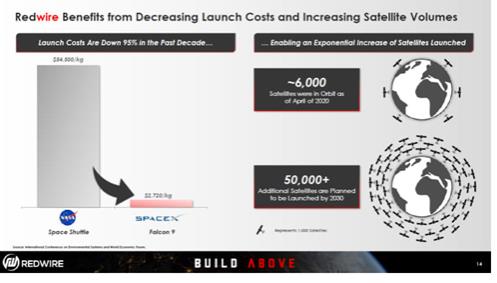

“I believe that there’s a direct correlation between reductions in launch costs and demand for

space infrastructure,” he added.

Overall, Cannito pitched his company as a firm that’s in the middle of the space economy, which has grown to

more than $420 billion.

“When space wins, Redwire wins,” Cannito said.

Forward Looking Statements

This document includes

“forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as

“forecast,” “intend,” “seek,” “target,” “anticipate,” “believe,” “expect,” “estimate,” “plan,” “outlook,” and “project” and other similar

expressions that predict or indicate future events or trends or that are not statements of historical matters. Such forward looking statements include estimated financial information, including without limitation, forecasted revenue and revenue

CAGR. Such forward looking statements with respect to revenues, earnings, performance, strategies, prospects and other aspects of the businesses of Genesis Park Acquisition Corp., Redwire or the combined company after completion of the Business

Combination are based on current expectations that are subject to risks and uncertainties. A number of factors could cause actual results or outcomes to differ materially from those indicated by such forward looking statements. These factors

include, but are not limited to: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement governing the proposed business combination; (2) the inability to complete the

transactions contemplated by the merger agreement due to the failure to obtain approval of the shareholders of Genesis Park Acquisition Corp. or other conditions to closing in the merger agreement; (3) the ability to meet NYSE’s listing

standards following the consummation of the transactions contemplated by the merger agreement; (4) the risk that the proposed transaction disrupts current plans and operations of Redwire as a result of the announcement and consummation of the

transactions described herein; (5) the ability to recognize the anticipated benefits of the proposed business combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth

profitably, maintain relationships with customers and suppliers and retain its management and key employees; (6) costs related to the proposed business combination; (7) changes in applicable laws or regulations; (8) the possibility

that Redwire may be adversely affected by other economic, business, and/or competitive factors; and (9) other risks and uncertainties indicated from time to time in other documents filed or to be filed with the SEC by Genesis Park

Acquisition Corp. You are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Genesis Park Acquisition Corp. and Redwire undertake no commitment to update or revise the forward-looking

statements, whether as a result of new information, future events or otherwise, except as may be required by law.

Additional Information

In connection with the proposed business combination between Redwire and Genesis Park Acquisition Corp., Genesis Park Acquisition Corp. intends to file with

the SEC a preliminary proxy statement / prospectus and will mail a definitive proxy statement / prospectus and other relevant documentation to Genesis Park Acquisition Corp. shareholders. This document does not contain all the information that

should be considered concerning the proposed business combination. It is not intended to form the basis of any investment decision or any other decision in respect to the proposed business combination. Genesis Park Acquisition Corp. shareholders and

other interested persons are advised to read, when