| | | | | | | | |

| 8226 Philips Highway, Suite 101 | | Investor Relations Contact: |

| Jacksonville, FL 32256 USA | | investorrelations@redwirespace.com |

Redwire Corporation Reports Second Quarter 2022 Financial Results

JACKSONVILLE, Fla. / August 10, 2022 Redwire Corporation (NYSE: RDW), a new leader in mission critical space solutions and high reliability components for the next generation space economy, today announced results for its second quarter ended June 30, 2022.

Redwire will live stream a presentation with slides. Please use the link below to follow along with the live stream: https://event.choruscall.com/mediaframe/webcast.html?webcastid=f52OeAqX

Q2 2022 Highlights

•Revenue increased $4.6 million, or 14.2%, to $36.7 million for the three months ended June 30, 2022, from $32.1 million for the three months ended June 30, 2021.

•Successful delivery of proven and differentiated products and services for multiple National Security Space (“NSS”) and commercial customers, including for multi-year, multi-shipset missions.

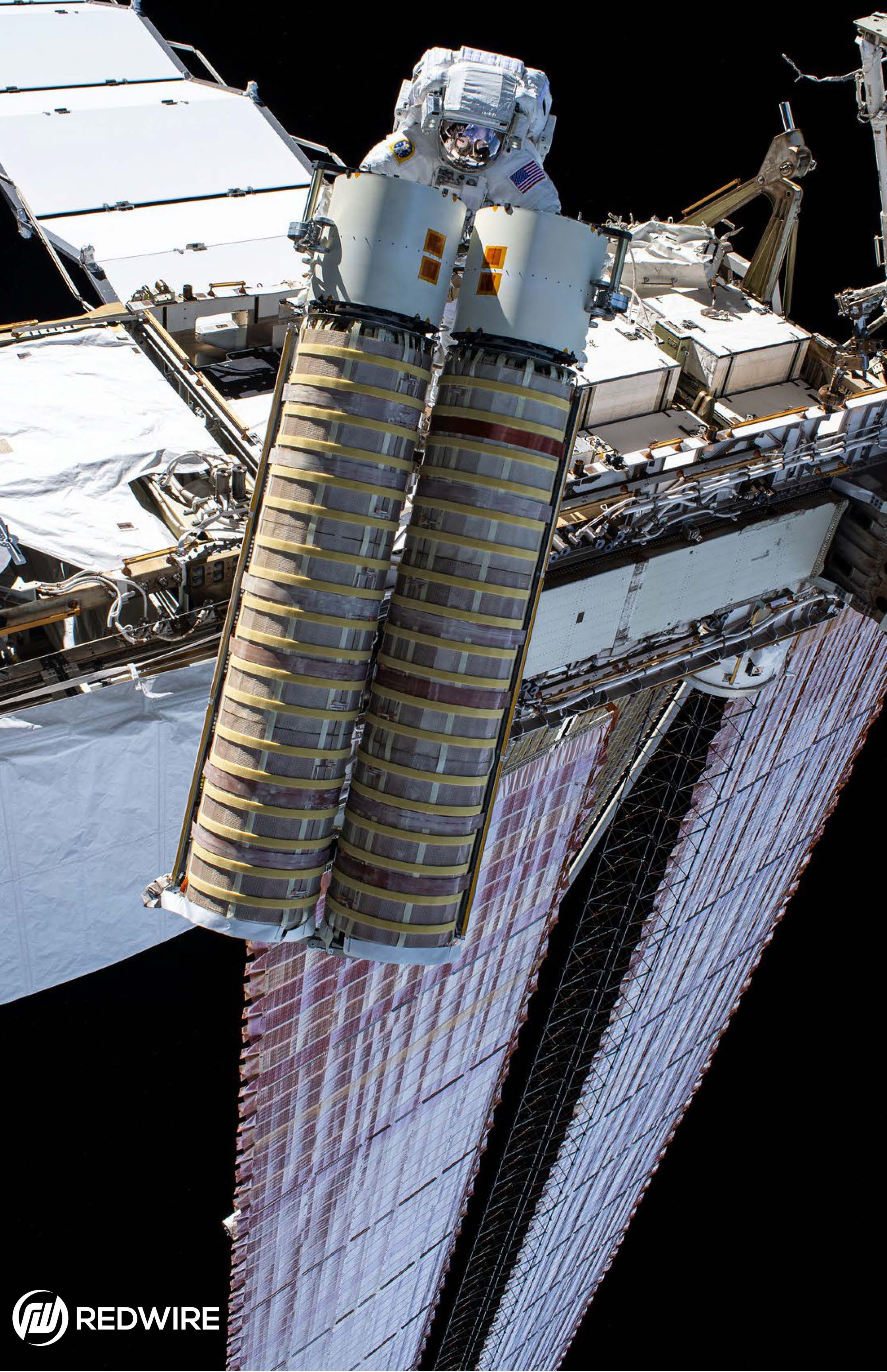

•Operational successes have led to additional work and cross-selling of higher gross margin products and services with improved on-time deliveries, including for large solar array programs and navigation component projects.

•Investments continue to expand production capacity and increase scale and execution efficiency; opened new facility in Luxembourg to specialize in design and development of robotic arms for orbital, free-flying and lunar missions.

•Our significantly higher 1.68 book-to-bill ratio1, combined with increased gross margins, provides for an improved financial outlook for the second half of 2022 and 2023.

“We continued to execute on our long-term strategy during the second quarter, building on our diversified portfolio of proven products, demonstrated flight heritage and long-term customer relationships across the government civil, national security and commercial segments,” stated Peter Cannito, Chairman and Chief Executive Officer of Redwire. “With approximately seventy percent of our revenue from government contracts in the expanding civil space and national security segments that have been cultivated over decades, Redwire has a solid foundation to capitalize on the extraordinary potential of the rapidly growing commercial space segment as that segment emerges over time. We are well-positioned for the long term, regardless of the broader macro-economic environment.”

Additional Q2 2022 Financial Highlights:

•Net loss and Pro Forma Adjusted EBITDA1 were $(77.0) million and $(4.1) million, respectively, for the three months ended June 30, 2022 compared to net loss and Pro Forma Adjusted EBITDA of $(15.9) million and $2.1 million, respectively, for the three months ended June 30, 2021. The net loss in the second quarter of 2022 included an $80.5 million non-cash goodwill, intangible and long-lived asset impairment charge.

1 Total book-to-bill, a key business measure, and Pro Forma Adjusted EBITDA are not a measure of results under generally accepted accounting principles in the United States. See “Non-GAAP Financial Information” and the reconciliation tables included in this press release for details regarding the calculation of book-to-bill, Adjusted EBITDA and Pro forma Adjusted EBITDA.

Page 1

•The three months ended June 30, 2022 delivered better financial performance compared to the three months ended March 31, 2022 with improved revenues of 11.7%, gross margin of 3.3%, Adjusted EBITDA1 of 13.2%, and Free Cash Flow1 of $(0.5) million compared to $(6.4) million for the three months ended June 30, 2022 and March 31, 2022, respectively.

•Redwire expects to achieve positive Adjusted EBITDA in the second half of 2022 driven by increased revenue and changes in contract mix with higher gross margins. For the fiscal year ended December 31, 2022, Redwire is updating its previously provided guidance and now expects revenues to be in a range of approximately $165 million to $175 million and Pro Forma Adjusted EBITDA2 to be in a range between $(2.0) million and $3.0 million.

“Q2 revenues grew year-over-year and sequentially,” said Jonathan Baliff, Chief Financial Officer of Redwire. “Our flight heritage and investments we have made in the first half of 2022 create the scale to compete and win more and larger opportunities, as demonstrated by our second quarter 2022 book-to-bill ratio of 1.68. When combined with new contract awards with increased gross margin, Redwire has a much-improved financial outlook for the second half of 2022 and 2023 compared to the first half of 2022.”

Capitalization and Liquidity

On August 8, 2022, the Company entered into the Fourth Amendment to the Adams Street Capital Credit Agreement. The Fourth Amendment, among other things, suspends the requirement to comply with the consolidated total net leverage ratio, commencing with the quarter ended June 30, 2022 through June 30, 2023. The Company is required to maintain a minimum liquidity covenant of $5 million measured on the last day of each fiscal month commencing with month ending September 30, 2022 through September 30, 2023. In addition, the Fourth Amendment increased the per annum interest rate with respect to the initial term loans, delayed draw term loans and revolving loans by 2.00%, which interest shall accrue and be paid in kind, until the Company is in compliance with the consolidated total net leverage ratio.

In connection with the execution of the Fourth Amendment, AE Industrial Partners Fund II, LP and certain of its affiliates (the “AEI Guarantors”), provided a limited guarantee for the payment of outstanding term loans up to $7.5 million in the aggregate. In the event that the AEI Guarantors are required to make payments to the lenders under the Adams Street Capital Credit Agreement pursuant to the terms of the limited guarantee, each AEI Guarantor would be subrogated to the rights of the lenders. In connection with the limited guarantee, the Lead Borrower agreed to pay to the AEI Guarantors, a fee equal to 2% of any amount actually paid by such guarantors under the limited guarantee. The fee is waivable by the AEI Guarantors in their discretion.

Financial Results Investor Call

Management will conduct a conference call starting at 9:00 a.m. ET on Wednesday, August 10, 2022 to review financial results for the second quarter ended June 30, 2022. This release and the most recent investor slide presentation are available in the investor relations area of our website at redwirespace.com.

Redwire will live stream a presentation with slides during the call. Please use the following link to follow along with the live stream: https://event.choruscall.com/mediaframe/webcast.html?webcastid=f52OeAqX. The dial-in number for the live call is 877-485-3108 (toll free) or 201-689-8264 (toll), and the conference ID is 13732244.

A telephone replay of the call will be available for two weeks following the event by dialing 877-660-6853 (toll-free) or 201-612-7415 (toll) and entering the access code 13732244. The accompanying investor presentation will be available on August 10, 2022 on the investor section of Redwire’s website at ir.redwirespace.com.

1 Free Cash Flow and Adjusted EBITDA are not measures of results under generally accepted accounting principles in the United States. See “Non-GAAP Financial Information” and the reconciliation tables included in this press release for details regarding the calculation of Free Cash Flow, Adjusted EBITDA and pro forma Adjusted EBITDA.

2 Pro forma Adjusted EBITDA is not a measure of results under generally accepted accounting principles in the United States. We are unable to provide guidance for net income (loss) or reconciliations to forward looking net income (loss) because we are unable to provide a meaningful or accurate calculation or estimation of certain reconciling items without unreasonable effort. This is due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation. Thus, we are unable to present a quantitative reconciliation of the aforementioned forward looking non-GAAP financial measures to the most closely comparable forward looking U.S. GAAP financial measure because such information is not available. See Appendix for more information regarding Pro Forma Adjusted EBITDA.

Page 2

Any replay, rebroadcast, transcript or other reproduction of this conference call, other than the replay accessible by calling the number and website above, has not been authorized by Redwire Corporation and is strictly prohibited. Investors should be aware that any unauthorized reproduction of this conference call may not be an accurate reflection of its contents.

About Redwire Corporation

Redwire Corporation (NYSE: RDW) is a new leader in space infrastructure for the next generation space economy, with valuable intellectual property for solar power generation and in-space 3D printing and manufacturing. With decades of flight heritage combined with the agile and innovative culture of a commercial space platform, Redwire is uniquely positioned to assist its customers in solving the complex challenges of future space missions. For more information, please visit www.redwirespace.com.

Cautionary Statement Regarding Forward-Looking Statements

Readers are cautioned that the statements contained in this press release regarding expectations of our performance or other matters that may affect our business, results of operations, or financial condition are “forward looking statements” as defined by the “safe harbor” provisions in the Private Securities Litigation Reform Act of 1995. Such statements are made in reliance on the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical fact, included or incorporated in this press release, including statements regarding our strategy, financial position, guidance, funding for continued operations, cash reserves, liquidity, projected costs, plans, projects, awards and contracts, and objectives of management, are forward looking statements. Words such as “expect,” “anticipate,” “should,” “believe,” “hope,” “target,” “continued,” “project,” “plan,” “goals,” “opportunity,” “appeal,” “estimate,” “potential,” “predict,” “may,” “will,” “might,” “could,” “intend,” “shall,” “possible,” “would,” “approximately,” “likely,” “schedule,” and variations of these terms or the negative of these terms and similar expressions are intended to identify these forward-looking statements, but the absence of these words does not mean that a statement is not forward looking. These forward-looking statements are not guarantees of future performance, conditions or results. Forward looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond our control.

These factors and circumstances include, but are not limited to: (1) the company’s limited operating history; (2) the development and continued refinement of many of the company’s proprietary technologies, produces and service offerings; (3) the possibility that the company’s assumptions relating to future results may prove incorrect; (4) the inability to successfully integrate recently completed and future acquisitions; (5) the possibility that the company may be adversely affected by other macroeconomic, business, and/or competitive factors; (6) the impacts of COVID-19 on the company’s business; (7) unsatisfactory performance of our products; (8) the emerging nature of the market for in-space infrastructure services; (9) inability to realize benefits from new offerings or the application of our technologies; (10) the inability to convert orders in backlog into revenue; (11) data breaches or incidents involving the company’s technology; (12) the company’s dependence on senior management and other highly skilled personnel; (13) incurrence of significant expenses and capital expenditures to execute our business plan; (14) the ability to recognize the anticipated benefits of the business combination Genesis Park Acquisition Corp., which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees; (15) costs related to the business combination with Genesis Park Acquisition Corp.; (16) early termination, audits, investigations, sanctions and penalties with respect to government contracts; (17) inability to report our financial condition or results of operations accurately or timely as a result of identified material weaknesses; (18) inability to meet or maintain stock exchange listing standards; (19) the need for substantial additional funding to finance our operations, which may not be available when we need it, on acceptable terms or at all; (20) significant fluctuation of our operating results; (21) adverse publicity stemming from any incident involving the Company or its competitors; (22) changes in applicable laws or regulations; ; and (23) other risks and uncertainties described in our most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q and those indicated from time to time in other documents filed or to be filed with the SEC by the Company.

The forward-looking statements contained in this press release are based on our current expectations and beliefs concerning future developments and their potential effects on us. If underlying assumptions to forward looking statements prove inaccurate, or if known or unknown risks or uncertainties materialize, actual results could vary materially from those anticipated, estimated, or projected. The forward-looking statements contained in this press release are made as of the date of this press release, and the Company disclaims any intention or obligation, other than imposed by law, to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. Persons reading this press release are cautioned not to place undue reliance on forward looking statements.

Non-GAAP Financial Information

This press release contains financial measures that have not been prepared in accordance with United States Generally Accepted Accounting Principles (“U.S. GAAP”). These financial measures include Total backlog, book-to-bill, Adjusted EBITDA, Pro Forma Adjusted EBITDA and Free Cash Flow.

We use certain financial measures to evaluate our operating performance, generate future operating plans, and make strategic decisions, including those relating to operating expenses and the allocation of internal resources which are not calculated in accordance with U.S. GAAP and are considered to be Non-GAAP financial performance measures. These Non-GAAP financial performance measures are used to supplement the financial information presented on a U.S. GAAP basis and should not be considered in isolation or as a substitute for the relevant U.S. GAAP measures and should be read in conjunction with information presented on a U.S. GAAP basis. Because not all companies use identical calculations, our presentation of Non-GAAP measures may not be comparable to other similarly titled measures of other companies.

Adjusted EBITDA, Pro Forma Adjusted EBITDA, and Free Cash Flow are three such Non-GAAP financial measures that we use. Adjusted EBITDA is defined as net income (loss) adjusted for interest expense (income), net, income tax (benefit) expense, depreciation and amortization, impairment expense, acquisition deal costs, acquisition integration costs, acquisition earnout costs, purchase accounting fair value adjustment related to deferred revenue, severance costs, capital market and advisory fees, write-off of long-lived assets, equity-based compensation, committed equity facility transaction costs, and warrant liability fair value adjustments. Pro Forma Adjusted EBITDA is computed in accordance with Article 8 of Regulation S-X and is computed to give effect to the business combinations as if they occurred on January 1 of the year in which they occurred. Free Cash Flow is computed as Adjusted EBITDA less capital expenditures and changes in net working capital.

REDWIRE CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(In thousands of U.S. dollars, except share data)

| | | | | | | | | | | |

| June 30, 2022 | | December 31, 2021 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 10,879 | | | $ | 20,523 | |

| Accounts receivable, net | 12,702 | | | 16,262 | |

| Contract assets | 14,747 | | | 11,748 | |

| Inventory | 1,681 | | | 688 | |

| Income tax receivable | 688 | | | 688 | |

| | | |

| Prepaid insurance | 692 | | | 2,819 | |

| Prepaid expenses and other current assets | 4,073 | | | 2,488 | |

| Total current assets | 45,462 | | | 55,216 | |

| Property, plant and equipment, net | 5,824 | | | 19,384 | |

| Right-of-use assets | 12,080 | | | — | |

| Intangible assets, net | 57,724 | | | 90,842 | |

| Goodwill | 56,752 | | | 96,314 | |

| | | |

| Other non-current assets | 756 | | | — | |

| Total assets | $ | 178,598 | | | $ | 261,756 | |

| Liabilities and Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 18,408 | | | $ | 13,131 | |

| Notes payable to sellers | 1,000 | | | 1,000 | |

| Short-term debt, including current portion of long-term debt | 780 | | | 2,684 | |

| Short-term lease liabilities | 2,904 | | | — | |

| Accrued expenses | 14,588 | | | 17,118 | |

| Deferred revenue | 15,823 | | | 15,734 | |

| Other current liabilities | 1,829 | | | 1,571 | |

| Total current liabilities | 55,332 | | | 51,238 | |

| Long-term debt | 84,625 | | | 74,867 | |

| Long-term lease liabilities | 9,503 | | | — | |

| Warrant liabilities | 3,943 | | | 19,098 | |

| Deferred tax liabilities | 3,772 | | | 8,601 | |

| Other non-current liabilities | 325 | | | 730 | |

| Total liabilities | 157,500 | | | 154,534 | |

| Shareholders’ Equity: | | | |

| Preferred stock, $0.0001 par value, 100,000,000 shares authorized; none issued and outstanding as of June 30, 2022 and December 31, 2021 | — | | | — | |

| Common stock, $0.0001 par value, 500,000,000 shares authorized; 63,253,836 and 62,690,869 issued and outstanding as of June 30, 2022 and December 31, 2021, respectively | 6 | | | 6 | |

| Additional paid-in capital | 191,707 | | | 183,024 | |

| Accumulated deficit | (170,232) | | | (75,911) | |

| Accumulated other comprehensive income (loss) | (383) | | | 103 | |

| Shareholders’ equity | 21,098 | | | 107,222 | |

| Total liabilities and shareholders’ equity | $ | 178,598 | | | $ | 261,756 | |

REDWIRE CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

(Unaudited)

(In thousands of U.S. dollars, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, 2022 | | June 30, 2021 | | June 30, 2022 | | June 30, 2021 |

| Revenues | $ | 36,728 | | | $ | 32,148 | | | $ | 69,595 | | | $ | 63,846 | |

| Cost of sales | 29,746 | | | 23,534 | | | 57,442 | | | 47,755 | |

| Gross margin | 6,982 | | | 8,614 | | | 12,153 | | | 16,091 | |

| Operating expenses: | | | | | | | |

| Selling, general and administrative expenses | 17,562 | | | 12,143 | | | 38,513 | | | 23,399 | |

| Contingent earnout expense | — | | | 11,114 | | | — | | | 11,114 | |

| Transaction expenses | 48 | | | 2 | | | 94 | | | 2,419 | |

| | | | | | | |

| Impairment expense | 80,462 | | | — | | | 80,462 | | | — | |

| Research and development | 1,708 | | | 958 | | | 3,432 | | | 1,954 | |

| Operating income (loss) | (92,798) | | | (15,603) | | | (110,348) | | | (22,795) | |

| Interest expense, net | 1,670 | | | 1,770 | | | 3,122 | | | 3,191 | |

| Other (income) expense, net | (15,515) | | | (110) | | | (14,335) | | | (23) | |

| Income (loss) before income taxes | (78,953) | | | (17,263) | | | (99,135) | | | (25,963) | |

| Income tax expense (benefit) | (1,925) | | | (1,362) | | | (4,814) | | | (2,388) | |

| Net income (loss) | $ | (77,028) | | | $ | (15,901) | | | $ | (94,321) | | | $ | (23,575) | |

| | | | | | | |

| Net income (loss) per share, basic and diluted | $ | (1.22) | | | $ | (0.43) | | | $ | (1.50) | | | $ | (0.63) | |

| Weighted-average shares outstanding: | | | | | | | |

| Basic and diluted | 62,992,454 | | | 37,200,000 | | | 62,842,495 | | | 37,200,000 | |

| | | | | | | |

| Comprehensive income (loss): | | | | | | | |

| Net income (loss) | $ | (77,028) | | | $ | (15,901) | | | $ | (94,321) | | | $ | (23,575) | |

| Foreign currency translation gain (loss), net of tax | (358) | | | 52 | | | (486) | | | (179) | |

| Total other comprehensive income (loss), net of tax | (358) | | | 52 | | | (486) | | | (179) | |

| Total comprehensive income (loss) | $ | (77,386) | | | $ | (15,849) | | | $ | (94,807) | | | $ | (23,754) | |

| | | | | | | |

REDWIRE CORPORATION

RECONCILIATION OF ADJUSTED EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION AND AMORTIZATION (“ADJUSTED EBITDA”)(1)

(Unaudited)

The table below presents a reconciliation of Adjusted EBITDA, Pro Forma Adjusted EBITDA, and Free Cash Flow to net income (loss), computed in accordance with U.S. GAAP for the following periods:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| (in thousands) | June 30, 2022 | | June 30, 2021 | | June 30, 2022 | | June 30, 2021 |

| Net income (loss) | $ | (77,028) | | | $ | (15,901) | | | $ | (94,321) | | | $ | (23,575) | |

| Interest expense | 1,669 | | | 1,770 | | | 3,121 | | | 3,192 | |

| Income tax expense (benefit) | (1,925) | | | (1,362) | | | (4,814) | | | (2,388) | |

| Depreciation and amortization | 3,402 | | | 2,618 | | | 7,060 | | | 4,889 | |

| Impairment expense | 80,462 | | | — | | | 80,462 | | | — | |

| Acquisition deal costs (i) | 48 | | | 2 | | | 94 | | | 2,419 | |

| Acquisition integration costs (i) | 954 | | | 491 | | | 1,402 | | | 805 | |

| Acquisition earnout costs (ii) | — | | | 11,114 | | | — | | | 11,114 | |

| Purchase accounting fair value adjustment related to deferred revenue (ii) | 40 | | | 94 | | | 66 | | | 167 | |

| Severance costs (iii) | 453 | | | — | | | 463 | | | — | |

| Capital market and advisory fees (iv) | 1,450 | | | 2,824 | | | 3,408 | | | 6,004 | |

| | | | | | | |

| Litigation-related expenses (v) | 302 | | | — | | | 2,568 | | | — | |

| Equity-based compensation (vi) | 1,743 | | | — | | | 6,154 | | | — | |

| Committed equity facility transaction costs (vii) | 770 | | | — | | | 770 | | | — | |

| Warrant liability change in fair value adjustment (viii) | (16,393) | | | — | | | (15,155) | | | — | |

| Adjusted EBITDA | $ | (4,053) | | | $ | 1,650 | | | (8,722) | | | 2,627 | |

| Pro forma impact on EBITDA (ix) | — | | | 429 | | | — | | | 1,527 | |

| Pro forma adjusted EBITDA | $ | (4,053) | | | $ | 2,079 | | | $ | (8,722) | | | $ | 4,154 | |

| | | | | | | |

| Adjusted EBITDA | $ | (4,053) | | | $ | 1,650 | | | $ | (8,722) | | | $ | 2,627 | |

| Less: Capital expenditures | (1,059) | | | (748) | | | (2,073) | | | (1,324) | |

| Less / plus: Change in net working capital | 4,586 | | | (4,077) | | | 3,825 | | | (10,232) | |

| Free Cash Flow | $ | (526) | | | $ | (3,175) | | | $ | (6,970) | | | $ | (8,929) | |

i.Redwire incurred acquisition costs including due diligence and integration costs.

ii.Redwire incurred acquisition costs related to the Roccor and MIS contingent earnout payments and purchase accounting fair value adjustments to unwind deferred revenue for MIS and DPSS.

iii.Redwire incurred severance costs related to separation agreements entered into with former employees, including, but not limited to, the Company’s former CFO.

iv.Redwire incurred capital market and advisory fees related to advisors assisting with preparation for the Merger and transitional costs associated with becoming a public company.

v.Redwire incurred expenses related to the Audit Committee investigation and securities litigation.

vi.Redwire incurred expenses related to equity-based compensation under Redwire’s equity-based compensation plan.

vii.Redwire incurred expenses related to the committed equity facility with B. Riley, which includes consideration paid to enter into the Purchase Agreement as well as changes in the fair value of the committed equity facility derivative asset.

viii.Redwire adjusted the fair value of the private warrant liability with changes in fair value recognized as a gain or loss during the respective periods.

ix.Pro forma impact represents the incremental results of a full period of operations assuming the entities acquired during the periods presented were acquired from January 1 of the year in which they occurred. For the three months ended June 30, 2021, the pro forma impact included the results of Techshot, while the six months ended June 30, 2021 included the results of Oakman, DPSS and Techshot.

(1) Adjusted EBITDA and pro forma Adjusted EBITDA are not measures of results under generally accepted accounting principles in the United States.

REDWIRE CORPORATION

TOTAL BOOK-TO-BILL

(Unaudited)

Book-to-bill is the ratio of total contract awarded to revenues recorded in the same period. The contracts awarded balance includes firm contract orders including time and material contracts which were awarded during the period and does not include unexercised contract options or potential orders under indefinite delivery/indefinite quantity contracts. Although the contracts awarded balance reflects firm contract orders, terminations, amendments, or contract cancellations may occur which could result in a reduction to the contracts awarded balance.

We view book-to-bill as an indicator of future revenue growth potential. To drive future revenue growth, our goal is for the level of contract awarded in a given period to exceed the revenue recorded, thus yielding a book-to-bill ratio greater than 1.0.

Our book-to-bill ratio was as follows for the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| (in thousands, except ratio) | June 30, 2022 | | June 30, 2021 | | June 30, 2022 | | June 30, 2021 |

| Contracts awarded | $ | 61,563 | | | $ | 14,484 | | | $ | 91,990 | | | $ | 81,718 | |

| Revenues | 36,728 | | | 32,148 | | | 69,595 | | | 63,846 | |

| Book-to-bill ratio | 1.68 | | 0.45 | | 1.32 | | 1.28 |

Our book-to-bill ratio was 1.68 for the three months ended June 30, 2022, as compared to 0.45 for the three months ended June 30, 2021. For both the three months ended June 30, 2022 and June 30, 2021, none of the contracts awarded balance relates to acquired contract value.

Our book-to-bill ratio was 1.32 for six months ended June 30, 2022, as compared to 1.28 for six months ended June 30, 2021. For the six months ended June 30, 2022, none of the contracts awarded balance relates to acquired contract value. For the six months ended June 30, 2021, $37.7 million of the contracts awarded balance relates to acquired contract value from the Oakman and DPSS acquisitions.

REDWIRE CORPORATION

TOTAL BACKLOG

(Unaudited)

We view growth in backlog as a key measure of our business growth. Contracted backlog represents the estimated dollar value of firm funded executed contracts for which work has not been performed (also known as the remaining performance obligations on a contract). Our contracted backlog includes $32.9 million and $10.7 million in remaining contract value from time and materials contracts as of June 30, 2022 and as of December 31, 2021, respectively.

Organic contracted backlog change excludes backlog activity from acquisitions for the first four full quarters since the entities’ acquisition date. Contracted backlog activity for the first four full quarters since the entities’ acquisition date is included in acquisition-related contracted backlog change. After the completion of four fiscal quarters, acquired entities are treated as organic for current and comparable historical periods.

Organic contract value includes the remaining contract value as of January 1 not yet recognized as revenue and additional orders awarded during the period for those entities treated as organic. Acquisition-related contract value includes remaining contract value as of the acquisition date not yet recognized as revenue and additional orders awarded during the period for entities not treated as organic. Similarly, organic revenue includes revenue earned during the period presented for those entities treated as organic, while acquisition-related revenue includes the same for all other entities, excluding any pre-acquisition revenue earned during the period.

| | | | | | | | | | | | | |

| (in thousands) | June 30, 2022 | | December 31, 2021 | | |

| Organic backlog as of January 1 | $ | 133,115 | | | $ | 122,273 | | | |

| Organic additions during the period | 84,302 | | | 146,880 | | | |

| Organic revenue recognized during the period | (66,793) | | | (136,038) | | | |

| Organic backlog at end of period | 150,624 | | | 133,115 | | | |

| | | | | |

| Acquisition-related contract value beginning of period | 6,627 | | | — | | | |

| Acquisition-related additions during the period | 7,688 | | | 8,190 | | | |

| Acquisition-related revenue recognized during the period | (2,802) | | | (1,563) | | | |

| Acquisition-related backlog at end of period | 11,513 | | | 6,627 | | | |

| | | | | |

| Contracted backlog at end of period | $ | 162,137 | | | $ | 139,742 | | | |

Our total backlog as of June 30, 2022, which includes both contracted and uncontracted backlog, was $251.7 million. Uncontracted backlog represents the anticipated contract value, or portion thereof, of goods and services to be delivered under existing contracts which have not been appropriated or otherwise authorized. Our uncontracted backlog as of June 30, 2022 was $89.5 million. Uncontracted backlog includes $25.5 million of contract extensions under negotiation that are priced, fully scoped, verbally awarded, and expected to be executed shortly.