Exhibit 10.2 INVESTMENT AGREEMENT by and between REDWIRE CORPORATION and AE INDUSTRIAL PARTNERS FUND II, L.P. AE INDUSTRIAL PARTNERS STRUCTURED SOLUTIONS I, L.P. Dated as of October 28, 2022

TABLE OF CONTENTS Page ARTICLE I Definitions .................................................................................................................. 1 Section 1.01 Definitions................................................................................................... 1 ARTICLE II Purchase and Sale .................................................................................................... 10 Section 2.01 Purchase and Sale ..................................................................................... 10 Section 2.02 Closing ...................................................................................................... 10 ARTICLE III Representations and Warranties of the Company .................................................. 10 Section 3.01 Organization; Good Standing ................................................................... 10 Section 3.02 Capitalization ............................................................................................ 11 Section 3.03 Authority; Noncontravention .................................................................... 13 Section 3.04 Governmental Approvals .......................................................................... 14 Section 3.05 Company SEC Documents; Undisclosed Liabilities. ............................... 14 Section 3.06 Absence of Certain Changes ..................................................................... 15 Section 3.07 Legal Proceedings ..................................................................................... 16 Section 3.08 Compliance with Laws; Permits ............................................................... 16 Section 3.09 Contracts ................................................................................................... 17 Section 3.10 Tax Matters ............................................................................................... 17 Section 3.11 No Rights Agreement; Anti-Takeover Provisions .................................... 17 Section 3.12 Brokers and Other Advisors ...................................................................... 17 Section 3.13 Employee Benefit Plans ............................................................................ 17 Section 3.14 Labor Matters ............................................................................................ 18 Section 3.15 Sale of Securities....................................................................................... 18 Section 3.16 Listing and Maintenance Requirements .................................................... 18 Section 3.17 Vote Required ........................................................................................... 18 Section 3.18 Indebtedness .............................................................................................. 19 Section 3.19 Real Property ............................................................................................ 19 Section 3.20 Environmental Matters.............................................................................. 19 Section 3.21 Intellectual Property .................................................................................. 20 Section 3.22 Affiliate Transactions ................................................................................ 20 ARTICLE IV Representations and Warranties of the Investor .................................................... 20 Section 4.01 Organization; Standing ............................................................................. 20 Section 4.02 Authority; Noncontravention .................................................................... 20 Section 4.03 Governmental Approvals .......................................................................... 21 Section 4.04 Ownership of Company Stock .................................................................. 21 Section 4.05 Brokers and Other Advisors ...................................................................... 21 Section 4.06 Purchase for Investment ............................................................................ 21 Section 4.07 Non-Reliance on Company Estimates, Projections, Forecasts, Forward-Looking Statements and Business Plans .................................... 22 ARTICLE V Additional Agreements ........................................................................................... 22 Section 5.01 Anti-Takeover Laws ................................................................................. 22

2 Section 5.02 Public Disclosure ...................................................................................... 23 Section 5.03 Confidentiality .......................................................................................... 23 Section 5.04 NYSE Listing of Shares. . ........................................................................ 24 Section 5.05 Standstill. .................................................................................................. 24 Section 5.06 Transfer Restrictions ................................................................................. 26 Section 5.07 Legend....................................................................................................... 27 Section 5.08 Tax Matters ............................................................................................... 28 Section 5.09 Use of Proceeds ......................................................................................... 29 Section 5.10 Preemptive Rights ..................................................................................... 29 Section 5.11 Appointment Right.................................................................................... 32 Section 5.12 Required Holders ...................................................................................... 33 Section 5.13 Section 16 Matters .................................................................................... 33 Section 5.14 Maintenance of Listing ............................................................................. 34 Section 5.15 Related Party Transactions ....................................................................... 34 ARTICLE VI Conditions to Consummation of the Transactions ................................................. 34 Section 6.01 Conditions of the Investor ......................................................................... 34 Section 6.02 Conditions of the Company ...................................................................... 35 ARTICLE VII Miscellaneous ....................................................................................................... 36 Section 7.01 Survival ..................................................................................................... 36 Section 7.02 Amendments; Waivers .............................................................................. 36 Section 7.03 Extension of Time, Waiver, Etc. ............................................................... 36 Section 7.04 Assignment ............................................................................................... 36 Section 7.05 Counterparts .............................................................................................. 37 Section 7.06 Entire Agreement; No Third-Party Beneficiaries ..................................... 37 Section 7.07 Governing Law; Jurisdiction ..................................................................... 37 Section 7.08 Specific Enforcement ................................................................................ 37 Section 7.09 Waiver of Jury Trial .................................................................................. 38 Section 7.10 Notices ...................................................................................................... 38 Section 7.11 Severability ............................................................................................... 39 Section 7.12 Fees and Expenses .................................................................................... 39 Section 7.13 Interpretation ............................................................................................. 40 Section 7.14 Non-Recourse ........................................................................................... 41 Exhibits Exhibit A: Form of Series A Convertible Preferred Stock Certificate of Designation Exhibit B: Form of Registration Rights Agreement

INVESTMENT AGREEMENT, dated as of October 28, 2022 (this “Agreement”), by and between Redwire Corporation, a Delaware corporation (the “Company”), and each of (i) AE Industrial Partners, Fund II, LP, a Delaware limited partnership (“AE Fund II”), a (ii) AE Industrial Partners Structured Solutions I, LP, a Delaware limited partnership (“AE Structured Solutions”) (together with their successors and any Affiliate that becomes a party hereto pursuant to Section 5.06(b) and Section 7.04, the “Investor”). WHEREAS, subject to the terms and conditions set forth herein, the Company desires to issue, sell and deliver to the Investor, and the Investor desires to purchase and acquire from the Company, an aggregate of 40,000 shares of the Company’s Series A Convertible Preferred Stock, par value $0.0001 per share (the “Convertible Preferred Stock”), having the designation, preferences, rights (including with respect to conversion), privileges, powers, and terms and conditions, as specified in the form of the Series A Convertible Preferred Stock Certificate of Designation attached hereto as Exhibit A (the “Certificate of Designation”); NOW, THEREFORE, in consideration of the mutual covenants, representations, warranties and agreements contained in this Agreement, the receipt and sufficiency of which are hereby acknowledged, the parties to this Agreement hereby agree as follows: ARTICLE I Definitions Section 1.01 Definitions. (a) As used in this Agreement (including the recitals hereto), the following terms shall have the following meanings: “25% Beneficial Ownership Requirement” shall have the same meaning and be calculated in the same manner as “50% Beneficial Ownership Requirement” below, except that references to “50%” are deemed replaced with “25%.” “50% Beneficial Ownership Requirement” means that the Investor Parties continue to beneficially own at all times shares of Common Stock, in the aggregate and on an as-converted basis, at least equal to 50% of the number of shares of Common Stock issued to the Investor, on an as-converted basis, as of the Closing. For purposes of this calculation as of any date of determination, (i) to the extent any shares of Common Stock otherwise issuable upon conversion of the Preferred Shares are paid in cash, whether due to any limitation on conversion, including, but not limited to, the Conversion Share Cap or otherwise, such shares shall be excluded and (ii) such calculation shall take into effect any stock split, stock dividend or combination subsequent to the Closing in calculating the number of shares issued to the Investor on an as-converted basis as of the Closing. “Acquisition” means the proposed acquisition by Redwire Space Europe, LLC, a Delaware limited liability company, of the whole of the issued share capital of QinetiQ Space NV, a public limited liability company (naamloze vennootschap / société anonyme), incorporated under the laws of Belgium.

2 “Activist Investor” means, as of any date, any Person identified on the most recently available “SharkWatch 50” list (or, if “SharkWatch 50” is no longer available, then the prevailing comparable list as reasonably determined by the Company), or any Person who, to the knowledge of the Investor, is an Affiliate of such Person. “AE Affiliate” means any Affiliate of AE Industrial Partners, LP that serves as general partner of, or manages or advises, any investment fund affiliated with AE Industrial Partners, LP that has a direct or indirect investment in the Company. “AE Excluded Entity” means (i) any leveraged finance investment fund or any other investment fund associated or affiliated with AE Industrial Partners, LP, the primary purpose of which is to invest in loans or debt securities, or (ii) any hedge fund associated or affiliated with AE Industrial Partners, LP. “AE Group” means the Investor, together with its Affiliates, including AE Affiliates. “Affiliate” means, as to any Person, any other Person that, directly or indirectly, controls, or is controlled by, or is under common control with, such Person; provided, however, (i) that the Company and its Subsidiaries shall not be deemed to be Affiliates of any Investor Party or any of its Affiliates, and (ii) neither (A) “portfolio companies” (as such term is customarily used in the private equity industry) of funds managed or advised by any Affiliate of any Investor Party, (B) any fund affiliated with any member of the AE Group (including any AE Excluded Entity), or (C) any of their respective Affiliates shall be considered to be Affiliates of any Investor Party or any of its Affiliates so long as such Person (x) is not acting at the direction of any Investor Party or any Investor Director Designee to carry out any act prohibited by this Agreement, including Section 5.06, and (y) has not received from any Investor Party, any Affiliate of any Investor Party or any Investor Director Designee any Confidential Information; provided that, no Person specified in (A) or (B) above shall be deemed to have received Confidential Information solely by virtue of the fact that an individual that received Confidential Information serves as a director, officer, manager, employee or advisor of such Person (or other similarly situated dual-role individuals). For this purpose, “control” (including, with its correlative meanings, “controlled by” and “under common control with”) shall mean the possession, directly or indirectly, of the power to direct or cause the direction of management or policies of a Person, whether through the ownership of securities or partnership or other ownership interests, by contract or otherwise. “as-converted basis” means, as of any date, (i) all outstanding shares of Common Stock as of such date and (ii) with respect to any outstanding shares of Convertible Preferred Stock as of such date, the number of shares of Common Stock issuable upon conversion of such shares of Convertible Preferred Stock on such date (at the Conversion Price in effect on such date as set forth in the Certificate of Designation, and without regard to any limitations on conversion). “Beneficial Ownership Limitation” has the meaning set forth in the Certificate of Designation.

3 “beneficially own”, “beneficial ownership of”, or “beneficially owning” any securities shall have the meaning set forth in Rule 13d-3 of the rules and regulations under the Exchange Act. “Board” means the Board of Directors of the Company. “Business Day” means any day except a Saturday, a Sunday or other day on which the SEC or banks in the City of New York are authorized or required by Law to be closed. “Code” means the United States Internal Revenue Code of 1986, as amended. “Common Stock” means the common stock, par value $0.0001 per share, of the Company. “Company Charter Documents” means the Company’s certificate of incorporation and bylaws. “Company Lease” means all leases, pursuant to which the Company or any Subsidiary holds any Leased Real Property. “Company Plan” means each “employee benefit plan” (as defined in Section 3(3) of ERISA, whether or not subject to ERISA) and any other benefit or compensation plan, policy, program, contract, agreement or arrangement, in each case that is sponsored, maintained or contributed to by the Company or any of its Subsidiaries or to which the Company or any of its Subsidiaries contributes or is obligated to contribute to, or has or may have any current or contingent liability or obligation, other than any plan, program, policy, agreement or arrangement sponsored and administered by a Governmental Authority. “Company RSU” means a restricted stock unit of the Company issued pursuant to a Company Plan subject to time-based and/or performance-based vesting conditions. “Company Sale” means a transaction that would constitute a Fundamental Change under clause (a) of such definition. “Company Stock Option” means an option to purchase shares of Common Stock issued pursuant to a Company Plan. “Company Stock Plan” means the Redwire Corporation 2021 Omnibus Incentive Plan, as amended, and any other plan, program, agreement or arrangement providing for the grant of equity-based awards to directors, officers, employees or other service providers of the Company or any of the Company’s Subsidiaries. “Company Warrant” means a warrant entitling the holder thereof to purchase the number of shares of Common Stock per warrant as set forth therein. “Conversion Date” has the meaning set forth in the Certificate of Designation. “Conversion Price” has the meaning set forth in the Certificate of Designation.

4 “Conversion Share Cap” has the meaning set forth in the Certificate of Designation. “Credit Agreement” means the Credit Agreement dated October 28, 2020, conformed through that certain First Amendment to Credit Agreement, dated February 17, 2021, Second Amendment to Credit Agreement, dated September 2, 2021, Third Amendment to Credit Agreement, dated March 25, 2022, and Fourth Amendment to Credit Agreement dated August 8, 2022, by and among Redwire Holdings, LLC, as lead borrower, Redwire Intermediate Holdings, LLC, the other borrowers party thereto, the other guarantors party thereto, Adams Street Credit Advisors LP, as administrative agent and as collateral agent and each lender party thereto. “DGCL” means the Delaware General Corporation Law, as amended, supplemented or restated from time to time. “Environmental Laws” means all Laws relating to human health and safety or pollution or protection of the environment, including all Laws relating to the design, production, sale, installation, distribution, labeling, marketing, manufacture, handling, treatment, storage, or disposal of, or exposure of any Person to, Hazardous Substances or products containing Hazardous Substances. “ERISA” means the Employee Retirement Income Security Act of 1974, as amended. “Exchange Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder. “Fair Market Value” means, with respect to any security or other property (other than cash), the fair market value of such security or other property as reasonably determined in good faith by a majority of the Board, or an authorized committee thereof. “Fraud” means actual, not constructive, common law fraud (under the laws of the State of New York). “Fundamental Change” shall have the meaning set forth in the Certificate of Designation. “Fundamental Representations and Warranties” means Section 3.01(a), Section 3.02, Section 3.03(a), Section 3.03(c)(i) and Section 3.12. “GAAP” means generally accepted accounting principles in the United States, consistently applied. “Governmental Authority” means any government, court, regulatory or administrative agency, commission, arbitrator (public or private) or authority or other legislative, executive or judicial governmental entity (in each case including any self-regulatory organization), whether federal, state or local, domestic, foreign or multinational. “Hazardous Substances” means any substance, waste, or material that is listed, defined, designated, or regulated as hazardous, toxic, or a pollutant by, or otherwise for which

5 liability or standards of conduct may be imposed under, any Environmental Law, including petroleum or any fraction thereof, asbestos, pesticides, herbicides, radiation or radioactive materials, polychlorinated biphenyls, lead-containing products, per and polyfluoroalkyl substances, and mold or microbial matter. “Intellectual Property” means all intellectual property rights of any type in any jurisdiction throughout the world, including any (a) trademarks, service marks, trade names, Internet domain names or logos, (b) utility models and industrial designs, patents (including any continuations, divisionals, continuations-in-part, provisionals, renewals, reissues, and re- examinations), (c) copyrights and copyrightable works, (d) rights in computer software (including source code and object code) data, databases, compilations, algorithms, interfaces, firmware, development tools, templates, menus, and all documentation thereof (“Software”), (e) trade secrets and confidential information, and know-how, technology, and inventions (whether patentable or not) (together with all goodwill associated therewith and including any registrations or applications for registration of any of the foregoing (a) through (e)). “Investor Director” means a member of the Board who was elected to the Board as a representative of the AE Group. “Investor Material Adverse Effect” means any effect, change, event or occurrence that would reasonably be expected to, individually or in the aggregate, prevent or materially delay or impair the consummation by the Investor of any of the Transactions on a timely basis. “Investor Parties” means the Investor and each Affiliate of the Investor to whom shares of Convertible Preferred Stock or Common Stock are transferred pursuant to Section 5.06(b)(i). “IRS” means the United States Internal Revenue Service. “Knowledge” means, with respect to the Company, the actual knowledge of the Company’s CEO, CFO or General Counsel, with respect to matters within such individual’s functional responsibilities with the Company, in each case after reasonable inquiry. “Leased Real Property” means all right, title and interest of the Company and its Subsidiaries to any leasehold interests in any Real Property, together with all buildings, structures, improvements and fixtures thereon. “Liens” means liens, encumbrances, mortgages, charges, claims, restrictions, pledges, security interests, title defects, easements, rights-of-way, covenants, encroachments or other adverse claims of any kind with respect to a property or asset. “Material Adverse Effect” means any effect, change, event or occurrence that has a material adverse effect on (x) the business, results of operations, assets, liabilities or condition (financial or otherwise) of the Company and its Subsidiaries, taken as a whole or (y) the ability of the Company to consummate the Transactions on a timely basis. “Material Contract” means any Contract between the Company or any of its Subsidiaries and any of the top ten (10) customers and suppliers of the Company or any of its

6 Subsidiaries, determined based on the aggregate amounts paid to, or received by, the Company or any of its Subsidiaries in the year ended December 31, 2021. “NYSE” means the New York Stock Exchange. “Permitted Liens” means (i) statutory Liens for Taxes not yet due and payable, for which reserves have been established in accordance with GAAP (if required by GAAP), (ii) mechanics, carriers’, workmen’s, repairmen’s or other like liens arising or incurred in the ordinary course of business consistent with past practice or amounts that are not delinquent and which are not, individually or in the aggregate, material to the business of the Company and its Subsidiaries, taken as a whole, (iii) easements, rights of way, zoning ordinances and other similar encumbrances affecting Real Property which are not, individually or in the aggregate, material to the business of the Company and its Subsidiaries, taken as a whole, (iv) liens arising under original purchase price conditional sales contracts and equipment leases with third parties entered into in the ordinary course of business consistent with past practice which are not, individually or in the aggregate, material to the business of the Company and its Subsidiaries, taken as a whole and (v) liens granted under the Credit Agreement. “Permitted Transferee” means, with respect to any Person, (i) any Affiliate of such Person, or (ii) with respect to any Person that is an investment fund, vehicle or similar entity, (x) any other investment fund, vehicle or similar entity of which such Person or an Affiliate, advisor or manager of such Person serves as the general partner, manager or advisor and (y) any direct or indirect limited partner or investor in such investment fund, vehicle or similar entity or any direct or indirect limited partner or investor in any other investment fund, vehicle or similar entity of which such Person or an Affiliate, advisor or manager of such Person serves as the general partner, manager or advisor; provided, however, that in no event shall any “portfolio companies” (as such term is customarily used in the private equity industry) of any holder of shares of Convertible Preferred Stock or Common Stock or any entity that is controlled by a “portfolio company” of a holder of shares of Convertible Preferred Stock or Common Stock constitute a Permitted Transferee. “Person” means an individual, corporation, limited liability company, partnership, joint venture, association, trust, unincorporated organization or any other entity, including a Governmental Authority. “PIK Dividend” has the meaning set forth in the Certificate of Designation. “Registration Rights Agreement” means that certain Registration Rights Agreement to be entered into by the Company and the Investor, the form of which is set forth as Exhibit B hereto. “Required Holders” has the meaning set forth in the Certificate of Designation. “Requisite Stockholder Approval” has the meaning set forth in the Certificate of Designation.

7 “Representatives” means, with respect to any Person, its officers, directors, principals, partners, managers, members, employees, consultants, agents, financial advisors, investment bankers, attorneys, accountants, other advisors and other representatives. “Rule 144” means Rule 144 promulgated by the SEC pursuant to the Securities Act, as such rule may be amended from time to time, or any similar rule or regulation hereafter adopted by the SEC having substantially the same effect as such rule. “SEC” means the Securities and Exchange Commission. “Securities Act” means the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder. “Specified Competitor” means the Persons set forth on Schedule 1.01(a). “Standstill Period” means the period from and after the Closing Date until the date which is 12 months following the Closing Date; provided that the Standstill Period shall immediately terminate and expire (and the restrictions of Section 5.06 shall cease to apply and shall be of no further force and effect) at the earliest of: (a) the Company entering into a definitive written agreement with a Third Party to consummate a Fundamental Change or (b) the commencement by a Third Party of a tender offer or exchange offer for a majority of the Common Stock (whether or not recommended by, or approved by, the Board). “Subsidiary”, when used with respect to any Person, means any corporation, limited liability company, partnership, association, trust or other entity of which (x) securities or other ownership interests representing more than 50% of the ordinary voting power (or, in the case of a partnership, more than 50% of the general partnership interests) or (y) sufficient voting rights to elect at least a majority of the board of directors or other governing body are, as of such date, owned by such Person or one or more Subsidiaries of such Person. “Tax” means any and all United States federal, state, local or non-United States taxes, fees, levies, duties, tariffs, imposts, and other similar charges imposed by any Governmental Authority, including taxes or other charges on or with respect to income, franchises, windfall or other profits, gross receipts, property, sales, use, capital stock, payroll, employment, social security, workers’ compensation, unemployment compensation or net worth; taxes or other charges in the nature of excise, withholding, ad valorem, stamp, transfer, value added or gains taxes; license, registration and documentation fees; and customs duties, tariffs and similar charges, in each case together with any interest, penalty, addition to tax or additional amount imposed by any Governmental Authority. “Tax Return” means any returns, reports, claims for refund, declarations of estimated Taxes and information statements with respect to Taxes, including any schedule or attachment thereto or any amendment thereof, filed or required to be filed with any Governmental Authority, including consolidated, combined and unitary tax returns. “Taxing Authority” means any Governmental Authority having jurisdiction over the assessment, determination, collection or imposition of any Tax (including the IRS).

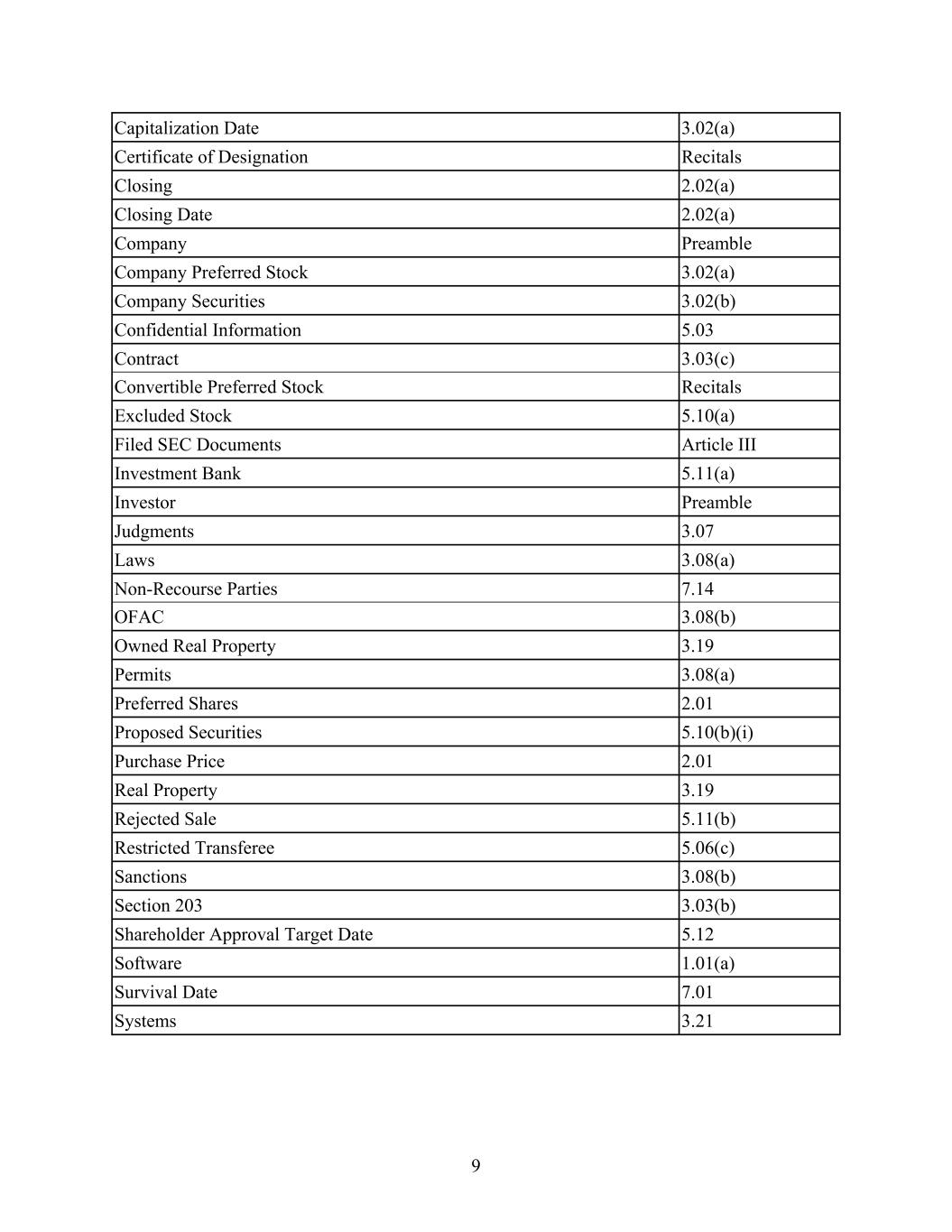

8 “Third Party” shall mean a Person other than the Investor or any of its Permitted Transferees. “Transaction Documents” means this Agreement, the Registration Rights Agreement and all other documents, certificates or agreements executed in connection with the Transactions contemplated by this Agreement, the Certificate of Designation and the Registration Rights Agreement. “Transactions” means the transactions expressly contemplated by this Agreement and the other Transaction Documents, including the issuance of the Convertible Preferred Stock and the issuance of Common Stock upon conversion thereof. “Transfer” by any Person means to sell, transfer, assign, pledge, encumber, hypothecate or otherwise dispose of or transfer (by the operation of law or otherwise), or to enter into any contract, option or other arrangement, agreement or understanding with respect to the sale, transfer, assignment, pledge, encumbrance, hypothecation or other disposition or transfer (by the operation of law or otherwise), of any voting interest in any equity securities beneficially owned by such Person; provided, however, that, notwithstanding anything to the contrary in this Agreement, a Transfer shall not include (i) the conversion of one or more shares of Convertible Preferred Stock into shares of Common Stock pursuant to the Certificate of Designation, (ii) the redemption or other acquisition of Common Stock or Convertible Preferred Stock by the Company, (iii) the exchange of any Convertible Preferred Stock for another series of preferred stock or (iv) the sale, disposition, issuance or transfer of any equity interests in the Investor (or any fund, managed account, side-by-side vehicle or other investment vehicle or product advised or managed by the Investor or any of its Affiliates or any direct or indirect parent entity of the Investor). “Voting Cap” has the meaning set forth in the Certificate of Designation. (b) In addition to the terms defined in Section 1.01(a), the following terms have the meanings assigned thereto in the Sections set forth below: Term Section Action 3.07 AE Fund II Preamble AE Structured Solutions Preamble Agreement Preamble Announcement 5.02 Anti-Corruption Laws 3.08(b) Appointment Notice 5.11(a) Appointment Right 5.11(a) Balance Sheet Date 3.05(c) Bankruptcy and Equity Exception 3.03(a)

9 Capitalization Date 3.02(a) Certificate of Designation Recitals Closing 2.02(a) Closing Date 2.02(a) Company Preamble Company Preferred Stock 3.02(a) Company Securities 3.02(b) Confidential Information 5.03 Contract 3.03(c) Convertible Preferred Stock Recitals Excluded Stock 5.10(a) Filed SEC Documents Article III Investment Bank 5.11(a) Investor Preamble Judgments 3.07 Laws 3.08(a) Non-Recourse Parties 7.14 OFAC 3.08(b) Owned Real Property 3.19 Permits 3.08(a) Preferred Shares 2.01 Proposed Securities 5.10(b)(i) Purchase Price 2.01 Real Property 3.19 Rejected Sale 5.11(b) Restricted Transferee 5.06(c) Sanctions 3.08(b) Section 203 3.03(b) Shareholder Approval Target Date 5.12 Software 1.01(a) Survival Date 7.01 Systems 3.21

10 ARTICLE II Purchase and Sale Section 2.01 Purchase and Sale. On the terms of this Agreement, at the Closing, the Investor shall purchase and acquire from the Company an aggregate of 40,000 (with AE Fund II acquiring 30,000 shares and AE Structured Solutions acquiring 10,000 shares), shares of Convertible Preferred Stock, and the Company shall issue, sell and deliver to the Investor, the shares of Convertible Preferred Stock (the “Preferred Shares”), free and clear of all Liens (except restrictions imposed by the Securities Act and any applicable foreign and state securities Laws, and transfer restrictions expressly set forth in the Transaction Documents, including Section 5.06 hereof), for a purchase price per Preferred Share equal to $1,000.00 and an aggregate purchase price of $40,000,000 (constituting $30,000,000 for AE Fund II and $10,000,000 for AE Structured Solutions, and such aggregate purchase price, the “Purchase Price”), to be paid in full to the Company on the Closing Date. Section 2.02 Closing. (a) On the terms of this Agreement, and subject to the conditions set forth herein, the closing of the sale and purchase of the Preferred Shares (the “Closing”) shall take place remotely via the exchange of documents and signature pages and shall occur 10:00 a.m. (New York City time) on October 28, 2022, or at such other later time and date as shall be agreed between the Company and the Investor (the date on which the Closing occurs, the “Closing Date”). (b) At the Closing: (i) the Company shall deliver to the Investor (1) evidence of the issuance of the Preferred Shares in book-entry form (or, at the Investor’s election, physical share certificates representing the Preferred Shares) and (2) the Registration Rights Agreement, duly executed by the Company; and (ii) the Investor shall (1) pay the Purchase Price by wire transfer in immediately available U.S. federal funds, to the account designated by the Company in writing and (2) deliver to the Company the Registration Rights Agreement, duly executed by the Investor. ARTICLE III Representations and Warranties of the Company The Company represents and warrants to the Investor as of the Closing (except to the extent made only as of a specified date, in which case such representation and warranty is made as of such date) that, except as disclosed in the Company’s annual report on Form 10-K for the year ended December 31, 2021, the Company’s definitive proxy statement filed on April 22, 2022, the Company’s quarterly reports on Form 10-Q for the quarters ended on March 31, 2022 and June 30, 2022, any Current Report on Form 8-K filed by the Company on or after September 2, 2021 and publicly available on the SEC’s EDGAR system prior to and as of the date hereof, and in each case, the exhibits thereto (together, the “Filed SEC Documents”), other than any disclosures in any such Filed SEC Document contained in the “Risk Factors” section thereof (other

11 than statements of fact contained therein) or any forward-looking statements within the meaning of the Securities Act or the Exchange Act thereof (it being acknowledged that nothing disclosed in the Filed SEC Documents shall be deemed to qualify or modify the representations and warranties set forth in 0, Section 3.02, Section 3.03, Section 3.04, Section 3.10, Section 3.11, Section 3.12 and Section 3.15): Section 3.01 Organization; Good Standing. (a) The Company is a corporation duly organized and validly existing and in good standing under the Laws of the State of Delaware and has all requisite corporate power and corporate authority necessary to carry on its business as it is now being conducted, except for any failure to be in good standing as would not reasonably be expected to be material to the Company and its Subsidiaries. The Company is duly licensed or qualified to do business and is in good standing (where such concept is recognized under applicable Law) in each jurisdiction in which the nature of the business conducted by it or the character or location of the properties and assets owned or leased by it makes such licensing or qualification necessary, except where the failure to be so licensed, qualified or in good standing would not, individually or in the aggregate, reasonably be expected to be material to the Company and its Subsidiaries. True and complete copies of the Company Charter Documents are included in the Filed SEC Documents. (b) Each of the Company’s Subsidiaries is duly organized, validly existing and in good standing (to the extent such concept or a functional equivalent is recognized under applicable Law) under the Laws of the jurisdiction of its organization, except where the failure to be so in good standing would not, individually or in the aggregate, reasonably be expected to be material to the Company and its Subsidiaries. Section 3.02 Capitalization. (a) The authorized capital stock of the Company consists of 500,000,000 shares of Common Stock, par value $0.0001 per share, and 100,000,000 shares of preferred stock, par value $0.0001 per share (the “Company Preferred Stock”). At the close of business on October 28, 2022 (the “Capitalization Date”), (i) 63,852,690 shares of Common Stock were issued and outstanding, (ii) 3,725,240 shares of Common Stock were reserved and available for issuance pursuant to the Company Stock Plan, (iii) 1,382,731 shares of Common Stock were reserved and available for issuance pursuant to the Company’s 2021 Employee Stock Purchase Plan, (iv) 8,090,331 shares of Common Stock were reserved and available for issuance pursuant to the Common Stock Purchase Agreement, dated April 14, 2022, by and between the Company and B. Riley Principal Capital, LLC, (v) 2,400,718 shares of Common Stock were subject to outstanding Company Stock Options, (vi) 3,063,995 Company RSUs were outstanding pursuant to which a maximum of 3,063,995 shares of Common Stock could be issued (assuming maximum achievement of all applicable performance conditions), (vii) 15,920,979 shares of Common Stock could be issued upon exercise of outstanding Company Warrants and (vi) no shares of Company Preferred Stock were issued and outstanding.

12 (b) Except as described in this Section 3.02, as of the Capitalization Date, there were (i) no outstanding shares of capital stock of, or other equity or voting interests in, the Company, (ii) no outstanding securities convertible into or exchangeable for shares of capital stock of, or other equity or voting interests in, the Company, (iii) no outstanding options, warrants, rights or other commitments or agreements to acquire from the Company or any Subsidiary, or that obligate the Company or any Subsidiary to issue, any capital stock of, or other equity or voting interests (or voting debt) in, or any securities convertible into or exchangeable for shares of capital stock of, or other equity or voting interests in, the Company, (iv) no obligations of the Company or any Subsidiary to grant, extend or enter into any subscription, warrant, right, debt, convertible or exchangeable security or other similar agreement or commitment relating to any capital stock of, or other equity or voting interests in, the Company (the items in clauses (i), (ii), (iii) and (iv) being referred to collectively as “Company Securities”) and (v) no other obligations by the Company or any of its Subsidiaries to make any payments based on the price or value of any Company Securities, including any phantom equity or stock appreciation rights. (c) As of the date of this Agreement, (i) there are no outstanding agreements of any kind which obligate the Company or any of its Subsidiaries to repurchase, redeem or otherwise acquire any Company Securities, or obligate the Company to grant, extend or enter into any such agreements relating to any Company Securities, including any agreements granting any preemptive rights, subscription rights, anti-dilutive rights, rights of first refusal or similar rights with respect to any Company Securities, (ii) none of the Company or any Subsidiary of the Company is a party to any stockholders’ agreement, voting trust agreement, registration rights agreement or other similar agreement or understanding relating to any Company Securities or any other agreement relating to the disposition, voting or dividends with respect to any Company Securities, (iii) all outstanding shares of Common Stock and Company Preferred Stock have been duly authorized and validly issued and are fully paid, nonassessable and free of preemptive rights. (d) The Convertible Preferred Stock and the shares of Common Stock issuable upon conversion of the Convertible Preferred Stock will be, when issued, duly authorized and validly issued, fully paid and nonassessable and issued in compliance with all applicable federal and state securities Laws, and such shares will not be issued in violation of any purchase option, call option, preemptive right, resale right, subscription right, right of first refusal or similar right, and will be free and clear of all Liens, except restrictions imposed by the Securities Act and any applicable foreign and state securities Laws, and transfer restrictions expressly set forth in the Transaction Documents including Section 5.06 hereof. The Convertible Preferred Stock, when issued, and the shares of Common Stock issuable upon conversion of the Convertible Preferred Stock, if and when issued, will have the terms and conditions and entitle the holders thereof to the rights set forth in the Company Charter Documents, as amended by the Certificate of Designation. The maximum number of shares of Common Stock initially issuable upon conversion of the Convertible Preferred Stock have been duly reserved for such issuance. (e) All of the outstanding shares of capital stock of, or other equity or voting interests in, each Subsidiary of the Company (except for directors' qualifying shares or the

13 like as required by applicable law) are owned directly or indirectly, beneficially and of record, by the Company free and clear of all material Liens, other than Liens over shares of capital stock (including other equity or voting interests) of the Company’s Subsidiaries under the Credit Agreement and the other Loan Documents (as defined in the Credit Agreement). Section 3.03 Authority; Noncontravention. (a) All corporate action on the part of the Company, its officers, directors, and shareholders necessary for the authorization, execution, and delivery of this Agreement and each Transaction Document, the performance of all obligations of the Company under this Agreement and each Transaction Document, and the authorization, issuance (or reservation for issuance), sale, and delivery of (i) the Convertible Preferred Stock being sold or issued hereunder, as applicable, and (ii) the shares of Common Stock issuable upon the conversion of the Convertible Preferred Stock in the case of clause (i) has been taken, and, in the case of clause (ii), will be taken prior to earlier of the Conversion Date or the Shareholder Approval Target Date, and this Agreement and each Transaction Document, assuming due authorization, execution and delivery by the Investor or any other party thereto, constitutes valid and legally binding obligations of the Company, enforceable in accordance with their respective terms, except that such enforceability (i) may be limited by bankruptcy, insolvency, fraudulent transfer, reorganization, moratorium and other similar Laws of general application affecting or relating to the enforcement of creditors’ rights generally and (ii) is subject to general principles of equity, whether considered in a proceeding at Law or in equity (the “Bankruptcy and Equity Exception”). (b) The Board has duly adopted resolutions (i) authorizing and approving the execution and delivery of this Agreement and the other Transaction Documents and the consummation of the Transactions (including the reservation of the maximum number of shares initially issuable upon conversion of the Convertible Preferred Stock) (having the effect of exempting the Investor and its Affiliates as an “interested stockholder” under Article X of the Company’s Certificate of Incorporation), and (ii) approving the Certificate of Designation. The Board (or an authorized committee thereof) has reviewed the transactions contemplated hereby with respect to any “related party transaction,” including for purposes of the DGCL and Rule 314.00 of the NYSE Listed Company Manual, and has approved any such transaction consistent with the applicable standards. (c) Neither the execution and delivery of this Agreement or the other Transaction Documents by the Company, nor the consummation by the Company of the Transactions, nor performance or compliance by the Company with any of the terms or provisions hereof or thereof, will (i) conflict with or violate any provision of the Company Charter Documents, (ii) conflict with or violate any provision of similar organizational documents of any of the Company’s Subsidiaries or (iii) assuming that any authorizations, consents and approvals referred to in Section 3.04 are obtained prior to the Closing Date and any filings required under any applicable Laws to enter into this Agreement or perform any Transaction hereunder referred to in Section 3.04 are made (if required to be made under any Laws prior to the Closing Date) and any applicable waiting periods thereunder have terminated or expired prior to the Closing Date, (x) violate any Law or Judgment

14 applicable to the Company or (y) violate or constitute a default (or constitute an event which, with notice or lapse of time or both, would violate or constitute a default) or accelerate the performance required by the Company under any of the terms or provisions of any loan or credit agreement, indenture, debenture, note, bond, mortgage, deed of trust, lease, sublease, license, contract or other agreement (each, a “Contract”) to which the Company or any of its Subsidiaries is a party or accelerate the Company’s or, if applicable, any of its Subsidiaries’ obligations under any such Contract, except, in the case of clause (ii), as would not, individually or in the aggregate, reasonably be expected to be material to the Company and its Subsidiaries. Section 3.04 Governmental Approvals. Except for (a) the filing of the Certificate of Designation with the Delaware Secretary of State, (b) any filings with the SEC under the Securities Act and Exchange Act, (c) compliance with any applicable state securities or blue sky Laws and (d) with respect to the rules of NYSE, with respect to the conversion of the Convertible Preferred Stock in excess of the Conversion Share Cap, the receipt of the affirmative vote (in person or by proxy) of the holders of a majority of the securities entitled to vote thereon, no consent or approval of or filing, license, Permit or authorization, declaration or registration with, or notice to any Governmental Authority or any stock market or stock exchange is necessary for the execution and delivery of this Agreement and the other Transaction Documents by the Company, the performance by the Company of its obligations hereunder and thereunder and the consummation by the Company of the Transactions. Section 3.05 Company SEC Documents; Undisclosed Liabilities. (a) Except, for the avoidance of doubt, as otherwise disclosed in its Filed SEC Documents, the Company has filed with the SEC, on a timely basis, all required reports, schedules, forms, statements and other documents required to be filed by the Company with the SEC pursuant to the Exchange Act since September 2, 2021 (collectively, the “Company SEC Documents”). As of their respective SEC filing dates, the Company SEC Documents complied in all material respects with the requirements of the Securities Act, the Exchange Act or the Sarbanes-Oxley Act of 2002 (and the regulations promulgated thereunder), as the case may be, applicable to such Company SEC Documents, and none of the Company SEC Documents as of such respective dates (or, if amended prior to the date hereof, the date of the filing of such amendment, with respect to the disclosures that are amended) contains any untrue statement of a material fact or omits to state a material fact necessary in order to make the statements therein, in the light of the circumstances under which they were made, not misleading. Except, for the avoidance of doubt, as otherwise disclosed in its Filed SEC Documents, as of the date hereof, (i) none of the Company’s Subsidiaries is required to file any documents with the SEC, (ii) there are no outstanding or unresolved comments in comment letters from the SEC staff with respect to any of the Company SEC Documents and (iii) to the Company’s Knowledge, none of the Company SEC Documents is the subject of ongoing SEC review, outstanding SEC comment or outstanding SEC investigation. Each of the certifications and statements relating to the Company SEC Documents required by: (A) Rule 13a-14 or Rule 15d-14 under the Exchange Act: (B) 18 U.S.C. §1350 (Section 906 of the Sarbanes-Oxley Act); or (C) any other rule or regulation promulgated by the SEC or applicable to the Company

15 SEC Documents is accurate and complete, and complies as to form and content in all material respects with all applicable Laws. (b) The consolidated financial statements of the Company (including all related notes or schedules) included or incorporated by reference in the Company SEC Documents (i) complied as to form, as of their respective dates of filing with the SEC, in all material respects with the published rules and regulations of the SEC with respect thereto, (ii) have been prepared in accordance with GAAP (except, in the case of unaudited quarterly statements, as permitted by Form 10-Q of the SEC or other rules and regulations of the SEC) applied on a consistent basis during the periods involved (except (i) as may be indicated in the notes thereto or (ii) as permitted by Regulation S-X), and (iii) fairly present in all material respects as of the dates thereof the consolidated financial position of the Company and its Subsidiaries and the consolidated results of their operations and cash flows for the periods shown (subject, in the case of unaudited quarterly financial statements, to normal year-end adjustments that would not be material). (c) Neither the Company nor any of its Subsidiaries has any material liabilities of any nature (whether accrued, absolute, contingent or otherwise), except liabilities (i) reflected or to the extent reserved against in the balance sheet (or the notes thereto) of the Company and its Subsidiaries as of June 30, 2022 (the “Balance Sheet Date”) included in the Filed SEC Documents, (ii) incurred after the Balance Sheet Date in the ordinary course of business (other than any such liabilities related to any breach of Contract, violation of Law or tort) or (iii) that have been discharged or paid prior to the date of this Agreement. (d) Except, for the avoidance of doubt, as disclosed in the Filed SEC Documents, the Company has established and maintains, and at all times since September 2, 2021 has maintained, disclosure controls and procedures and a system of internal controls over financial reporting (as such terms are defined in paragraphs (e) and (f), respectively, of Rule 13a-15 under the Exchange Act) as required by Rule 13a-15 under the Exchange Act. Neither the Company nor, to the Knowledge of the Company, the Company’s independent registered public accounting firm, has identified or been made aware of “material weaknesses” (as defined by the Public Company Accounting Oversight Board) in the design or operation of the Company’s internal controls over and procedures relating to financial reporting which would reasonably be expected to adversely affect in any material respect the Company’s ability to record, process, summarize and report financial data, in each case which has not been subsequently remediated. The Company is, and has been at all times since September 2, 2021, in compliance in all material respects with the applicable listing requirements and corporate governance rules and regulations of the NYSE. Section 3.06 Absence of Certain Changes. Since December 31, 2021, (i) the business of the Company and its Subsidiaries has been operated and conducted, in the ordinary course of business consistent with past practice; (ii) the Company and its Subsidiaries have not suffered any material casualty, loss, theft, destruction or damage to its assets or properties, whether or not covered by insurance; and (iii) there has not been any Material Adverse Effect.

16 Section 3.07 Legal Proceedings. There is no (a) pending or, to the Knowledge of the Company, threatened material legal or administrative proceeding, suit, audit, charge, claim, investigation, arbitration or action (an “Action”) against the Company or any of its Subsidiaries or (b) outstanding order, judgment, injunction, ruling, writ or decree of any Governmental Authority (“Judgments”) imposed upon the Company or any of its Subsidiaries, in each case, by or before any Governmental Authority. Section 3.08 Compliance with Laws; Permits. (a) The Company and each of its Subsidiaries are, and for the past three (3) years, have been in compliance in all material respects with all state or federal laws, common law, statutes, ordinances, codes, rules or regulations, orders, executive orders, judgments, injunctions, governmental guidelines or interpretations that have the force of law, Permits, decrees, or other similar requirements enacted, adopted, promulgated, or applied by any Governmental Authority (“Laws”) or Judgments, in each case, that are applicable to the Company or any of its Subsidiaries. The Company and each of its Subsidiaries hold all material licenses, franchises, permits, certificates, approvals and authorizations from Governmental Authorities (“Permits”) necessary for the lawful conduct of their respective businesses. (b) The Company, each of its Subsidiaries, and each of their respective officers, directors and employees and, to the Knowledge of the Company, agents or other third party representatives acting on behalf of any of them is, and for the past three (3) years have been, in compliance in all material respects with (i) the Foreign Corrupt Practices Act of 1977 and any rules and regulations promulgated thereunder, and any other Laws applicable to the Company and its Subsidiaries, in each country in which they operate, that address the prevention of corruption (the “Anti-Corruption Laws”), and have maintained accurate books and records and adopted and adhered to a system of policies, procedures, and internal controls as required by applicable Anti-Corruption Laws, (ii) all sanctions regulations, orders or other financial restrictions administered by the United States (including without limitation the Office of Foreign Assets Control of the United States Treasury Department (“OFAC”)) and similar sanctions, Laws and regulations applicable to the Company or its Subsidiaries from time to time (collectively, “Sanctions”) and has not to the Company’s Knowledge transacted any business with or for the benefit of any Person designated on OFAC’s list of Specially Designated Nationals and Blocked Persons that was not in compliance with such Sanctions, and (iii) all Laws applicable to the Company and its Subsidiaries relating to export, re-export, transfer, and import controls, including the Export Administration Regulations, the International Traffic in Arms Regulations, and the customs and import Laws administered by U.S. Customs and Border Protection. (c) For the past three (3) years, to the Knowledge of the Company, none of the Company or any Subsidiary or any of their respective directors, officers, employees or any Person acting on behalf of the Company or any Subsidiary have been the subject of any allegation, complaint, voluntary disclosure, investigation, inquiry, prosecution or other enforcement action related to any Anti-Corruption Laws, Sanctions, or applicable Laws related to export, re-export, transfer or import controls.

17 Section 3.09 Contracts. Each Material Contract is valid, binding and enforceable on the Company and any of its Subsidiaries to the extent such Person is a party thereto, as applicable, and to the Knowledge of the Company, each other party thereto, and is in full force and effect. The Company and each of its Subsidiaries, and, to the Knowledge of the Company, any other party thereto, is in compliance in all material respects with all Material Contracts and has performed all obligations required to be performed by it. Section 3.10 Tax Matters. (a) Except as would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect: (a) the Company and its Subsidiaries have prepared (or caused to be prepared) and timely filed (taking into account any applicable extensions of time within which to file) all Tax Returns required to be filed by any of them, (b) all Taxes owed by the Company or its Subsidiaries that are due (whether or not shown on any Tax Return) have been timely paid except for Taxes that are being contested in good faith by appropriate proceedings and that have been adequately reserved against on the Company’s consolidated financial statements in accordance with GAAP, (c) no proceeding, examination or audit of any Tax Return of the Company or its Subsidiaries or with respect to any Taxes paid by, due from or with respect to the Company or its Subsidiaries by any Taxing Authority is currently in progress or threatened in writing (or, to the Knowledge of the Company, otherwise), (d) none of the Company or any of its subsidiaries have engaged in, or have any liability or obligation with respect to, any “listed transaction” within the meaning of Treasury Regulations Section 1.6011-4, and (e) none of the Company or any of its Subsidiaries have distributed stock of another Person, or have had its stock distributed by another Person, in a transaction that was or was purported or intended to be governed in whole or in part by Section 355 of 361 of the Code. Notwithstanding anything to the contrary in this Agreement, the representations and warranties set forth in this Section 3.07 and the representations and warranties contained in Section 3.09 to the extent specifically addressing Taxes shall be the only representations or warranties of the Company and its Subsidiaries in this Agreement with respect to Tax matters. Nothing in this Section 3.07 or otherwise in this Agreement shall be construed as a representation or warranty with respect to (i) the amount or availability of any Tax asset or attribute of the Company or any of its Subsidiaries in any taxable period or (ii) any Tax position that the Investor or the Company and its Subsidiaries may take in respect of any taxable period (or portion thereof) beginning after the Closing. Section 3.11 No Rights Agreement; Anti-Takeover Provisions. The Company is not party to a stockholder rights agreement, “poison pill” or similar anti-takeover agreement or plan. No other “business combination,” “control share acquisition,” “fair price,” “moratorium” or other anti-takeover Laws apply or will apply to the Company as a result of this Agreement or the Transactions. Section 3.12 Brokers and Other Advisors. Except for Jefferies LLC, no broker, investment banker, financial advisor or other Person is entitled to any broker’s, finder’s, financial advisor’s or similar fee or commission, or the reimbursement of expenses in connection therewith, in connection with the Transactions based upon arrangements made by or on behalf of the Company or any of its Subsidiaries. Section 3.13 Employee Benefit Plans. (i) Each Company Plan has been established, operated, maintained and administered in accordance with its terms and in compliance in all material respects with the applicable provisions of ERISA, the Code and other applicable Laws;

18 (ii) no Company Plan subject to the Laws outside of the United States which covers individual service providers located outside of the United States has any material unfunded or underfunded liabilities or obligations; and (iii) all contributions required to be made to any benefit or compensation plan or arrangement sponsored or maintained by a Governmental Authority have been timely made or, if not yet due, properly accrued in accordance with local accounting principles. No Company Plan is, and none of the Company or any of its Subsidiaries sponsors, maintains, contributes to (is required to contribute to), or has any material current or contingent liability or obligation (including on account of being considered a single employer under Section 414 of the Code with any other Person) with respect to or under: (x) a U.S. “defined benefit plan” as defined in Section 3(35) of ERISA or a plan in the United States that is or was subject to Title IV of ERISA or Section 412 of the Code; or (y) a “multiemployer plan” as defined in Section 3(37) of ERISA. Section 3.14 Labor Matters. Except as required by Law, (a) neither the Company nor any of its Subsidiaries is party to or bound by any collective bargaining agreement or Contract with any labor organization, labor union, or works council, nor to the Company’s Knowledge, is any union organizational activities threatened; (b) there are no active, nor, to the Knowledge of the Company, threatened, material labor strikes, slowdowns, work stoppages, pickets, walkouts, lockouts or other material labor disputes with respect to the employees of the Company or any of its Subsidiaries; and (c) to the Knowledge of the Company, no material employee layoff, facility closure, or material reduction in force is currently planned or announced and pending completion. Section 3.15 Sale of Securities. Based in part on the representations and warranties set forth in Section 4.06, the sale and/or issuance of the Convertible Preferred Stock pursuant to this Agreement is exempt from the registration and prospectus delivery requirements of the Securities Act. Without limiting the foregoing, neither the Company nor, to the Knowledge of the Company, any other Person authorized by the Company to act on its behalf, has engaged in a general solicitation or general advertising (within the meaning of Regulation D of the Securities Act) of investors with respect to offers or sales of Convertible Preferred Stock, and neither the Company nor, to the Knowledge of the Company, any Person acting on its behalf has made any offers or sales of any security or solicited any offers to buy any security, under circumstances that would cause the offering or issuance of Convertible Preferred Stock under this Agreement to be integrated with prior offerings by the Company for purposes of the Securities Act that would result in none of Regulation D or any other applicable exemption from registration under the Securities Act to be available. Section 3.16 Listing and Maintenance Requirements. The Common Stock is registered pursuant to Section 12(b) of the Exchange Act and listed on the NYSE, and the Company has taken no action designed to, or which to the Knowledge of the Company is reasonably likely to have the effect of, terminating the registration of the Common Stock under the Exchange Act or delisting the Common Stock from the NYSE, nor has the Company received as of the date of this Agreement any notification that the SEC or the NYSE is contemplating terminating such registration or listing. Section 3.17 Vote Required. No vote or approval of the holders of any class or series of capital stock of the Company or any of its Subsidiaries is required under the rules and

19 regulations of the SEC, the DGCL, NYSE or the Company Charter Documents to approve the Transactions and the consummation thereof. Section 3.18 Indebtedness. (a) As of the date of this Agreement, the Company is not party to any Contract, and is not subject to any provision in the Company Charter Documents or other governing documents or resolutions of the Board that, in each case, by its terms restricts, limits, prohibits or prevents the Company from paying dividends in form and the amounts contemplated by the Certificate of Designation. (b) The Company and its Subsidiaries and, to the Knowledge of the Company, each of the other parties thereto, are not in material breach of, default or violation under, the Credit Agreement and no event has occurred that with notice or lapse of time, or both, would constitute such a material breach, default or violation. Section 3.19 Real Property. (a) the Company or one of its Subsidiaries has good and valid title to the material real estate owned by the Company or any of its Subsidiaries (the “Owned Real Property” and, collectively with the Leased Real Property, the “Real Property”), free and clear of all Liens other than Permitted Liens, (b) the Company or one of its Subsidiaries has a good and valid leasehold interest in each material Company Lease, free and clear of all Liens other than Permitted Liens and (c) to the Knowledge of the Company, none of the Company or any of its Subsidiaries has received written notice of any material default under any agreement evidencing any Lien (other than any Permitted Lien) or other agreement affecting the Owned Real Property or any material Company Lease, which default continues on the date hereof. Section 3.20 Environmental Matters. (a) The Company and its Subsidiaries are, and at all times for the past three (3) years have been, in compliance in all material respects with all Environmental Laws, which compliance includes and has included obtaining, maintaining, and complying with all Company Permits required pursuant to, or issued under, Environmental Laws; (b) For the past three (3) years there have not been, and there are not, any Actions pending, threatened in writing or, to the Knowledge of the Company, orally threatened against the Company or any of its Subsidiaries pursuant to Environmental Laws, and none of the Company or any of its Subsidiaries has received any written notice, report, claim, order, directive, or other information, in each case, alleging any material violation of, or liability under, Environmental Laws; (c) None of the Company or any of its Subsidiaries (nor any other Person, to the extent giving rise to liability to the Company or any of its Subsidiaries) has treated, stored, disposed of, permitted, or arranged for the disposal of, transported, distributed, manufactured, designed, produced, sold, repaired, installed, marketed, handled, released, or exposed any Person to, or owned or operated any property or facility contaminated by, any Hazardous Substance or products containing Hazardous Substances, in each case, in material violation of, or so as to give rise to any material liabilities under, any Environmental Law; and

20 (d) None of the Company or any of its Subsidiaries has assumed, provided an indemnity with respect to, or otherwise become subject to any liability under Environmental Laws of any other Person that could reasonably be expected to result in a payment by the Company in excess of $100,000. Section 3.21 Intellectual Property. Except as previously disclosed to the Investor (including, for the avoidance of doubt, in the Filed SEC Documents): (i) the Company or one of its Subsidiaries, as applicable, exclusively owns, possesses, or has a valid and enforceable license or right to use or otherwise exploit, all Intellectual Property that is used in and material to the operation of the business of the Company and its Subsidiaries as conducted as of the Closing Date, as applicable, and such exclusively owned Intellectual Property is, to the Knowledge of the Company, valid, subsisting and enforceable in all material respects; (ii) the Company has not received notice in writing which asserts that the conduct of the business of the Company and its Subsidiaries are infringing, misappropriating, or violating the Intellectual Property of any other Person in any material respect; (iii) the Company has taken commercially reasonable efforts to ensure that there are no material unauthorized intrusions, breaches (including security breaches such as phishing incidents, ransomware, malware attacks), failures, breakdowns, or other adverse events material computer Software, websites and systems owned or controlled by the Company or its Subsidiaries (“Systems”); and (iv) the Company and its Subsidiaries have taken commercially reasonable steps to maintain the confidentiality of the material trade secrets owned by the Company or its Subsidiaries and the security of the Systems. Section 3.22 Affiliate Transactions. As of the date of this Agreement, none of the officers or directors or other Affiliates of the Company is presently a party to any transaction with the Company or any of its Subsidiaries (other than as holders of options, and/or other grants or awards under the Company Stock Plan, and for services as employees, officers and directors) that is material to the Company and its Subsidiaries, taken as a whole or where the amount involved exceeds $120,000, other than (a) as disclosed in the Filed SEC Documents and (b) the entry into this Agreement and any transactions contemplated hereby. ARTICLE IV Representations and Warranties of the Investor The Investor represents and warrants to the Company, as of the Closing Date: Section 4.01 Organization; Standing. The Investor is duly organized, validly existing and in good standing under the Laws of its jurisdiction of formation and has all requisite limited partnership power and authority to carry on its business as presently conducted. Section 4.02 Authority; Noncontravention. (a) The Investor has all necessary limited partnership power and limited partnership authority to execute and deliver this Agreement and the other Transaction Documents to which it is a party and to perform its obligations hereunder and thereunder and to consummate the Transactions. The execution, delivery and performance by the Investor of this Agreement and the other Transaction Documents and the consummation by the Investor of the Transactions have been duly authorized and approved by all

21 necessary action on the part of the Investor, and no further action, approval or authorization by any of its partners, is necessary to authorize the execution, delivery and performance by the Investor of this Agreement and the other Transaction Documents and the consummation by the Investor of the Transactions. This Agreement has been duly executed and delivered by the Investor and, assuming due authorization, execution and delivery hereof by the Company, constitutes a legal, valid and binding obligation of the Investor, enforceable against the Investor in accordance with its terms, except as such enforceability may be limited by the Bankruptcy and Equity Exception. (b) Neither the execution and delivery of this Agreement or the other Transaction Documents by the Investor, nor the consummation of the Transactions by the Investor, nor performance or compliance by the Investor with any of the terms or provisions hereof or thereof, will (i) conflict with or violate any provision of the organizational documents of the Investor (including any applicable certificate of limited partnership), or (ii) assuming that the authorizations, consents and approvals referred to in Section 4.03 are obtained prior to the Closing Date and the filings referred to in Section 4.03 are made and any waiting periods with respect to such filings have terminated or expired prior to the Closing Date (x) violate any Law or Judgment applicable to the Investor or (y) violate or constitute a default (or constitute an event which, with notice or lapse of time or both, would violate or constitute a default) under any of the terms, conditions or provisions of any Contract to which the Investor is a party or accelerate the Investor’s obligations under any such Contract, except, in the case of clause (ii), as would not, individually or in the aggregate, reasonably be expected to have an Investor Material Adverse Effect. Section 4.03 Governmental Approvals. Except for the filing by the Company of the Certificate of Designation with the Delaware Secretary of State, no consent or approval of, or filing, license, Permit or authorization, declaration or registration with, any Governmental Authority is necessary for the execution and delivery of this Agreement and the other Transaction Documents by the Investor, the performance by the Investor of its obligations hereunder and thereunder and the consummation by the Investor of the Transactions, other than such other consents, approvals, filings, licenses, Permits, authorizations, declarations or registrations that, if not obtained, made or given, would not, individually or in the aggregate, reasonably be expected to have an Investor Material Adverse Effect. Section 4.04 Ownership of Company Stock. None of the Investor nor any of its controlled Affiliates owns any capital stock or other equity or equity-linked securities of the Company. Section 4.05 Brokers and Other Advisors. No broker, investment banker, financial advisor or other Person is entitled to any broker’s, finder’s, financial advisor’s or other similar fee or commission, or the reimbursement of expenses in connection therewith, in connection with the Transactions based upon arrangements made by or on behalf of the Investor, except for Persons, if any, whose fees and expenses will be paid by the Investor. Section 4.06 Purchase for Investment. The Investor acknowledges that the Convertible Preferred Stock and the Common Stock issuable upon the conversion of the Convertible Preferred Stock have not been registered under the Securities Act or under any state or other applicable

22 securities Laws. The Investor (a) acknowledges that it is acquiring the Convertible Preferred Stock and the Common Stock issuable upon the conversion of the Convertible Preferred Stock pursuant to an exemption from registration under the Securities Act solely for investment with no intention to distribute any of the foregoing to any Person, (b) will not sell, Transfer, or otherwise dispose of any of the Convertible Preferred Stock or the Common Stock issuable upon the conversion of the Convertible Preferred Stock, except in compliance with this Agreement and the registration requirements or exemption provisions of the Securities Act and any other applicable securities Laws, (c) has such knowledge and experience in financial and business matters and in investments of this type that it is capable of evaluating the merits and risks of its investment in the Convertible Preferred Stock and the Common Stock issuable upon the conversion of the Convertible Preferred Stock and of making an informed investment decision, (d) is an “accredited investor” (as that term is defined by Rule 501 of the Securities Act) and (e) (1) has reviewed the information that it considers necessary or appropriate to make an informed investment decision with respect to the Convertible Preferred Stock and the Common Stock issuable upon conversion of the Convertible Preferred Stock, (2) has had an opportunity to discuss with the Company and its Representatives the intended business and financial affairs of the Company and to obtain information necessary to verify the information furnished to it or to which it had access and (3) can bear the economic risk of (i) an investment in the Convertible Preferred Stock and the Common Stock issuable upon the conversion of the Convertible Preferred Stock indefinitely and (ii) a total loss in respect of such investment. The Investor has such knowledge and experience in business and financial matters so as to enable it to understand and evaluate the risks of, and form an investment decision with respect to its investment in, the Convertible Preferred Stock and the Common Stock issuable upon the conversion of the Convertible Preferred Stock. Section 4.07 Non-Reliance on Company Estimates, Projections, Forecasts, Forward-Looking Statements and Business Plans. In connection with the due diligence investigation of the Company by the Investor and its respective Representatives, the Investor and its respective Representatives have received and may continue to receive from the Company and its Representatives certain estimates, projections, forecasts and other forward-looking information, as well as certain business plan information, in each case containing forward-looking information, regarding the Company and its Subsidiaries and their respective businesses and operations. The Investor hereby acknowledges that there are uncertainties inherent in attempting to make such estimates, projections, forecasts and other forward-looking statements, as well as in such business plans to the extent each of them contain forward-looking information, with which the Investor is familiar, that the Investor is making its own evaluation of the adequacy and accuracy of such forward-looking information so furnished to the Investor (including the reasonableness of the assumptions underlying such forward-looking information), and that, except for the representations and warranties made by the Company in Article III, the Transaction Documents and in any certificate or other document delivered in connection with this Agreement or the Transaction Documents, and other than for Fraud, the Investor will have no claim against the Company or any of its Subsidiaries, or any of their respective Representatives, with respect thereto. ARTICLE V Additional Agreements Section 5.01 Anti-Takeover Laws. The Company and the Company Board (and any committee empowered to take such action, if applicable) will (a) take all actions within their power