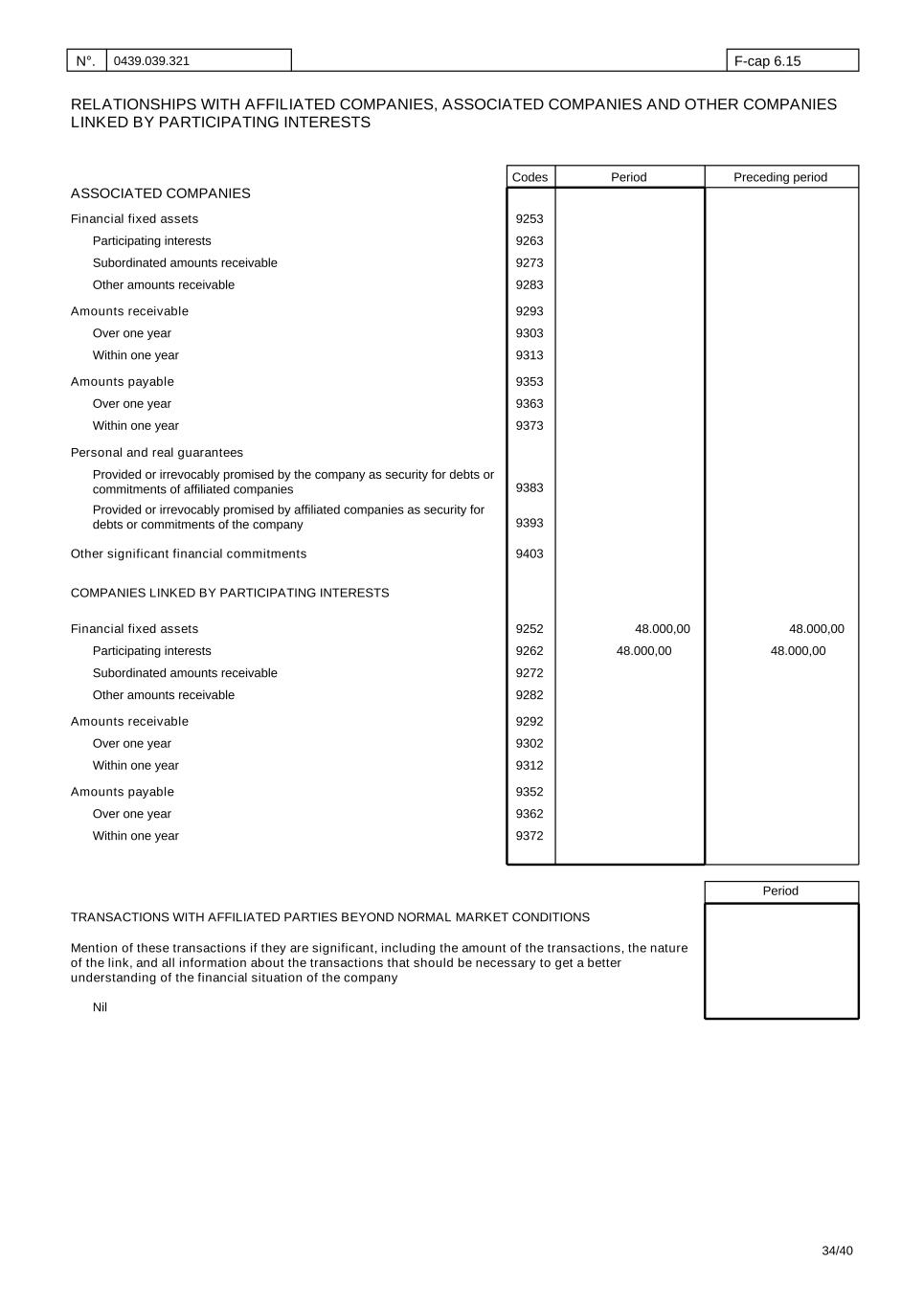

N°. 0439.039.321 F-cap 6.15 RELATIONSHIPS WITH AFFILIATED COMPANIES, ASSOCIATED COMPANIES AND OTHER COMPANIES LINKED BY PARTICIPATING INTERESTS Codes Period Preceding period ASSOCIATED COMPANIES Participating interests COMPANIES LINKED BY PARTICIPATING INTERESTS Provided or irrevocably promised by affiliated companies as security for debts or commitments of the company Subordinated amounts receivable Financial fixed assets Other amounts receivable Amounts receivable Over one year Within one year Amounts payable Over one year Within one year Personal and real guarantees Provided or irrevocably promised by the company as security for debts or commitments of affiliated companies Other significant financial commitments Financial fixed assets 48.000,00 48.000,00 48.000,00 48.000,00 9253 9263 9273 9283 9293 9303 9313 9353 9363 9373 9383 9393 9403 9262 9252 Participating interests Amounts receivable Amounts payable 9362 9372 9272 9282 9292 9302 9352 9312 Subordinated amounts receivable Other amounts receivable Over one year Within one year Over one year Within one year Period TRANSACTIONS WITH AFFILIATED PARTIES BEYOND NORMAL MARKET CONDITIONS Mention of these transactions if they are significant, including the amount of the transactions, the nature of the link, and all information about the transactions that should be necessary to get a better understanding of the financial situation of the company Nil 34/40

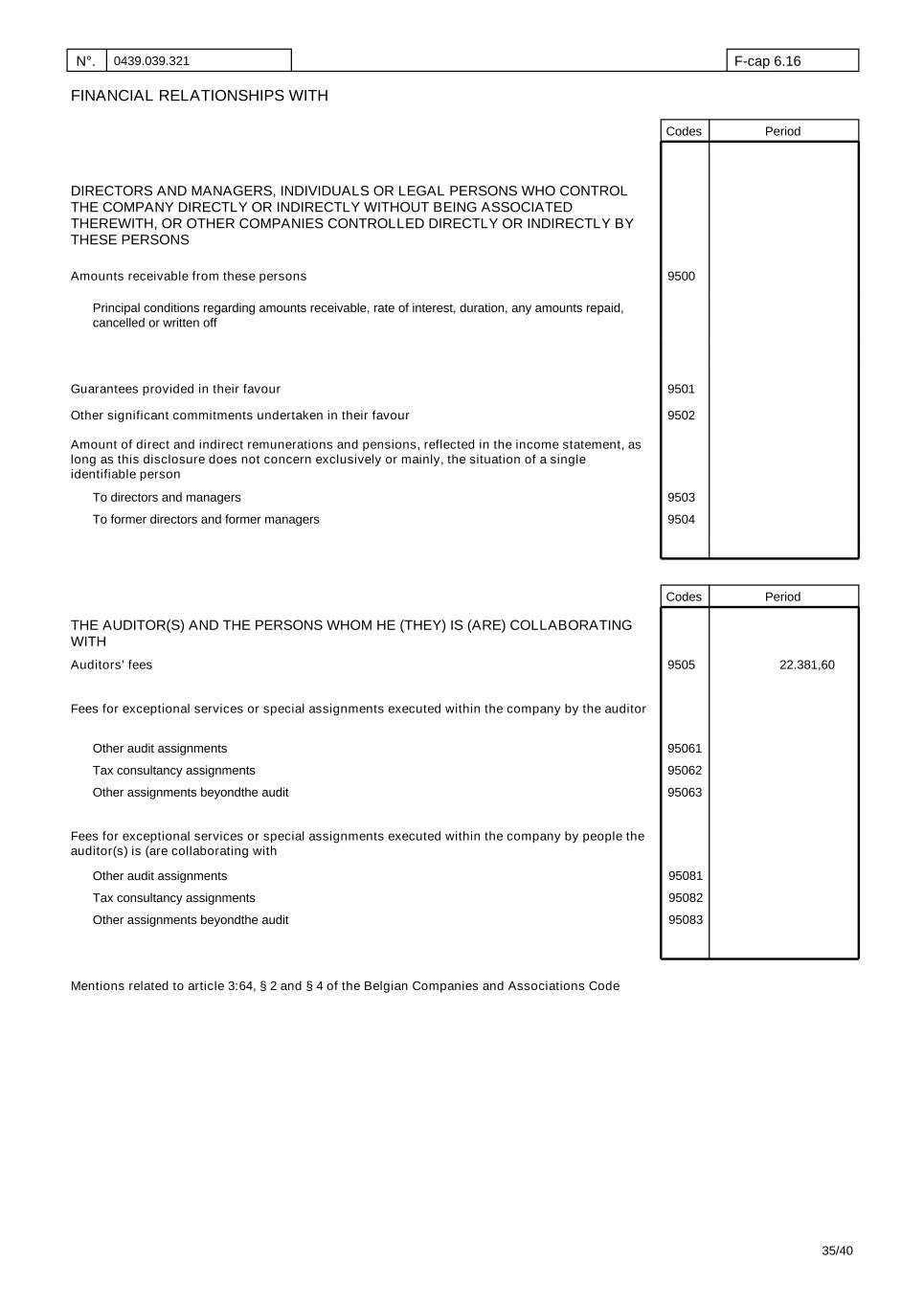

N°. 0439.039.321 F-cap 6.16 FINANCIAL RELATIONSHIPS WITH PeriodCodes DIRECTORS AND MANAGERS, INDIVIDUALS OR LEGAL PERSONS WHO CONTROL THE COMPANY DIRECTLY OR INDIRECTLY WITHOUT BEING ASSOCIATED THEREWITH, OR OTHER COMPANIES CONTROLLED DIRECTLY OR INDIRECTLY BY THESE PERSONS Amounts receivable from these persons 9500 Principal conditions regarding amounts receivable, rate of interest, duration, any amounts repaid, cancelled or written off Guarantees provided in their favour 9501 Other significant commitments undertaken in their favour 9502 Amount of direct and indirect remunerations and pensions, reflected in the income statement, as long as this disclosure does not concern exclusively or mainly, the situation of a single identifiable person To directors and managers To former directors and former managers 9504 9503 Codes Period THE AUDITOR(S) AND THE PERSONS WHOM HE (THEY) IS (ARE) COLLABORATING WITH Auditors' fees Fees for exceptional services or special assignments executed within the company by the auditor Other audit assignments Tax consultancy assignments Other assignments beyondthe audit 22.381,609505 95061 95062 95063 Fees for exceptional services or special assignments executed within the company by people the auditor(s) is (are collaborating with 95081 95082 95083 Other audit assignments Tax consultancy assignments Other assignments beyondthe audit Mentions related to article 3:64, § 2 and § 4 of the Belgian Companies and Associations Code 35/40

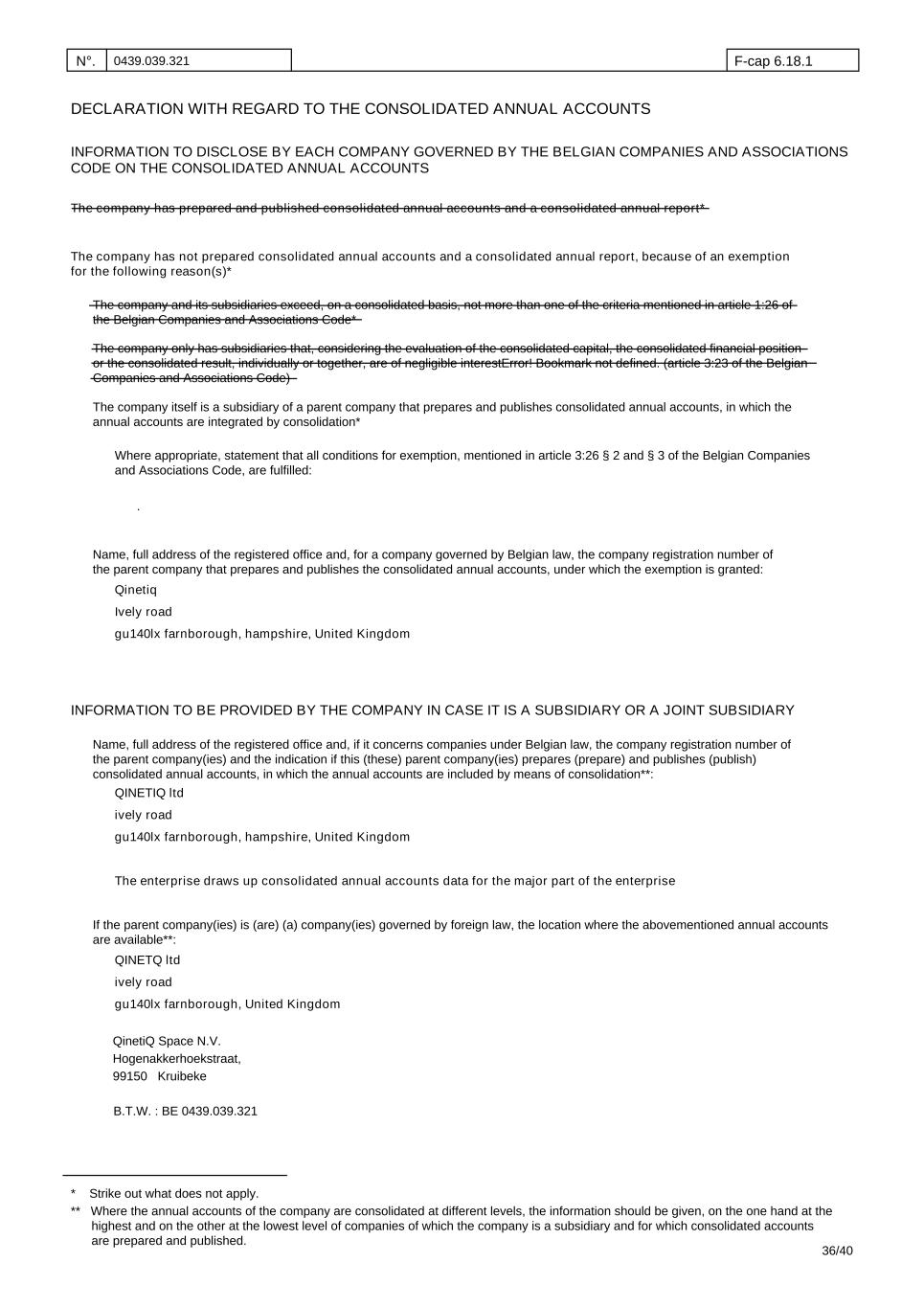

N°. 0439.039.321 F-cap 6.18.1 DECLARATION WITH REGARD TO THE CONSOLIDATED ANNUAL ACCOUNTS INFORMATION TO DISCLOSE BY EACH COMPANY GOVERNED BY THE BELGIAN COMPANIES AND ASSOCIATIONS CODE ON THE CONSOLIDATED ANNUAL ACCOUNTS The company has prepared and published consolidated annual accounts and a consolidated annual report* The company has not prepared consolidated annual accounts and a consolidated annual report, because of an exemption for the following reason(s)* The company and its subsidiaries exceed, on a consolidated basis, not more than one of the criteria mentioned in article 1:26 of the Belgian Companies and Associations Code* The company itself is a subsidiary of a parent company that prepares and publishes consolidated annual accounts, in which the annual accounts are integrated by consolidation* Where appropriate, statement that all conditions for exemption, mentioned in article 3:26 § 2 and § 3 of the Belgian Companies and Associations Code, are fulfilled: The company only has subsidiaries that, considering the evaluation of the consolidated capital, the consolidated financial position or the consolidated result, individually or together, are of negligible interestError! Bookmark not defined. (article 3:23 of the Belgian Companies and Associations Code) . Name, full address of the registered office and, for a company governed by Belgian law, the company registration number of the parent company that prepares and publishes the consolidated annual accounts, under which the exemption is granted: Qinetiq Ively road gu140lx farnborough, hampshire, United Kingdom INFORMATION TO BE PROVIDED BY THE COMPANY IN CASE IT IS A SUBSIDIARY OR A JOINT SUBSIDIARY QINETIQ ltd ively road gu140lx farnborough, hampshire, United Kingdom Name, full address of the registered office and, if it concerns companies under Belgian law, the company registration number of the parent company(ies) and the indication if this (these) parent company(ies) prepares (prepare) and publishes (publish) consolidated annual accounts, in which the annual accounts are included by means of consolidation**: If the parent company(ies) is (are) (a) company(ies) governed by foreign law, the location where the abovementioned annual accounts are available**: QINETQ ltd ively road gu140lx farnborough, United Kingdom QinetiQ Space N.V. Hogenakkerhoekstraat, 9 9150 Kruibeke B.T.W. : BE 0439.039.321 The enterprise draws up consolidated annual accounts data for the major part of the enterprise * Strike out what does not apply. ** Where the annual accounts of the company are consolidated at different levels, the information should be given, on the one hand at the highest and on the other at the lowest level of companies of which the company is a subsidiary and for which consolidated accounts are prepared and published. 36/40

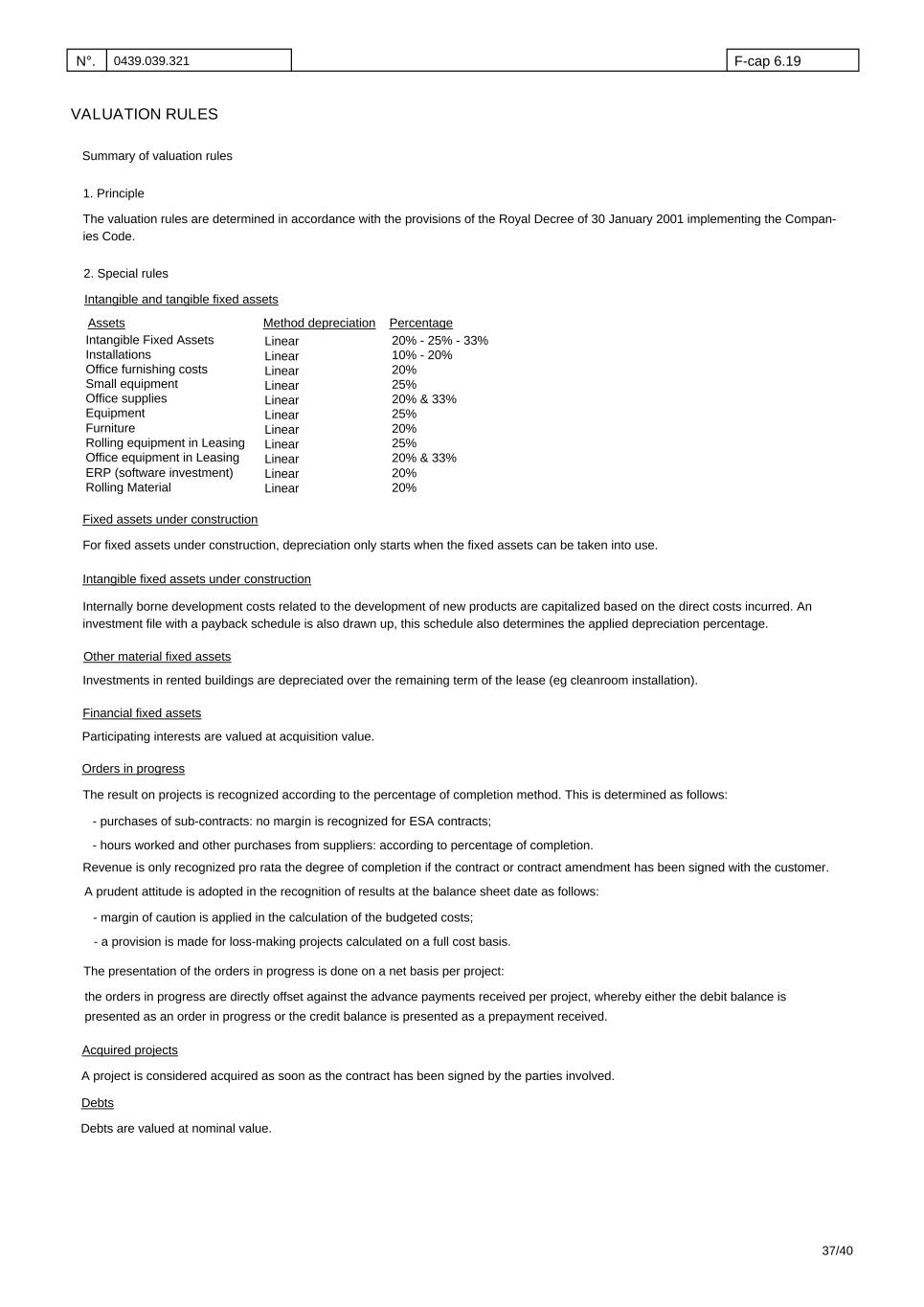

N°. 0439.039.321 F-cap 6.19 VALUATION RULES Summary of valuation rules 1. Principle The valuation rules are determined in accordance with the provisions of the Royal Decree of 30 January 2001 implementing the Compan- ies Code. 2. Special rules Intangible and tangible fixed assets Assets Method depreciation Percentage Intangible Fixed Assets Installations Office furnishing costs Small equipment Office supplies Equipment Furniture Rolling equipment in Leasing Office equipment in Leasing ERP (software investment) Rolling Material Fixed assets under construction For fixed assets under construction, depreciation only starts when the fixed assets can be taken into use. Intangible fixed assets under construction Internally borne development costs related to the development of new products are capitalized based on the direct costs incurred. An investment file with a payback schedule is also drawn up, this schedule also determines the applied depreciation percentage. Investments in rented buildings are depreciated over the remaining term of the lease (eg cleanroom installation). Financial fixed assets Participating interests are valued at acquisition value. Orders in progress The result on projects is recognized according to the percentage of completion method. This is determined as follows: - purchases of sub-contracts: no margin is recognized for ESA contracts; - hours worked and other purchases from suppliers: according to percentage of completion. Revenue is only recognized pro rata the degree of completion if the contract or contract amendment has been signed with the customer. - margin of caution is applied in the calculation of the budgeted costs; - a provision is made for loss-making projects calculated on a full cost basis. The presentation of the orders in progress is done on a net basis per project: 37/40 20% - 25% - 33% 10% - 20% 20% 25% 20% & 33% 25% 20% 25% 20% & 33% 20% 20% Other material fixed assets A prudent attitude is adopted in the recognition of results at the balance sheet date as follows: the orders in progress are directly offset against the advance payments received per project, whereby either the debit balance is presented as an order in progress or the credit balance is presented as a prepayment received. Acquired projects A project is considered acquired as soon as the contract has been signed by the parties involved. Debts Debts are valued at nominal value. Linear Linear Linear Linear Linear Linear Linear Linear Linear Linear Linear

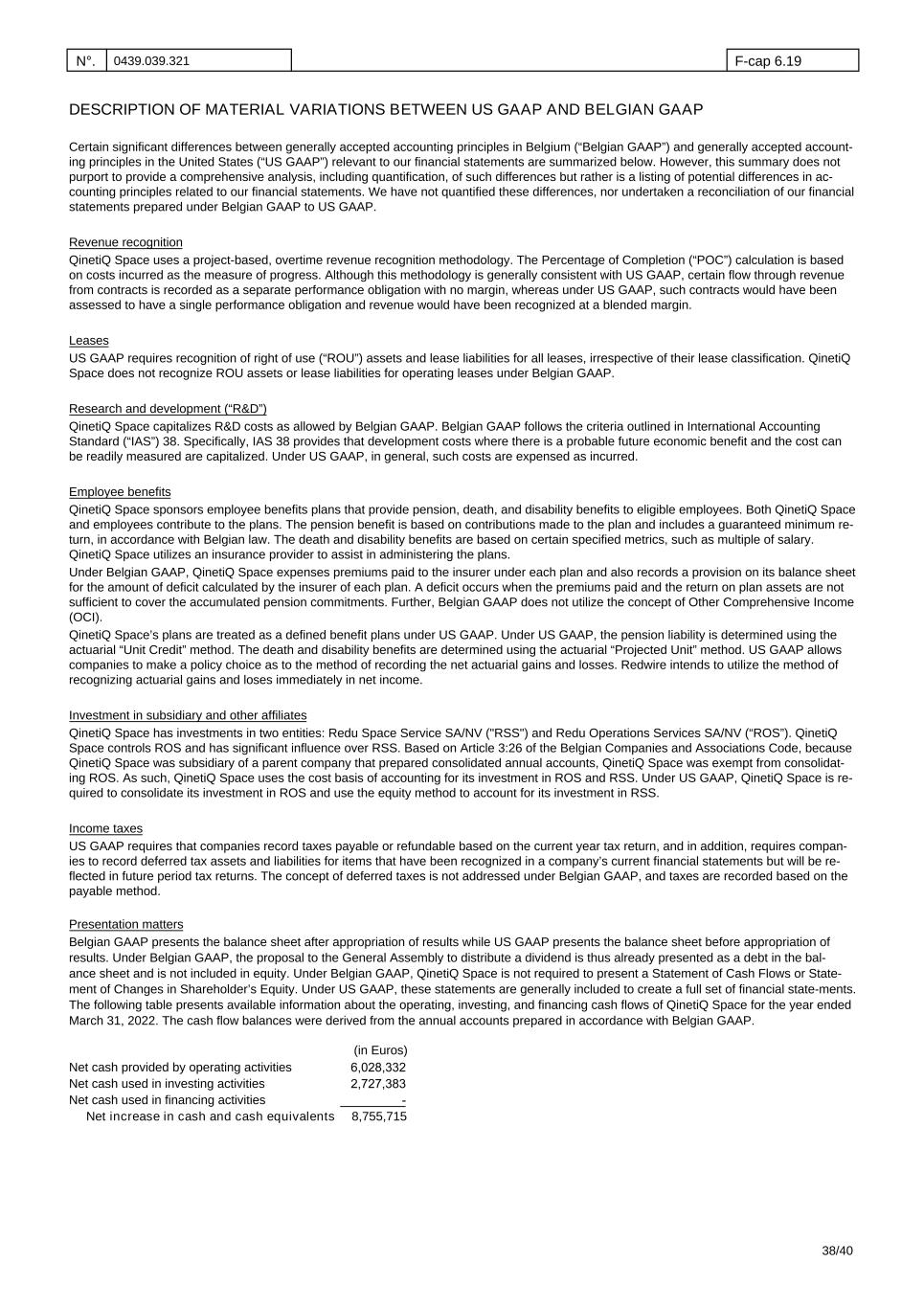

N°. 0439.039.321 F-cap 6.19 38/40 VALUATION RULES Acquired projects DESCRIPTION OF MATERIAL VARIATIONS BETWEEN US GAAP AND BELGIAN GAAP Certain significant differences between generally accepted accounting principles in Belgium (“Belgian GAAP”) and generally accepted account- ing principles in the United States (“US GAAP”) relevant to our financial statements are summarized below. However, this summary does not purport to provide a comprehensive analysis, including quantification, of such differences but rather is a listing of potential differences in ac- counting principles related to our financial statements. We have not quantified these differences, nor undertaken a reconciliation of our financial statements prepared under Belgian GAAP to US GAAP. Revenue recognition QinetiQ Space uses a project-based, overtime revenue recognition methodology. The Percentage of Completion (“POC”) calculation is based on costs incurred as the measure of progress. Although this methodology is generally consistent with US GAAP, certain flow through revenue from contracts is recorded as a separate performance obligation with no margin, whereas under US GAAP, such contracts would have been assessed to have a single performance obligation and revenue would have been recognized at a blended margin. Leases US GAAP requires recognition of right of use (“ROU”) assets and lease liabilities for all leases, irrespective of their lease classification. QinetiQ Space does not recognize ROU assets or lease liabilities for operating leases under Belgian GAAP. Research and development (“R&D”) QinetiQ Space capitalizes R&D costs as allowed by Belgian GAAP. Belgian GAAP follows the criteria outlined in International Accounting Standard (“IAS”) 38. Specifically, IAS 38 provides that development costs where there is a probable future economic benefit and the cost can be readily measured are capitalized. Under US GAAP, in general, such costs are expensed as incurred. Employee benefits QinetiQ Space sponsors employee benefits plans that provide pension, death, and disability benefits to eligible employees. Both QinetiQ Space and employees contribute to the plans. The pension benefit is based on contributions made to the plan and includes a guaranteed minimum re- turn, in accordance with Belgian law. The death and disability benefits are based on certain specified metrics, such as multiple of salary. QinetiQ Space utilizes an insurance provider to assist in administering the plans. Under Belgian GAAP, QinetiQ Space expenses premiums paid to the insurer under each plan and also records a provision on its balance sheet for the amount of deficit calculated by the insurer of each plan. A deficit occurs when the premiums paid and the return on plan assets are not sufficient to cover the accumulated pension commitments. Further, Belgian GAAP does not utilize the concept of Other Comprehensive Income (OCI). QinetiQ Space’s plans are treated as a defined benefit plans under US GAAP. Under US GAAP, the pension liability is determined using the actuarial “Unit Credit” method. The death and disability benefits are determined using the actuarial “Projected Unit” method. US GAAP allows companies to make a policy choice as to the method of recording the net actuarial gains and losses. Redwire intends to utilize the method of recognizing actuarial gains and loses immediately in net income. Investment in subsidiary and other affiliates QinetiQ Space has investments in two entities: Redu Space Service SA/NV ("RSS") and Redu Operations Services SA/NV (“ROS”). QinetiQ Space controls ROS and has significant influence over RSS. Based on Article 3:26 of the Belgian Companies and Associations Code, because QinetiQ Space was subsidiary of a parent company that prepared consolidated annual accounts, QinetiQ Space was exempt from consolidat- ing ROS. As such, QinetiQ Space uses the cost basis of accounting for its investment in ROS and RSS. Under US GAAP, QinetiQ Space is re- quired to consolidate its investment in ROS and use the equity method to account for its investment in RSS. Income taxes US GAAP requires that companies record taxes payable or refundable based on the current year tax return, and in addition, requires compan- ies to record deferred tax assets and liabilities for items that have been recognized in a company’s current financial statements but will be re- flected in future period tax returns. The concept of deferred taxes is not addressed under Belgian GAAP, and taxes are recorded based on the payable method. Presentation matters Belgian GAAP presents the balance sheet after appropriation of results while US GAAP presents the balance sheet before appropriation of results. Under Belgian GAAP, the proposal to the General Assembly to distribute a dividend is thus already presented as a debt in the bal- ance sheet and is not included in equity. Under Belgian GAAP, QinetiQ Space is not required to present a Statement of Cash Flows or State- ment of Changes in Shareholder’s Equity. Under US GAAP, these statements are generally included to create a full set of financial state-ments. The following table presents available information about the operating, investing, and financing cash flows of QinetiQ Space for the year ended March 31, 2022. The cash flow balances were derived from the annual accounts prepared in accordance with Belgian GAAP. (in Euros) Net cash provided by operating activities Net cash used in investing activities Net cash used in financing activities 6,028,332 2,727,383 - Net increase in cash and cash equivalents 8,755,715 US GAAP requires that companies record taxes payable or refundable based on the current year tax return, and in addition, requires companies to record deferred tax assets and liabilities for items that have been recognized in a company’s current financial statements but will be reflected in future period tax returns. The concept of de- ferred taxes is not addressed under Belgian GAAP, and taxes are recorded based on the payable method. Presentation matters Under Belgian GAAP QinetiQ Space is not required to present a Statement of Cash Flows or Statement of Changes in Shareholder’s Equity. Under US GAAP these statements are generally included to create a full set of financial statements.

Independent Auditor’s Report To the shareholders of Redwire Space NV (formerly known as Qinetiq Space NV) Opinion We have audited the annual accounts of Qinetiq Space NV (the Company), which comprise the balance sheet as of March 31, 2022, and the related profit and loss account for the year then ended, the appropriation account and the related notes to the annual accounts. In our opinion, the accompanying annual accounts present fairly, in all material respects, the financial position of the Company as of March 31, 2022, and the results of its operations for the year then ended in accordance with accounting principles generally accepted in Belgium (“BE GAAP”). Basis for Opinion We conducted our audit in accordance with auditing standards generally accepted in the United States of America (US GAAS). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Annual Accounts section of our report. We are required to be independent of the Company and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audit. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Emphasis of matter: US GAAP versus BE GAAP Generally accepted accounting principles in the United States of America vary in certain significant respects from Belgian generally accepted accounting principles. An additional note was added to the annual accounts on F-cap 6.19 with information relating to the nature of such differences. Responsibilities of Management for the Annual Accounts Management is responsible for the preparation and fair presentation of the annual accounts in accordance with accounting principles generally accepted in Belgium, and for the design, implementation and maintenance of internal control relevant to the preparation and fair presentation of annual accounts that are free from material misstatement, whether due to fraud or error. In preparing the annual accounts, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern within one year after the date that the annual accounts are issued or available to be issued. Auditor’s Responsibilities for the Audit of the Annual Accounts Our objectives are to obtain reasonable assurance about whether the annual accounts as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with US GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the annual accounts. In performing an audit in accordance with US GAAS, we: Exercise professional judgment and maintain professional skepticism throughout the audit. Identify and assess the risks of material misstatement of the annual accounts, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the annual accounts.

Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. Accordingly, no such opinion is expressed. Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the annual accounts. Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for a reasonable period of time. We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control–related matters that we identified during the audit. Antwerp, Belgium January 17, 2023 RSM INTERAUDIT BV /s/ RSM INTERAUDIT BV