Exhibit 99.1

Building the Future of Space in LEO and Beyond Andrew Rush President & Chief Operating Officer • Redwire Space February 2022

Disclaimer Disclaimers and Other Important Information No representations or warranties, express or implied are given in, or in respect of, this presentation (this “Presentation”). To the fullest extent permitted by law, in no circumstances will Redwire Corporation (“Redwire”) or any representatives, partners, directors, officers, employees, advisors or agents be responsible or liable for any direct, indirect or consequenti al loss or loss of profit arising from the use of this Presentation, its contents, its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith. Industry a nd market data used in this Presentation have been obtained from third - party industry publications and sources as well as from research reports prepared for other purposes. Redwire has not independently verified the data obtained from these source s a nd cannot assure you of the data’s accuracy or completeness. This data is subject to change. Recipients of this Presentation are not to construe its contents, or any prior or subsequent communications from or with Redwire or its represen tat ives as investment, legal or tax advice. In addition, this Presentation does not purport to be all - inclusive or to contain all of the information that may be required to make a full analysis of Redwire. Recipients of this Presentation should each make the ir own evaluation of Redwire and of the relevance and adequacy of the information and should make such other investigations as they deem necessary. Statements other than historical facts, including but not limited to those concerning mar ket conditions or trends, consumer or customer preferences or other similar concepts with respect to Redwire, are based on current expectations, estimates, projections, targets, opinions and/or beliefs of Redwire or, when applicable, of on e o r more third - party sources. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. In addition, no representation or warranty is made with respect to the reasonabl ene ss of any estimates, forecasts, illustrations, prospects or returns, which should be regarded as illustrative only, or that any profits will be realized. The metrics regarding select aspects of Redwire's operations were selected by Redwire or its su bsi diaries on a subjective basis. Such metrics are provided solely for illustrative purposes to demonstrate elements of Redwire's businesses, are incomplete, and are not necessarily indicative of Redwire’s or its subsidiaries’ performance or ove ral l operations. There can be no assurance that historical trends will continue. The preliminary revenue and backlog information included in this presentation is preliminary, unaudited and subject to comple tio n, reflect management’s current views, and may change as a result of management’s review of results and other information, which may not be currently available. Such preliminary results are subject to the finalization of year - end financia l and accounting procedures (which have yet to be performed) and should not be viewed as a substitute for audited results prepared in accordance with U.S. generally accepted accounting principles. The actual results may be materially diffe ren t from the preliminary results. See the factors discussed under the caption “Risk Factors” in the Company’s final prospectus, dated October 4, 2021 and filed with the Securities and Exchange Commission on the same date. We use certain financial measures, including uncontra ct ed and total backlog, to evaluate our operating performance, generate future operating plans, and make strategic decisions, including those relating to operating expenses and the allocation of internal res ources which are not calculated in accordance with Generally Accepted Accounting Principles (“GAAP”) and are considered to be Non - GAAP financial performance measures. These Non - GAAP financial performance measures are used to supplement the financial inf ormation presented on a GAAP basis and should not be considered in isolation or as a substitute for the relevant GAAP measures and should be read in conjunction with information presented on a GAAP basis. Becau se not all companies use identical calculations, our presentation of Non - GAAP measures may not be comparable to other similarly titled measures of other companies. Forward Looking Statements This document includes “forward looking statements” within the meaning of the “safe harbor” provisions of the United States P riv ate Securities Litigation Reform Act of 1995. Forward - looking statements may be identified by the use of words such as “forecast,” “intend,” “seek,” “target,” “anticipate,” “believe,” “expect,” “estimate,” “plan,” “outlook,” and “project” an d o ther similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Such forward looking statements include certain financial information. Such forward looking statements with respect to, among ot her things, prospects and other aspects of the business of Redwire are based on current expectations that are subject to risks and uncertainties. A number of factors could cause actual results or outcomes to differ materially from those indicated by such forward looking statements. Th ese factors include, but are not limited to the risks and uncertainties indicated from time to time in documents filed or to be filed with the SEC by Redwire. You are cautioned not to place undue reliance up on any forward - looking statements, which speak only as of the date made. Redwire undertakes no commitment to update or revise the forward - looking statements, whether as a result of new information, future events or otherwise, except as may be r equired by law. Trademarks This Presentation contains trademarks, service marks, tradenames and copyrights of Redwire and other companies, which are the pr operty of their respective owners. The use herein does not imply an affiliation with, or endorsement by, the owners of these service marks, trademarks and tradenames. Third - party logos herein may represent past customers, present customers or m ay be provided simply for illustrative purposes only. Inclusion of such logos does not necessarily imply affiliation with or endorsement by such firms or businesses. There is no guarantee that Redwire will work, or continue to work, with any of the firms or businesses whose logos are included herein in the future.

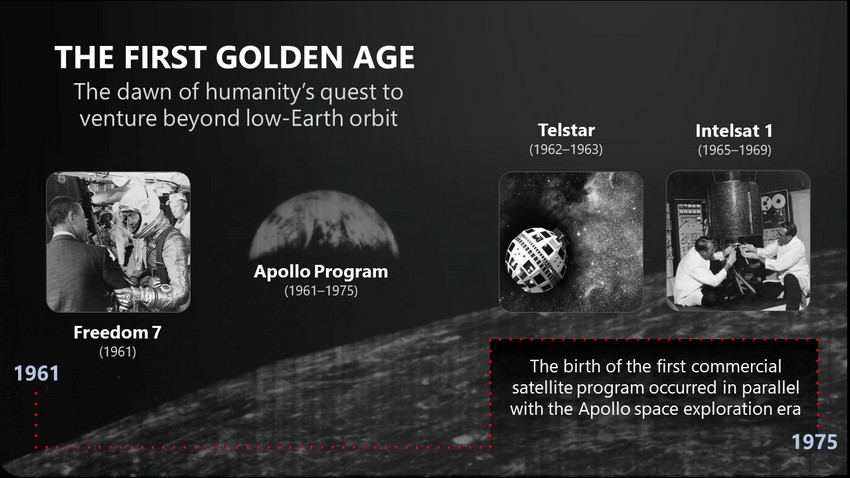

THE FIRST GOLDEN AGE Freedom 7 (1961) Apollo Program (1961 – 1975) Telstar (1962 – 1963) Intelsat 1 (1965 – 1969) The dawn of humanity’s quest to venture beyond low - Earth orbit 1961 1975 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ............................................................. ............................................................. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . The birth of the first commercial satellite program occurred in parallel with the Apollo space exploration era

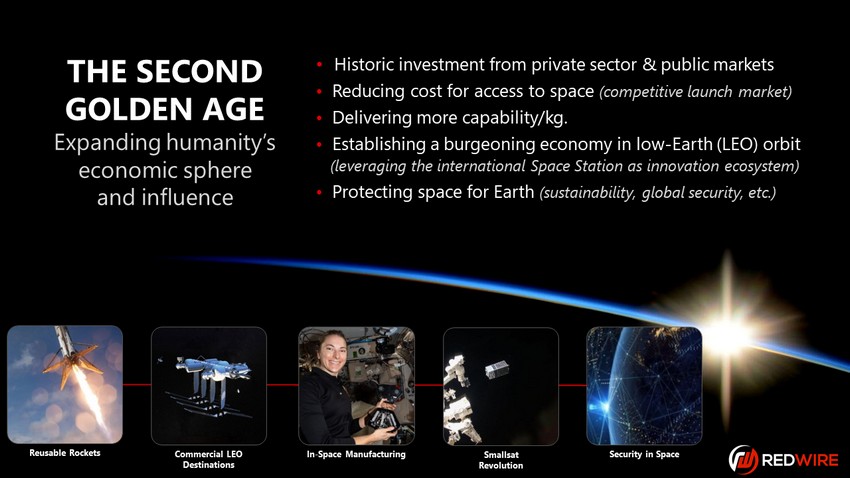

THE SECOND GOLDEN AGE Expanding humanity’s economic sphere and influence • Historic investment from private sector & public markets • Reducing cost for access to space (competitive launch market) • Delivering more capability/kg. • Establishing a burgeoning economy in low - Earth (LEO) orbit (leveraging the international Space Station as innovation ecosystem) • Protecting space for Earth (sustainability, global security, etc.) Reusable Rockets Commercial LEO Destinations In - Space Manufacturing Smallsat Revolution Security in Space

We are providing the foundational building blocks for the future of space infrastructure Accelerating humanity’s expansion into space by delivering reliable, economical and sustainable infrastructure for future generations MISSION

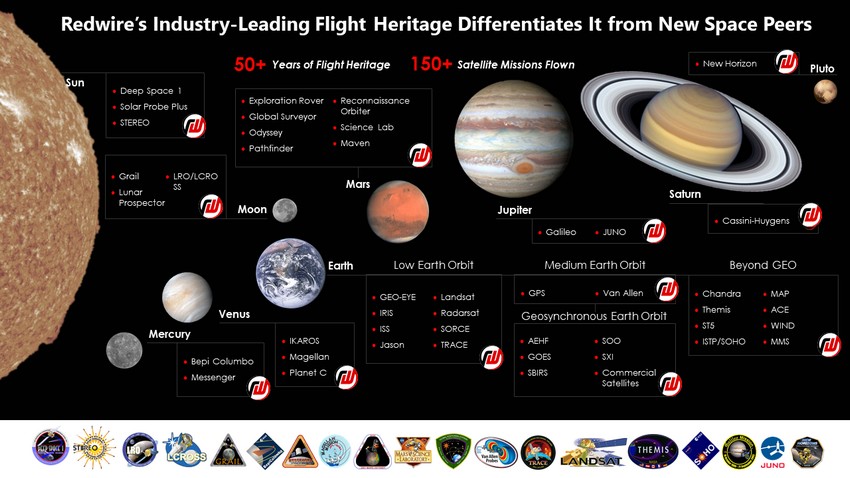

1. Insert Footnote Redwire’s Industry - Leading Flight Heritage Differentiates It from New Space Peers 7 Mars Jupiter Saturn Pluto IKAROS Magellan Planet C GEO - EYE IRIS ISS Jason Landsat Radarsat SORCE TRACE Low Earth Orbit GPS Van Allen Medium Earth Orbit AEHF GOES SBIRS SOO SXI Commercial Satellites Geosynchronous Earth Orbit Chandra Themis ST5 ISTP/SOHO MAP ACE WIND MMS Beyond GEO Venus Mercury Earth Sun Exploration Rover Global Surveyor Odyssey Pathfinder Reconnaissance Orbiter Science Lab Maven Moon Galileo JUNO Cassini - Huygens New Horizon Years of Flight Heritage 50+ Satellite Missions Flown 150+ Deep Space 1 Solar Probe Plus STEREO Grail Lunar Prospector LRO/LCRO SS Bepi Columbo Messenger

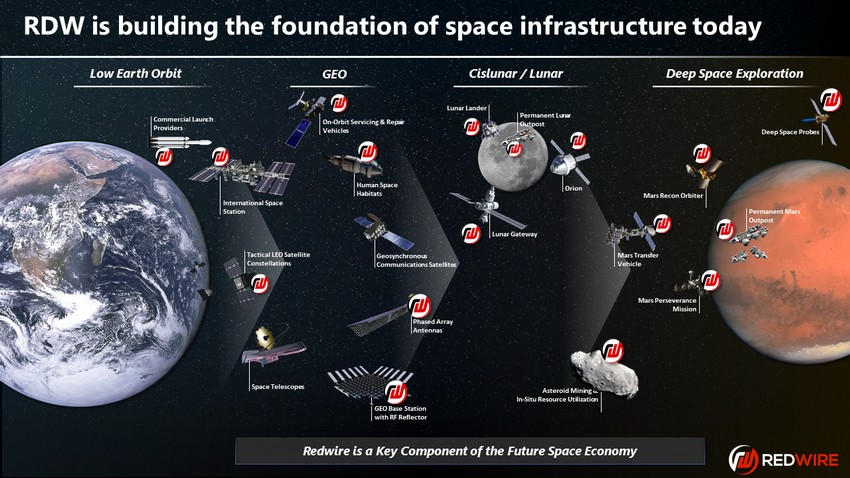

RDW is building the foundation of space infrastructure today Low Earth Orbit Cislunar / Lunar Deep Space Exploration Space Telescopes Commercial Launch Providers International Space Station Orion Lunar Gateway Tactical LEO Satellite Constellations Phased Array Antennas GEO GEO Base Station with RF Reflector Geosynchronous Communications Satellites Human Space Habitats Mars Transfer Vehicle Mars Perseverance Mission Asteroid Mining & In - Situ Resource Utilization Lunar Lander Mars Recon Orbiter On - Orbit Servicing & Repair Vehicles Deep Space Probes Permanent Lunar Outpost Permanent Mars Outpost Redwire is a Key Component of the Future Space Economy

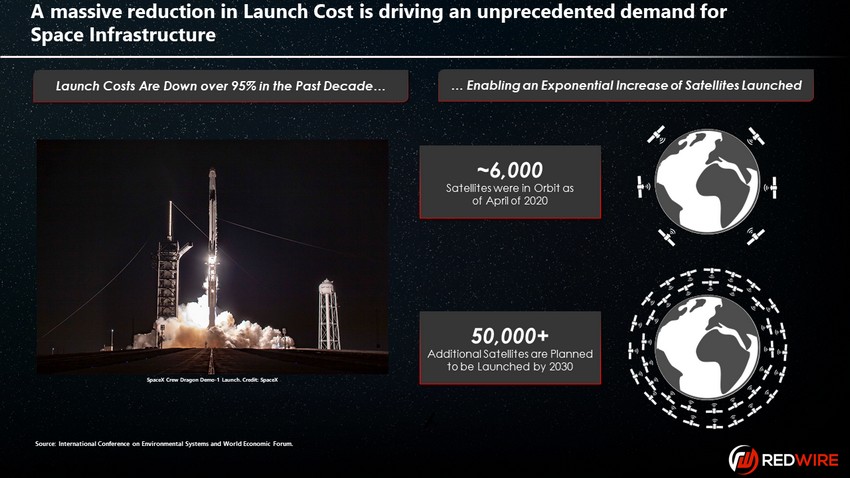

1. Insert Footnote Source: International Conference on Environmental Systems and World Economic Forum. A massive reduction in Launch Cost is driving an unprecedented demand for Space Infrastructure Launch Costs Are Down over 95% in the Past Decade… … Enabling an Exponential Increase of Satellites Launched ~6,000 Satellites were in Orbit as of April of 2020 50,000+ Additional Satellites are Planned to be Launched by 2030 SpaceX Crew Dragon Demo - 1 Launch. Credit: SpaceX

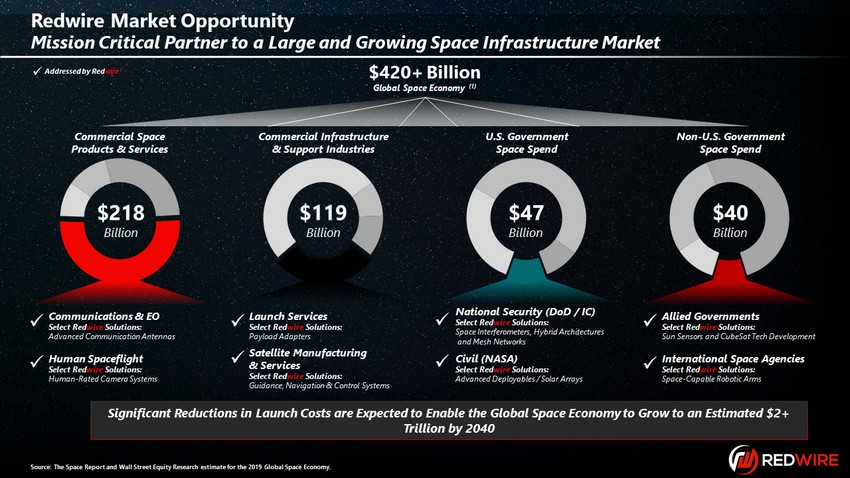

1. Insert Footnote Source: The Space Report and Wall Street Equity Research estimate for the 2019 Global Space Economy. Redwire Market Opportunity Mission Critical Partner to a Large and Growing Space Infrastructure Market Commercial Space Products & Services Commercial Infrastructure & Support Industries U.S. Government Space Spend Non - U.S. Government Space Spend Communications & EO Select Red wire Solutions: Advanced Communication Antennas x x Addressed by Red wire Human Spaceflight Select Red wire Solutions: Human - Rated Camera Systems x Launch Services Select Red wire Solutions: Payload Adapters x Satellite Manufacturing & Services Select Red wire Solutions: Guidance, Navigation & Control Systems x National Security (DoD / IC) Select Red wire Solutions: Space Interferometers, Hybrid Architectures and Mesh Networks x Civil (NASA) Select Red wire Solutions: Advanced Deployables / Solar Arrays x Allied Governments Select Red wire Solutions: Sun Sensors and CubeSat Tech Development x International Space Agencies Select Red wire Solutions: Space - Capable Robotic Arms x $218 Billion $119 Billion $47 Billion $40 Billion $420+ Billion Global Space Economy (1) Significant Reductions in Launch Costs are Expected to Enable the Global Space Economy to Grow to an Estimated $2+ Trillion by 2040

RDW Provides the Building Blocks for the Future of Space • Power Generation • Structures and Satellite Design • Sensors and Components • Human Spaceflight Mission Design and Support • 3D Printing, Biotechnology, and Manufacturing Payloads • Digital Engineering These are the foundational technologies for the future of space infrastructure

Foundational Technology for Mission Critical Capability OSAM Built - in - space with additive manufacturing for cost efficiency iROSA Modular system, improving space station’s power capacity by 20 - 30% Navigation & Avionics High - res capability enabled for docking, navigation, inspection, and in - space monitoring 3D Printing To enable long - term habitation of planetary bodies without the need for consistent resupply missions Artemis I Orion Spacecraft Blue Ghost Lunar Lander iROSA Solar Arrays Archinaut Satellite Regolith Print Facility

Advanced Manufacturing in Microgravity • ZBLAN Optical Fiber • High Performance Ceramics Improving Human Health Through Biotechnology • Bioprinting human tissue • Space farming Commercial LEO Destinations • Commercial space stations • Orbital factories in low - Earth orbit • Increased U.S. access to LEO ESTABLISHING A ROBUST LEO ECONOMY • Optical Crystals • High Performance Metals

Techshot advances Redwire’s unique positioning as the leader in on - orbit manufacturing Marquee and Trusted Enabler of Space Research and Commercialization for more than 30 years 1 Biological and physical science research in space • Supporting pharmacological research in space • Researching and developing techniques for manufacturing human tissues and organs Space Commercialization • 3D BioFabrication Facility (BFF) for biological tissue culture • In - space manufacturing of replacement parts for spacecraft Enabling deep space exploration • Supporting design and development of next - generation spacesuits • Supporting internal outfitting of NASA Lunar Gateway for future Artemis missions Techshot fits well within Redwire’s existing portfolio , and brings further expertise to in - space manufacturing, protein crystallization, and bioprinting, which is needed for LEO commercialization

PROTECTING SPACE FOR EARTH • Enabling more science and discovery • Climate change mitigation • Space sustainability and debris mitigation • National Security • Hypersonics and missile defense • Intelligence, surveillance and reconnaissance Compact and autonomous star tracker Roll Out Solar Array Technology

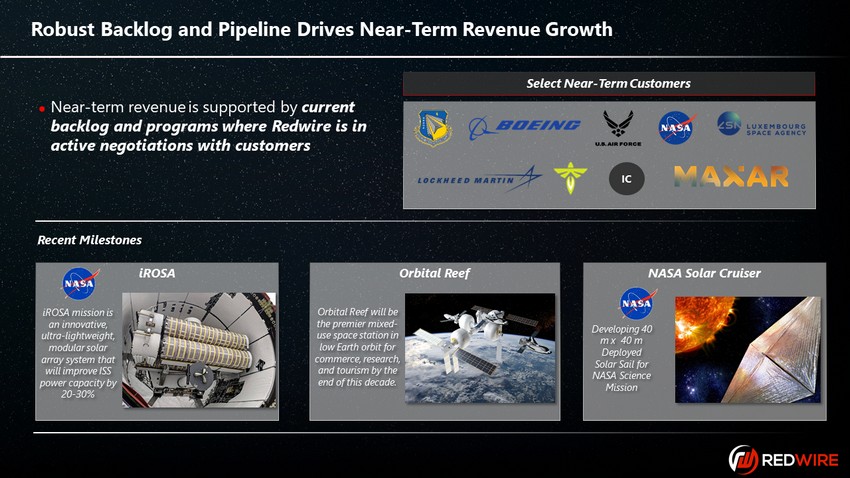

1. Insert Footnote Robust Backlog and Pipeline Drives Near - Term Revenue Growth Near - term revenue is supported by current backlog and programs where Redwire is in active negotiations with customers IC Select Near - Term Customers Recent Milestones iROSA Orbital Reef NASA Solar Cruiser Developing 40 m x 40 m Deployed Solar Sail for NASA Science Mission Orbital Reef will be the premier mixed - use space station in low Earth orbit for commerce, research, and tourism by the end of this decade. iROSA mission is an innovative, ultra - lightweight, modular solar array system that will improve ISS power capacity by 20 - 30%

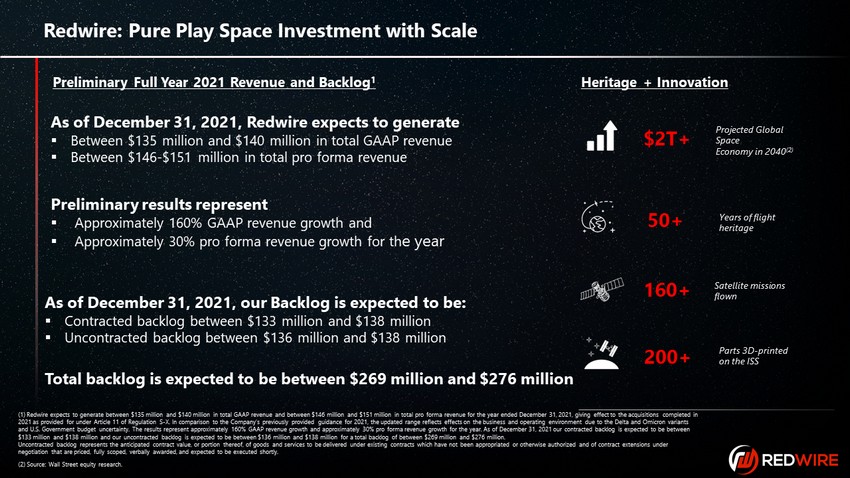

1. Insert Footnote Redwire: Pure Play Space Investment with Scale As of December 31, 2021, Redwire expects to generate ▪ Between $135 million and $140 million in total GAAP revenue ▪ Between $146 - $151 million in total pro forma revenue (1) Redwire expects to generate between $135 million and $140 million in total GAAP revenue and between $146 million and $151 mi llion in total pro forma revenue for the year ended December 31, 2021, giving effect to the acquisitions completed in 2021 as provided for under Article 11 of Regulation S - X. In comparison to the Company’s previously provided guidance for 2021, t he updated range reflects effects on the business and operating environment due to the Delta and Omicron variants and U.S. Government budget uncertainty. The results represent approximately 160% GAAP revenue growth and approximately 30% pr o f orma revenue growth for the year. As of December 31, 2021 our contracted backlog is expected to be between $133 million and $138 million and our uncontracted backlog is expected to be between $136 million and $138 million for a tota l b acklog of between $269 million and $276 million. Uncontracted backlog represents the anticipated contract value, or portion thereof, of goods and services to be delivered und er existing contracts which have not been appropriated or otherwise authorized and of contract extensions under negotiation that are priced, fully scoped, verbally awarded, and expected to be executed shortly. Preliminary results represent ▪ Approximately 160% GAAP revenue growth and ▪ Approximately 30% pro forma revenue growth for th e year As of December 31, 2021, our Backlog is expected to be: ▪ Contracted backlog b etween $133 million and $138 million ▪ Uncontracted backlog between $136 million and $138 million Total backlog is expected to be between $269 million and $276 million Years of flight heritage 50+ Satellite missions flown 160+ Parts 3D - printed on the ISS 200+ Projected Global Space Economy in 2040 (2) $2T+ Heritage + Innovation (2) Source: Wall Street equity research. Preliminary Full Year 2021 Revenue and Backlog 1