Filed by Genesis Park Acquisition Corp. pursuant to

Rule 425 under the Securities Act of 1933, as amended

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934, as amended

Subject Company: Genesis Park Acquisition Corp.

(Commission File No. 001-39733)

Investor Presentation | March 25, 2021

Disclaimer 2 Disclaimers and Other Important Information This investor presentation (this “Presentation”) is provided for informational purposes only and has been prepared to assist interested parties in making their own evaluation with respect to the proposed business combination between Redwire, LLC and Genesis Park Acquisition Corp. (“Genesis Park”) and related transactions (the “Proposed Business Combination”) and for no other purpose. By reviewing or reading this Presentation, you will be deemed to have agreed to the obligations and restrictions set out below. Without the express prior written consent of Genesis Park and Redwire, this Presentation and any information contained within it may not be (i) reproduced (in whole or in part), (ii) copied at any time, (iii) used for any purpose other than your evaluation of Redwire, Genesis Park and the Proposed Business Combination or (iv ) provided to any other person, in whole or in part, directly or indirectly, except your employees and advisors with a need to know who are advised of the confidentiality of the information. This Presentation supersedes and replaces all previous oral or written communications relating to the subject matter hereof. No person has been authorized to make any statement concerning Genesis Park or Redwire other than as will be set forth in the offering materials related to the Proposed Business Combination, and any representation or information not contained therein may not be relied upon. An investment in Redwire should be made only after careful review of the information contained in the offering materials related to the Proposed Business Combination. This Presentation and any oral statements made in connection with this Presentation do not constitute an offer to sell, or a solicitation of an offer to buy, or a recommendation to purchase, any securities in any jurisdiction, or the solicitation of any proxy, vote, consent or approval in any jurisdiction in connection with the Proposed Business Combination or any related transactions, nor shall there be any sale, issuance or transfer of any securities in any jurisdiction where, or to any person to whom, such offer, solicitation or sale may be unlawful under the laws of such jurisdiction. This Presentation does not constitute either advice or a recommendation regarding any securities. Any offer to sell securities will be made only pursuant to a definitive Subscription Agreement and will be made in reliance on an exemption from registration under the Securities Act of 1933, as amended, for offers and sales of securities that do not involve a public offering. Genesis Park and Redwire reserve the right to withdraw or amend for any reason any offering and to reject any Subscription Agreement for any reason. The communication of this Presentation is restricted by law; it is not intended for distribution to, or use by any person in any jurisdiction where such distribution or use would be contrary to local law or regulation. No representations or warranties, express or implied are given in, or in respect of, this Presentation. To the fullest extent permitted by law, in no circumstances will Genesis Park, Redwire or any of their respective subsidiaries, stockholders, members, affiliates, representatives, partners, directors, officers, employees, advisors or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this Presentation, its contents, its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith. Industry and market data used in this Presentation have been obtained from third-party industry publications and sources as well as from research reports prepared for other purposes. Neither Genesis Park nor Redwire has independently verified the data obtained from these sources and cannot assure you of the data’s accuracy or completeness. This data is subject to change. Recipients of this Presentation are not to construe its contents, or any prior or subsequent communications from or with Genesis Park, Redwire or their respective representatives as investment, legal or tax advice. In addition, this Presentation does not purport to be all-inclusive or to contain all of the information that may be required to make a full analysis of Redwire, Genesis Park or the Proposed Business Combination. Recipients of this Presentation should each make their own evaluation of Redwire, Genesis Park and the Proposed Business Combination and of the relevance and adequacy of the information and should make such other investigations as they deem necessary. Statements other than historical facts, including but not limited to those concerning (i) the Proposed Business Combination, (ii) the PIPE Offering, (iii) market conditions, or (iv) trends, consumer or customer preferences or other similar concepts with respect to Genesis Park, Redwire or the Proposed Business Combination, are based on current expectations, estimates, projections, targets, opinions and/or beliefs of Genesis Park and the applicable Companies or, when applicable, of one or more third-party sources. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. In addition, no representation or warranty is made with respect to the reasonableness of any estimates, forecasts, illustrations, prospects or returns, which should be regarded as illustrative only, or that any profits will be realized. The metrics regarding select aspects of Genesis Park’s and Redwire's operations were selected by Genesis Park and Redwire on a subjective basis. Such metrics are provided solely for illustrative purposes to demonstrate elements of Genesis Park’s and Redwire's businesses, are incomplete, and are not necessarily indicative of Genesis Park’s and Companies’ performance or overall operations. There can be no assurance that historical trends will continue. This Investor Presentation is being distributed to selected recipients only and is not intended for distribution to, or use by any person or entity in, any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Neither this Investor Presentation nor any part or copy of it may be taken or transmitted into the United States or published, released, disclosed or distributed, directly or indirectly, in the United States, as that term is defined in the United States Securities Act of 1933, as amended (the “Securities Act”), except to a limited number of qualified institutional buyers (“QIBs”), as defined in Rule 144A under the Securities Act, or institutional “accredited investors” within the meaning of Regulation D under the Securities Act.

Disclaimer 3 Forward-Looking Statements This document includes “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “forecast,” “intend,” “seek,” “target,” “anticipate,” “believe,” “expect,” “estimate,” “plan,” “outlook,” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Such forward looking statements include estimated financial information, including without limitation, forecasted revenue and revenue CAGR. Such forward looking statements with respect to revenues, earnings, performance, strategies, prospects and other aspects of the businesses of Genesis Park Acquisition Corp., Redwire or the combined company after completion of the Business Combination are based on current expectations that are subject to risks and uncertainties. A number of factors could cause actual results or outcomes to differ materially from those indicated by such forward looking statements. These factors include, but are not limited to: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement governing the proposed business combination; (2) the inability to complete the transactions contemplated by the merger agreement due to the failure to obtain approval of the shareholders of Genesis Park Acquisition Corp. or other conditions to closing in the merger agreement; (3) the ability to meet NYSE’s listing standards following the consummation of the transactions contemplated by the merger agreement; (4) the risk that the proposed transaction disrupts current plans and operations of Redwire as a result of the announcement and consummation of the transactions described herein; (5) the ability to recognize the anticipated benefits of the proposed business combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees; (6) costs related to the proposed business combination; (7) changes in applicable laws or regulations; (8) the possibility that Redwire may be adversely affected by other economic, business, and/or competitive factors; and (9) other risks and uncertainties indicated from time to time in other documents filed or to be filed with the SEC by Genesis Park Acquisition Corp. You are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Genesis Park Acquisition Corp. and Redwire undertake no commitment to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law. Use of Projections This Presentation contains projected financial information with respect to Redwire. Such projected financial information constitutes forward-looking information, and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The assumptions and estimates underlying such financial forecasts are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties. See “Forward-Looking Statements” above. Actual results may differ materially from the results contemplated by the financial forecast information contained in this Presentation, and the inclusion of such information in this Presentation should not be regarded as a representation by any person that results reflected in such forecasts will be achieved. The performance projections and estimates are subject to the ongoing COVID-19 pandemic, and have the potential to be revised to take into account further adverse effects of the COVID-19 pandemic on the future performance of Genesis Park and Redwire. Projected returns and estimates are based on an assumption that public health, economic, market, and other conditions will improve; however, there can be no assurance that such conditions will improve within the time period or to the extent estimated by Genesis Park and Redwire. The full impact of the COVID-19 pandemic on future performance is particularly uncertain and difficult to predict, therefore actual results may vary materially and adversely from the Projections included herein. There are numerous factors related to the markets in general or the implementation of any operational strategy that cannot be fully accounted for with respect to the Projections herein. Any targets or estimates are therefore subject to a number of important risks, qualifications, limitations, and exceptions that could materially and adversely affect Genesis Park and Redwire's performance. Moreover, actual events are difficult to project and often depend upon factors that are beyond the control of Genesis Park and the applicable Company and its affiliates. The performance projections and estimates are subject to the ongoing COVID-19 pandemic, and have the potential to be revised to take into account further adverse effects of the COVID-19 pandemic on the future performance of Genesis Park and the applicable Company. Projected returns and estimates are based on an assumption that public health, economic, market, and other conditions will improve; however, there can be no assurance that such conditions will improve within the time period or to the extent estimated by Genesis Park and Redwire. The full impact of the COVID-19 pandemic on future performance is particularly uncertain and difficult to predict, therefore actual results may vary materially and adversely from the Projections included herein. Trademarks This Presentation contains trademarks, service marks, tradenames and copyrights of Redwire, Genesis Park and other companies, which are the property of their respective owners. The use herein does not imply an affiliation with, or endorsement by, the owners of these service marks, trademarks and tradenames. Third-party logos herein may represent past customers, present customers or may be provided simply for illustrative purposes only. Inclusion of such logos does not necessarily imply affiliation with or endorsement by such firms or businesses. There is no guarantee that either Genesis Park or any of Redwire will work, or continue to work, with any of the firms or businesses whose logos are included herein in the future.

Disclaimer 4 Financial Information; Non-GAAP Financial Terms The financial information and data contained in this Presentation is unaudited and does not conform to Regulation S-X promulgated by the SEC. No independent registered public accounting firm has audited, reviewed, compiled, or performed any procedures with respect to the combined financial information of Redwire for the purpose of inclusion in this Presentation, and accordingly, neither Genesis Park nor any of Redwire expresses an opinion or provides any other form of assurance with respect thereto for the purpose of this Presentation. Accordingly, such information and data may not be included in, may be adjusted in, or may be presented differently in, any registration statement or proxy statement or other report or document to be filed or furnished by Genesis Park with the SEC. Furthermore, some of the projected financial information and data contained in this Presentation, such as Adjusted EBITDA (and related measures), has not been prepared in accordance with United States generally accepted accounting principles (“GAAP”). Redwire and Genesis Park believe these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to Redwire’s financial condition and results of operations. Redwire’s management uses these non-GAAP measures for trend analyses and for budgeting and planning purposes. Redwire and Genesis Park believe that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating projected operating results and trends and in comparing Redwire’s financial measures with other similar companies, many of which present similar non-GAAP financial measures to investors. Management of Redwire does not consider these non-GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limitation of these non-GAAP financial measures is that they exclude significant expenses and income that are required by GAAP to be recorded in Redwire’s financial statements. In addition, they are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non-GAAP financial measures. You should review the audited financial statements of Redwire and certain businesses acquired by Redwire that will be presented in the Registration Statement to be filed with the SEC, and not rely on any single financial measure to evaluate Redwire’s business. A reconciliation of non-GAAP financial measures in this Presentation to the most directly comparable GAAP financial measures is not included, because, without unreasonable effort, Redwire is unable to predict with reasonable certainty the amount or timing of non-GAAP adjustments that are used to calculate these non-GAAP financial measures. Unless otherwise specified, all Redwire financial information herein is presented on a pro forma basis, including the impact of the acquisitions by Redwire of Adcole Space, Made in Space, Deep Space Systems, Roccor, LoadPath, Oakman Aerospace and Deployable Space Systems. Such financial information assumes that such acquisitions were consummated on January 1st, 2020. Additional Information In connection with the proposed business combination between Redwire and Genesis Park Acquisition Corp., Genesis Park Acquisition Corp. intends to file with the SEC a preliminary proxy statement / prospectus and will mail a definitive proxy statement / prospectus and other relevant documentation to Genesis Park Acquisition Corp. shareholders. This document does not contain all the information that should be considered concerning the proposed business combination. It is not intended to form the basis of any investment decision or any other decision in respect to the proposed business combination. Genesis Park Acquisition Corp. shareholders and other interested persons are advised to read, when available, the preliminary proxy statement / prospectus and any amendments thereto, and the definitive proxy statement / prospectus in connection with Genesis Park Acquisition Corp.’s solicitation of proxies for the special meeting to be held to approve the transactions contemplated by the proposed business combination because these materials will contain important information about Redwire, Genesis Park Acquisition Corp. and the proposed business combination. The definitive proxy statement / prospectus will be mailed to Genesis Park Acquisition Corp. shareholders as of a record date to be established for voting on the proposed business combination when it becomes available. Shareholders will also be able to obtain a copy of the preliminary proxy statement / prospectus and the definitive proxy statement / prospectus once they are available, without charge, at the SEC’s website at http://sec.gov or by directing a request to: investorrelations@redwirespace.com. This document shall not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed business combination. Participants in the Solicitation Genesis Park Acquisition Corp. and its directors and officers may be deemed participants in the solicitation of proxies of Genesis Park Acquisition Corp. shareholders in connection with the proposed business combination. Genesis Park Acquisition Corp. shareholders and other interested persons may obtain, without charge, more detailed information regarding the directors and officers of Genesis Park Acquisition Corp. in Genesis Park Acquisition Corp.’s prospectus relating to its initial public offering filed with the SEC on November 24, 2020. Redwire and its directors and executive officers may also be deemed to be participants in the solicitation of proxies from the shareholders of Genesis Park Acquisition Corp. in connection with the Business Combination. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to Genesis Park Acquisition Corp. shareholders in connection with the proposed business combination will be set forth in the proxy statement / prospectus for the transaction when available. Additional information regarding the interests of participants in the solicitation of proxies in connection with the proposed transaction will be included in the proxy statement / prospectus that Genesis Park Acquisition Corp. intends to file with the SEC.

Pure-Play Space Infrastructure Company Providing Critical Technology and Services 5 Strong secular tailwinds as the global space economy reaches an inflection point Market projected to grow 4x by 2040, driven by lower launch costs and greater national security requirements A unique combination of decades of space flight heritage with IP-protected innovations enables the capture of significant growth opportunities Purpose-built as an innovative, independent provider of infrastructure and services for space’s 2nd Golden Age Proven capabilities serving a diverse set of customers across national security, civil and commercial space Market leader in critical technologies such as in-space 3D printing / manufacturing and robotic assembly Unique combination of current revenue, EBITDA and free cash flow with significant organic growth driven by a $23+ billion pipeline of identifiable national security, civil and commercial opportunities High visibility into near-term financial performance supported by backlog and incumbency Significant revenue diversification across products, services and customers with low capital intensity Expanding profitability through margin improvement as Redwire continues to scale Unique and compelling valuation compared to publicly traded peers with pro forma enterprise value of $615 million Source: Science and Technology Policy Institute. When Space Wins, Redwire Wins: Platform-Agnostic High-Growth Opportunities Across Space Mobility, Satellites and Launch

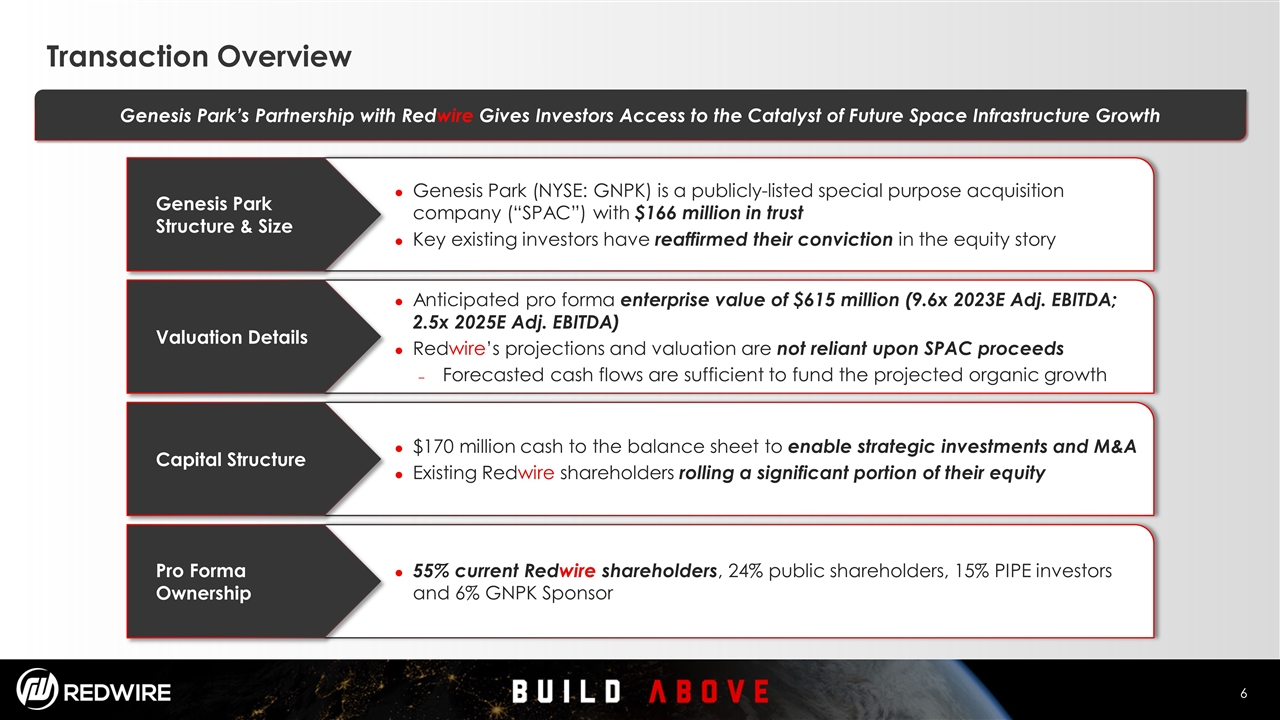

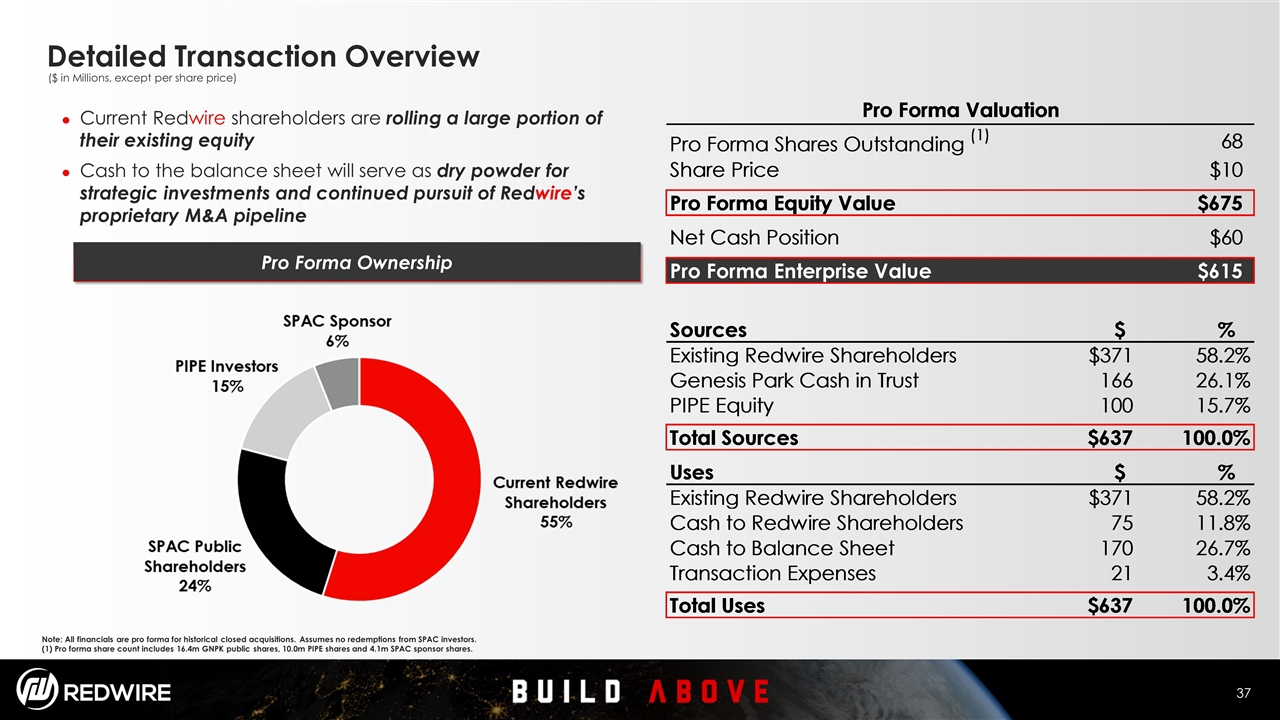

Transaction Overview Genesis Park (NYSE: GNPK) is a publicly-listed special purpose acquisition company (“SPAC”) with $166 million in trust Key existing investors have reaffirmed their conviction in the equity story Anticipated pro forma enterprise value of $615 million (9.6x 2023E Adj. EBITDA; 2.5x 2025E Adj. EBITDA) Redwire’s projections and valuation are not reliant upon SPAC proceeds Forecasted cash flows are sufficient to fund the projected organic growth $170 million cash to the balance sheet to enable strategic investments and M&A Existing Redwire shareholders rolling a significant portion of their equity 55% current Redwire shareholders, 24% public shareholders, 15% PIPE investors and 6% GNPK Sponsor Genesis Park Structure & Size Valuation Details Capital Structure Pro Forma Ownership Genesis Park’s Partnership with Redwire Gives Investors Access to the Catalyst of Future Space Infrastructure Growth

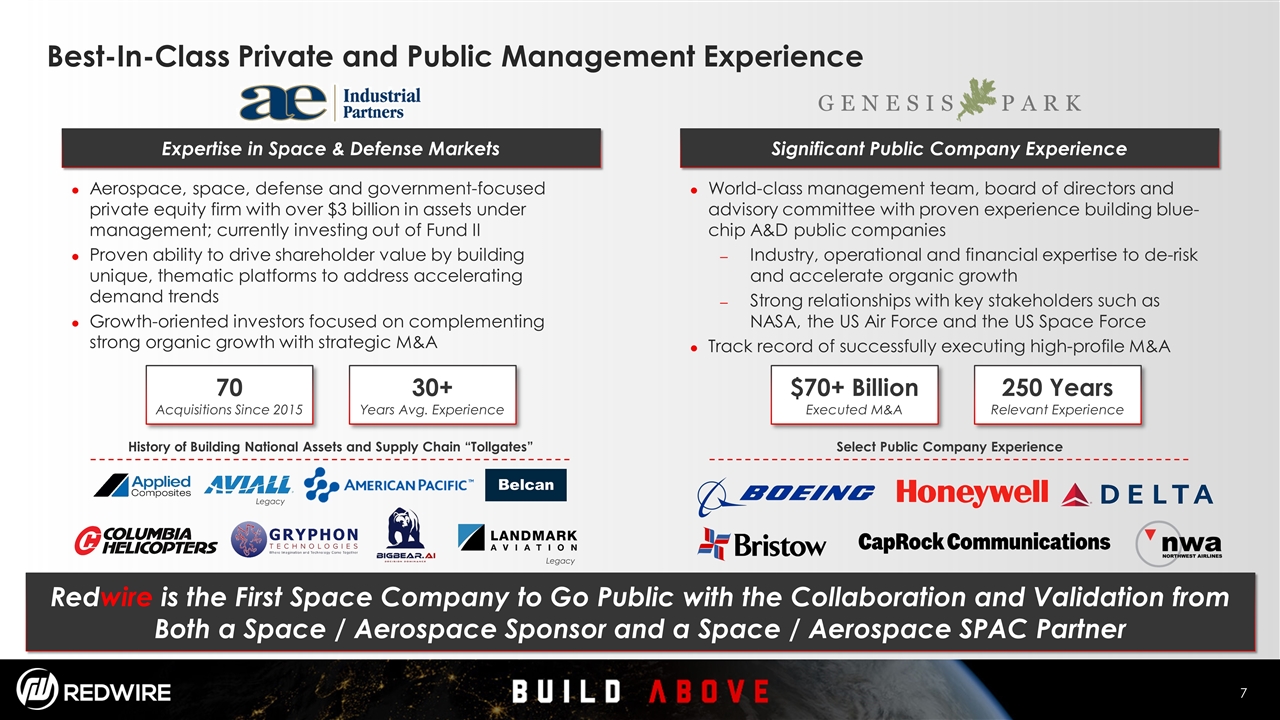

Best-In-Class Private and Public Management Experience 7 Expertise in Space & Defense Markets Significant Public Company Experience Aerospace, space, defense and government-focused private equity firm with over $3 billion in assets under management; currently investing out of Fund II Proven ability to drive shareholder value by building unique, thematic platforms to address accelerating demand trends Growth-oriented investors focused on complementing strong organic growth with strategic M&A World-class management team, board of directors and advisory committee with proven experience building blue-chip A&D public companies Industry, operational and financial expertise to de-risk and accelerate organic growth Strong relationships with key stakeholders such as NASA, the US Air Force and the US Space Force Track record of successfully executing high-profile M&A Select Public Company Experience History of Building National Assets and Supply Chain “Tollgates” $70+ Billion Executed M&A 250 Years Relevant Experience 70 Acquisitions Since 2015 30+ Years Avg. Experience Legacy Legacy Redwire is the First Space Company to Go Public with the Collaboration and Validation from Both a Space / Aerospace Sponsor and a Space / Aerospace SPAC Partner

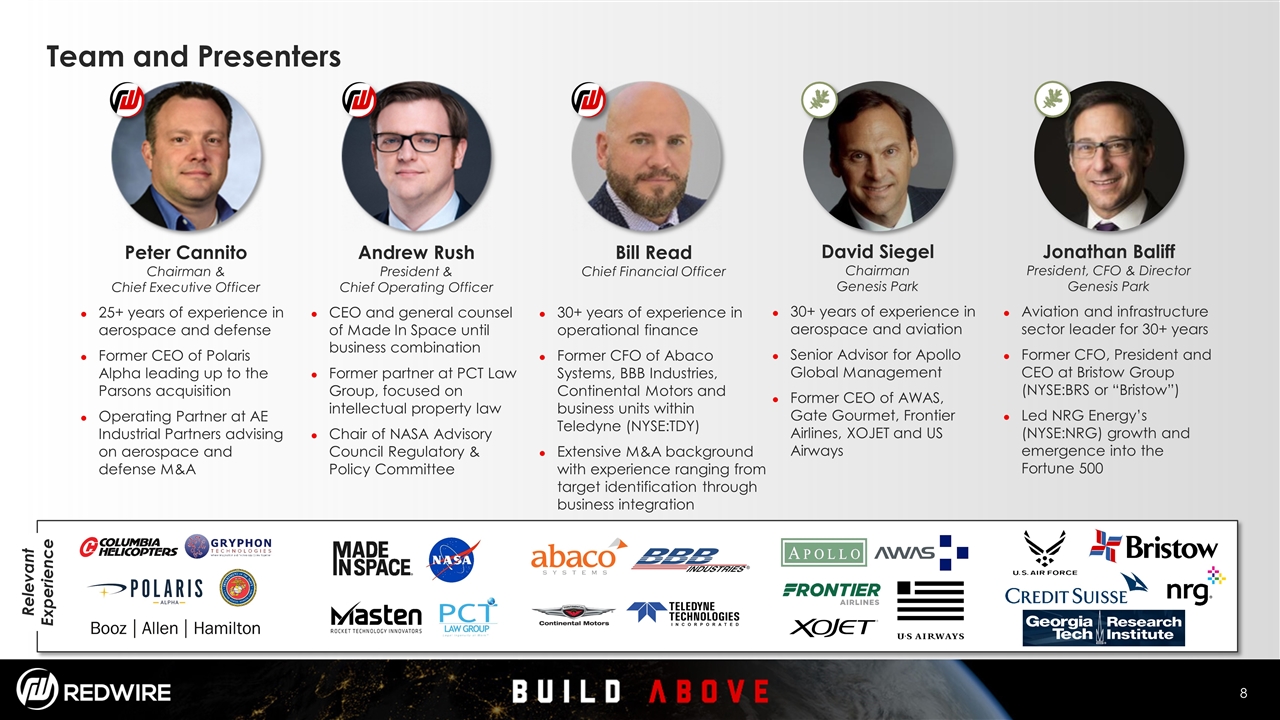

Team and Presenters Peter Cannito Chairman & Chief Executive Officer 25+ years of experience in aerospace and defense Former CEO of Polaris Alpha leading up to the Parsons acquisition Operating Partner at AE Industrial Partners advising on aerospace and defense M&A Andrew Rush President & Chief Operating Officer CEO and general counsel of Made In Space until business combination Former partner at PCT Law Group, focused on intellectual property law Chair of NASA Advisory Council Regulatory & Policy Committee Relevant Experience Bill Read Chief Financial Officer 30+ years of experience in operational finance Former CFO of Abaco Systems, BBB Industries, Continental Motors and business units within Teledyne (NYSE:TDY) Extensive M&A background with experience ranging from target identification through business integration Jonathan Baliff President, CFO & Director Genesis Park Aviation and infrastructure sector leader for 30+ years Former CFO, President and CEO at Bristow Group (NYSE:BRS or “Bristow”) Led NRG Energy’s (NYSE:NRG) growth and emergence into the Fortune 500 David Siegel Chairman Genesis Park 30+ years of experience in aerospace and aviation Senior Advisor for Apollo Global Management Former CEO of AWAS, Gate Gourmet, Frontier Airlines, XOJET and US Airways

Our Mission is accelerating humanity’s expansion into space by delivering reliable, economical and sustainable infrastructure for future generations

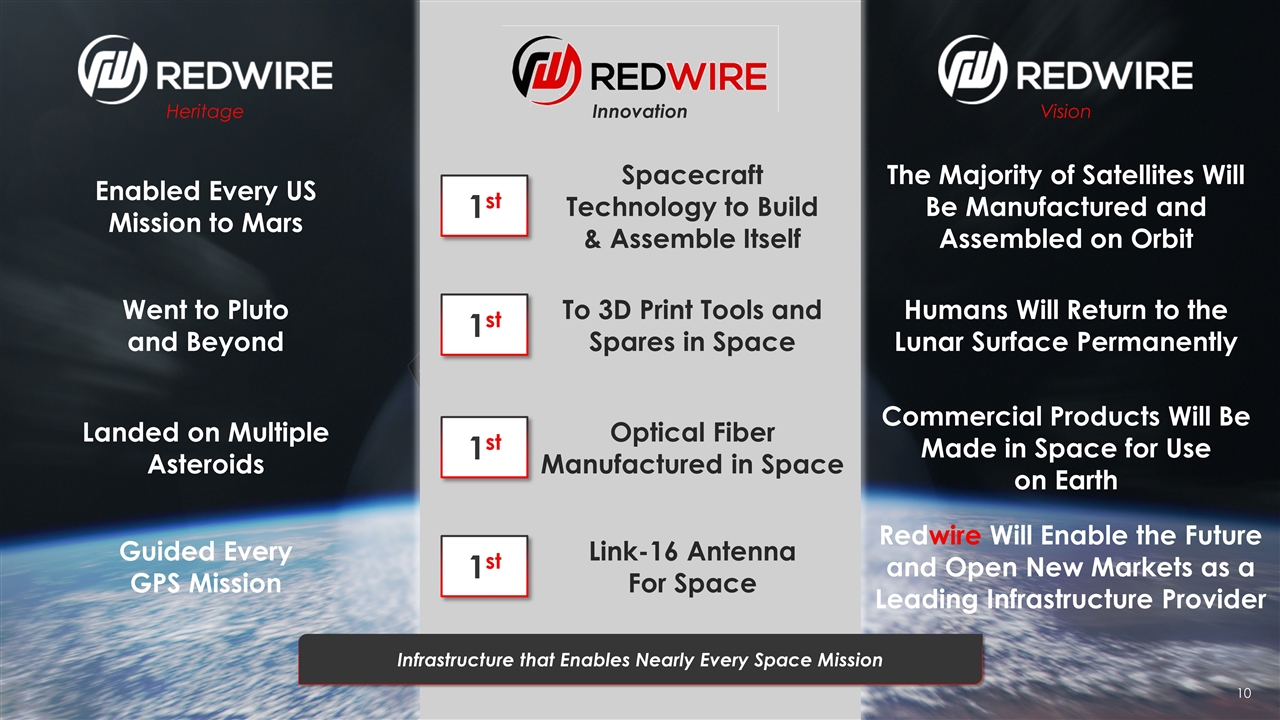

Enabled Every US Mission to Mars Went to Pluto and Beyond Landed on Multiple Asteroids Guided Every GPS Mission Spacecraft Technology to Build & Assemble Itself 1st To 3D Print Tools and Spares in Space Link-16 Antenna For Space Optical Fiber Manufactured in Space Heritage Innovation Vision The Majority of Satellites Will Be Manufactured and Assembled on Orbit Commercial Products Will Be Made in Space for Use on Earth Redwire Will Enable the Future and Open New Markets as a Leading Infrastructure Provider Humans Will Return to the Lunar Surface Permanently 1st 1st 1st Infrastructure that Enables Nearly Every Space Mission

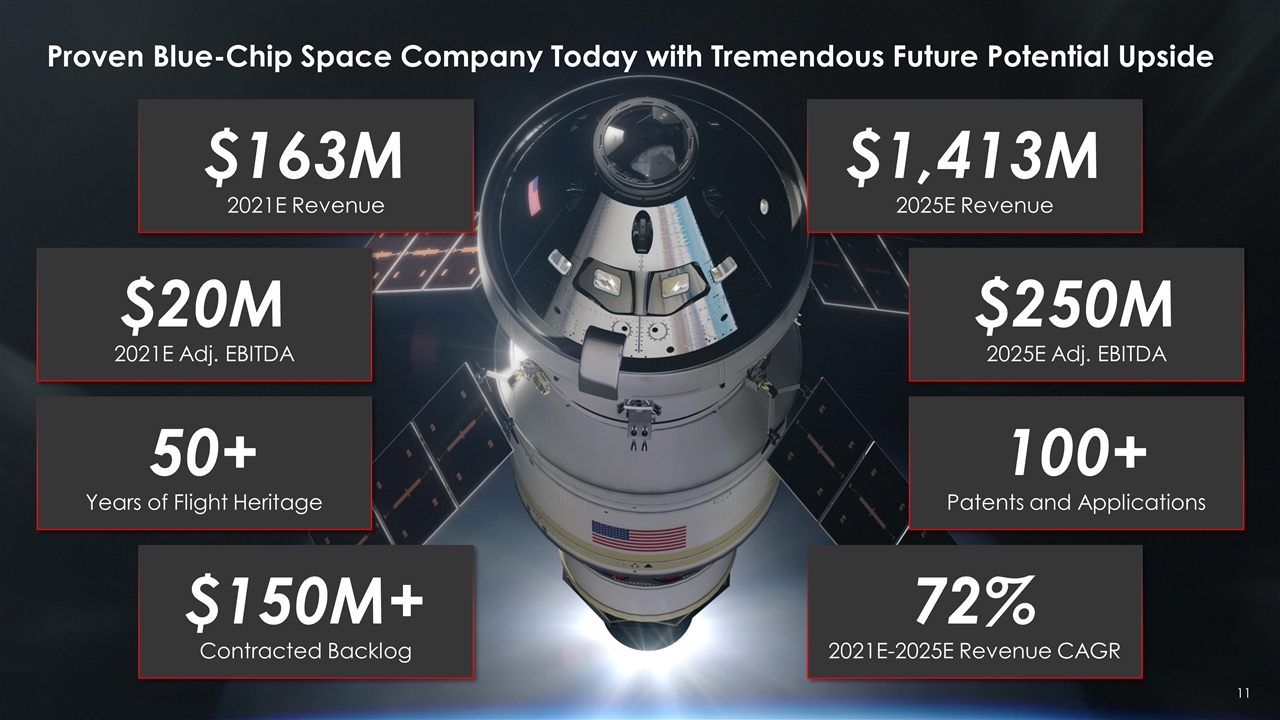

Proven Blue-Chip Space Company Today with Tremendous Future Potential Upside 50+ Years of Flight Heritage $163M 2021E Revenue $1,413M 2025E Revenue 100+ Patents and Applications $20M 2021E Adj. EBITDA $150M+ Contracted Backlog $250M 2025E Adj. EBITDA 72% 2021E-2025E Revenue CAGR

Market Overview

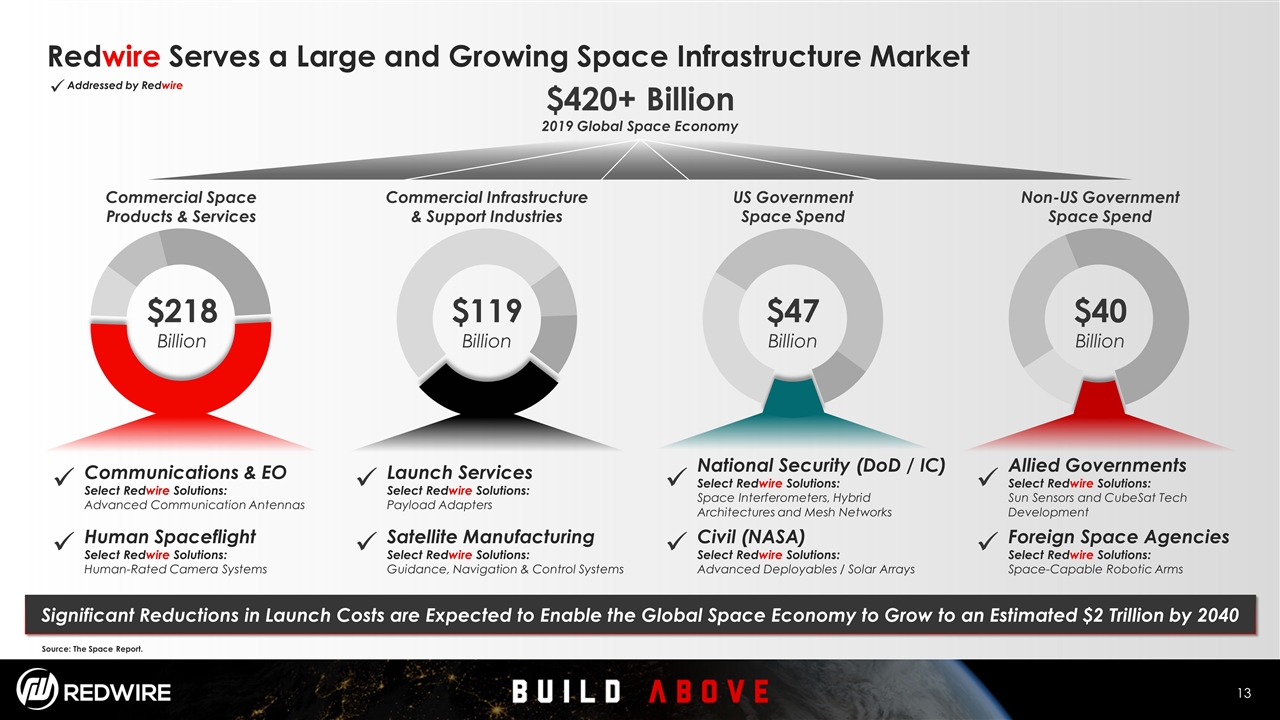

Redwire Serves a Large and Growing Space Infrastructure Market Source: The Space Report. Commercial Space Products & Services Commercial Infrastructure & Support Industries US Government Space Spend Non-US Government Space Spend Communications & EO Select Redwire Solutions: Advanced Communication Antennas ü ü Addressed by Redwire Human Spaceflight Select Redwire Solutions: Human-Rated Camera Systems ü Launch Services Select Redwire Solutions: Payload Adapters ü Satellite Manufacturing Select Redwire Solutions: Guidance, Navigation & Control Systems ü National Security (DoD / IC) Select Redwire Solutions: Space Interferometers, Hybrid Architectures and Mesh Networks ü Civil (NASA) Select Redwire Solutions: Advanced Deployables / Solar Arrays ü Allied Governments Select Redwire Solutions: Sun Sensors and CubeSat Tech Development ü Foreign Space Agencies Select Redwire Solutions: Space-Capable Robotic Arms ü $218 Billion $119 Billion $47 Billion $40 Billion $420+ Billion 2019 Global Space Economy Significant Reductions in Launch Costs are Expected to Enable the Global Space Economy to Grow to an Estimated $2 Trillion by 2040

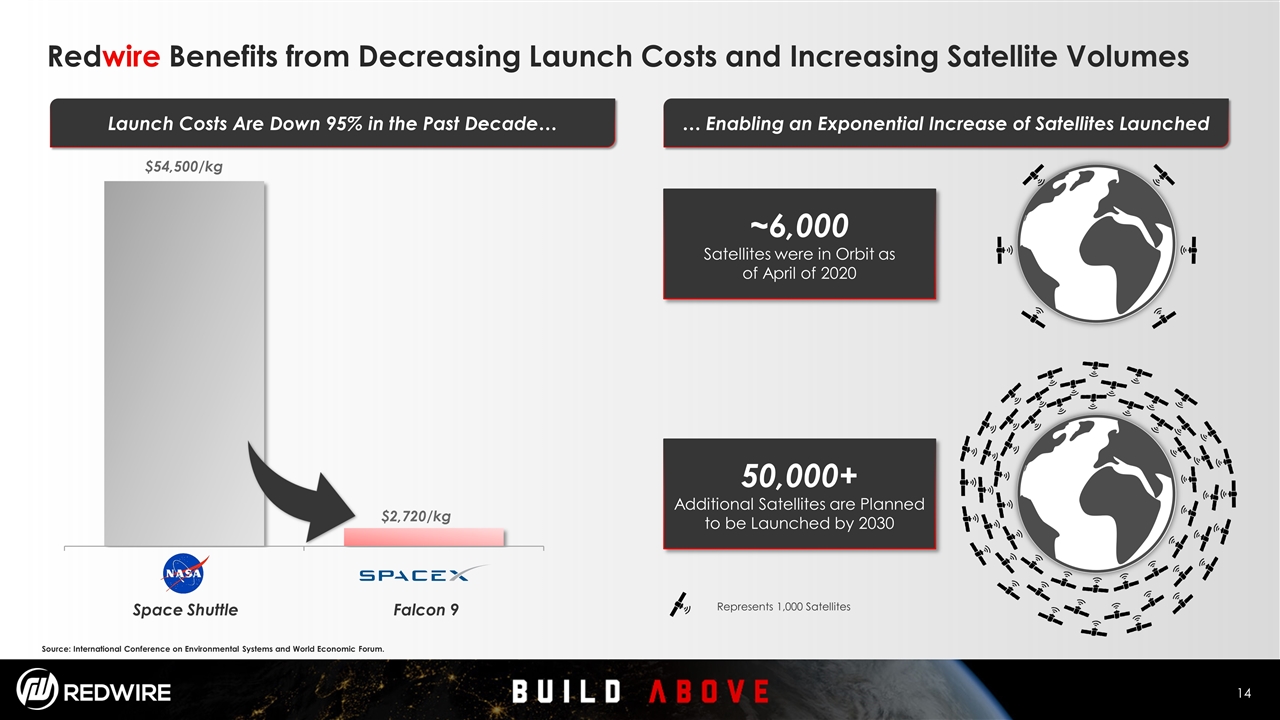

Redwire Benefits from Decreasing Launch Costs and Increasing Satellite Volumes Source: International Conference on Environmental Systems and World Economic Forum. Space Shuttle Falcon 9 Launch Costs Are Down 95% in the Past Decade… … Enabling an Exponential Increase of Satellites Launched ~6,000 Satellites were in Orbit as of April of 2020 50,000+ Additional Satellites are Planned to be Launched by 2030 Represents 1,000 Satellites

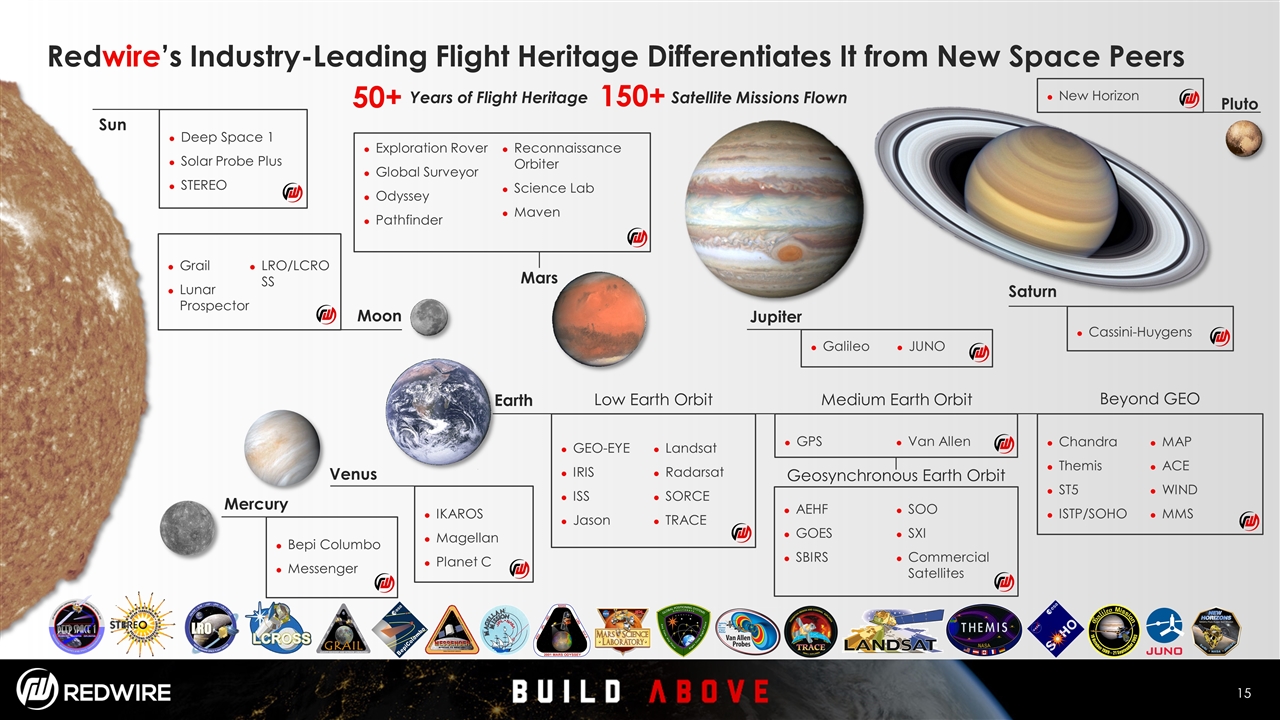

Redwire’s Industry-Leading Flight Heritage Differentiates It from New Space Peers Mars Jupiter Saturn Pluto IKAROS Magellan Planet C GEO-EYE IRIS ISS Jason Landsat Radarsat SORCE TRACE Low Earth Orbit GPS Van Allen Medium Earth Orbit AEHF GOES SBIRS SOO SXI Commercial Satellites Geosynchronous Earth Orbit Chandra Themis ST5 ISTP/SOHO MAP ACE WIND MMS Beyond GEO Venus Mercury Earth Sun Exploration Rover Global Surveyor Odyssey Pathfinder Reconnaissance Orbiter Science Lab Maven Moon Galileo JUNO Cassini-Huygens New Horizon Years of Flight Heritage 50+ Satellite Missions Flown 150+ Deep Space 1 Solar Probe Plus STEREO Grail Lunar Prospector LRO/LCROSS Bepi Columbo Messenger

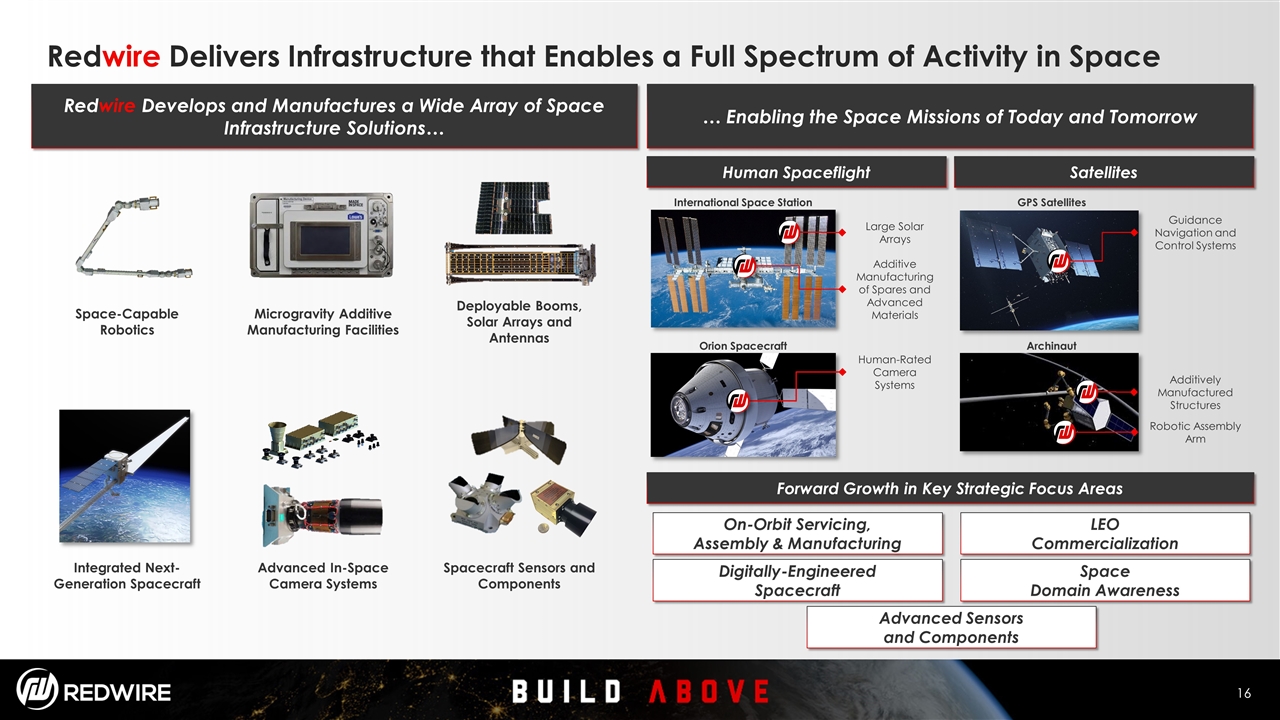

Redwire Delivers Infrastructure that Enables a Full Spectrum of Activity in Space Redwire Develops and Manufactures a Wide Array of Space Infrastructure Solutions… Space-Capable Robotic Arms … Enabling the Space Missions of Today and Tomorrow Space-Capable Robotics Microgravity Additive Manufacturing Facilities Deployable Booms, Solar Arrays and Antennas Integrated Next-Generation Spacecraft Advanced In-Space Camera Systems Spacecraft Sensors and Components Guidance Navigation and Control Systems Large Solar Arrays Additive Manufacturing of Spares and Advanced Materials International Space Station Human-Rated Camera Systems Orion Spacecraft Human Spaceflight Satellites GPS Satellites Guidance Navigation and Control Systems Archinaut Robotic Assembly Arm Additively Manufactured Structures On-Orbit Servicing, Assembly & Manufacturing Digitally-Engineered Spacecraft Advanced Sensors and Components LEO Commercialization Space Domain Awareness Forward Growth in Key Strategic Focus Areas

In-Space Manufacturing & Robotic Assembly Are Critical Capabilities “If NASA can print things in three-dimensions in space and then robotically assemble those things, those capabilities are going to be absolutely game changing for NASA and for our partners in the US government and commercial industry.” Jim Bridenstine NASA Administrator Spacecraft & Large Structures Tomorrow (2025+) Proliferation & Commercialization Today (2018 – 2025) Adoption & Expansion The Past (2000 – 2018) Discovering & Demonstrating Research Phase Additive Manufacturing Facility Installed on ISS Archinaut Successfully Demonstrates In-Space Manufacturing of Satellites Tools & Spare Parts Sustainable Human Space Habitats ZBLAN and Other Materials for Earth Asteroid Mining & Energy Generation

Legacy Defense Primes Legacy Space Hardware New Space First-Movers Fragmented New Space Base Focus on large, exquisite projects and major contracts Compete directly with major defense primes and pursue tangential opportunities that take focus away from new space innovation Significant flight heritage, but less nimble in design and conform to rigid pricing models Significant scale and flight heritage, but depend on many specialized subcontractors Lack of cooperation among primes creates customer inefficiencies Focus on vertical integration of supply chain where possible Founding focus on capex-heavy launch capabilities, now branching out to focused missions (comms, habitation, exploration) Diversified business model can distract from space segments First movers with narrow subsector focus Infrastructure supplier across all major space industry segments 50+ years of flight heritage and customer intimacy Key partner for the primes on major programs, while acting as a prime in select focus areas Aligned with premier customers in the fast currents of the space industry Novel, next-generation technology shaping the future of in-space architecture Innovative and agile framework allows for rapid iteration Narrow focus on specific technological application Lack scale to compete on large programs; prime continued consolidation opportunity for Redwire Hundreds of Founder-Owned and Early-Stage Companies Redwire Was Purpose Built to Be a Pure-Play, Independent Provider of Solutions for New Space

Redwire is a Platform-Agnostic Play Across the High-Growth, New Space Sectors Launch & Exploration In-Space Mobility Earth Observation Satellite Communication When Space Wins, Redwire Wins

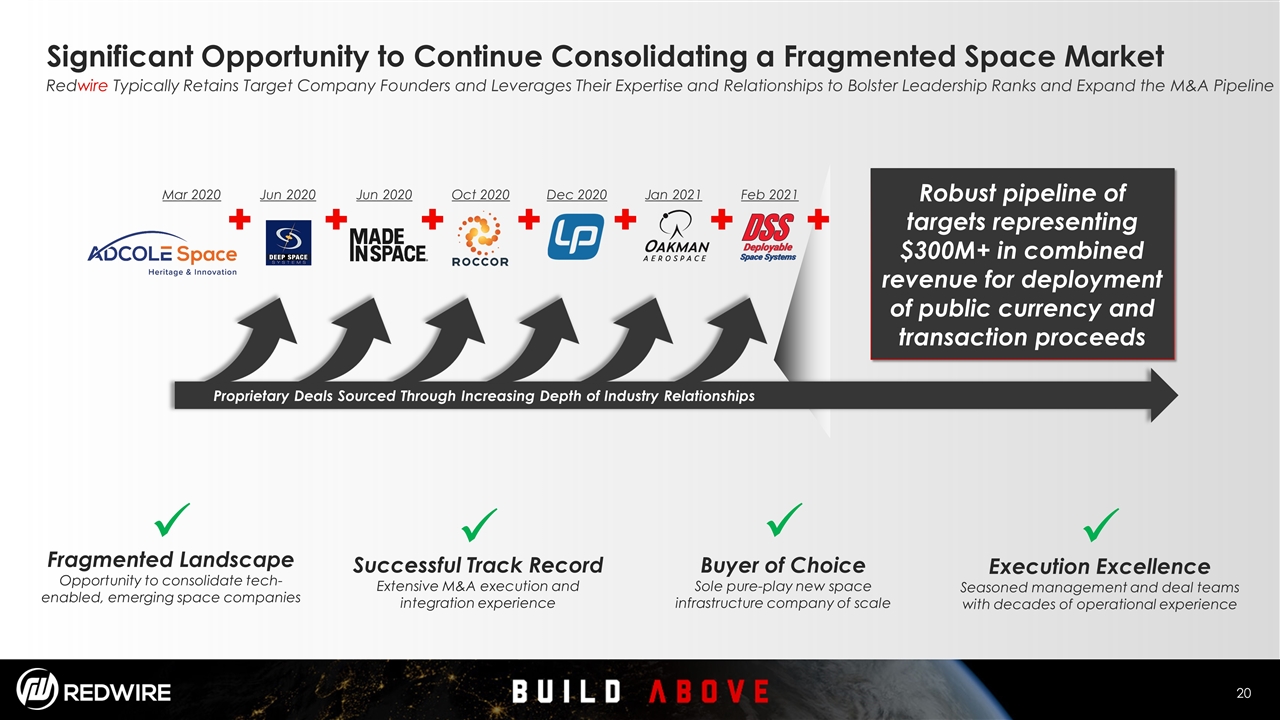

Significant Opportunity to Continue Consolidating a Fragmented Space Market Fragmented Landscape Opportunity to consolidate tech-enabled, emerging space companies Buyer of Choice Sole pure-play new space infrastructure company of scale Successful Track Record Extensive M&A execution and integration experience Execution Excellence Seasoned management and deal teams with decades of operational experience ü ü ü ü Mar 2020 Jun 2020 Jun 2020 Oct 2020 Dec 2020 Jan 2021 Feb 2021 Redwire Typically Retains Target Company Founders and Leverages Their Expertise and Relationships to Bolster Leadership Ranks and Expand the M&A Pipeline Proprietary Deals Sourced Through Increasing Depth of Industry Relationships Robust pipeline of targets representing $300M+ in combined revenue for deployment of public currency and transaction proceeds

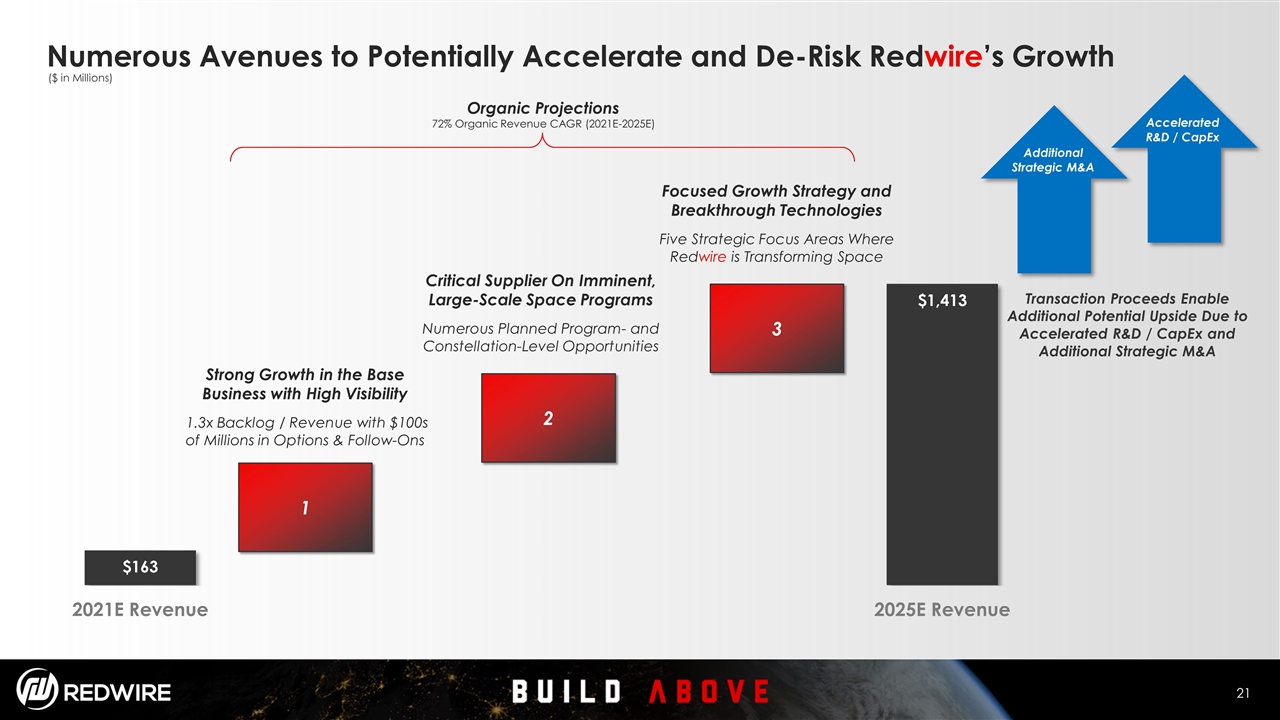

Numerous Avenues to Potentially Accelerate and De-Risk Redwire’s Growth ($ in Millions) Accelerated R&D / CapEx 1 2 Strong Growth in the Base Business with High Visibility 1.3x Backlog / Revenue with $100s of Millions in Options & Follow-Ons Transaction Proceeds Enable Additional Potential Upside Due to Accelerated R&D / CapEx and Additional Strategic M&A Critical Supplier On Imminent, Large-Scale Space Programs Numerous Planned Program- and Constellation-Level Opportunities 3 Focused Growth Strategy and Breakthrough Technologies Five Strategic Focus Areas Where Redwire is Transforming Space Additional Strategic M&A Organic Projections 72% Organic Revenue CAGR (2021E-2025E)

Redwire’s Growth is Driven by Proven Capabilities and Transformative Technologies

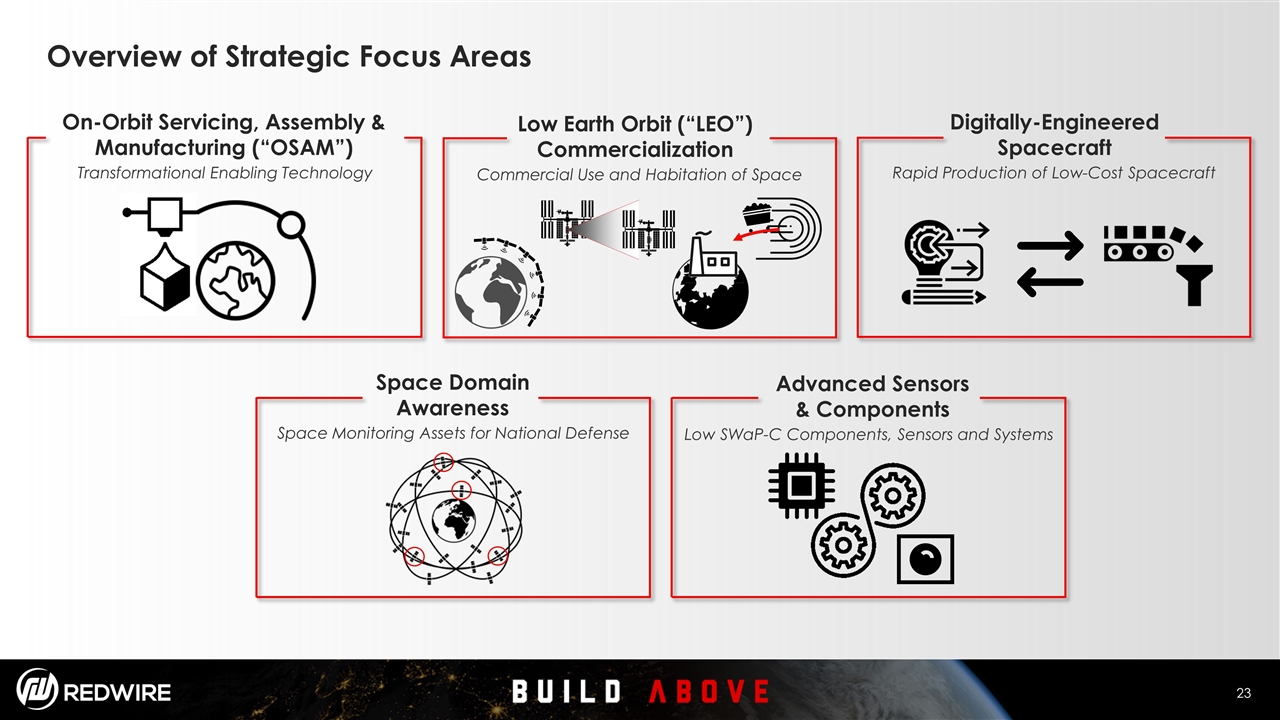

Overview of Strategic Focus Areas Advanced Sensors & Components Digitally-Engineered Spacecraft On-Orbit Servicing, Assembly & Manufacturing (“OSAM”) Low SWaP-C Components, Sensors and Systems Rapid Production of Low-Cost Spacecraft Transformational Enabling Technology Low Earth Orbit (“LEO”) Commercialization Commercial Use and Habitation of Space Space Domain Awareness Space Monitoring Assets for National Defense

Limitations on Power and Capability and Reduced Mission Effectiveness Redwire’s OSAM Capabilities Transform What Can Be Accomplished in Space Current Paradigm Space-Capable Robotic Arms Redwire OSAM Solution Guidance Navigation and Control Systems Today, Satellites Are Engineered for Launch First and Mission Capability Second Must Survive a Violent Launch Protecting Fragile Structures (e.g. solar arrays, antennas) Increases Payload Weight and Launch Cost Must Fit On Launch Vehicle Limits Size of Large Structures, Requires Complex Origami Folding Redwire’s OSAM Solution, Enabled By In-Space Robotics and Additive Manufacturing, Allows Customers to Optimize For The Mission Launch Raw Materials Into Orbit Manufacture In-Space Production of Component Parts Assemble Robotic Assembly of Functional Objects Archinaut-Enabled Capabilities Legacy $100s M $10s M $60M $10M Lower-Cost Deployment… … Of Higher-Power Capabilities

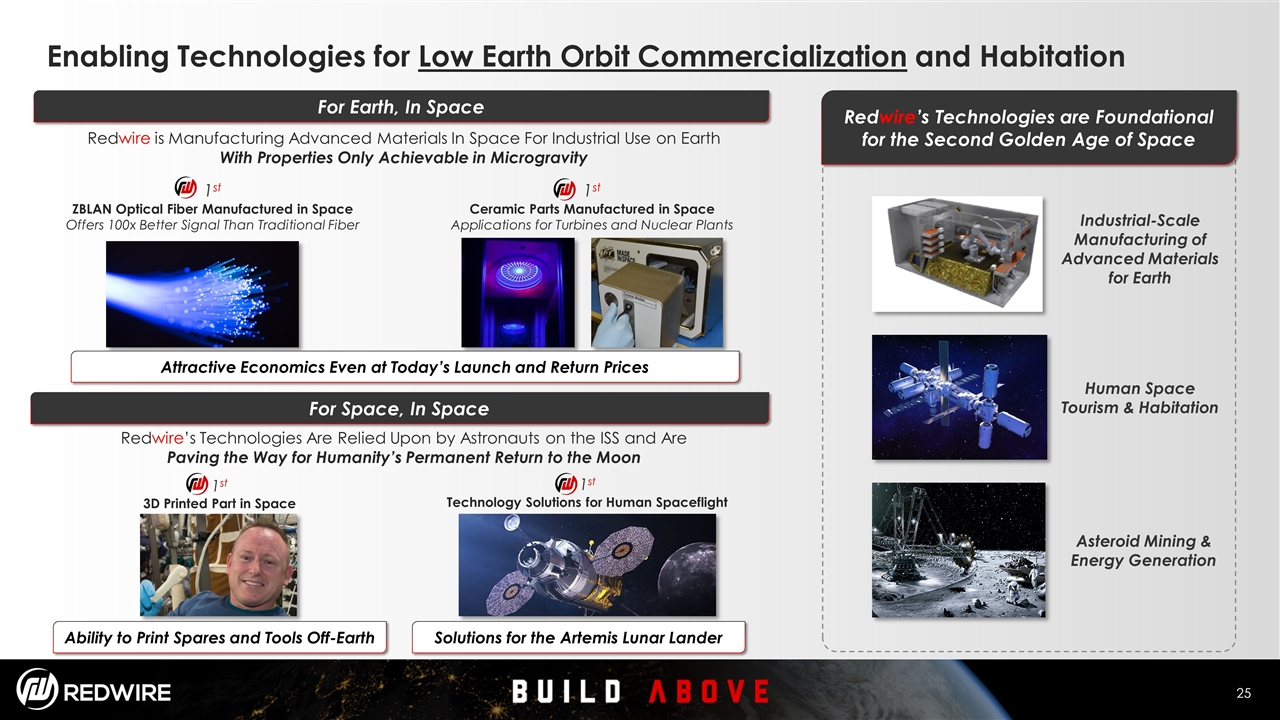

Enabling Technologies for Low Earth Orbit Commercialization and Habitation For Earth, In Space For Space, In Space Redwire is Manufacturing Advanced Materials In Space For Industrial Use on Earth With Properties Only Achievable in Microgravity 1st ZBLAN Optical Fiber Manufactured in Space Offers 100x Better Signal Than Traditional Fiber 1st Ceramic Parts Manufactured in Space Applications for Turbines and Nuclear Plants Human Space Tourism & Habitation Asteroid Mining & Energy Generation w 1st Technology Solutions for Human Spaceflight 1st 3D Printed Part in Space Redwire’s Technologies are Foundational for the Second Golden Age of Space Attractive Economics Even at Today’s Launch and Return Prices Industrial-Scale Manufacturing of Advanced Materials for Earth Ability to Print Spares and Tools Off-Earth Redwire’s Technologies Are Relied Upon by Astronauts on the ISS and Are Paving the Way for Humanity’s Permanent Return to the Moon Solutions for the Artemis Lunar Lander

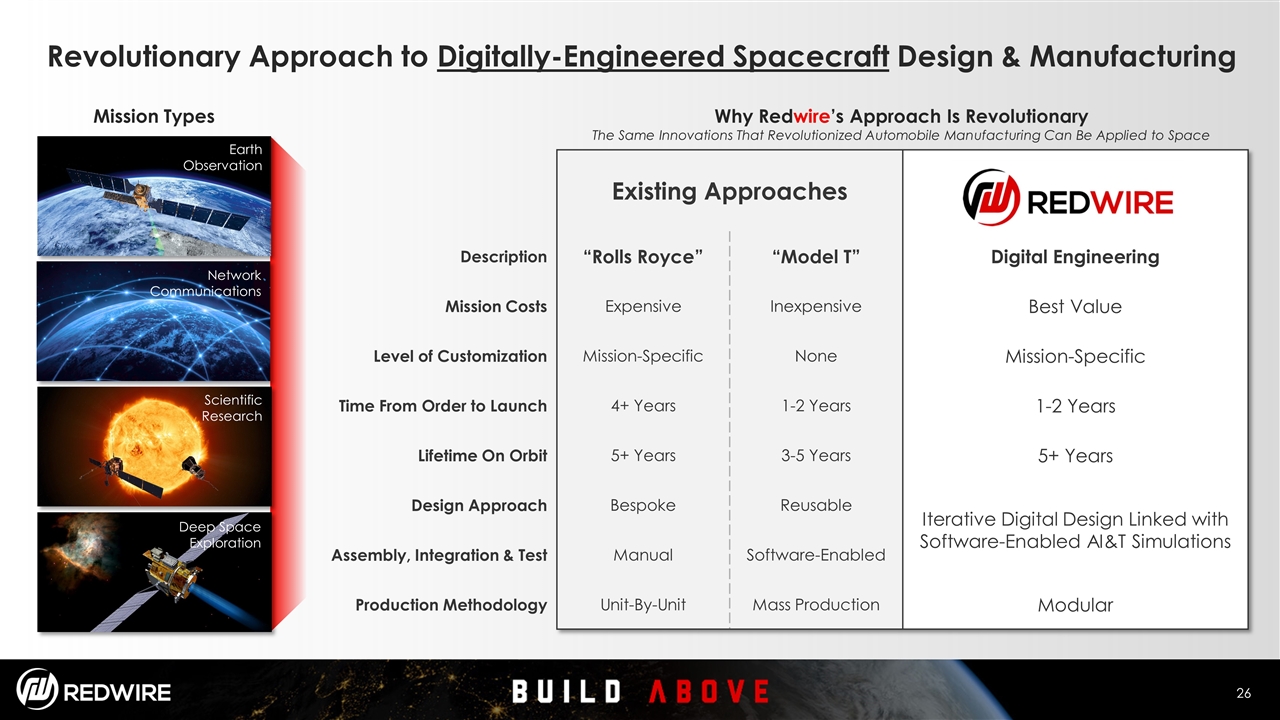

Existing Approaches Description “Rolls Royce” “Model T” Digital Engineering Mission Costs Expensive Inexpensive Best Value Level of Customization Mission-Specific None Mission-Specific Time From Order to Launch 4+ Years 1-2 Years 1-2 Years Lifetime On Orbit 5+ Years 3-5 Years 5+ Years Design Approach Bespoke Reusable Iterative Digital Design Linked with Software-Enabled AI&T Simulations Assembly, Integration & Test Manual Software-Enabled Production Methodology Unit-By-Unit Mass Production Modular Revolutionary Approach to Digitally-Engineered Spacecraft Design & Manufacturing Earth Observation Network Communications Scientific Research Deep Space Exploration Mission Types Why Redwire’s Approach Is Revolutionary The Same Innovations That Revolutionized Automobile Manufacturing Can Be Applied to Space

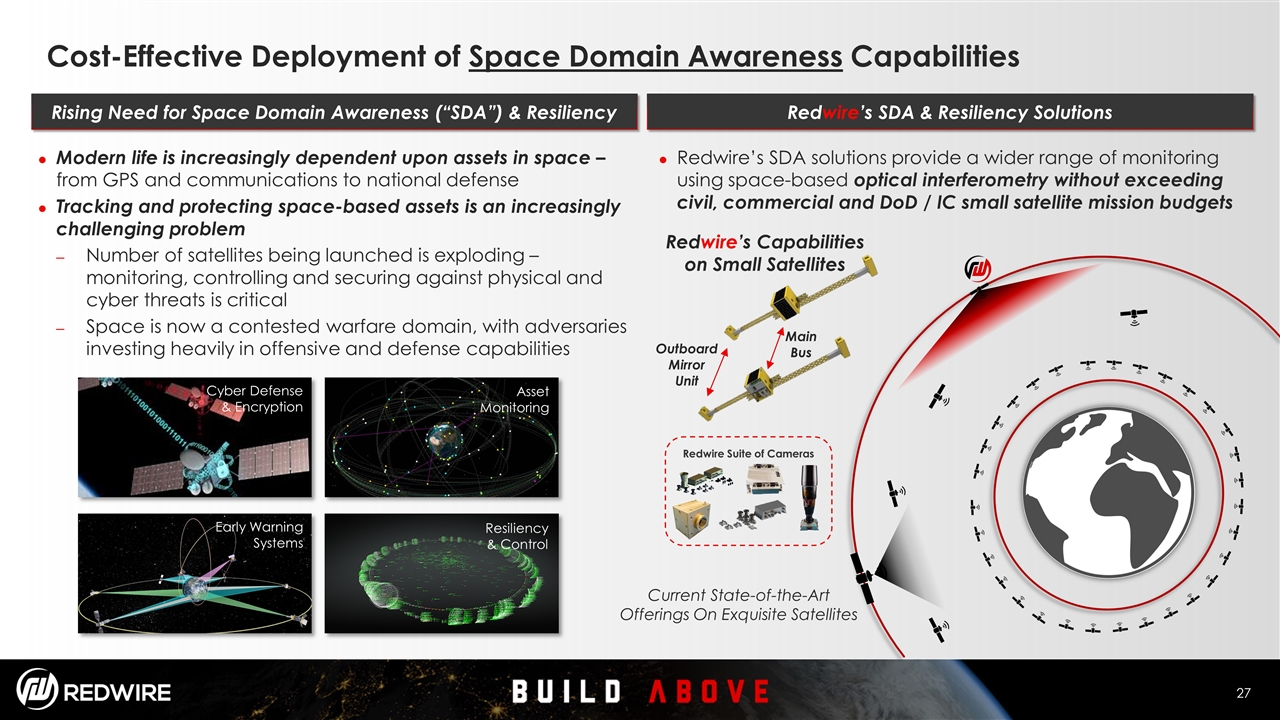

Modern life is increasingly dependent upon assets in space –from GPS and communications to national defense Tracking and protecting space-based assets is an increasingly challenging problem Number of satellites being launched is exploding – monitoring, controlling and securing against physical and cyber threats is critical Space is now a contested warfare domain, with adversaries investing heavily in offensive and defense capabilities Rising Need for Space Domain Awareness (“SDA”) & Resiliency Redwire’s SDA & Resiliency Solutions Redwire’s SDA solutions provide a wider range of monitoring using space-based optical interferometry without exceeding civil, commercial and DoD / IC small satellite mission budgets Redwire’s Capabilities on Small Satellites Current State-of-the-Art Offerings On Exquisite Satellites Main Bus Outboard Mirror Unit Cost-Effective Deployment of Space Domain Awareness Capabilities Redwire Suite of Cameras Cyber Defense & Encryption Asset Monitoring Early Warning Systems Resiliency & Control

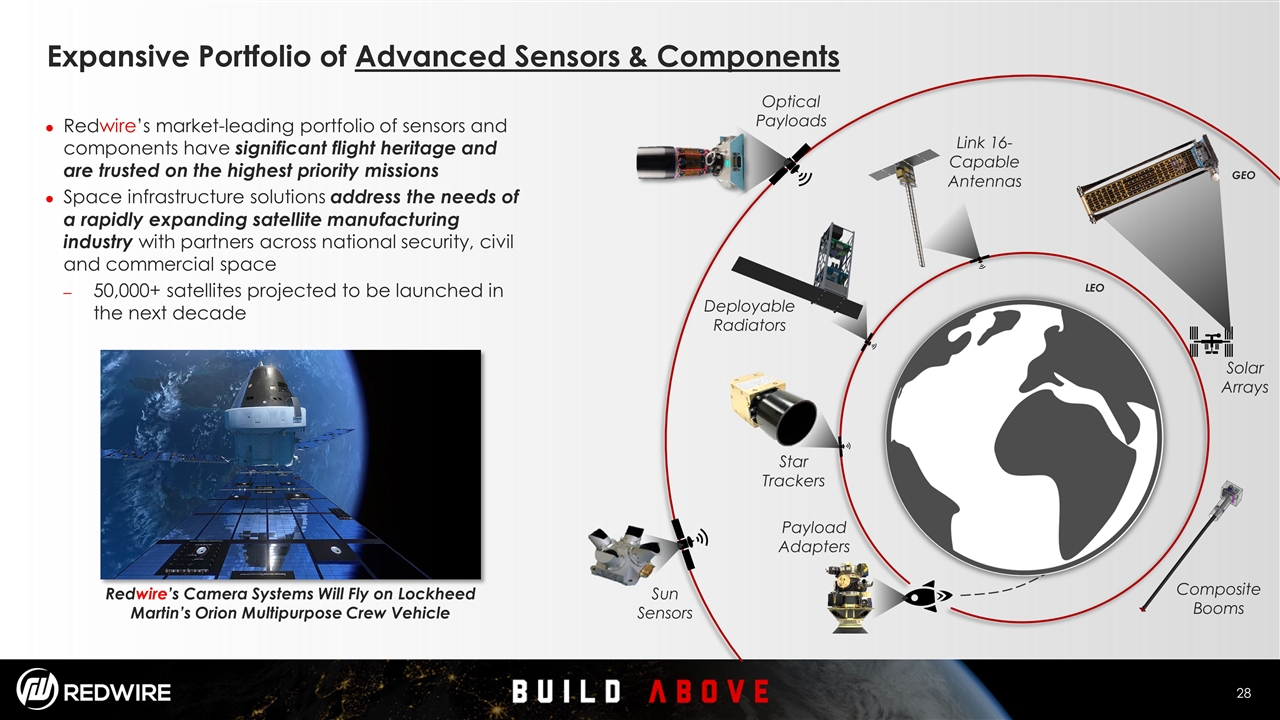

Expansive Portfolio of Advanced Sensors & Components GEO LEO Redwire’s market-leading portfolio of sensors and components have significant flight heritage and are trusted on the highest priority missions Space infrastructure solutions address the needs of a rapidly expanding satellite manufacturing industry with partners across national security, civil and commercial space 50,000+ satellites projected to be launched in the next decade Star Trackers Sun Sensors Deployable Radiators Solar Arrays Optical Payloads Payload Adapters Redwire’s Camera Systems Will Fly on Lockheed Martin’s Orion Multipurpose Crew Vehicle Link 16-Capable Antennas Composite Booms

Archinaut’s Win Validates Redwire’s Position as the Leader in In-Space Manufacturing Redwire is the prime on Archinaut 1 (“A1”), the first on-orbit demonstration using additive manufacturing to build and assemble complex components in space Could result in 5x power outputs when compared to state-of-the-art solar arrays Archinaut Today Archinaut Enables the Future A1 Demonstrates the Transformational Capability of OSAM, Potentially Driving Widespread Adoption $74M Contract Value 2023 Planned Launch Archinaut Can Enable and Expand the Multi-Trillion Dollar Space Economy 66 ft 6 ft Cost Efficient Satellite Launched into Space Cost Efficient Satellite Built in Space The small spacecraft will 3D print two beams that extend nearly 33 feet from each side of the spacecraft HALO Large Structures Deep Space Gateway

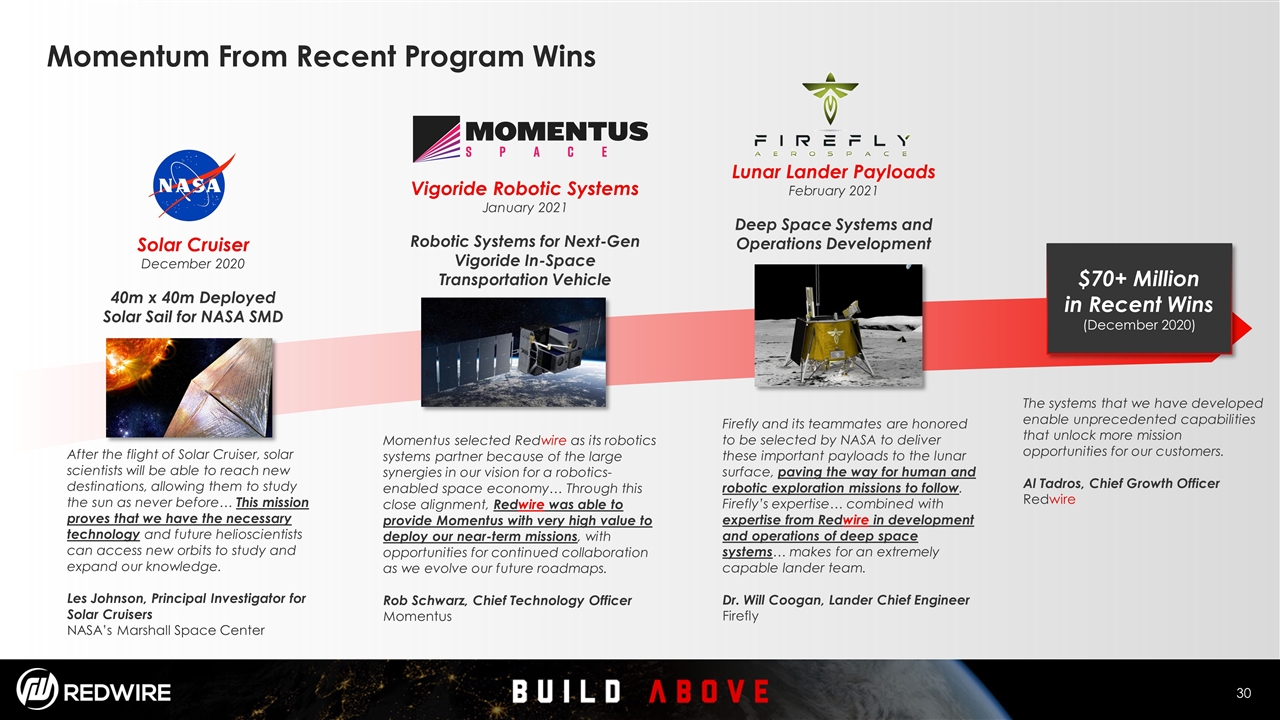

Momentum From Recent Program Wins Solar Cruiser December 2020 40m x 40m Deployed Solar Sail for NASA SMD Vigoride Robotic Systems January 2021 Robotic Systems for Next-Gen Vigoride In-Space Transportation Vehicle Lunar Lander Payloads February 2021 Deep Space Systems and Operations Development Firefly and its teammates are honored to be selected by NASA to deliver these important payloads to the lunar surface, paving the way for human and robotic exploration missions to follow. Firefly’s expertise… combined with expertise from Redwire in development and operations of deep space systems… makes for an extremely capable lander team. Dr. Will Coogan, Lander Chief Engineer Firefly After the flight of Solar Cruiser, solar scientists will be able to reach new destinations, allowing them to study the sun as never before… This mission proves that we have the necessary technology and future helioscientists can access new orbits to study and expand our knowledge. Les Johnson, Principal Investigator for Solar Cruisers NASA’s Marshall Space Center Momentus selected Redwire as its robotics systems partner because of the large synergies in our vision for a robotics-enabled space economy… Through this close alignment, Redwire was able to provide Momentus with very high value to deploy our near-term missions, with opportunities for continued collaboration as we evolve our future roadmaps. Rob Schwarz, Chief Technology Officer Momentus $70+ Million in Recent Wins (December 2020) The systems that we have developed enable unprecedented capabilities that unlock more mission opportunities for our customers. Al Tadros, Chief Growth Officer Redwire

Financial Overview

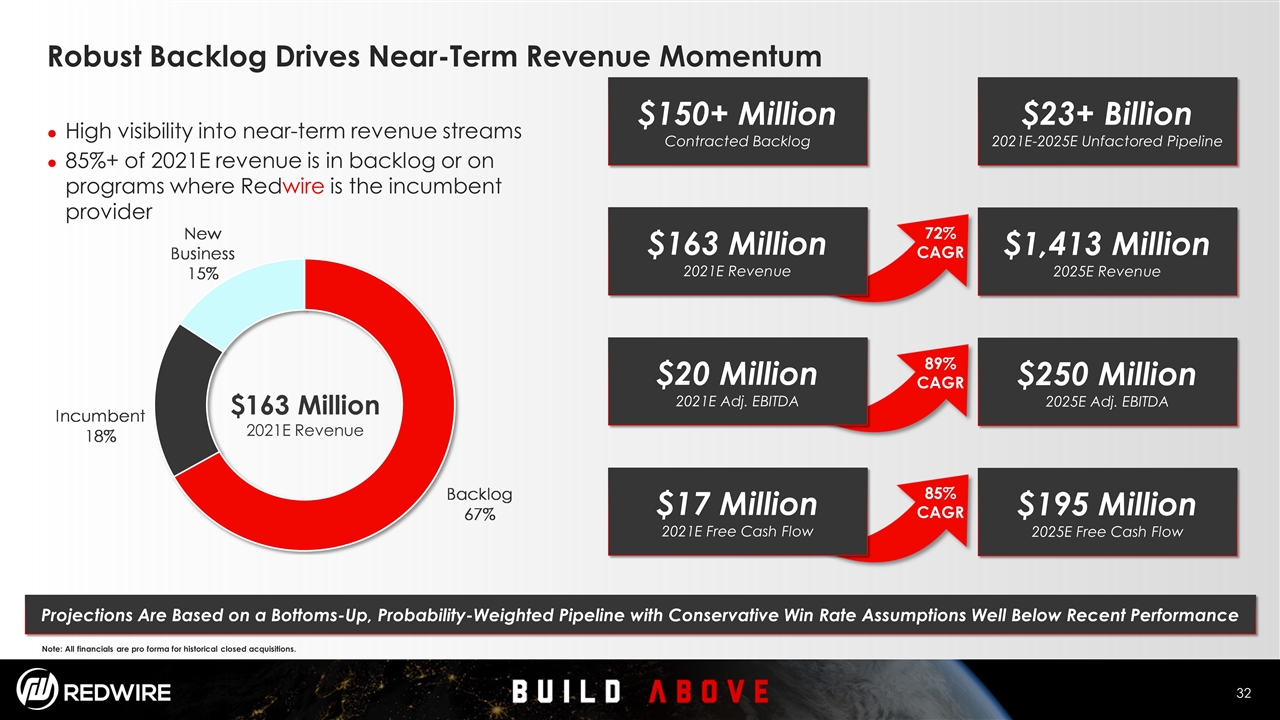

Robust Backlog Drives Near-Term Revenue Momentum Note: All financials are pro forma for historical closed acquisitions. High visibility into near-term revenue streams 85%+ of 2021E revenue is in backlog or on programs where Redwire is the incumbent provider $163 Million 2021E Revenue $150+ Million Contracted Backlog $23+ Billion 2021E-2025E Unfactored Pipeline $1,413 Million 2025E Revenue $250 Million 2025E Adj. EBITDA $195 Million 2025E Free Cash Flow $163 Million 2021E Revenue $20 Million 2021E Adj. EBITDA $17 Million 2021E Free Cash Flow 72% CAGR 89% CAGR 85% CAGR Projections Are Based on a Bottoms-Up, Probability-Weighted Pipeline with Conservative Win Rate Assumptions Well Below Recent Performance

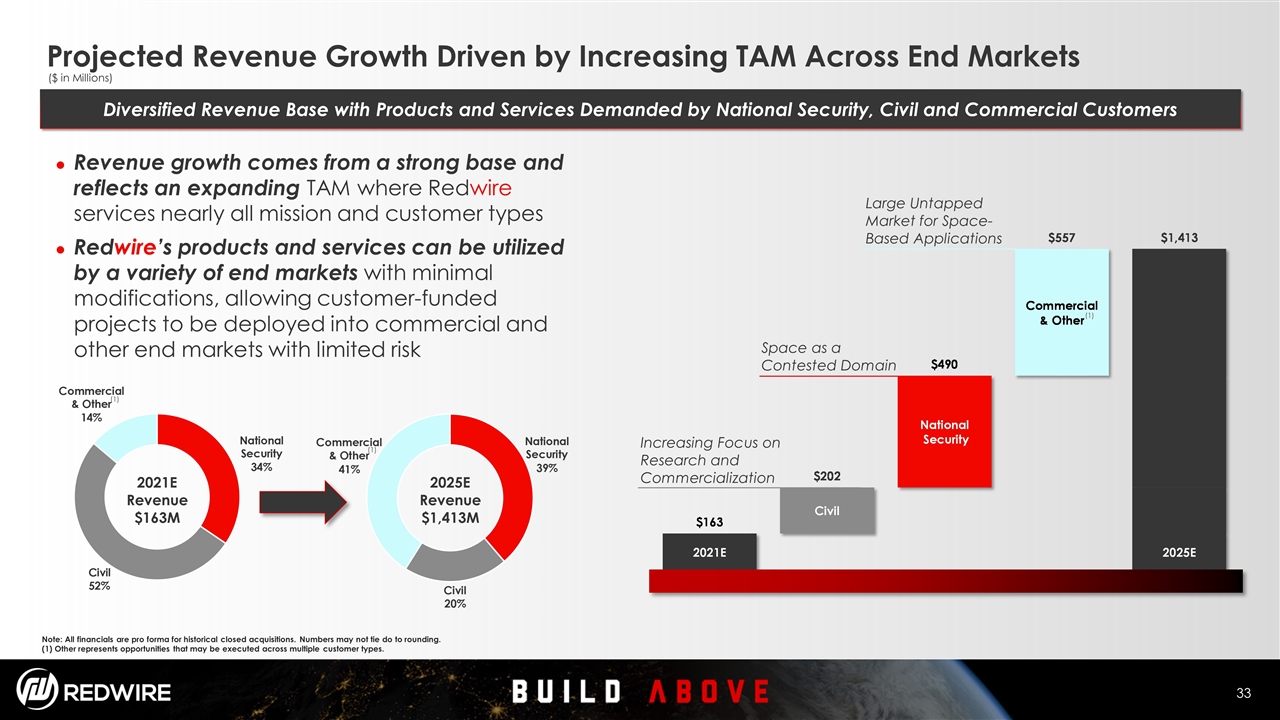

Projected Revenue Growth Driven by Increasing TAM Across End Markets Note: All financials are pro forma for historical closed acquisitions. Numbers may not tie do to rounding. (1) Other represents opportunities that may be executed across multiple customer types. Revenue growth comes from a strong base and reflects an expanding TAM where Redwire services nearly all mission and customer types Redwire’s products and services can be utilized by a variety of end markets with minimal modifications, allowing customer-funded projects to be deployed into commercial and other end markets with limited risk Diversified Revenue Base with Products and Services Demanded by National Security, Civil and Commercial Customers ($ in Millions) Space as a Contested Domain Increasing Focus on Research and Commercialization Large Untapped Market for Space-Based Applications (1) 2021E Revenue $163M 2025E Revenue $1,413M (1) (1) (1)

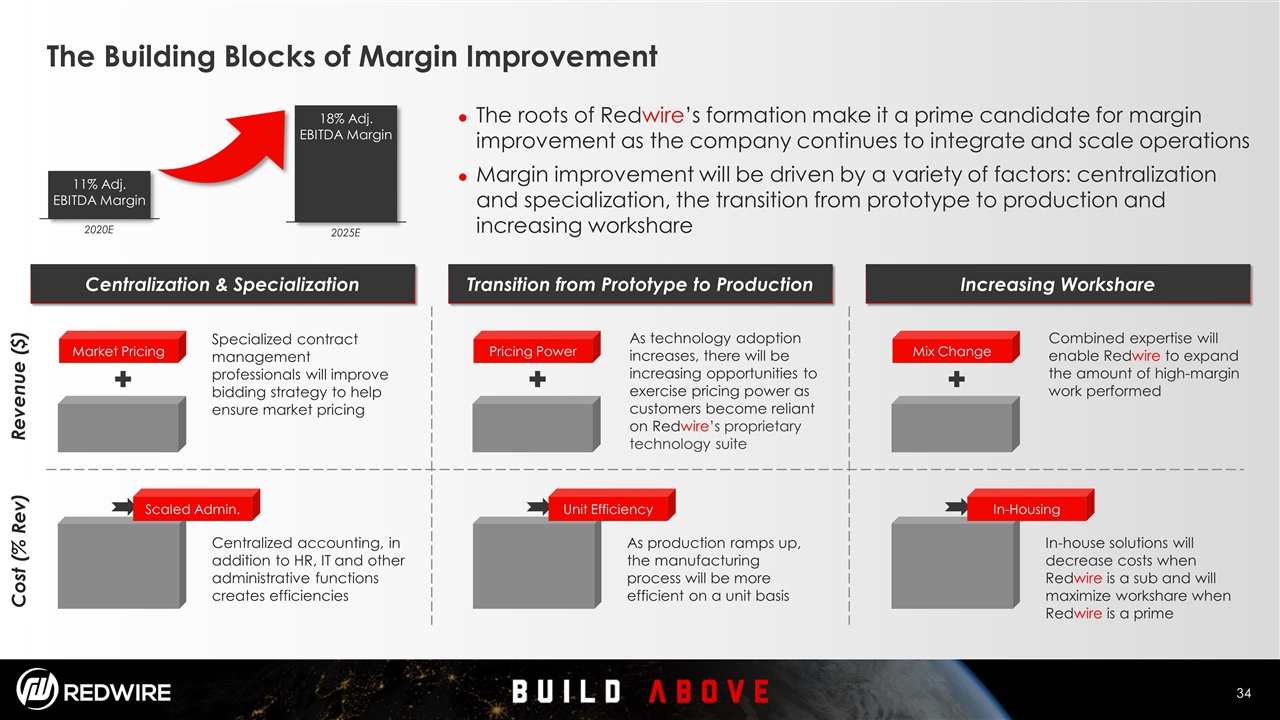

The Building Blocks of Margin Improvement Centralization & Specialization Transition from Prototype to Production Increasing Workshare Revenue ($) Cost (% Rev) The roots of Redwire’s formation make it a prime candidate for margin improvement as the company continues to integrate and scale operations Margin improvement will be driven by a variety of factors: centralization and specialization, the transition from prototype to production and increasing workshare 18% Adj. EBITDA Margin 2025E 11% Adj. EBITDA Margin 2020E 29 Specialized contract management professionals will improve bidding strategy to help ensure market pricing As technology adoption increases, there will be increasing opportunities to exercise pricing power as customers become reliant on Redwire’s proprietary technology suite Market Pricing Pricing Power Combined expertise will enable Redwire to expand the amount of high-margin work performed Mix Change Centralized accounting, in addition to HR, IT and other administrative functions creates efficiencies As production ramps up, the manufacturing process will be more efficient on a unit basis In-house solutions will decrease costs when Redwire is a sub and will maximize workshare when Redwire is a prime Scaled Admin. Unit Efficiency In-Housing

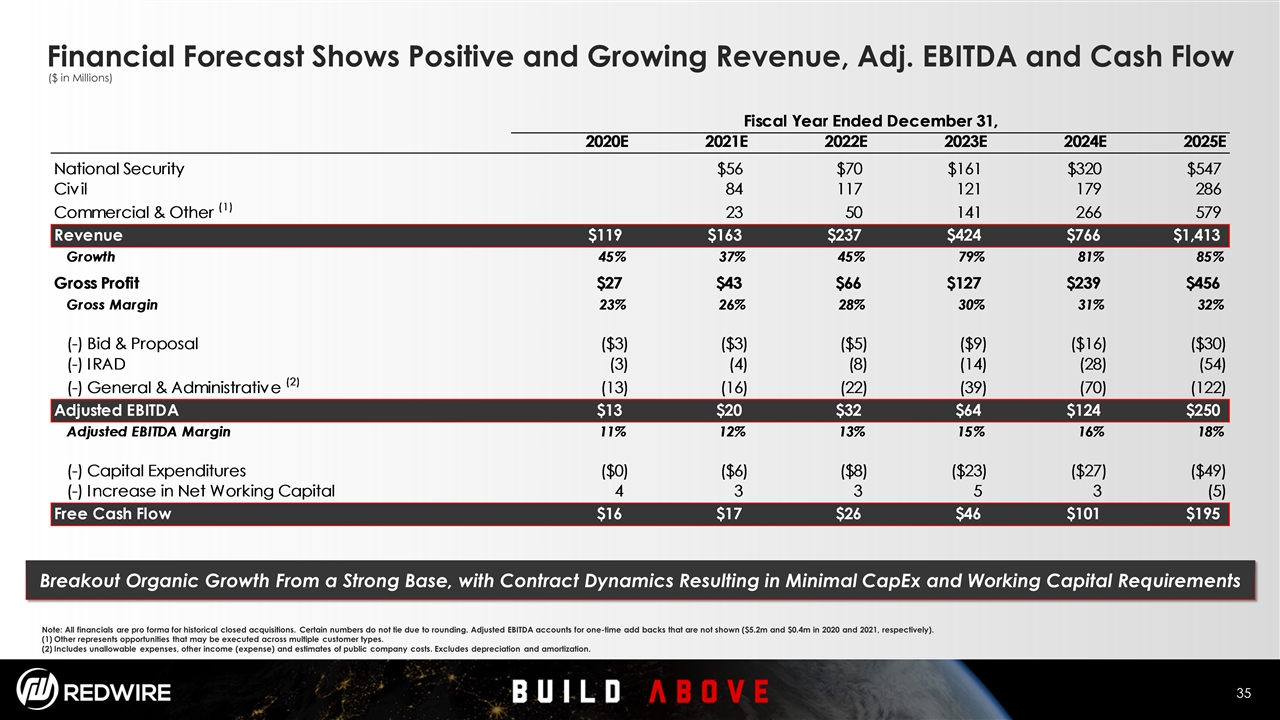

Financial Forecast Shows Positive and Growing Revenue, Adj. EBITDA and Cash Flow ($ in Millions) Note: All financials are pro forma for historical closed acquisitions. Certain numbers do not tie due to rounding. Adjusted EBITDA accounts for one-time add backs that are not shown ($5.2m and $0.4m in 2020 and 2021, respectively). Other represents opportunities that may be executed across multiple customer types. Includes unallowable expenses, other income (expense) and estimates of public company costs. Excludes depreciation and amortization. Breakout Organic Growth From a Strong Base, with Contract Dynamics Resulting in Minimal CapEx and Working Capital Requirements

Transaction Details

Detailed Transaction Overview Current Redwire shareholders are rolling a large portion of their existing equity Cash to the balance sheet will serve as dry powder for strategic investments and continued pursuit of Redwire’s proprietary M&A pipeline Pro Forma Ownership Note: All financials are pro forma for historical closed acquisitions. Assumes no redemptions from SPAC investors. (1) Pro forma share count includes 16.4m GNPK public shares, 10.0m PIPE shares and 4.1m SPAC sponsor shares. ($ in Millions, except per share price)

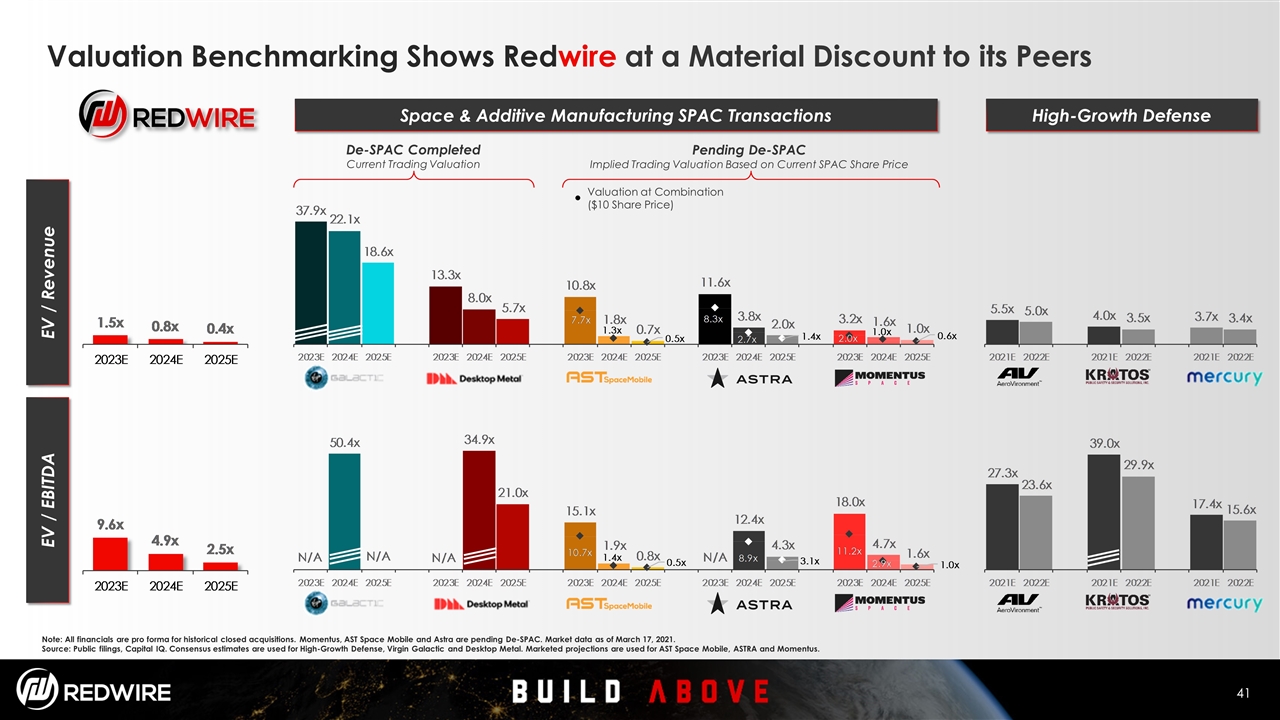

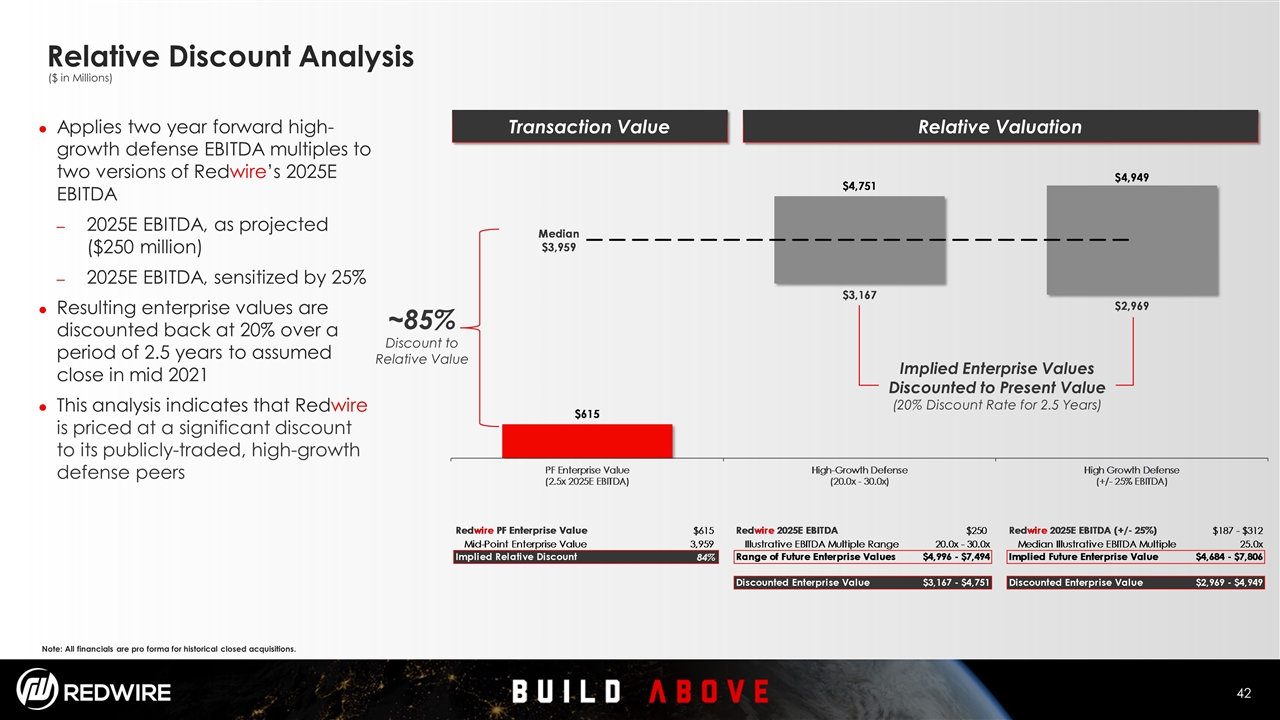

Redwire Is a Unique Growth and Value Investment in the Space Industry The $615 million pro forma enterprise value is underpinned by current revenue, EBITDA and free cash flow with highly-visible future growth in these metrics bolstered by a bottoms-up $23+ billion pipeline High visibility into near-term financial performance backed by backlog and incumbency on identified programs Unique financial profile among its space SPAC peers with current and projected free cash flow and very low capital requirements to achieve growth due to the nature of its contracted revenue Compelling valuation upside for a high-growth space company: Redwire’s 0.4x 2025 EV / Revenue is comparatively lower than the selected space and additive manufacturing SPACs which are valued at an average of 5.6x 2025 EV / Revenue Compelling valuation upside as a value investment compared to the well-established publicly traded high-growth defense peers that have lower growth and higher EV / EBITDA multiples Redwire has near-term revenue growth that is over 3.0x the average of the high-growth defense peers Redwire has near-term EBITDA growth that is over 3.0x the average of the high-growth defense peers Relative valuation analysis shows a significant discount to its high-growth defense peers Redwire Has a Compelling Valuation at a Discount to Space and High-Growth Defense Peers with a Pro Forma Enterprise Value of $615 Million Note: All financials are pro forma for historical closed acquisitions. Comparable companies detailed in the following pages. Market data as of March 17, 2021. Source: Public filings, Capital IQ. Consensus estimates are used for High-Growth Defense, Virgin Galactic and Desktop Metal. Marketed projections are used for AST Space Mobile, ASTRA and Momentus.

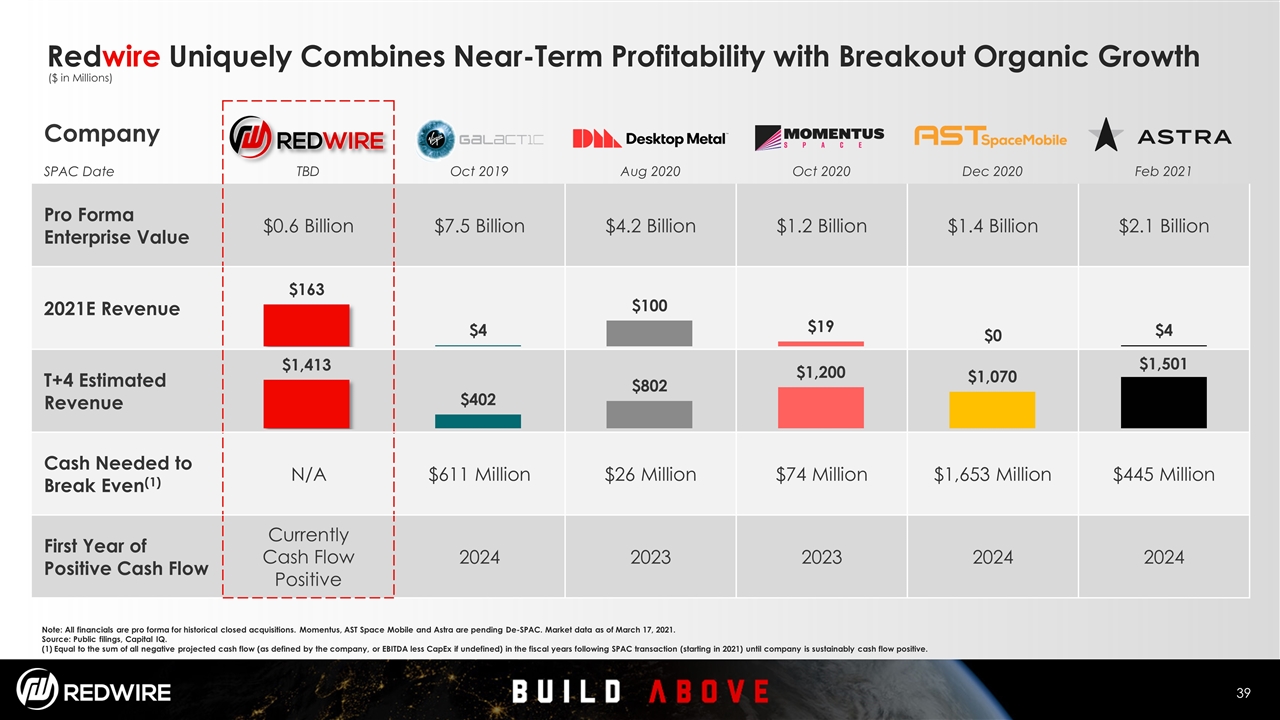

Redwire Uniquely Combines Near-Term Profitability with Breakout Organic Growth Note: All financials are pro forma for historical closed acquisitions. Momentus, AST Space Mobile and Astra are pending De-SPAC. Market data as of March 17, 2021. Source: Public filings, Capital IQ. Equal to the sum of all negative projected cash flow (as defined by the company, or EBITDA less CapEx if undefined) in the fiscal years following SPAC transaction (starting in 2021) until company is sustainably cash flow positive. Company SPAC Date TBD Oct 2019 Aug 2020 Oct 2020 Dec 2020 Feb 2021 Pro Forma Enterprise Value $0.6 Billion $7.5 Billion $4.2 Billion $1.2 Billion $1.4 Billion $2.1 Billion 2021E Revenue $0 T+4 Estimated Revenue Cash Needed to Break Even(1) N/A $611 Million $26 Million $74 Million $1,653 Million $445 Million First Year of Positive Cash Flow Currently Cash Flow Positive 2024 2023 2023 2024 2024 ($ in Millions)

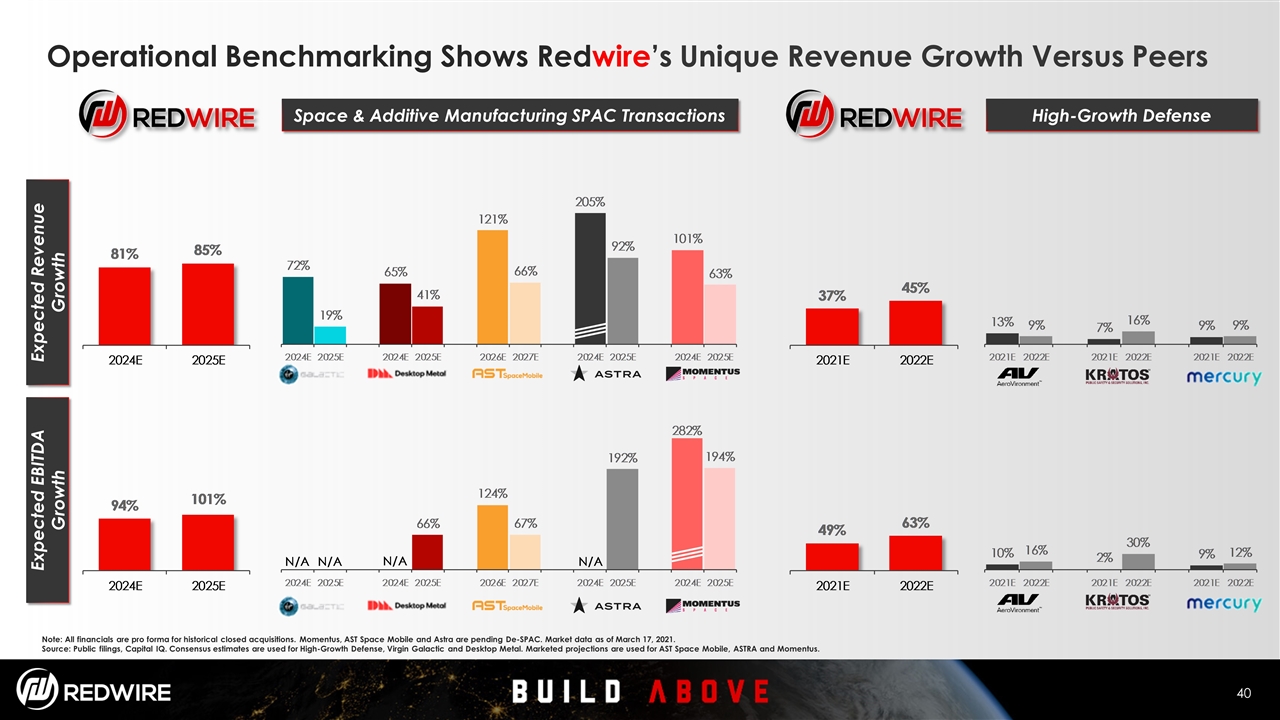

Operational Benchmarking Shows Redwire’s Unique Revenue Growth Versus Peers Note: All financials are pro forma for historical closed acquisitions. Momentus, AST Space Mobile and Astra are pending De-SPAC. Market data as of March 17, 2021. Source: Public filings, Capital IQ. Consensus estimates are used for High-Growth Defense, Virgin Galactic and Desktop Metal. Marketed projections are used for AST Space Mobile, ASTRA and Momentus. Space & Additive Manufacturing SPAC Transactions Expected Revenue Growth Expected EBITDA Growth High-Growth Defense

Valuation Benchmarking Shows Redwire at a Material Discount to its Peers Note: All financials are pro forma for historical closed acquisitions. Momentus, AST Space Mobile and Astra are pending De-SPAC. Market data as of March 17, 2021. Source: Public filings, Capital IQ. Consensus estimates are used for High-Growth Defense, Virgin Galactic and Desktop Metal. Marketed projections are used for AST Space Mobile, ASTRA and Momentus. EV / Revenue EV / EBITDA Space & Additive Manufacturing SPAC Transactions High-Growth Defense De-SPAC Completed Current Trading Valuation Pending De-SPAC Implied Trading Valuation Based on Current SPAC Share Price Valuation at Combination ($10 Share Price)

Relative Discount Analysis Relative Valuation Transaction Value Note: All financials are pro forma for historical closed acquisitions. Applies two year forward high-growth defense EBITDA multiples to two versions of Redwire’s 2025E EBITDA 2025E EBITDA, as projected ($250 million) 2025E EBITDA, sensitized by 25% Resulting enterprise values are discounted back at 20% over a period of 2.5 years to assumed close in mid 2021 This analysis indicates that Redwire is priced at a significant discount to its publicly-traded, high-growth defense peers ~85% Discount to Relative Value Implied Enterprise Values Discounted to Present Value (20% Discount Rate for 2.5 Years) ($ in Millions)