Filed by Genesis Park Acquisition Corp. pursuant to Rule 425 under the Securities Act of 1933, as amended and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934, as amended Subject Company: Genesis Park Acquisition Corp. (Commission File No. 001-39733)

Investor Presentation | August 2021

Disclaimer Disclaimers and Other Important Information No representations or warranties, express or implied are given in, or in respect of, this investor presentation (this “Presentation”). To the fullest extent permitted by law, in no circumstances will Genesis Park Acquisition Corp. (“Genesis Park”), Redwire, LLC (“Redwire”) or any representatives, partners, directors, officers, employees, advisors or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this Presentation, its contents, its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith. Industry and market data used in this Presentation have been obtained from third-party industry publications and sources as well as from research reports prepared for other purposes. Neither Genesis Park nor Redwire has independently verified the data obtained from these sources and cannot assure you of the data’s accuracy or completeness. This data is subject to change. Recipients of this Presentation are not to construe its contents, or any prior or subsequent communications from or with Genesis Park, Redwire or their respective representatives as investment, legal or tax advice. In addition, this Presentation does not purport to be all-inclusive or to contain all of the information that may be required to make a full analysis of Redwire, Genesis Park or the proposed business combination (the “Business Combination”). Recipients of this Presentation should each make their own evaluation of Redwire, Genesis Park and the Business Combination and of the relevance and adequacy of the information and should make such other investigations as they deem necessary. Statements other than historical facts, including but not limited to those concerning (i) the Business Combination, (ii) market conditions, or (iii) trends, consumer or customer preferences or other similar concepts with respect to Genesis Park, Redwire or the Business Combination, are based on current expectations, estimates, projections, targets, opinions and/or beliefs of Genesis Park and Redwire or, when applicable, of one or more third-party sources. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. In addition, no representation or warranty is made with respect to the reasonableness of any estimates, forecasts, illustrations, prospects or returns, which should be regarded as illustrative only, or that any profits will be realized. The metrics regarding select aspects of Genesis Park’s and Redwire's operations were selected by Genesis Park and Redwire or its subsidiaries on a subjective basis. Such metrics are provided solely for illustrative purposes to demonstrate elements of Genesis Park’s and Redwire's businesses, are incomplete, and are not necessarily indicative of Genesis Park’s and Redwire or its subsidiaries’ performance or overall operations. There can be no assurance that historical trends will continue. Forward Looking Statements This document includes “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “forecast,” “intend,” “seek,” “target,” “anticipate,” “believe,” “expect,” “estimate,” “plan,” “outlook,” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Such forward looking statements include estimated financial information, including without limitation, forecasted revenue and revenue CAGR. Such forward looking statements with respect to revenues, earnings, performance, strategies, prospects and other aspects of the businesses of Genesis Park Acquisition Corp., Redwire or the combined company after completion of the Business Combination are based on current expectations that are subject to risks and uncertainties. A number of factors could cause actual results or outcomes to differ materially from those indicated by such forward looking statements. These factors include, but are not limited to: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement governing the proposed business combination; (2) the inability to complete the transactions contemplated by the merger agreement due to the failure to obtain approval of the shareholders of Genesis Park Acquisition Corp. or other conditions to closing in the merger agreement; (3) the ability to meet NYSE’s listing standards following the consummation of the transactions contemplated by the merger agreement; (4) the risk that the proposed transaction disrupts current plans and operations of Redwire as a result of the announcement and consummation of the transactions described herein; (5) the ability to recognize the anticipated benefits of the proposed business combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees; (6) costs related to the proposed business combination; (7) changes in applicable laws or regulations; (8) the possibility that Redwire may be adversely affected by other economic, business, and/or competitive factors; and (9) other risks and uncertainties indicated from time to time in other documents filed or to be filed with the SEC by Genesis Park Acquisition Corp. You are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Genesis Park Acquisition Corp. and Redwire undertake no commitment to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law.

Disclaimer Additional Information In connection with the proposed business combination between Redwire and Genesis Park Acquisition Corp., Genesis Park Acquisition Corp. filed with the SEC a preliminary proxy statement / prospectus on July 6, 2021 and will mail a definitive proxy statement / prospectus and other relevant documentation to Genesis Park Acquisition Corp. shareholders. This document does not contain all the information that should be considered concerning the proposed business combination. It is not intended to form the basis of any investment decision or any other decision in respect to the proposed business combination. Genesis Park Acquisition Corp. shareholders and other interested persons are advised to read the preliminary proxy statement / prospectus and any amendments thereto, and, when available, the definitive proxy statement / prospectus in connection with Genesis Park Acquisition Corp.’s solicitation of proxies for the special meeting to be held to approve the transactions contemplated by the proposed business combination because these materials will contain important information about Redwire, Genesis Park Acquisition Corp. and the proposed business combination. The definitive proxy statement / prospectus, when it becomes available, will be mailed to Genesis Park Acquisition Corp. shareholders as of a record date to be established for voting on the proposed business combination. Shareholders are also able to obtain a copy of the preliminary proxy statement / prospectus, and will be able to obtain a copy of the definitive proxy statement / prospectus once it is available, without charge, at the SEC’s website at http://sec.gov or by directing a written request to Genesis Park Acquisition Corp., 2000 Edwards Street, Suite B, Houston, Texas 77007. This document shall not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed business combination. Participants in the Solicitation Genesis Park Acquisition Corp. and its directors and officers may be deemed participants in the solicitation of proxies of Genesis Park Acquisition Corp. shareholders in connection with the proposed business combination. Genesis Park Acquisition Corp. shareholders and other interested persons may obtain, without charge, more detailed information regarding the directors and officers of Genesis Park Acquisition Corp. in Genesis Park Acquisition Corp.’s prospectus relating to its initial public offering filed with the SEC on November 24, 2020. Redwire and its directors and executive officers may also be deemed to be participants in the solicitation of proxies from the shareholders of Genesis Park Acquisition Corp. in connection with the Business Combination. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies from Genesis Park Acquisition Corp. shareholders in connection with the proposed business combination is set forth in the preliminary proxy statement / prospectus for the transaction and will be set forth in the definitive proxy statement /prospectus for the transaction when available. Additional information regarding the interests of participants in the solicitation of proxies in connection with the proposed transaction is included in the preliminary proxy statement / prospectus Genesis Park Acquisition Corp. filed with the SEC and will be set forth in the definitive proxy statement / prospectus Genesis Park Acquisition Corp. intends to file with the SEC.

Disclaimer Financial Information; Non-GAAP Financial Terms The financial information and data contained in this Presentation is unaudited and does not conform to Regulation S-X promulgated by the SEC. No independent registered public accounting firm has audited, reviewed, compiled, or performed any procedures with respect to the combined financial information of Redwire for the purpose of inclusion in this Presentation, and accordingly, neither Genesis Park nor Redwire expresses an opinion or provides any other form of assurance with respect thereto for the purpose of this Presentation. Accordingly, such information and data may not be included in, may be adjusted in, or may be presented differently in, any registration statement or proxy statement or other report or document filed or to be filed or furnished by Genesis Park with the SEC. Furthermore, some of the projected financial information and data contained in this Presentation, such as Adjusted EBITDA (and related measures), has not been prepared in accordance with United States generally accepted accounting principles (“GAAP”). Redwire and Genesis Park believe these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to Redwire’s financial condition and results of operations. Redwire’s management uses these non-GAAP measures for trend analyses and for budgeting and planning purposes. Redwire and Genesis Park believe that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating projected operating results and trends and in comparing Redwire’s financial measures with other similar companies, many of which present similar non-GAAP financial measures to investors. Management of Redwire does not consider these non-GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limitation of these non-GAAP financial measures is that they exclude significant expenses and income that are required by GAAP to be recorded in Redwire’s financial statements. In addition, they are subject to inherent limitations as they reflect the exercise of judgments by management about which expenses and income are excluded or included in determining these non-GAAP financial measures. You should review the audited financial statements of Redwire and certain businesses acquired by Redwire that are presented in the Registration Statement which has been filed with the SEC, and not rely on any single financial measure to evaluate Redwire’s business. A reconciliation of forward-looking non-GAAP financial measures in this Presentation to the most directly comparable GAAP financial measures is not included, because, without unreasonable effort, Redwire is unable to predict with reasonable certainty the amount or timing of non-GAAP adjustments that are used to calculate these non-GAAP financial measures. Unless otherwise specified, all Redwire financial information herein is presented on a pro forma basis, including the impact of the acquisitions by Redwire of Adcole Space, Made in Space, Deep Space Systems, Roccor, LoadPath, Oakman Aerospace and Deployable Space Systems. Such financial information assumes that such acquisitions were consummated on January 1st, 2020. Trademarks This Presentation contains trademarks, service marks, tradenames and copyrights of Redwire, Genesis Park and other companies, which are the property of their respective owners. The use herein does not imply an affiliation with, or endorsement by, the owners of these service marks, trademarks and tradenames. Third-party logos herein may represent past customers, present customers or may be provided simply for illustrative purposes only. Inclusion of such logos does not necessarily imply affiliation with or endorsement by such firms or businesses. There is no guarantee that either Genesis Park or Redwire will work, or continue to work, with any of the firms or businesses whose logos are included herein in the future. Additional Information and Where to Find It This document relates to a proposed transaction between Redwire and Genesis Park. This document does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Genesis Park has filed the Registration Statement with the SEC. The Registration Statement will be sent to all Genesis Park stockholders. Genesis Park also will file other documents regarding the proposed transaction with the SEC. Before making any voting decision, investors and security holders of Genesis Park are urged to read the Registration Statement and all other relevant documents filed or that will be filed with the SEC in connection with the proposed transaction as they become available because they will contain important information about the proposed transactions. Investors and security holders will be able to obtain free copies of the Registration Statement and all other relevant documents filed or that will be filed with the SEC by Genesis Park through the website maintained by the SEC at www.sec.gov. In addition, the documents filed by Genesis Park may be obtained free of charge from Genesis Park’s website at www.genesis-park.com or by written request to Genesis Park at Genesis Park Acquisition Corp., 2000 Edwards Street, Suite B, Houston, Texas 77007.

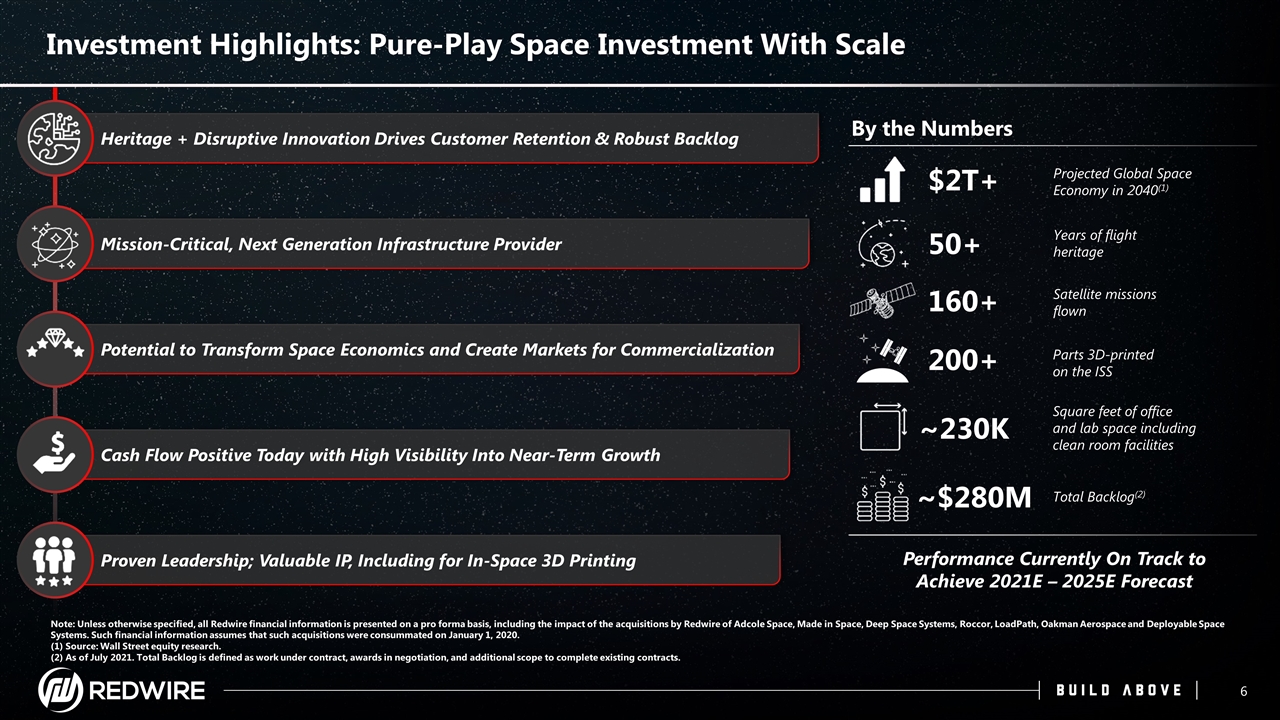

Heritage + Disruptive Innovation Drives Customer Retention & Robust Backlog Investment Highlights: Pure-Play Space Investment With Scale Potential to Transform Space Economics and Create Markets for Commercialization Mission-Critical, Next Generation Infrastructure Provider Cash Flow Positive Today with High Visibility Into Near-Term Growth Proven Leadership; Valuable IP, Including for In-Space 3D Printing Years of flight heritage 50+ Satellite missions flown 160+ Parts 3D-printed on the ISS 200+ Square feet of office and lab space including clean room facilities ~230K Total Backlog(2) ~$280M Projected Global Space Economy in 2040(1) $2T+ By the Numbers Performance Currently On Track to Achieve 2021E – 2025E Forecast Note: Unless otherwise specified, all Redwire financial information is presented on a pro forma basis, including the impact of the acquisitions by Redwire of Adcole Space, Made in Space, Deep Space Systems, Roccor, LoadPath, Oakman Aerospace and Deployable Space Systems. Such financial information assumes that such acquisitions were consummated on January 1, 2020. (1) Source: Wall Street equity research. (2) As of July 2021. Total Backlog is defined as work under contract, awards in negotiation, and additional scope to complete existing contracts.

Our Mission is accelerating humanity’s expansion into space by delivering reliable, economical and sustainable infrastructure for future generations

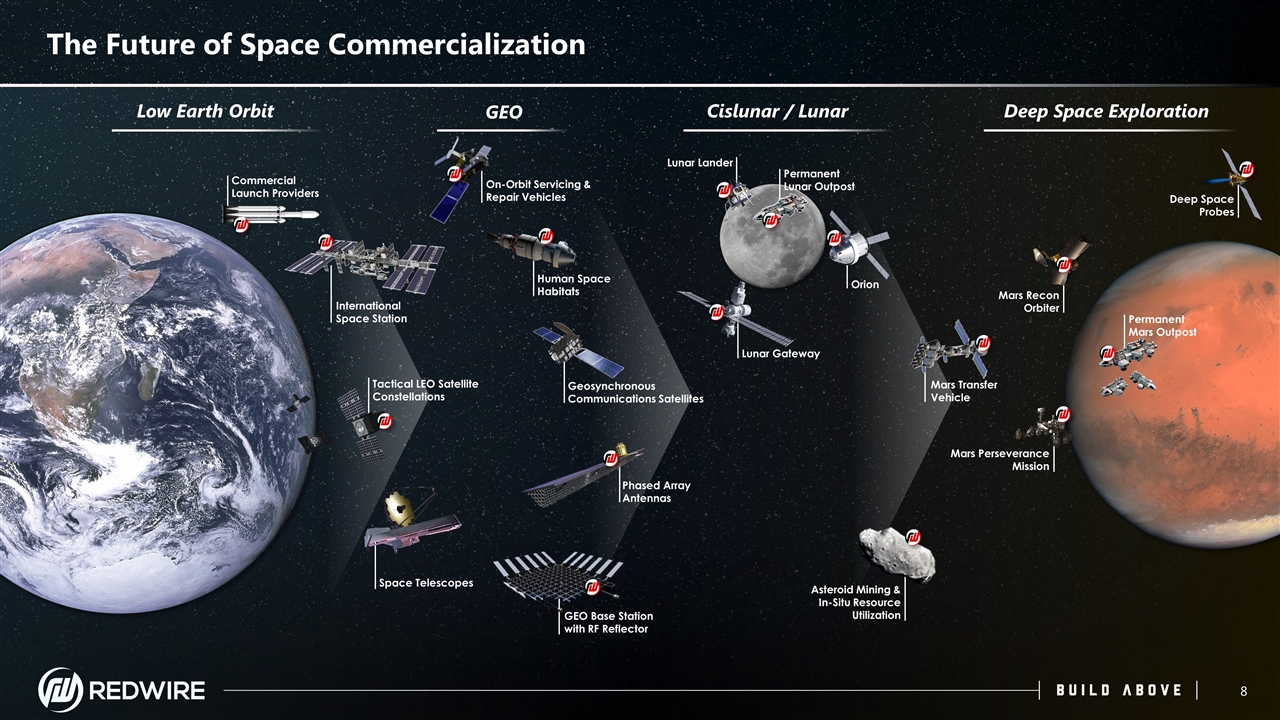

The Future of Space Commercialization Low Earth Orbit Cislunar / Lunar Deep Space Exploration Space Telescopes Commercial Launch Providers International Space Station Orion Lunar Gateway Tactical LEO Satellite Constellations Phased Array Antennas GEO GEO Base Station with RF Reflector Geosynchronous Communications Satellites Human Space Habitats Mars Transfer Vehicle Mars Perseverance Mission Asteroid Mining & In-Situ Resource Utilization Lunar Lander Mars Recon Orbiter On-Orbit Servicing & Repair Vehicles Deep Space Probes Permanent Lunar Outpost Permanent Mars Outpost

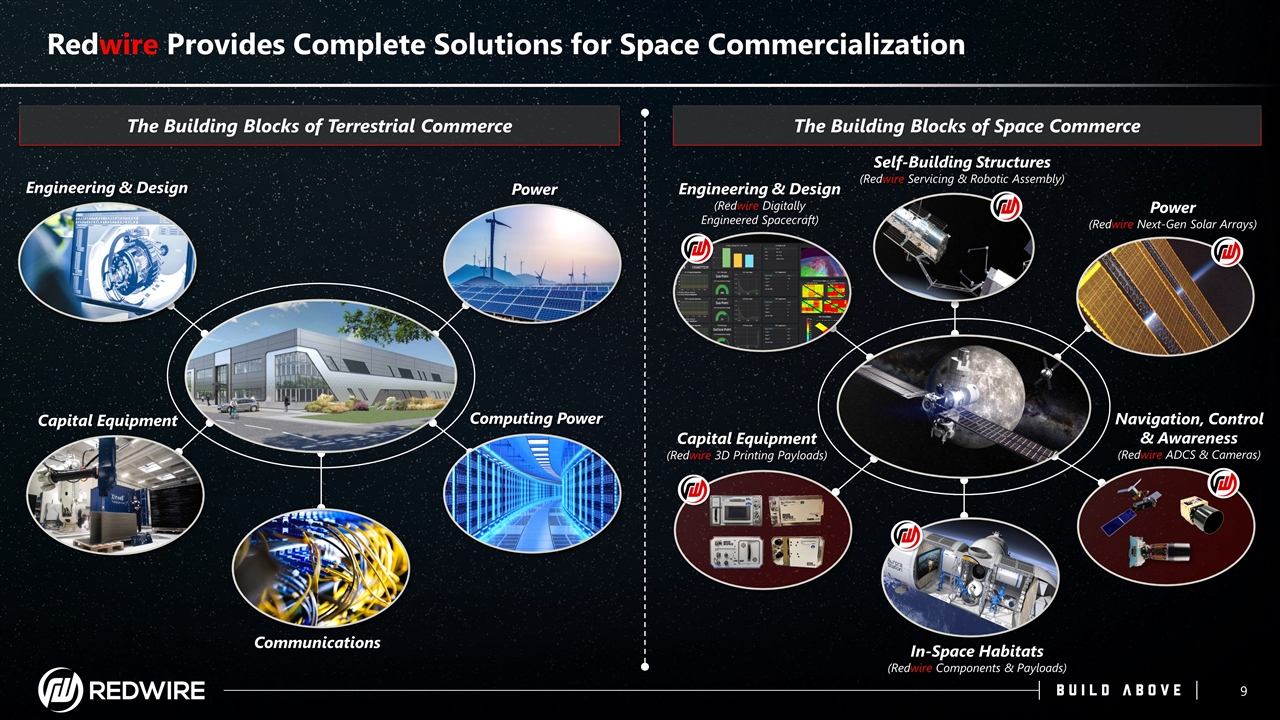

Redwire Provides Complete Solutions for Space Commercialization The Building Blocks of Terrestrial Commerce The Building Blocks of Space Commerce Engineering & Design Capital Equipment Power Computing Power Power (Redwire Next-Gen Solar Arrays) Capital Equipment (Redwire 3D Printing Payloads) Engineering & Design (Redwire Digitally Engineered Spacecraft) Navigation, Control & Awareness (Redwire ADCS & Cameras) Communications In-Space Habitats (Redwire Components & Payloads) Self-Building Structures (Redwire Servicing & Robotic Assembly)

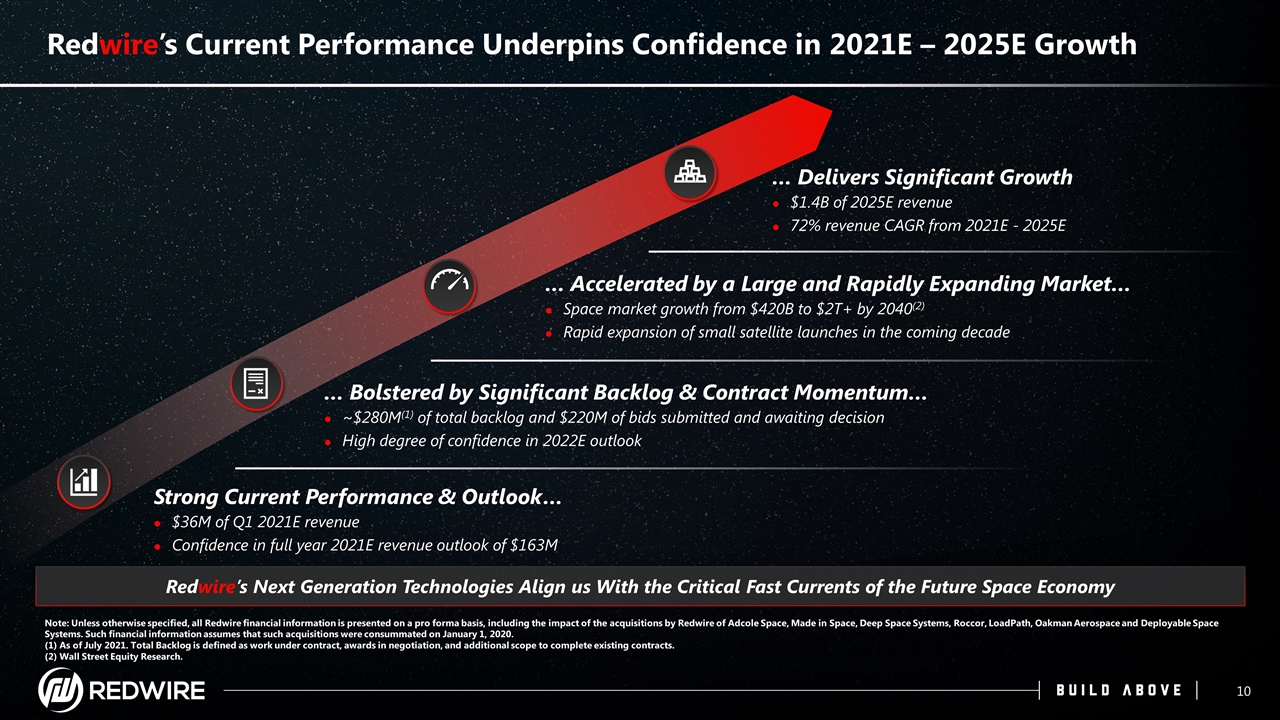

Redwire’s Current Performance Underpins Confidence in 2021E – 2025E Growth Strong Current Performance & Outlook… $36M of Q1 2021E revenue Confidence in full year 2021E revenue outlook of $163M … Bolstered by Significant Backlog & Contract Momentum… ~$280M(1) of total backlog and $220M of bids submitted and awaiting decision High degree of confidence in 2022E outlook … Delivers Significant Growth $1.4B of 2025E revenue 72% revenue CAGR from 2021E - 2025E … Accelerated by a Large and Rapidly Expanding Market… Space market growth from $420B to $2T+ by 2040(2) Rapid expansion of small satellite launches in the coming decade Note: Unless otherwise specified, all Redwire financial information is presented on a pro forma basis, including the impact of the acquisitions by Redwire of Adcole Space, Made in Space, Deep Space Systems, Roccor, LoadPath, Oakman Aerospace and Deployable Space Systems. Such financial information assumes that such acquisitions were consummated on January 1, 2020. (1) As of July 2021. Total Backlog is defined as work under contract, awards in negotiation, and additional scope to complete existing contracts. (2) Wall Street Equity Research. Redwire’s Next Generation Technologies Align us With the Critical Fast Currents of the Future Space Economy

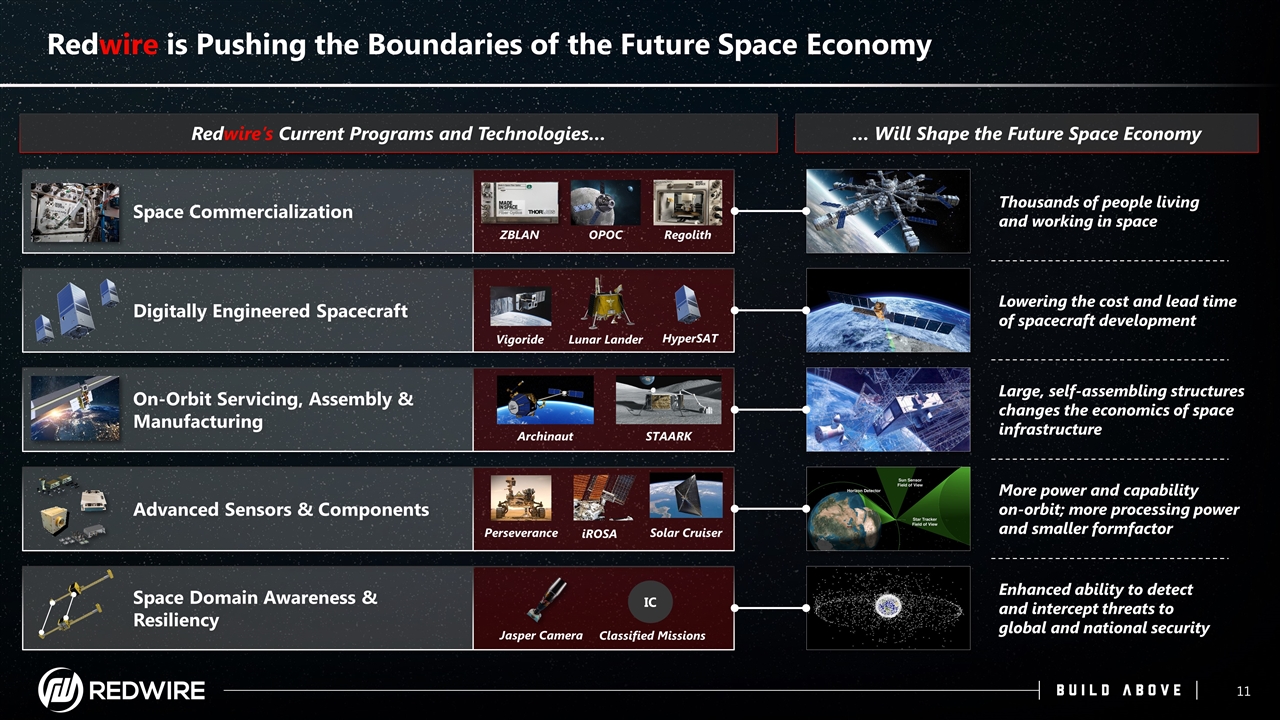

Redwire is Pushing the Boundaries of the Future Space Economy Redwire’s Current Programs and Technologies… … Will Shape the Future Space Economy On-Orbit Servicing, Assembly & Manufacturing Space Commercialization Digitally Engineered Spacecraft Advanced Sensors & Components Space Domain Awareness & Resiliency Thousands of people living and working in space Lowering the cost and lead time of spacecraft development Large, self-assembling structures changes the economics of space infrastructure More power and capability on-orbit; more processing power and smaller formfactor Enhanced ability to detect and intercept threats to global and national security Jasper Camera OPOC Solar Cruiser Archinaut HyperSAT Regolith ZBLAN Lunar Lander Vigoride STAARK iROSA Perseverance Classified Missions IC

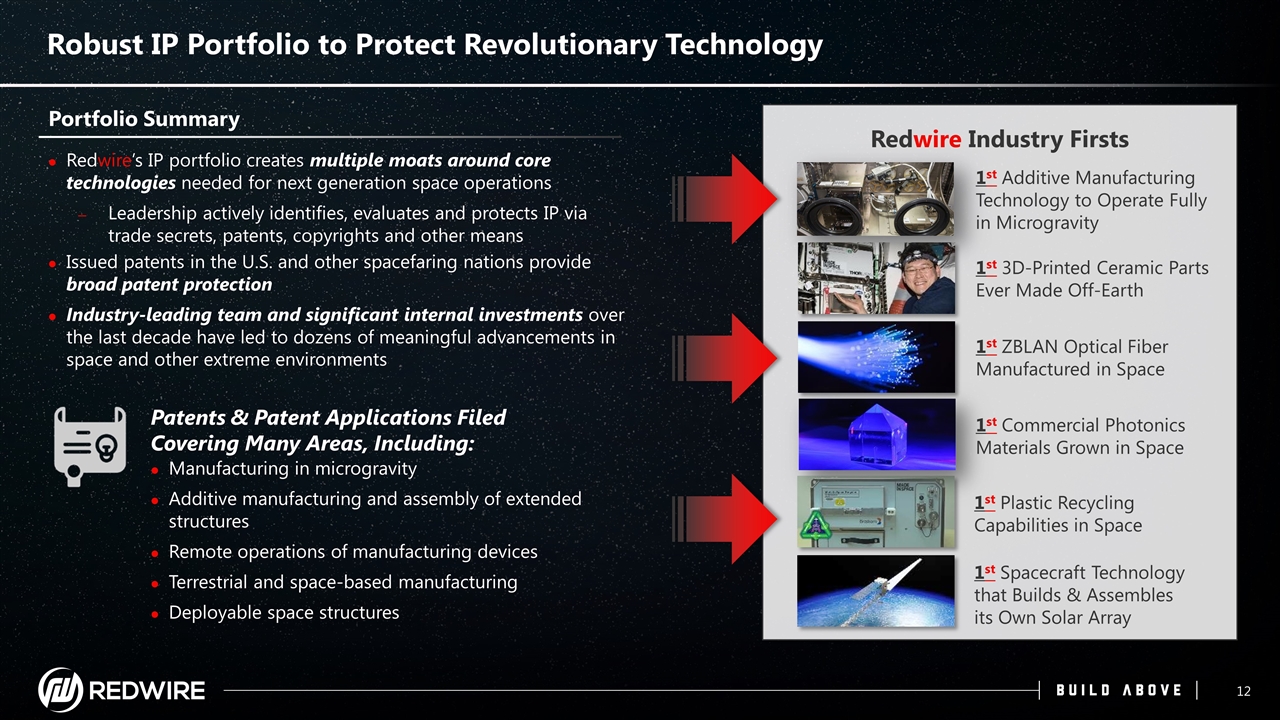

Redwire’s IP portfolio creates multiple moats around core technologies needed for next generation space operations Leadership actively identifies, evaluates and protects IP via trade secrets, patents, copyrights and other means Issued patents in the U.S. and other spacefaring nations provide broad patent protection Industry-leading team and significant internal investments over the last decade have led to dozens of meaningful advancements in space and other extreme environments Robust IP Portfolio to Protect Revolutionary Technology Portfolio Summary Manufacturing in microgravity Additive manufacturing and assembly of extended structures Remote operations of manufacturing devices Terrestrial and space-based manufacturing Deployable space structures Patents & Patent Applications Filed Covering Many Areas, Including: Redwire Industry Firsts 1st Additive Manufacturing Technology to Operate Fully in Microgravity 1st 3D-Printed Ceramic Parts Ever Made Off-Earth 1st ZBLAN Optical Fiber Manufactured in Space 1st Plastic Recycling Capabilities in Space 1st Spacecraft Technology that Builds & Assembles its Own Solar Array 1st Commercial Photonics Materials Grown in Space

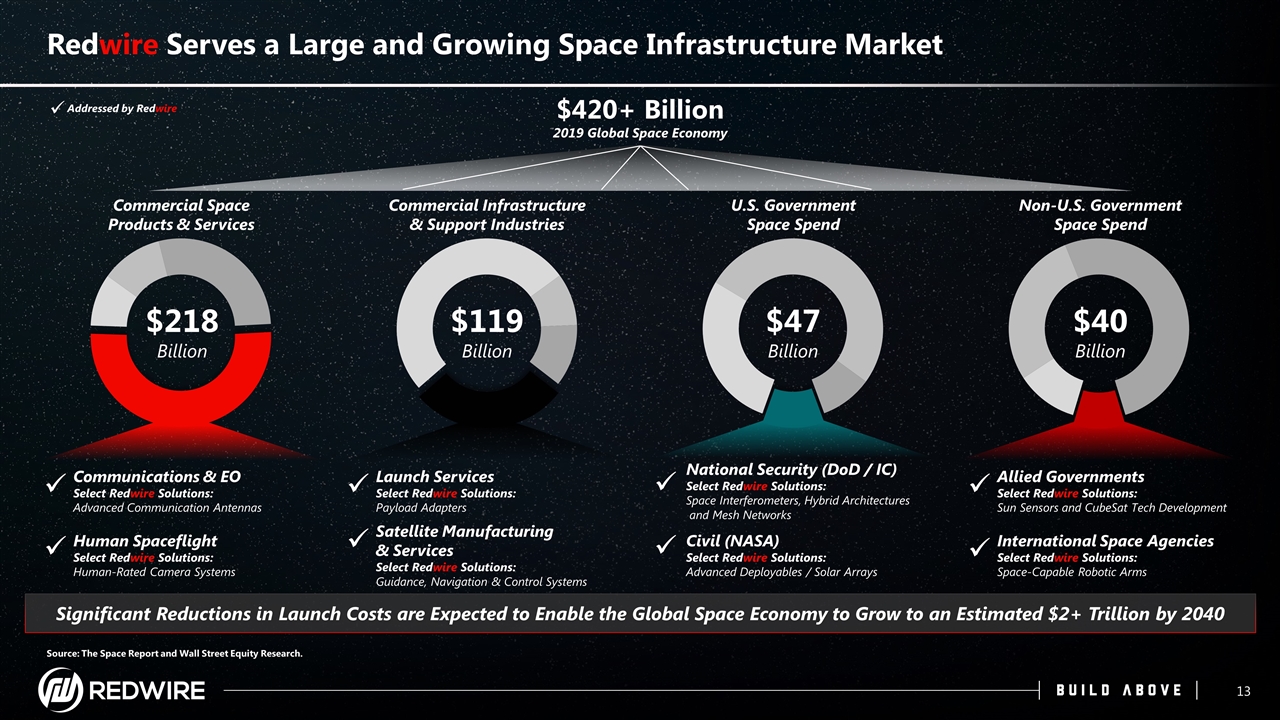

Source: The Space Report and Wall Street Equity Research. Redwire Serves a Large and Growing Space Infrastructure Market Commercial Space Products & Services Commercial Infrastructure & Support Industries U.S. Government Space Spend Non-U.S. Government Space Spend Communications & EO Select Redwire Solutions: Advanced Communication Antennas ü ü Addressed by Redwire Human Spaceflight Select Redwire Solutions: Human-Rated Camera Systems ü Launch Services Select Redwire Solutions: Payload Adapters ü Satellite Manufacturing & Services Select Redwire Solutions: Guidance, Navigation & Control Systems ü National Security (DoD / IC) Select Redwire Solutions: Space Interferometers, Hybrid Architectures and Mesh Networks ü Civil (NASA) Select Redwire Solutions: Advanced Deployables / Solar Arrays ü Allied Governments Select Redwire Solutions: Sun Sensors and CubeSat Tech Development ü International Space Agencies Select Redwire Solutions: Space-Capable Robotic Arms ü $218 Billion $119 Billion $47 Billion $40 Billion $420+ Billion 2019 Global Space Economy Significant Reductions in Launch Costs are Expected to Enable the Global Space Economy to Grow to an Estimated $2+ Trillion by 2040

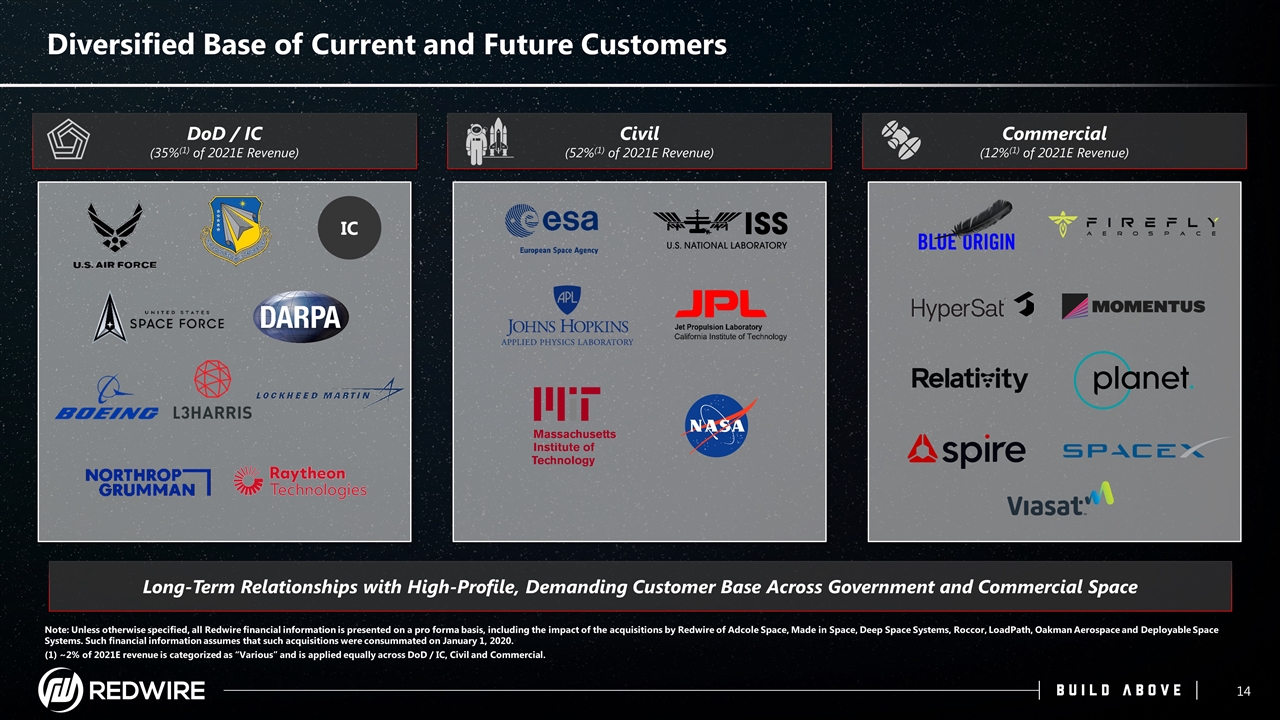

Note: Unless otherwise specified, all Redwire financial information is presented on a pro forma basis, including the impact of the acquisitions by Redwire of Adcole Space, Made in Space, Deep Space Systems, Roccor, LoadPath, Oakman Aerospace and Deployable Space Systems. Such financial information assumes that such acquisitions were consummated on January 1, 2020. (1) ~2% of 2021E revenue is categorized as “Various” and is applied equally across DoD / IC, Civil and Commercial. Diversified Base of Current and Future Customers DoD / IC (35%(1) of 2021E Revenue) IC Commercial (12%(1) of 2021E Revenue) Civil (52%(1) of 2021E Revenue) Long-Term Relationships with High-Profile, Demanding Customer Base Across Government and Commercial Space

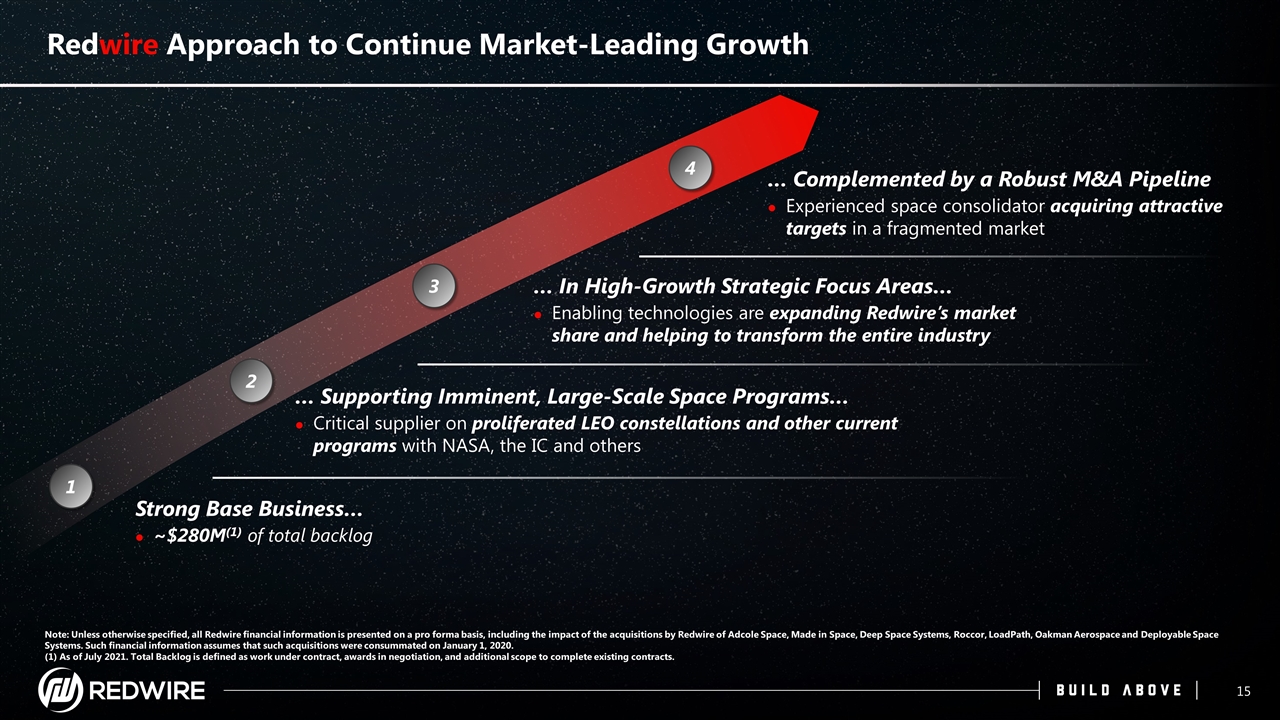

Redwire Approach to Continue Market-Leading Growth Strong Base Business… ~$280M(1) of total backlog 1 … Supporting Imminent, Large-Scale Space Programs… Critical supplier on proliferated LEO constellations and other current programs with NASA, the IC and others 2 … Complemented by a Robust M&A Pipeline Experienced space consolidator acquiring attractive targets in a fragmented market 4 … In High-Growth Strategic Focus Areas… Enabling technologies are expanding Redwire’s market share and helping to transform the entire industry 3 Note: Unless otherwise specified, all Redwire financial information is presented on a pro forma basis, including the impact of the acquisitions by Redwire of Adcole Space, Made in Space, Deep Space Systems, Roccor, LoadPath, Oakman Aerospace and Deployable Space Systems. Such financial information assumes that such acquisitions were consummated on January 1, 2020. (1) As of July 2021. Total Backlog is defined as work under contract, awards in negotiation, and additional scope to complete existing contracts.

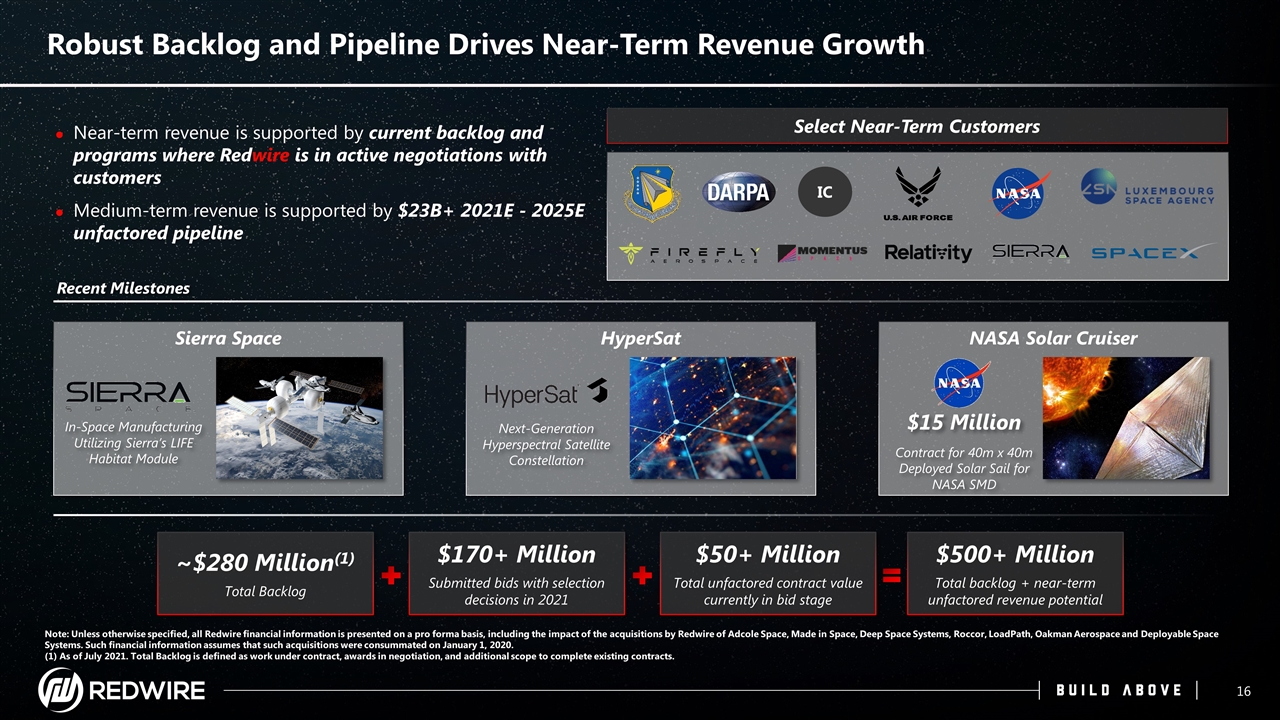

Robust Backlog and Pipeline Drives Near-Term Revenue Growth Near-term revenue is supported by current backlog and programs where Redwire is in active negotiations with customers Medium-term revenue is supported by $23B+ 2021E - 2025E unfactored pipeline IC Select Near-Term Customers Recent Milestones Sierra Space HyperSat NASA Solar Cruiser $15 Million Contract for 40m x 40m Deployed Solar Sail for NASA SMD Next-Generation Hyperspectral Satellite Constellation In-Space Manufacturing Utilizing Sierra’s LIFE Habitat Module Note: Unless otherwise specified, all Redwire financial information is presented on a pro forma basis, including the impact of the acquisitions by Redwire of Adcole Space, Made in Space, Deep Space Systems, Roccor, LoadPath, Oakman Aerospace and Deployable Space Systems. Such financial information assumes that such acquisitions were consummated on January 1, 2020. (1) As of July 2021. Total Backlog is defined as work under contract, awards in negotiation, and additional scope to complete existing contracts. $50+ Million Total unfactored contract value currently in bid stage $170+ Million Submitted bids with selection decisions in 2021 ~$280 Million(1) Total Backlog $500+ Million Total backlog + near-term unfactored revenue potential

Business Model Highlights Cashflow Positive with Improving Margins Leverageable Technology Strong Revenue Growth Significant Integration Experience Bottoms Up Forecast & Conservative Weightings Large and Expanding Pipeline of Opportunities Cash flow positive today with substantial margin improvement via vertical integration and the realization of the benefits of scale Technology is unmatched and supporting large, rapidly growing markets Winner-agnostic revenue growth story ties growth to the overall expansion of global space activity Strong integration experience produces a public-ready consolidator Revenue forecast built on a bottoms up basis from existing awards, options and addressable identified opportunities, with conservative “pWin” assumptions well inside of historical win rates Leveraging leading positions today to position for the significant potential opportunities of tomorrow

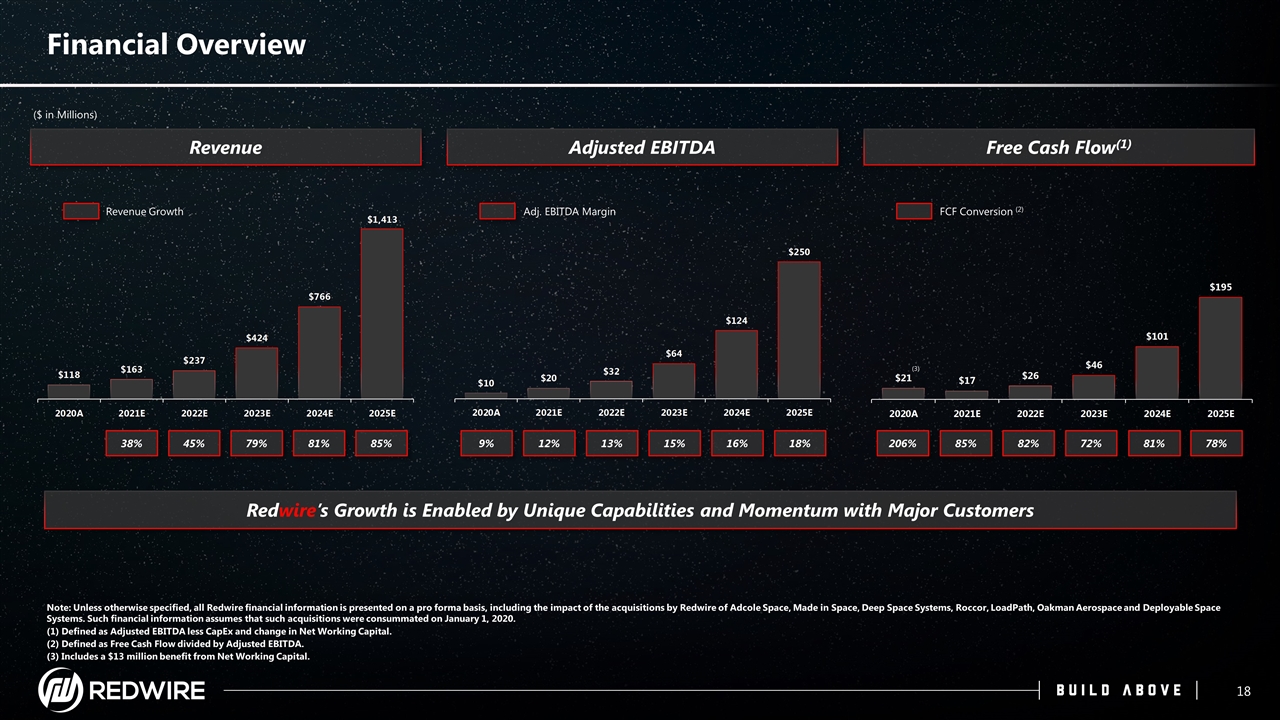

Free Cash Flow(1) 206% 78% 85% 82% 72% 81% Note: Unless otherwise specified, all Redwire financial information is presented on a pro forma basis, including the impact of the acquisitions by Redwire of Adcole Space, Made in Space, Deep Space Systems, Roccor, LoadPath, Oakman Aerospace and Deployable Space Systems. Such financial information assumes that such acquisitions were consummated on January 1, 2020. (1) Defined as Adjusted EBITDA less CapEx and change in Net Working Capital. (2) Defined as Free Cash Flow divided by Adjusted EBITDA. (3) Includes a $13 million benefit from Net Working Capital. Financial Overview ($ in Millions) Revenue 85% 38% 45% 79% 81% Redwire’s Growth is Enabled by Unique Capabilities and Momentum with Major Customers Adjusted EBITDA 9% 18% 12% 13% 15% 16% Revenue Growth Adj. EBITDA Margin FCF Conversion (2) (3)

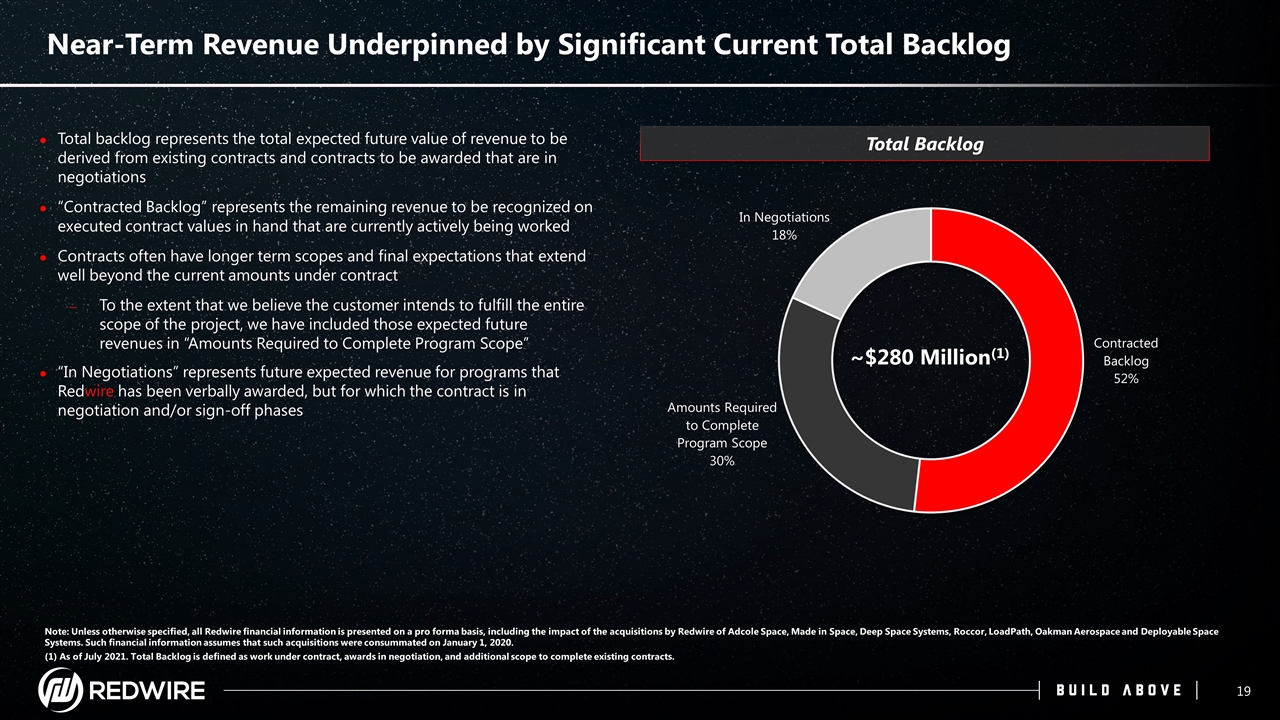

Near-Term Revenue Underpinned by Significant Current Total Backlog Total backlog represents the total expected future value of revenue to be derived from existing contracts and contracts to be awarded that are in negotiations “Contracted Backlog” represents the remaining revenue to be recognized on executed contract values in hand that are currently actively being worked Contracts often have longer term scopes and final expectations that extend well beyond the current amounts under contract To the extent that we believe the customer intends to fulfill the entire scope of the project, we have included those expected future revenues in “Amounts Required to Complete Program Scope” “In Negotiations” represents future expected revenue for programs that Redwire has been verbally awarded, but for which the contract is in negotiation and/or sign-off phases Total Backlog ~$280 Million(1) Note: Unless otherwise specified, all Redwire financial information is presented on a pro forma basis, including the impact of the acquisitions by Redwire of Adcole Space, Made in Space, Deep Space Systems, Roccor, LoadPath, Oakman Aerospace and Deployable Space Systems. Such financial information assumes that such acquisitions were consummated on January 1, 2020. (1) As of July 2021. Total Backlog is defined as work under contract, awards in negotiation, and additional scope to complete existing contracts.

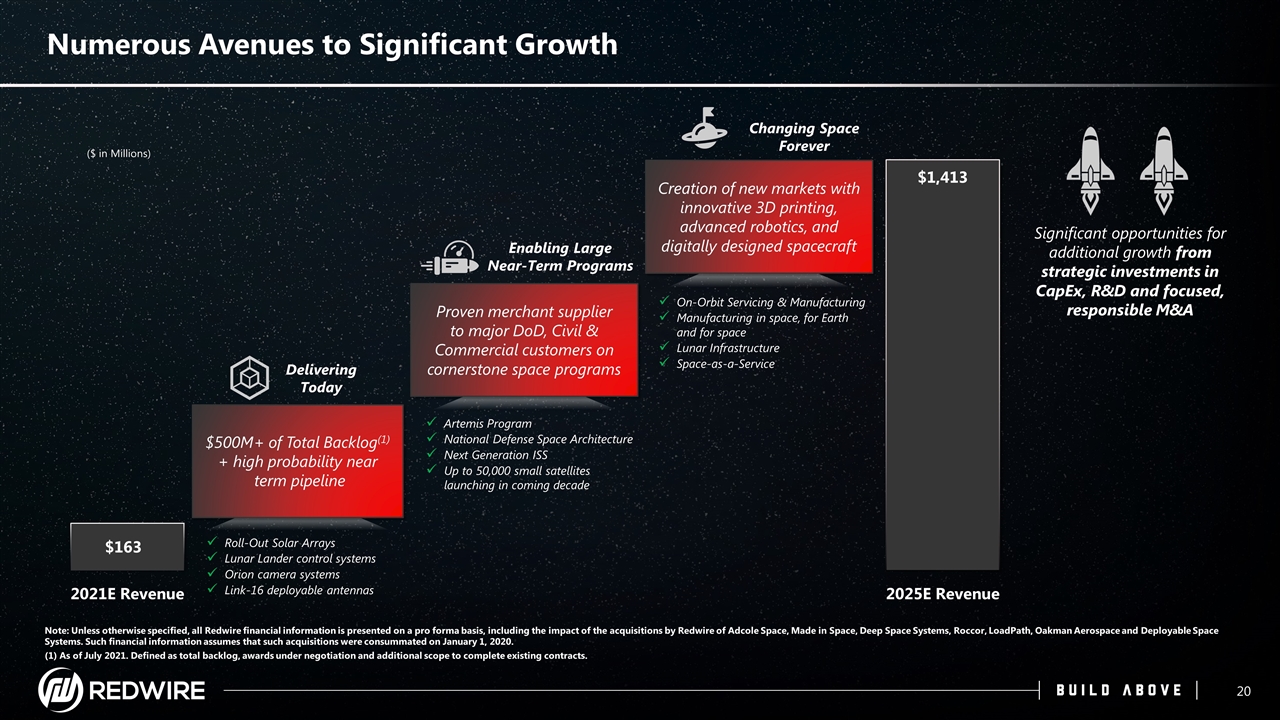

Numerous Avenues to Significant Growth $500M+ of Total Backlog(1) + high probability near term pipeline Significant opportunities for additional growth from strategic investments in CapEx, R&D and focused, responsible M&A Note: Unless otherwise specified, all Redwire financial information is presented on a pro forma basis, including the impact of the acquisitions by Redwire of Adcole Space, Made in Space, Deep Space Systems, Roccor, LoadPath, Oakman Aerospace and Deployable Space Systems. Such financial information assumes that such acquisitions were consummated on January 1, 2020. (1) As of July 2021. Defined as total backlog, awards under negotiation and additional scope to complete existing contracts. ($ in Millions) Roll-Out Solar Arrays Lunar Lander control systems Orion camera systems Link-16 deployable antennas Artemis Program National Defense Space Architecture Next Generation ISS Up to 50,000 small satellites launching in coming decade On-Orbit Servicing & Manufacturing Manufacturing in space, for Earth and for space Lunar Infrastructure Space-as-a-Service Proven merchant supplier to major DoD, Civil & Commercial customers on cornerstone space programs Creation of new markets with innovative 3D printing, advanced robotics, and digitally designed spacecraft

Q&A

Redwire | Build Above Contact information: William (Bill) Read Chief Financial Officer investorrelations@redwirespace.com