Filed by Genesis Park Acquisition Corp. pursuant to Rule 425 under the Securities Act of 1933, as amended and deemed filed pursuant to Rule 14a‐12 under the Securities Exchange Act of 1934, as amended Subject Company: Genesis Park Acquisition Corp. (Commission File No. 001‐39733) 1. Insert Footnote 1Filed by Genesis Park Acquisition Corp. pursuant to Rule 425 under the Securities Act of 1933, as amended and deemed filed pursuant to Rule 14a‐12 under the Securities Exchange Act of 1934, as amended Subject Company: Genesis Park Acquisition Corp. (Commission File No. 001‐39733) 1. Insert Footnote 1

st Canaccord Genuity 41 Annual Growth Conference August 12, 2021 Jonathan E. Baliff President and Chief Financial Officer A C Q U I S I T I O N C O R Pst Canaccord Genuity 41 Annual Growth Conference August 12, 2021 Jonathan E. Baliff President and Chief Financial Officer A C Q U I S I T I O N C O R P

Disclaimers and Other Important Information No representations or warranties, express or implied are given in, or in respect of, this investor presentation (this “Presentation”). To the fullest extent permitted by law, in no circumstances will Genesis Park Acquisition Corp. (“Genesis Park”), Redwire, LLC (“Redwire”) or any representatives, partners, directors, officers, employees, advisors or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this Presentation, its contents, its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith. Industry and market data used in this Presentation have been obtained from third-party industry publications and sources as well as from research reports prepared for other purposes. Neither Genesis Park nor Redwire has independently verified the data obtained from these sources and cannot assure you of the data’s accuracy or completeness. This data is subject to change. Recipients of this Presentation are not to construe its contents, or any prior or subsequent communications from or with Genesis Park, Redwire or their respective representatives as investment, legal or tax advice. In addition, this Presentation does not purport to be all-inclusive or to contain all of the information that may be required to make a full analysis of Redwire, Genesis Park or the proposed business combination (the “Business Combination”). Recipients of this Presentation should each make their own evaluation of Redwire, Genesis Park and the Business Combination and of the relevance and adequacy of the information and should make such other investigations as they deem necessary. Statements other than historical facts, including but not limited to those concerning (i) the Business Combination, (ii) market conditions, or (iii) trends, consumer or customer preferences or other similar concepts with respect to Genesis Park, Redwire or the Business Combination, are based on current expectations, estimates, projections, targets, opinions and/or beliefs of Genesis Park and Redwire or, when applicable, of one or more third-party sources. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. In addition, no representation or warranty is made with respect to the reasonableness of any estimates, forecasts, illustrations, prospects or returns, which should be regarded as illustrative only, or that any profits will be realized. The metrics regarding select aspects of Genesis Park’s and Redwire's operations were selected by Genesis Park and Redwire or its subsidiaries on a subjective basis. Such metrics are provided solely for illustrative purposes to demonstrate elements of Genesis Park’s and Redwire's businesses, are incomplete, and are not necessarily indicative of Genesis Park’s and Redwire or its subsidiaries’ performance or overall operations. There can be no assurance that historical trends will continue. Forward Looking Statements This document includes “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “forecast,” “intend,” “seek,” “target,” “anticipate,” “believe,” “expect,” “estimate,” “plan,” “outlook,” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Such forward looking statements include estimated financial information, including without limitation, forecasted revenue and revenue CAGR. Such forward looking statements with respect to revenues, earnings, performance, strategies, prospects and other aspects of the businesses of Genesis Park Acquisition Corp., Redwire or the combined company after completion of the Business Combination are based on current expectations that are subject to risks and uncertainties. A number of factors could cause actual results or outcomes to differ materially from those indicated by such forward looking statements. These factors include, but are not limited to: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement governing the proposed business combination; (2) the inability to complete the transactions contemplated by the merger agreement due to the failure to obtain approval of the shareholders of Genesis Park Acquisition Corp. or other conditions to closing in the merger agreement; (3) the ability to meet NYSE’s listing standards following the consummation of the transactions contemplated by the merger agreement; (4) the risk that the proposed transaction disrupts current plans and operations of Redwire as a result of the announcement and consummation of the transactions described herein; (5) the ability to recognize the anticipated benefits of the proposed business combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees; (6) costs related to the proposed business combination; (7) changes in applicable laws or regulations; (8) the possibility that Redwire may be adversely affected by other economic, business, and/or competitive factors; and (9) other risks and uncertainties indicated from time to time in other documents filed or to be filed with the SEC by Genesis Park Acquisition Corp. You are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Genesis Park Acquisition Corp. and Redwire undertake no commitment to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law. 2 A C Q U I S I T I O N C O R PDisclaimers and Other Important Information No representations or warranties, express or implied are given in, or in respect of, this investor presentation (this “Presentation”). To the fullest extent permitted by law, in no circumstances will Genesis Park Acquisition Corp. (“Genesis Park”), Redwire, LLC (“Redwire”) or any representatives, partners, directors, officers, employees, advisors or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this Presentation, its contents, its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith. Industry and market data used in this Presentation have been obtained from third-party industry publications and sources as well as from research reports prepared for other purposes. Neither Genesis Park nor Redwire has independently verified the data obtained from these sources and cannot assure you of the data’s accuracy or completeness. This data is subject to change. Recipients of this Presentation are not to construe its contents, or any prior or subsequent communications from or with Genesis Park, Redwire or their respective representatives as investment, legal or tax advice. In addition, this Presentation does not purport to be all-inclusive or to contain all of the information that may be required to make a full analysis of Redwire, Genesis Park or the proposed business combination (the “Business Combination”). Recipients of this Presentation should each make their own evaluation of Redwire, Genesis Park and the Business Combination and of the relevance and adequacy of the information and should make such other investigations as they deem necessary. Statements other than historical facts, including but not limited to those concerning (i) the Business Combination, (ii) market conditions, or (iii) trends, consumer or customer preferences or other similar concepts with respect to Genesis Park, Redwire or the Business Combination, are based on current expectations, estimates, projections, targets, opinions and/or beliefs of Genesis Park and Redwire or, when applicable, of one or more third-party sources. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. In addition, no representation or warranty is made with respect to the reasonableness of any estimates, forecasts, illustrations, prospects or returns, which should be regarded as illustrative only, or that any profits will be realized. The metrics regarding select aspects of Genesis Park’s and Redwire's operations were selected by Genesis Park and Redwire or its subsidiaries on a subjective basis. Such metrics are provided solely for illustrative purposes to demonstrate elements of Genesis Park’s and Redwire's businesses, are incomplete, and are not necessarily indicative of Genesis Park’s and Redwire or its subsidiaries’ performance or overall operations. There can be no assurance that historical trends will continue. Forward Looking Statements This document includes “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “forecast,” “intend,” “seek,” “target,” “anticipate,” “believe,” “expect,” “estimate,” “plan,” “outlook,” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Such forward looking statements include estimated financial information, including without limitation, forecasted revenue and revenue CAGR. Such forward looking statements with respect to revenues, earnings, performance, strategies, prospects and other aspects of the businesses of Genesis Park Acquisition Corp., Redwire or the combined company after completion of the Business Combination are based on current expectations that are subject to risks and uncertainties. A number of factors could cause actual results or outcomes to differ materially from those indicated by such forward looking statements. These factors include, but are not limited to: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement governing the proposed business combination; (2) the inability to complete the transactions contemplated by the merger agreement due to the failure to obtain approval of the shareholders of Genesis Park Acquisition Corp. or other conditions to closing in the merger agreement; (3) the ability to meet NYSE’s listing standards following the consummation of the transactions contemplated by the merger agreement; (4) the risk that the proposed transaction disrupts current plans and operations of Redwire as a result of the announcement and consummation of the transactions described herein; (5) the ability to recognize the anticipated benefits of the proposed business combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees; (6) costs related to the proposed business combination; (7) changes in applicable laws or regulations; (8) the possibility that Redwire may be adversely affected by other economic, business, and/or competitive factors; and (9) other risks and uncertainties indicated from time to time in other documents filed or to be filed with the SEC by Genesis Park Acquisition Corp. You are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Genesis Park Acquisition Corp. and Redwire undertake no commitment to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law. 2 A C Q U I S I T I O N C O R P

Additional Information In connection with the proposed business combination between Redwire and Genesis Park Acquisition Corp., Genesis Park Acquisition Corp. filed with the SEC a preliminary proxy statement / prospectus on July 6, 2021 and will mail a definitive proxy statement / prospectus and other relevant documentation to Genesis Park Acquisition Corp. shareholders. This document does not contain all the information that should be considered concerning the proposed business combination. It is not intended to form the basis of any investment decision or any other decision in respect to the proposed business combination. Genesis Park Acquisition Corp. shareholders and other interested persons are advised to read the preliminary proxy statement / prospectus and any amendments thereto, and, when available, the definitive proxy statement / prospectus in connection with Genesis Park Acquisition Corp.’s solicitation of proxies for the special meeting to be held to approve the transactions contemplated by the proposed business combination because these materials will contain important information about Redwire, Genesis Park Acquisition Corp. and the proposed business combination. The definitive proxy statement / prospectus, when it becomes available, will be mailed to Genesis Park Acquisition Corp. shareholders as of a record date to be established for voting on the proposed business combination. Shareholders are also able to obtain a copy of the preliminary proxy statement / prospectus, and will be able to obtain a copy of the definitive proxy statement / prospectus once it is available, without charge, at the SEC’s website at http://sec.gov or by directing a written request to Genesis Park Acquisition Corp., 2000 Edwards Street, Suite B, Houston, Texas 77007. This document shall not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed business combination. Participants in the Solicitation Genesis Park Acquisition Corp. and its directors and officers may be deemed participants in the solicitation of proxies of Genesis Park Acquisition Corp. shareholders in connection with the proposed business combination. Genesis Park Acquisition Corp. shareholders and other interested persons may obtain, without charge, more detailed information regarding the directors and officers of Genesis Park Acquisition Corp. in Genesis Park Acquisition Corp.’s prospectus relating to its initial public offering filed with the SEC on November 24, 2020. Redwire and its directors and executive officers may also be deemed to be participants in the solicitation of proxies from the shareholders of Genesis Park Acquisition Corp. in connection with the Business Combination. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies from Genesis Park Acquisition Corp. shareholders in connection with the proposed business combination is set forth in the preliminary proxy statement / prospectus for the transaction and will be set forth in the definitive proxy statement /prospectus for the transaction when available. Additional information regarding the interests of participants in the solicitation of proxies in connection with the proposed transaction is included in the preliminary proxy statement / prospectus Genesis Park Acquisition Corp. filed with the SEC and will be set forth in the definitive proxy statement / prospectus Genesis Park Acquisition Corp. intends to file with the SEC. 3 A C Q U I S I T I O N C O R PAdditional Information In connection with the proposed business combination between Redwire and Genesis Park Acquisition Corp., Genesis Park Acquisition Corp. filed with the SEC a preliminary proxy statement / prospectus on July 6, 2021 and will mail a definitive proxy statement / prospectus and other relevant documentation to Genesis Park Acquisition Corp. shareholders. This document does not contain all the information that should be considered concerning the proposed business combination. It is not intended to form the basis of any investment decision or any other decision in respect to the proposed business combination. Genesis Park Acquisition Corp. shareholders and other interested persons are advised to read the preliminary proxy statement / prospectus and any amendments thereto, and, when available, the definitive proxy statement / prospectus in connection with Genesis Park Acquisition Corp.’s solicitation of proxies for the special meeting to be held to approve the transactions contemplated by the proposed business combination because these materials will contain important information about Redwire, Genesis Park Acquisition Corp. and the proposed business combination. The definitive proxy statement / prospectus, when it becomes available, will be mailed to Genesis Park Acquisition Corp. shareholders as of a record date to be established for voting on the proposed business combination. Shareholders are also able to obtain a copy of the preliminary proxy statement / prospectus, and will be able to obtain a copy of the definitive proxy statement / prospectus once it is available, without charge, at the SEC’s website at http://sec.gov or by directing a written request to Genesis Park Acquisition Corp., 2000 Edwards Street, Suite B, Houston, Texas 77007. This document shall not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed business combination. Participants in the Solicitation Genesis Park Acquisition Corp. and its directors and officers may be deemed participants in the solicitation of proxies of Genesis Park Acquisition Corp. shareholders in connection with the proposed business combination. Genesis Park Acquisition Corp. shareholders and other interested persons may obtain, without charge, more detailed information regarding the directors and officers of Genesis Park Acquisition Corp. in Genesis Park Acquisition Corp.’s prospectus relating to its initial public offering filed with the SEC on November 24, 2020. Redwire and its directors and executive officers may also be deemed to be participants in the solicitation of proxies from the shareholders of Genesis Park Acquisition Corp. in connection with the Business Combination. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies from Genesis Park Acquisition Corp. shareholders in connection with the proposed business combination is set forth in the preliminary proxy statement / prospectus for the transaction and will be set forth in the definitive proxy statement /prospectus for the transaction when available. Additional information regarding the interests of participants in the solicitation of proxies in connection with the proposed transaction is included in the preliminary proxy statement / prospectus Genesis Park Acquisition Corp. filed with the SEC and will be set forth in the definitive proxy statement / prospectus Genesis Park Acquisition Corp. intends to file with the SEC. 3 A C Q U I S I T I O N C O R P

Financial Information; Non-GAAP Financial Terms The financial information and data contained in this Presentation is unaudited and does not conform to Regulation S-X promulgated by the SEC. No independent registered public accounting firm has audited, reviewed, compiled, or performed any procedures with respect to the combined financial information of Redwire for the purpose of inclusion in this Presentation, and accordingly, neither Genesis Park nor Redwire expresses an opinion or provides any other form of assurance with respect thereto for the purpose of this Presentation. Accordingly, such information and data may not be included in, may be adjusted in, or may be presented differently in, any registration statement or proxy statement or other report or document filed or to be filed or furnished by Genesis Park with the SEC. Furthermore, some of the projected financial information and data contained in this Presentation has not been prepared in accordance with United States generally accepted accounting principles (“GAAP”). Redwire and Genesis Park believe these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to Redwire’s financial condition and results of operations. Redwire’s management uses these non-GAAP measures for trend analyses and for budgeting and planning purposes. Redwire and Genesis Park believe that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating projected operating results and trends and in comparing Redwire’s financial measures with other similar companies, many of which present similar non-GAAP financial measures to investors. Management of Redwire does not consider these non-GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limitation of these non-GAAP financial measures is that they exclude significant expenses and income that are required by GAAP to be recorded in Redwire’s financial statements. In addition, they are subject to inherent limitations as they reflect the exercise of judgments by management about which expenses and income are excluded or included in determining these non-GAAP financial measures. You should review the audited financial statements of Redwire and certain businesses acquired by Redwire that are presented in the Registration Statement which has been filed with the SEC, and not rely on any single financial measure to evaluate Redwire’s business. A reconciliation of forward-looking non-GAAP financial measures in this Presentation to the most directly comparable GAAP financial measures is not included, because, without unreasonable effort, Redwire is unable to predict with reasonable certainty the amount or timing of non-GAAP adjustments that are used to calculate these non-GAAP financial measures. Unless otherwise specified, all Redwire financial information herein is presented on a pro forma basis, including the impact of the acquisitions by Redwire of Adcole Space, Made in Space, Deep Space Systems, Roccor, LoadPath, Oakman Aerospace and Deployable Space Systems. Such financial information assumes that such acquisitions were consummated on January 1st, 2020. Trademarks This Presentation contains trademarks, service marks, tradenames and copyrights of Redwire, Genesis Park and other companies, which are the property of their respective owners. The use herein does not imply an affiliation with, or endorsement by, the owners of these service marks, trademarks and tradenames. Third-party logos herein may represent past customers, present customers or may be provided simply for illustrative purposes only. Inclusion of such logos does not necessarily imply affiliation with or endorsement by such firms or businesses. There is no guarantee that either Genesis Park or Redwire will work, or continue to work, with any of the firms or businesses whose logos are included herein in the future. Additional Information and Where to Find It This document relates to a proposed transaction between Redwire and Genesis Park. This document does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Genesis Park filed with the SEC a preliminary proxy statement / prospectus on July 6, 2021 and will mail a definitive proxy statement / prospectus and other relevant documentation to Genesis Park Acquisition Corp. shareholders. Genesis Park also will file other documents regarding the proposed transaction with the SEC. Before making any voting decision, investors and security holders of Genesis Park are urged to read the definitive proxy statement / prospectus and all other relevant documents filed or that will be filed with the SEC in connection with the proposed transaction as they become available because they will contain important information about the proposed transactions. Investors and security holders will be able to obtain free copies of the definitive proxy statement / prospectus and all other relevant documents filed or that will be filed with the SEC by Genesis Park through the website maintained by the SEC at www.sec.gov. In addition, the documents filed by Genesis Park may be obtained free of charge from Genesis Park’s website at www.genesis- park.com or by written request to Genesis Park at Genesis Park Acquisition Corp., 2000 Edwards Street, Suite B, Houston, Texas 77007. 4 A C Q U I S I T I O N C O R PFinancial Information; Non-GAAP Financial Terms The financial information and data contained in this Presentation is unaudited and does not conform to Regulation S-X promulgated by the SEC. No independent registered public accounting firm has audited, reviewed, compiled, or performed any procedures with respect to the combined financial information of Redwire for the purpose of inclusion in this Presentation, and accordingly, neither Genesis Park nor Redwire expresses an opinion or provides any other form of assurance with respect thereto for the purpose of this Presentation. Accordingly, such information and data may not be included in, may be adjusted in, or may be presented differently in, any registration statement or proxy statement or other report or document filed or to be filed or furnished by Genesis Park with the SEC. Furthermore, some of the projected financial information and data contained in this Presentation has not been prepared in accordance with United States generally accepted accounting principles (“GAAP”). Redwire and Genesis Park believe these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to Redwire’s financial condition and results of operations. Redwire’s management uses these non-GAAP measures for trend analyses and for budgeting and planning purposes. Redwire and Genesis Park believe that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating projected operating results and trends and in comparing Redwire’s financial measures with other similar companies, many of which present similar non-GAAP financial measures to investors. Management of Redwire does not consider these non-GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limitation of these non-GAAP financial measures is that they exclude significant expenses and income that are required by GAAP to be recorded in Redwire’s financial statements. In addition, they are subject to inherent limitations as they reflect the exercise of judgments by management about which expenses and income are excluded or included in determining these non-GAAP financial measures. You should review the audited financial statements of Redwire and certain businesses acquired by Redwire that are presented in the Registration Statement which has been filed with the SEC, and not rely on any single financial measure to evaluate Redwire’s business. A reconciliation of forward-looking non-GAAP financial measures in this Presentation to the most directly comparable GAAP financial measures is not included, because, without unreasonable effort, Redwire is unable to predict with reasonable certainty the amount or timing of non-GAAP adjustments that are used to calculate these non-GAAP financial measures. Unless otherwise specified, all Redwire financial information herein is presented on a pro forma basis, including the impact of the acquisitions by Redwire of Adcole Space, Made in Space, Deep Space Systems, Roccor, LoadPath, Oakman Aerospace and Deployable Space Systems. Such financial information assumes that such acquisitions were consummated on January 1st, 2020. Trademarks This Presentation contains trademarks, service marks, tradenames and copyrights of Redwire, Genesis Park and other companies, which are the property of their respective owners. The use herein does not imply an affiliation with, or endorsement by, the owners of these service marks, trademarks and tradenames. Third-party logos herein may represent past customers, present customers or may be provided simply for illustrative purposes only. Inclusion of such logos does not necessarily imply affiliation with or endorsement by such firms or businesses. There is no guarantee that either Genesis Park or Redwire will work, or continue to work, with any of the firms or businesses whose logos are included herein in the future. Additional Information and Where to Find It This document relates to a proposed transaction between Redwire and Genesis Park. This document does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Genesis Park filed with the SEC a preliminary proxy statement / prospectus on July 6, 2021 and will mail a definitive proxy statement / prospectus and other relevant documentation to Genesis Park Acquisition Corp. shareholders. Genesis Park also will file other documents regarding the proposed transaction with the SEC. Before making any voting decision, investors and security holders of Genesis Park are urged to read the definitive proxy statement / prospectus and all other relevant documents filed or that will be filed with the SEC in connection with the proposed transaction as they become available because they will contain important information about the proposed transactions. Investors and security holders will be able to obtain free copies of the definitive proxy statement / prospectus and all other relevant documents filed or that will be filed with the SEC by Genesis Park through the website maintained by the SEC at www.sec.gov. In addition, the documents filed by Genesis Park may be obtained free of charge from Genesis Park’s website at www.genesis- park.com or by written request to Genesis Park at Genesis Park Acquisition Corp., 2000 Edwards Street, Suite B, Houston, Texas 77007. 4 A C Q U I S I T I O N C O R P

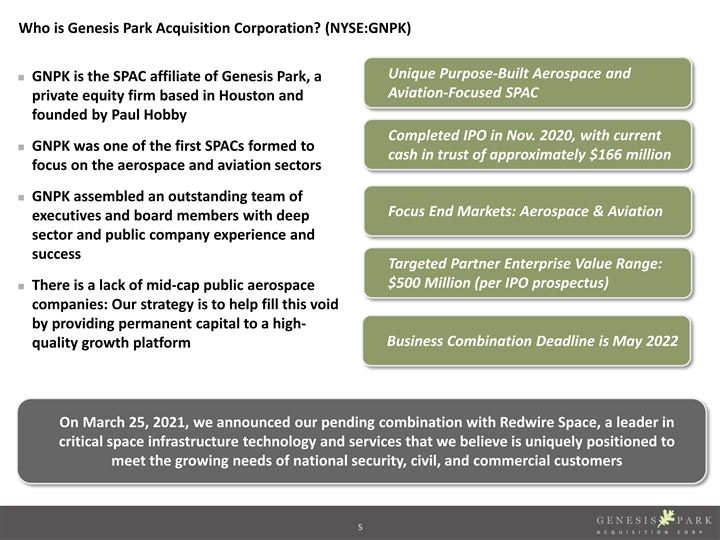

Who is Genesis Park Acquisition Corporation? (NYSE:GNPK) Unique Purpose-Built Aerospace and n GNPK is the SPAC affiliate of Genesis Park, a Aviation-Focused SPAC private equity firm based in Houston and founded by Paul Hobby Completed IPO in Nov. 2020, with current n GNPK was one of the first SPACs formed to cash in trust of approximately $166 million focus on the aerospace and aviation sectors n GNPK assembled an outstanding team of Focus End Markets: Aerospace & Aviation executives and board members with deep sector and public company experience and success Targeted Partner Enterprise Value Range: $500 Million (per IPO prospectus) n There is a lack of mid-cap public aerospace companies: Our strategy is to help fill this void by providing permanent capital to a high- Business Combination Deadline is May 2022 quality growth platform On March 25, 2021, we announced our pending combination with Redwire Space, a leader in critical space infrastructure technology and services that we believe is uniquely positioned to meet the growing needs of national security, civil, and commercial customers 5 A C Q U I S I T I O N C O R PWho is Genesis Park Acquisition Corporation? (NYSE:GNPK) Unique Purpose-Built Aerospace and n GNPK is the SPAC affiliate of Genesis Park, a Aviation-Focused SPAC private equity firm based in Houston and founded by Paul Hobby Completed IPO in Nov. 2020, with current n GNPK was one of the first SPACs formed to cash in trust of approximately $166 million focus on the aerospace and aviation sectors n GNPK assembled an outstanding team of Focus End Markets: Aerospace & Aviation executives and board members with deep sector and public company experience and success Targeted Partner Enterprise Value Range: $500 Million (per IPO prospectus) n There is a lack of mid-cap public aerospace companies: Our strategy is to help fill this void by providing permanent capital to a high- Business Combination Deadline is May 2022 quality growth platform On March 25, 2021, we announced our pending combination with Redwire Space, a leader in critical space infrastructure technology and services that we believe is uniquely positioned to meet the growing needs of national security, civil, and commercial customers 5 A C Q U I S I T I O N C O R P

GNPK is a Purpose-Built Team with Complementary Experience, Skill Sets and Relationships Jonathan E. Baliff Richard Anderson Gil West David N. Siegel Paul W. Hobby Chairman CEO & Director President, CFO & Director Director Director Andrea Fischer Newman Thomas Daniel Friedkin John S. Bolton Nina Jonsson Dave Davis Director Director Advisor Advisor Advisor See https://www.genesis-park.com/gnpk.html for more detail on our leadership team. 6 A C Q U I S I T I O N C O R PGNPK is a Purpose-Built Team with Complementary Experience, Skill Sets and Relationships Jonathan E. Baliff Richard Anderson Gil West David N. Siegel Paul W. Hobby Chairman CEO & Director President, CFO & Director Director Director Andrea Fischer Newman Thomas Daniel Friedkin John S. Bolton Nina Jonsson Dave Davis Director Director Advisor Advisor Advisor See https://www.genesis-park.com/gnpk.html for more detail on our leadership team. 6 A C Q U I S I T I O N C O R P

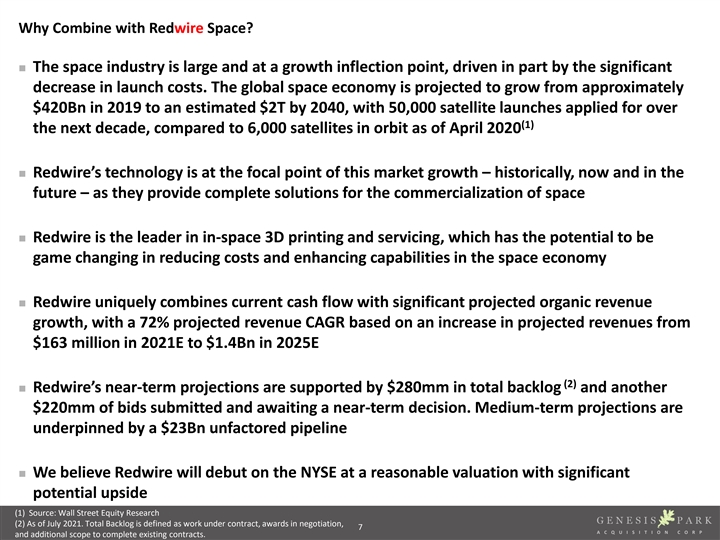

Why Combine with Redwire Space? n The space industry is large and at a growth inflection point, driven in part by the significant decrease in launch costs. The global space economy is projected to grow from approximately $420Bn in 2019 to an estimated $2T by 2040, with 50,000 satellite launches applied for over (1) the next decade, compared to 6,000 satellites in orbit as of April 2020 n Redwire’s technology is at the focal point of this market growth – historically, now and in the future – as they provide complete solutions for the commercialization of space n Redwire is the leader in in-space 3D printing and servicing, which has the potential to be game changing in reducing costs and enhancing capabilities in the space economy n Redwire uniquely combines current cash flow with significant projected organic revenue growth, with a 72% projected revenue CAGR based on an increase in projected revenues from $163 million in 2021E to $1.4Bn in 2025E (2) n Redwire’s near-term projections are supported by $280mm in total backlog and another $220mm of bids submitted and awaiting a near-term decision. Medium-term projections are underpinned by a $23Bn unfactored pipeline n We believe Redwire will debut on the NYSE at a reasonable valuation with significant potential upside (1) Source: Wall Street Equity Research (2) As of July 2021. Total Backlog is defined as work under contract, awards in negotiation, 7 A C Q U I S I T I O N C O R P and additional scope to complete existing contracts.Why Combine with Redwire Space? n The space industry is large and at a growth inflection point, driven in part by the significant decrease in launch costs. The global space economy is projected to grow from approximately $420Bn in 2019 to an estimated $2T by 2040, with 50,000 satellite launches applied for over (1) the next decade, compared to 6,000 satellites in orbit as of April 2020 n Redwire’s technology is at the focal point of this market growth – historically, now and in the future – as they provide complete solutions for the commercialization of space n Redwire is the leader in in-space 3D printing and servicing, which has the potential to be game changing in reducing costs and enhancing capabilities in the space economy n Redwire uniquely combines current cash flow with significant projected organic revenue growth, with a 72% projected revenue CAGR based on an increase in projected revenues from $163 million in 2021E to $1.4Bn in 2025E (2) n Redwire’s near-term projections are supported by $280mm in total backlog and another $220mm of bids submitted and awaiting a near-term decision. Medium-term projections are underpinned by a $23Bn unfactored pipeline n We believe Redwire will debut on the NYSE at a reasonable valuation with significant potential upside (1) Source: Wall Street Equity Research (2) As of July 2021. Total Backlog is defined as work under contract, awards in negotiation, 7 A C Q U I S I T I O N C O R P and additional scope to complete existing contracts.

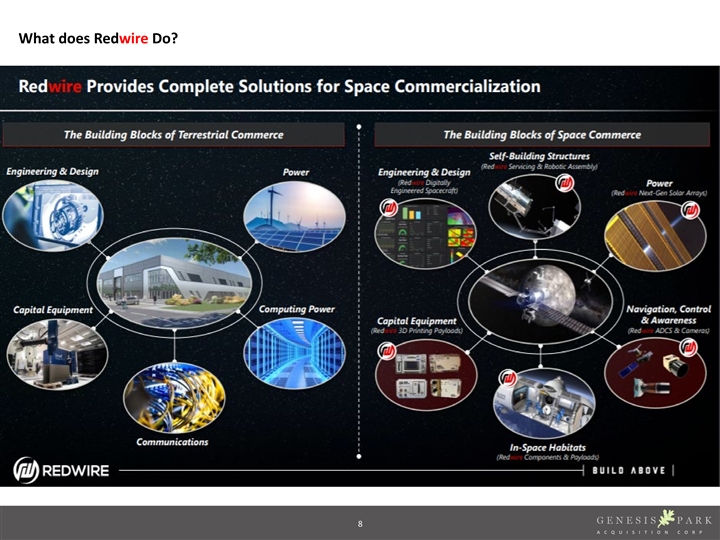

What does Redwire Do? 8 A C Q U I S I T I O N C O R PWhat does Redwire Do? 8 A C Q U I S I T I O N C O R P

What is Redwire’s IP? 9 A C Q U I S I T I O N C O R PWhat is Redwire’s IP? 9 A C Q U I S I T I O N C O R P

How will Redwire Grow? 10 A C Q U I S I T I O N C O R PHow will Redwire Grow? 10 A C Q U I S I T I O N C O R P

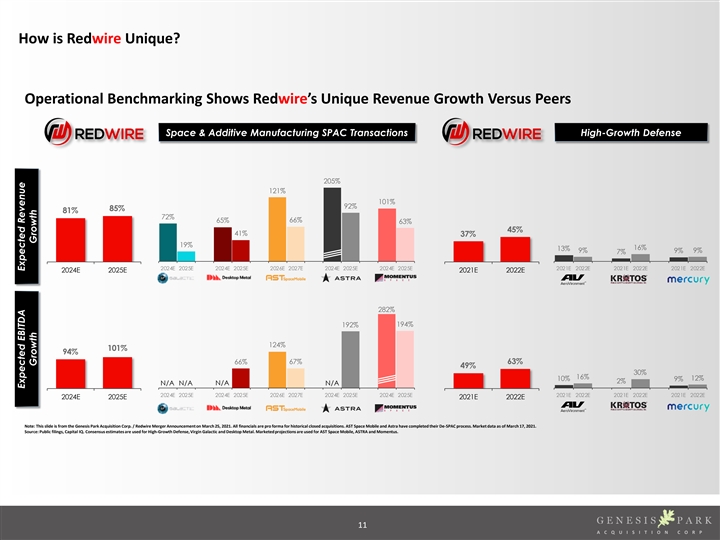

1 How is Redwire Unique? Operational Benchmarking Shows Redwire’s Unique Revenue Growth Versus Peers Space & Additive Manufacturing SPAC Transactions High-Growth Defense 205% 121% 101% 92% 85% 81% 72% 66% 65% 63% 45% 41% 37% 19% 16% 13% 9% 9% 9% 7% 2024E 2025E 2024E 2025E 2026E 2027E 2024E 2025E 2024E 2025E 2021E 2022E 2021E 2022E 2021E 2022E 2024E 2025E 2021E 2022E 282% 192% 194% 124% 101% 94% 66% 67% 63% 49% 30% 16% 10% 9% 12% 2% N/A N/A N/A N/A 2024E 2025E 2024E 2025E 2026E 2027E 2024E 2025E 2024E 2025E 2021E 2022E 2021E 2022E 2021E 2022E 2024E 2025E 2021E 2022E Note: This slide is from the Genesis Park Acquisition Corp. / Redwire Merger Announcement on March 25, 2021. All financials are pro forma for historical closed acquisitions. AST Space Mobile and Astra have completed their De-SPAC process. Market data as of March 17, 2021. Source: Public filings, Capital IQ. Consensus estimates are used for High-Growth Defense, Virgin Galactic and Desktop Metal. Marketed projections are used for AST Space Mobile, ASTRA and Momentus. 11 A C Q U I S I T I O N C O R P Expected EBITDA Expected Revenue Growth Growth1 How is Redwire Unique? Operational Benchmarking Shows Redwire’s Unique Revenue Growth Versus Peers Space & Additive Manufacturing SPAC Transactions High-Growth Defense 205% 121% 101% 92% 85% 81% 72% 66% 65% 63% 45% 41% 37% 19% 16% 13% 9% 9% 9% 7% 2024E 2025E 2024E 2025E 2026E 2027E 2024E 2025E 2024E 2025E 2021E 2022E 2021E 2022E 2021E 2022E 2024E 2025E 2021E 2022E 282% 192% 194% 124% 101% 94% 66% 67% 63% 49% 30% 16% 10% 9% 12% 2% N/A N/A N/A N/A 2024E 2025E 2024E 2025E 2026E 2027E 2024E 2025E 2024E 2025E 2021E 2022E 2021E 2022E 2021E 2022E 2024E 2025E 2021E 2022E Note: This slide is from the Genesis Park Acquisition Corp. / Redwire Merger Announcement on March 25, 2021. All financials are pro forma for historical closed acquisitions. AST Space Mobile and Astra have completed their De-SPAC process. Market data as of March 17, 2021. Source: Public filings, Capital IQ. Consensus estimates are used for High-Growth Defense, Virgin Galactic and Desktop Metal. Marketed projections are used for AST Space Mobile, ASTRA and Momentus. 11 A C Q U I S I T I O N C O R P Expected EBITDA Expected Revenue Growth Growth

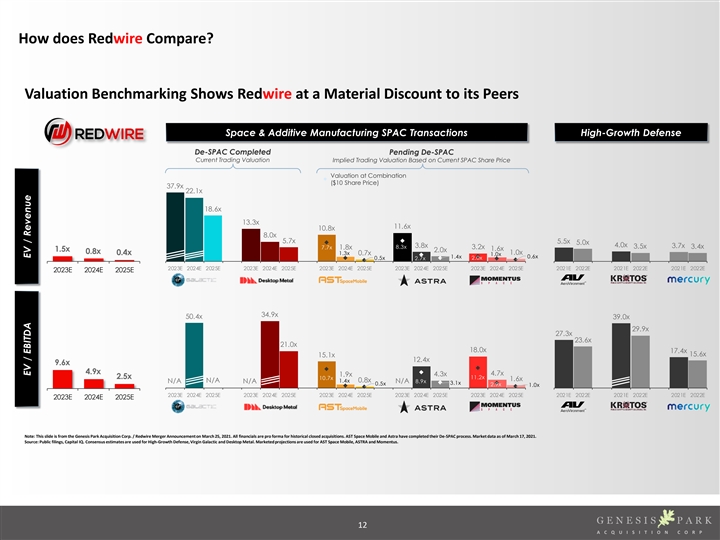

2 How does Redwire Compare? Valuation Benchmarking Shows Redwire at a Material Discount to its Peers Space & Additive Manufacturing SPAC Transactions High-Growth Defense De-SPAC Completed Pending De-SPAC Current Trading Valuation Implied Trading Valuation Based on Current SPAC Share Price Valuation at Combination ($10 Share Price) 37.9x 22.1x 18.6x 13.3x 11.6x 10.8x 8.0x 5.7x 5.5x 5.0x 4.0x 3.8x 3.7x 7.7x 8.3x 3.2x 3.5x 3.4x 1.8x 1.6x 1.5x 2.0x 0.8x 0.4x 1.3x 0.7x 1.0x 1.0x 0.6x 1.4x 0.5x 2.7x 2.0x 2023E 2024E 2025E 2023E 2024E 2025E 2023E 2024E 2025E 2023E 2024E 2025E 2023E 2024E 2025E 2021E 2022E 2021E 2022E 2021E 2022E 2023E 2024E 2025E 34.9x 50.4x 39.0x 29.9x 27.3x 23.6x 21.0x 18.0x 17.4x 15.6x 15.1x 12.4x 9.6x 4.9x 4.3x 4.7x 1.9x 2.5x 11.2x 10.7x 1.6x N/A N/A 1.4x 0.8x N/A 8.9x N/A 3.1x 0.5x 2.9x 1.0x 2023E 2024E 2025E 2023E 2024E 2025E 2023E 2024E 2025E 2023E 2024E 2025E 2023E 2024E 2025E 2021E 2022E 2021E 2022E 2021E 2022E 2023E 2024E 2025E Note: This slide is from the Genesis Park Acquisition Corp. / Redwire Merger Announcement on March 25, 2021. All financials are pro forma for historical closed acquisitions. AST Space Mobile and Astra have completed their De-SPAC process. Market data as of March 17, 2021. Source: Public filings, Capital IQ. Consensus estimates are used for High-Growth Defense, Virgin Galactic and Desktop Metal. Marketed projections are used for AST Space Mobile, ASTRA and Momentus. 12 A C Q U I S I T I O N C O R P EV / EBITDA EV / Revenue2 How does Redwire Compare? Valuation Benchmarking Shows Redwire at a Material Discount to its Peers Space & Additive Manufacturing SPAC Transactions High-Growth Defense De-SPAC Completed Pending De-SPAC Current Trading Valuation Implied Trading Valuation Based on Current SPAC Share Price Valuation at Combination ($10 Share Price) 37.9x 22.1x 18.6x 13.3x 11.6x 10.8x 8.0x 5.7x 5.5x 5.0x 4.0x 3.8x 3.7x 7.7x 8.3x 3.2x 3.5x 3.4x 1.8x 1.6x 1.5x 2.0x 0.8x 0.4x 1.3x 0.7x 1.0x 1.0x 0.6x 1.4x 0.5x 2.7x 2.0x 2023E 2024E 2025E 2023E 2024E 2025E 2023E 2024E 2025E 2023E 2024E 2025E 2023E 2024E 2025E 2021E 2022E 2021E 2022E 2021E 2022E 2023E 2024E 2025E 34.9x 50.4x 39.0x 29.9x 27.3x 23.6x 21.0x 18.0x 17.4x 15.6x 15.1x 12.4x 9.6x 4.9x 4.3x 4.7x 1.9x 2.5x 11.2x 10.7x 1.6x N/A N/A 1.4x 0.8x N/A 8.9x N/A 3.1x 0.5x 2.9x 1.0x 2023E 2024E 2025E 2023E 2024E 2025E 2023E 2024E 2025E 2023E 2024E 2025E 2023E 2024E 2025E 2021E 2022E 2021E 2022E 2021E 2022E 2023E 2024E 2025E Note: This slide is from the Genesis Park Acquisition Corp. / Redwire Merger Announcement on March 25, 2021. All financials are pro forma for historical closed acquisitions. AST Space Mobile and Astra have completed their De-SPAC process. Market data as of March 17, 2021. Source: Public filings, Capital IQ. Consensus estimates are used for High-Growth Defense, Virgin Galactic and Desktop Metal. Marketed projections are used for AST Space Mobile, ASTRA and Momentus. 12 A C Q U I S I T I O N C O R P EV / EBITDA EV / Revenue